|

Prime Lending Rate

The prime rate or prime lending rate is an interest rate used by banks, typically representing the rate at which they lend to their most creditworthy customers. Some variable interest rates may be expressed as a percentage above or below prime rate. Use in different banking systems United States and Canada Historically, in North American banking, the prime rate represented actual interest rate charged to borrowers, although this is no longer universally true. The prime rate varies little among banks and adjustments are generally made by banks at the same time, although this does not happen frequently. , the prime rate was 7.50% in the United States and 5.20% in Canada Canada is a country in North America. Its Provinces and territories of Canada, ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, making it the world's List of coun .... In the United States, the prime rate runs approximately 300 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In Malaysia

The economy of Malaysia is an Developing country, emerging and developing, List of countries by GNI (nominal) per capita, upper-middle income, highly industrialized, industrialised, mixed economy. It ranks the List of countries by GDP (nominal), 36th largest in the world in terms of nominal GDP, however, when measured by purchasing power parity, its GDP climbs to the List of countries by GDP (PPP), 30th largest. Malaysia is forecasted to have a nominal GDP of nearly half a trillion US$ by the end of 2024. The labour productivity of Malaysian workers is the 62nd highest in the world and significantly higher than China, Indonesia, Vietnam, and the Philippines. Malaysia excels above similar income group peers in terms of business competitiveness and innovation. Global Competitiveness Report 2024 ranks Malaysian economy as the 34th most competitive country economy in the world while Global Innovation Index 2024 ranks Malaysia as the 33rd most innovative nation globally. Malaysia is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Although an instrument of the U.S. government, the Federal Reserve System considers itself "an independent central bank because its monetary policy decisions do not have to be approved by the president or by anyone else in the executive or legislative branches of government, it does not receive funding appropriated by Congress, and the terms of the members of the board of governors span multiple presidential and congressional terms." Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overnight Rate

The overnight rate is generally the interest rate that large banks use to borrow and lend from one another in the overnight market. In some countries (the United States, for example), the overnight rate may be the rate targeted by the central bank to influence monetary policy. In most countries, the central bank is also a participant on the overnight lending market, and will lend or borrow money to some group of banks. There may be a published overnight rate that represents an average of the rates at which banks lend to each other; certain types of overnight operations may be limited to qualified banks. The precise name of the overnight rate will vary from country to country. Background Throughout the course of a day, banks will transfer money to each other, to foreign banks, to large clients, and other counterparties on behalf of clients or on their own account. At the end of each working day, a bank may have a surplus or shortage of funds (or a shortage or excess reserves in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FRED (Federal Reserve Economic Data)

Federal Reserve Economic Data (FRED) is a database maintained by the Research division of the Federal Reserve Bank of St. Louis that has more than 816,000 economic time series from various sources. They cover banking, business/fiscal, consumer price indexes, employment and population, exchange rates, gross domestic product, interest rates, monetary aggregates, producer price indexes, reserves and monetary base, U.S. trade and international transactions, and U.S. financial data. The time series are compiled by the Federal Reserve and many are collected from government agencies such as the U.S. Census and the Bureau of Labor Statistics. Services ALRED (Archival Reserve Economic Data) lets users retrieve vintage versions of economic data that were available on specific dates in history. The ALRED website states that “In general, economic data for past observation periods are revised as more accurate estimates become available. As a result, previous vintages of data can be supers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Home Equity Line Of Credit

A home equity line of credit, or HELOC ( /ˈhiːˌlɒk/ ''HEE-lok''), is a revolving type of secured loan in which the lender agrees to lend a maximum amount within an agreed period (called a term), where the collateral is the borrower's property (akin to a second mortgage). Because a home often is a consumer's most valuable asset, many homeowners use their HELOC for major purchases or projects, such as home improvements, education, property investment or medical bills, and choose not to use them for day-to-day expenses. A reason for the popularity of HELOCs is their flexibility, both in terms of borrowing and repaying. Furthermore, their popularity may also stem from having a better image than a " second mortgage", a term which can more directly imply an undesirable level of debt. However, within the lending industry itself, HELOCs are categorized as a second mortgage. HELOCs are usually offered at attractive interest rates. This is because they are secured against a borrower� ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Loans

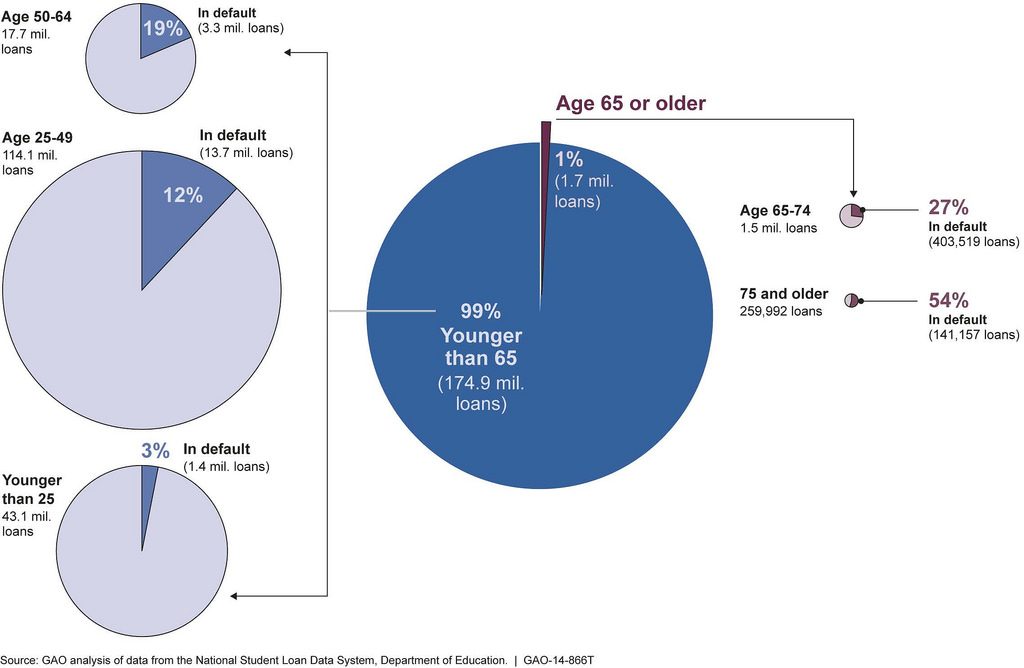

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries. Australia Tertiary student places in Australia are usually funded through the HECS-HELP scheme. This funding is in the form of loans that are not normal debts. They are repaid over time via a supplementary tax, using a sliding scale based on taxable income. As a consequence, loan repayments are only made when the former student has income to support the repayments. Discounts are available for early repayment. The scheme is available to cit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Variable Rate

A floating interest rate, also known as a variable or adjustable rate, refers to any type of debt instrument, such as a loan, bond, mortgage, or credit, that does not have a fixed rate of interest over the life of the instrument. Floating interest rates typically change based on a reference rate (a benchmark of any financial factor, such as the Consumer Price Index). One of the most common reference rates to use as the basis for applying floating interest rates is the Secure Overnight Financing Rate, or SOFR. The rate for such debt will usually be referred to as a spread or margin over the base rate: for example, a five-year loan may be priced at the six-month SOFR + 2.50%. At the end of each six-month period, the rate for the following period will be based on the SOFR at that point (the reset date), plus the spread. The basis will be agreed between the borrower and lender, but 1, 3, 6 or 12 month money market rates are commonly used for commercial loans. Typically, floating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adjustable-rate Mortgage

A variable-rate mortgage, adjustable-rate mortgage (ARM), or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted based on an index which reflects the cost to the lender of borrowing on the credit markets.Wiedemer, John P, ''Real Estate Finance, 8th Edition'', pp 99–105 The loan may be offered at the lender's standard variable rate/base rate. There may be a direct and legally defined link to the underlying index, but where the lender offers no specific link to the underlying market or index, the rate can be changed at the lender's discretion. The term "variable-rate mortgage" is most common outside the United States, whilst in the United States, "adjustable-rate mortgage" is most common, and implies a mortgage regulated by the Federal government, with caps on charges. In many countries, adjustable rate mortgages are the norm, and in such places, may simply be referred to as mortgages. Among the most common indices are the rates on 1-year co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |