|

Rating Agencies

A credit rating agency (CRA, also called a ratings service) is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of default. An agency may rate the creditworthiness of issuers of debt obligations, of debt instruments, and in some cases, of the servicers of the underlying debt, but not of individual consumers. Other forms of a rating agency include environmental, social and corporate governance (ESG) rating agencies and the Chinese Social Credit System. The debt instruments rated by CRAs include government bonds, corporate bonds, CDs, municipal bonds, preferred stock, and collateralized securities, such as mortgage-backed securities and collateralized debt obligations. The issuers of the obligations or securities may be companies, special purpose entities, state or local governments, non-profit organizations, or sovereign nations. A credit rating facilitates the tradi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Rating

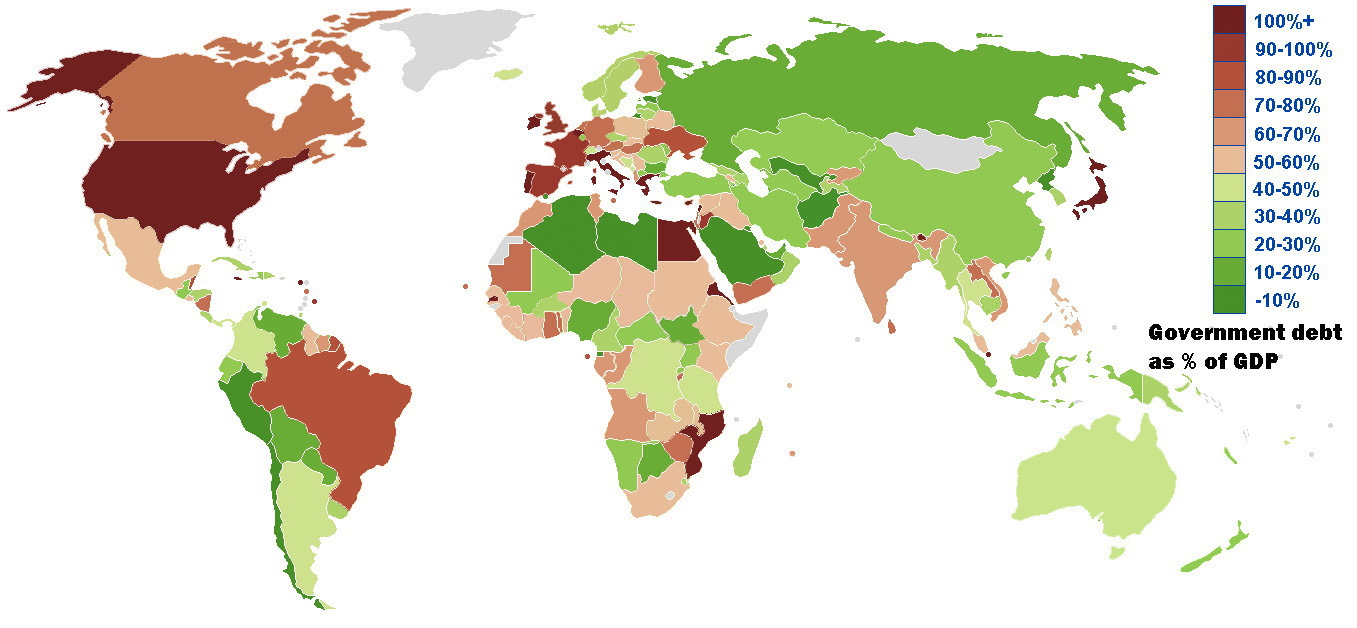

A credit rating is an evaluation of the credit risk of a prospective debtor (an individual, a business, company or a government). It is the practice of predicting or forecasting the ability of a supposed debtor to pay back the debt or default. The credit rating represents an evaluation from a credit rating agency of the qualitative and quantitative information for the prospective debtor, including information provided by the prospective debtor and other non-public information obtained by the credit rating agency's analysts. Credit reporting (or credit score) is a subset of credit rating. It is a numeric evaluation of an ''individual's'' credit worthiness, which is done by a credit bureau or consumer credit reporting agency. Sovereign credit ratings A sovereign credit rating is the credit rating of a sovereign entity, such as a national government. The sovereign credit rating indicates the risk level of the investing environment of a country and is used by investors when looki ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Bureau

A credit bureau is a data collection agency that gathers account information from various creditors and provides that information to a consumer reporting agency in the United States, a credit reference agency in the United Kingdom, a credit reporting body in Australia, a credit information company (CIC) in India, a Special Accessing Entity in the Philippines, and also to private lenders. It is not the same as a credit rating agency. Description A consumer reporting agency is an organization providing information on individuals' borrowing and bill-paying habits. Such credit information institutions reduce the effect of asymmetric information between borrowers and lenders, and alleviate problems of adverse selection and moral hazard. For example, adequate credit information could facilitate lenders in screening and monitoring borrowers as well as avoiding giving loans to high risk individuals. Lenders use this to evaluate credit worthiness, the ability to pay back a loan, and can a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Henry Varnum Poor

Henry Varnum Poor (December 8, 1812 – January 4, 1905) was an American financial analyst and founder of H.V. and H.W. Poor Co, which later evolved into the financial research and analysis bellwether, Standard & Poor's. Biography Born in East Andover, Massachusetts (now Andover, Maine) to Sylvanus and Mary (Merrill) Poor, he was the first of his family to attend college, graduating from Bowdoin in 1835. He was descended from General Enoch Poor of the Revolutionary War. He joined his uncle's law firm, being called to the bar in 1838. Later Henry and his brother John established a law practice in Bangor, Maine. By investing money in Maine's growing timber industry, the Poor brothers made a fortune. John Poor became a minor railway magnate in association with the European and North American Railway, and was heavily involved in the building of the Maine rail network. In 1849, John purchased the '' American Railroad Journal'', of which Henry became manager and editor. In 1860, H ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lewis Tappan

Lewis Tappan (May 23, 1788 – June 21, 1873) was an American abolitionist who in 1841 helped to secure freedom for the enslaved Africans aboard the '' Amistad''. He was born in Northampton, Massachusetts, into a Calvinist household. Tappan was also one of the founders of the American Missionary Association in 1846, which established over 100 anti-slavery Congregational churches throughout the Midwest. After the American Civil War, the association founded numerous schools and colleges to support the education of freedmen. Contacted by Connecticut abolitionists shortly after the ''Amistad'' arrived in port, Tappan devoted significant attention to the captive Africans. He ensured the acquisition of high-quality lawyers for the captives, ultimately leading to their release after the case reached the United States Supreme Court. Alongside his brother Arthur, Tappan not only secured legal assistance and acquittal for the Africans but also successfully bolstered public support and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1837

The Panic of 1837 was a financial crisis in the United States that began a major depression (economics), depression which lasted until the mid-1840s. Profits, prices, and wages dropped, westward expansion was stalled, unemployment rose, and pessimism abounded. The panic had both domestic and foreign origins. Speculation, Speculative lending practices in the West, a sharp decline in cotton prices, a collapsing land bubble, international Bullion coin, specie flows, and restrictive lending policies in Britain were all factors. The lack of a central bank to regulate fiscal matters, which President Presidency of Andrew Jackson, Andrew Jackson had ensured by not extending the charter of the Second Bank of the United States, was also key. The ailing economy of early 1837 led investors to panic, and a bank run ensued, giving the crisis its name. The bank run came to a head on May 10, 1837, when banks in New York City ran out of gold and silver. They immediately suspended hard money (p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fitch Ratings

Fitch Ratings Inc. is an American credit rating agency. It is one of the three nationally recognized statistical rating organizations (NRSRO) designated by the U.S. Securities and Exchange Commission and is considered as being one of the " Big Three credit rating agencies", along with Moody's and Standard & Poor's. History Fitch Ratings is dual headquartered in New York and London. Hearst owns 100 percent of the company following its acquisition of an additional 20 percent for $2.8 billion on April 12, 2018. Hearst had owned 80 percent of the company after increasing its ownership stake by 30 percent on December 12, 2014, in a transaction valued at $1.965 billion. Hearst's previous equity interest was 80 percent following expansions on an original acquisition of 20 percent interest in 2006. Hearst had jointly owned Fitch with FIMALAC SA, which held 20 percent of the company until the 2018 transaction. Fitch Ratings and Fitch Solutions are part of the Fitch Group. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moody's Investors Service

Moody's Ratings, previously and still legally known as Moody's Investors Service and often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its historical name. Moody's Ratings provides international financial research on bonds issued by commercial and government entities. Moody's, along with Standard & Poor's and Fitch Group, is considered one of the Big Three credit rating agencies. It is also included in the ''Fortune'' 500 list of 2021. The company ranks the creditworthiness of borrowers using a standardized ratings scale which measures expected investor loss in the event of default. Moody's Ratings rates debt securities in several bond market segments. These include government, municipal and corporate bonds; managed investments such as money market funds and fixed-income funds; financial institutions including banks and non-bank finance companies; and asset classes in s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard & Poor's

S&P Global Ratings (previously Standard & Poor's and informally known as S&P) is an American credit rating agency (CRA) and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. S&P is considered the largest of the Big Three credit-rating agencies, which also include Moody's Ratings and Fitch Ratings. Its head office is located on 55 Water Street in Lower Manhattan, New York City. Corporate history The company traces its history back to 1860, with the publication by Henry Varnum Poor of ''History of Railroads and Canals in the United States''. This book compiled comprehensive information about the financial and operational state of U.S. railroad companies. In 1868, Henry Varnum Poor established H.V. and H.W. Poor Co. with his son, Henry William Poor, and published two annually updated hardback guidebooks, '' Poor's Manual of the Railroads of the United States'' and ''Poor's Directory of Railway Officials''. In 1906, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Big Three (credit Rating Agencies)

The Big Three credit rating agencies are S&P Global Ratings (S&P), Moody's, and Fitch Group. S&P and Moody's are based in the US, while Fitch is dual-headquartered in New York City and London, and is controlled by Hearst. As of 2013 they hold a collective global market share of "roughly 95 percent" with Moody's and Standard & Poor's having approximately 40% each, and Fitch around 15%. According to an analysis by Deutsche Welle, "their special status has been cemented by law — at first only in the United States, but then in Europe as well." From the mid-1990s until early 2003, the Big Three were the only " Nationally Recognized Statistical Rating Organizations (NRSROs)" in the United States — a designation meaning they were used by the US government in several regulatory areas. (Four other NRSROs merged with Fitch in the 1990s.) The European Union has considered setting up a state-supported EU-based agency. The Asian credit rating market is relatively diverse. Due to the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Sovereign Debt Crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The eurozone member states of Greece, Portugal, Ireland, and Cyprus were unable to repay or refinance their government debt or to bailout fragile banks under their national supervision and needed assistance from other eurozone countries, the European Central Bank (ECB), and the International Monetary Fund (IMF). The crisis included the Greek government-debt crisis, the 2008–2014 Spanish financial crisis, the 2010–2014 Portuguese financial crisis, the post-2008 Irish banking crisis and the post-2008 Irish economic downturn, as well as the 2012–2013 Cypriot financial crisis. The crisis contributed to changes in leadership in Greece, Ireland, France, Italy, Portugal, Spain, Slovenia, Slovakia, Belgium, and the Netherlands as well as in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Hidden History Of The Financial Crisis

''The'' is a grammatical article in English, denoting nouns that are already or about to be mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the most frequently used word in the English language; studies and analyses of texts have found it to account for seven percent of all printed English-language words. It is derived from gendered articles in Old English which combined in Middle English and now has a single form used with nouns of any gender. The word can be used with both singular and plural nouns, and with a noun that starts with any letter. This is different from many other languages, which have different forms of the definite article for different genders or numbers. Pronunciation In most dialects, "the" is pronounced as (with the voiced dental fricative followed by a schwa) when followed by a consonant sound, and as (homophone of the archaic pronoun ''thee' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joe Nocera

Joseph Nocera (born May 6, 1952) is an American business journalist and author. He has written for ''The New York Times'' since April 2005, writing for the editorial page from 2011 to 2015. He was also an opinion columnist for '' Bloomberg Opinion''. He has co-written the books ''The Big Fail'', ''A Piece of the Action'' and '' All the Devils Are Here.'' Early life and education Nocera was born in Providence, Rhode Island. He earned a B.S. in journalism from Boston University in 1974. Career Early years (1970s-2014) Nocera became a business columnist for ''The New York Times'' in April 2005. In March 2011, Nocera became a regular opinion columnist for ''The Times''s Op-Ed page, writing on Tuesdays and Saturdays. He was also a business commentator for NPR’s '' Weekend Edition'' with Scott Simon. 2015-2024 In November 2015, Nocera began writing in the sports page of ''The Times''. Executives at ''The Times'' cited Nocera's interest in sports, specifically injuries to studen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |