|

Myerson–Satterthwaite Theorem

The Myerson–Satterthwaite theorem is an important result in mechanism design and the economics of asymmetric information, and named for Roger Myerson and Mark Satterthwaite. Informally, the result says that there is no efficient way for two parties to trade a good when they each have secret and probabilistically varying valuations for it, without the risk of forcing one party to trade at a loss. The Myerson–Satterthwaite theorem is among the most remarkable and universally applicable negative results in economics—a kind of negative mirror to the fundamental theorems of welfare economics. It is, however, much less famous than those results or Arrow's earlier result on the impossibility of satisfactory electoral systems. Notation There are two agents: Sally (the seller) and Bob (the buyer). Sally holds an item that is valuable for both her and Bob. Each agent values the item differently: Bob values it as v_B and Sally as v_S. Each agent knows his/her own valuation with c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mechanism Design

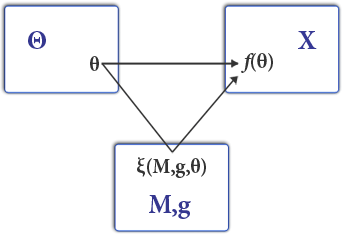

Mechanism design (sometimes implementation theory or institution design) is a branch of economics and game theory. It studies how to construct rules—called Game form, mechanisms or institutions—that produce good outcomes according to Social welfare function, some predefined metric, even when the designer does not know the players' true preferences or what information they have. Mechanism design thus focuses on the study of solution concepts for a class of private-information games. Mechanism design has broad applications, including traditional domains of economics such as market design, but also political science (through voting theory). It is a foundational component in the operation of the internet, being used in networked systems (such as inter-domain routing), e-commerce, and Sponsored search auction, advertisement auctions by Facebook and Google. Because it starts with the end of the game (a particular result), then works backwards to find a game that implements it, it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Information Asymmetry

In contract theory, mechanism design, and economics, an information asymmetry is a situation where one party has more or better information than the other. Information asymmetry creates an imbalance of power in transactions, which can sometimes cause the transactions to be inefficient, causing market failure in the worst case. Examples of this problem are adverse selection, moral hazard,Dembe, Allard E. and Boden, Leslie I. (2000). "Moral Hazard: A Question of Morality?" New Solutions 2000 10(3). 257–79 and monopolies of knowledge. A common way to visualise information asymmetry is with a scale, with one side being the seller and the other the buyer. When the seller has more or better information, the transaction will more likely occur in the seller's favour ("the balance of power has shifted to the seller"). An example of this could be when a used car is sold, the seller is likely to have a much better understanding of the car's condition and hence its market value than the buy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Roger Myerson

Roger Bruce Myerson (born March 29, 1951) is an American economist and professor at the University of Chicago. He holds the title of the David L. Pearson Distinguished Service Professor of Global Conflict Studies at The Pearson Institute for the Study and Resolution of Global Conflicts in the Harris School of Public Policy Studies, Harris School of Public Policy, the Griffin Department of Economics, and the College of the University of Chicago. Previously, he held the title The Glen A. Lloyd Distinguished Service Professor of Economics. In 2007, he was the winner of the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel with Leonid Hurwicz and Eric Maskin for "having laid the foundations of mechanism design theory". He was elected a Member of the American Philosophical Society in 2019. Biography Roger Myerson was born in 1951 in Boston into a Jews, Jewish family. He attended Harvard University, where he received his Bachelor of Arts, A.B., ''summa cum laude'', ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mark Satterthwaite

Mark Allen Satterthwaite is an economist at the Kellogg School of Management at Northwestern University in Evanston, Illinois. He is currently an A.C. Buehler Professor in Hospital & Health Services Management, professor of strategic management and managerial economics, and chair of the Management & Strategy Department. He is a fellow of the Econometric Society and a member of the American Academy of Arts and Sciences The American Academy of Arts and Sciences (The Academy) is one of the oldest learned societies in the United States. It was founded in 1780 during the American Revolution by John Adams, John Hancock, James Bowdoin, Andrew Oliver, and other .... See also * Gibbard–Satterthwaite theorem * Muller–Satterthwaite theorem * Myerson–Satterthwaite theorem References American economists Fellows of the Econometric Society Fellows of the American Academy of Arts and Sciences Living people Year of birth missing (living people) Kellogg School of Ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fundamental Theorems Of Welfare Economics

There are two fundamental theorems of welfare economics. The first states that in economic equilibrium, a set of complete markets, with complete information, and in perfect competition, will be Pareto optimal (in the sense that no further exchange would make one person better off without making another worse off). The requirements for perfect competition are these: # There are no externalities and each actor has perfect information. # Firms and consumers take prices as given (no economic actor or group of actors has market power). The theorem is sometimes seen as an analytical confirmation of Adam Smith's "invisible hand" principle, namely that ''competitive markets ensure an efficient allocation of resources''. However, there is no guarantee that the Pareto optimal market outcome is equitative, as there are many possible Pareto efficient allocations of resources differing in their desirability (e.g. one person may own everything and everyone else nothing). The second theorem s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arrow's Impossibility Theorem

Arrow's impossibility theorem is a key result in social choice theory showing that no ranked-choice procedure for group decision-making can satisfy the requirements of rational choice. Specifically, Arrow showed no such rule can satisfy the independence of irrelevant alternatives axiom. This is the principle that a choice between two alternatives and should not depend on the quality of some third, unrelated option, . The result is often cited in discussions of voting rules, where it shows no ranked voting rule to eliminate the spoiler effect. This result was first shown by the Marquis de Condorcet, whose voting paradox showed the impossibility of logically-consistent majority rule; Arrow's theorem generalizes Condorcet's findings to include non-majoritarian rules like collective leadership or consensus decision-making. While the impossibility theorem shows all ranked voting rules must have spoilers, the frequency of spoilers differs dramatically by rule. Plurality-rule me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probability Density

In probability theory, a probability density function (PDF), density function, or density of an absolutely continuous random variable, is a function whose value at any given sample (or point) in the sample space (the set of possible values taken by the random variable) can be interpreted as providing a '' relative likelihood'' that the value of the random variable would be equal to that sample. Probability density is the probability per unit length, in other words, while the ''absolute likelihood'' for a continuous random variable to take on any particular value is 0 (since there is an infinite set of possible values to begin with), the value of the PDF at two different samples can be used to infer, in any particular draw of the random variable, how much more likely it is that the random variable would be close to one sample compared to the other sample. More precisely, the PDF is used to specify the probability of the random variable falling ''within a particular range o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revelation Principle

The revelation principle is a fundamental result in mechanism design, social choice theory, and game theory which shows it is always possible to design a strategy-resistant implementation of a Social welfare function, social decision-making mechanism (such as an electoral system or Market (economics), market).Gibbard, A. 1973. Manipulation of voting schemes: a general result. Econometrica 41, 587–601. It can be seen as a kind of mirror image to Gibbard's theorem. The revelation principle says that if a social choice function can be implemented with some non-honest Mechanism design, mechanism—one where players have an incentive to lie—the same function can be implemented by an Incentive compatibility, incentive-compatible (honesty-promoting) mechanism with the same equilibrium outcome (payoffs). The revelation principle shows that, while Gibbard's theorem proves it is impossible to design a system that will always be fully invulnerable to strategy (if we do not know how playe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Rationality

Rational choice modeling refers to the use of decision theory (the theory of rational choice) as a set of guidelines to help understand economic and social behavior. The theory tries to approximate, predict, or mathematically model human behavior by analyzing the behavior of a rational actor facing the same costs and benefits.Gary Browning, Abigail Halcli, Frank Webster (2000). ''Understanding Contemporary Society: Theories of the Present'', London: Sage Publications. Rational choice models are most closely associated with economics, where mathematical analysis of behavior is standard. However, they are widely used throughout the social sciences, and are commonly applied to cognitive science, criminology, political science, and sociology. Overview The basic premise of rational choice theory is that the decisions made by individual actors will collectively produce aggregate social behaviour. The theory also assumes that individuals have preferences out of available choice ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nash Equilibrium

In game theory, the Nash equilibrium is the most commonly used solution concept for non-cooperative games. A Nash equilibrium is a situation where no player could gain by changing their own strategy (holding all other players' strategies fixed). The idea of Nash equilibrium dates back to the time of Cournot, who in 1838 applied it to his model of competition in an oligopoly. If each player has chosen a strategy an action plan based on what has happened so far in the game and no one can increase one's own expected payoff by changing one's strategy while the other players keep theirs unchanged, then the current set of strategy choices constitutes a Nash equilibrium. If two players Alice and Bob choose strategies A and B, (A, B) is a Nash equilibrium if Alice has no other strategy available that does better than A at maximizing her payoff in response to Bob choosing B, and Bob has no other strategy available that does better than B at maximizing his payoff in response to Alice c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Incentive Compatibility

In game theory and economics, a mechanism is called incentive-compatible (IC) if every participant can achieve their own best outcome by reporting their true preferences. For example, there is incentive compatibility if high-risk clients are better off in identifying themselves as high-risk to insurance firms, who only sell discounted insurance to high-risk clients. Likewise, they would be worse off if they pretend to be low-risk. Low-risk clients who pretend to be high-risk would also be worse off. The concept is attributed to the Russian-born American economist Leonid Hurwicz. Typology There are several different degrees of incentive-compatibility: * The stronger degree is dominant-strategy incentive-compatibility (DSIC). This means that truth-telling is a weakly-dominant strategy, i.e. you fare best or at least not worse by being truthful, regardless of what the others do. In a DSIC mechanism, strategic considerations cannot help any agent achieve better outcomes than the tru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pareto Efficiency

In welfare economics, a Pareto improvement formalizes the idea of an outcome being "better in every possible way". A change is called a Pareto improvement if it leaves at least one person in society better off without leaving anyone else worse off than they were before. A situation is called Pareto efficient or Pareto optimal if all possible Pareto improvements have already been made; in other words, there are no longer any ways left to make one person better off without making some other person worse-off. In social choice theory, the same concept is sometimes called the unanimity principle, which says that if ''everyone'' in a society (strict inequality, non-strictly) prefers A to B, society as a whole also non-strictly prefers A to B. The Pareto frontier, Pareto front consists of all Pareto-efficient situations. In addition to the context of efficiency in ''allocation'', the concept of Pareto efficiency also arises in the context of productive efficiency, ''efficiency in prod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |