|

Climate Bond

A green bond is a fixed-income financial instrument ( bond) which is used to fund projects that have positive environmental benefits. When referring to climate change mitigation projects they are also known as ''climate bonds''. Green bonds follow the ''Green Bond Principles'' stated by the International Capital Market Association (ICMA), and the proceeds from the issuance of which are to be used for the pre-specified types of projects. The categories of ''eligible green projects'' include for example: Renewable energy, energy efficiency, pollution prevention and control, environmentally sustainable management of living natural resources and land use, terrestrial and aquatic biodiversity, clean transportation, climate change adaptation. Like normal bonds, green bonds can be issued by governments, multi-national banks or corporations and the issuing organization repays the bond and any interest. The main difference is that the funds will be used only for positive climate chang ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of Security (finance), security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor (e.g. repay the principal (i.e. amount borrowed) of the bond at the Maturity (finance), maturity date and interest (called the coupon (bond), coupon) over a specified amount of time.) The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and Share capital, stocks are both Security (finance), securities, but the major difference between the two is that (capital) stockholders h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clean Energy

Energy is sustainable if it "meets the needs of the present without compromising the ability of future generations to meet their own needs." Definitions of sustainable energy usually look at its effects on the environment, the economy, and society. These impacts range from greenhouse gas emissions and air pollution to energy poverty and toxic waste. Renewable energy sources such as wind, hydro, solar, and geothermal energy can cause environmental damage but are generally far more sustainable than fossil fuel sources. The role of non-renewable energy sources in sustainable energy is controversial. Nuclear power does not produce carbon pollution or air pollution, but has drawbacks that include radioactive waste, the risk of nuclear proliferation, and the Nuclear and radiation accidents and incidents, risk of accidents. Switching from coal to natural gas has environmental benefits, including a lower climate change, climate impact, but may lead to a delay in switching to mor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Rating

A credit rating is an evaluation of the credit risk of a prospective debtor (an individual, a business, company or a government). It is the practice of predicting or forecasting the ability of a supposed debtor to pay back the debt or default. The credit rating represents an evaluation from a credit rating agency of the qualitative and quantitative information for the prospective debtor, including information provided by the prospective debtor and other non-public information obtained by the credit rating agency's analysts. Credit reporting (or credit score) is a subset of credit rating. It is a numeric evaluation of an ''individual's'' credit worthiness, which is done by a credit bureau or consumer credit reporting agency. Sovereign credit ratings A sovereign credit rating is the credit rating of a sovereign entity, such as a national government. The sovereign credit rating indicates the risk level of the investing environment of a country and is used by investors when looki ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk-weighted Asset

Risk-weighted asset (also referred to as RWA) is a bank's assets or off-balance-sheet exposures, weighted according to risk. This sort of asset calculation is used in determining the capital requirement or Capital Adequacy Ratio (CAR) for a financial institution. In the Basel I accord published by the Basel Committee on Banking Supervision, the Committee explains why using a risk-weight approach is the preferred methodology which banks should adopt for capital calculation: *it provides an easier approach to compare banks across different geographies *off-balance-sheet exposures can be easily included in capital adequacy calculations *banks are not deterred from carrying low risk liquid assets in their books Usually, different classes of assets have different risk weights associated with them. The calculation of risk weights is dependent on whether the bank has adopted the standardized or IRB approach under the Basel II framework. Some assets, such as debentures, are assigned a hig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stakeholder (corporate)

In a corporation, a stakeholder is a member of "groups without whose support the organization would cease to exist", as defined in the first usage of the word in a 1963 internal memorandum at the Stanford Research Institute. The theory was later developed and championed by R. Edward Freeman in the 1980s. Since then it has gained wide acceptance in business practice and in theorizing relating to strategic management, corporate governance, business purpose and corporate social responsibility (CSR). The definition of corporate responsibilities through a classification of stakeholders to consider has been criticized as creating a false dichotomy between the "shareholder model" and the "stakeholder model", or a false analogy of the obligations towards shareholders and other interested parties. Types Any action taken by any organization or any group might affect those people who are linked with them in the private sector. For examples these are parents, children, customers, owners ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

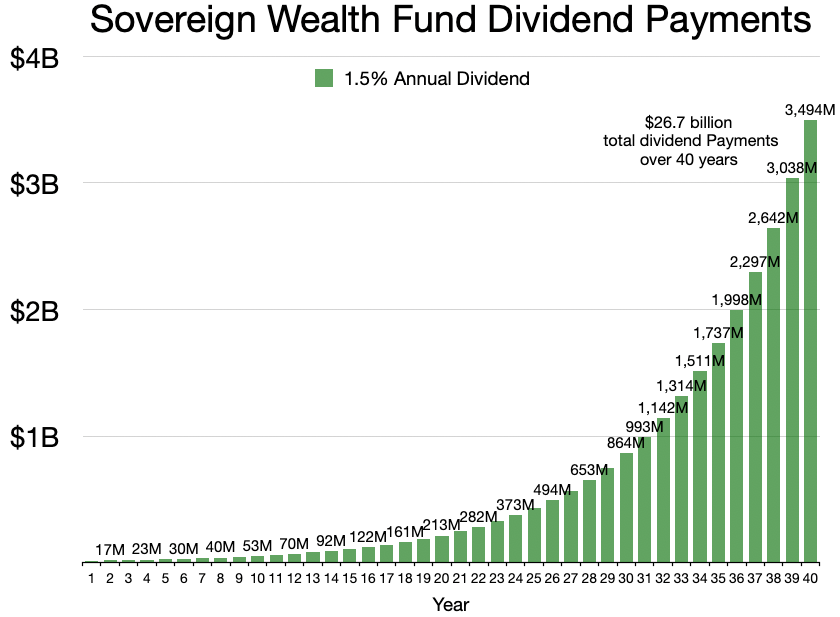

Sovereign Wealth Fund

A sovereign wealth fund (SWF), or sovereign investment fund, is a state-owned investment fund that invests in real and financial assets such as stocks, Bond (finance), bonds, real estate, precious metals, or in alternative investments such as private equity funds or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign exchange reserves held by the central bank. Some sovereign wealth funds may be held by a central bank, which accumulates the funds in the course of its management of a nation's banking system; this type of fund is usually of major economic and fiscal importance. Other sovereign wealth funds are simply the state savings that are invested by various entities for investment return, and that may not have a significant role in fiscal management. The accumulated funds may have their origin in, or may represent, foreign currency deposits, gold, special drawing rights (SDRs) and International Moneta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investor

An institutional investor is an entity that pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, real estate investment trusts, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Institutional investors appear to be more sophisticated than retail investors, but it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Axa Investment Managers

Axa Investment Managers (Axa IM) is a global investment management firm. It operates as the investment arm for Axa, a global insurance and reinsurance company. History In 1994, Axa created an investment management subsidiary under the name, Axa Asset Management. It operated separately from the insurance business lines and was headed by Jean-Pierre Hellebuyck. In 1997, Henri de Castries launched AXA Investment Managers (Axa IM) which Axa Asset Management became a part of. Donald Brydon was selected to be its chief executive officer. In 1996, Dominique Senequier joined Axa and founded the Axa Private equity platform. It operated under Axa IM until 2013 where it was spun off as a separate firm and renamed Ardian. During 1999, Axa IM paid US$125 million for a controlling stake in the Rosenberg Group, an active quantitative global equity manager based in California. It was renamed to "Rosenberg Equities" which now operates as the quantitative investment platform under ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Theme

Theme or themes may refer to: * Theme (Byzantine district), an administrative district in the Byzantine Empire governed by a Strategos * Theme (computing), a custom graphical appearance for certain software. * Theme (linguistics), topic * Theme (narrative), the unifying subject or idea of a work * Theme Building, a landmark building in the Los Angeles International Airport * Theme music a piece often written specifically for a radio program, television program, video game, or film, and usually played during the intro, opening credits, or ending credits * Theme vowel or thematic vowel, a vowel placed before the word ending in certain Proto-Indo-European words * Subject (music), sometimes called ''theme'', a musical idea, usually a recognizable melody, upon which part or all of a composition is based * Thematic elements, a term used by the Motion Picture Association The Motion Picture Association (MPA) is an American trade association representing the Major film studios, five ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ringfenced

In business and finance, ringfencing or ring-fencing occurs when a portion of a company's assets or profits are financially separated without necessarily being operated as a separate entity. This might be for: * regulatory reasons * creating asset protection schemes with respect to financing arrangements * segregating into separate income streams for taxation purposes * avoiding sanctions against a country. Asset protection In asset protection arrangements, ring-fencing can be employed through segregating specific assets and liabilities into separate companies of a corporate group. It can also be used as a method for mitigating liquidation risk or to improve a corporate credit rating. Separation for tax purposes In the United Kingdom, ring fence profits arise from income and gains from oil extraction activities or oil rights in the UK and UK continental shelf, and are subject to a higher rate of corporation tax. This petroleum fiscal regime can be seen in other countries as well. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset-backed Security

An asset-backed security (ABS) is a Security (finance), security whose income payments, and hence value, are derived from and collateralized (or "backed") by a specified pool of underlying assets. The pool of assets is typically a group of small and illiquid assets which are unable to be sold individually. Pooling the assets into financial instruments allows them to be sold to general investors, a process called securitization, and allows the risk of investing in the underlying assets to be diversified because each security will represent a fraction of the total value of the diverse pool of underlying assets. The pools of underlying assets can vary from common payments on credit cards, auto loans, and mortgage loans, to esoteric cash flows from aircraft leases, royalty payments, or movie revenues. Often a separate institution, called a special-purpose vehicle, is created to handle the securitization of asset-backed securities. The special-purpose vehicle, which creates and sell ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Le Temps

' (, ) is a Swiss French-language daily newspaper published in Berliner format in Geneva by Le Temps SA. The paper was launched in 1998, formed out of the merger of two other newspapers, and (the former being a merger of two other papers), as those papers were facing financial problems. It is the sole nationwide French-language non-specialised daily newspaper of Switzerland. Since 2021, it has been owned by Fondation Aventinus, a not-for-profit organisation. is considered a newspaper of record in Switzerland. History Predecessor papers The paper's three predecessors were the (founded 1798), the (founded 1826), and (founded 1991). The ' and the ' were merged in 1991 as the , which was partially motivated by those paper's financial issues as well as the impending creation of .' Due to financial issues, it was proposed that the ' and merge in 1996. The editorial staff of both papers met, but this was declined by publisher Edipresse as it would have resulted in lay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |