|

List Of Recessions In The United Kingdom

This is a list of recessions (and depressions) that have affected the economy of the United Kingdom and its predecessor states. In the United Kingdom and all other EU member states, a recession is generally defined as two successive quarters of negative economic growth, as measured by the seasonally adjusted quarter-on-quarter figures for real GDP. See also * List of recessions in the United States * List of stock market crashes and bear markets * Office for National Statistics References External links Office for National Statistics website * [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Recessions In The United States

There have been as many as 48 recessions in the United States dating back to the Articles of Confederation, and although economists and historians dispute certain 19th-century recessions, the consensus view among economists and historians is that "The cyclical volatility of GDP and unemployment was greater before the Great Depression than it has been since the end of World War II." Cycles in the country's agricultural production, industrial production, consumption, business investment, and the health of the banking industry contribute to these declines. U.S. recessions have increasingly affected economies on a worldwide scale, especially as countries' economies become more intertwined. The unofficial beginning and ending dates of recessions in the United States have been defined by the National Bureau of Economic Research (NBER), an American private nonprofit research organization. The NBER defines a recession as "a significant decline in economic activity spread across the ec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Charter Act 1844

The Bank Charter Act 1844 (7 & 8 Vict. c. 32), sometimes referred to as the Peel Banking Act of 1844, was an Act of the Parliament of the United Kingdom, passed under the government of Robert Peel, which restricted the powers of British banks and gave exclusive note-issuing powers to the central Bank of England. It is one of the Bank of England Acts 1694 to 1892. Purpose Until the mid-nineteenth century, commercial banks in Britain and Ireland were able to issue their own banknotes, and notes issued by provincial banking companies were commonly in circulation. Under the 1844 Act, bullionism was institutionalized in Britain, creating a ratio between the gold reserves held by the Bank of England and the notes that the Bank could issue, and limited the issuance by English and Welsh banks of non-gold-backed Bank of England notes to up to £14 million. The Act also placed strict curbs on the issuance of notes by the country banks, barring any new "banks of issue" in any part of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

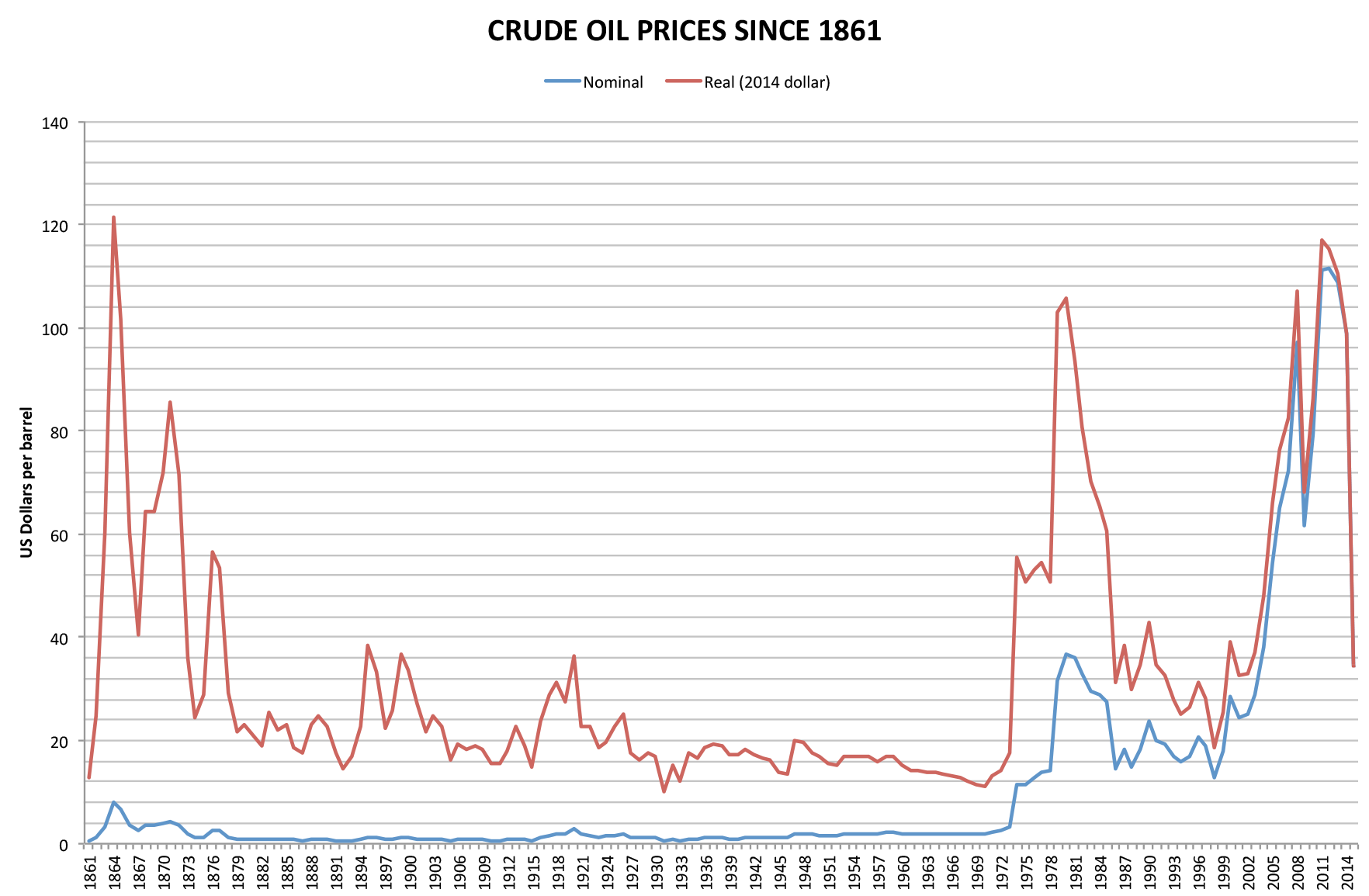

1973 Oil Crisis

The 1973 oil crisis or first oil crisis began in October 1973 when the members of the Organization of Arab Petroleum Exporting Countries (OAPEC), led by Saudi Arabia, proclaimed an oil embargo. The embargo was targeted at nations that had supported Israel during the Yom Kippur War. The initial nations targeted were Canada, Japan, the Netherlands, the United Kingdom and the United States, though the embargo also later extended to Portugal, Rhodesia and South Africa. By the end of the embargo in March 1974, the price of oil had risen nearly 300%, from US to nearly globally; US prices were significantly higher. The embargo caused an oil crisis, or "shock", with many short- and long-term effects on global politics and the global economy. It was later called the "first oil shock", followed by the 1979 oil crisis, termed the "second oil shock". Background Arab-Israeli conflict Ever since the recreation of the State of Israel in 1948 there has been Arab–Israeli confli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1973–1975 Recession

The 1973–1975 recession or 1970s recession was a period of economic stagnation in much of the Western world during the 1970s, putting an end to the overall post–World War II economic expansion. It differed from many previous recessions by involving stagflation, in which high unemployment and high inflation existed simultaneously. United States Among the causes were the 1973 oil crisis, the deficits of the Vietnam War under President Johnson, and the fall of the Bretton Woods system after the Nixon Shock. The emergence of newly industrialized countries increased competition in the metal industry, triggering a steel crisis, where industrial core areas in North America and Europe were forced to re-structure. The 1973–74 stock market crash made the recession evident. The recession in the United States lasted from November 1973 (the Richard Nixon presidency) to March 1975 (the Gerald Ford presidency), and its effects on the US were felt through the Jimmy Carter presidency ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

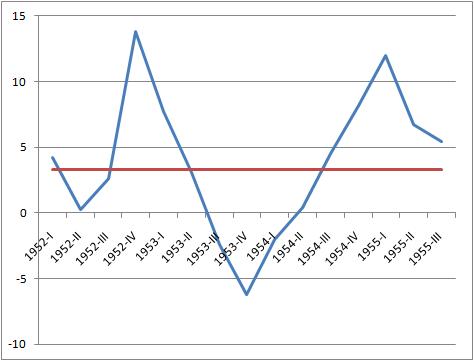

Recession Of 1960–1961

The Recession of 1960–1961 was a recession in the United States. According to the National Bureau of Economic Research the recession lasted for 10 months, beginning in April 1960 and ending in February 1961. The recession preceded the third-longest economic expansion in U.S. history, from February 1961 until the beginning of the Recession of 1969–1970 in December 1969—to date only the 1990s and post-financial crisis (2009-2020) have seen a longer period of growth. The Federal Reserve had started to tighten monetary policy in 1959 and eased off in 1960. During this recession, the GDP of the United States fell 1.4 percent. Though the recession ended in November 1960, the unemployment rate did not peak for several more months. In May 1961, the rate reached its height for the cycle of 7.1 percent. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double-dip Recession

Recession shapes or recovery shapes are used by economists to describe different types of recessions and their subsequent recoveries. There is no specific academic theory or classification system for recession shapes; rather the terminology is used as an informal shorthand to characterize recessions and their recoveries. The most commonly used terms are V-shaped (with variations of square-root shaped, and Nike-swoosh shaped), U-shaped, W-shaped (also known as a double-dip recession), and L-shaped recessions, with the COVID-19 pandemic leading to the K-shaped recession (also known as a two-stage recession). The names derive from the shape the economic data – particularly GDP – takes during the recession and recovery. V-shaped In a V-shaped recession, the economy suffers a sharp but brief period of economic decline with a clearly defined trough, followed by a strong recovery. V-shapes are the normal shape for a recession, as the strength of the economic recovery is typicall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gold Standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves. Historically, the silver standard and bimetallism have been more common than the gold standard. The shift to an international monetary system based on a gold standard reflected accident, network externalities, and path dependence. Great Britain accidentally adopted a ''de facto'' gold standard in 1717 when Sir Isaac Newton, then-master of the Royal Mint, set the exchange rate of silver to gold too low, thus causing silver coins to go out of circulation. As Great Britain became the world's leading fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

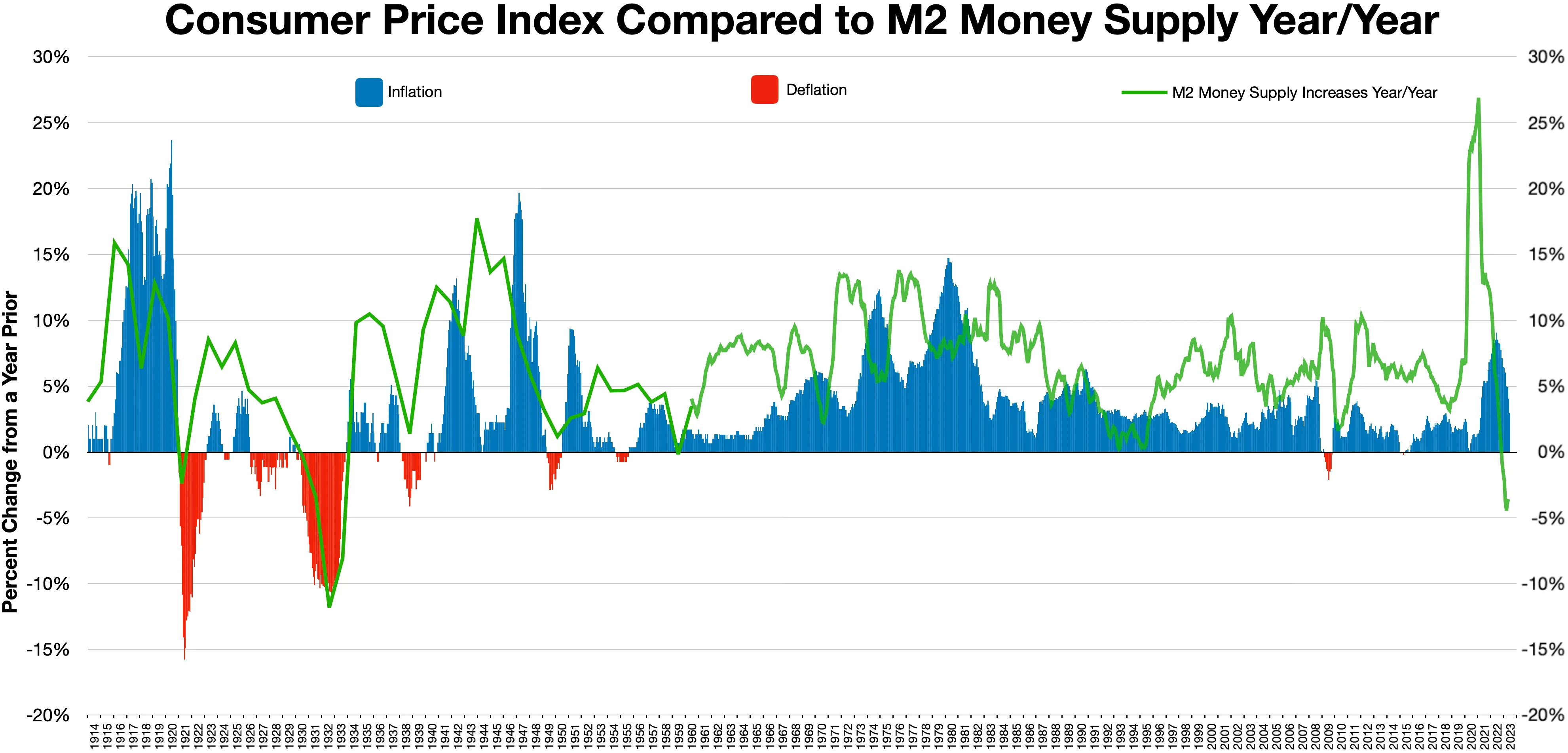

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The Financial contagion, economic contagion began around September and led to the Wall Street Crash of 1929, Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide Gross domestic product, gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression In The United Kingdom

The Great Depression in the United Kingdom also known as the Great Slump, was a period of national economic downturn in the 1930s, which had its origins in the global Great Depression. It was Britain's largest and most profound economic depression of the 20th century. The Great Depression originated in the United States in late 1929 and quickly spread to the world. Britain did not experience the boom that had characterized the U.S., Germany, Canada and Australia in the 1920s, so its effect appeared less severe.H. W. Richardson, "The Economic Significance of the Depression in Britain," ''Journal of Contemporary History'' (1970) 4#4 pp. 3–1in JSTOR/ref> Britain's world trade fell by half (1929–33), the output of heavy industry fell by a third, employment profits plunged in nearly all sectors. At the depth in summer 1932, registered unemployed numbered 3.5 million, and many more had only part-time employment. However at the same time, it is important to consider that from 1929 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from disinflation, a slow-down in the inflation rate, i.e. when inflation declines to a lower rate but is still positive. Economists generally believe that a sudden deflationary shock is a problem in a modern economy because it increases the real value of debt, especially if the deflation is unexpected. Deflation may also aggravate recessions and lead to a deflationary spiral. Some economists argue that prolonged deflationary periods are related to the underlying of technological progress in an economy, because as productivity increases ( TFP), the cost of goods decreases. Deflation usually happens when ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World War I

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, the United States, and the Ottoman Empire, with fighting occurring throughout Europe, the Middle East, Africa, the Pacific, and parts of Asia. An estimated 9 million soldiers were killed in combat, plus another 23 million wounded, while 5 million civilians died as a result of military action, hunger, and disease. Millions more died in genocides within the Ottoman Empire and in the 1918 influenza pandemic, which was exacerbated by the movement of combatants during the war. Prior to 1914, the European great powers were divided between the Triple Entente (comprising France, Russia, and Britain) and the Triple Alliance (containing Germany, Austria-Hungary, and Italy). Tensions in the Balkans came to a head on 28 June 1914, following the assassination of Archduke Franz Ferdi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Post–World War I Recession

The post–World War I recession was an economic recession that hit much of the world in the aftermath of World War I. In many nations, especially in North America, economic growth continued and even accelerated during World War I as nations mobilized their economies to fight the war in Europe. After the war ended, the global economy began to decline. In the United States, 1918–1919 saw a modest economic retreat, but the second part of 1919 saw a mild recovery. A more severe recession hit the United States in 1920 and 1921, when the global economy fell very sharply. North America In North America, the recession immediately following World War I was extremely brief, lasting for only seven months from August 1918 (even before the war had actually ended) to March 1919. A second, much more severe recession, sometimes labeled a depression, began in January 1920. Several indices of economic activity suggest the recession was moderately severe. The Axe-Houghton Index of Trad ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |