|

Knightian Uncertainty

In economics, Knightian uncertainty is a lack of any quantifiable knowledge about some possible occurrence, as opposed to the presence of quantifiable risk (e.g., that in statistical noise or a parameter's confidence interval). The concept acknowledges some fundamental degree of ignorance, a limit to knowledge, and an essential unpredictability of future events. Knightian uncertainty is named after University of Chicago economist Frank Knight (1885–1972), who distinguished risk and uncertainty in his 1921 work ''Risk, Uncertainty, and Profit:''Knight, F. H. (1921Risk, Uncertainty, and Profit Boston, MA: Hart, Schaffner & Marx; Houghton Mifflin Company :"Uncertainty must be taken in a sense radically distinct from the familiar notion of Risk, from which it has never been properly separated.... The essential fact is that 'risk' means in some cases a quantity susceptible of measurement, while at other times it is something distinctly not of this character; and there are far- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ellsberg Paradox

In decision theory, the Ellsberg paradox (or Ellsberg's paradox) is a paradox in which people's decisions are inconsistent with subjective expected utility theory. John Maynard Keynes published a version of the paradox in 1921. Daniel Ellsberg popularized the paradox in his 1961 paper, "Risk, Ambiguity, and the Savage Axioms". It is generally taken to be evidence of ambiguity aversion, in which a person tends to prefer choices with quantifiable risks over those with unknown, incalculable risks. Ellsberg's findings indicate that choices with an underlying level of risk are favored in instances where the likelihood of risk is clear, rather than instances in which the likelihood of risk is unknown. A decision-maker will overwhelmingly favor a choice with a transparent likelihood of risk, even in instances where the unknown alternative will likely produce greater utility. When offered choices with varying risk, people prefer choices with calculable risk, even when those choices ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Uninformative Prior

A prior probability distribution of an uncertain quantity, simply called the prior, is its assumed probability distribution before some evidence is taken into account. For example, the prior could be the probability distribution representing the relative proportions of voters who will vote for a particular politician in a future election. The unknown quantity may be a parameter of the model or a latent variable rather than an observable variable. In Bayesian statistics, Bayes' rule prescribes how to update the prior with new information to obtain the posterior probability distribution, which is the conditional distribution of the uncertain quantity given new data. Historically, the choice of priors was often constrained to a conjugate family of a given likelihood function, so that it would result in a tractable posterior of the same family. The widespread availability of Markov chain Monte Carlo methods, however, has made this less of a concern. There are many ways to construc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

There Are Known Knowns

"There are unknown unknowns" is a phrase from a response United States Secretary of Defense Donald Rumsfeld gave to a question at a U.S. Department of Defense (DoD) news briefing on February 12, 2002, about the lack of evidence linking the government of Ba'athist Iraq, Iraq with the supply of weapons of mass destruction to terrorist groups. Rumsfeld stated: The statement became the subject of much commentary. In ''The Decision Book'' (2013), author refers to it as the "Rumsfeld matrix". The statement also features in a 2013 documentary film, ''The Unknown Known'', directed by Errol Morris. Known unknowns refers to "risks you are aware of, such as canceled flights", whereas unknown unknowns are risks that come from situations that are so unexpected that they would not be considered. With respect to awareness and understanding, unknown unknowns can be compared to other types of problems in the following matrix: Origins Rumsfeld's statement brought attention to the concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perfect Information

Perfect information is a concept in game theory and economics that describes a situation where all players in a game or all participants in a market have knowledge of all relevant information in the system. This is different than complete information, which implies Common knowledge (logic), common knowledge of each agent's utility functions, payoffs, strategies and "types". A system with perfect information may or may not have complete information. In economics this is sometimes described as "no hidden information" and is a feature of perfect competition. In a market with perfect information all consumers and producers would have complete and instantaneous knowledge of all market prices, their own utility and cost functions. In game theory, a sequential game has perfect information if each player, when making any decision, is perfectly informed of all the events that have previously occurred, including the "initialization event" of the game (e.g. the starting hands of each player ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Information Asymmetry

In contract theory, mechanism design, and economics, an information asymmetry is a situation where one party has more or better information than the other. Information asymmetry creates an imbalance of power in transactions, which can sometimes cause the transactions to be inefficient, causing market failure in the worst case. Examples of this problem are adverse selection, moral hazard,Dembe, Allard E. and Boden, Leslie I. (2000). "Moral Hazard: A Question of Morality?" New Solutions 2000 10(3). 257–79 and monopolies of knowledge. A common way to visualise information asymmetry is with a scale, with one side being the seller and the other the buyer. When the seller has more or better information, the transaction will more likely occur in the seller's favour ("the balance of power has shifted to the seller"). An example of this could be when a used car is sold, the seller is likely to have a much better understanding of the car's condition and hence its market value than the buy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Saras Sarasvathy

Saras D. Sarasvathy (born 1959) is an American entrepreneurship professor and recipient of the 2022 Global Award for Entrepreneurship Research. She is currently the Paul M. Hammaker Professor in Business Administration at the University of Virginia Darden School of Business and the Jamuna Raghavan Chair Professor in Entrepreneurship, Indian Institute of Management, Bangalore. She serves on the editorial boards or as associate editor of several academic journals as well as serving as an outside director to the public company LendingTree. She is best known for her conception of Effectuation, a theory of Entrepreneurial action based on the study of Expert Entrepreneurs. Her award-winning journal article - "Causation and Effectuation: Toward a Theoretical Shift from Economic Inevitability to Entrepreneurial Contingency" is one of the most highly cited academic articles about entrepreneurship of all time. Early life, Entrepreneurial Career, and Education Sarasvathy grew up ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

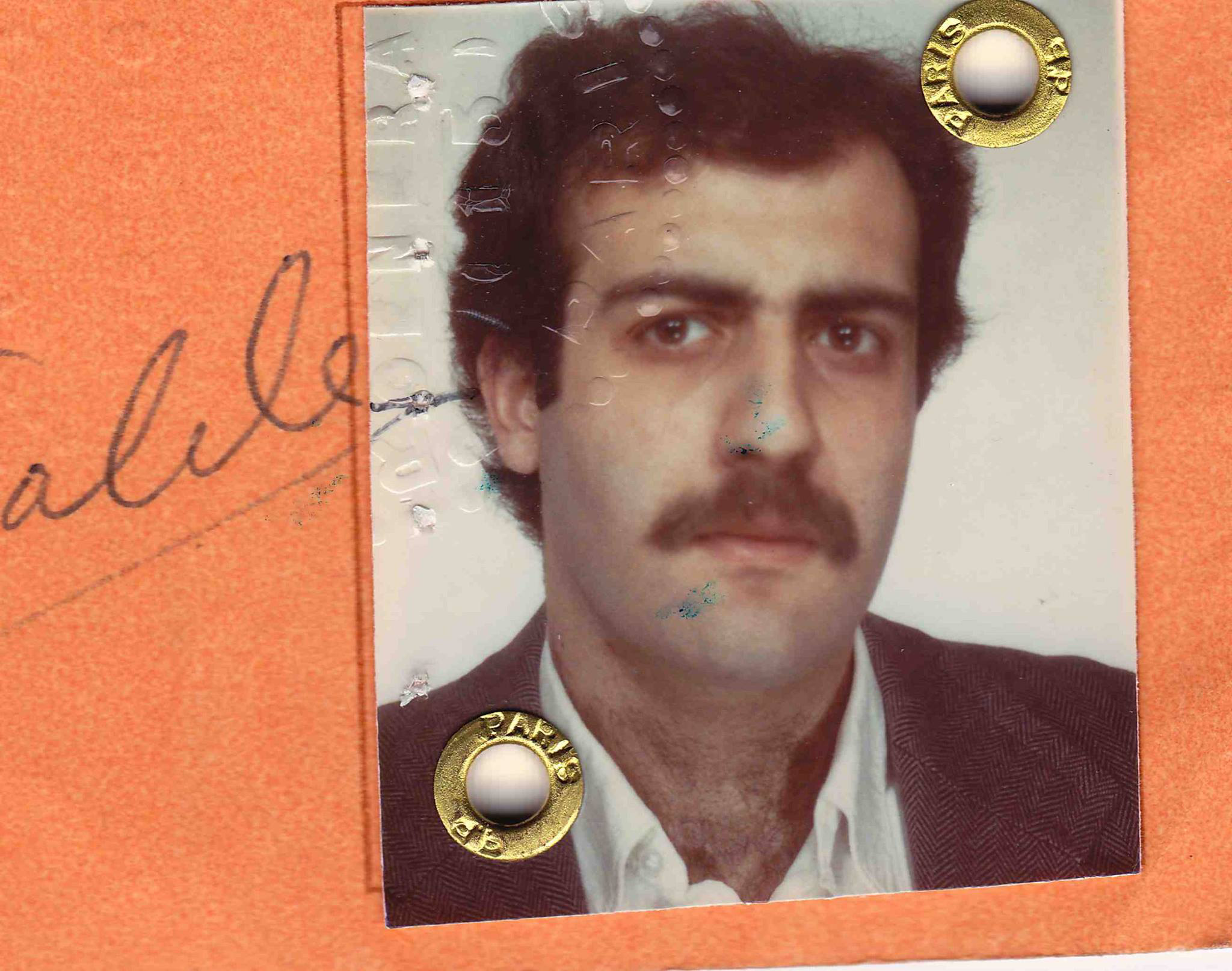

Nassim Nicholas Taleb

Nassim Nicholas Taleb (; alternatively ''Nessim ''or'' Nissim''; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist. His work concerns problems of randomness, probability, complexity, and uncertainty. Taleb is the author of the ''Incerto'', a five-volume work on the nature of uncertainty published between 2001 and 2018 (notably, '' The Black Swan'' and '' Antifragile''). He has taught at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has also been a practitioner of mathematical finance and is currently an adviser at Universa Investments. ''The Sunday Times'' described his 2007 book '' The Black Swan'' as one of the 12 most influential books since World War II. Taleb criticized risk management methods used by the finance industry and warned about financial crises, subsequently pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Swan Theory

The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. The term arose from a Latin expression which was based on the presumption that black swans did not exist. The expression was used in the original manner until around 1697 when Dutch mariners saw black swans living in Australia. After this, the term was reinterpreted to mean an unforeseen and consequential event. The reinterpreted theory was articulated by Nassim Nicholas Taleb, starting in 2001, to explain: # The disproportionate role of high-profile, hard-to-predict, and rare events that are beyond the realm of normal expectations in history, science, finance, and technology. # The non-computability of the probability of consequential rare events using scientific methods (owing to the very nature of small probabilities). # The psychological biases that bl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ambiguity Aversion

In decision theory and economics, ambiguity aversion (also known as uncertainty aversion) is a preference for known risks over unknown risks. An ambiguity-averse individual would rather choose an alternative where the probability distribution of the outcomes is known over one where the probabilities are unknown. This behavior was first introduced through the Ellsberg paradox (people prefer to bet on the outcome of an urn with 50 red and 50 black balls rather than to bet on one with 100 total balls but for which the number of black or red balls is unknown). There are two categories of imperfectly predictable events between which choices must be made: risky and ambiguous events (also known as Knightian uncertainty). Risky events have a known probability distribution over outcomes while in ambiguous events the probability distribution is not known. The reaction is behavioral and still being formalized. Ambiguity aversion can be used to explain incomplete contracts, volatility in stoc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utility Theory

In economics, utility is a measure of a certain person's satisfaction from a certain state of the world. Over time, the term has been used with at least two meanings. * In a Normative economics, normative context, utility refers to a goal or objective that we wish to maximize, i.e., an objective function. This kind of utility bears a closer resemblance to the original Utilitarianism, utilitarian concept, developed by moral philosophers such as Jeremy Bentham and John Stuart Mill. * In a Positive economics, descriptive context, the term refers to an ''apparent'' objective function; such a function is Revealed preference, revealed by a person's behavior, and specifically by their preferences over Lottery (decision theory), lotteries, which can be any quantified choice. The relationship between these two kinds of utility functions has been a source of controversy among both Economics, economists and Ethics, ethicists, with most maintaining that the two are distinct but generally re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |