|

Henry Hillman

Henry Lea Hillman (December 25, 1918 – April 14, 2017) was an American billionaire businessman, investor, civic leader, and philanthropist. He was chairman of The Hillman Company, a family office and investment company headquartered in Pittsburgh, Pennsylvania, and owned by the Hillman family. He chaired the board of trustees of Hillman Family Foundations, which manages 18 named foundations. Early life Henry Lea Hillman was born and raised in Pittsburgh, Pennsylvania. He was the fifth child and second son of John Hartwell Hillman Jr. (1880–1959) and his wife, Juliet Cummins Hillman (née Lea; 1885–1940). His father built upon his own father's small iron brokerage firm to create a diversified industrial operation with holdings in coal and coke, steel and utilities, energy, transportation, real estate, and banking. Hillman attended Shady Side Academy in Pittsburgh, the Taft School in Watertown, Connecticut, and Princeton University, where he earned an A.B. degree in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pittsburgh

Pittsburgh ( ) is a city in the Commonwealth of Pennsylvania, United States, and the county seat of Allegheny County. It is the most populous city in both Allegheny County and Western Pennsylvania, the second-most populous city in Pennsylvania behind Philadelphia, and the 68th-largest city in the U.S. with a population of 302,971 as of the 2020 census. The city anchors the Pittsburgh metropolitan area of Western Pennsylvania; its population of 2.37 million is the largest in both the Ohio Valley and Appalachia, the second-largest in Pennsylvania, and the 27th-largest in the U.S. It is the principal city of the greater Pittsburgh–New Castle–Weirton combined statistical area that extends into Ohio and West Virginia. Pittsburgh is located in southwest Pennsylvania at the confluence of the Allegheny River and the Monongahela River, which combine to form the Ohio River. Pittsburgh is known both as "the Steel City" for its more than 300 steel-related businesses and as the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Perrigo

Perrigo Company plc is an American Irish–registered manufacturer of private label over-the-counter pharmaceuticals, and while 70% of Perrigo's net sales are from the U.S. healthcare system, Perrigo is legally headquartered in Ireland for tax purposes, which accounts for 0.60% of net sales. In 2013, Perrigo completed the sixth-largest US corporate tax inversion in history when it reregistered its tax status to Ireland to avoid U.S. corporate taxes. Perrigo maintains its corporate headquarters in Grand Rapids, MI, within Michigan State University's Grand Rapids Innovation Park. Perrigo engages in the acquisition (for repricing), manufacture, and sale of consumer healthcare products, generic prescription drugs, and active pharmaceutical ingredients (APIs), primarily in the United States, from its base in Ireland. On 21 December 2018, Perrigo suffered its biggest one-day share price fall in its history after the Irish Revenue Commissioners issued a tax claim against Perrigo that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

JPMorgan Chase

JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of 2022, JPMorgan Chase is the largest bank in the United States, the world's largest bank by market capitalization, and the fifth largest bank in the world in terms of total assets, with total assets of US$3.774 trillion. Additionally, JPMorgan Chase is ranked 24th on the Fortune 500 list of the largest United States corporations by total revenue. It is considered a systemically important bank by the Financial Stability Board. As a " Bulge Bracket" bank, it is a major provider of various investment banking and financial services. It is one of America's Big Four banks, along with Bank of America, Citigroup, and Wells Fargo. JPMorgan Chase is considered to be a universal bank and a custodian bank. The J.P. Morgan brand is used by the investment banking, asset management, private banking, wealth man ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chemical Bank

Chemical Bank was a bank with headquarters in New York City from 1824 until 1996. At the end of 1995, Chemical was the third-largest bank in the U.S., with about $182.9 billion in assets and more than 39,000 employees around the world. Beginning in 1920 and accelerating in the 1980s and 1990s, Chemical was a leading consolidator of the U.S. banking industry, acquiring Chase Manhattan Bank, Manufacturers Hanover, Texas Commerce Bank and Corn Exchange Bank among others. After 1968, the bank operated as the primary subsidiary of a bank holding company that was eventually renamed Chemical Banking Corporation. In 1996, Chemical acquired Chase Manhattan Corporation in a merger valued at $10 billion to create the largest financial institution in the United States. Although Chemical was the acquiring company and the nominal survivor, the merged bank adopted the Chase name, which was considered to be better known, particularly internationally. Overview of the company Chemical Ban ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Duracell

Duracell Inc. is an American manufacturer of alkaline batteries, specialty cells, rechargeables and smart power systems, owned by Berkshire Hathaway. The company has its origins in the 1920s, through the work of Samuel Ruben and Philip Mallory, and the formation of the P. R. Mallory Company. Through a number of corporate mergers and acquisitions, Duracell came to be owned by the consumer products conglomerate Procter & Gamble (P&G). In November 2014, P&G reached an agreement to sell the company to Berkshire Hathaway through a transfer of shares. Under the deal, Berkshire Hathaway exchanged the shares it held in P&G for ownership of the Duracell business. History Origins Duracell originated via the partnership of scientist Samuel Ruben and businessman Philip Rogers Mallory, who met during the 1920s. The P. R. Mallory Company of Burlington, Massachusetts, United States, relocated its headquarters to Indianapolis, Indiana, in 1924. The company produced mercury batteri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beatrice Foods

Beatrice Foods Company was a major American food processing company founded in 1894. In 1987, its international food operations were sold to Reginald Lewis, a corporate attorney, creating TLC Beatrice International, after which the majority of its domestic (U.S.) brands and assets were acquired by KKR, with the bulk of its holdings sold off. By 1990, the remaining operations were ultimately acquired by ConAgra Foods. History Early years 1894-1912 The Beatrice Creamery Company was founded in 1894 by George Everett Haskell and William W. Bosworth, by leasing the factory of a bankrupt firm of the same name located in Beatrice, Nebraska. At the time, they purchased butter, milk, and eggs from local farmers and graded them for resale. They promptly began separating the butter themselves at their plant, making their own butter on site and packaging and distributing it under their own label. They devised special protective packages and distributed them to grocery stores and restaura ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fred Meyer

Fred Meyer is an American chain of hypermarket superstores founded in 1922 in Portland, Oregon, USA, by Fred G. Meyer. The stores are found in the northwest U.S., within the states of Oregon, Washington, Idaho, and Alaska. The company merged with Kroger in 1998, though the stores are still branded Fred Meyer. The chain was one of the first in the United States to promote one-stop shopping, eventually combining a complete grocery supermarket with a drugstore, bank, clothing, jewelry, home decor, home improvement, garden, electronics, restaurant, shoes, sporting goods and toys. The western region of Kroger corporation is headquartered in Portland. History 1920s–1950s: beginnings In 1922, the first Fred Meyer store opened in Portland at the corner of SW 5th & Yamhill. The store combined separate shops under one roof such as meat, produce, cheese, and other merchandise. Mr. Meyer’s vision was to give customers more reasons to shop in his store than in any other. The first ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Forest Products Corporation

American Forest Products Corporation (AFPC) was a Fortune 500 company initially producing wooden boxes and shipping materials but expanding into the timber, sawmill, and lumber industries. The company began in the 1920s and operated under the same leadership until it was sold to the Bendix Corporation in 1969. History The company began in 1910 in Stockton, California as the Stockton Manufacturing Company, a joint effort of Horace Tartar and Clarence Albert Webster. The company produced wooden boxes used primarily by fruit growers and canners and shook, the material of shipping strips which were used to keep boxes from shifting in transit. In 1911, the company was renamed the Stockton Box Company. Tartar and Webster incorporated in 1918 and later included their legal partner, Walter S. Johnson, to become Tartar, Webster and Johnson, Inc. The box company expanded in the 1920s to include timber, saw mills and lumber. The company name became the American Forest Products Co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kohlberg Kravis Roberts

KKR & Co. Inc., also known as Kohlberg Kravis Roberts & Co., is an American global investment company that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and, through its strategic partners, hedge funds. , the firm had completed more than 650 private equity investments in portfolio companies with approximately $675 billion of total enterprise value. , assets under management ("AUM") and fee paying assets under management ("FPAUM") were $471 billion and $357 billion, respectively. The firm was founded in 1976 by Jerome Kohlberg Jr., and cousins Henry Kravis and George R. Roberts, all of whom had previously worked together at Bear Stearns, where they completed some of the earliest leveraged buyout transactions. Since its founding, KKR has completed a number of transactions, including the 1989 leveraged buyout of RJR Nabisco, which was the largest buyout in history to that point, as well as the 2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hybritech

Beckman Coulter Inc. is a Danaher Corporation company that develops, manufactures, and markets products that simplify, automate and innovate complex biomedical testing. It operates in two industries: Diagnostics and Life Sciences. For more than 80 years, Beckman Coulter Inc. has helped healthcare and laboratory professionals, pharmaceutical and biotechnology companies, universities, medical schools, and research institutions worldwide. The company eventually grew to employ over 12,000 people, with $5.8 billion in annual sales by 2017. It is currently headquartered in Brea, California. Beckman Coulter was acquired by Danaher Corporation in 2011. History Founded by Caltech professor Arnold O. Beckman in 1935 as National Technical Laboratories to commercialize a pH meter that he had invented. In the 1940s, Beckman changed the name to Arnold O. Beckman, Inc. to sell oxygen analyzers, the ''Helipot'' precision potentiometer, and spectrophotometers. In the 1950s, the company name c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

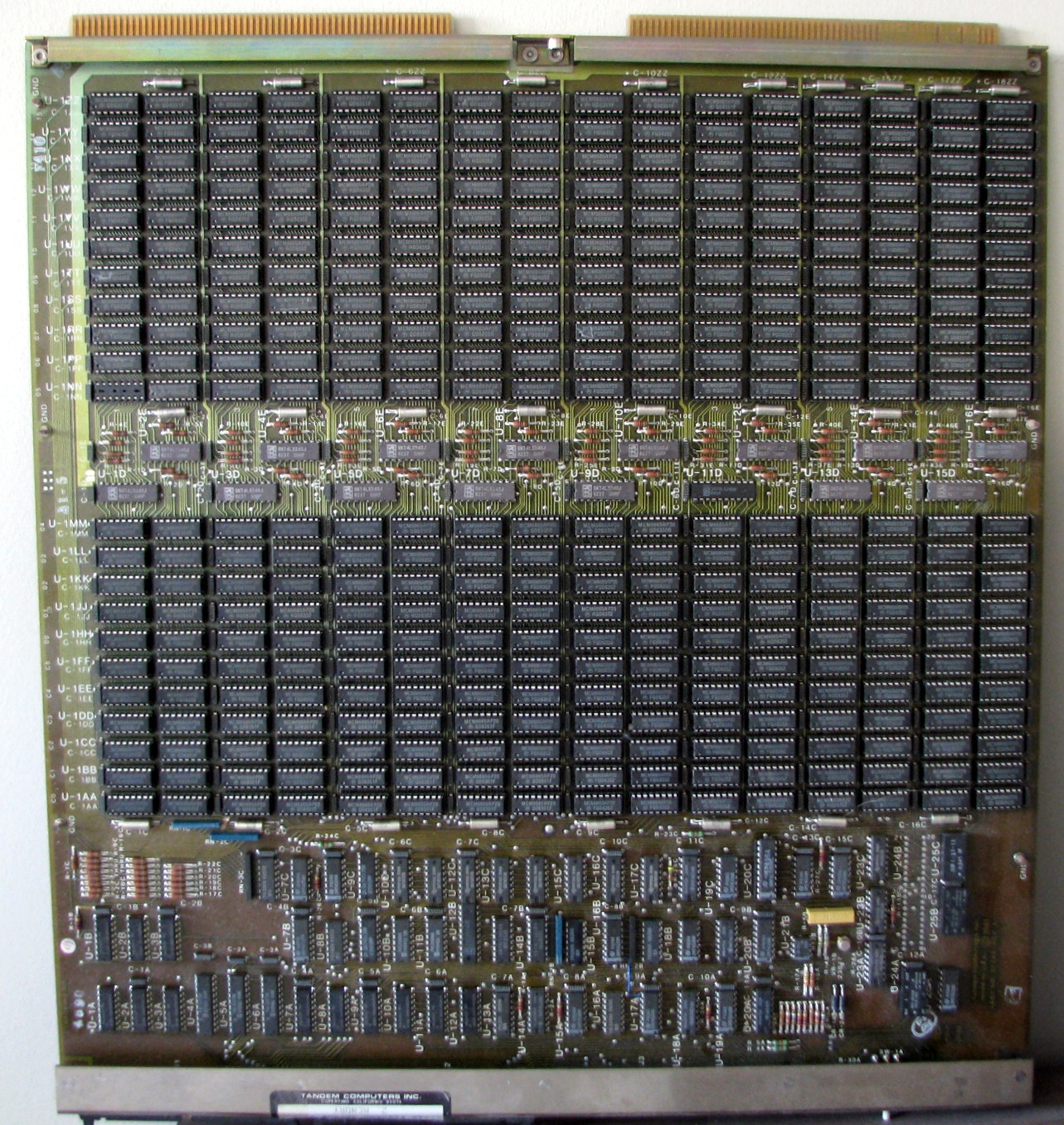

Tandem Computers

Tandem Computers, Inc. was the dominant manufacturer of fault-tolerant computer systems for ATM networks, banks, stock exchanges, telephone switching centers, and other similar commercial transaction processing applications requiring maximum uptime and zero data loss. The company was founded by Jimmy Treybig in 1974 in Cupertino, California. It remained independent until 1997, when it became a server division within Compaq. It is now a server division within Hewlett Packard Enterprise, following Hewlett-Packard's acquisition of Compaq and the split of Hewlett Packard into HP Inc. and Hewlett Packard Enterprise. Tandem's NonStop systems use a number of independent identical processors and redundant storage devices and controllers to provide automatic high-speed "failover" in the case of a hardware or software failure. To contain the scope of failures and of corrupted data, these multi-computer systems have no shared central components, not even main memory. Conventional multi- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |