|

EdFund

EdFund is the United States' second largest provider of student loan guarantee services under the Federal Family Education Loan Program (FFELP). It is organized as a non-profit public-benefit corporation. EdFund offers students and their families a wide range of information on the value of higher education, how to pursue it, how to pay for it, and debt management. In addition, EdFund supports schools with advanced loan processing solutions and default prevention techniques. Operating as an auxiliary corporation of the California Student Aid Commission, EdFund processes more than $9.3 billion in student loans in the United States annually (including Consolidation loans) and manages a portfolio of outstanding loans valued at $29 billion. EdFund is headquartered in Rancho Cordova, California with regional offices located throughout the United States. History EdFund is a nonprofit corporation founded by the California Student Aid Commission on January 1, 1997. EdFund was organi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Loans In The United States

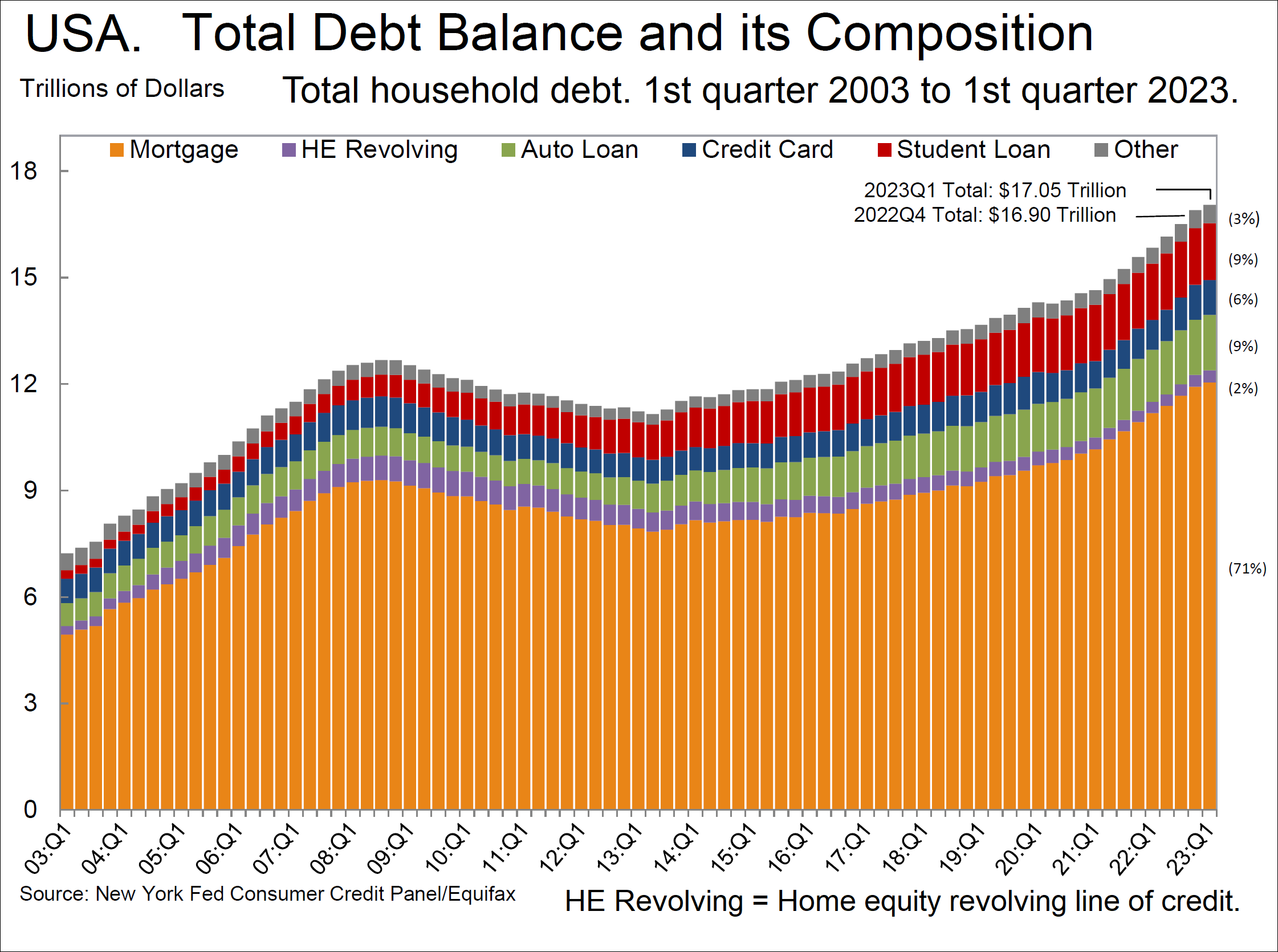

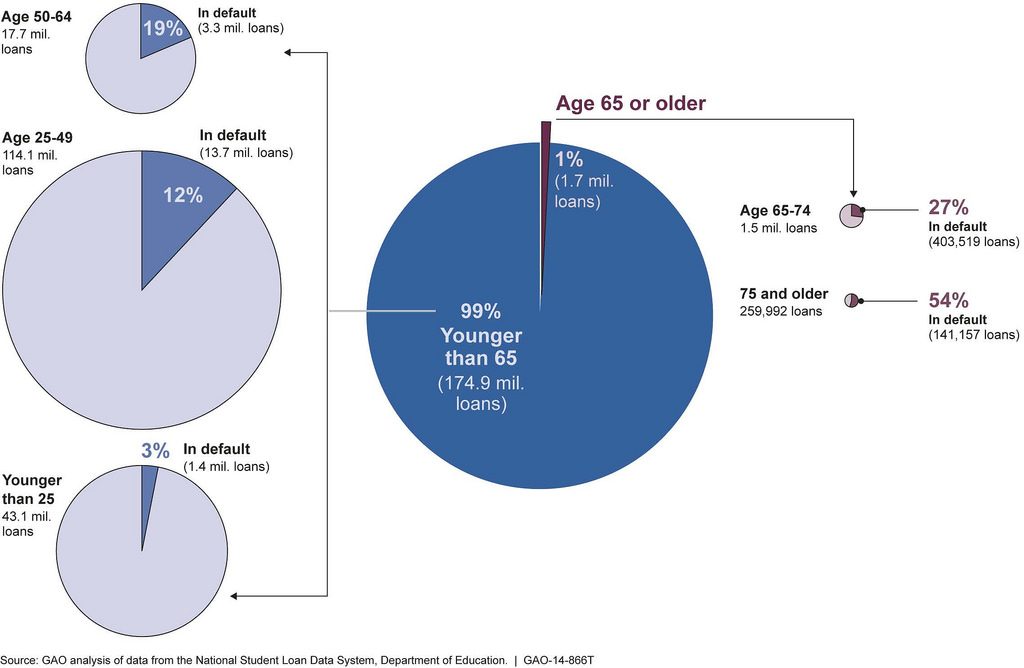

In the United States, student loans are a form of Student financial aid (United States), financial aid intended to help students access higher education. In 2018, 70 percent of higher education graduates had used loans to cover some or all of their expenses. With notable exceptions, student loans must be repaid, in contrast to other forms of financial aid such as scholarships and bursary, bursaries which are not repaid, and Grant (money), grants, which rarely have to be repaid. Student loans may be discharged through bankruptcy, but this is difficult. Research shows that access to student loans increases credit-constrained students' degree completion and later-life earnings while having no impact on overall debt. Student loan debt has proliferated since 2006, totaling $1.73 trillion by July 2021. In 2019, students who borrowed to complete a bachelor's degree had about $30,000 of debt upon graduation. Almost half of all loans are for graduate school, typically in much higher a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

College Tuition In The United States

College tuition in the United States is the cost of higher education collected by educational institutions in the United States, and paid by individuals. It does not include the tuition covered through general taxes or from other government funds, or that which is paid from university endowment funds or gifts. Tuition for college has increased as the value, quality, and quantity of education have increased. Many feel that increases in cost have ''not'' been accompanied by increases in quality, and that administrative costs are excessive. The value of a college education has become a topic of national debate in the U.S. History Under the Tenth Amendment to the United States Constitution, the powers of the federal government are limited to those mentioned explicitly in the Constitution. As education is not mentioned, educational policy and schools are state matters in the United States. The federal government operates military academies, but there is no national university nor nation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Debt

Student debt refers to the debt incurred by an individual to pay for education-related expenses. This debt is most commonly assumed to pay for tertiary education, such as university. The amount loaned or the loan agreement is often referred to as a student loan''.'' In many countries, student loans work differently compared to mortgages with differing laws governing renegotiation and bankruptcy. As with most other types of debt, student debt may be considered defaulted after a given period of no response to requests by the school or the lender for information, payment, or negotiation. Afterward, the debt is turned over to a student loan guarantor or a collection agency. Canada , Canada is ranked third in the world (behind Russia and South Korea) for the percentage of people ages 25–34 who have completed tertiary education. As of September 2012, the average debt for a Canadian post-university student was 28,000 Canadian dollars, with this accumulated debt taking an average of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Loan

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries. Australia Tertiary student places in Australia are usually funded through the HECS-HELP scheme. This funding is in the form of loans that are not normal debts. They are repaid over time via a supplementary tax, using a sliding scale based on taxable income. As a consequence, loan repayments are only made when the former student has income to support the repayments. Discounts are available for early repayment. The scheme is available to ci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Loans In The United States

In the United States, student loans are a form of Student financial aid (United States), financial aid intended to help students access higher education. In 2018, 70 percent of higher education graduates had used loans to cover some or all of their expenses. With notable exceptions, student loans must be repaid, in contrast to other forms of financial aid such as scholarships and bursary, bursaries which are not repaid, and Grant (money), grants, which rarely have to be repaid. Student loans may be discharged through bankruptcy, but this is difficult. Research shows that access to student loans increases credit-constrained students' degree completion and later-life earnings while having no impact on overall debt. Student loan debt has proliferated since 2006, totaling $1.73 trillion by July 2021. In 2019, students who borrowed to complete a bachelor's degree had about $30,000 of debt upon graduation. Almost half of all loans are for graduate school, typically in much higher a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tuition Payments

Tuition payments, usually known as tuition in American English and as tuition fees in Commonwealth English, are fees charged by education institutions for instruction or other services. Besides public spending (by governments and other public bodies), private spending via tuition payments are the largest revenue sources for education institutions in some countries. In most developed countries, especially countries in Scandinavia and Continental Europe, there are no or only nominal tuition fees for all forms of education, including university and other higher education.Garritzmann, Julian L., 2016. ''The Political Economy of Higher Education Finance. The Politics of Tuition Fees and Subsidies in OECD countries, 1945-2015''. Basingstoke: Palgrave Macmillan. Payment methods Some of the methods used to pay for tuition include: * Scholarship * Bursary * Company sponsorship or funding * Grant * Government student loan * Educational 7 (private) * Family (parental) money * Savings ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tuition Freeze

Tuition freeze is a government policy restricting the ability of administrators of post-secondary educational facilities (i.e. colleges and universities) to increase tuition fees for students. Although governments have various reasons for implementing such a policy, the main reason cited is improving accessibility for working- and middle-class students. A tuition fee freeze is a common political goal of the Canadian student movement, especially the Canadian Federation of Students. A tuition freeze is best known as a Canadian political construct, and can accurately be applied only to other countries that offer post-secondary education at a cost. However, the practice of regulating the rates paid by consumers, a formal regulatory process known as utility ratemaking, is carried out in many countries, including the United States, where many industries are classified as public utilities. Although the classification of public utilities has changed over time, typically such businesses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Family Education Loan Program

The Federal Family Education Loan (FFEL) Program was a system of private student loans which were subsidized and guaranteed by the United States federal government. The program issued loans from 1965 until it was ended in 2010. Similar loans are now provided under the Federal Direct Student Loan Program, which are federal loans issued directly by the United States Department of Education. The FFEL was initiated by the Higher Education Act of 1965 and was funded through a public/private partnership administered at the state and local level. In 2007-08, FFEL served 6.5 million students and parents, lending a total of $54.7 billion in new loans (or 80% of all new federal student loans). Since 1965, 60 million Americans have used FFEL loans to pay for education expenses. Following the passage of the Health Care and Education Reconciliation Act of 2010 on January 5, 2010 the program was terminated, and no subsequent loans were permitted to be made under the program after June 30 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public-benefit Nonprofit Corporation

A public-benefit nonprofit corporationnonprofit A nonprofit organization (NPO), also known as a nonbusiness entity, nonprofit institution, not-for-profit organization, or simply a nonprofit, is a non-governmental (private) legal entity organized and operated for a collective, public, or so ... corporation chartered by a state governments of the United States, U.S. state government and organized primarily or exclusively for Institution, social, educational institution, educational, Recreation, recreational or Charitable organization, charitable purposes by like-minded citizens. Public-benefit nonprofit corporations are distinct in the law from mutual-benefit nonprofit corporations in that they are organized for the general public benefit rather than for the interest of its members. They are also distinct in the law from religious corporations. See also * Civic society * New York state public-benefit corporations References External links Non-profit corporations ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rancho Cordova, California

Rancho Cordova is a city in Sacramento County, California, United States. Incorporated in 2003, it is part of the Sacramento Metropolitan Area. The population was 79,332 at the 2020 census. In 2010 and 2019, Rancho Cordova received the All-America City Award. History Originally called Mayhew's Crossing and Hangtown Crossing (c. 1855) during the Gold Rush era, the area was renamed Mayhew Station and Mills Station (c. 1900), respectively. The city itself was named for the Cordova Vineyard, which was located in the center of the Rancho Rio de los Americanos land grant. Other names of the town included Cordova Vineyards and Cordova Village, before it was officially named Rancho Cordova when a post office was established in the community in 1955. In the Gold Rush era of mid-19th-century California, placer mining took place around Rancho Cordova, and some traces of it can still be found. The elevation of the generally level terrain is approximately above mean sea level. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

501(c)(3)

A 501(c)(3) organization is a United States corporation, Trust (business), trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) organization, 501(c) nonprofit organizations in the US. 501(c)(3) tax-exemptions apply to entities that are organized and operated exclusively for religion, religious, Charitable organization, charitable, science, scientific, literature, literary or educational purposes, for Public security#Organizations, testing for public safety, to foster national or international amateur sports competition, or for the prevention of Child abuse, cruelty to children or Cruelty to animals, animals. 501(c)(3) exemption applies also for any non-incorporated Community Chest (organization), community chest, fund, Cooperating Associations, cooperating association or foundation organized and operated exclusively for those purposes. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Educational Credit Management Corporation

Educational Credit Management Corporation (ECMC) is a United States nonprofit corporation based in Minnesota. Since 1994, ECMC has operated in the areas of student loan bankruptcy management and loan collection. ECMC is one of a number of ''guaranty agencies'' that oversee student loans for the United States Department of Education. As a guarantor working on behalf of the U.S. Department of Education, ECMC charges fees to debtors and earns commissions from taxpayers by collecting on defaulted student loans pursuant to the Higher Education Act. In return, the U.S. government has retrieved billions of dollars from student loan debtors. From 1994 to 2015, according to ECMC, they returned $4.3 billion to the U.S. Treasury. According to ECMC the company works to reduce student-loan default rates and provide resources to help students repay their loans, and promotes financial literacy and student success in higher education. It provides current and future borrowers with free services, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |