|

Residuary Estate

A residuary estate, in the law of wills, is any portion of the testator's estate that is not specifically devised to someone in the will, or any property that is part of such a specific devise that fails. It is also known as a residual estate or simply residue. The will may identify the taker of the residuary estate through a ''residuary clause'' or ''residuary bequest''. The person identified in such a clause is called the ''residuary taker'', ''residuary beneficiary'', ''residuary legatee'', or ''residuary devisee''.HM Revenue and CustomsTSEM11000 - Glossary ''Trusts, Settlements and Estates Manual'', updated on 27 November 2024, accessed on 12 January 2025 Such a clause may state that, in the event that all other heirs predecease the testator, the estate would pass to a charity (that would, presumably, have remained in existence). If no such clause is present, however, the residuary estate will pass to the testator's heirs by intestacy. At common law Common law (also ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

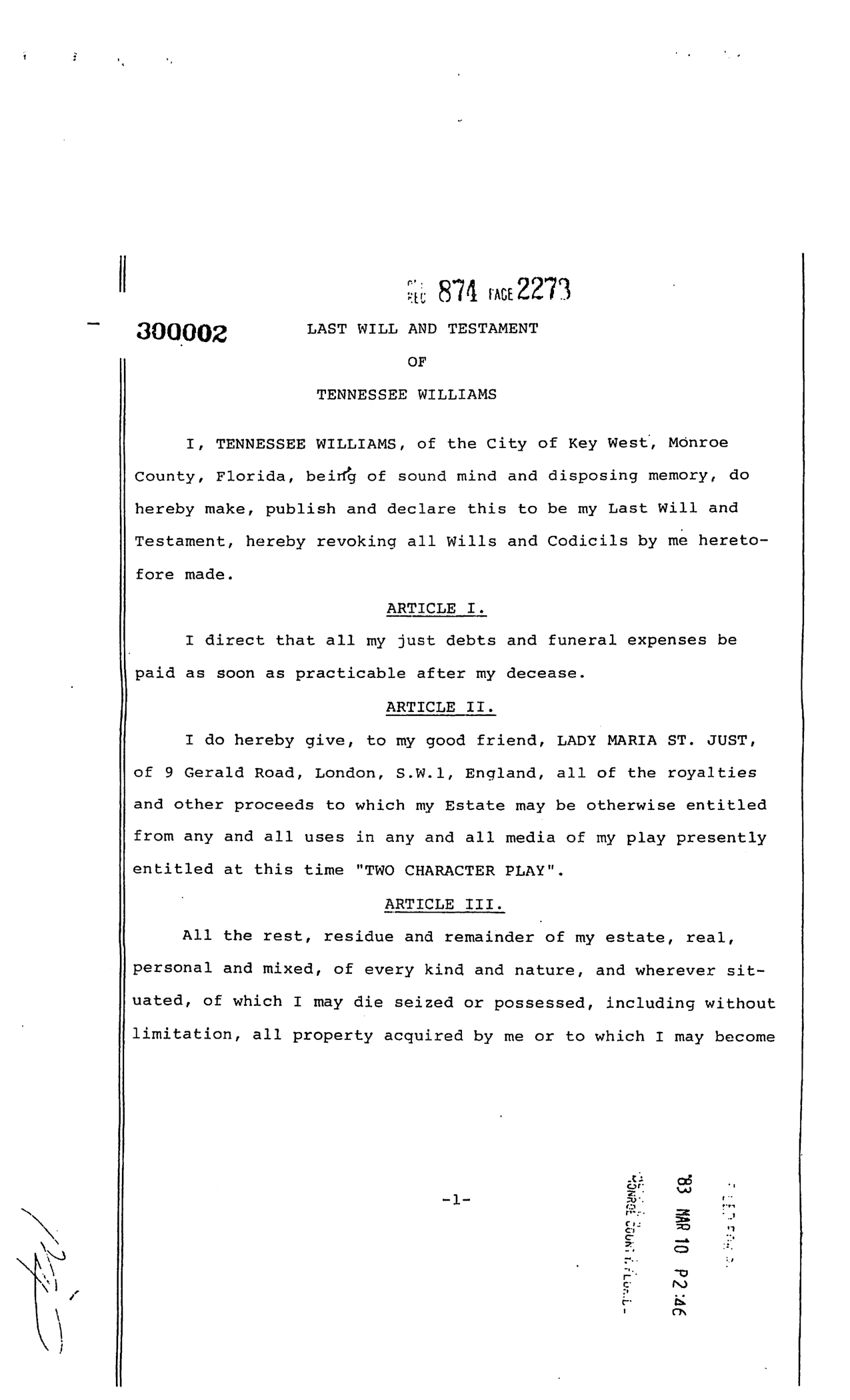

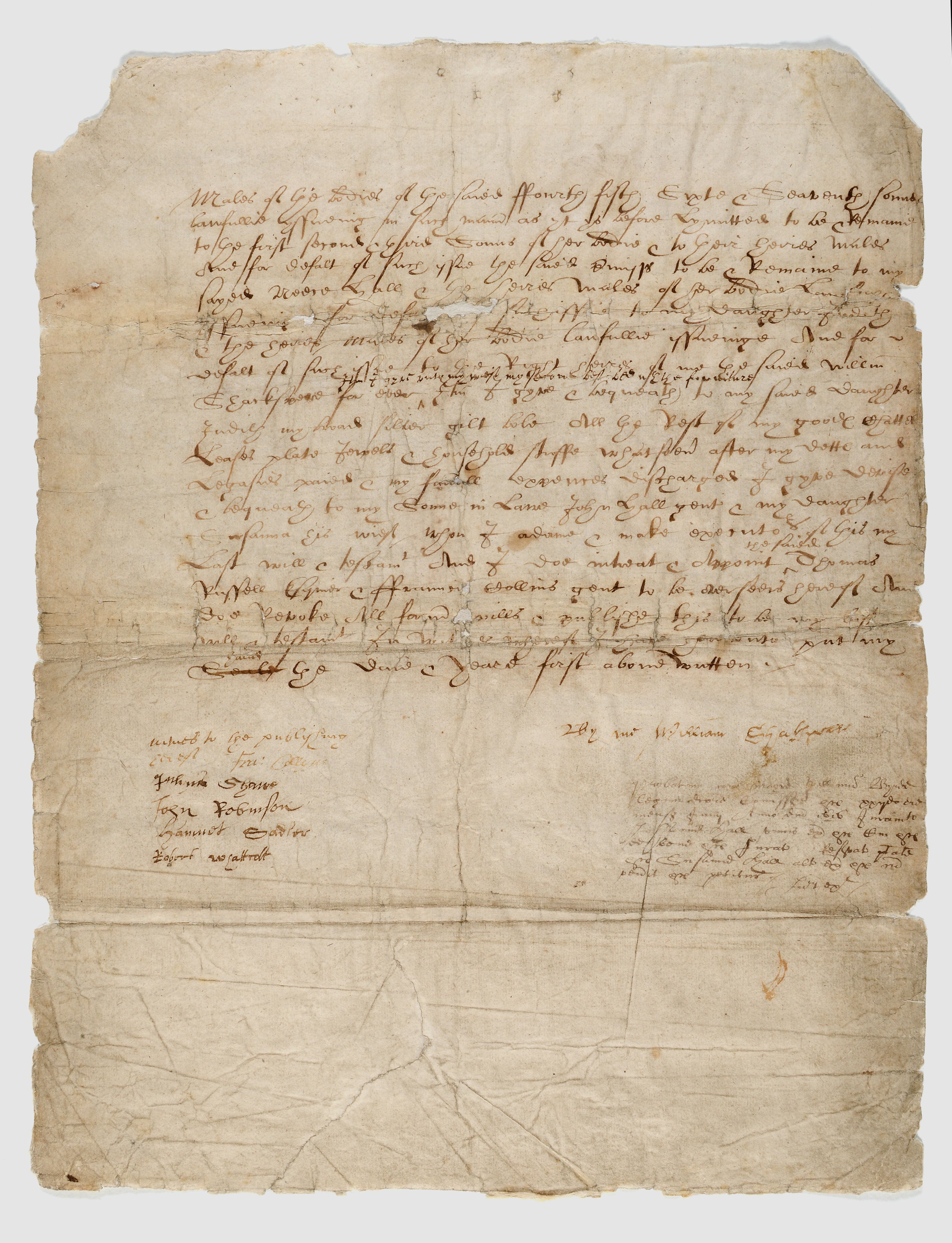

Will (law)

A will and testament is a legal document that expresses a person's (testator) wishes as to how their property ( estate) is to be distributed after their death and as to which person ( executor) is to manage the property until its final distribution. For the distribution (devolution) of property not determined by a will, see inheritance and intestacy. Though it has been thought a "will" historically applied only to real property, while "testament" applied only to personal property (thus giving rise to the popular title of the document as "last will and testament"), records show the terms have been used interchangeably. Thus, the word "will" validly applies to both personal and real property. A will may also create a testamentary trust that is effective only after the death of the testator. History Throughout most of the world, the disposition of a dead person's estate has been a matter of social custom. According to Plutarch, the written will was invented by Solon. Originally ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Testator

A testator () is a person who has written and executed a last will and testament that is in effect at the time of their death. It is any "person who makes a will."Gordon Brown, ''Administration of Wills, Trusts, and Estates'', 3d ed. (2003), p. 556. . Related terms * A female testator is sometimes referred to as a testatrix (), plural testatrices (), particularly in older cases. *In Ahmadiyya Islam, a testator is referred to as a moosi, who is someone that has signed up for Wasiyyat or a will, under the plan initiated by the Promised Messiah, thus committing a portion, not less than one-tenth, of his lifetime earnings and any property to a cause. * The adjectival form of the word is testamentary, as in: # Testamentary capacity, or mental capacity or ability to execute a will and # Testamentary disposition, or gift made in a will (see that article for types). # Testamentary trust, a trust that is created in a will. * A will Will may refer to: Common meanings * Will an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate (law)

In common law, an estate is a living or deceased person's net worth. It is the sum of a person's assets – the legal rights, interests, and entitlements to property of any kind – less all liabilities at a given time. The issue is of special legal significance on a question of bankruptcy and death of the person. (See inheritance.) Depending on the particular context, the term is also used in reference to an estate in land or of a particular kind of property (such as real estate or personal estate). The term is also used to refer to the sum of a person's assets only. The equivalent in civil law legal systems is patrimony. Bankruptcy Under United States bankruptcy law, a person's estate consists of all assets or property of any kind available for distribution to creditors. However, some assets are recognized as exempt to allow a person significant resources to restart their financial life. In the United States, asset exemptions depend on various factors, inclu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bequest

A devise is the act of giving real property by will, traditionally referring to real property. A bequest is the act of giving property by will, usually referring to personal property. Today, the two words are often used interchangeably due to their combination in many wills as ''devise and bequeath'', a legal doublet. The phrase ''give, devise, and bequeath'', a legal triplet, has been used for centuries, including the will of William Shakespeare. The word ''bequeath'' is a verb form for the act of making a ''bequest''. Etymology Bequest comes from Old English , "to declare or express in words"—cf. "quoth". Interpretations Part of the process of probate involves interpreting the instructions in a will. Some wordings that define the scope of a bequest have specific interpretations. "All the estate I own" would involve all of the decedent's possessions at the moment of death. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beneficiary

A beneficiary in the broadest sense is a natural person or other legal entity who receives money or other benefits from a benefactor. For example, the beneficiary of a life insurance policy is the person who receives the payment of the amount of insurance after the death of the insured. In trust law, beneficiaries are also known as '' cestui que use''. Most beneficiaries may be designed to designate where the assets will go when the owner(s) dies. However, if the primary beneficiary or beneficiaries are not alive or do not qualify under the restrictions, the assets will probably pass to the ''contingent beneficiaries''. Other restrictions such as being married or more creative ones can be used by a benefactor to attempt to control the behavior of the beneficiaries. Some situations such as retirement accounts do not allow any restrictions beyond the death of the primary beneficiaries, but trusts allow any restrictions that are not illegal or for an illegal purpose. The concept o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HM Revenue And Customs

His Majesty's Revenue and Customs (commonly HM Revenue and Customs, or HMRC, and formerly Her Majesty's Revenue and Customs) is a department of the UK government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. HMRC was formed by the merger of the Inland Revenue and HM Customs and Excise, which took effect on 18 April 2005. The department's logo is the Tudor Crown enclosed within a circle. Departmental responsibilities The department is responsible for the administration and collection of direct taxes including Income Tax, Corporation Tax, Capital Gains Tax (CGT) and Inheritance Tax (IHT), indirect taxes including Value Added Tax (VAT), excise duties and Stamp Duty Land Tax (SDLT), and environmental taxes such as Air Passenger Duty and the Climate Change Levy. Other aspects of the departmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Heirs

Inheritance is the practice of receiving private property, titles, debts, entitlements, privileges, rights, and obligations upon the death of an individual. The rules of inheritance differ among societies and have changed over time. Officially bequeathing private property and/or debts can be performed by a testator via will, as attested by a notary or by other lawful means. Terminology In law, an "heir" ( heiress) is a person who is entitled to receive a share of property from a decedent (a person who died), subject to the rules of inheritance in the jurisdiction where the decedent was a citizen, or where the decedent died or owned property at the time of death. The inheritance may be either under the terms of a will or by intestate laws if the deceased had no will. However, the will must comply with the laws of the jurisdiction at the time it was created or it will be declared invalid (for example, some states do not recognise handwritten wills as valid, or only in speci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Charitable Organization

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being (e.g. educational, Religion, religious or other activities serving the public interest or common good). The legal definition of a charitable organization (and of charity) varies between countries and in some instances regions of the country. The Charity regulators, regulation, the tax treatment, and the way in which charity law affects charitable organizations also vary. Charitable organizations may not use any of their funds to profit individual persons or entities. However, some charitable organizations have come under scrutiny for spending a disproportionate amount of their income to pay the salaries of their leadership. Financial figures (e.g. tax refunds, revenue from fundraising, revenue from the sale of goods and services or revenue from investment, and funds held in reserve) are indicators to assess the financial sustainability of a charity, especiall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intestacy

Intestacy is the condition of the estate of a person who dies without a legally valid will, resulting in the distribution of their estate under statutory intestacy laws rather than by their expressed wishes. Alternatively this may also apply where a will or declaration has been made, but only applies to part of the estate; the remaining estate forms the "intestate estate". Intestacy law, also referred to as the law of descent and distribution, which vary by jurisdiction, refers to the body of law ( statutory and case law), establish a hierarchy for inheritance, typically prioritizing close relatives such as spouses, children, and then extended family members and determines who is entitled to the property from the estate under the rules of inheritance. History and the common law Intestacy has a limited application in those jurisdictions that follow civil law or Roman law because the concept of a will is itself less important; the doctrine of forced heirship automatically giv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Common Law

Common law (also known as judicial precedent, judge-made law, or case law) is the body of law primarily developed through judicial decisions rather than statutes. Although common law may incorporate certain statutes, it is largely based on precedent—judicial rulings made in previous similar cases. The presiding judge determines which precedents to apply in deciding each new case. Common law is deeply rooted in Precedent, ''stare decisis'' ("to stand by things decided"), where courts follow precedents established by previous decisions. When a similar case has been resolved, courts typically align their reasoning with the precedent set in that decision. However, in a "case of first impression" with no precedent or clear legislative guidance, judges are empowered to resolve the issue and establish new precedent. The common law, so named because it was common to all the king's courts across England, originated in the practices of the courts of the English kings in the centuries fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gift

A gift or present is an item given to someone (who is not already the owner) without the expectation of payment or anything in return. Although gift-giving might involve an expectation of reciprocity, a gift is intended to be free. In many countries, the act of mutually exchanging money, goods, etc., may sustain social relationships and contribute to social cohesion. Economists have elaborated the economics of gift-giving into the notion of a gift economy. By extension, the term ''gift'' can refer to any item or act of service that makes the other happier or less sad, especially as a favor, including forgiveness and kindness. Gifts are often presented on occasions such as birthdays and holidays. History Gift-giving has played a central role in social and economic systems throughout human history. Anthropologist Marcel Mauss argued in '' The Gift'' (1925) that gifts in archaic societies were embedded in systems of obligation, where the act of giving, receiving, and recip ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |