|

Cash Flow Return On Investment

Cash-flow return on investment (CFROI) is a valuation model that assumes the stock market sets prices based on cash flow, not on corporate performance and earnings. :\text = \frac For the corporation, it is essentially internal rate of return (IRR). CFROI is compared to a hurdle rate to determine if investment/product is performing adequately. The hurdle rate is the total cost of capital for the corporation calculated by a mix of cost of debt financing plus investors' expected return on equity investments. The CFROI must exceed the hurdle rate to satisfy both the debt financing and the investors expected return. :\text = \frac Michael J. Mauboussin in his 2006 book ''More Than You Know: Finding Financial Wisdom in Unconventional Places'', quoted an analysis by Credit Suisse First Boston, that, measured by CFROI, performance of companies tend to converge after five years in terms of their survival rates. The CFROI for a firm or a division can then be written as follows: ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Valuation (finance)

In finance, valuation is the process of determining the value of a (potential) investment, asset, or security. Generally, there are three approaches taken, namely discounted cashflow valuation, relative valuation, and contingent claim valuation. Valuations can be done for assets (for example, investments in marketable securities such as companies' shares and related rights, business enterprises, or intangible assets such as patents, data and trademarks) or for liabilities (e.g., bonds issued by a company). Valuation is a subjective exercise, and in fact, the process of valuation itself can also affect the value of the asset in question. Valuations may be needed for various reasons such as investment analysis, capital budgeting, merger and acquisition transactions, financial reporting, taxable events to determine the proper tax liability. In a business valuation context, various techniques are used to determine the (hypothetical) price that a third party would pay for a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange as well as stock that is only traded privately, such as shares of private companies that are sold to investors through equity crowdfunding platforms. Investments are usually made with an investment strategy in mind. Size of the market The total market capitalization of all publicly traded stocks worldwide rose from US$2.5 trillion in 1980 to US$111 trillion by the end of 2023. , there are 60 stock exchanges in the world. Of these, there are 16 exchanges with a market capitalization of $1 trillion or more, and they account for 87% of global market capitalization. Apart from the Australian Securities Exchange, these 16 exchanges are all in North America, Europe, or Asia. By country, the largest stock markets as of January 2022 are in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Flow

Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or virtual movement of money. *Cash flow, in its narrow sense, is a payment (in a currency), especially from one central bank account to another. The term 'cash flow' is mostly used to describe payments that are expected to happen in the future, are thus uncertain, and therefore need to be forecast with cash flows. *A cash flow is determined by its time , nominal amount , currency , and account ; symbolically, . Cash flows are narrowly interconnected with the concepts of value, interest rate, and liquidity. A cash flow that shall happen on a future day can be transformed into a cash flow of the same value in . This transformation process is known as discounting, and it takes into account the time value of money by adjusting the nominal amount of the cash flow based on the prevailing interest rates at the time. Cash flow analy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Rate Of Return

Internal rate of return (IRR) is a method of calculating an investment's rate of return. The term ''internal'' refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk. The method may be applied either ex-post or ex-ante. Applied ex-ante, the IRR is an estimate of a future annual rate of return. Applied ex-post, it measures the actual achieved investment return of a historical investment. It is also called the discounted cash flow rate of return (DCFROR)Project Economics and Decision Analysis, Volume I: Deterministic Models, M.A.Main, Page 269 or yield rate. Definition (IRR) The IRR of an investment or project is the "annualized effective compounded return rate" or rate of return that sets the net present value (NPV) of all cash flows (both positive and negative) from the investment equal to zero. Equivalently, it is the interest rate at which the net present value of the future cash fl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to Shareholder value, maximize or increase valuation (finance), shareholder value.SeCorporate Finance: First Principles Aswath Damodaran, New York University's Stern School of Business Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding Project#Corporate finance, projects should receive investment funding, and whether to finance that investment with ownership equity, equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and Current liability, cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Of Debt

In economics and accounting, the cost of capital is the cost of a company's funds (both debt and equity), or from an investor's point of view is "the required rate of return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new project has to meet. Basic concept For an investment to be worthwhile, the expected return on capital has to be higher than the cost of capital. Given a number of competing investment opportunities, investors are expected to put their capital to work in order to maximize the return. In other words, the cost of capital is the rate of return that capital could be expected to earn in the best alternative investment of equivalent risk; this is the opportunity cost of capital. If a project is of similar risk to a company's average business activities it is reasonable to use the company's average cost ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Equity

The return on equity (ROE) is a measure of the profitability of a business in relation to its equity; where: : Jason Fernando (2023)"Return on Equity (ROE) Calculation and What It Means" Investopedia Thus, ROE is equal to a fiscal year's net income (after preferred stock dividends, before common stock dividends), divided by total equity (excluding preferred shares), expressed as a percentage. Because shareholder's equity can be calculated by taking all assets and subtracting all liabilities, ROE can also be thought of as a return on NAV, or ''assets less liabilities''. Usage ROE measures how many dollars of profit are generated for each dollar of shareholder's equity, and is thus a metric of how well the company utilizes its equity to generate profits. ROE is especially used for comparing the performance of companies in the same industry. As with return on capital, an ROE is a measure of management's ability to generate income from the equity available to it. ROEs of 15–2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Return

The expected return (or expected gain) on a financial investment is the expected value of its return (of the profit on the investment). It is a measure of the center of the distribution of the random variable that is the return. It is calculated by using the following formula: :E \sum_^R_P_ where :: R_ is the return in scenario i; ::P_ is the probability for the return R_ in scenario i; and ::n is the number of scenarios. The expected rate of return is the expected return per currency unit (e.g., dollar) invested. It is computed as the expected return divided by the amount invested. The required rate of return is what an investor would require to be compensated for the risk borne by holding the asset; "expected return" is often used in this sense, as opposed to the more formal, mathematical, sense above. Application Although the above represents what one expects the return to be, it only refers to the long-term average. In the short term, any of the various scenarios could occu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Michael J

Michael may refer to: People * Michael (given name), a given name * he He ..., a given name * Michael (surname), including a list of people with the surname Michael Given name * Michael (bishop elect)">Michael (surname)">he He ..., a given name * Michael (surname), including a list of people with the surname Michael Given name * Michael (bishop elect), English 13th-century Bishop of Hereford elect * Michael (Khoroshy) (1885–1977), cleric of the Ukrainian Orthodox Church of Canada * Michael Donnellan (fashion designer), Michael Donnellan (1915–1985), Irish-born London fashion designer, often referred to simply as "Michael" * Michael (footballer, born 1982), Brazilian footballer * Michael (footballer, born 1983), Brazilian footballer * Michael (footballer, born 1993), Brazilian footballer * Michael (footballer, born February 1996), Brazilian footballer * Michael (footballer, born March 1996), Brazilian footballer * Michael (footballer, born 1999), Brazilian football ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Suisse First Boston

Credit Suisse First Boston (also known as CSFB and CS First Boston) was the investment banking affiliate of Credit Suisse headquartered in New York. The company was created by the merger of First Boston Corporation and Credit Suisse Group in 1988 and was active in investment banking, capital markets and financial services. In 2006, Credit Suisse reorganized and merged CS First Boston into the parent company and retired use of the "First Boston" brand. In 2022, as part of a major restructuring, Credit Suisse began the process of spinning out the investment bank into an independent company and revived the brand. The process ultimately failed, and Credit Suisse was merged into rival Swiss bank UBS. History Credit Suisse / First Boston 50 / 50 Joint Venture (1978–1988) ''Main Article First Boston'' In 1978, Credit Suisse and First Boston Corporation formed a London-based 50-50 investment banking joint venture called ''Financière Crédit Suisse-First Boston''. This joint ve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

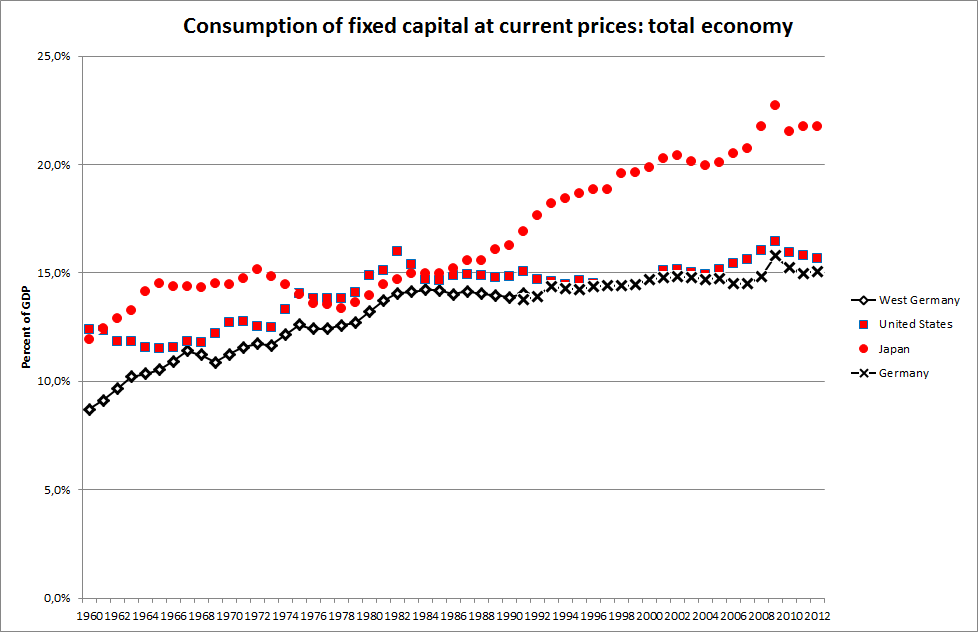

Depreciation (economics)

In economics, depreciation is the gradual decrease in the economic value theory, value of the capital stock of a firm, nation or other entity, either through physical depreciation, obsolescence or changes in the demand for the services of the capital in question. If the capital stock is K_t in one period t, gross investment, gross (total) investment spending on newly produced capital is I_t and depreciation is D_t, the capital stock in the next period, K_, is K_t + I_t - D_t. The net (economics), net increment to the capital stock is the difference between gross investment and depreciation, and is called net investment. Models In economics, the value of a capital asset may be modeled as the present value of the flow of services the asset will generate in future, appropriately adjusted for uncertainty. Economic depreciation over a given period is the reduction in the remaining value of future goods and services. Under certain circumstances, such as an unanticipated increase in th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Replacement Value

The term replacement cost or replacement value refers to the amount that an entity would have to pay to replace an asset at the present time, according to its current worth. In the insurance industry, "replacement cost" or "replacement cost value" is one of several methods of determining the value of an insured item. Replacement cost is the actual cost to replace an item or structure at its pre-loss condition. This may not be the "market value" of the item, and is typically distinguished from the "actual cash value" payment which includes a deduction for depreciation. For insurance policies for property insurance, a contractual stipulation that the lost asset must be actually repaired or replaced before the replacement cost can be paid is common. This prevents overinsurance, which contributes to arson and insurance fraud.Thomas JE, Wilson B. (2005). The Indemnity Principle: Evolution from a Financial to a Functional Paradigm]. ''Journal of Risk Management & Insurance''Free full-t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |