|

Online Banking

Online banking, also known as internet banking, virtual banking, web banking or home banking, is a system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution's website or mobile app. Since the early 2010s, this has become the most common way that customers access their bank accounts. The online banking system will typically connect to or be part of the core banking system operated by a bank to provide customers access to banking services in addition to or in place of historic branch banking. Online banking significantly reduces the banks' operating cost by reducing reliance on a physical branch network and offers convenience to some customers by lessening the need to visit a bank branch as well as being able to perform banking transactions even when branches are closed, for example outside the conventional banking hours or at weekends and on holidays. Internet banking provides personal an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

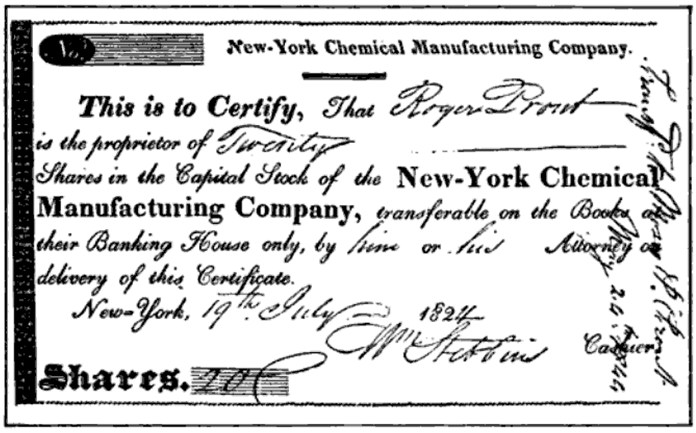

Chemical Bank

Chemical Bank, headquartered in New York City, was the principal operating subsidiary of Chemical Banking Corporation, a bank holding company. In 1996, it acquired Chase Bank, adopted the Chase name, and became the largest bank in the United States. Prior to the 1996 merger, Chemical was the third-largest bank in the U.S., with $182.9 billion in assets and more than 39,000 employees. In addition to operations in the U.S., it had a major presence in Japan, Germany, and the United Kingdom. It was active in both corporate banking as well as retail banking as well as investment banking and underwriting corporate bonds and equity (finance), equity. The bank was founded in 1824 as a subsidiary of the New York Chemical Manufacturing Company by Balthazar P. Melick and others; the manufacturing operations were sold by 1851. Major acquisitions by the bank included Corn Exchange Bank in 1954, Texas Commerce Bank in 1987, and Manufacturers Hanover in 1991. The bank converted to the holding co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

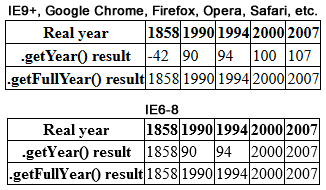

Year 2000 Problem

The term year 2000 problem, or simply Y2K, refers to potential computer errors related to the Time formatting and storage bugs, formatting and storage of calendar data for dates in and after the year 2000. Many Computer program, programs represented four-digit years with only the final two digits, making the year 2000 indistinguishable from 1900. Computer systems' inability to distinguish dates correctly had the potential to bring down worldwide infrastructures for computer-reliant industries. In the years leading up to the turn of the millennium, the public gradually became aware of the "Y2K scare", and individual companies predicted the global damage caused by the bug would require anything between $400 million and $600 billion to rectify. A lack of clarity regarding the potential dangers of the bug led some to stock up on food, water, and firearms, purchase backup generators, and withdraw large sums of money in anticipation of a computer-induced Global catastrophic risk, ap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

McKinsey And Company

McKinsey & Company (informally McKinsey or McK) is an American multinational strategy and management consulting firm that offers professional services to corporations, governments, and other organizations. Founded in 1926 by James O. McKinsey, McKinsey is the oldest and largest of the " MBB" management consultancies. The firm mainly focuses on the finances and operations of their clients. Under the direction of Marvin Bower, McKinsey expanded into Europe during the 1940s and 1950s. In the 1960s, McKinsey's Fred Gluck—along with Boston Consulting Group's Bruce Henderson, Bill Bain at Bain & Company, and Harvard Business School's Michael Porter—initiated a program designed to transform corporate culture. A 1975 publication by McKinsey's John L. Neuman introduced the business practice of "overhead value analysis" that contributed to a downsizing trend that eliminated many jobs in middle management. McKinsey has been the subject of significant controversy and is the su ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Digital Banking

Digital banking is part of the broader context for the move to online banking, where banking services are delivered over the internet. The shift from traditional to digital banking has been gradual, remains ongoing, and is constituted by differing degrees of banking service digitization. Digital banking involves high levels of process automation and web-based services and may include APIs enabling cross-institutional service composition to deliver banking products and provide transactions. It provides the ability for users to access financial data through desktop, mobile and ATM services. Description A digital bank represents a virtual process that includes online banking, mobile banking, and beyond. As an end-to-end platform, digital banking must encompass the front end that consumers see, the back end that bankers see through their servers and admin control panels, and the middleware that connects these nodes. Ultimately, a digital bank should facilitate all functional level ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Product Bundling

In marketing, product bundling is offering several products or services for sale as one combined product or service package. It is a common feature in many imperfectly competitive product and service markets. Industries engaged in the practice include telecommunications services, financial services, health care, information, and consumer electronics. A software bundle might include a word processor, spreadsheet, and presentation program into a single office suite. The cable television industry often bundles many TV and movie channels into a single tier or package. The fast food industry combines separate food items into a " combo meal" or "value meal". A bundle of products may be called a package deal; in recorded music or video games, a compilation or box set; or in publishing, an anthology. Product bundling is most suitable for high volume and high margin (i.e., low marginal cost) products. Research by Yannis Bakos and Erik Brynjolfsson found that bundling was particula ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Cooperative Bank

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world. Cooperative banking, as discussed here, includes retail banking carried out by credit unions, mutual savings banks, Building society, building societies and cooperatives, as well as commercial banking services provided by mutual organizations (such as cooperative federations) to cooperative businesses. Institutions Cooperative banks Cooperative banks are owned by their customers and follow the Rochdale Principles, cooperative principle of one person, one vote. Co-operative banks are often regulated under both banking and cooperative legislation. They provide services such as savings and loans to non-members as well as to members, and some participate in the wholesale markets for bonds, money and even equities. Many cooperative banks are traded on public stock markets, with the result that they are p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |