|

Mob Mentality

Herd mentality, mob mentality or pack mentality describes how people can be influenced by their peers to adopt certain behaviors on a largely emotional, rather than rational, basis. When individuals are affected by mob mentality, they may make different decisions than they would have individually. Social psychologists study the related topics of group intelligence, crowd wisdom, groupthink, and deindividuation. History The idea of a " group mind" or "mob behavior" was first put forward by 19th-century social psychologists Gabriel Tarde and Gustave Le Bon. Herd behavior in human societies has also been studied by Sigmund Freud and Wilfred Trotter, whose book ''Instincts of the Herd in Peace and War'' is a classic in the field of social psychology. Sociologist and economist Thorstein Veblen's ''The Theory of the Leisure Class'' illustrates how individuals imitate other group members of higher social status in their consumer behavior. More recently, Malcolm Gladwell in ''The Tip ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emotion

Emotions are mental states brought on by neurophysiological changes, variously associated with thoughts, feelings, behavioral responses, and a degree of pleasure or displeasure. There is currently no scientific consensus on a definition. Emotions are often intertwined with mood, temperament, personality, disposition, or creativity. Research on emotion has increased over the past two decades with many fields contributing including psychology, medicine, history, sociology of emotions, and computer science. The numerous theories that attempt to explain the origin, function and other aspects of emotions have fostered more intense research on this topic. Current areas of research in the concept of emotion include the development of materials that stimulate and elicit emotion. In addition, PET scans and fMRI scans help study the affective picture processes in the brain. From a mechanistic perspective, emotions can be defined as "a positive or negative experience that is as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Malcolm Gladwell

Malcolm Timothy Gladwell (born 3 September 1963) is an English-born Canadian journalist, author, and public speaker. He has been a staff writer for ''The New Yorker'' since 1996. He has published seven books: '' The Tipping Point: How Little Things Can Make a Big Difference'' (2000); '' Blink: The Power of Thinking Without Thinking'' (2005); '' Outliers: The Story of Success'' (2008); '' What the Dog Saw: And Other Adventures'' (2009), a collection of his journalism; '' David and Goliath: Underdogs, Misfits, and the Art of Battling Giants'' (2013); '' Talking To Strangers: What We Should Know about the People We Don't Know'' (2019) and '' The Bomber Mafia: A Dream, a Temptation, and the Longest Night of the Second World War'' (2021). His first five books were on ''The New York Times'' Best Seller list. He is also the host of the podcast '' Revisionist History'' and co-founder of the podcast company Pushkin Industries. Gladwell's writings often deal with the unexpected implicat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asch Conformity Experiments

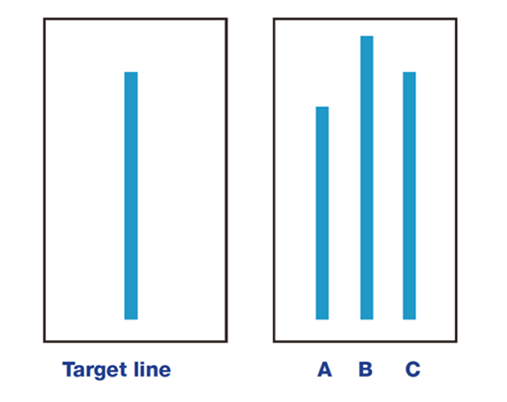

In psychology Psychology is the scientific study of mind and behavior. Psychology includes the study of conscious and unconscious phenomena, including feelings and thoughts. It is an academic discipline of immense scope, crossing the boundaries betwe ..., the Asch conformity experiments or the Asch paradigm were a series of studies directed by Solomon Asch studying if and how individuals yielded to or defied a majority (sociology), majority group and the effect of such influences on beliefs and opinions.Asch, S.E. (1952b). "Social psychology". Englewood Cliffs, NJ:Prentice Hall. Developed in the 1950s, the methodology remains in use by many researchers. Uses include the study of conformity effects of Conformity#Different stimuli, task importance, Conformity#Age, age, Conformity#Gender, sex, and Conformity#Culture, culture. Initial conformity experiment Rationale Many early studies in social psychology were adaptations of earlier work on "suggestibility" whereby ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Crash

A stock market crash is a sudden dramatic decline of stock In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company ... prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often follow speculation and economic bubbles. A stock market crash is a social phenomenon where external economic events combine with crowd psychology in a positive feedback loop where selling by some market participants drives more market participants to sell. Generally speaking, crashes usually occur under the following conditions: a prolonged period of rising stock prices (a Market trend#Market terminology, bull market) and excessive economic optimism, a market where price–earnings ratios exce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth (e.g. dot-com bubble), and/or by the belief that intrinsic valuation is no longer relevant when making an investment (e.g. Tulip mania). They have appeared in most asset classes, including equities (e.g. Roaring Twenties), commodities (e.g. Uranium bubble), real estate (e.g. 2000s US housing bubble), and even esoteric assets (e.g. Cryptocurrency bubble). Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles (e.g. 1980s Japanese asset bubble and the 2020–21 Everything bubble), are attributed to central banking liquidity (e.g. overuse of the Fed put). In the early stages o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Greed And Fear

Greed and fear refer to two opposing emotional states theorized as factors causing the unpredictability and volatility of the stock market, and irrational market behavior inconsistent with the efficient-market hypothesis. Greed and fear relate to an old Wall Street saying: “financial markets are driven by two powerful emotions – greed and fear.” Greed and fear are among the animal spirits that Keynes identified as profoundly affecting economies and markets. Warren Buffett found an investing rule in acting contrary to such prevailing moods, advising that the timing of buying or selling stocks should be "fearful when others are greedy and greedy only when others are fearful." He uses the overall Market capitalization-to-GDP ratio to indicate relative value of the stock market in general, hence this ratio has become known as the "Buffett indicator". Greed Greed is usually described as an irresistible craving to possess more of something (money, material goods) than one ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Amos Tversky

Amos Nathan Tversky ( he, עמוס טברסקי; March 16, 1937 – June 2, 1996) was an Israeli cognitive and mathematical psychologist and a key figure in the discovery of systematic human cognitive bias and handling of risk. Much of his early work concerned the foundations of measurement. He was co-author of a three-volume treatise, ''Foundations of Measurement''. His early work with Daniel Kahneman focused on the psychology of prediction and probability judgment; later they worked together to develop prospect theory, which aims to explain irrational human economic choices and is considered one of the seminal works of behavioral economics. Six years after Tversky's death, Kahneman received the 2002 Nobel Memorial Prize in Economic Sciences for the work he did in collaboration with Amos Tversky. (The prize is not awarded posthumously.) Kahneman told ''The New York Times'' in an interview soon after receiving the honor: "I feel it is a joint prize. We were twinned for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vernon L

Vernon may refer to: Places Australia *Vernon County, New South Wales Canada *Vernon, British Columbia, a city *Vernon, Ontario France * Vernon, Ardèche *Vernon, Eure United States * Vernon, Alabama * Vernon, Arizona * Vernon, California * Lake Vernon, California * Vernon, Colorado * Vernon, Connecticut * Vernon, Delaware * Vernon, Florida, a city * Vernon Lake (Idaho) * Vernon, Illinois * Vernon, Indiana * Vernon, Kansas * Vernon Community, Hestand, Kentucky * Vernon Parish, Louisiana ** Vernon Lake, a man-made lake in the parish * Vernon, Michigan * Vernon Township, Isabella County, Michigan * Vernon Township, Shiawassee County, Michigan * Vernon, Jasper County, Mississippi * Vernon, Madison County, Mississippi * Vernon, Winston County, Mississippi * Vernon Township, New Jersey * Vernon (town), New York ** Vernon (village), New York * Vernon (Mount Olive, North Carolina), a historic plantation house * Vernon Township, Crawford County, Ohio * Vernon Township, Scioto Cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert Shiller

Robert James Shiller (born March 29, 1946) is an American economist, academic, and author. As of 2019, he serves as a Sterling Professor of Economics at Yale University and is a fellow at the Yale School of Management's International Center for Finance. Shiller has been a research associate of the National Bureau of Economic Research (NBER) since 1980, was vice president of the American Economic Association in 2005, its president-elect for 2016, and president of the Eastern Economic Association for 2006–2007. He is also the co‑founder and chief economist of the investment management firm MacroMarkets LLC. Shiller was ranked by the ''IDEAS'' RePEc publications monitor in 2008 as among the 100 most influential economists of the world; and was still on the list in 2019. Eugene Fama, Lars Peter Hansen and Shiller jointly received the 2013 Nobel Memorial Prize in Economic Sciences, "for their empirical analysis of asset prices".* Background Shiller was born in Detroit, Michi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Daniel Kahneman

Daniel Kahneman (; he, דניאל כהנמן; born March 5, 1934) is an Israeli-American psychologist and economist notable for his work on the psychology of judgment and decision-making, as well as behavioral economics, for which he was awarded the 2002 Nobel Memorial Prize in Economic Sciences (shared with Vernon L. Smith). His empirical findings challenge the assumption of human rationality prevailing in modern economic theory. With Amos Tversky and others, Kahneman established a cognitive basis for common human errors that arise from heuristics and biases, and developed prospect theory. In 2011 he was named by '' Foreign Policy'' magazine in its list of top global thinkers. In the same year his book ''Thinking, Fast and Slow'', which summarizes much of his research, was published and became a best seller. In 2015, ''The Economist'' listed him as the seventh most influential economist in the world. He is professor emeritus of psychology and public affairs at Princeton U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Wisdom Of Crowds

''The Wisdom of Crowds: Why the Many Are Smarter Than the Few and How Collective Wisdom Shapes Business, Economies, Societies and Nations'', published in 2004, is a book written by James Surowiecki about the aggregation of information in groups, resulting in decisions that, he argues, are often better than could have been made by any single member of the group. The book presents numerous case studies and anecdotes to illustrate its argument, and touches on several fields, primarily economics and psychology. The opening anecdote relates Francis Galton's surprise that the crowd at a county fair accurately guessed the weight of an ox when their individual guesses were averaged (the average was closer to the ox's true butchered weight than the estimates of most crowd members). The book relates to diverse collections of independently deciding individuals, rather than crowd psychology as traditionally understood. Its central thesis, that a diverse collection of independently decidi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |