|

Shared Check Authorization Network

Shared Check Authorization Network (SCAN) is a database of bad check writers in the United States. The database is used by retailers in order to reduce the number of bad checks received. The database keeps track of those who have written outstanding bad checks to any retailer using the system, and retailers can determine, based on these records, whether or not to accept a check from a particular accountholder. Retailers using the SCAN system have at least one scanner in the store, and often one at every register, that is used to scan checks that are written. The scanner reads the account number and compares it with the database of checking account numbers for which bad checks have been written to any participating retailer and not repaid. If the account number matches one in the system, the retailer will be notified, and will not likely accept the check. SCAN also operates a collection service on bad checks that are written. See also *Bad check restitution program * Check fraud * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Database

In computing, a database is an organized collection of data or a type of data store based on the use of a database management system (DBMS), the software that interacts with end users, applications, and the database itself to capture and analyze the data. The DBMS additionally encompasses the core facilities provided to administer the database. The sum total of the database, the DBMS and the associated applications can be referred to as a database system. Often the term "database" is also used loosely to refer to any of the DBMS, the database system or an application associated with the database. Before digital storage and retrieval of data have become widespread, index cards were used for data storage in a wide range of applications and environments: in the home to record and store recipes, shopping lists, contact information and other organizational data; in business to record presentation notes, project research and notes, and contact information; in schools as flash c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bad Check

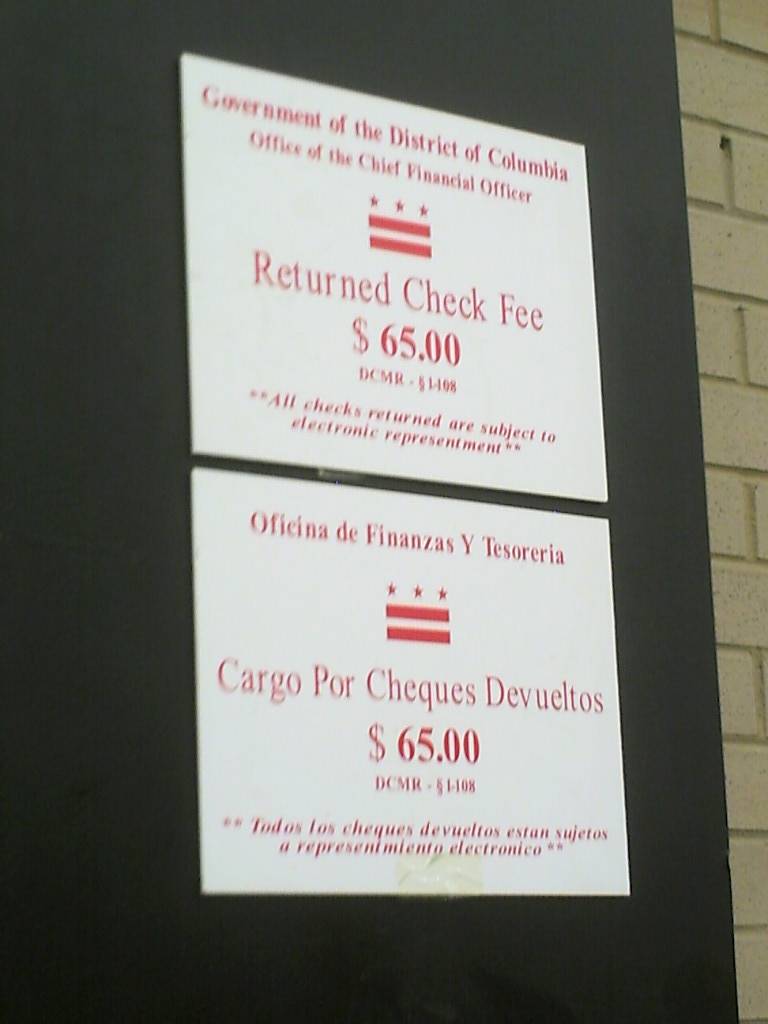

A dishonoured cheque (US spelling: dishonored check) is a cheque that the bank on which it is drawn declines to pay ("honour"). There are a number of reasons why a bank might refuse to honour a cheque, with non-sufficient funds (NSF) being the most common, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF cheque may be referred to as a bad cheque, dishonoured cheque, bounced cheque, cold cheque, rubber cheque, returned item, or hot cheque. Lost or bounced cheques result in late payments and affect the relationship with customers. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed "Present again", by which time the funds should have cleared. When more than one cheque is presented fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retailer

Retail is the sale of goods and services to consumers, in contrast to wholesaling, which is the sale to business or institutional customers. A retailer purchases goods in large quantities from manufacturers, directly or through a wholesaler, and then sells in smaller quantities to consumers for a profit. Retailers are the final link in the supply chain from producers to consumers. Retail markets and shops have a long history, dating back to antiquity. Some of the earliest retailers were itinerant peddlers. Over the centuries, retail shops were transformed from little more than "rude booths" to the sophisticated shopping malls of the modern era. In the digital age, an increasing number of retailers are seeking to reach broader markets by selling through multiple channels, including both bricks and mortar and online retailing. Digital technologies are also affecting the way that consumers pay for goods and services. Retailing support services may also include the provision ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque

A cheque (or check in American English) is a document that orders a bank, building society, or credit union, to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked in or a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bad Check Restitution Program

A bad check restitution program (BCRP) is a program in the United States that works to retrieve funds from bad check writers in order to repay moneys owed to the recipients of the cheque, checks. In other words, these are debt collection operations. Many of these programs are operated by private companies that add fees that may exceed $200, regardless of the amount of the check. They call these operations "bad check enforcement," or "bad check restitution," or "bad check diversion." Sometime, these programs are actually run in house by real prosecutors. The private companies send check writers letters which state basically, that to avoid being prosecuted, the check writer may enroll in an expensive diversion program. In most instances, the prosecution threats are false and made only to coerce payment of high fees. In the US very few states have laws that specifically permit district attorneys to allow private collection agencies to collect checks in the district attorney's nam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Check Fraud

Cheque fraud or check fraud (American English) refers to a category of criminal acts that involve making the unlawful use of cheques in order to illegally acquire or borrow funds that do not exist within the account balance or account-holder's legal ownership. Most methods involve taking advantage of the '' float'' (the time between the negotiation of the cheque and its clearance at the cheque writer's financial institution) to draw out these funds. Specific kinds of cheque fraud include cheque kiting, where funds are deposited before the end of the float period to cover the fraud, and paper hanging, where the float offers the opportunity to write fraudulent cheques but the account is never replenished. Types of cheque fraud Cheque kiting Cheque kiting full refers to use of the float to take advantage and delay the notice of non-existent funds. Embezzlement While some cheque kiters fully intend to bring their accounts into good standing, others, often known as ''paper hange ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ChexSystems

ChexSystems is an American check verification service and consumer reporting agency owned by the eFunds subsidiary of Fidelity National Information Services. It provides information about the use of deposit accounts by consumers. History In 1991, the agency was owned by Deluxe Corporation, and it was part of the spin-off from Deluxe that formed eFunds in 1999. Fidelity National Information Services acquired eFunds in 2007. The number of "bank and thrift branches" served in 1991 was 59,000. Services Eighty percent of commercial banks and credit unions in the United States use ChexSystems to screen applicants for checking and savings accounts. eFunds claims that their services are used in over 9,000 banks, including over 100,000 individual bank branches in the United States. As of 1991, ChexSystems held 7.3 million names of consumers whose bank accounts had been closed "for cause". Services include verification of identity, reports on account history, and transaction mon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheques

A cheque (or check in American English) is a document that orders a bank, building society, or credit union, to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked in or a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |