|

Appaloosa Management

Appaloosa Management is an American hedge fund founded in 1993 by David Tepper and Jack Walton specializing in distressed debt. Appaloosa Management invests in public equity and fixed income markets around the world. History In 1993, David Tepper and Jack Walton, founded Appaloosa Management, an employee-owned hedge fund, in Chatham, New Jersey. Throughout the 1990s, the firm was known as a junk bond investment boutique, and through the 2000s it was known as a hedge fund. In March 2021, David Tepper said it's increasingly difficult to be bearish on stock rights now, feeling that rising rates are set to stabilize, and that the sell off in treasuries that has driven rates up is probably over. 2002 Conseco & Marconi Corp. In the fourth quarter of 2002, Appaloosa Management returns were heavily a result of junk-bond and distressed debt bets in Conseco and Marconi Corp. that the market was bottoming out. 2007 Delphi Assets under management in 2007 were $5.3 billion. The ''Fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Partnership

A limited partnership (LP) is a form of partnership similar to a general partnership except that while a general partnership must have at least two general partners (GPs), a limited partnership must have at least one GP and at least one limited partner. Limited partnerships are distinct from limited liability partnerships, in which all partners have limited liability. The GPs are, in all major respects, in the same legal position as partners in a conventional firm: they have management control, share the right to use partnership property, share the profits of the firm in predefined proportions, and have joint and several liability for the debts of the partnership. As in a general partnership, the GPs have actual authority, as agents of the firm, to bind the partnership in contracts with third parties that are in the ordinary course of the partnership's business. As with a general partnership, "an act of a general partner which is not apparently for carrying on in the ordinary c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delphi Corporation

Aptiv PLC is an Irish- American automotive technology supplier with headquarters in Dublin. Aptiv grew out of the now-defunct American company, Delphi Automotive Systems, which itself was formerly a component of General Motors. History The company was established as General Motors' Automotive Components Group in 1994, which changed its name to Delphi Automotive Systems in 1995. Delphi disclosed some irregular accounting practices in 2005. A number of executives, including CFO Alan Dawes, resigned. Delphi Chairman J.T. Battenberg retired. Delphi then filed for Chapter 11 bankruptcy protection to reorganize its struggling U.S. operations. As a result of this action, the Securities and Exchange Commission granted an application by the New York Stock Exchange to delist Delphi's common stock and bonds. Plants in Puerto Real, Cádiz, Spain, closed, with a loss of 1,600 direct jobs, and more than 2,500 indirect jobs in February 2007, despite having agreed to continue its manufac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 1993

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assessmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit Sharing Plan

A profit-sharing agreement for pensions, typically in the United States, is an agreement that establishes a pension plan maintained by the employer to share a portion of its profits with its employees. History A profit-sharing agreement used to be supplemental to a type of pension called a defined contribution plan. For example, if an employee should become ill or incur economic hardship, then access to some or all of profit sharing account would prevent the employee from quitting. Today, most newer companies only have profit-sharing plans and don't have a defined benefits plan. The simplest and most common profit sharing implementation is for the employer to contribute a flat dollar amount that is allocated based on a percentage of the employees' annual compensation. Total annual contributions limits are based on how much the employee defers, plus how much the employer contributes. Currently, the total amount contributed to the plan cannot exceed the lesser of: * 100 percent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

High-net-worth Individual

High-net-worth individual (HNWI) is a term used by some segments of the financial services industry to designate persons whose investible wealth (assets such as stocks and bonds) exceeds a given amount. Typically, these individuals are defined as holding financial assets (excluding their primary residence) with a value greater than US$1 million. "Very-HNWI" (VHNWI) can refer to someone with a net worth of at least US$5 million. The Capgemini World Wealth Report 2020 defines an additional class of ultra-high-net-worth individuals (UHNWIs), those with US$30 million in investible assets. According to The Knight Frank Wealth Report, HNWI can refer to someone with a net worth of at least US$1 million while UHNWI can refer to someone with a net worth of at least US$30 million. , there were estimated to be just over 15 million HNWIs in the world according to the Global Citizens Report by Henley & Partners. The United States had the highest number of HNWIs (5,325,000) of any ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BusinessWeek

''Bloomberg Businessweek'', previously known as ''BusinessWeek'', is an American weekly business magazine published fifty times a year. Since 2009, the magazine is owned by New York City-based Bloomberg L.P. The magazine debuted in New York City in September 1929. Bloomberg Businessweek business magazines are located in the Bloomberg Tower, 731 Lexington Avenue, Manhattan in New York City and market magazines are located in the Citigroup Center, 153 East 53rd Street between Lexington and Third Avenue, Manhattan in New York City. History ''Businessweek'' was first published based in New York City in September 1929, weeks before the stock market crash of 1929. The magazine provided information and opinions on what was happening in the business world at the time. Early sections of the magazine included marketing, labor, finance, management and Washington Outlook, which made ''Businessweek'' one of the first publications to cover national political issues that directly impacted t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Junk Bond

In finance, a high-yield bond (non-investment-grade bond, speculative-grade bond, or junk bond) is a bond that is rated below investment grade by credit rating agencies. These bonds have a higher risk of default or other adverse credit events, but offer higher yields than investment-grade bonds in order to compensate for the increased risk. Default risk As indicated by their lower credit ratings, high-yield debt entails more risk to the investor compared to investment grade bonds. Investors require a greater yield to compensate them for investing in the riskier securities. In the case of high-yield bonds, the risk is largely that of default: the possibility that the issuer will be unable to make scheduled interest and principal payments in a timely manner. The default rate in the high-yield sector of the U.S. bond market has averaged about 5% over the long term. During the liquidity crisis of 1989-90, the default rate was in the 5.6% to 7% range. During the pandemic of 2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of the contract with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Options (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in '' over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified strik ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

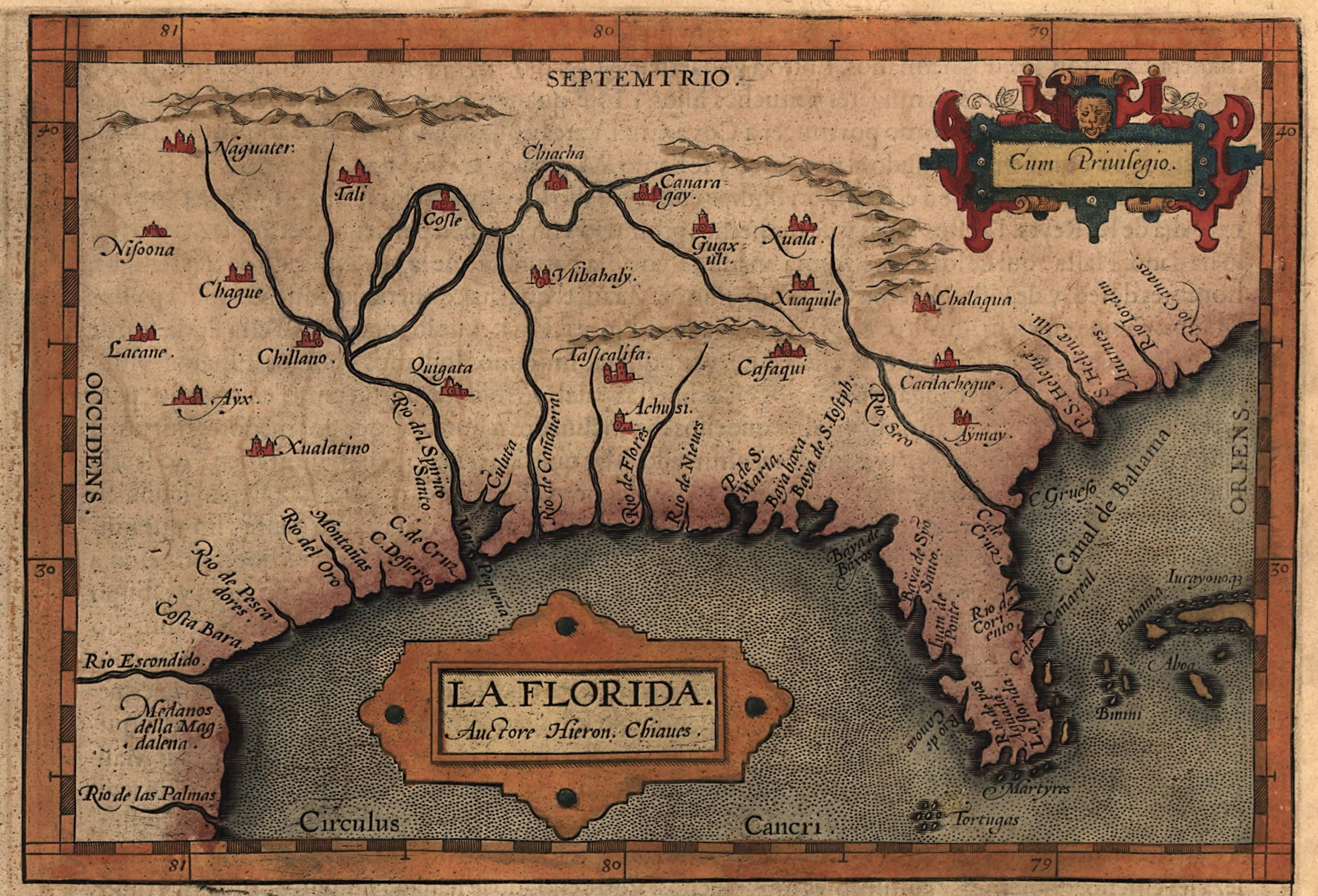

Florida

Florida is a state located in the Southeastern region of the United States. Florida is bordered to the west by the Gulf of Mexico, to the northwest by Alabama, to the north by Georgia, to the east by the Bahamas and Atlantic Ocean, and to the south by the Straits of Florida and Cuba; it is the only state that borders both the Gulf of Mexico and the Atlantic Ocean. Spanning , Florida ranks 22nd in area among the 50 states, and with a population of over 21 million, it is the third-most populous. The state capital is Tallahassee, and the most populous city is Jacksonville. The Miami metropolitan area, with a population of almost 6.2 million, is the most populous urban area in Florida and the ninth-most populous in the United States; other urban conurbations with over one million people are Tampa Bay, Orlando, and Jacksonville. Various Native American groups have inhabited Florida for at least 14,000 years. In 1513, Spanish explorer Juan Ponce de León became the first k ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Secret

Trade secrets are a type of intellectual property that includes formulas, practices, processes, designs, instruments, patterns, or compilations of information that have inherent economic value because they are not generally known or readily ascertainable by others, and which the owner takes reasonable measures to keep secret. Intellectual property law gives the owner of a trade secret the right to restrict others from disclosing it. In some jurisdictions, such secrets are referred to as confidential information. Definition The precise language by which a trade secret is defined varies by jurisdiction, as do the particular types of information that are subject to trade secret protection. Three factors are common to all such definitions: A trade secret is information that * is not generally known to the public; * confers economic benefit on its holder the information is not publicly known; and * where the holder makes reasonable efforts to maintain its secrecy. In interna ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Washington Mutual

Washington Mutual (often abbreviated to WaMu) was the United States' largest savings and loan association until its collapse in 2008. A savings bank holding company is defined in United States Code: Title 12: Banks and Banking; Section 1842: Definitions; Subsection (l): Savings Bank Holding Company See: On Thursday, September 25, 2008, the United States Office of Thrift Supervision (OTS) seized Washington Mutual’s banking operations and placed it into receivership with the Federal Deposit Insurance Corporation (FDIC). The OTS took the action due to the withdrawal of $16.7 billion in deposits during a 9-day bank run (amounting to 9% of the deposits it had held on June 30, 2008). The FDIC sold the banking subsidiaries (minus unsecured debt and equity claims) to JPMorgan Chase for $1.9 billion, which had been considering acquiring WaMu as part of a plan internally nicknamed “Project West.” All WaMu branches were rebranded as Chase branches by the end of 2009. The holding ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |