|

SPACs

A special-purpose acquisition company (SPAC; ), also known as a blank check company or a blind-pool stock offering, is a shell corporation listed on a stock exchange with the purpose of acquiring (or merging with) a private company, thus taking the private company public through a procedure which requires less regulatory filings and has less safeguards for investors than the initial public offering (IPO) process. According to the U.S. Securities and Exchange Commission (SEC), SPACs are created specifically to pool funds to finance a future merger or acquisition opportunity within a set timeframe; these opportunities usually have yet to be identified while raising funds. In the U.S., SPACs are registered with the SEC and considered publicly traded companies. The general public may buy their shares on stock exchanges before any merger or acquisition takes place. For this reason they have at times been referred to as the "poor man's private equity funds." The majority of companies p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Everything Bubble

The expression "everything bubble" refers to the correlated impact of monetary easing by the Federal Reserve (and followed by the European Central Bank and the Bank of Japan) on asset prices in most asset classes, namely equities, housing, bonds, many commodities, and even exotic assets such as cryptocurrencies and SPACs. The policy itself and the techniques of direct and indirect methods of quantitative easing used to execute it are sometimes referred to as the Fed put. Modern monetary theory advocates the use of such tools, even in non-crisis periods, to create economic growth through asset price inflation. The term "everything bubble" first came in use during the chair of Janet Yellen, but it is most associated with the subsequent chair of Jerome Powell, and the 2020–2021 period of the coronavirus pandemic. The everything bubble was not only notable for the simultaneous extremes in valuations recorded in a wide range of asset classes and the high level of speculation in th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shell Corporation

A shell corporation is a company or corporation with no significant assets or operations often formed to obtain financing before beginning business. Shell companies were primarily vehicles for lawfully hiding the identity of their beneficial owners, and this is still the defining feature of shell companies due to the loopholes in the global corporate transparency initiatives. It may hold passive investments or be the registered owner of assets, such as intellectual property, or ships. Shell companies may be registered to the address of a company that provides a service setting up shell companies, and which may act as the agent for receipt of legal correspondence (such as an accountant or lawyer). The company may serve as a vehicle for business transactions without itself having any significant assets or operations. Shell companies are used for legitimate purposes but can be used for tax evasion, tax avoidance, money laundering, to dodge current or future lawsuits or to achi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust Law

A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a designated person. In the English common law, the party who entrusts the property is known as the "settlor", the party to whom it is entrusted is known as the "trustee", the party for whose benefit the property is entrusted is known as the "beneficiary", and the entrusted property is known as the "corpus" or "trust property". A ''testamentary trust'' is an irrevocable trust established and funded pursuant to the terms of a deceased person's will. An inter vivos trust is a trust created during the settlor's life. The trustee is the legal owner of the assets held in trust on behalf of the trust and its beneficiaries. The beneficiaries are equitable owners of the trust property. Trustees have a fiduciary duty to manage the trust for the benefit of the equitable owners. Trustees must provide regular accountings of trust income ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loyens & Loeff

Loyens & Loeff N.V. (L&L) is an international law and tax firm headquartered in Rotterdam. It has offices in the Netherlands, Belgium, Luxembourg and Switzerland (home markets), as well as representation offices in major international financial centres. It is ranked as the second firm in the European 100 ranking by The Lawyer. The firm has about 1.500 employees, including more than 800 tax and legal advisers. Loyens & Loeff and its professionals regularly appear in national and regional rankings in the top tiers. Loyens & Loeff was presented with the "Law firm of the year: Benelux" award by The Lawyer in its European Awards 2021. History Loyens & Loeff was created in 2000 through a merger between the tax law firm Loyens & Volkmaars and part of the law firm Loeff Claeys Verbeke. See also *Law firms of the Netherlands In 2019, the top 50 Dutch law firms () had around 4,476 attorneys () and the top 30 law firms had around 183 notaries () and 527 candidate notaries. According to the C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BofA

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina, with investment banking and auxiliary headquarters in Manhattan. The bank was founded by the merger of NationsBank and Bank of America (1904–1998), Bank of America in 1998. It is the List of largest banks in the United States, second-largest banking institution in the United States and the second-largest bank in the world by market capitalization, both after JPMorgan Chase. Bank of America is one of the Big Four (banking)#United States, Big Four banking institutions of the United States. and one of eight systemically important financial institutions in the US. It serves about 10 percent of all American bank deposits, in direct competition with JPMorgan Chase, Citigroup, and Wells Fargo. Its primary financial se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Goldman Sachs

The Goldman Sachs Group, Inc. ( ) is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many international financial centers. Goldman Sachs is the second-largest investment bank in the world by revenue and is ranked 55th on the ''Fortune'' 500 list of the largest United States corporations by total revenue. In the Forbes Global 2000 of 2024, Goldman Sachs ranked 23rd. It is considered a systemically important financial institution by the Financial Stability Board. Goldman Sachs offers services in investment banking (advisory for mergers and acquisitions and restructuring), securities underwriting, prime brokerage, asset management, and wealth management. It is a market maker for many types of financial products and provides clearing and custodian bank services. It operates private-equity funds and hedge funds. It structures complex and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Suisse

Credit Suisse Group AG (, ) was a global Investment banking, investment bank and financial services firm founded and based in Switzerland. According to UBS, eventually Credit Suisse was to be fully integrated into UBS. While the integration was yet to be completed, both banks are operating separately. However, on May 31, 2024, it was announced that Credit Suisse ceased to exist. Headquartered in Zürich, as a standalone firm, it maintained offices in all major financial centres around the world and provided services in investment banking, private banking, asset management, and shared services. It was known for strict Bank secrecy, bank–client confidentiality and Banking in Switzerland, banking secrecy. The Financial Stability Board considered it to be a Systemically important financial institution, global systemically important bank. Credit Suisse was also a primary dealer and Forex counterparty of the Federal Reserve in the United States. Credit Suisse was founded in 185 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

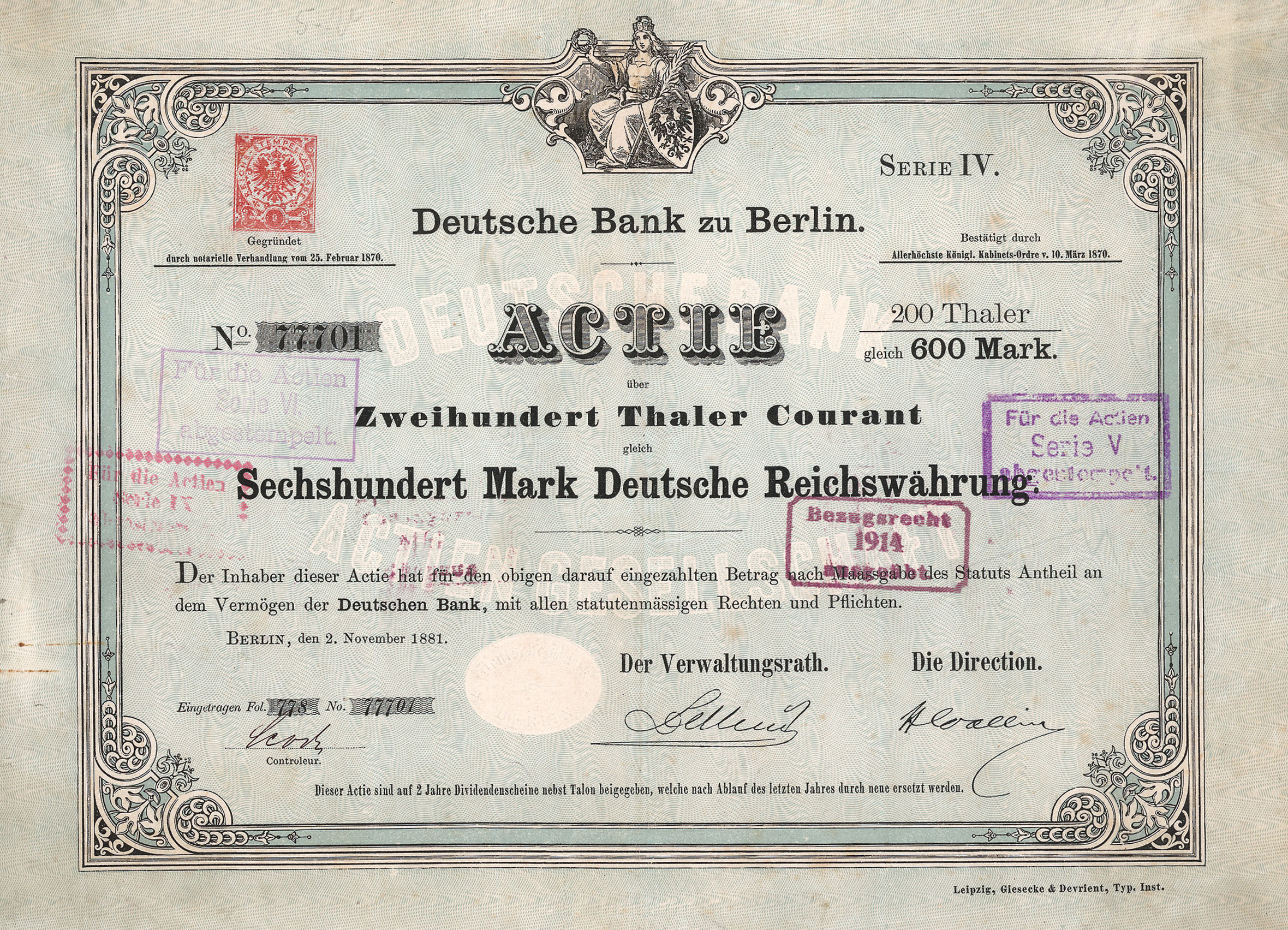

Deutsche Bank

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. Deutsche Bank was founded in 1870 in Berlin. From 1929 to 1937, following its merger with Disconto-Gesellschaft, it was known as ''Deutsche Bank und Disconto-Gesellschaft'' or DeDi-Bank. Other transformative acquisitions have included those of Mendelssohn & Co. in 1938, Morgan, Grenfell & Company, Morgan Grenfell in 1990, Bankers Trust in 1998, and Deutsche Postbank in 2010. As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. It is a component of the DAX stock market index and is often referred to as the List of banks in Germany, largest German banking institution, with Deutsche Bank holding the majority stake in DWS Group for combined assets of 2.2 trillion euros, rivaling even Spa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cantor Fitzgerald

Cantor Fitzgerald, L.P. is an American financial services firm that was founded in 1945. It specializes in institutional equity, fixed-income sales and trading, and serving the middle market with investment banking services, prime brokerage, and commercial real estate financing. It is also active in new businesses, including advisory and asset management services, gaming technology, and e-commerce. It has more than 5,000 institutional clients. Cantor Fitzgerald is one of 24 primary dealers that are authorized to trade US government securities with the Federal Reserve Bank of New York. Cantor Fitzgerald's 1,600 employees work in more than 30 locations, including financial centers in the Americas, Europe, Asia-Pacific, and the Middle East. Together with its affiliates, Cantor Fitzgerald operates in more than 60 offices in 20 countries and has more than 12,500 employees. Before 2001, the company's headquarters were located between the 101st and 105th floors of the North Tower o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

I-Bankers Direct

I-Bankers Direct operates an online funding platform that provides accredited individual investors with the ability to evaluate and invest in early-stage companies. The platform provides access to video presentations, offering documents, management conference calls, company slide decks and other decision-making support. The company is headquartered in New York City, and maintains offices in Palo Alto, California and Lugano Lugano ( , , ; ) is a city and municipality within the Lugano District in the canton of Ticino, Switzerland. It is the largest city in both Ticino and the Italian-speaking region of southern Switzerland. Lugano has a population () of , and an u ..., Switzerland. It was founded in 2012 by entrepreneurs and investment banking professionals Mike McCrory and John Kallassy with the goal of transforming the process of investing in growth-stage companies. References Crowdfund Insider, July 18, 2013: "Crowdfunding Platform I-Bankers Direct Comments on General Solic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bookrunner

In investment banking, a bookrunner is usually the main underwriter or lead-manager/arranger/coordinator in equity, debt, or hybrid securities issuances. The bookrunner usually syndicates with other investment banks in order to lower its risk. The bookrunner is listed first among all underwriters participating in the issuance. When more than one bookrunner manages a security issuance, the parties are referred to as "joint bookrunners", or a "multi-bookrunner syndicate". The bank that runs the books is the closest one to the issuer and controls the allocations of shares In financial markets, a share (sometimes referred to as stock or equity) is a unit of equity ownership in the capital stock of a corporation. It can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Sha ... to investors, holding significant discretion in doing so, which places the bookrunner in a very favored position. References External linksNew Look mandate continu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |