|

Federal Reserve Notes

Federal Reserve Notes are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 and issues them to the Federal Reserve Banks at the discretion of the Board of Governors of the Federal Reserve System. The Reserve Banks then circulate the notes to their member banks, at which point they become liabilities of the Reserve Banks and obligations of the United States. Federal Reserve Notes are legal tender, with the words "this note is legal tender for all debts, public and private" printed on each note. The notes are backed by financial assets that the Federal Reserve Banks pledge as collateral, which are mainly Treasury securities and mortgage agency securities that they purchase on the open market by fiat payment. History Following the enactment of the Constitution, states began chartering commercial banks that issued their own notes. These notes w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US One Dollar Bill, Obverse, Series 2009

US or Us most often refers to: * Us (pronoun), ''Us'' (pronoun), the objective case of the English first-person plural pronoun ''we'' * US, an abbreviation for the United States US, U.S., Us, us, or u.s. may also refer to: Arts and entertainment Albums * Us (Brother Ali album), ''Us'' (Brother Ali album) or the title song, 2009 * Us (Empress Of album), ''Us'' (Empress Of album), 2018 * Us (Mull Historical Society album), ''Us'' (Mull Historical Society album), 2003 * Us (Peter Gabriel album), ''Us'' (Peter Gabriel album), 1992 * Us (EP), ''Us'' (EP), by Moon Jong-up, 2021 * ''Us'', by Maceo Parker, 1974 * ''Us'', mini-album by Peakboy, 2019 Songs * Us (James Bay song), "Us" (James Bay song), 2018 * Us (Jennifer Lopez song), "Us" (Jennifer Lopez song), 2018 * Us (Regina Spektor song), "Us" (Regina Spektor song), 2004 * Us (Gracie Abrams song), "Us" (Gracie Abrams song), 2024 * "Us", by Azealia Banks from ''Fantasea (mixtape), Fantasea'', 2012 * "Us", by Celine Dion from ''Let's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Banking Act

The National Banking Acts of 1863 and 1864 were two United States federal banking acts that established a system of national banks chartered at the federal level, and created the United States National Banking System. They encouraged development of a national currency backed by bank holdings of U.S. Treasury securities and established the Office of the Comptroller of the Currency as part of the United States Department of the Treasury. The Act shaped today's national banking system and its support of a uniform U.S. banking policy. Background Antebellum Period At the end of the Second Bank of the United States in 1836, the control of banking regimes devolved mostly to the states. Different states adopted policies including a total ban on banking (as in Wisconsin), a single state-chartered bank (as in Indiana and Illinois), limited chartering of banks (as in Ohio), and free entry (as in New York). While the relative success of New York's "free banking" laws led several states also ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clearing (finance)

In banking and finance, clearing refers to all activities from the time a commitment is made for a transaction until it is settled. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another. Clearing houses were formed to facilitate such transactions among banks. Description In trading, clearing is necessary because the speed of trades is much faster than the cycle time for completing the underlying transaction. It involves the management of post-trading, pre-settlement credit exposures to ensure that trades are settled in accordance with market rules, even if a buyer or seller should become insolvent prior to settlement. Processes included in clearing are reporting/monitoring, risk margining, netting of trades to single positions, tax handling, and failure handling. Systemically important payment systems (SIPS) are payment systems which have the characteristic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Reserves

Bank reserves are a commercial bank's cash holdings physically held by the bank, and deposits held in the bank's account with the central bank. In most countries, the Central bank may set minimum reserve requirements that mandate commercial banks under their purview to hold cash or deposits at the central bank equivalent to at least a prescribed percentage of their liabilities, such as customer deposits. Such sums are usually termed required reserves, and any funds above the required amount are called excess reserves. These reserves are prescribed to ensure that, in the normal events, there is sufficient liquidity in the banking system to provide funds to bank customers wishing to withdraw cash. Even when there are no reserve requirements, banks often as a matter of prudent management hold reserves in case of unexpected events, such as unusually large net withdrawals by customers (such as before Christmas) or bank runs. Traditionally, central banks do not pay interest on reserve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Bank Note

National Bank Notes were United States currency banknotes issued by national banks chartered by the United States Government. The notes were usually backed by United States bonds the bank deposited with the United States Treasury. In addition, banks were required to maintain a redemption fund amounting to five percent of any outstanding note balance, in gold or "lawful money." The notes were not legal tender in general, but were satisfactory for nearly all payments to and by the federal government. National Bank Notes were retired as a currency type by the U.S. government in the 1930s, when U.S. currency was consolidated into Federal Reserve Notes, United States Notes, and silver certificates. Background Prior to the American Civil War, state banks and chartered private banks issued their own banknotes. Privately issued banknotes were nominally backed by specie ( hard money) or financial securities held by the banks but oversight of issuing banks often was lax and encourage ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

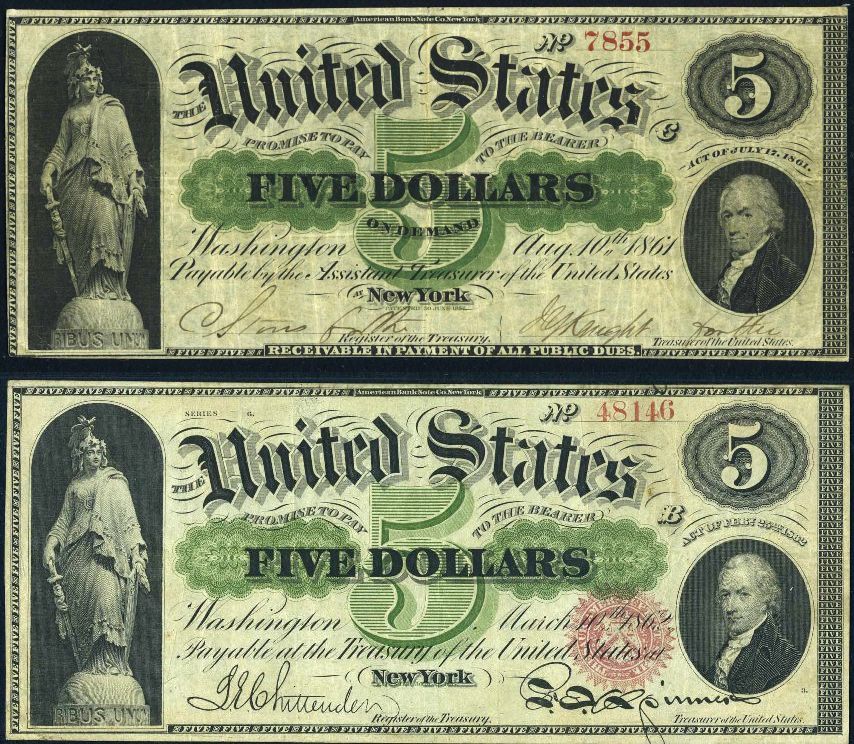

United States Note

A United States Note, also known as a Legal Tender Note, is a type of Banknote, paper money that was issued from 1862 to 1971 in the United States. Having been current for 109 years, they were issued for longer than any other form of U.S. paper money other than the currently issued Federal Reserve Note. They were known popularly as "greenbacks", a name inherited from the earlier Greenback (1860s money), greenbacks, the Demand Notes, that they replaced in 1862. Often termed Legal Tender Notes, they were named United States Notes by the First Legal Tender Act, which authorized them as a form of fiat currency. During the early 1860s the so-called ''second obligation'' on the reverse of the notes stated: By the 1930s, this obligation would eventually be shortened to: They were originally issued directly into circulation by the United States Department of the Treasury, U.S. Treasury to pay expenses incurred by the Union (American Civil War), Union during the American Civil War. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Secretary Of The Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal advisor to the president of the United States on all matters pertaining to economic and fiscal policy. The secretary is, by custom, a member of the Cabinet of the United States, president's cabinet and, by law, a member of the United States National Security Council, National Security Council, and fifth in the U.S. presidential line of succession. Under the Appointments Clause of the United States Constitution, the officeholder is nominated by the president of the United States, and, following a confirmation hearing before the United States Senate Committee on Finance, Senate Committee on Finance, will take the office if confirmed by the majority of the full United States Senate. The United States Secretary of State, secretary of state, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasurer Of The United States

The treasurer of the United States is an officer in the United States Department of the Treasury who serves as the custodian and trustee of the federal government's collateral assets and the supervisor of the department's currency and coinage production functions. On March 23, 2025, Donald Trump named Georgia state senator Brandon Beach—breaking a 75-year streak of women holding the position—to be the next treasurer. He was formally appointed on the 28th of May. Responsibilities By law, the treasurer is the depositary officer of the United States with regard to deposits of gold, special drawing rights, and financial gifts to the Library of Congress. The treasurer also directly oversees the Bureau of Engraving and Printing (BEP) and the United States Mint, which respectively print and mint United States dollar, U.S. currency and Coins of the United States dollar, coinage. In connection to the influence of Monetary policy of the United States, federal monetary policy on currenc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States. It is one of 15 current U.S. government departments. The department oversees the Bureau of Engraving and Printing and the U.S. Mint, two federal agencies responsible for printing all paper currency and minting coins. The treasury executes currency circulation in the domestic fiscal system, collects all federal taxes through the Internal Revenue Service, manages U.S. government debt instruments, licenses and supervises banks and thrift institutions, and advises the legislative and executive branches on fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes. The dep ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William Howard Taft

William Howard Taft (September 15, 1857March 8, 1930) served as the 27th president of the United States from 1909 to 1913 and the tenth chief justice of the United States from 1921 to 1930. He is the only person to have held both offices. Taft was born in Cincinnati, Ohio. His father, Alphonso Taft, was a U.S. attorney general and secretary of war. Taft attended Yale and joined Skull and Bones, of which his father was a founding member. After becoming a lawyer, Taft was appointed a judge while still in his twenties. He continued a rapid rise, being named Solicitor General of the United States, solicitor general and a judge of the Sixth Circuit Court of Appeals. In 1901, President William McKinley appointed Taft Governor-General of the Philippines, civilian governor of the Philippines. In 1904, President Theodore Roosevelt made him Secretary of War, and he became Roosevelt's hand-picked successor. Despite his personal ambition to become chief justice, Taft declined repeated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Series Of 1928 (United States Currency)

The Series of 1928 was the first issue of Federal_Reserve_Note#Small_size_notes, small-size currency printed and released by the U.S. government. These notes, first released to the public on July 10, 1929, were the first standardized notes in terms of design and characteristics, featuring similar portraits and other facets. These notes were also the first to measure 6.14" by 2.61", smaller than the Large-sized note, large-sized predecessors of Series 1923 and earlier that measured 7.375" by 3.125". Certain one-dollar notes in this series were called Funnybacks. Federal Reserve Notes Federal Reserve Notes featured a green Seal of the United States Department of the Treasury, Treasury Seal starting in 1928. This was the only type of currency that, at first, featured the seal over the large engraved word to the right of the portrait. These notes also carried a seal bearing the identity of the Federal Reserve Bank of issuance. The bank was noted in the black, circular seal to the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |