|

Means Test

A means test is a determination of whether an individual or family is eligible for government benefits, assistance or welfare, based upon whether the individual or family possesses the means to do with less or none of that help. Means testing is in opposition to universal coverage, which extends benefits to everyone. Canada In Canada, means tests are used for student finance (for post-secondary education), legal aid, and " welfare" (direct transfer payments to individuals to combat poverty). They are not generally used for primary and secondary education which are tax-funded. Means tests for public health insurance were once common but are now illegal, as the Canada Health Act of 1984 requires that all the provinces provide universal healthcare coverage to be eligible for subsidies from the federal government. Means tests are also not used for pensions and seniors' benefits, but there is a clawback of Old Age Security payments for people making over $69,562 (in 2012). T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare Spending

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed (e.g. pensions), as opposed to ''social assistance'' programs which provide support on the basis of need alone (e.g. most disability benefits). The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury. More broadly, welfare may also encompass efforts to provide a basic level of well-being through subsidized ''social services'' such as healthcare, education, infrastructure, vocational training, and public housing.''The New Fontana Diction ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Rule

The capital rule is a British rule for determining eligibility for social security benefits. The means tested social security system in the United Kingdom has always operated an eligibility test for savings. The Poor law required claimants to be destitute but there does not appear to be any documentation about how the test of destitution was applied. The great increase in home-ownership during the twentieth century in the UK necessitated detailed rules about how a claimant's capital should be treated. Since at least 1948 the value of a claimant's home has been disregarded in assessing their resources. Capital has always been assessed on a household basis, that is jointly for a couple, whether or not married. The capital of any dependent children is normally disregarded. The National Assistance Act 1948 ( 11 & 12 Geo. 6. c. 29) established that the value of the claimant's home should be disregarded, as were war savings and up to £375 in savings. Capital in excess of £50 but be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cold Weather Payment

Cold weather payments are paid by the United Kingdom government to recipients of certain state benefits in the event of particularly cold weather in the winter. The Social Fund Cold Weather Payments (General) Regulations 1988 govern the system under the Social Security Contributions and Benefits Act 1992 The Social Security Contributions and Benefits Act 1992 (c. 4) is the primary legislation concerning the state retirement provision, accident insurance, statutory sick pay and maternity pay in the United Kingdom. Contents *Part I Contributions .... Each time the local temperature is less than 0 °C (32 °F) for seven consecutive days between 1 November and 31 March then a payment of £25 is made. This is in addition to the Winter Fuel Payment. From 1 November 2022 Social Security Scotland has run a separate scheme, Winter Heating Payment to replace the Cold Weather Payment in Scotland. This is a £50 flat payment for those eligible, unconnected with the weather. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Aid

Legal aid is the provision of assistance to people who are unable to afford legal representation and access to the court system. Legal aid is regarded as central in providing access to justice by ensuring equality before the law, the right to counsel and the right to a fair trial. This article describes the development of legal aid and its principles, primarily as known in Europe, the Commonwealth of Nations and in the United States. Legal aid is essential to guaranteeing equal access to justice for all, as provided for by Article 6.3 of the European Convention on Human Rights regarding criminal law cases and Article 6.1 of the same Convention both for civil and criminal cases. Especially for citizens who do not have sufficient financial means, the provision of legal aid to clients by governments increases the likelihood, within court proceedings, of being assisted by legal professionals for free or at a lower cost, or of receiving financial aid. A number of delivery mod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prescription Charges

In the United Kingdom most medicines are supplied via the National Health Service at either no charge, or for a fixed charge for up to three months' worth of any medicine. Charges for prescriptions for medicines and some medical appliances are payable by adults in England under the age of 60, but not by older people or children. However, people may be exempt from charges in various exemption categories. Charges were abolished by NHS Wales in 2007, Health and Social Care in Northern Ireland in 2010 and by NHS Scotland in 2011. In 2010/11, in England, £450million was raised through these charges, some 0.5% of the total NHS budget. the prescription charge is £9.90 per item. Ireland also has a system of fixed charges rather than individually priced medicines, but the details are totally different. History When the National Health Service was established in 1948 all prescriptions were free. The power to make a charge was introduced in the NHS Amendment Act 1949 under pressure fro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free School Meals

A school meal (whether it is a breakfast, lunch, or evening meal) is a meal provided to students and sometimes teachers at a school, typically in the middle or beginning of the school day. Countries around the world offer various kinds of school meal programs, and altogether, these are among the world's largest social safety nets. An estimated 380 million school children around the world receive meals (or snacks or take-home rations) at their respective schools. The extent of school feeding coverage varies from country to country, and as of 2020, the aggregate coverage rate worldwide is estimated to be 27% (and 40% specifically for primary school-age children).Global Child Nutrition Foundation (GCNF). 2022School Meal Programs Around the World: Results from the 2021 Global Survey of School Meal Programs GCNF: Seattle. The objectives and benefits of school meals vary. In developing countries, school meals provide food security at times of crisis and help children to become healt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Working Tax Credit

Working Tax Credit (WTC) was a state benefit in the United Kingdom made to people who worked and received a low income. It was introduced in April 2003 and was a means-tested benefit. Despite the name, the payment was not a tax credit linked to a person's tax bill, but a payment used to top-up low wages. The amount of WTC received could exceed the amount of tax paid. Unlike most other benefits, WTC was paid by HM Revenue and Customs (HMRC). WTC could be claimed by working individuals, childless couples and working families with dependent children. In addition, some other people were also entitled to Child Tax Credit (CTC) if they were responsible for any children. WTC and CTC were assessed jointly and families remained eligible for CTC even if no adult was working or they had too much income to receive WTC. In 2010, the coalition government announced that the Working Tax Credit would, by 2017, be integrated into and replaced by Universal Credit. However, implementation of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing Benefit

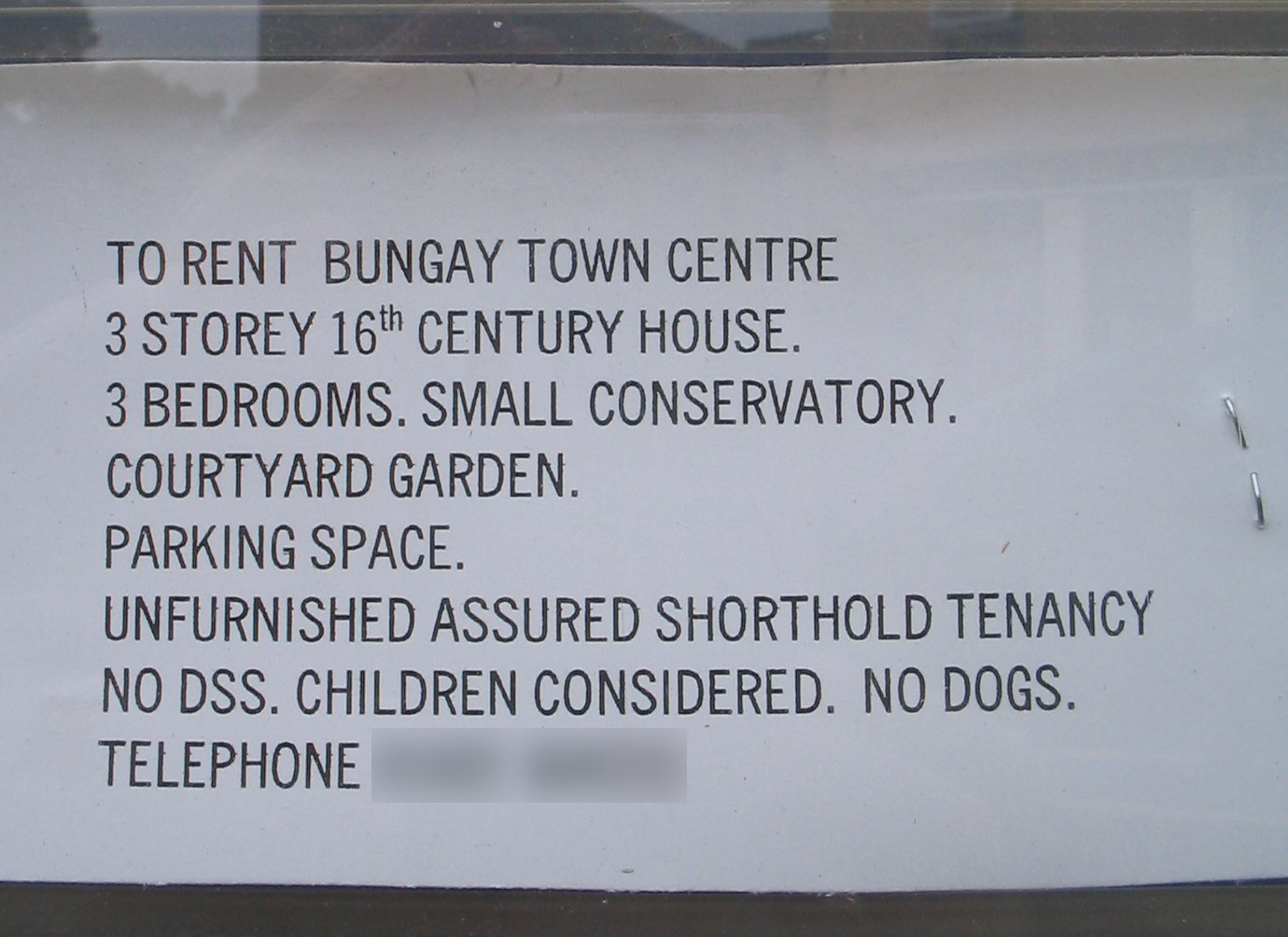

Housing Benefit is a means-tested social security benefit in the United Kingdom that is intended to help meet housing costs for rented accommodation. It is the second biggest item in the Department for Work and Pensions' budget after the state pension, totalling £23.8 billion in 2013–14. The primary legislation governing Housing Benefit is the Social Security Contributions and Benefits Act 1992. Operationally, the governing regulations are statutory instruments arising from that Act. It is governed by one of two sets of regulations. For working age claimants it is governed by the "Housing Benefit Regulations 2006", but for those who have reached the qualifying age for Pension Credit (regardless of whether it has been claimed) it is governed by the "Housing Benefit (Persons who have attained the qualifying age for state pension credit) Regulations 2006". It is normally administered by the local authority in whose area the property being rented lies. In some circumstance ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Universal Credit

Universal Credit is a United Kingdom based Welfare state in the United Kingdom, social security payment. It is Means test, means-tested and is replacing and combining six benefits, for working-age households with a low income: income-related Employment and Support Allowance (ESA), income-based Jobseeker's Allowance (JSA), and Income Support; Child Tax Credit (CTC) and Working Tax Credit (WTC); and Housing Benefit. An award of UC is made up of different elements, which become payable to the claimant if relevant criteria apply: a standard allowance for singles or couples, child elements and disabled child elements for children in the household, housing cost element, childcare costs element, as well as elements for being a carer or for having limited capability to work-related activities, due to illness or disability. The new policy was announced in 2010 at the Conservative Party (UK), Conservative Party annual party conference, conference by the Work and Pensions Secretary, Iain Du ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension Credit

Pension Credit is the principal element of the UK welfare system for people of pension age. It is intended to supplement the UK State Pension, or to replace it (for example, if the claimant did not meet the conditions to claim a State Pension). It was introduced in the UK in 2003 by Gordon Brown, then Chancellor of the Exchequer. It has been subject to a number of changes over its existence, but has the core aim of lifting retired people of limited means out of poverty. Eligibility may be estimated on a government website. Core elements The scheme was introduced to replace the ''Minimum Income Guarantee'', which had been introduced in 1997, also by Gordon Brown. This combined the existing ''applicable amount'' (of benefit) in Income Support, together with the ''Pensioner Premium'', which was itself substantially increased; these changes gave the impression of a new, more generous benefit package aimed at pensioners. Pension Credit has two elements: *The first element, Guarantee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employment And Support Allowance

Employment and Support Allowance (ESA) is a United Kingdom welfare payment for adults younger than the State Pension age who are having difficulty finding work because of their long-term medical condition or a disability. It is a basic income-replacement benefit paid in lieu of wages. It is currently being phased out and replaced with Universal Credit for claimants on low incomes, although the contribution-based element remains available. Eligibility for ESA An individual can put in a claim for ESA if they satisfy all of these conditions: * They live in the United Kingdom * They are over the age of sixteen * They have not reached their State Pension age * They have a sick-note from their doctor They will not be paid ESA if they are entitled to Statutory Sick Pay (which is paid out by a current employer) and it is not possible to receive ESA at the same time as the other main out-of-work benefits, i.e. Jobseekers Allowance or Income Support. Universal Credit, which is received ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |