|

Mizuho Investors Securities Co., Ltd.

The , known from 2000 to 2003 as Mizuho Holdings and abbreviated as MHFG or simply Mizuho, is a Japanese banking holding company headquartered in the Ōtemachi district of Chiyoda, Tokyo, Japan. The group was formed in 2000-2002 by merger of Dai-Ichi Kangyo Bank, Fuji Bank, and Industrial Bank of Japan. The name literally means "abundant rice" in Japanese and "harvest" in the figurative sense. Mizuho Financial Group is the parent holding of Mizuho Bank, Mizuho Trust & Banking, Mizuho Securities, and Mizuho Capital, and the majority owner of Asset Management One. The group offers a range of financial services, including banking, securities, trust and asset management services, employing more than 59,000 people throughout 880 offices. It is listed on the Tokyo Stock Exchange—where it is a constituent of the Nikkei 225 and TOPIX Core30 indices—and in the New York Stock Exchange in the form of American depositary receipts. Upon its founding, Mizuho was the largest bank in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Otemachi Tower

The is a Tower block, high-rise Office, office building with integrated retail and restaurant facilities (which are also known as OTEMORI) located in the Ōtemachi, Otemachi business district in Chiyoda, Tokyo, Chiyoda ward, Tokyo. The 38-story tower serves as the headquarters of Mizuho Bank. A luxury hotel facility operated by Aman Resorts occupies the top six floors of the tower. Overview The Otemachi Tower replaced the previous 16-story head office complex of Fuji Bank then of Mizuho Financial Group, Muzuho Holdings, which had been built in 1990 on the same site and was demolished in 2012. A major feature is a 3,600-m2 green area named "Otemachi Forest" occupying one third of the site. The building is situated above a nexus of Tokyo Metro, five subway lines. The basement floors connect directly to Ōtemachi Station (Tokyo), Ōtemachi Station, as well as other nearby buildings. References External links Marunouchi Skyscraper office buildings in Tokyo Offi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equities Trading

A stock trader or equity trader or share trader, also called a stock investor, is a person or company involved in trading equity securities and attempting to profit from the purchase and sale of those securities. Stock traders may be an investor, agent, hedger, arbitrageur, speculator, or stockbroker. Such equity trading in large publicly traded companies may be through a stock exchange. Stock shares in smaller public companies may be bought and sold in over-the-counter (OTC) markets or in some instances in equity crowdfunding platforms. Stock traders can trade on their own account, called proprietary trading or self-directed trading, or through an agent authorized to buy and sell on the owner's behalf. That agent is referred to as a stockbroker. Agents are paid a commission for performing the trade. Proprietary or self-directed traders who use online brokerages (e.g., Fidelity, Interactive Brokers, Schwab, tastytrade) benefit from commission-free trades. Major stock e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Management One

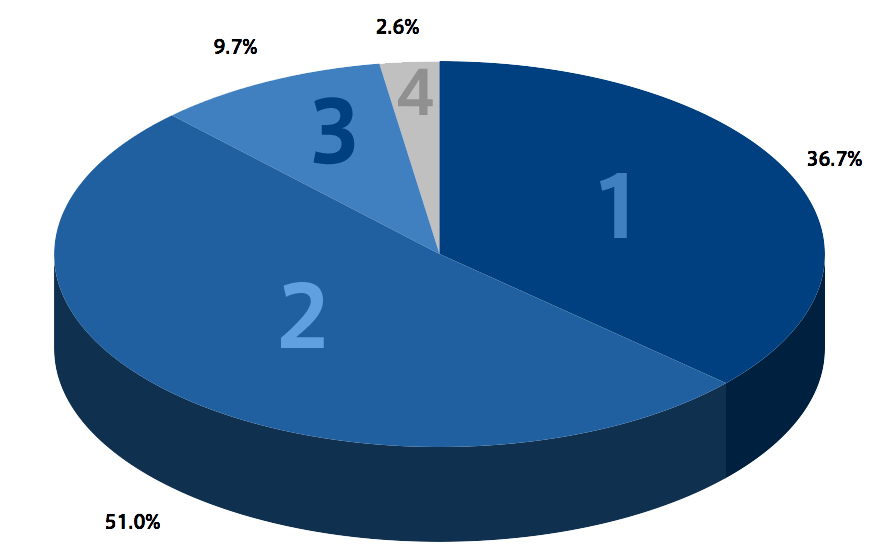

Asset Management One Co., Ltd. (アセットマネジメントOne株式会社), abbreviated as AM-One, is a Japanese asset management company. It is a subsidiary of the Mizuho Financial Group and is one of the largest asset management companies in Asia. AM-One acts as one of the investment managers for the Government Pension Investment Fund and is the largest manager of Japanese public pension assets. History AM-One was formed on 1 October 2016, as a joint venture between Mizuho Financial Group and Dai-ichi Life using the pre-existing asset management units within each company. There were four companies which were merged to create AM-One. They were DIAM Co, Mizuho Asset Management, Shinko Asset Management, and Asset Management Division of Mizuho Trust & Banking. Currently, Mizuho Financial Group holds 70% of the company's shares and 51% of voting rights while Dai-ichi Life holds 30% of the company's shares and 49% of voting rights. While initially focused on Japan, the com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ōtemachi

is a district of Chiyoda, Tokyo, Japan. It is located north of Tokyo Station and Marunouchi, east of the Imperial Palace, west of Nihonbashi and south of Kanda. It is the location of the former site of the village of Shibazaki, the most ancient part of Tokyo. Ōtemachi is known as a center of Japanese journalism, housing the main offices of three of the "big five" newspapers as well as being a key financial center and headquarters for large Japanese corporations. The Tokyo Fire Department is headquartered in Ōtemachi. History Ōtemachi derives its name of ''Ōtemon'' ("Great Hand Gate") of Edo Castle. During the Edo period, various ''daimyōs'' constructed their lavish residences outside the castle, such as the residence of the ''daimyō'' Matsudaira Tadamasa. Ōtemachi was completely destroyed during the Great Fire of Meireki in 1657. It was rebuilt, albeit on a smaller, less grand scale. Ōtemachi remained however in the possession of the various ''daimyō'' f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Holding Company

A holding company is a company whose primary business is holding a controlling interest in the Security (finance), securities of other companies. A holding company usually does not produce goods or services itself. Its purpose is to own Share capital, stock of other companies to create a corporate group. In some jurisdictions around the world, holding companies are called parent companies, which, besides holding Share capital, stock in other companies, can conduct trade and other business activities themselves. Holding companies reduce risk for the shareholders, and can permit the ownership and control of a number of different companies. ''The New York Times'' uses the term ''parent holding company''. Holding companies can be subsidiaries in a Subsidiary#Tiered subsidiaries, tiered structure. Holding companies are also created to hold assets such as intellectual property or trade secrets, that are protected from the operating company. That creates a smaller risk when it comes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kabushiki Kaisha

A or ''kabushiki kaisha'', commonly abbreviated K.K. or KK, is a type of defined under the Companies Act of Japan. The term is often translated as "stock company", "joint-stock company" or "stock corporation". The term ''kabushiki gaisha'' in Japan refers to any joint-stock company regardless of country of origin or incorporation; however, outside Japan the term refers specifically to joint-stock companies incorporated in Japan. Usage in language In Latin script, ''kabushiki kaisha'', with a , is often used, but the original Japanese pronunciation is ''kabushiki gaisha'', with a , owing to '' rendaku''. A ''kabushiki gaisha'' must include "" in its name (Article 6, paragraph 2 of the Companies Act). In a company name, "" can be used as a prefix (e.g. , '' kabushiki gaisha Dentsū'', a style called , ''mae-kabu'') or as a suffix (e.g. , '' Toyota Jidōsha kabushiki gaisha'', a style called , ''ato-kabu''). Many Japanese companies translate the phrase "" in their name as "Com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mizuho Securities

is a Japanese investment banking and securities firm. It is a wholly owned subsidiary of Mizuho Financial Group. History The current Mizuho Securities is established by a merger between Shinko Securities and the former Mizuho Securities. The former Shinko Securities (a former equity-method affiliate of Mizuho Financial Group) and the former Mizuho Securities (a former consolidated subsidiary of Mizuho Financial Group) merged on 7 May 2009 after it was postponed due to the 2008 financial crisis. The surviving entity was the former Shinko Securities, which changed its name to Mizuho Securities upon the merger. After the merger, Mizuho Financial Group holds 59.51% equity ownership of the new Mizuho Securities. In 2004, the Polaris Capital Group was divested, focusing on private equity investment. Mizuho Securities is involved in bond and stock trading, debt and equity financing, and advisory services for structured finance; its clients include financial institutions, public corpora ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mizuho Trust & Banking

is the trust banking arm of Mizuho Financial Group The , known from 2000 to 2003 as Mizuho Holdings and abbreviated as MHFG or simply Mizuho, is a Japanese banking holding company headquartered in the Ōtemachi district of Chiyoda, Tokyo, Japan. The group was formed in 2000-2002 by merger of Dai- .... History The merger of the Dai-Ichi Kangyo Bank, Fuji Bank and the Industrial Bank of Japan in 2000 was followed by the merger of their respective trust banking subsidiaries, creating Mizuho Trust & Banking Co. The company is known for developing trust products for specific types of families, including those in the LGBT community. Its main activities include asset management for individuals, securitization, private banking, and custody. Mizuho Trust & Banking also has administration services for a variety of trust, including money trusts, pecuniary trusts, investment trusts, and securities trusts. Its pension activities include corporate pension design planning, the management ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mizuho Bank

is the integrated retail and corporate banking unit of Mizuho Financial Group (; ). It is one of the largest financial services company in Japan with total assets of approximately $1.9 trillion USD in 2023, and considered one of Japan's three so-called megabank groups, along with MUFG and SMBC. Mizuho Bank provides financial products and services to a wide range of clients, including individuals, small and medium-sized enterprises, large corporations, financial institutions and public sector entities. The bank client base extends to 90% of Forbes Global 200 companies, and over 80% of the listed companies in Japan. Its headquarters is located in Otemachi, the prominent business district of Tokyo. With over 505 branches and offices in Japan, it is the only bank to have branches in every prefecture in Japan. The bank also operates from 110 offices in 40 countries. The name "Mizuho" is an archaic Japanese term meaning "golden ears of rice," deriving from the classical text ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth Management

Wealth management (WM) or wealth management advisory (WMA) is an investment advisory service that provides financial management and wealth advisory services to a wide array of clients ranging from affluent to high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals and families. It is a discipline which incorporates structuring and planning wealth to assist in growing, preserving, and protecting wealth, whilst passing it onto the family in a tax-efficient manner and in accordance with their wishes. Wealth management brings together tax planning, wealth protection, estate planning, succession planning, and family governance. Private wealth management Private wealth management is sought by high-net-worth investors. Generally, this includes advice on the use of various estate planning vehicles, business-succession or stock-option planning, and the occasional use of hedging derivatives for large blocks of stock. Traditionally, the wealthiest retail clients of investment ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

Private equity (PE) is stock in a private company that does not offer stock to the general public; instead it is offered to specialized investment funds and limited partnerships that take an active role in the management and structuring of the companies. In casual usage "private equity" can refer to these investment firms rather than the companies in which they invest. Private-equity capital (economics), capital is invested into a target company either by an investment management company (private equity firm), a venture capital fund, or an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Private equity can provide working capital to finance a target company's expansion, including the development of new products and services, operational restructuring, management changes, and shifts in ownership and control. As a financial product, a private-equity fund is private capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |