|

Private Pension

A private pension is a plan into which individuals contribute from their earnings, which then will pay them a private pension after retirement. It is an alternative to the state pension. Usually, individuals invest funds into saving schemes or mutual funds, run by insurance companies. Often private pensions are also run by the employer and are called occupational pensions. The contributions into private pension schemes are usually tax-deductible. This is similar to the regular pension. History The first evidence of pension payments comes from the Roman Empire in the 1st century BC, but beginnings of private pensions go back to the 19th century. The first private pension plan in the USA was created in 1875 by the American Express Co. But the growth of people coveraged by private pensions was relatively slow. In 1950, only 25 percent of employees in nonagricultural field were anticipated in some private pension system. Situation in the 21st century Nowadays, governments of dev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bert Rürup

Hans-Adalbert Rürup (born 7 November 1943) is a German economist and former chairman of the German Council of Economic Experts. He was formerly a professor of economics at the Darmstadt University of Technology. From 2010 to 2012, he was president of the International School of Management in Dortmund. In 2013 he changed into the ISM's board of trustees and took up a position as the president of the newly founded ''Handelsblatt The ''Handelsblatt'' (literally "commerce paper" in English) is a German-language business newspaper published in Düsseldorf by Handelsblatt Media Group, formerly known as Verlagsgruppe Handelsblatt. History and profile ''Handelsblatt'' was ... Research Institute'' . See also * Rürup-Rente, part of the private pensions in Germany References * 1943 births Living people German economists University of Cologne alumni Academic staff of Technische Universität Darmstadt Commanders Crosses of the Order of Merit of the Federal Republic of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

People And Households Without Private Pensions

A person ( : people) is a being that has certain capacities or attributes such as reason, morality, consciousness or self-consciousness, and being a part of a culturally established form of social relations such as kinship, ownership of property, or legal responsibility. The defining features of personhood and, consequently, what makes a person count as a person, differ widely among cultures and contexts. In addition to the question of personhood, of what makes a being count as a person to begin with, there are further questions about personal identity and self: both about what makes any particular person that particular person instead of another, and about what makes a person at one time the same person as they were or will be at another time despite any intervening changes. The plural form "people" is often used to refer to an entire nation or ethnic group (as in "a people"), and this was the original meaning of the word; it subsequently acquired its use as a plural form of pe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defined Contribution Plan

A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts (through employee contributions and, if applicable, employer contributions) plus any investment earnings on the money in the account. In defined contribution plans, future benefits fluctuate on the basis of investment earnings. The most common type of defined contribution plan is a savings and thrift plan. Under this type of plan, the employee contributes a predetermined portion of his or her earnings (usually pretax) to an individual account, all or part of which is matched by the employer. In the United States, specifies a defined contribution plan as a "plan which provides for an individual account for each participant and for benefits based solely on the amount contributed to the participant's account, and any income, expense ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Annuity

In investment, an annuity is a series of payments made at equal intervals.Kellison, Stephen G. (1970). ''The Theory of Interest''. Homewood, Illinois: Richard D. Irwin, Inc. p. 45 Examples of annuities are regular deposits to a savings account, monthly home mortgage payments, monthly insurance payments and pension payments. Annuities can be classified by the frequency of payment dates. The payments (deposits) may be made weekly, monthly, quarterly, yearly, or at any other regular interval of time. Annuities may be calculated by mathematical functions known as "annuity functions". An annuity which provides for payments for the remainder of a person's lifetime is a life annuity. Types Annuities may be classified in several ways. Timing of payments Payments of an ''annuity-immediate'' are made at the end of payment periods, so that interest accrues between the issue of the annuity and the first payment. Payments of an ''annuity-due'' are made at the beginning of payment p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Burden

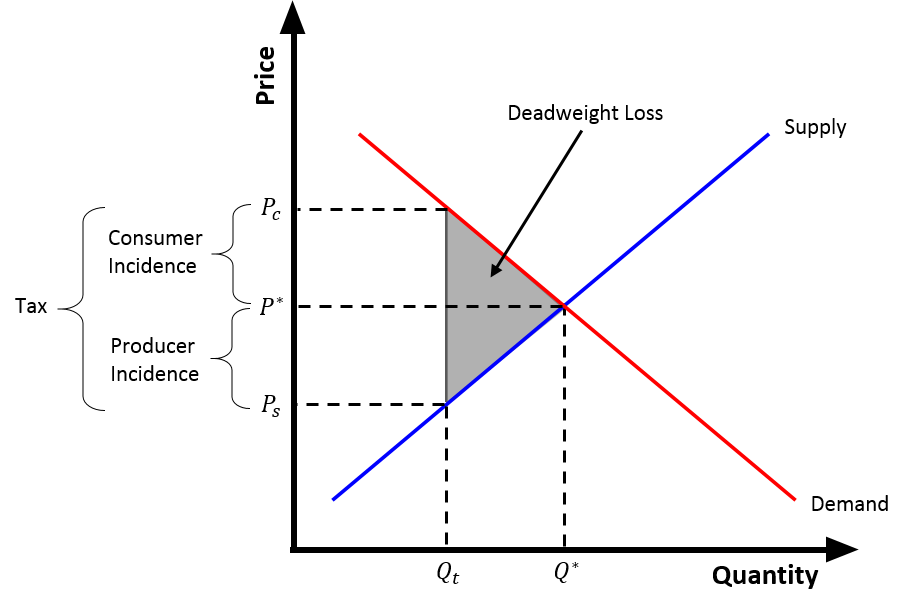

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. The tax burden measures the true economic weight of the tax, measured by the difference between real incomes or utilities before and after imposing the tax, taking into account how the tax leads prices to change. If a 10% tax is imposed on sellers of butter, for example, but the market price rises 8% as a result, most of the burden is on buyers, not sellers. The concept of tax incidence was initially brought to economists' attention by the French Physiocrats, in particular François Quesnay, who argued that the incidence of all taxation falls ultimately on landowners and is at the expense of land rent. Tax incidence is said to "fall" upon the group that ultimately bears the burden of, or ultimately suffers a loss from, the tax. The key conc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Subsidies

A subsidy or government incentive is a form of financial aid or support extended to an economic sector (business, or individual) generally with the aim of promoting economic and social policy. Although commonly extended from the government, the term subsidy can relate to any type of support – for example from NGOs or as implicit subsidies. Subsidies come in various forms including: direct (cash grants, interest-free loans) and indirect (tax breaks, insurance, low-interest loans, accelerated depreciation, rent rebates). Furthermore, they can be broad or narrow, legal or illegal, ethical or unethical. The most common forms of subsidies are those to the producer or the consumer. Producer/production subsidies ensure producers are better off by either supplying market price support, direct support, or payments to factors of production. Consumer/consumption subsidies commonly reduce the price of goods and services to the consumer. For example, in the US at one time it was cheaper to bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employment

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuities, bonus payments or stock options. In some types of employment, employees may receive benefits in addition to payment. Benefits may include health insurance, housing, disability insurance. Employment is typically governed by employment laws, organisation or legal contracts. Employees and employers An employee contributes labour and expertise to an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self-Invested Personal Pension

A self-invested personal pension (SIPP) is the name given to the type of UK government-approved personal pension scheme which allows individuals to make their own investment decisions from the full range of investments approved by HM Revenue and Customs (HMRC). SIPPs are " tax wrappers", allowing tax rebates on contributions in exchange for limits on accessibility. The HMRC rules allow for a greater range of investments to be held than personal pension schemes, notably equities and property. Rules for contributions, benefit withdrawal etc. are the same as for other personal pension schemes. Another subset of this type of pension is the stakeholder pension scheme. History The rules and conditions for a broader range of investments were originally set out in ''Joint Office Memorandum 101'' issued by the UK's Inland Revenue in 1989. However, the first true SIPP was taken out in March 1990. James Hay Partnership, the parent company of then Personal Pension Management, offered the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stakeholder Pension Scheme

Stakeholder pension schemes were introduced in the UK on 6 April 2001 as a consequence of the Welfare Reform and Pensions Act 1999. They were intended to encourage more long-term saving for retirement, particularly among those on low to moderate earnings. They are required to meet a number of conditions set out in legislation, including a cap on charges, low minimum contributions, and flexibility in relation to stopping and starting contributions. Employers with five or more employees are required to provide access to a stakeholder pension scheme for their employees unless they offer a suitable alternative pension scheme. The features of stakeholder pensions were intended to make them cheaper to sell than existing personal pensions and to provide a more transparent and attractive saving vehicle. Although many stakeholder pensions have been taken out, they have largely not been successful in encouraging lower earners to save more. The government announced in May 2006 that it pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Pension Scheme

A personal pension scheme (PPS), sometimes called a personal pension plan (PPP), is a UK tax-privileged individual investment vehicle, with the primary purpose of building a capital sum to provide retirement benefits, although it will usually also provide death benefits. These plans first became available on 1 July 1988 and replaced retirement annuity plans. Both the individual can contribute as well as their employer. Benefits can be taken at any time after age 55 if the plan rules allow, or earlier in the case of ill health. In the past, legislation required benefits to be taken before age 75, and many plans still contain this restriction. Part of the fund (usually 25%) may be taken as a tax-free lump sum at retirement. New rules on drawing on the retirement fund, known as "Pension Freedom", came into effect on 5 April 2015. There are two types of personal pension scheme: insured personal pensions, where each contract will have a set range of investment funds for planholders ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Workplace Pension

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a " defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "retirement plan" and "superannuation" tend to refer to a pension granted upon retirement of the individual. Retirement plans may be set up by employers, insurance companies, the government, or other institutions such as employer associations or trade unions. Called ''retirement plans' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Pension (United Kingdom)

The State Pension is part of the United Kingdom Government's pension arrangements. Benefits vary depending on the age of the individual and their contribution record. Anyone can make a claim, provided they have a minimum number of qualifying years of contributions. Background Basic State Pension The basic State Pension (alongside the Graduated Retirement Benefit, the State Earnings-Related Pension Scheme, and the State Second Pension) is payable to men born before 6 April 1951, and to women born before 6 April 1953. The maximum amount payable is £141.85 a week (April 2022 - April 2023). New State Pension The new State Pension is payable to men born on or after 6 April 1951, and to women born on or after 6 April 1953. The maximum amount payable is £185.15 a week (April 2022 - April 2023). Contribution record The State Pension is a 'contribution-based' benefit, and depends on an individual's National Insurance (NI) contribution history. To qualify for a full pension ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1938.jpg)