|

SeedInvest

SeedInvest is an equity crowdfunding platform that connects startups with investors online. The company was founded in 2012 and launched in 2013. SeedInvest has focused on building liquidity in the platform by attracting high-net-worth individuals, family offices and venture capital firms. SeedInvest screens and vets deals before allowing them to take advantage of the JOBS Act exemption permitting General Solicitation. In September 2014 the company launched a partnership with Angel Investing website Gust. In October 2018, SeedInvest was acquired by peer-to-peer payment company Circle Internet Financial Ltd. In 2023, StartEngine, a U.S.-based equity crowdfunding platform, officially acquired assets of SeedInvest, from Pluto Holdings, LLC, an affiliate of Circle Internet Financial. Funding SeedInvest raised a significant portion of its own $4.15 million Series A funding round online in April 2014. It was led by Scout Ventures, a venture capital firm, and a mix of other v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Circle (company)

Circle Internet Group, Inc., doing business as Circle, is a peer-to-peer payments technology company that now manages the stablecoin USD Coin, USDC, a cryptocurrency the value of which is Fixed exchange rate system, pegged to the U.S. dollar. It was founded by Jeremy Allaire and Sean Neville in October 2013. Circle was founded and headquartered in Boston, Massachusetts, but is currently headquartered in New York City. USDC, the second largest stablecoin worldwide, is designed to hold at or near a stable price of $1. The majority of its stablecoin collateral is held in short-term U.S. government securities. Funding The company has received over million in venture capital from 4 rounds of investments from 2013 to 2016, including million led by Goldman Sachs. In April 2015 ''The New York Times'' reporter Nathaniel Popper wrote that the Goldman Sachs investment "should help solidify Bitcoin’s reputation as a technology that serious financial firms can work with." In June 2016, Ci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Series A

A series A is the name typically given to a company's first significant round of venture capital financing. It can be followed by the word round, investment or financing. The name refers to the class of preferred stock sold to investors in exchange for their investment. It is usually the first series of stock after the common stock and common stock options issued to company founders, employees, friends and family and angel investors. Series A rounds are traditionally a critical stage in the funding of new companies. Series A investors typically purchase 10% to 30% of the company. The capital raised during a series A is usually intended to capitalize the company for 6 months to 2 years as it develops its products, performs initial marketing and branding, hires its initial employees, and otherwise undertakes early stage business operations. It may be followed by more rounds ( Series B, Series C, etc). Sources of capital Because there are no public exchanges listing their secu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

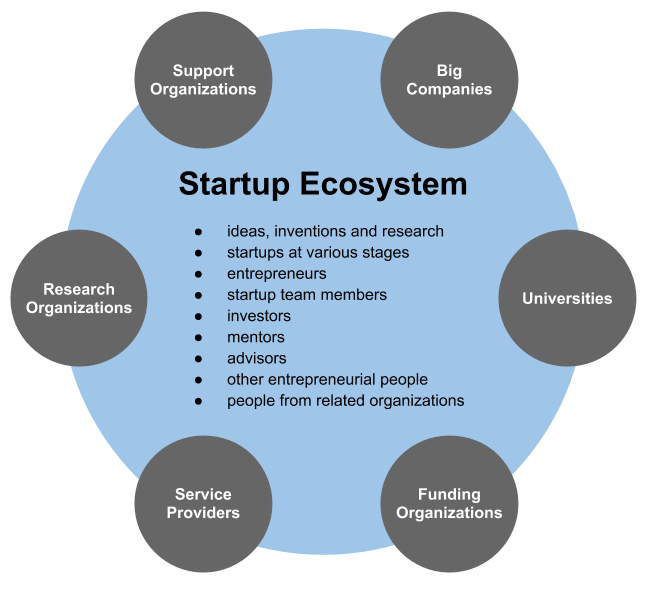

Startup Company

A startup or start-up is a company or project undertaken by an Entrepreneurship, entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship includes all new businesses including self-employment and businesses that do not intend to Initial public offering, go public, startups are new businesses that intend to grow large beyond the solo-founder. During the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to become successful and influential, such as unicorn (finance), unicorns.Erin Griffith (2014)Why startups fail, according to their founders, Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will do the market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate thei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity Crowdfunding

Equity crowdfunding is the online offering of private company securities to a group of people for investment and therefore it is a part of the capital markets. Because equity crowdfunding involves investment into a commercial enterprise, it is often subject to securities and financial regulation. Equity crowdfunding is also referred to as crowdinvesting, investment crowdfunding, or crowd equity. Equity crowdfunding is a mechanism that enables broad groups of investors to fund startup companies and small businesses in return for equity. Investors give money to a business and receive ownership of a small piece of that business. If the business succeeds, then its value goes up, as well as the value of a share in that business—the converse is also true. Coverage of equity crowdfunding indicates that its potential is greatest with startup businesses that are seeking smaller investments to achieve establishment, while follow-on funding (required for subsequent growth) may come fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regulation A

In the United States under the Securities Act of 1933, any offer to sell securities must either be registered with the United States Securities and Exchange Commission (SEC) or meet certain qualifications to exempt it from such registration. Regulation A (or Reg A) contains rules providing exemptions from the registration requirements, allowing some companies to use equity crowdfunding to offer and sell their securities without having to register the securities with the SEC. Regulation A offerings are intended to make access to capital possible for small and medium-sized companies that could not otherwise bear the costs of a normal SEC registration and to allow nonaccredited investors to participate in the offering. The regulation is found under Title 17 of the Code of Federal Regulations, chapter 2, part 230. The legal citation is 17 C.F.R. §230.251 ''et seq.'' On March 25, 2015, the SEC issued new final regulations amending Regulation A. Montana and Massachusetts state regulator ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York City

New York, often called New York City (NYC), is the most populous city in the United States, located at the southern tip of New York State on one of the world's largest natural harbors. The city comprises five boroughs, each coextensive with a respective county. The city is the geographical and demographic center of both the Northeast megalopolis and the New York metropolitan area, the largest metropolitan area in the United States by both population and urban area. New York is a global center of finance and commerce, culture, technology, entertainment and media, academics, and scientific output, the arts and fashion, and, as home to the headquarters of the United Nations, international diplomacy. With an estimated population in 2024 of 8,478,072 distributed over , the city is the most densely populated major city in the United States. New York City has more than double the population of Los Angeles, the nation's second-most populous city. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 2012

Finance refers to monetary resources and to the study and discipline of money, currency, assets and liabilities. As a subject of study, is a field of Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into personal, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. Due to its wide scope, a broad range of subfields exists within finance. Asset-, money-, risk- and investment management aim to maximize value and minimize volatility. Financial analysis assesses the viability, stability, and prof ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity Crowdfunding Platforms

Equity may refer to: Finance, accounting and ownership *Equity (finance), ownership of assets that have liabilities attached to them ** Stock, equity based on original contributions of cash or other value to a business ** Home equity, the difference between the market value and unpaid mortgage balance on a home ** Private equity, stock in a privately held company ** The equity method of accounting for large investment interests Business, justice and law * Equity (law), in common law jurisdictions * Equity (economics), the study of fairness in economics * Educational equity, the study and achievement of population-proportionate group inclusion and credentialing in education * Intergenerational equity, equality and fairness in relationships between people in different generations (including those yet to be born) * Equity theory, on the relations and perceptions of fairness in distributions of resources within social and professional situations. * Employment equity (Canada), polic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jumpstart Our Business Startups Act

The Jumpstart Our Business Startups Act, or JOBS Act, is a law intended to encourage funding of small businesses in the United States by easing many of the country's securities regulations. It passed with bipartisan support, and was signed into law by President Barack Obama on April 5, 2012. Title III, also known as the CROWDFUND Act, has drawn the most public attention because it creates a way for companies to use crowdfunding to issue securities, something that was not previously permitted. Title II went into effect on September 23, 2013. On October 30, 2015, the SEC adopted final rules allowing Title III equity crowdfunding. These rules went into effect on May 16, 2016; this section of the law is known as Regulation CF. Other titles of the Act had previously become effective in the years since the Act's passage. Legislative history Following a decrease in small business activity in the wake of the 2008 financial crisis, Congress considered a number of solutions to help sp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Congress

The United States Congress is the legislature, legislative branch of the federal government of the United States. It is a Bicameralism, bicameral legislature, including a Lower house, lower body, the United States House of Representatives, U.S. House of Representatives, and an Upper house, upper body, the United States Senate, U.S. Senate. They both meet in the United States Capitol in Washington, D.C. Members of Congress are chosen through direct election, though vacancies in the Senate may be filled by a Governor (United States), governor's appointment. Congress has a total of 535 voting members, a figure which includes 100 United States senators, senators and 435 List of current members of the United States House of Representatives, representatives; the House of Representatives has 6 additional Non-voting members of the United States House of Representatives, non-voting members. The vice president of the United States, as President of the Senate, has a vote in the Senate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regulation D (SEC)

In the United States under the Securities Act of 1933, any offer to sell securities must either be registered with the United States Securities and Exchange Commission (SEC) or meet certain qualifications to exempt them from such registration. Regulation D (Reg D) contains the rules providing exemptions from the registration requirements, allowing some companies to offer and sell their securities without having to register the securities with the SEC. A Regulation D offering is intended to make access to the capital markets possible for small companies that could not otherwise bear the costs of a normal SEC registration. Reg D may also refer to an investment strategy, mostly associated with hedge funds, based upon the same regulation. The regulation is found under Title 17 of the Code of Federal Regulations In the law of the United States, the ''Code of Federal Regulations'' (''CFR'') is the codification of the general and permanent regulatory law, regulations promulgated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |