|

Marginal Productivity

In economics and in particular neoclassical economics, the marginal product or marginal physical productivity of an input ( factor of production) is the change in output resulting from employing one more unit of a particular input (for instance, the change in output when a firm's labor is increased from five to six units), assuming that the quantities of other inputs are kept constant. The marginal product of a given input can be expressed as: :MP = \frac where \Delta X is the change in the firm's use of the input (conventionally a one-unit change) and \Delta Y is the change in quantity of output produced (resulting from the change in the input). Note that the quantity Y of the "product" is typically defined ignoring external costs and benefits. If the output and the input are infinitely divisible, so the marginal "units" are infinitesimal, the marginal product is the mathematical derivative of the production function with respect to that input. Suppose a firm's output ''Y'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

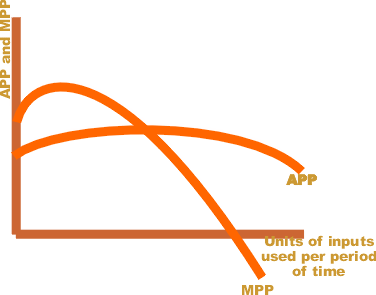

Average And Marginal Product Curves Small

In colloquial, ordinary language, an average is a single number taken as representative of a list of numbers, usually the sum of the numbers divided by how many numbers are in the list (the arithmetic mean). For example, the average of the numbers 2, 3, 4, 7, and 9 (summing to 25) is 5. Depending on the context, an average might be another statistics, statistic such as the median, or Mode (statistics), mode. For example, the average income, personal income is often given as the median—the number below which are 50% of personal incomes and above which are 50% of personal incomes—because the mean would be higher by including personal incomes from a few billionaires. For this reason, it is recommended to avoid using the word "average" when discussing measures of central tendency. General properties If all numbers in a list are the same number, then their average is also equal to this number. This property is shared by each of the many types of average. Another universal property i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Product Of Capital

In economics, the marginal product of capital (MPK) is the additional production that a firm experiences when it adds an extra unit of capital. It is a feature of the production function, alongside the labour input. Definition The marginal product of capital (MPK) is the additional output resulting, ceteris paribus ("all things being equal"), from the use of an additional unit of physical capital, such as machines or buildings used by businesses. The marginal product of capital (MPK) is the amount of extra output the firm gets from an extra unit of capital, holding the amount of labor constant: : MP_K = F(K + 1, L) - F(K, L) Thus, the marginal product of capital is the difference between the amount of output produced with K + 1 units of capital and that produced with only K units of capital.N. Gregory Mankiw. (2010). Macroeconomics. United States: Worth Publishers Determining marginal product of capital is essential when a firm is debating on whether or not to invest on the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shadow Price

A shadow price is the monetary value assigned to an abstract or intangible commodity which is not traded in the marketplace. This often takes the form of an externality. Shadow prices are also known as the recalculation of known market prices in order to account for the presence of distortionary market instruments (e.g. quotas, tariffs, taxes or subsidies). Shadow Prices are the real economic prices given to goods and services after they have been appropriately adjusted by removing distortionary market instruments and incorporating the societal impact of the respective good or service. A shadow price is often calculated based on a group of assumptions and estimates because it lacks reliable data, so it is subjective and somewhat inaccurate. The need for shadow prices arises as a result of “externalities” and the presence of distortionary market instruments. An externality is defined as a cost or benefit incurred by a third party as a result of production or consumption of a g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Of Production

Manufacturing cost is the sum of costs of all resources consumed in the process of making a product. The manufacturing cost is classified into three categories: direct materials cost, direct labor cost and manufacturing overhead. It is a factor in total delivery cost. Direct materials cost Direct materials are the raw materials that become a part of the finished product. Manufacturing adds value to raw materials by applying a chain of operations to maintain a deliverable product. There are many operations that can be applied to raw materials such as welding, cutting and painting. It is important to differentiate between direct materials and indirect materials. Direct labour cost The direct labour cost is the cost of workers who can be easily identified with the unit of production. Types of labour who are considered to be part of the direct labour cost are the assembly workers on an assembly line. Manufacturing overhead Manufacturing overhead is any manufacturing cost ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Average Product

Production is the process of combining various inputs, both material (such as metal, wood, glass, or plastics) and immaterial (such as plans, or knowledge) in order to create output. Ideally this output will be a good or service which has value and contributes to the utility of individuals. The area of economics that focuses on production is called production theory, and it is closely related to the consumption (or consumer) theory of economics. The production process and output directly result from productively utilising the original inputs (or factors of production). Known as primary producer goods or services, land, labour, and capital are deemed the three fundamental production factors. These primary inputs are not significantly altered in the output process, nor do they become a whole component in the product. Under classical economics, materials and energy are categorised as secondary factors as they are byproducts of land, labour and capital. Delving further, primary facto ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Production Theory

Production is the process of combining various inputs, both material (such as metal, wood, glass, or plastics) and immaterial (such as plans, or knowledge) in order to create output. Ideally this output will be a good or service which has value and contributes to the utility of individuals. The area of economics that focuses on production is called production theory, and it is closely related to the consumption (or consumer) theory of economics. The production process and output directly result from productively utilising the original inputs (or factors of production). Known as primary producer goods or services, land, labour, and capital are deemed the three fundamental production factors. These primary inputs are not significantly altered in the output process, nor do they become a whole component in the product. Under classical economics, materials and energy are categorised as secondary factors as they are byproducts of land, labour and capital. Delving further, primary factor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is incremented, the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced. At each level of production and time period being considered, marginal cost includes all costs that vary with the level of production, whereas costs that do not vary with production are fixed. For example, the marginal cost of producing an automobile will include the costs of labor and parts needed for the additional automobile but not th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Revenue Productivity Theory Of Wages

The marginal revenue productivity theory of wages is a model of wage levels in which they set to match to the marginal revenue product of labor, MRP (the value of the marginal product of labor), which is the increment to revenues caused by the increment to output produced by the last laborer employed. In a model, this is justified by an assumption that the firm is profit-maximizing and thus would employ labor only up to the point that marginal labor costs equal the marginal revenue generated for the firm.Daniel S. Hamermesh. 1986. The demand for labor in the long run. ''Handbook of Labor Economics'' (Orley Ashenfelter and Richard Layard, ed.) p. 429. This is a model of the neoclassical economics type. The marginal revenue product (MRP) of a worker is equal to the product of the marginal product of labour (MP) (the increment to output from an increment to labor used) and the marginal revenue (MR) (the increment to sales revenue from an increment to output): MRP = MP \times MR. The t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Product Of Capital

In economics, the marginal product of capital (MPK) is the additional production that a firm experiences when it adds an extra unit of capital. It is a feature of the production function, alongside the labour input. Definition The marginal product of capital (MPK) is the additional output resulting, ceteris paribus ("all things being equal"), from the use of an additional unit of physical capital, such as machines or buildings used by businesses. The marginal product of capital (MPK) is the amount of extra output the firm gets from an extra unit of capital, holding the amount of labor constant: : MP_K = F(K + 1, L) - F(K, L) Thus, the marginal product of capital is the difference between the amount of output produced with K + 1 units of capital and that produced with only K units of capital.N. Gregory Mankiw. (2010). Macroeconomics. United States: Worth Publishers Determining marginal product of capital is essential when a firm is debating on whether or not to invest on the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Product Of Labor

In economics, the marginal product of labor (MPL) is the change in output that results from employing an added unit of labor. It is a feature of the production function, and depends on the amounts of physical capital and labor already in use. Definition The marginal product of a factor of production is generally defined as the change in output resulting from a unit or infinitesimal change in the quantity of that factor used, holding all other input usages in the production process constant. The marginal product of labor is then the change in output (''Y'') per unit change in labor (''L''). In discrete terms the marginal product of labor is: : \frac . In continuous terms, the ''MPL'' is the first derivative of the production function: : \frac .Perloff, J., ''Microeconomics Theory and Applications with Calculus'', Pearson 2008. p. 173. Graphically, the ''MPL'' is the slope of the production function. Examples There is a factory which produces toys. When there are no workers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cambridge Capital Controversy

The Cambridge capital controversy, sometimes called "the capital controversy"Brems (1975) pp. 369-384 or "the two Cambridges debate", was a dispute between proponents of two differing theoretical and mathematical positions in economics that started in the 1950s and lasted well into the 1960s. The debate concerned the nature and role of capital goods and a critique of the neoclassical vision of aggregate production and distribution.Tcherneva (2011) The name arises from the location of the principals involved in the controversy: the debate was largely between economists such as Joan Robinson and Piero Sraffa at the University of Cambridge in England and economists such as Paul Samuelson and Robert Solow at the Massachusetts Institute of Technology, in Cambridge, Massachusetts, United States. The English side is most often labeled " post-Keynesian", while some call it " neo-Ricardian", and the Massachusetts side " neoclassical". Most of the debate is mathematical, while some ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rate Of Profit

In economics and finance, the profit rate is the relative profitability of an investment project, a capitalist enterprise or a whole capitalist economy. It is similar to the concept of rate of return on investment. Historical cost ''vs.'' market value The rate of profit depends on the definition of ''capital invested''. Two measurements of the value of capital exist: capital at historical cost and capital at market value. Historical cost is the original cost of an asset at the time of purchase or payment. Market value is the re-sale value, replacement value, or value in present or alternative use. To compute the rate of profit, replacement cost of capital assets must be used to define the capital cost. Assets such as machinery cannot be replaced at their historical cost but must be purchased at the current market value. When inflation occurs, historical cost would not take account of rising prices of equipment. The rate of profit would be overestimated using lower historic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |