|

Macd2

MACD, short for moving average convergence/divergence, is a technical indicator, trading indicator used in technical analysis of securities prices, created by Gerald Appel in the late 1970s. It is designed to reveal changes in the strength, direction, momentum (finance), momentum, and duration of a trend in a stock's price. The MACD indicator (or "oscillator") is a collection of three time series calculated from historical price data, most often the share price, closing price. These three series are: the MACD series proper, the "signal" or "average" series, and the "divergence" series which is the difference between the two. The MACD series is the difference between a "fast" (short period) moving average#Exponential moving average, exponential moving average (EMA), and a "slow" (longer period) EMA of the price series. The average series is an EMA of the MACD series itself. The MACD indicator thus depends on three time parameters, namely the time constants of the three EMAs. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

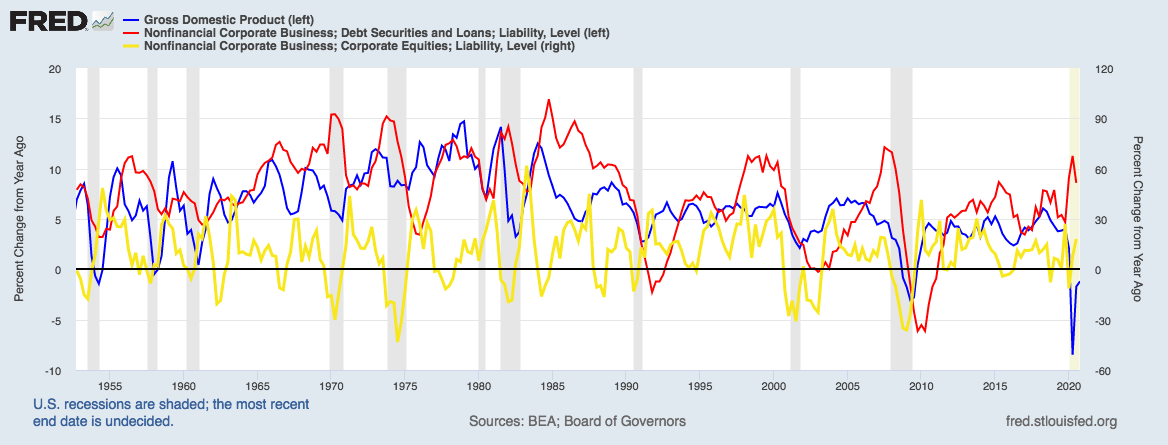

Economic Indicator

An economic indicator is a statistic about an Economics, economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic indicators include various indices, earnings reports, and economic summaries: for example, the unemployment rate, quits rate (quit rate in American English), housing starts, consumer price index (a measure for inflation (economics), inflation), inverted yield curve, consumer leverage ratio, industrial production, bankruptcies, gross domestic product, broadband internet access, broadband internet penetration, retail sales, price index, and changes in credit conditions. The leading business cycle dating committee in the United States, United States of America is the private National Bureau of Economic Research. The Bureau of Labor Statistics is the principal fact-finding agency for the U.S. government in the field of labor economics ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Williams %R

Williams %R, or just %R, is a technical analysis oscillator showing the current closing price in relation to the high and low of the past days (for a given ). It was developed by a publisher and promoter of trading materials, Larry Williams. Its purpose is to tell whether a stock or commodity market is trading near the high or the low, or somewhere in between, of its recent trading range. The Williams %R (Percent Range), created by Larry Williams, is a momentum oscillator. It represents the price level in relation to the highest point in the previous period. The default period is generally set to 14. By doing this, you can monitor overbought and oversold conditions. Since the Williams %R fluctuates between 0 and -100, this would mean that readings between 0 and -20 are overbought, while readings between -80 and -100 are oversold. This means that the Williams %R is a bound indicator. : \%\text = \times -100 The oscillator is on a negative scale, from −100 (lowest) up to 0 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ultimate Oscillator

The ultimate oscillator is a theoretical concept in finance developed by Larry R. Williams, Larry Williams as a way to account for the problems experienced in most oscillators when used over different lengths of time. The oscillator is a technical analysis indicator based on a notion of buying or selling "pressure" represented by where a day's closing price falls within the day's Average true range#Calculation, true range. The calculation starts with "buying pressure", which is the amount by which the close is above the "true low" on a given day. The true low is the lesser of the given day's trading low and the previous close. : \text = \text - \min (\text, \text) The true range (the same as used in average true range) is the difference between the "true high" and the true low above. The true high is the greater of the given day's trading high and the previous close. : \text = \max (\text, \text) - \min (\text, \text) The total buying pressure over the past 7 days is expres ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Relative Strength Index

The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading period. The indicator should not be confused with relative strength. The RSI is classified as a momentum oscillator, measuring the velocity and magnitude of price movements. Momentum is the rate of the rise or fall in price. The relative strength RS is given as the ratio of higher closes to lower closes. Concretely, one computes two averages of absolute values of closing price changes, i.e. two sums involving the sizes of candles in a candle chart. The RSI computes momentum as the ratio of higher closes to overall closes: stocks which have had more or stronger positive changes have a higher RSI than stocks which have had more or stronger negative changes. The RSI is most typically used on a 14-day timeframe, measured on a scale from 0 to 10 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stochastic Oscillator

Stochastic oscillator is a momentum indicator within technical analysis that uses support and resistance levels as an oscillator. George Lane developed this indicator in the late 1950s. The term ''stochastic Stochastic (; ) is the property of being well-described by a random probability distribution. ''Stochasticity'' and ''randomness'' are technically distinct concepts: the former refers to a modeling approach, while the latter describes phenomena; i ...'' refers to the point of a current price in relation to its price range over a period of time. This method attempts to predict price turning points by comparing the closing price of a security to its price range. The 5-period stochastic oscillator in a daily timeframe is defined as follows: :\%K = 100\times\frac \%D_N = \frac where \mathrm_5 and \mathrm_5 are the highest and lowest prices in the last 5 days respectively, while %''D'' is the ''N''-day moving average of %''K'' (the last ''N'' values of %''K''). Usua ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prentice Hall Press

Prentice Hall was a major American educational publisher. It published print and digital content for the 6–12 and higher-education market. It was an independent company throughout the bulk of the twentieth century. In its last few years it was owned by, then absorbed into, Savvas Learning Company. In the Web era, it distributed its technical titles through the Safari Books Online e-reference service for some years. History On October 13, 1913, law professor Charles Gerstenberg and his student Richard Ettinger founded Prentice Hall. Gerstenberg and Ettinger took their mothers' maiden names, Prentice and Hall, to name their new company. At the time the name was usually styled as Prentice-Hall (as seen for example on many title pages), per an orthographic norm for coordinate elements within such compounds (compare also ''McGraw-Hill'' with later styling as ''McGraw Hill''). Prentice-Hall became known as a publisher of trade books by authors such as Norman Vincent Peale; eleme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Detrended Price Oscillator

The detrended price oscillator (DPO) is an indicator in technical analysis that attempts to eliminate the long-term trends in prices by using a displaced moving average so it does not react to the most current price action. This allows the indicator to show intermediate overbought and oversold levels effectively. The detrended price oscillator is a form of price oscillator, like the "percentage price oscillator" (PPO) and the "absolute price oscillator" (APO) both of which are forms of Gerald Appel's moving average convergence/divergence indicator (MACD). The APO is an equivalent to the MACD indicator while the PPO is an improved alternative to the APO or the MACD for use when a stock's price change has been large, or when comparing the oscillator behavior for different stocks which have significantly different prices. Although these are not so commonly used with the DPO, for the other price oscillators, as for the MACD, a signal line is frequently generated for the price oscilla ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Low-pass Filter

A low-pass filter is a filter that passes signals with a frequency lower than a selected cutoff frequency and attenuates signals with frequencies higher than the cutoff frequency. The exact frequency response of the filter depends on the filter design. The filter is sometimes called a high-cut filter, or treble-cut filter in audio applications. A low-pass filter is the complement of a high-pass filter. In optics, high-pass and low-pass may have different meanings, depending on whether referring to the frequency or wavelength of light, since these variables are inversely related. High-pass frequency filters would act as low-pass wavelength filters, and vice versa. For this reason, it is a good practice to refer to wavelength filters as ''short-pass'' and ''long-pass'' to avoid confusion, which would correspond to ''high-pass'' and ''low-pass'' frequencies. Low-pass filters exist in many different forms, including electronic circuits such as a '' hiss filter'' used in audio, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

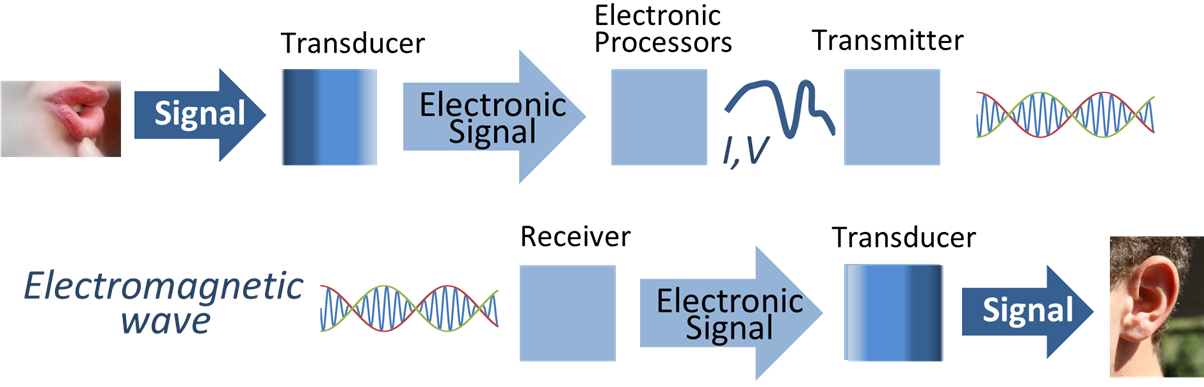

Signal Processing

Signal processing is an electrical engineering subfield that focuses on analyzing, modifying and synthesizing ''signals'', such as audio signal processing, sound, image processing, images, Scalar potential, potential fields, Seismic tomography, seismic signals, Altimeter, altimetry processing, and scientific measurements. Signal processing techniques are used to optimize transmissions, Data storage, digital storage efficiency, correcting distorted signals, improve subjective video quality, and to detect or pinpoint components of interest in a measured signal. History According to Alan V. Oppenheim and Ronald W. Schafer, the principles of signal processing can be found in the classical numerical analysis techniques of the 17th century. They further state that the digital refinement of these techniques can be found in the digital control systems of the 1940s and 1950s. In 1948, Claude Shannon wrote the influential paper "A Mathematical Theory of Communication" which was publis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macd Indicator

MACD, short for moving average convergence/divergence, is a trading indicator used in technical analysis of securities prices, created by Gerald Appel in the late 1970s. It is designed to reveal changes in the strength, direction, momentum, and duration of a trend in a stock's price. The MACD indicator (or "oscillator") is a collection of three time series calculated from historical price data, most often the closing price. These three series are: the MACD series proper, the "signal" or "average" series, and the "divergence" series which is the difference between the two. The MACD series is the difference between a "fast" (short period) exponential moving average (EMA), and a "slow" (longer period) EMA of the price series. The average series is an EMA of the MACD series itself. The MACD indicator thus depends on three time parameters, namely the time constants of the three EMAs. The notation "MACD(''a'',''b'',''c'')" usually denotes the indicator where the MACD series is the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Indicator

In technical analysis in finance, a technical indicator is a mathematical calculation based on historic price, volume, or (in the case of futures contracts) open interest information that aims to forecast financial market direction. Technical indicators are a fundamental part of technical analysis and are typically plotted as a chart pattern to try to predict the market trend A market trend is a perceived tendency of the financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time .... Indicators generally overlay on price chart data to indicate where the price is going, or whether the price is in an "overbought" condition or an "oversold" condition. Many technical indicators have been developed and new variants continue to be developed by traders with the aim of getting better results. New Indicators are often backtested on historic pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |