|

Stash (company)

Stash Financial, Inc., or Stash, is an American financial technology and financial services company based in New York, NY. The company operates both a web platform and mobile app, mobile apps, allowing users to incrementally invest small amounts, commonly known as micro-investing. It also provides Robo-advisor, robo advice. History Stash was founded in February 2015 by Brandon Krieg, David Ronick, and Ed Robinson. It was launched on the App Store (iOS), iOS App Store in October 2015 and made available on Android (operating system), Android in March 2016. By summer 2017, Stash had approximately 1 million users. In February 2018, the firm raised $37.5 million in a Series D funding in a round led by Union Square Ventures. In April 2020, it raised another $112 million in Series F funding in a round led by LendingTree. As of July 2020, Stash's user base had grown to over 5 million customers. Reception In February 2018, CNBC praised the app's automation and ease-of-use. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Company

A privately held company (or simply a private company) is a company whose Stock, shares and related rights or obligations are not offered for public subscription or publicly negotiated in their respective listed markets. Instead, the Private equity, company's stock is offered, owned, traded or exchanged privately, also known as "over-the-counter (finance), over-the-counter". Related terms are unlisted organisation, unquoted company and private equity. Private companies are often less well-known than their public company, publicly traded counterparts but still have major importance in the world's economy. For example, in 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for $1.8 trillion in revenues and employed 6.2 million people, according to ''Forbes''. In general, all companies that are not owned by the government are classified as private enterprises. This definition encompasses both publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Union Square Ventures

Union Square Ventures (USV) is an American venture capital firm based in New York City. The firm has backed more than 130 startups, including Twitter, Etsy, Stripe, Coinbase, Zynga, Tumblr, Stack Overflow, Meetup, Kickstarter, MongoDB, Flurry, and Carta. History Union Square Ventures (USV) was founded in 2003 by Fred Wilson and Brad Burnham. They created USV with the intent of investing in and fostering the development of early-stage companies. Their investments are "mostly U.S.-based Internet and mobile companies considered to be ‘disruptive’". Since its establishment, USV is one of the companies that are regularly included in Red Herring’s lists of top venture capital firms. As of 2016, USV had 7 billion dollar exits, including Twitter Twitter, officially known as X since 2023, is an American microblogging and social networking service. It is one of the world's largest social media platforms and one of the most-visited websites. Users can share s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Based In New York City

Finance refers to monetary resources and to the study and discipline of money, currency, assets and liabilities. As a subject of study, is a field of Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into personal, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. Due to its wide scope, a broad range of subfields exists within finance. Asset-, money-, risk- and investment management aim to maximize value and minimize volatility. Financial analysis assesses the viability, stability ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acorns (company)

Acorns is an American financial technology and financial services company. Based in Irvine, California, Acorns specializes in micro-investing and robo advice. According to Fortune's ''Impact 20'' list, Acorns had 8.2 million customers in 2020. In 2022, the company's total assets under management exceeded $6.2 billion. History The company was launched in 2012 by father and son duo Walter Wemple Cruttenden III and Jeffrey James Cruttenden to promote incremental and passive investing. It launched in 2014 with an app for iOS and Android devices. The portfolio options a user can select from were designed in partnership with paid advisor Harry Markowitz, a Nobel laureate. Since its inception, the platform has expanded to include checking account services and retirement IRA products. This was made possible following an acquisition of Portland, Oregon fintech retirement startup, Vault. In 2018, behavioral economist Shlomo Benartzi was appointed chair of a behavioral economic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CNN Money

CNN Business (formerly CNN Money) is a financial news and information website, operated by CNN. The website was originally formed as a joint venture between CNN.com and Time Warner's '' Fortune'' and '' Money'' magazines. Since the spin-off of Time Warner's publishing assets as Time Inc. (and their subsequent sale to Meredith Corporation and later, to IAC's Dotdash), the site has since operated as an affiliate of CNN. History CNN Money launched in 2001, replacing CNNfn's website. Time Warner had also announced an intention to relaunch the CNNfn television network under the CNN Money moniker, but those plans were apparently scrapped. Prior to June 2014, the website was operated as a joint venture between CNN and two Time Warner-published business magazines; '' Fortune'' and '' Money''. In June 2014, Time Warner's publishing assets were spun-out as Time Inc.; as a result, all three properties launched separate web presences, and CNN Money introduced a new logo that removed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NerdWallet

NerdWallet is an American personal finance company, founded in 2009 by Tim Chen and Jacob Gibson. It has a website and app that earns money by promoting financial products to its users. History NerdWallet was founded in August 2009 by Tim Chen and Jacob Gibson, with an initial capital investment of $800. Its first product was a web application that provided comparative information about credit cards. Subsequently, it generated large quantities of content to help boost its search engine results. Website traffic grew quickly in 2010 and, by March 2014, the website had up to 30 million users. The following year, it raised $64 million in its first round of funding, at an estimated valuation of $500 million. In 2016, the company acquired the retirement planning firm AboutLife, and was valued at $520 million. In August 2020, the company expanded its footprint into the UK by acquiring Know Your Money, a Norwich-based startup that provides a similar range of comparison and informat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Custodial Account

A custodial account is a financial account (such as a bank account, a trust fund or a brokerage account) set up for the benefit of a beneficiary, and administered by a responsible person, known as a legal guardian or custodian, who has a fiduciary obligation to the beneficiary. Custodial accounts come in a number of forms, one being an account set up for a minor, since the minor is under the legal age of majority. The custodian is often the minor's parent. In the U.S., this type of account is often structured as a Coverdell ESA, allowing for tax-advantaged treatment of educational expenses. Another form is a trust account owned by an individual or institution, managed by a named party for purposes of rapid distribution of funds in that account. This is commonly used for petty cash, or for transactions that have very limited and clearly defined payees and transaction types. For example, law firm accounting includes trust accounts for disbursing funds entrusted to the law fir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Traditional IRA

A traditional IRA is an individual retirement arrangement (IRA), established in the United States by the Employee Retirement Income Security Act of 1974 (ERISA) (, codified in part at ). Normal IRAs also existed before ERISA. Overview An author described the traditional IRA in 1982 as "the biggest tax break in history". The IRA is held at a custodian institution such as a bank or brokerage, and may be invested in anything that the custodian allows (for instance, a bank may allow certificates of deposit, and a brokerage may allow stocks and mutual funds). Unlike the Roth IRA, the only criterion for being eligible to contribute to a traditional IRA is sufficient income to make the contribution. Contributions are tax-deductible but with eligibility requirements based on income, filing status, and availability of other retirement plans (mandated by the Internal Revenue Service). Transactions and profits in the account are not taxed. Withdrawals are subject to federal income tax (see bel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

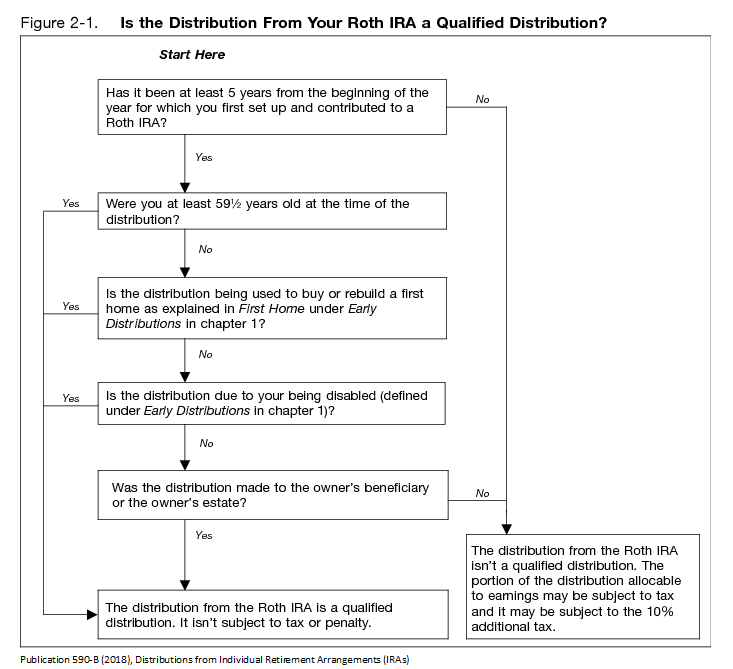

Roth IRA

A Roth IRA is an individual retirement account (IRA) under United States law that is generally not Taxation in the United States, taxed upon distribution, provided certain conditions are met. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting an income tax reduction for contributions to the retirement plan, qualified withdrawals from the Roth IRA plan are tax-free, and growth in the account is tax-free. The Roth IRA was introduced as part of the Taxpayer Relief Act of 1997 and is named for Senator William Roth. Overview A Roth IRA can be an individual retirement account containing investments in securities, usually common stock, common stocks and bond (finance), bonds, often through mutual fund, mutual funds (although other investments, including derivatives, notes, Certificate of deposit, certificates of deposit, and real estate are possible). A Roth IRA can also be an individual retirement Annuity (US financial p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retirement Account

Retirement is the withdrawal from one's position or occupation or from one's active working life. A person may also semi-retire by reducing work hours or workload. Many people choose to retire when they are elderly or incapable of doing their job for health reasons. People may also retire when they are eligible for private or public pension benefits, although some are forced to retire when bodily conditions no longer allow the person to work any longer (by illness or accident) or as a result of legislation concerning their positions. In most countries, the idea of retirement is of recent origin, being introduced during the late-nineteenth and early-twentieth centuries. Previously, low life expectancy, lack of social security and the absence of pension arrangements meant that most workers continued to work until their death. Germany was the first country to introduce retirement benefits in 1889. Nowadays, most developed countries have systems to provide pensions on retirement in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brokerage Account

A securities account, sometimes known as a brokerage account, is an account which holds financial assets such as securities A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ... on behalf of an investor with a bank, broker or custodian. Investors and traders typically have a securities account with the broker or bank they use to buy and sell securities. Securities accounts can be of different types, such as a share account, options account, margin account or cash account. Securities accounts are typically treated as client funds, keeping them separate from the firm's funds. This separation meets the financial regulations of most countries. References Securities (finance) Stock market {{Finance stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Fund

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold bars. Many ETFs provide some level of diversification compared to owning an individual stock. An ETF divides ownership of itself into shares that are held by shareholders. Depending on the country, the legal structure of an ETF can be a corporation, trust, open-end management investment company, or unit investment trust. Shareholders indirectly own the assets of the fund and are entitled to a share of the profits, such as interest or dividends, and would be entitled to any residual value if the fund undergoes liquidation. They also receive annual reports. An ETF generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occur. The larges ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |