|

Knightian Uncertainty

In economics, Knightian uncertainty is a lack of any quantifiable knowledge about some possible occurrence, as opposed to the presence of quantifiable risk (e.g., that in statistical noise or a parameter's confidence interval). The concept acknowledges some fundamental degree of ignorance, a limit to knowledge, and an essential unpredictability of future events. Knightian uncertainty is named after University of Chicago economist Frank Knight (1885–1972), who distinguished risk and uncertainty in his 1921 work ''Risk, Uncertainty, and Profit:''Knight, F. H. (1921Risk, Uncertainty, and Profit Boston, MA: Hart, Schaffner & Marx; Houghton Mifflin Company :"Uncertainty must be taken in a sense radically distinct from the familiar notion of Risk, from which it has never been properly separated.... The essential fact is that 'risk' means in some cases a quantity susceptible of measurement, while at other times it is something distinctly not of this character; and there are far-re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is the social science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on glossary of economics, these elements. Other broad distinctions within economics include those between positive economics, desc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probability Interpretations

The word probability has been used in a variety of ways since it was first applied to the mathematical study of games of chance. Does probability measure the real, physical, tendency of something to occur, or is it a measure of how strongly one believes it will occur, or does it draw on both these elements? In answering such questions, mathematicians interpret the probability values of probability theory. There are two broad categories The taxonomy of probability interpretations given here is similar to that of the longer and more complete Interpretations of Probability article in the online Stanford Encyclopedia of Philosophy. References to that article include a parenthetic section number where appropriate. A partial outline of that article: * Section 2: Criteria of adequacy for the interpretations of probability * Section 3: ** 3.1 Classical Probability ** 3.2 Logical Probability ** 3.3 Subjective Probability ** 3.4 Frequency Interpretations ** 3.5 Propensity Interpretations "T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Uninformative Prior

In Bayesian statistical inference, a prior probability distribution, often simply called the prior, of an uncertain quantity is the probability distribution that would express one's beliefs about this quantity before some evidence is taken into account. For example, the prior could be the probability distribution representing the relative proportions of voters who will vote for a particular politician in a future election. The unknown quantity may be a parameter of the model or a latent variable rather than an observable variable. Bayes' theorem calculates the renormalized pointwise product of the prior and the likelihood function, to produce the ''posterior probability distribution'', which is the conditional distribution of the uncertain quantity given the data. Similarly, the prior probability of a random event or an uncertain proposition is the unconditional probability that is assigned before any relevant evidence is taken into account. Priors can be created using a nu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

There Are Known Knowns

"There are unknown unknowns" is a phrase from a response United States Secretary of Defense Donald Rumsfeld gave to a question at a U.S. Department of Defense (DoD) news briefing on February 12, 2002, about the lack of evidence linking the government of Ba'athist Iraq, Iraq with the supply of weapons of mass destruction to terrorist groups. Rumsfeld stated: The statement became the subject of much commentary. In ''The Decision Book'', author Mikael Krogerus refers to it as the "Rumsfeld matrix". The statement also features in a 2013 documentary film, ''The Unknown Known'', directed by Errol Morris. Known unknowns refers to "risks you are aware of, such as canceled flights," whereas unknown unknowns are risks that come from situations that are so unexpected that they would not be considered. Origins Rumsfeld's statement brought attention to the concepts of known knowns, known unknowns, and unknown unknowns, but national security and intelligence professionals have long used a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perfect Information

In economics, perfect information (sometimes referred to as "no hidden information") is a feature of perfect competition. With perfect information in a market, all consumers and producers have complete and instantaneous knowledge of all market prices, their own utility, and own cost functions. In game theory, a sequential game has perfect information if each player, when making any decision, is perfectly informed of all the events that have previously occurred, including the "initialization event" of the game (e.g. the starting hands of each player in a card game).Archived aGhostarchiveand thWayback Machine Perfect information defined at 0:25, with academic sources and . Perfect information is importantly different from complete information, which implies common knowledge of each player's utility functions, payoffs, strategies and "types". A game with perfect information may or may not have complete information. Games where some aspect of play is ''hidden'' from opponents - su ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Information Asymmetry

In contract theory and economics, information asymmetry deals with the study of decisions in transactions where one party has more or better information than the other. Information asymmetry creates an imbalance of power in transactions, which can sometimes cause the transactions to be inefficient, causing market failure in the worst case. Examples of this problem are adverse selection, moral hazard, and monopolies of knowledge. A common way to visualise information asymmetry is with a scale with one side being the seller and the other the buyer. When the seller has more or better information the transaction will more likely occur in the seller's favour ("the balance of power has shifted to the seller"). An example of this could be when a used car is sold, the seller is likely to have a much better understanding of the car's condition and hence its market value than the buyer, who can only estimate the market value based on the information provided by the seller and their own a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

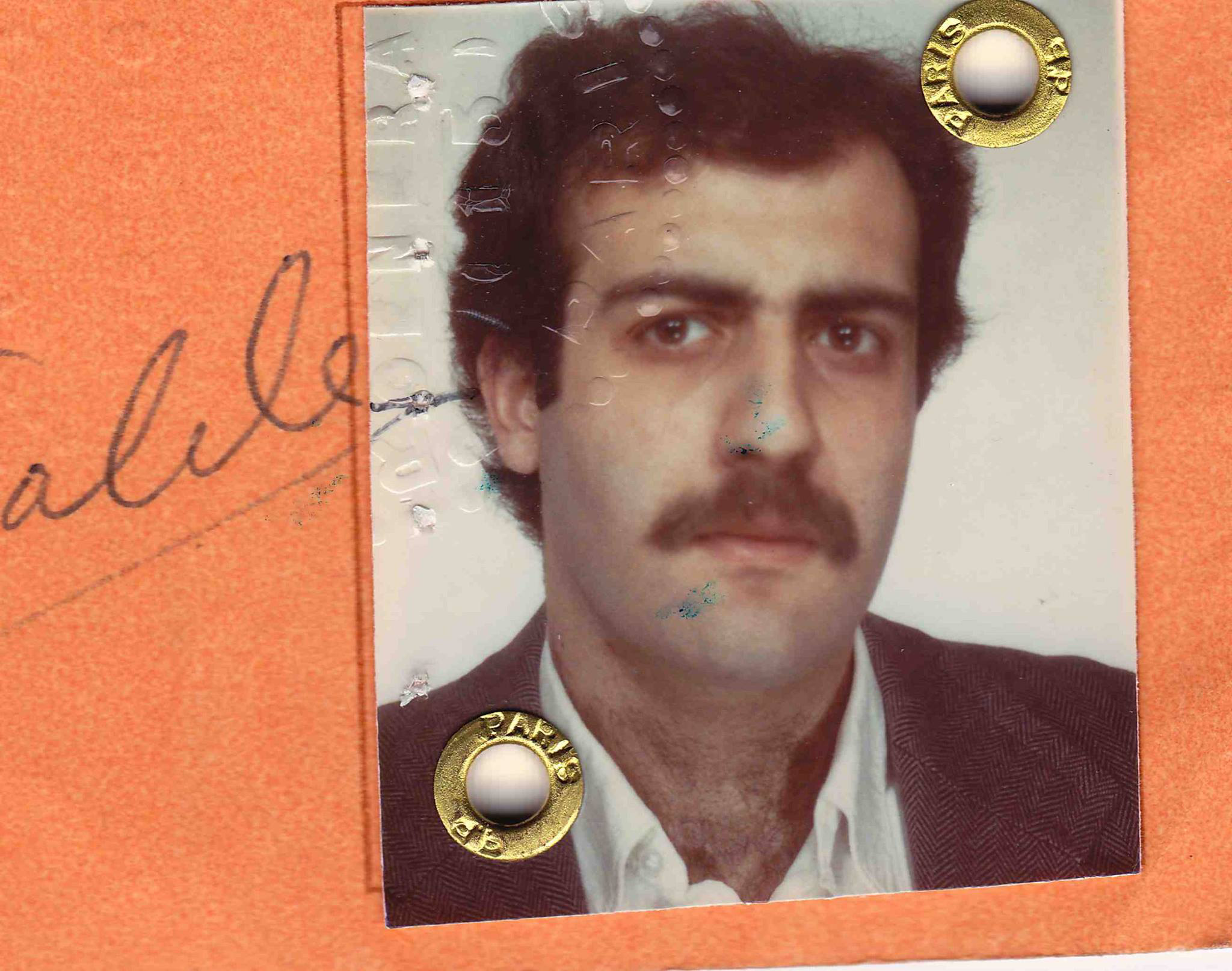

Nassim Nicholas Taleb

Nassim Nicholas Taleb (; alternatively ''Nessim ''or'' Nissim''; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist whose work concerns problems of randomness, probability, and uncertainty. ''The Sunday Times'' called his 2007 book '' The Black Swan'' one of the 12 most influential books since World War II. Taleb is the author of the ''Incerto'', a five-volume philosophical essay on uncertainty published between 2001 and 2018 (of which the best-known books are ''The Black Swan'' and ''Antifragile''). He has been a professor at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has been co-editor-in-chief of the academic journal ''Risk and Decision Analysis'' since September 2014. He has also been a practitioner of mathematical finance, a hedge fund manager, and a derivatives trader, and i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Swan Theory

The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. The term is based on an ancient saying that presumed black swans did not exist a saying that became reinterpreted to teach a different lesson after they were discovered in Australia. The theory was developed by Nassim Nicholas Taleb, starting in 2001, to explain: # The disproportionate role of high-profile, hard-to-predict, and rare events that are beyond the realm of normal expectations in history, science, finance, and technology. # The non-computability of the probability of consequential rare events using scientific methods (owing to the very nature of small probabilities). # The psychological biases that blind people, both individually and collectively, to uncertainty and a rare event's massive role in historical affairs. Taleb's "black swan theory" ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ambiguity Aversion

In decision theory and economics, ambiguity aversion (also known as uncertainty aversion) is a preference for known risks over unknown risks. An ambiguity-averse individual would rather choose an alternative where the probability distribution of the outcomes is known over one where the probabilities are unknown. This behavior was first introduced through the Ellsberg paradox (people prefer to bet on the outcome of an urn with 50 red and 50 black balls rather than to bet on one with 100 total balls but for which the number of black or red balls is unknown). There are two categories of imperfectly predictable events between which choices must be made: risky and ambiguous events (also known as Knightian uncertainty). Risky events have a known probability distribution over outcomes while in ambiguous events the probability distribution is not known. The reaction is behavioral and still being formalized. Ambiguity aversion can be used to explain incomplete contracts, volatility in stock ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utility Theory

As a topic of economics, utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or happiness as part of the theory of utilitarianism by moral philosophers such as Jeremy Bentham and John Stuart Mill. The term has been adapted and reapplied within neoclassical economics, which dominates modern economic theory, as a utility function that represents a single consumer's preference ordering over a choice set but is not comparable across consumers. This concept of utility is personal and based on choice rather than on pleasure received, and so is specified more rigorously than the original concept but makes it less useful (and controversial) for ethical decisions. Utility function Consider a set of alternatives among which a person can make a preference ordering. The utility obtained from these alternatives is an unknown function of the utilities obtained from each alternative, not the sum of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ellsberg Paradox

In decision theory, the Ellsberg paradox (or Ellsberg's paradox) is a paradox in which people's decisions are inconsistent with subjective expected utility theory. Daniel Ellsberg popularized the paradox in his 1961 paper, “Risk, Ambiguity, and the Savage Axioms”. John Maynard Keynes published a version of the paradox in 1921. It is generally taken to be evidence of ambiguity aversion, in which a person tends to prefer choices with quantifiable risks over those with unknown, incalculable risks. Ellsberg's findings indicate that choices with an underlying level of risk are favored in instances where the likelihood of risk is clear, rather than instances in which the likelihood of risk is unknown. A decision-maker will overwhelmingly favor a choice with a transparent likelihood of risk, even in instances where the unknown alternative will likely produce greater utility. When offered choices with varying risk, people prefer choices with calculable risk, even when they have less ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Philosophy Of Probability

The word probability has been used in a variety of ways since it was first applied to the mathematical study of games of chance. Does probability measure the real, physical, tendency of something to occur, or is it a measure of how strongly one believes it will occur, or does it draw on both these elements? In answering such questions, mathematicians interpret the probability values of probability theory. There are two broad categories The taxonomy of probability interpretations given here is similar to that of the longer and more complete Interpretations of Probability article in the online Stanford Encyclopedia of Philosophy. References to that article include a parenthetic section number where appropriate. A partial outline of that article: * Section 2: Criteria of adequacy for the interpretations of probability * Section 3: ** 3.1 Classical Probability ** 3.2 Logical Probability ** 3.3 Subjective Probability ** 3.4 Frequency Interpretations ** 3.5 Propensity Interpretations " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |