|

Jobseekers Act 1995

The Jobseekers Act 1995c 18 is an Act of Parliament of the United Kingdom, which empowers the government to provide unemployment income insurance, or " Jobseeker's Allowance" while people are looking for work. In its current form, jobseeker's allowance is available without any means testing (i.e. inquiry into people's income or assets) for people who have paid into the National Insurance fund in at least the last two years. People can claim this for up to 182 days. After this, one's income and assets are means tested. If people do not have enough in National Insurance Contributions (e.g. because they have just left school or university), the other kind of Jobseeker's allowance, income-based, is being phased out and replaced by universal credit, started by the Welfare Reform Act 2012. This requires means-testing. Contents Part I, sections 1 to 25 concern the Jobseeker’s Allowance. Part II, sections 26 to 29 concern Back to Work Schemes. Part III, sections 30 to 41 are Miscell ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Act Of Parliament

Acts of Parliament, sometimes referred to as primary legislation, are texts of law passed by the Legislature, legislative body of a jurisdiction (often a parliament or council). In most countries with a parliamentary system of government, acts of parliament begin as a Bill (law), bill, which the legislature votes on. Depending on the structure of government, this text may then be subject to assent or approval from the Executive (government), executive branch. Bills A draft act of parliament is known as a Bill (proposed law), bill. In other words, a bill is a proposed law that needs to be discussed in the parliament before it can become a law. In territories with a Westminster system, most bills that have any possibility of becoming law are introduced into parliament by the government. This will usually happen following the publication of a "white paper", setting out the issues and the way in which the proposed new law is intended to deal with them. A bill may also be introduced in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Means Testing

A means test is a determination of whether an individual or family is eligible for government assistance or welfare, based upon whether the individual or family possesses the means to do without that help. Canada In Canada, means tests are used for student finance (for post-secondary education), legal aid, and "welfare" (direct transfer payments to individuals to combat poverty). They are not generally used for primary and secondary education which are tax-funded. Means tests for public health insurance were once common but are now illegal, as the Canada Health Act of 1984 requires that all the provinces provide universal healthcare coverage to be eligible for subsidies from the federal government. Means tests are also not used for pensions and seniors' benefits, but there is a clawback of Old Age Security payments for people making over $69,562 (in 2012). The Last Post Fund uses a means test on a deceased veteran's estate and surviving widow to determine whether they are eligi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Insurance

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. Introduced by the National Insurance Act 1911 and expanded by the Labour government in 1948, the system has been subjected to numerous amendments in succeeding years. Initially, it was a contributory form of insurance against illness and unemployment, and eventually provided retirement pensions and other benefits. Currently, workers pay contributions from the age of 16 years, until the age they become eligible for the State pension. Contributions are due from employed people earning at or above a threshold called the Lower Earnings Limit, the value of which is reviewed each year. Self-employed people contribute partly through a fixed weekly or monthly payment and partly on a percentage of net profits above a threshold, which is revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Universal Credit

Universal Credit is a United Kingdom social security payment. It is means-tested and is replacing and combining six benefits for working-age households with a low income: income-related Employment and Support Allowance, income-based Jobseeker's Allowance, and Income Support; Child Tax Credit and Working Tax Credit; and Housing Benefit. An award of UC is made up of different elements, which become payable to the claimant if relevant criteria apply: a standard allowance for singles or couples, child elements and disabled child elements for children in the household, housing cost element, childcare costs element, as well as elements for being a carer or having an illness or disability and therefore having limited capability to work. The new policy was announced in 2010 at the Conservative Party annual conference by the Work and Pensions Secretary, Iain Duncan Smith, who said it would make the social security system fairer to claimants and taxpayers. At the same venue the Welfare R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare Reform Act 2012

The Welfare Reform Act 2012 is an Act of Parliament in the United Kingdom which makes changes to the rules concerning a number of benefits offered within the British social security system. It was enacted by the Parliament of the United Kingdom on 8 March 2012. Among the provisions of the Act are changes to housing benefit which came into force on 1 April 2013. These changes include an "under-occupancy penalty" which reduces the amount of benefit paid to claimants in social housing if they are deemed to have too much living space in the property they are renting.(This already applied to tenants in private rental accommodation). Although the Act does not introduce any new direct taxes, this ''penalty'' has been characterised by the Labour Party and some in the media as the "Bedroom Tax", attempting to link it with the public debate about the "Poll Tax" in the 1990s. Advocating the Act, the Chancellor of the Exchequer (George Osborne) stated that the changes would reduce welfare ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Labour Law

United Kingdom labour law regulates the relations between workers, employers and trade unions. People at work in the UK can rely upon a minimum charter of employment rights, which are found in Acts of Parliament, Regulations, common law and equity (legal concept), equity. This includes the right to a minimum wage of £9.50 for over-23-year-olds from April 2022 under the National Minimum Wage Act 1998. The Working Time Regulations 1998 give the right to 28 days paid holidays, breaks from work, and attempt to limit long working hours. The Employment Rights Act 1996 gives the right to leave for child care, and the right to request flexible working patterns. The Pensions Act 2008 gives the right to be automatically enrolled in a basic occupational pension, whose funds must be protected according to the Pensions Act 1995. Workers must be able to vote for trustees of their occupational pensions under the Pensions Act 2004. In some enterprises, such as universities, staff can Codetermina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

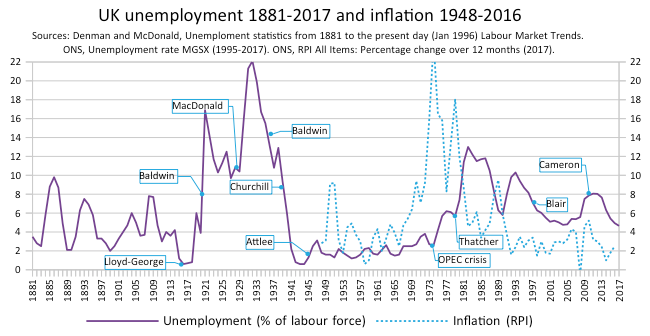

Unemployment In The United Kingdom

Unemployment in the United Kingdom is measured by the Office for National Statistics. In the most recent three-month figures (July to September 2022) the unemployment rate was estimated at 3.6%, which is 0.2 percentage points lower than the previous three-month period. The ONS said the employment rate, or percentage of people in work for those aged between 16 and 64, was estimated to be 75.5%. This was largely unchanged compared with the previous three-month period and 1.1 percentage points lower than before the pandemic (December 2019 to February 2020). The economic inactivity rate (is the proportion of people aged between 16 and 64 years who are not in the labour force) is 21.6%, an increase of 0.2 percentage points on the quarter The figures are compiled through the Labour Force Survey, which asks a sample of 53,000 households and is conducted every 3 months. Unemployment levels and rates are published each month by the Office for National Statistics in thLabour Market Stat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Universal Credit

Universal Credit is a United Kingdom social security payment. It is means-tested and is replacing and combining six benefits for working-age households with a low income: income-related Employment and Support Allowance, income-based Jobseeker's Allowance, and Income Support; Child Tax Credit and Working Tax Credit; and Housing Benefit. An award of UC is made up of different elements, which become payable to the claimant if relevant criteria apply: a standard allowance for singles or couples, child elements and disabled child elements for children in the household, housing cost element, childcare costs element, as well as elements for being a carer or having an illness or disability and therefore having limited capability to work. The new policy was announced in 2010 at the Conservative Party annual conference by the Work and Pensions Secretary, Iain Duncan Smith, who said it would make the social security system fairer to claimants and taxpayers. At the same venue the Welfare R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |