|

Capital Formation

Capital formation is a concept used in macroeconomics, national accounts and financial economics. Occasionally it is also used in corporate accounts. It can be defined in three ways: *It is a specific statistical concept, also known as net investment, used in national accounts statistics, econometrics and macroeconomics. In that sense, it refers to a measure of the ''net additions'' to the (physical) capital stock of a country (or an economic sector) in an accounting interval, or, a measure of the amount by which the total physical capital stock ''increased'' during an accounting period. To arrive at this measure, standard valuation principles are used. *It is used also in economic theory, as a modern general term for capital accumulation, referring to the total "stock of capital" that has been formed, or to the growth of this total capital stock. *In a much broader or vaguer sense, the term "capital formation" has in more recent times been used in financial economics to refer to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Fixed Capital Formation

Gross fixed capital formation (GFCF) is a macroeconomic concept used in official national accounts such as the United Nations System of National Accounts (UNSNA), National Income and Product Accounts (NIPA) and the European System of Accounts (ESA). The concept dates back to the National Bureau of Economic Research (NBER) studies of Simon Kuznets of capital formation in the 1930s, and standard measures for it were adopted in the 1950s. Statistically it measures the value of acquisitions of new or existing fixed assets by the business sector, governments and "pure" households (excluding their unincorporated enterprises) ''less'' disposals of fixed assets. GFCF is a component of the expenditure on gross domestic product (GDP), and thus shows something about how much of the new value added in the economy is invested rather than consumed. GFCF is called "gross" because the measure does not make any adjustments to deduct the consumption of fixed capital (depreciation of fixed assets) f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Value

Market value or OMV (Open Market Valuation) is the price at which an asset would trade in a competitive auction setting. Market value is often used interchangeably with ''open market value'', '' fair value'' or ''fair market value'', although these terms have distinct definitions in different standards, and differ in some circumstances. Definition International Valuation Standards defines market value as "the estimated amount for which a property should exchange on the date of valuation between a willing buyer and a willing seller in an arm’s-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently, and without compulsion". Market value is a concept distinct from market price, which is "the price at which one can transact", while market value is "the true underlying value" according to theoretical standards. The concept is most commonly invoked in inefficient markets or disequilibrium situations where prevailing market prices ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Replacement Cost

The term replacement cost or replacement value refers to the amount that an entity would have to pay to replace an asset at the present time, according to its current worth. In the insurance industry, "replacement cost" or "replacement cost value" is one of several methods of determining the value of an insured item. Replacement cost is the actual cost to replace an item or structure at its pre-loss condition. This may not be the "market value" of the item, and is typically distinguished from the "actual cash value" payment which includes a deduction for depreciation. For insurance policies for property insurance, a contractual stipulation that the lost asset must be actually repaired or replaced before the replacement cost can be paid is common. This prevents overinsurance, which contributes to arson and insurance fraud.Thomas JE, Wilson B. (2005). The Indemnity Principle: Evolution from a Financial to a Functional Paradigm]. ''Journal of Risk Management & Insurance''Free full-t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Historic Cost

In accounting, an economic item's historical cost is the original nominal monetary value of that item. Historical cost accounting involves reporting assets and liabilities at their historical costs, which are not updated for changes in the items' values. Consequently, the amounts reported for these balance sheet items often differ from their current economic or market values. While use of historical cost measurement is criticised for its lack of timely reporting of value changes, it remains in use in most accounting systems during periods of low and high inflation and deflation. During hyperinflation, International Financial Reporting Standards (IFRS) require financial capital maintenance in units of constant purchasing power in terms of the monthly CPI as set out in IAS 29, Financial Reporting in Hyperinflationary Economies. Various adjustments to historical cost are used, many of which require the use of management judgment and may be difficult to verify. The trend in most acc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lease

A lease is a contractual arrangement calling for the user (referred to as the ''lessee'') to pay the owner (referred to as the ''lessor'') for the use of an asset. Property, buildings and vehicles are common assets that are leased. Industrial or business equipment are also leased. Basically a lease agreement is a contract between two parties: the lessor and the lessee. The lessor is the legal owner of the asset, while the lessee obtains the right to use the asset in return for regular rental payments. The lessee also agrees to abide by various conditions regarding their use of the property or equipment. For example, a person leasing a car may agree to the condition that the car will only be used for personal use. The term rental agreement can refer to two kinds of leases: * A lease in which the asset is tangible property. Here, the user '' rents'' the asset (e.g. land or goods) ''let out'' or ''rented out'' by the owner (the verb ''to lease'' is less precise because it can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

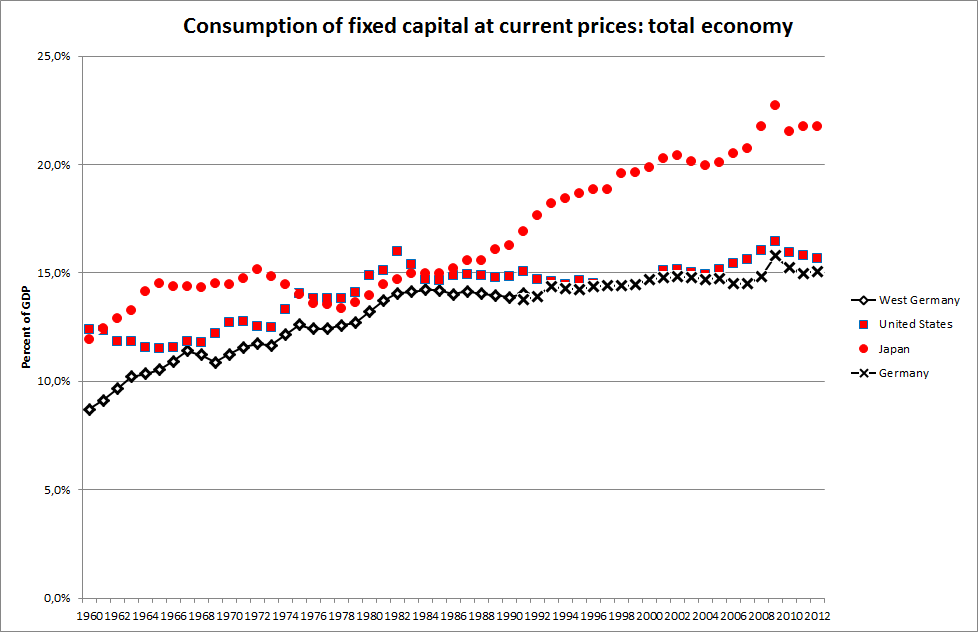

Consumption Of Fixed Capital

Consumption of fixed capital (CFC) is a term used in business accounts, tax assessments and national accounts for depreciation of fixed assets. CFC is used in preference to "depreciation" to emphasize that fixed capital is used up in the process of generating new output, and because unlike depreciation it is not valued at historic cost but at current market value (so-called "economic depreciation"); CFC may also include other expenses incurred in using or installing fixed assets beyond actual depreciation charges. Normally the term applies only to ''producing'' enterprises, but sometimes it applies also to real estate assets. CFC refers to a depreciation charge (or "write-off") against the gross income of a producing enterprise, which reflects the decline in value of fixed capital being operated with. Fixed assets will decline in value after they are purchased for use in production, due to wear and tear, changed market valuation and possibly market obsolescence. Thus, CFC represen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Nations Conference On Trade And Development

The United Nations Conference on Trade and Development (UNCTAD) is an intergovernmental organization within the United Nations Secretariat that promotes the interests of developing countries in world trade. It was established in 1964 by the United Nations General Assembly (UNGA) and reports to that body and the United Nations Economic and Social Council (ECOSOC). UNCTAD is composed of 195 member states and works with nongovernmental organizations worldwide; its permanent secretariat is in Geneva, Switzerland. The primary objective of UNCTAD is to formulate policies relating to all aspects of development, including trade, aid, transport, finance and technology. It was created in response to concerns among developing countries that existing international institutions like GATT (now replaced by the World Trade Organization), the International Monetary Fund (IMF), and the World Bank were not properly organized to handle the particular problems of developing countries; UNCTAD ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Capital

Financial capital (also simply known as capital or equity in finance, accounting and economics) is any economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their products or to provide their services to the sector of the economy upon which their operation is based, ''e.g.'', retail, corporate, investment banking, etc. In other words, financial capital is internal retained earnings generated by the entity or funds provided by lenders (and investors) to businesses in order to purchase real capital equipment or services for producing new goods and/or services. In contrast, real capital (or economic capital) comprises physical goods that assist in the production of other goods and services, e.g. shovels for gravediggers, sewing machines for tailors, or machinery and tooling for factories. IFRS concepts of capital maintenance ''Financial capital'' generally refers to saved-up financial wealth, especially that use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World Bank

The World Bank is an international financial institution that provides loans and grants to the governments of low- and middle-income countries for the purpose of pursuing capital projects. The World Bank is the collective name for the International Bank for Reconstruction and Development (IBRD) and International Development Association (IDA), two of five international organizations owned by the World Bank Group. It was established along with the International Monetary Fund at the 1944 Bretton Woods Conference. After a slow start, its first loan was to France in 1947. In the 1970s, it focused on loans to developing world countries, shifting away from that mission in the 1980s. For the last 30 years, it has included NGOs and environmental groups in its loan portfolio. Its loan strategy is influenced by the Sustainable Development Goals as well as environmental and social safeguards. , the World Bank is run by a president and 25 executive directors, as well as 29 various v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world." Formed in 1944, started on 27 December 1945, at the Bretton Woods Conference primarily by the ideas of Harry Dexter White and John Maynard Keynes, it came into formal existence in 1945 with 29 member countries and the goal of reconstructing the international monetary system. It now plays a central role in the management of balance of payments difficulties and international financial crises. Countries contribute funds to a pool through a quota system from which countries experiencing balance of payments problems can borrow money. , the fund had XDR 477 billi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |