|

Insular Area

In the law of the United States, an insular area is a U.S.-associated jurisdiction that is not part of a U.S. state or the Washington, D.C., District of Columbia. This includes fourteen Territories of the United States, U.S. territories administered under U.S. sovereignty, as well as three sovereign states each with a Compact of Free Association with the United States. The term also may be used to refer to the previous status of the Swan Islands, Honduras, Swan Islands, Hawaii, and the Philippines, as well as the Trust Territory of the Pacific Islands when it existed. Three of the U.S. territories are in the Caribbean Sea, eleven are in the Pacific Ocean, and all three freely associated states are also in the Pacific. Two additional Caribbean territories are disputed and administered by Colombia. Article Four of the United States Constitution#Clause 2: Property Clause, Article IV, Section 3, Clause 2 of the Constitution of the United States, U.S. Constitution grants to the Unit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Minor Outlying Islands

The United States Minor Outlying Islands is a statistical designation applying to the minor outlying islands and groups of islands that comprise eight United States insular areas in the Pacific Ocean (Baker Island, Howland Island, Jarvis Island, Johnston Atoll, Kingman Reef, Midway Atoll, Palmyra Atoll, and Wake Island) and one in the Caribbean Sea (Navassa Island). It is defined by the International Organization for Standardization's ISO 3166-1 code. The entry code is ISO 3166-2:UM. While the strategically important islands scattered across Polynesia and Micronesia are relatively small, they are rich in history and nature. The nearly barren Howland is famous for being the island renowned American pilot Amelia Earhart intended to land on before she vanished during her round-the-world flight in 1937. Wake, home Wake Island rail, to a now extinct flightless bird, was the site of a Pitched battle, pitched Battle of Wake Island, World War II battle in 1941, and was an essential ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Archaism

In language, an archaism is a word, a sense of a word, or a style of speech or writing that belongs to a historical epoch beyond living memory, but that has survived in a few practical settings or affairs. lexicon, Lexical archaisms are single archaic words or expressions used regularly in an affair (e.g. religion or law) or freely; literature, literary archaism is the survival of archaic language in a traditional literary text such as a nursery rhyme or the deliberate use of a style (fiction), style characteristic of an earlier age—for example, in his 1960 novel ''The Sot-Weed Factor (1960 novel), The Sot-Weed Factor'', John Barth writes in an 18th-century style. Archaic words or expressions may have distinctive emotional connotations—some can be humorous (''forsooth''), some highly formal (''What say you?''), and some solemn (''With thee do I plight my troth''). The word ''archaism'' is from the , ''archaïkós'', 'old-fashioned, antiquated', ultimately , ''archaîos'', 'f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Northern Mariana Islands

The Northern Mariana Islands, officially the Commonwealth of the Northern Mariana Islands (CNMI), is an Territories of the United States, unincorporated territory and Commonwealth (U.S. insular area), commonwealth of the United States consisting of 14 islands in the northwestern Pacific Ocean.Lin, Tom C.W.Americans, Almost and Forgotten 107 California Law Review (2019) The CNMI includes the 14 northernmost islands in the Mariana Islands, Mariana Archipelago; the southernmost island, Guam, is a separate U.S. territory. The Northern Mariana Islands were listed by the United Nations as a non-self-governing territory until 1990. During the colonial period, the Northern Marianas were variously under the control of the Spanish Empire, Spanish, German colonial empire, German, and Empire of Japan, Japanese empires. After World War II, the islands were part of the United Nations trust territories under American administration before formally joining the United States as a territory in 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Spain

Spain, or the Kingdom of Spain, is a country in Southern Europe, Southern and Western Europe with territories in North Africa. Featuring the Punta de Tarifa, southernmost point of continental Europe, it is the largest country in Southern Europe and the fourth-most populous European Union member state. Spanning across the majority of the Iberian Peninsula, its territory also includes the Canary Islands, in the Eastern Atlantic Ocean, the Balearic Islands, in the Western Mediterranean Sea, and the Autonomous communities of Spain#Autonomous cities, autonomous cities of Ceuta and Melilla, in mainland Africa. Peninsular Spain is bordered to the north by France, Andorra, and the Bay of Biscay; to the east and south by the Mediterranean Sea and Gibraltar; and to the west by Portugal and the Atlantic Ocean. Spain's capital and List of largest cities in Spain, largest city is Madrid, and other major List of metropolitan areas in Spain, urban areas include Barcelona, Valencia, Seville, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

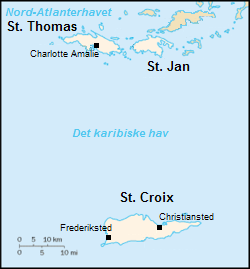

Danish Virgin Islands

The Danish West Indies () or Danish Virgin Islands () or Danish Antilles were a Danish colony in the Caribbean, consisting of the islands of Saint Thomas with , Saint John () with , Saint Croix with , and Water Island. The islands of St Thomas, St John, and St Croix were purchased by United States in 1917 and became known as the United States Virgin Islands. Water Island was sold in 1905 to the Danish East Asiatic Company and bought by the U.S. Government in 1944. In 1996, it also became part of the U.S. Virgin Islands. Historical overview Acquisition The Danish West India-Guinea Company annexed uninhabited St. Thomas in 1672. It annexed St. John in 1718 and bought St. Croix from France (King Louis XV) on 28 June 1733. When the Danish West India-Guinea Company went bankrupt in 1754, King Frederik V of Denmark–Norway assumed direct control of the three islands. Although, during the Napoleonic Wars, Britain twice occupied the Danish West Indies, first in 1801� ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

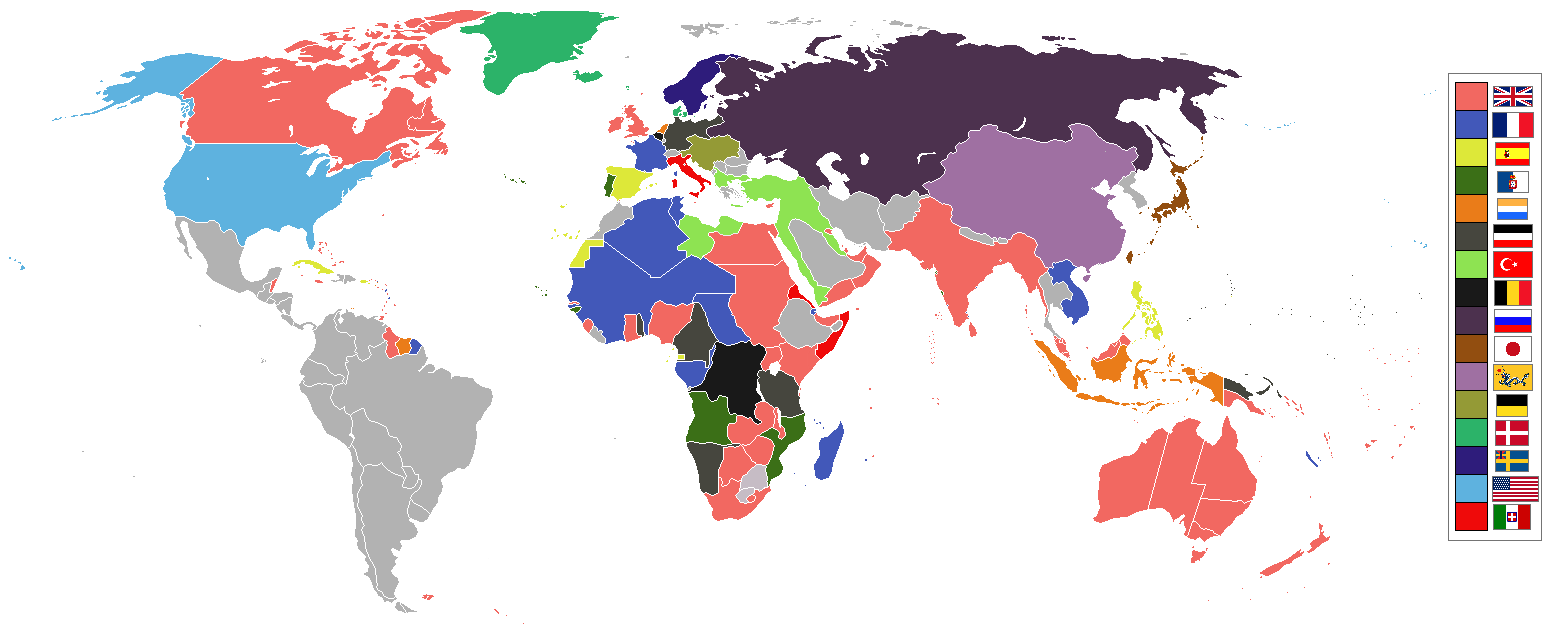

World War I

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting took place mainly in European theatre of World War I, Europe and the Middle Eastern theatre of World War I, Middle East, as well as in parts of African theatre of World War I, Africa and the Asian and Pacific theatre of World War I, Asia-Pacific, and in Europe was characterised by trench warfare; the widespread use of Artillery of World War I, artillery, machine guns, and Chemical weapons in World War I, chemical weapons (gas); and the introductions of Tanks in World War I, tanks and Aviation in World War I, aircraft. World War I was one of the List of wars by death toll, deadliest conflicts in history, resulting in an estimated World War I casualties, 10 million military dead and more than 20 million wounded, plus some 10 million civilian de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Spanish–American War

The Spanish–American War (April 21 – August 13, 1898) was fought between Restoration (Spain), Spain and the United States in 1898. It began with the sinking of the USS Maine (1889), USS ''Maine'' in Havana Harbor in Cuba, and resulted in the U.S. acquiring sovereignty over Puerto Rico, Guam, and the Philippines, and establishing a protectorate over Cuba. It represented U.S. intervention in the Cuban War of Independence and Philippine Revolution, with the latter later leading to the Philippine–American War. The Spanish–American War brought an end to almost four centuries of Spanish presence in the Americas, Asia, and the Pacific; the United States meanwhile not only became a major world power, but also gained several island possessions spanning the globe, which provoked rancorous debate over the wisdom of expansionism. The 19th century represented a clear decline for the Spanish Empire, while the United States went from a newly founded country to a rising power. In 1895, C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ofu Beach American Samoa US National Park Service

Ofu or OFU may refer to * Ofu-Olosega, an island in the Manu'a group in American Samoa **Ofu Airport Ofu Airport is a public airport located one mile (2 km) southeast of the village of Ofu on the island of Ofu in American Samoa, an unincorporated territory of the United States. This airport is publicly owned by Government of American Sam ... (IATA code OFU), a public airport on the island * Ofu County, American Samoa * Ofu, Nigeria, a town and Local Government Area in Kogi State {{geodis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of Insular Affairs

The Office of Insular Affairs (OIA) is a unit of the United States Department of the Interior that oversees federal administration of several United States insular areas. It is the successor to the Bureau of Insular Affairs of the War Department, which administered certain territories from 1902 to 1939, and the Office of Territorial Affairs (formerly the Division of Territories and Island Possessions and then the Office of Territories) in the Interior Department, which was responsible for certain territories from the 1930s to the 1990s. The word "insular" comes from the Latin word ''insula'' ("island"). Currently, the OIA has administrative responsibility for coordinating federal policy in the territories of American Samoa, Guam, the U.S. Virgin Islands, and the Commonwealth of the Northern Mariana Islands, and oversight of federal programs and funds in the freely associated Federated States of Micronesia, the Republic of the Marshall Islands, and the Republic of Palau. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Samoa

American Samoa is an Territories of the United States, unincorporated and unorganized territory of the United States located in the Polynesia region of the Pacific Ocean, South Pacific Ocean. Centered on , it is southeast of the island country of Samoa, east of the International Date Line and the Wallis and Futuna Islands, west of the Cook Islands, north of Tonga, and some south of Tokelau. American Samoa is the southernmost territory of the United States, situated southwest of the U.S. state of Hawaii, and one of two U.S. territories south of the Equator, along with the uninhabited Jarvis Island. American Samoa consists of the eastern part of the Samoan Islands, Samoan archipelagothe inhabited volcanic islands of Tutuila, Aunuʻu, Ofu-Olosega, Ofu, Ofu-Olosega, Olosega and Taʻū and the uninhabited Rose Atollas well as Swains Island, a remote coral atoll in the List of islands of Tokelau, Tokelau volcanic island group. The total land area is , slightly larger than Washing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Autonomy

In developmental psychology and moral, political, and bioethical philosophy, autonomy is the capacity to make an informed, uncoerced decision. Autonomous organizations or institutions are independent or self-governing. Autonomy can also be defined from a human resources perspective, where it denotes a (relatively high) level of discretion granted to an employee in his or her work. In such cases, autonomy is known to generally increase job satisfaction. Self-actualized individuals are thought to operate autonomously of external expectations. In a medical context, respect for a patient's personal autonomy is considered one of many fundamental ethical principles in medicine. Sociology In the sociology of knowledge, a controversy over the boundaries of autonomy inhibited analysis of any concept beyond relative autonomy, until a typology of autonomy was created and developed within science and technology studies. According to it, the institution of science's existing autonom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Organic Act

In United States law, an organic act is an act of the United States Congress that establishes an administrative agency or local government, for example, the laws that established territory of the United States and specified how they are to be governed, or established agency to manage certain federal lands. In the absence of organic law, the body of laws that define and establish a government, a territory is classified as unorganized. The first such act was the Northwest Ordinance, passed in 1787 by the U.S. Congress of the Confederation (under the Articles of Confederation, predecessor of the United States Constitution). The Northwest Ordinance created the Northwest Territory in the land west of Pennsylvania and northwest of the Ohio River and set the pattern of development that was followed for all subsequent territories. The Northwest Territory covered more than 260,000 square miles and included all of the modern states of Ohio, Indiana, Illinois, Michigan, Wisconsin, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |