|

Investing

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditures and receipts are defined in terms of money, then the net monetary receipt in a time period is termed cash flow, while money received in a series of several time periods is termed cash flow stream. In finance, the purpose of investing is to generate a return on the invested asset. The return may consist of a capital gain (profit) or loss, realised if the investment is sold, unrealised capital appreciation (or depreciation) if yet unsold. It may also consist of periodic income such as dividends, interest, or rental income. The return may also include currency g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity Crowdfunding

Equity crowdfunding is the online offering of private company securities to a group of people for investment and therefore it is a part of the capital markets. Because equity crowdfunding involves investment into a commercial enterprise, it is often subject to securities and financial regulation. Equity crowdfunding is also referred to as crowdinvesting, investment crowdfunding, or crowd equity. Equity crowdfunding is a mechanism that enables broad groups of investors to fund startup companies and small businesses in return for equity. Investors give money to a business and receive ownership of a small piece of that business. If the business succeeds, then its value goes up, as well as the value of a share in that business—the converse is also true. Coverage of equity crowdfunding indicates that its potential is greatest with startup businesses that are seeking smaller investments to achieve establishment, while follow-on funding (required for subsequent growth) may come fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital

Venture capital (VC) is a form of private equity financing provided by firms or funds to start-up company, startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc. Venture capital firms or funds invest in these early-stage companies in exchange for Equity (finance), equity, or an ownership stake. Venture capitalists take on the risk of financing start-ups in the hopes that some of the companies they support will become successful. Because Startup company, startups face high uncertainty, VC investments have high rates of failure. Start-ups are usually based on an innovation, innovative technology or business model and often come from high technology industries such as information technology (IT) or biotechnology. Pre-seed and seed money, seed rounds are the initial stages of funding for a startup company, typically occurring earl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Angel Investor

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital to a business or businesses, including startups, usually in exchange for convertible debt or ownership equity. Angel investors often provide support to startups at a very early stage (when the risk of their failure is relatively high), once or in a consecutive manner, and when most investors are not prepared to back them. In a survey of 150 founders conducted by Wilbur Labs, about 70% of entrepreneurs will face potential business failure, and nearly 66% will face this potential failure within 25 months of launching their company. A small but increasing number of angel investors invest online through equity crowdfunding or organize themselves into angel groups or angel networks to share investment capital and provide advice to their portfolio companies. The number of angel investors has greatly increased since the mid-20th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Estate Investing

Real estate investing involves purchasing, owning, managing, renting, or selling real estate to generate profit or long-term wealth. A real estate investor or entrepreneur may participate actively or passively in real estate transactions. The primary goal of real estate investing is to increase value or generate a profit through strategic decision-making and market analysis. Investors analyze real estate projects by identifying property types, as each type requires a unique investment strategy. Valuation is a critical factor in assessing real estate investments, as it determines a property’s true worth, guiding investors in purchases, sales, financing, and risk management. Accurate valuation helps investors avoid overpaying for assets, maximize returns, and minimize financial risk. Additionally, proper valuation plays a crucial role in securing financing, as lenders use valuations to determine loan amounts and interest rates. Financing is fundamental to real estate investing, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alternative Investment

An alternative investment, also known as an alternative asset or alternative investment fund (AIF), is an investment in any Asset classes, asset class excluding capital stocks, Bond (finance), bonds, and cash. The term is a relatively loose one and includes tangible investment, tangible assets such as Gold as an investment, precious metals, collectibles (art, Investment wine, wine, antiques, vintage cars, Coin collecting, coins, watches, musical instruments, or Stamp collecting, stamps) and some financial assets such as real estate, commodities, private equity, distressed securities, hedge funds, exchange funds, carbon credits, venture capital, film production, Derivative (finance), financial derivatives, Cryptocurrency, cryptocurrencies, Non-fungible token, non-fungible tokens, and Tax Receivable Agreements. Investments in real estate, forestry and Shipping investments, shipping are also often termed "alternative" despite the ancient use of such real assets to enhance and pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

Private equity (PE) is stock in a private company that does not offer stock to the general public; instead it is offered to specialized investment funds and limited partnerships that take an active role in the management and structuring of the companies. In casual usage "private equity" can refer to these investment firms rather than the companies in which they invest. Private-equity capital (economics), capital is invested into a target company either by an investment management company (private equity firm), a venture capital fund, or an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Private equity can provide working capital to finance a target company's expansion, including the development of new products and services, operational restructuring, management changes, and shifts in ownership and control. As a financial product, a private-equity fund is private capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

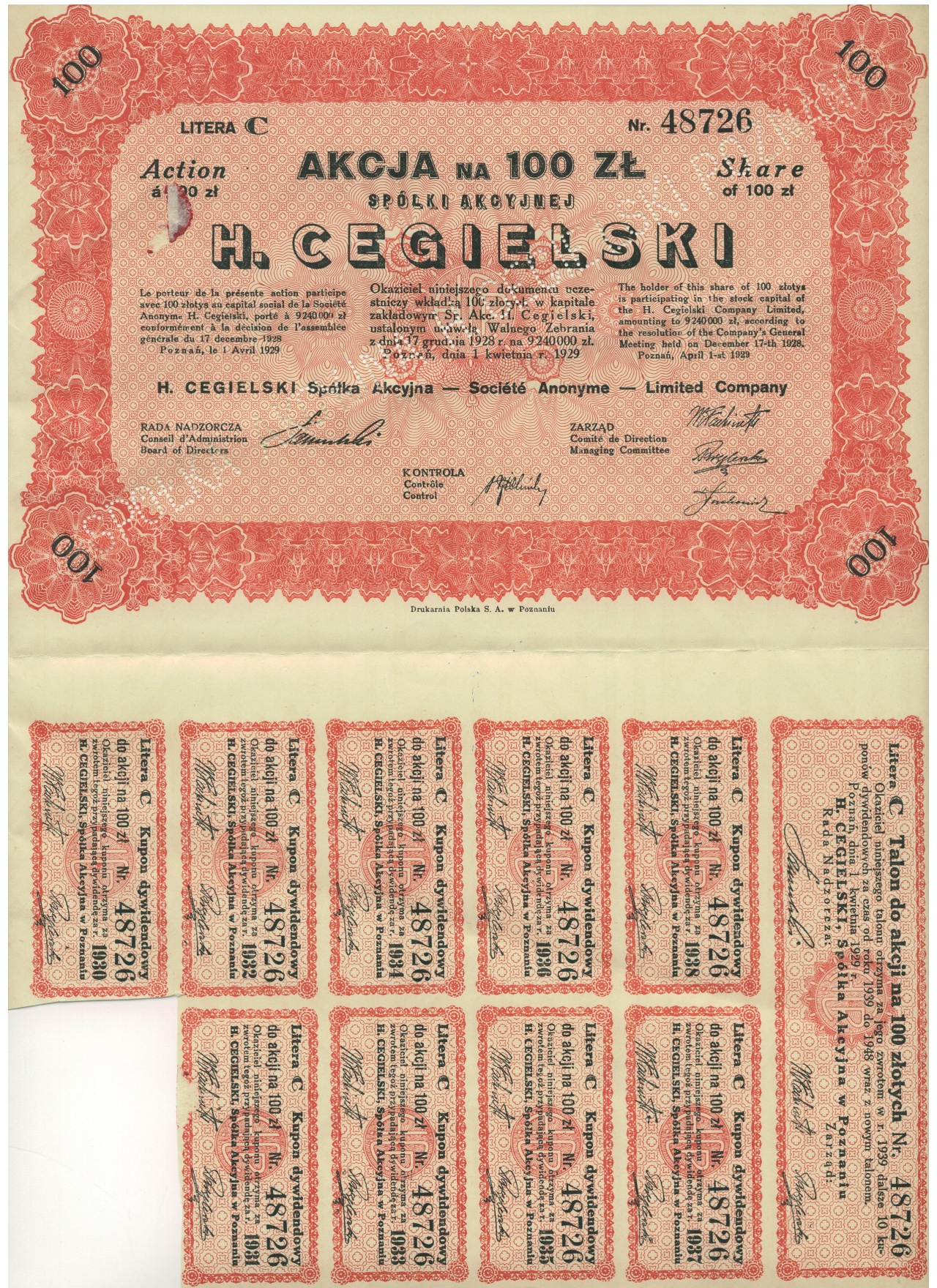

Dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex-dividend date, though more often than not it may open higher. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash (usually by bank transfer) or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets. The dividend received by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investor

An investor is a person who allocates financial capital with the expectation of a future Return on capital, return (profit) or to gain an advantage (interest). Through this allocated capital the investor usually purchases some species of property. Types of investments include Stock, equity, Bond (finance), debt, Security (finance), securities, real estate, infrastructure, currency, commodity, Exonumia, token, derivatives such as put and call Option (finance), options, Futures contract, futures, Forward contract, forwards, etc. This definition makes no distinction between the investors in the Primary market, primary and secondary markets. That is, someone who provides a business with capital and someone who buys a stock are both investors. An investor who owns stock is a shareholder. Types of investors There are two types of investors: retail investors and institutional investors. A ''retail investor'' is also known as an ''individual investor''. There are several sub-typ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Traditional Investments

In finance, the notion of traditional investments refers to putting money into well-known assets (such as Bond (finance), bonds, cash, real estate, and equity shares) with the expectation of capital appreciation, dividends, and interest earnings. Traditional investments are to be contrasted with alternative investments. Bonds Here the investor purchases debt issued by companies or Government debt, governments which promises to pay an annual return until the debt is repaid. The value of the investment changes as the level of general interest rates fluctuates, causing the bond to become more or less valuable. Cash In cash Investment, investing, money is typically invested in short-term, low-risk investment vehicles like Certificate of deposit, certificates of deposit, money market funds, and high yield bank accounts. Real estate In real estate, money is used to purchase property for the purpose of holding, reselling or leasing for income and there is an element of capital risk. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Exchange

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic system to process financial transactions. To be able to trade a security on a particular stock exchange, the security must be listed there. Usually, there is a central location for record keeping, but trade is increasingly less linked to a physical place as mod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Flow

Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or virtual movement of money. *Cash flow, in its narrow sense, is a payment (in a currency), especially from one central bank account to another. The term 'cash flow' is mostly used to describe payments that are expected to happen in the future, are thus uncertain, and therefore need to be forecast with cash flows. *A cash flow is determined by its time , nominal amount , currency , and account ; symbolically, . Cash flows are narrowly interconnected with the concepts of value, interest rate, and liquidity. A cash flow that shall happen on a future day can be transformed into a cash flow of the same value in . This transformation process is known as discounting, and it takes into account the time value of money by adjusting the nominal amount of the cash flow based on the prevailing interest rates at the time. Cash flow analy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |