|

CME Group

CME Group Inc. is an American financial services company based in Chicago that operates financial derivatives exchanges including the Chicago Mercantile Exchange, Chicago Board of Trade, New York Mercantile Exchange, and the Commodity Exchange. The company also owns 27% of S&P Dow Jones Indices. It is the world's largest operator of financial derivatives exchanges. Its exchanges are platforms for trading in agricultural products, currencies, energy, interest rates, metals, futures contracts, Option (finance), options, stock indexes, and cryptocurrencies futures. In addition to its headquarters in Chicago, the company also has offices in New York, Houston, and Washington D.C., in the U.S., as well as abroad in Bangalore, Beijing, Belfast, Calgary, Hong Kong, London, Seoul, Singapore, and Tokyo. History The Chicago Mercantile Exchange (CME), was founded in 1898 as a nonprofit corporation. In 1919, it established its clearing house. In 2000, CME demutualized (became a joint stock ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listing (finance), listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states and so have associations and formal designations, which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation, though a corporation need not be a public company. In the United Kin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

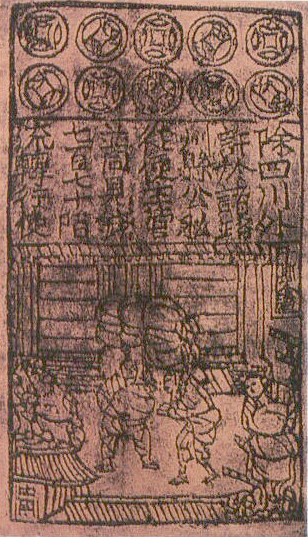

Currencies

A currency is a standardization of money in any form, in use or currency in circulation, circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the Pound sterling, British Pound sterling (£), euros (€), Japanese yen (¥), and United States dollar, U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as store of value, stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for Payment, payments to government agencies. Other definitions of the term ''currency'' appe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Winter Wheat

Winter wheat (usually ''Common wheat, Triticum aestivum'') are strains of wheat that are planted in the autumn to germinate and develop into young plants that remain in the vegetative phase during the winter and resume growth in early spring. Classification into spring wheat versus winter wheat is common and traditionally refers to the season during which the crop is grown. For winter wheat, the physiological stage of heading (when the ear first emerges) is delayed until the plant experiences vernalization, a period of 30 to 60 days of cold winter temperatures (). Winter wheat is usually planted from September to November (in the Northern Hemisphere) and harvested in the summer or early autumn of the next year. In the Southern Hemisphere a winter-wheat crop fully 'completes' in a year's time before harvest. Winter wheat usually yields more than spring wheat. So-called "facultative" wheat varieties need shorter periods of vernalization time (15–30 days) and temperatures of . ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States. The DJIA is one of the oldest and most commonly followed equity indices. It is Price-weighted index, price-weighted, unlike other common indexes such as the Nasdaq Composite or S&P 500, which use Capitalization-weighted index, market capitalization. The DJIA also contains fewer stocks, which could exhibit higher risk; however, it could be less volatile when the market is rapidly rising or falling due to its components being well-established large-cap companies. The value of the index can also be calculated as the sum of the stock prices of the companies included in the index, divided by a factor, which is approximately 0.163 . The factor is changed whenever a constituent company undergoes a stock split so that the value of the index is unaffected by the stock split. First calculated on May 26, 1896, the ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Google

Google LLC (, ) is an American multinational corporation and technology company focusing on online advertising, search engine technology, cloud computing, computer software, quantum computing, e-commerce, consumer electronics, and artificial intelligence (AI). It has been referred to as "the most powerful company in the world" by the BBC and is one of the world's List of most valuable brands, most valuable brands. Google's parent company, Alphabet Inc., is one of the five Big Tech companies alongside Amazon (company), Amazon, Apple Inc., Apple, Meta Platforms, Meta, and Microsoft. Google was founded on September 4, 1998, by American computer scientists Larry Page and Sergey Brin. Together, they own about 14% of its publicly listed shares and control 56% of its stockholder voting power through super-voting stock. The company went public company, public via an initial public offering (IPO) in 2004. In 2015, Google was reorganized as a wholly owned subsidiary of Alphabet Inc. Go ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listing (finance), listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states and so have associations and formal designations, which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation, though a corporation need not be a public company. In the United Kin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demutualized

Demutualization is the process by which a customer-owned mutual organization (''mutual'') or co-operative changes legal form to a joint stock company. It is sometimes called stocking or privatization. As part of the demutualization process, members of a mutual usually receive a "windfall" payout, in the form of shares in the successor company, a cash payment, or a mixture of both. Mutualization or mutualisation is the opposite process, wherein a shareholder-owned company is converted into a mutual organization, typically through takeover by an existing mutual organization. Furthermore, re-mutualization depicts the process of aligning or refreshing the interest and objectives of the members of the mutual society. The mutual traditionally raises capital from its customer members in order to provide services to them (for example building societies, where members' savings enable the provision of mortgages to members). It redistributes some profits to its members. By contrast, a join ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nonprofit Corporation

A nonprofit corporation is any legal entity which has been incorporated under the law of its jurisdiction for purposes other than making profits for its owners or shareholders. Depending on the laws of the jurisdiction, a nonprofit corporation may seek official recognition as such, and may be taxed differently from for-profit corporations, and treated differently in other ways. Public-benefit nonprofit corporations A public-benefit nonprofit corporation is a type of nonprofit corporation chartered by a state government, and organized primarily or exclusively for social, educational, recreational or charitable purposes by like-minded citizens. Public-benefit nonprofit corporations are distinct in the law from mutual-benefit nonprofit corporations in that they are organized for the general public benefit, rather than for the interest of its members. They are also distinct in the law from religious corporations. Religious corporation A religious corporation is a nonprofi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cryptocurrencies

A cryptocurrency (colloquially crypto) is a digital currency designed to work through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it. Individual coin ownership records are stored in a digital ledger or blockchain, which is a computerized database that uses a consensus mechanism to secure E-commerce, transaction records, control the creation of additional coins, and verify the transfer of coin ownership. The two most common consensus mechanisms are proof of work and proof of stake. Despite the name, which has come to describe many of the fungibility, fungible blockchain tokens that have been created, cryptocurrencies are not considered to be Currency, currencies in the traditional sense, and varying legal treatments have been applied to them in various jurisdictions, including classification as Commodity, commodities, Security (finance), securities, and currencies. Cryptocurrencies are generally viewed as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Index

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance. Two of the primary criteria of an index are that it is ''investable'' and ''transparent'': The methods of its construction are specified. Investors may be able to invest in a stock market index by buying an index fund, which is structured as either a mutual fund or an exchange-traded fund, and "track" an index. The difference between an index fund's performance and the index, if any, is called '' tracking error''. Types of indices by coverage Stock market indices may be classified and segmented by the set of underlying stocks included in the index, sometimes referred to as the "coverage". The underlying stocks are typically grouped together based on their underlying economics or underlying investor demand that the index is seeking ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |