|

Indentured

An indenture is a legal contract that reflects an agreement between two parties. Although the term is most familiarly used to refer to a labor contract between an employer and a laborer with an indentured servant status, historically indentures were used for a variety of contracts, including transfers and rents of land and even peace agreements between rulers. Historical usage An indenture is a legal contract between two parties, whether for Indentured servant, indentured labour or a term of apprenticeship or for certain real estate, land transactions. The term comes from the medieval English "indenture of retainer"—a legal contract written in duplicate on the same sheet, with the copies separated by cutting along a jagged (toothed, hence the term "indenture") line so that the teeth of the two parts could later be refitted to confirm authenticity (chirograph). Each party to the deed would then retain a part. When the agreement was made before a court of law a ''tripartite'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indentured Servant

Indentured servitude is a form of Work (human activity), labor in which a person is contracted to work without salary for a specific number of years. The contract called an "indenture", may be entered voluntarily for a prepaid lump sum, as payment for some good or service (e.g. travel), purported eventual compensation, or debt repayment. An indenture may also be imposed involuntarily as a Sentence (law), judicial punishment. The practice has been compared to the similar institution of slavery, although there are differences. Historically, in an apprenticeship, an apprentice worked with no pay for a master tradesman to learn a craft, trade. This was often for a fixed length of time, usually seven years or less. Apprenticeship was not the same as indentureship, although many apprentices were tricked into falling into debt and thus having to indenture themselves for years more to pay off such sums. Like any loan, an indenture could be sold. Most masters had to depend on middlemen o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

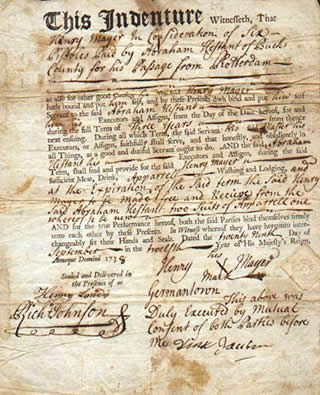

Indenture 1723

An indenture is a legal contract that reflects an agreement between two parties. Although the term is most familiarly used to refer to a labor contract between an employer and a laborer with an indentured servant status, historically indentures were used for a variety of contracts, including transfers and rents of land and even peace agreements between rulers. Historical usage An indenture is a legal contract between two parties, whether for indentured labour or a term of apprenticeship or for certain land transactions. The term comes from the medieval English "indenture of retainer"—a legal contract written in duplicate on the same sheet, with the copies separated by cutting along a jagged (toothed, hence the term "indenture") line so that the teeth of the two parts could later be refitted to confirm authenticity ( chirograph). Each party to the deed would then retain a part. When the agreement was made before a court of law a ''tripartite'' indenture was made, with the t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, meaning the term ''bankruptcy'' is not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian language, Italian , literally meaning . The term is often described as having originated in Renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment. However, the existence of such a ritual is doubted. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into "debt slavery" until the creditor recouped losses through their Manual labour, physical labour. Many city-states in ancient Greece lim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity (law)

In the field of jurisprudence, equity is the particular body of law, developed in the English Court of Chancery, with the general purpose of providing legal remedies for cases wherein the common law is inflexible and cannot fairly resolve the disputed legal matter. Conceptually, equity was part of the historical origins of the system of common law of England, yet is a field of law separate from common law, because equity has its own unique rules and principles, and was administered by courts of equity. Equity exists in domestic law, both in civil law and in common law systems, as well as in international law. The tradition of equity begins in antiquity with the writings of Aristotle (''epieikeia'') and with Roman law ('' aequitas''). Later, in civil law systems, equity was integrated in the legal rules, while in common law systems it became an independent body of law. Equity in common law jurisdictions (general) In jurisdictions following the English common law syste ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiduciary

A fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties (legal person or group of persons). Typically, a fiduciary prudently takes care of money or other assets for another person. One party, for example, a corporate trust company or the trust department of a bank, acts in a fiduciary capacity to another party, who, for example, has entrusted funds to the fiduciary for safekeeping or investment. Likewise, financial advisers, financial planners, and asset managers, including managers of pension plans, endowments, and other tax-exempt assets, are considered fiduciaries under applicable statutes and laws. In a fiduciary relationship, one person, in a position of vulnerability, justifiably vests confidence, good faith, reliance, and trust in another whose aid, advice, or protection is sought in some matter... In such a relation, good conscience requires the fiduciary to act at all times for the sole benefit and interest of the on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arm's Length Principle

The arm's length principle (ALP) is the condition or the fact that the parties of a transaction are independent and on an equal footing. Such a transaction is known as an "arm's-length transaction". It is used specifically in contract law to arrange an agreement that will stand up to legal scrutiny, even though the parties may have shared interests (e.g., employer-employee) or are too closely related to be seen as completely independent (e.g., the parties have familial ties). An arm's length relationship is distinguished from a fiduciary relationship, where the parties are not on an equal footing, but rather, power and information asymmetries exist. It is also one of the key elements in international taxation as it allows an adequate allocation of profit taxation rights among countries that conclude double tax conventions, through transfer pricing, among each other. Transfer pricing and the arm's length principle were one of the focal points of the base erosion and profit s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Default (finance)

In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment, or when a corporation or government fails to pay a bond which has reached maturity. A national or sovereign default is the failure or refusal of a government to repay its national debt. The biggest private default in history is Lehman Brothers, with over $600 billion when it filed for bankruptcy in 2008 (equivalent to over $ billion in ). The biggest sovereign default is Greece, with $138 billion in March 2012 (equivalent to $ billion in ). Distinction from insolvency, illiquidity and bankruptcy The term "default" should be distinguished from the terms "insolvency", illiquidity and "bankruptcy": * Default: Debtors have been passed behind the payment deadline on a debt whose payment was due. * Illiquidity: Debtors have insufficient cash (or other "liquefiable" assets) to pay debts. * Insolvency: A legal term meani ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust Indenture Act Of 1939

The Trust Indenture Act of 1939 (TIA), codified at , supplements the Securities Act of 1933 in the case of the distribution of debt securities in the United States. Generally speaking, the TIA requires the appointment of a suitably independent and qualified trustee to act for the benefit of the holders of the securities, and specifies various substantive provisions for the trust indenture that must be entered into by the issuer and the trustee. The TIA is administered by the U.S. Securities and Exchange Commission (SEC), which has made various regulations under the act. History Section 211 of The Securities Exchange Act of 1934 mandated that the SEC conduct various studies. Although not expressly required to study the trustee system then in use for the issuance of debt securities, William O. Douglas, who would later become a Commissioner and then Chair of the SEC, was convinced by November 1934 that the system needed legislative reform. In June 1936, the Protective Committee S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prospectus (finance)

A prospectus, in finance, is a disclosure document that describes a financial security for potential buyers. It commonly provides investors with material information about mutual funds, stocks, bonds and other investments, such as a description of the company's business, financial statements, biographies of officers and directors, detailed information about their compensation, any litigation that is taking place, a list of material properties and any other material information. In the context of an individual securities offering, such as an initial public offering, a prospectus is distributed by underwriters or other financial firms to potential investors. Today, prospectuses are most widely distributed through websites such as EDGAR and its equivalents in other countries. United States In a securities offering in the United States, a prospectus is required to be filed with the Securities and Exchange Commission (SEC) as part of a registration statement. The issuer may not ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convertible Bond

In finance, a convertible bond, convertible note, or convertible debt (or a convertible debenture if it has a maturity of greater than 10 years) is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a hybrid security with debt- and equity-like features. It originated in the mid-19th century, and was used by early speculators such as Jacob Little and Daniel Drew to counter market cornering. Convertible bonds are also considered debt security because the companies agree to give fixed or floating interest rate as they do in common bonds for the funds of investor. To compensate for having additional value through the option to convert the bond to stock, a convertible bond typically has a coupon rate lower than that of similar, non-convertible debt. The investor receives the potential upside of conversion into equity while protecting downside with cash flow from the coupon payments a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |