|

Reciprocal Tariff Act

The Reciprocal Tariff Act (enacted June 12, 1934, ch. 474, , ) provided for the negotiation of tariff agreements between the United States and separate nations, particularly Latin American countries. The Act served as an institutional reform intended to authorize the president to negotiate with foreign nations to reduce tariffs in return for reciprocal reductions in tariffs in the United States up to 50%. It resulted in a reduction of duties. This was the policy of the low tariff Democrats in response to the high tariff Republican program which produced the Smoot–Hawley tariff of 1930 that raised rates, and sharply reduced international trade. The Reciprocal Tariff Act was promoted heavily by Secretary of State Cordell Hull. Reciprocal Tariff Act of 1934 President Franklin D. Roosevelt signed the Reciprocal Trade Agreements Act (RTAA) into law in 1934. It gave the president power to negotiate bilateral, reciprocal trade agreements with other countries and enabled Roosevelt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Franklin D

Franklin may refer to: People * Franklin (given name) * Franklin (surname) * Franklin (class), a member of a historical English social class Places Australia * Franklin, Tasmania, a township * Division of Franklin, federal electoral division in Tasmania * Division of Franklin (state), state electoral division in Tasmania * Franklin, Australian Capital Territory, a suburb in the Canberra district of Gungahlin * Franklin River, river of Tasmania * Franklin Sound, waterway of Tasmania Canada * District of Franklin, a former district of the Northwest Territories * Franklin, Quebec, a municipality in the Montérégie region * Rural Municipality of Franklin, Manitoba * Franklin, Manitoba, an unincorporated community in the Rural Municipality of Rosedale, Manitoba * Franklin Glacier Complex, a volcano in southwestern British Columbia * Franklin Range, a mountain range on Vancouver Island, British Columbia * Franklin River (Vancouver Island), British Columbia * Franklin Strai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Imports

An import is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade. In international trade, the importation and exportation of goods are limited by import quotas and mandates from the customs authority. The importing and exporting jurisdictions may impose a tariff (tax) on the goods. In addition, the importation and exportation of goods are subject to trade agreements between the importing and exporting jurisdictions. History Definition Imports consist of transactions in goods and services to a resident of a jurisdiction (such as a nation) from non-residents. The exact definition of imports in national accounts includes and excludes specific "borderline" cases. Importation is the action of buying or acquiring products or services from another country or another market other than own. Imports are important for the economy because they allow a country to supply nonexistent, scarc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quid Pro Quo

Quid pro quo ('what for what' in Latin) is a Latin phrase used in English to mean an exchange of goods or services, in which one transfer is contingent upon the other; "a favor for a favor". Phrases with similar meanings include: "give and take", "tit for tat", "you scratch my back, and I'll scratch yours", and "one hand washes the other". Other languages use other phrases for the same purpose. Origins The Latin phrase ''quid pro quo'' originally implied that something had been substituted, as in ''this instead of that''. Early usage by English speakers followed the original Latin meaning, with occurrences in the 1530s where the term referred to substituting one medicine for another, whether unintentionally or fraudulently. By the end of the same century, ''quid pro quo'' evolved into a more current use to describe equivalent exchanges. In 1654, the expression ''quid pro quo'' was used to generally refer to something done for personal gain or with the expectation of reciprocity ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Act Of 1913

The Revenue Act of 1913, also known as the Underwood Tariff or the Underwood-Simmons Act (ch. 16, ), re-established a federal income tax in the United States and substantially lowered tariff rates. The act was sponsored by Representative Oscar Underwood, passed by the 63rd United States Congress, and signed into law by President Woodrow Wilson. Wilson and other members of the Democratic Party had long seen high tariffs as equivalent to unfair taxes on consumers, and tariff reduction was President Wilson's first priority upon taking office. Following the ratification of the Sixteenth Amendment in 1913, Democratic leaders agreed to seek passage of a major bill that would dramatically lower tariffs and implement an income tax. Underwood quickly shepherded the revenue bill through the House of Representatives, but the bill won approval in the United States Senate only after extensive lobbying by the Wilson administration. Wilson signed the bill into law on October 3, 1913. The Rev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wilson–Gorman Tariff Act

The Revenue Act or Wilson-Gorman Tariff of 1894 (ch. 349, §73, , August 27, 1894) slightly reduced the United States tariff rates from the numbers set in the 1890 McKinley tariff and imposed a 2% tax on income over $4,000. It is named for William L. Wilson, Representative from West Virginia, chair of the U.S. House Ways and Means Committee, and Senator Arthur P. Gorman of Maryland, both Democrats. Supported by pro-free trade members of the Democratic Party, this attempt at tariff reform imposed the first peacetime income tax (2% on income over $4,000, or $88,100 in 2010 dollars, which meant fewer than 1% of households would pay any). The purpose of the income tax was to make up for revenue that would be lost by tariff reductions. The democrats under the Cleveland administration wanted to move away from the protectionism proposed by the McKinley tariff while Cleveland was still in office. By coincidence, $4,000 ($88,100 in 2010 dollars) would be the exemption for married c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Liberalization

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold economically liberal positions, while economic nationalist and left-wing political parties generally support protectionism, the opposite of free trade. Most nations are today members of the World Trade Organization multilateral trade agreements. Free trade was best exemplified by the unilateral stance of Great Britain who reduced regulations and duties on imports and exports from the mid-nineteenth century to the 1920s. An alternative approach, of creating free trade areas between groups of countries by agreement, such as that of the European Economic Area and the Mercosur open markets, creates a protectionist barrier between that free trade area and the rest of the world. Most governments still impose some protectionist policies that are inten ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Policy

A State (polity), state's foreign policy or external policy (as opposed to internal or domestic policy) is its objectives and activities in relation to its interactions with other states, unions, and other political entities, whether bilaterally or through multilateralism, multilateral platforms.Foreign policy ''Encyclopedia Britannica'' (published January 30, 2020). The ''Encyclopedia Britannica'' notes that a government's foreign policy may be influenced by "domestic considerations, the policies or behaviour of other states, or plans to advance specific geopolitical designs." History The idea of long-term management of relationships followed the development of professional diplomatic corps that managed diplomacy. In the 18th century, due to extreme turbulence in History of Europe# ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Agreements

A trade agreement (also known as trade pact) is a wide-ranging taxes, tariff and trade treaty that often includes investment guarantees. It exists when two or more countries agree on terms that help them trade with each other. The most common trade agreements are of the preferential and free trade types, which are concluded in order to reduce (or eliminate) tariffs, quotas and other trade restrictions on items traded between the signatories. The logic of formal trade agreements is that they outline what is agreed upon and the punishments for deviation from the rules set in the agreement. Trade agreements therefore make misunderstandings less likely, and create confidence on both sides that cheating will be punished; this increases the likelihood of long-term cooperation. An international organization, such as the IMF, can further incentivize cooperation by monitoring compliance with agreements and reporting third countries of the violations. Monitoring by international agencie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reciprocity (international Relations)

In international relations and treaties, the principle of reciprocity states that favors, benefits, or penalties that are granted by one state to the citizens or legal entities of another, should be returned in kind. For example, reciprocity has been used in the reduction of tariffs, the grant of copyrights to foreign authors, the mutual recognition and enforcement of judgments, and the relaxation of travel restrictions and visa requirements. The principle of reciprocity also governs agreements on extradition. Specific and diffuse reciprocity Several theorists have drawn a distinction between specific forms of reciprocity and "diffuse reciprocity" (Keohane 1986). While specific reciprocity is exemplified by international trade negotiations, as suggested above, diffuse reciprocity points to a wider institutionalisation of trust. Through consistent cooperation in an international society, states are seen as building generally accepted standards of behaviour. These general standar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Two-thirds Majority

{{numberdis ...

2/3 may refer to: * A fraction with decimal value 0.6666... * A way to write the expression "2 ÷ 3" ("two divided by three") * 2nd Battalion, 3rd Marines of the United States Marine Corps * February 3 * March 2 Events Pre-1600 * 537 – Siege of Rome: The Ostrogoth army under king Vitiges begins the siege of the capital. Belisarius conducts a delaying action outside the Flaminian Gate; he and a detachment of his ''bucellarii'' are almost cut o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Majority

A majority, also called a simple majority or absolute majority to distinguish it from #Related terms, related terms, is more than half of the total.Dictionary definitions of ''majority'' aMerriam-Webster Oxford English Dictionary an Cambridge English Dictionary It is a subset of a Set (mathematics), set consisting of more than ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

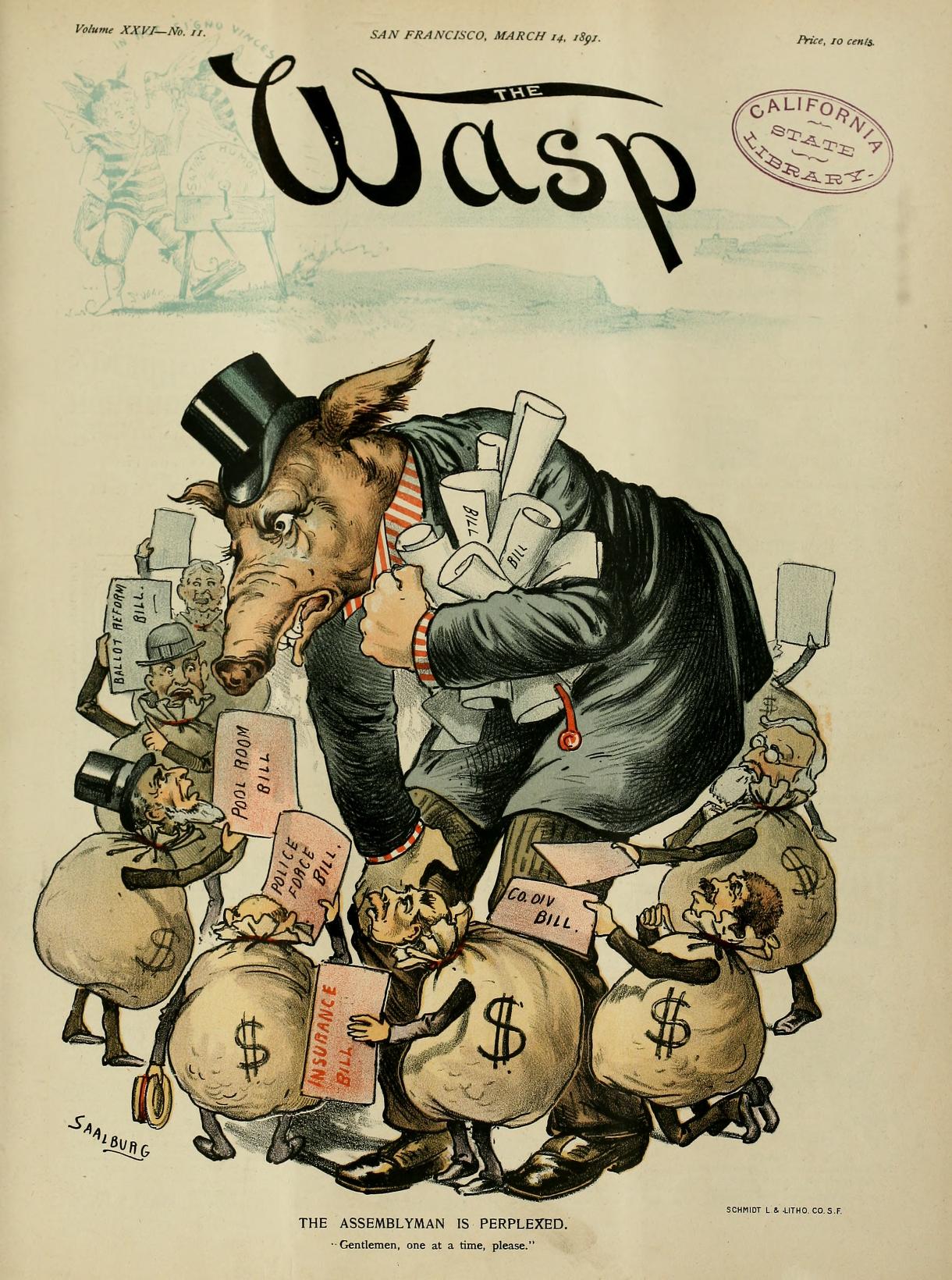

Lobbyists

In politics, lobbying, persuasion or interest representation is the act of lawfully attempting to influence the actions, policies, or decisions of government officials, most often legislators or members of regulatory agencies. Lobbying, which usually involves direct, face-to-face contact, is done by many types of people, associations and organized groups, including individuals in the private sector, corporations, fellow legislators or government officials, or advocacy groups (interest groups). Lobbyists may be among a legislator's constituencies, meaning a voter or bloc of voters within their electoral district; they may engage in lobbying as a business. Professional lobbyists are people whose business is trying to influence legislation, regulation, or other government decisions, actions, or policies on behalf of a group or individual who hires them. Individuals and nonprofit organizations can also lobby as an act of volunteering or as a small part of their normal job. Governm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |