|

LightStream

LightStream is an American online lender that is a division of Truist Bank. Truist was formed in December 2019, as the result of a “merger of equals” between SunTrust Bank (of which LightStream was a division) and BB&T. Debuting in March 2013, LightStream is a financial services technology company that provides unsecured, personal loans to people with good credit rating, through a digital process. Predecessor companies histories PeopleFirst Finance LLC PeopleFirst was established in 1995, by founders Gary Miller and Dave G. Zeller, who had backgrounds in the auto finance and banking industries. Based in San Diego, California, the company began offering direct-to-consumer auto loans through the internet in 1997. People applied online and when approved, quickly received a so called "Blank Check" loan by mail. By 2003, PeopleFirst had grown to be the nation's largest online vehicle lender. Capital One Capital One purchased PeopleFirst in 2001. In 2003, the PeopleFirst b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public

In public relations and communication science, publics are groups of individual people, and the public (a.k.a. the general public) is the totality of such groupings. This is a different concept to the sociological concept of the ''Öffentlichkeit'' or public sphere. The concept of a public has also been defined in political science, psychology, marketing, and advertising. In public relations and communication science, it is one of the more ambiguous concepts in the field. Although it has definitions in the theory of the field that have been formulated from the early 20th century onwards, and suffered more recent years from being blurred, as a result of conflation of the idea of a public with the notions of audience, market segment, community, constituency, and stakeholder. Etymology and definitions The name "public" originates with the Latin '' publicus'' (also '' poplicus''), from ''populus'', to the English word 'populace', and in general denotes some mass population ("the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2012

File:2012 Events Collage V3.png, From left, clockwise: The passenger cruise ship Costa Concordia lies capsized after the Costa Concordia disaster; Damage to Casino Pier in Seaside Heights, New Jersey as a result of Hurricane Sandy; People gather at a Mayan temple to commemorate the end of the Mayan calendar on December 21, when it was predicted a doomsday event would occur; NASA's Curiosity Rover lands on the surface of Mars; The Sandy Hook Elementary School shooting caused shock and outrage across the United States and the world; K-pop artist Psy performs his hit single Gangnam Style, which became a cultural phenomenon in 2012; the elementary particle, the Higgs boson, dubbed "The God Particle", is discovered by CERN and revolutionizes quantum physics; The 2012 Summer Olympics open in London., 300x300px, thumb rect 0 0 200 200 Costa Concordia disaster rect 200 0 400 200 Hurricane Sandy rect 400 0 600 200 2012 phenomenon rect 0 200 300 400 2012 Summer Olympics rect 300 2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

San Diego, California

San Diego ( , ; ) is a city on the Pacific Ocean coast of Southern California located immediately adjacent to the Mexico–United States border. With a 2020 population of 1,386,932, it is the eighth most populous city in the United States and the seat of San Diego County, the fifth most populous county in the United States, with 3,338,330 estimated residents as of 2019. The city is known for its mild year-round climate, natural deep-water harbor, extensive beaches and parks, long association with the United States Navy, and recent emergence as a healthcare and biotechnology development center. San Diego is the second largest city in the state of California, after Los Angeles. Historically home to the Kumeyaay people, San Diego is frequently referred to as the "Birthplace of California", as it was the first site visited and settled by Europeans on what is now the U.S. west coast. Upon landing in San Diego Bay in 1542, Juan Rodríguez Cabrillo claimed the are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Loans

In finance, unsecured debt refers to any type of debt or general obligation that is not protected by a guarantor, or collateralized by a lien on specific assets of the borrower in the case of a bankruptcy or liquidation or failure to meet the terms for repayment. Unsecured debts are sometimes called signature debt or personal loans. These differ from secured debt such as a mortgage, which is backed by a piece of real estate. In the event of the bankruptcy of the borrower, the unsecured creditors have a general claim on the assets of the borrower after the specific pledged assets have been assigned to the secured creditors. The unsecured creditors usually realize a smaller proportion of their claims than the secured creditors. In some legal systems, unsecured creditors who are ''also'' indebted to the insolvent debtor are able (and, in some jurisdictions, required) to set off the debts, so actually putting the unsecured creditor with a matured liability to the debtor in a pre-p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Technology

Fintech, a portmanteau of "financial technology", refers to firms using new technology to compete with traditional financial methods in the delivery of financial services. Artificial intelligence, blockchain, cloud computing, and big data are regarded as the "ABCD" (four key areas) of fintech. The use of smartphones for mobile banking, investing, borrowing services, and cryptocurrency are examples of technologies designed to make financial services more accessible to the general public. Fintech companies consist of both startups and established financial institutions and technology companies trying to replace or enhance the usage of financial services provided by existing financial companies. A subset of fintech companies that focus on the insurance industry are collectively known as insurtech or insuretech companies. Key areas Academics Artificial intelligence (AI), blockchain, cloud computing, and big data are considered the four key areas of FinTech. Artificial intelli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Truist Financial

Truist Financial Corporation is an American bank holding company headquartered in Charlotte, North Carolina. The company was formed in December 2019 as the result of the merger of BB&T (Branch Banking and Trust Company) and SunTrust Banks. Its bank operates 2,781 branches in 15 states and Washington, D.C., and offers consumer and commercial banking, securities brokerage, asset management, mortgage, and insurance products and services. It is on the list of largest banks in the United States by assets; as of June 2021, it is the 10th largest bank with $509 billion in assets. As of January 2021, Truist Insurance Holdings is the seventh largest insurance broker in the world with $2.27 billion in annual revenue. History History of BB&T In 1872, Alpheus Branch and Thomas Jefferson Hadley founded the Branch and Hadley merchant bank in their hometown of Wilson, North Carolina. After many transactions, mostly with local farmers, Branch bought out Hadley's shares in 1887 and renamed t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SunTrust Banks

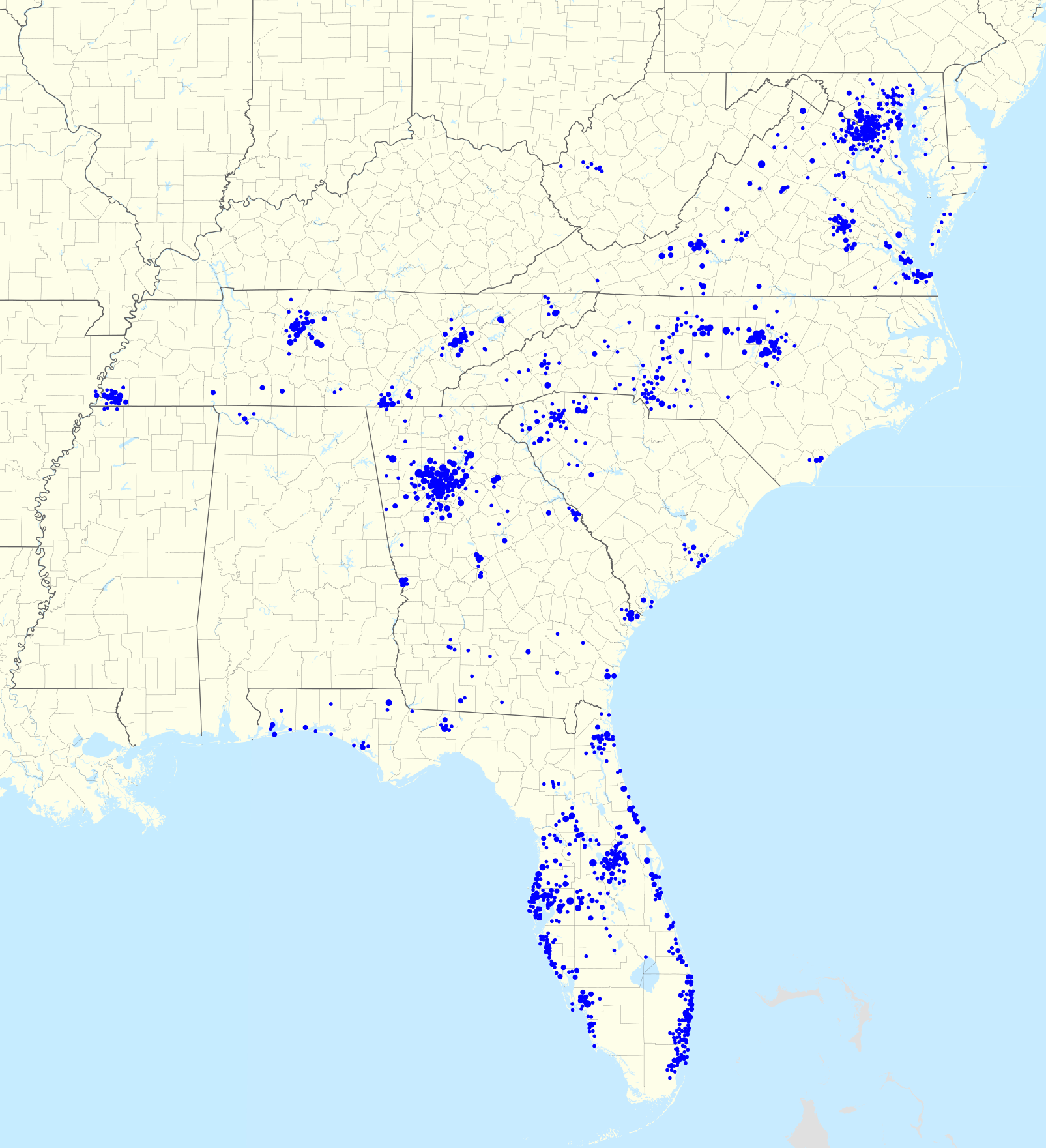

SunTrust Banks, Inc. was an American bank holding company with SunTrust Bank as its largest subsidiary and assets of US$199 billion as of March 31, 2018. The bank's most direct corporate parent was established in 1891 in Atlanta, where it was headquartered. As of September 2016, SunTrust Bank operated 1,400 bank branches and 2,160 ATMs across 11 southeastern states and Washington, D.C. The bank's primary businesses included deposits, lending, credit cards, and trust and investment services. Through its various subsidiaries, the company provided corporate and investment banking, capital market services, mortgage banking, and wealth management — with nearly 24,000 employees. In 2013, it was ordered to pay $1.5 billion "to resolve claims of shoddy mortgage lending, servicing and foreclosure practices," and it reached a preliminary $968 Million settlement with the US government in 2014. In February 2019, SunTrust Banks announced its pending purchase by BB&T for $28 billion i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unsecured Debt

In finance, unsecured debt refers to any type of debt or general obligation that is not protected by a guarantor, or collateralized by a lien on specific assets of the borrower in the case of a bankruptcy or liquidation or failure to meet the terms for repayment. Unsecured debts are sometimes called signature debt or personal loans. These differ from secured debt such as a mortgage, which is backed by a piece of real estate. In the event of the bankruptcy of the borrower, the unsecured creditors have a general claim on the assets of the borrower after the specific pledged assets have been assigned to the secured creditors. The unsecured creditors usually realize a smaller proportion of their claims than the secured creditors. In some legal systems, unsecured creditors who are ''also'' indebted to the insolvent debtor are able (and, in some jurisdictions, required) to set off the debts, so actually putting the unsecured creditor with a matured liability to the debtor in a pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Rating

A credit rating is an evaluation of the credit risk of a prospective debtor (an individual, a business, company or a government), predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulting. The credit rating represents an evaluation of a credit rating agency of the qualitative and quantitative information for the prospective debtor, including information provided by the prospective debtor and other non-public information obtained by the credit rating agency's analysts. Credit reporting (or credit score) – is a subset of credit rating – it is a numeric evaluation of an ''individual's'' credit worthiness, which is done by a credit bureau or consumer credit reporting agency. Sovereign credit ratings A sovereign credit rating is the credit rating of a sovereign entity, such as a national government. The sovereign credit rating indicates the risk level of the investing environment of a country and is used by investors when ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital One

Capital One Financial Corporation is an American bank holding company specializing in credit cards, auto loans, banking, and savings accounts, headquartered in McLean, Virginia with operations primarily in the United States. It is on the list of largest banks in the United States and has developed a reputation for being a technology-focused bank. The bank has 755 branches including 30 café style locations and 2,000 ATMs. It is ranked 99th on the Fortune 500, 9th on Fortune's 100 Best Companies to Work For list, and conducts business in the United States, Canada, and the United Kingdom. The company helped pioneer the mass marketing of credit cards in the 1990s. In 2016, it was the 5th largest credit card issuer by purchase volume, after American Express, JPMorgan Chase, Bank of America, and Citigroup. With a market share of 5%, Capital One is also the second largest auto finance company in the United States, following Ally Financial. The company's three divisions are cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SunTrust Bank

SunTrust Banks, Inc. was an American bank holding company with SunTrust Bank as its largest subsidiary and assets of US$199 billion as of March 31, 2018. The bank's most direct corporate parent was established in 1891 in Atlanta, where it was headquartered. As of September 2016, SunTrust Bank operated 1,400 bank branches and 2,160 ATMs across 11 southeastern states and Washington, D.C. The bank's primary businesses included deposits, lending, credit cards, and trust and investment services. Through its various subsidiaries, the company provided corporate and investment banking, capital market services, mortgage banking, and wealth management — with nearly 24,000 employees. In 2013, it was ordered to pay $1.5 billion "to resolve claims of shoddy mortgage lending, servicing and foreclosure practices," and it reached a preliminary $968 Million settlement with the US government in 2014. In February 2019, SunTrust Banks announced its pending purchase by BB&T for $28 billio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)