|

Ledger Enquirer Word Logo

A ledger is a book or collection of accounts in which account transactions are recorded. Each account has an opening or carry-forward balance, and would record each transaction as either a debit or credit in separate columns, and the ending or closing balance. Overview The ledger is a permanent summary of all amounts entered in supporting journals which list individual transactions by date. Every transaction flows from a journal, to one or more ledgers. A company's financial statements are generated from summary totals in the ledgers. Ledgers include: *Sales ledger, records accounts receivable. This ledger consists of the financial transactions made by customers to the company. *Purchase ledger records money spent for purchasing by the company. * General ledger representing the five main account types: assets, liabilities, income, expenses, and capital. For every debit recorded in a ledger, there must be a corresponding credit, so that the debits equal the credits in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expenses

An expense is an item requiring an outflow of money, or any form of fortune in general, to another person or group as payment for an item, service, or other category of costs. For a tenant, rent is an expense. For students or parents, tuition is an expense. Buying food, clothing, furniture, or an automobile is often referred to as an expense. An expense is a cost that is "paid" or " remitted", usually in exchange for something of value. Something that seems to cost a great deal is "expensive". Something that seems to cost little is "inexpensive". "Expenses of the table" are expenses for dining, refreshments, a feast, etc. In accounting, ''expense'' is any specific outflow of cash or other valuable assets from a person or company to another person or company. This outflow is generally one side of a trade for products or services that have equal or better current or future value to the buyer than to the seller. Technically, an expense is an event in which a proprietary stake is dimi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Digital Data

Digital data, in information theory and information systems, is information represented as a string of discrete symbols each of which can take on one of only a finite number of values from some alphabet, such as letters or digits. An example is a text document, which consists of a string of alphanumeric characters . The most common form of digital data in modern information systems is ''binary data'', which is represented by a string of binary digits (bits) each of which can have one of two values, either 0 or 1. Digital data can be contrasted with ''analog data'', which is represented by a value from a continuous range of real numbers. Analog data is transmitted by an analog signal, which not only takes on continuous values, but can vary continuously with time, a continuous real-valued function of time. An example is the air pressure variation in a sound wave. The word ''digital'' comes from the same source as the words digit and ''digitus'' (the Latin word for ''finger'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Distributed Ledger

A distributed ledger (also called a shared ledger or distributed ledger technology or DLT) is the consensus of replicated, shared, and synchronized digital data that is geographically spread (distributed) across many sites, countries, or institutions. In contrast to a centralized database, a distributed ledger does not require a central administrator, and consequently does not have a single (central) point-of-failure. In general, a distributed ledger requires a peer-to-peer (P2P) computer network and consensus algorithms so that the ledger is reliably replicated across distributed computer nodes (servers, clients, etc.). The most common form of distributed ledger technology is the blockchain (commonly associated with the Bitcoin cryptocurrency), which can either be on a public or private network. Infrastructure for data management is a common barrier to implementing DLT. In some cases, where the distributed digital information functions as an accounting journal rather than an a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Final Accounts

Final accounts gives an idea about the profitability and financial position of a business to its management, owners, and other interested parties. All business transactions are first recorded in a journal. They are then transferred to a ledger and balanced. These final tallies are prepared for a specific period. The preparation of a final accounting is the last stage of the accounting cycle. It determines the financial position of the business. Under this, it is compulsory to make a trading account, the profit and loss account, and balance sheet. The term "final accounts" includes the trading account, the profit and loss account, and the balance sheet. Legal provisions Sections 209 to 220 of the Indian Companies Act, 2013 deal with legal provisions relating to preparation and presentation of final accounts by companies. Section 210 deals with the preparation of final accounts by companies, while section 211 deals with the form and the contents of the balance sheet and the pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Specialized Journals

Special journals (in the field of accounting) are specialized lists of financial transaction records which accountants call journal entries. In contrast to a general journal, each special journal records transactions of a specific type, such as sales or purchases. For example, when a company purchases merchandise from a vendor, and then in turn sells the merchandise to a customer, the purchase is recorded in one journal and the sale is recorded in another. Types of special journals The types of Special Journals that a business uses are determined by the nature of the business. Special journals are designed as a simple way to record the most frequently occurring transactions. There are four types of Special Journals that are frequently used by merchandising businesses: Sales journals, Cash receipts journals, Purchases journals, and Cash payments journals. Sales journal Sales journals record transactions that involve sales purely on credit. Source documents here would proba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debits And Credits

Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value ''to'' that account, and a credit entry represents a transfer ''from'' the account. Each transaction transfers value from credited accounts to debited accounts. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited. Debits and credits are traditionally distinguished by writing the transfer amounts in separate columns of an account book. Alternately, they can be listed in one column, indicating debits with the suffix "Dr" or writing them plain, and indicating credits with the suffix "Cr" or a minus si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bookkeeping

Bookkeeping is the recording of financial transactions, and is part of the process of accounting in business and other organizations. It involves preparing source documents for all transactions, operations, and other events of a business. Transactions include purchases, sales, receipts and payments by an individual person or an organization/corporation. There are several standard methods of bookkeeping, including the single-entry and double-entry bookkeeping systems. While these may be viewed as "real" bookkeeping, any process for recording financial transactions is a bookkeeping process. The person in an organisation who is employed to perform bookkeeping functions is usually called the bookkeeper (or book-keeper). They usually write the '' daybooks'' (which contain records of sales, purchases, receipts, and payments), and document each financial transaction, whether cash or credit, into the correct daybook—that is, petty cash book, suppliers ledger, customer ledger, etc. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wriothesley's Chronicle

''A Chronicle of England During the Reigns of the Tudors, From A.D. 1485 to 1559'', better known as Wriothesley's Chronicle, was written during the reigns of Henry VIII, Edward VI, Mary I and Elizabeth I, by Charles Wriothesley, officer of arms at the College of Arms in London. This chronicle of English affairs, detailing the accession of Henry VII to the first year of the reign of Elizabeth I, edited by , was published in two volumes, by the Camden Society in 1875. References Sources * * External links ''A Chronicle of England During the Reigns of the Tudors, From A.D. 1485 to 1559,'' IWriothesley's Chronicle, Volume I at Internet Archive ''A Chronicle of England During the Reigns of the Tudors, From A.D. 1485 to 1559,'' IIWriothesley's Chronicle, Volume II at Internet Archive The Internet Archive is an American digital library with the stated mission of "universal access to all knowledge". It provides free public access to collections of digitized materials, incl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Charles Wriothesley

Charles Wriothesley ( ''REYE-əths-lee''; 8 May 1508 – 25 January 1562) was a long-serving officer of arms at the College of Arms in London. He was the last member of a dynasty of heralds that started with his grandfather— Garter Principal King of Arms John Writhe. Personal life Charles Wriothesley was a younger son of Thomas Wriothesley, who also became Garter King of Arms, and his wife, Jane Hall. His uncle, William Wriothesley, had also served at the College of Arms as York Herald. Charles Wriothesley was born in London on 8 May 1508. In 1511, he moved with his family into Garter House, which his father had built as an embodiment of the family's rise to fame. His father sent him to Cambridge to study law. He was being educated at Trinity Hall, Cambridge by 1522.See . He has no entry in ''Alumni Cantabrigienses''. He seems to have married twice. His first wife was the daughter of a Mr Mallory. When he died at his lodgings London on 25 January 1562, however, there was no men ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

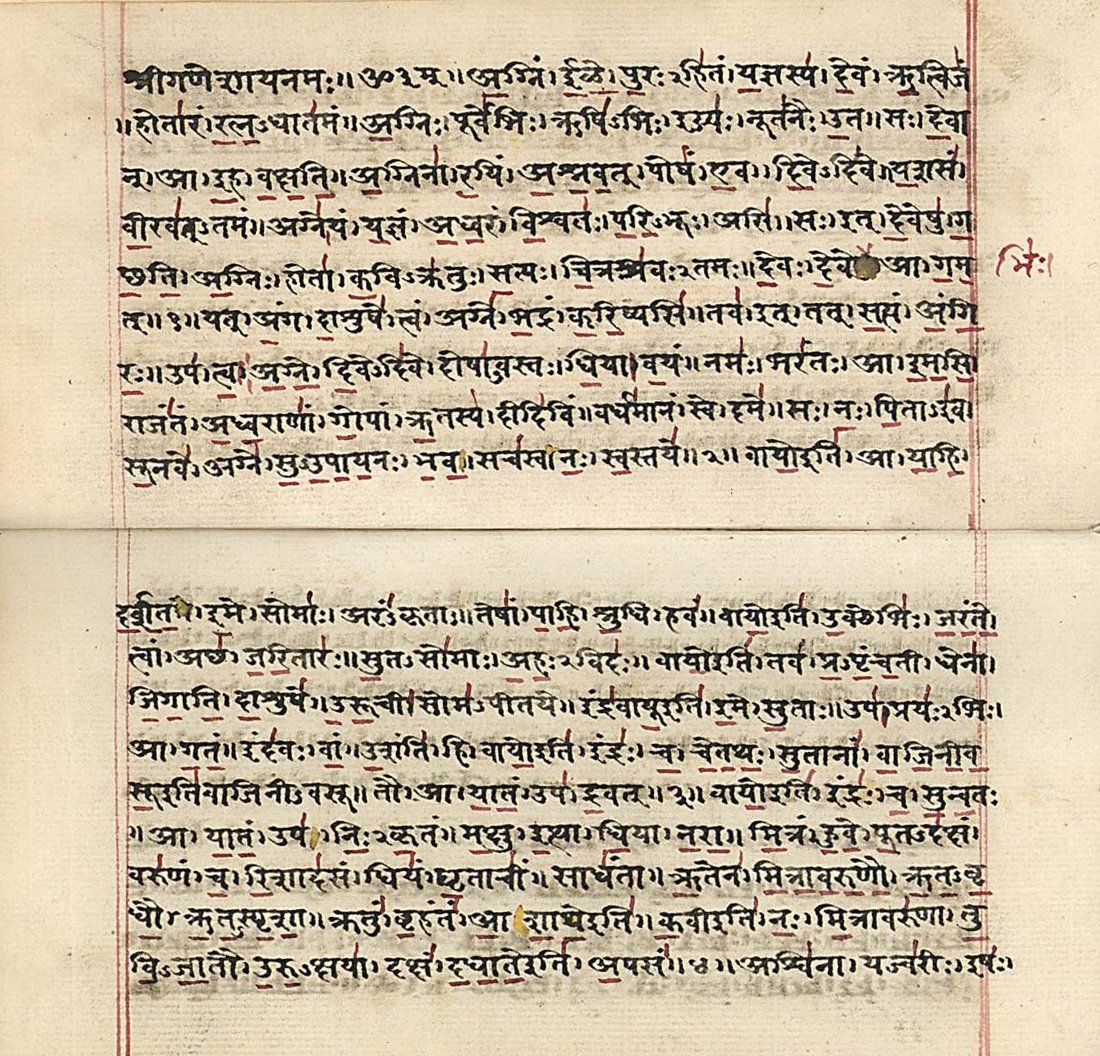

Scripture

Religious texts, including scripture, are texts which various religions consider to be of central importance to their religious tradition. They differ from literature by being a compilation or discussion of beliefs, mythologies, ritual practices, commandments or laws, ethical conduct, spiritual aspirations, and for creating or fostering a religious community. The relative authority of religious texts develops over time and is derived from the ratification, enforcement, and its use across generations. Some religious texts are accepted or categorized as canonical, some non-canonical, and others extracanonical, semi-canonical, deutero-canonical, pre-canonical or post-canonical. "Scripture" (or "scriptures") is a subset of religious texts considered to be "especially authoritative", revered and "holy writ", "sacred, canonical", or of "supreme authority, special status" to a religious community. The terms ''sacred text'' and ''religious text'' are not necessarily interchangeable ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |