|

Financial Crisis Responsibility Fee

The Financial Crisis Responsibility Fee was a bank tax proposed by U.S. President Barack Obama in January 2010,Richard T. Page"Foolish Revenge or Shrewd Regulation? Financial-Industry Tax Law Reforms Proposed in the Wake of the Financial Crisis?"85 Tul. L. Rev. 191, 197-98, 205-14 (2010). to apply to financial firms with $50 billion or more in consolidated assets. The fee would have been payable until the firm had paid off all money provided to it under the Troubled Assets Relief Program (TARP). Approximately 50 banks and similar firms would have been charged the fee, raising a total of roughly $9 billion a year for at least 10 years. The fee would continue to be payable for longer if required to fully recover TARP costs. The fee would only apply to those U.S. firms, or firms that received TARP subsidies, with $50 billion or more in consolidated assets. The fee would be calculated by taking the total assets, subtracting that amount from Tier 1 capital and insured deposits, and the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Tax

A bank tax, or a bank levy, is a tax on banks which was discussed in the context of the financial crisis of 2007–08. The bank tax is levied on the capital at risk of financial institutions, excluding federally insured deposits, with the aim of discouraging banks from taking unnecessary risks. The bank tax is levied on a limited number of sophisticated taxpayers and is not especially difficult to understand. It can be used as a counterbalance to the various ways in which banks are currently subsidized by the tax system, such as the ability to subtract bad loan reserves, delay tax on interest received abroad, and buy other banks and use their losses to offset future income. In other words, the bank tax is a small reimbursement of taxpayer funds used to bail out major banks after the 2008 financial crisis, and it is carefully structured to target only certain institutions that are considered "too big to fail." On 16 April 2010, the International Monetary Fund (IMF) put forward th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

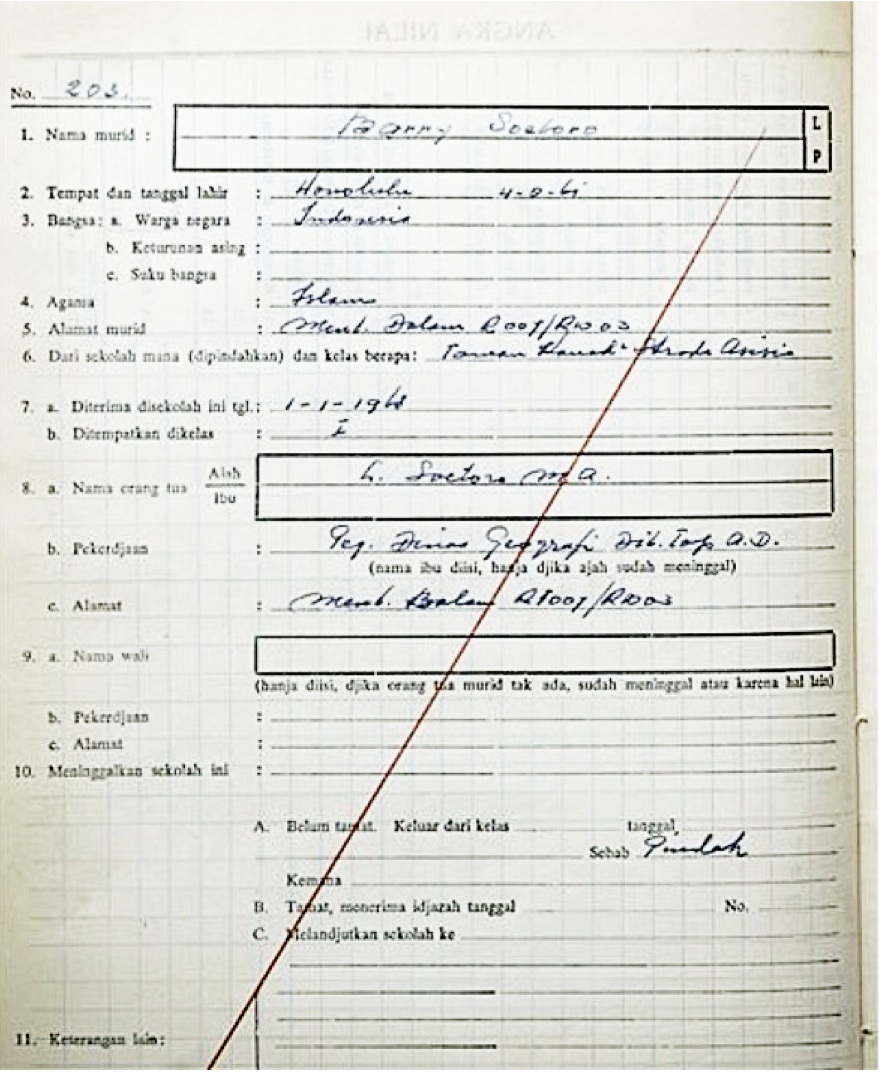

Barack Obama

Barack Hussein Obama II ( ; born August 4, 1961) is an American politician who served as the 44th president of the United States from 2009 to 2017. A member of the Democratic Party (United States), Democratic Party, Obama was the first African-American president of the United States. He previously served as a U.S. senator from Illinois from 2005 to 2008 and as an Illinois state senator from 1997 to 2004, and previously worked as a civil rights lawyer before entering politics. Obama was born in Honolulu, Hawaii. After graduating from Columbia University in 1983, he worked as a Community organizing, community organizer in Chicago. In 1988, he enrolled in Harvard Law School, where he was the first black president of the ''Harvard Law Review''. After graduating, he became a civil rights attorney and an academic, teaching constitutional law at the University of Chicago Law School from 1992 to 2004. Turning to elective politics, he Illinois Senate career of Barack Obama, repre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Troubled Assets Relief Program

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George Bush. It was a component of the government's measures in 2009 to address the subprime mortgage crisis. The TARP originally authorized expenditures of $700 billion. The Emergency Economic Stabilization Act of 2008 created the TARP. The Dodd–Frank Wall Street Reform and Consumer Protection Act, signed into law in 2010, reduced the amount authorized to $475 billion. By October 11, 2012, the Congressional Budget Office (CBO) stated that total disbursements would be $431 billion, and estimated the total cost, including grants for mortgage programs that have not yet been made, would be $24 billion. On December 19, 2014, the U.S. Treasury sold its remaining holdings of Ally Financial, essentially ending the program. Purpose TARP allo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tier 1 Capital

Tier 1 capital is the core measure of a bank's financial strength from a regulator's point of view.By definition of Bank for International Settlements. It is composed of ''core capital'', which consists primarily of common stock and disclosed reserves (or retained earnings), but may also include non-redeemable non-cumulative preferred stock. The Basel Committee also observed that banks have used innovative instruments over the years to generate Tier 1 capital; these are subject to stringent conditions and are limited to a maximum of 15% of total Tier 1 capital. This part of the Tier 1 capital will be phased out during the implementation of Basel III. Capital in this sense is related to, but different from, the accounting concept of shareholders' equity. Both Tier 1 and Tier 2 capital were first defined in the Basel I capital accord and remained substantially the same in the replacement Basel II accord. Tier 2 capital represents "supplementary capital" such as undisclosed r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Obama Administration

Barack Obama's tenure as the 44th president of the United States began with his first inauguration on January 20, 2009, and ended on January 20, 2017. A Democrat from Illinois, Obama took office following a decisive victory over Republican nominee John McCain in the 2008 presidential election. Four years later, in the 2012 presidential election, he defeated Republican nominee Mitt Romney to win re-election. Obama is the first African American president, the first multiracial president, the first non-white president, and the first president born in Hawaii. Obama's accomplishments during the first 100 days of his presidency included signing the Lilly Ledbetter Fair Pay Act of 2009 relaxing the statute of limitations for equal-pay lawsuits; signing into law the expanded State Children's Health Insurance Program(S-CHIP); winning approval of a congressional budget resolution that put Congress on record as dedicated to dealing with major health care reform legislation in 200 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emergency Economic Stabilization Act

The Emergency Economic Stabilization Act of 2008, often called the "bank bailout of 2008", was proposed by Treasury Secretary Henry Paulson, passed by the 110th United States Congress, and signed into law by President George W. Bush. It became law as part of Public Law 110-343 on October 3, 2008, in the midst of the financial crisis of 2007–2008. It created the $700 billion Troubled Asset Relief Program (TARP) to purchase toxic assets from banks. The funds were mostly redirected to inject capital into banks and other financial institutions while the Treasury continued to examine the usefulness of targeted asset purchases. A financial crisis had developed throughout 2007 and 2008 partly due to a subprime mortgage crisis, causing the failure or near-failure of major financial institutions like Lehman Brothers and American International Group. Seeking to prevent the collapse of the financial system, Secretary of the Treasury Paulson called for the U.S. government to purchase seve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

KAIROS

Kairos ( grc, καιρός) is an ancient Greek word meaning 'the right, critical, or opportune moment'. In modern Greek, ''kairos'' also means 'weather' or 'time'. It is one of two words that the ancient Greeks had for 'time'; the other being (). Whereas the latter refers to chronological or sequential time, ''kairos'' signifies a proper or opportune time for action. In this sense, while is quantitative, ''kairos'' has a qualitative, permanent nature. The plural, () means 'the times'. Kairos is a term, idea, and practice that has been applied in several fields including classical rhetoric, modern rhetoric, digital media, Christian theology, and science. Origins In Onians's 1951 etymological studies of the word, he traces the primary root back to the ancient Greek association with both archery and weaving. In archery, ''kairos'' denotes the moment in which an arrow may be fired with sufficient force to penetrate a target. In weaving, ''kairos'' denotes the moment ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tulane Law Review

The ''Tulane Law Review'', a publication of the Tulane University Law School, was founded in 1916, and is currently published five times annually. The Law Review has an international circulation and is one of few American law reviews carried by law libraries in the United Kingdom. History The Law Review was started as the Southern Law Quarterly by Rufus Carrollton Harris, the school's twelfth dean. Charles E. Dunbar, Jr., the civil service reformer who became a Tulane law professor, served on the board of advisory editors of ''Tulane Law Review'' from its inception until his death in 1959. A 1937 ''Time'' magazine about Rufus Harris describes the Tulane Law Review as "nationally famed." The Law Review was most recently cited by the United States Supreme Court on April 27, 2010. Membership Membership to the Tulane Law Review is conferred upon Tulane law students who have "outstanding scholastic records or demonstrated ability in legal research and writing." Specifically, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defazio Financial Transactions Tax

The proposed bill Let Wall Street Pay for the Restoration of Main Street Bill is officially contained in the United States House of Representatives bill entitled H.R. 4191: Let Wall Street Pay for the Restoration of Main Street Act of 2009. It is a proposed piece of legislation that was introduced into the United States House of Representatives on December 3, 2009 to assess a tax on US financial market securities transactions.Richard T. Page"Foolish Revenge or Shrewd Regulation? Financial-Industry Tax Law Reforms Proposed in the Wake of the Financial Crisis?"85 Tul. L. Rev. 191, 193-94, 205-14 (2010). Its official purpose is "to fund job creation and deficit reduction." Projected annual revenue is $150 billion per year, half of which would go towards deficit reduction and half of which would go towards job promotion activities. History The US imposed a financial transaction tax from 1914 to 1966. The federal tax on stock sales of 0.1 per cent at issuance and 0.04 per cent on tra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Tax

A bank tax, or a bank levy, is a tax on banks which was discussed in the context of the financial crisis of 2007–08. The bank tax is levied on the capital at risk of financial institutions, excluding federally insured deposits, with the aim of discouraging banks from taking unnecessary risks. The bank tax is levied on a limited number of sophisticated taxpayers and is not especially difficult to understand. It can be used as a counterbalance to the various ways in which banks are currently subsidized by the tax system, such as the ability to subtract bad loan reserves, delay tax on interest received abroad, and buy other banks and use their losses to offset future income. In other words, the bank tax is a small reimbursement of taxpayer funds used to bail out major banks after the 2008 financial crisis, and it is carefully structured to target only certain institutions that are considered "too big to fail." On 16 April 2010, the International Monetary Fund (IMF) put forward th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Let Wall Street Pay For The Restoration Of Main Street Bill

The proposed bill Let Wall Street Pay for the Restoration of Main Street Bill is officially contained in the United States House of Representatives bill entitled H.R. 4191: Let Wall Street Pay for the Restoration of Main Street Act of 2009. It is a proposed piece of legislation that was introduced into the United States House of Representatives on December 3, 2009 to assess a tax on US financial market securities transactions.Richard T. Page"Foolish Revenge or Shrewd Regulation? Financial-Industry Tax Law Reforms Proposed in the Wake of the Financial Crisis?"85 Tul. L. Rev. 191, 193-94, 205-14 (2010). Its official purpose is "to fund job creation and deficit reduction." Projected annual revenue is $150 billion per year, half of which would go towards deficit reduction and half of which would go towards job promotion activities. History The US imposed a financial transaction tax from 1914 to 1966. The federal tax on stock sales of 0.1 per cent at issuance and 0.04 per cent on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In The United States

Banking in the United States began by the 1780s along with the country's founding and has developed into highly influential and complex system of banking and financial services. Anchored by New York City and Wall Street, it is centered on various financial services namely private banking, asset management, and deposit security. The beginnings of the banking industry can be traced to 1780 when the Bank of Pennsylvania was founded to fund the American Revolutionary War. After merchants in the Thirteen Colonies needed a currency as a medium of exchange, the Bank of North America was opened to facilitate more advanced financial transactions. As of 2018, the largest banks in the United States were JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and Goldman Sachs. It is estimated that banking assets were equal to 56 percent of the U.S. economy. As of September 8, 2021, there were 4,951 FDIC insured commercial banks and savings institutions in the U.S. History Merchant ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |