|

Accounting

Accounting, also known as accountancy, is the measurement, processing, and communication of financial and non financial information about economic entities such as businesses and corporations. Accounting, which has been called the "language of business", measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used as synonyms. Accounting can be divided into several fields including financial accounting, management accounting, tax accounting and cost accounting. Financial accounting focuses on the reporting of an organization's financial information, including the preparation of financial statements, to the external users of the information, such as investors, regulators and suppliers; and management accounting focuses on the measurement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Accounting Standards Board

The Financial Accounting Standards Board (FASB) is a private standard-setting body whose primary purpose is to establish and improve Generally Accepted Accounting Principles (GAAP) within the United States in the public's interest. The Securities and Exchange Commission (SEC) designated the FASB as the organization responsible for setting accounting standards for public companies in the US. The FASB replaced the American Institute of Certified Public Accountants' (AICPA) Accounting Principles Board (APB) on July 1, 1973. The FASB is run by the nonprofit Financial Accounting Foundation. FASB accounting standards are accepted as authoritative by many organizations, including state Boards of Accountancy and the American Institute of CPAs (AICPA). Structure The FASB is based in Norwalk, Connecticut, and is led by seven full-time Board members,Spiceland, David; Sepe, James; Nelson, Mark; & Tomassini, Lawrence (2009). ''Intermediate Accounting'' (5th Edition). McGraw-Hill/Irw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Financial Reporting Standards

International Financial Reporting Standards, commonly called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB). They constitute a standardised way of describing the company's financial performance and position so that company financial statements are understandable and comparable across international boundaries. They are particularly relevant for companies with shares or securities listed on a public stock exchange. IFRS have replaced many different national accounting standards around the world but have not replaced the separate accounting standards in the United States where U.S. GAAP is applied. History The International Accounting Standards Committee (IASC) was established in June 1973 by accountancy bodies representing ten countries. It devised and published International Accounting Standards (IAS), interpretations and a conceptual framework. These were looked to by many national accounting standard-set ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Management Accounting

In management accounting or managerial accounting, managers use accounting information in decision-making and to assist in the management and performance of their control functions. Definition One simple definition of management accounting is the provision of financial and non-financial decision-making information to managers. In other words, management accounting helps the directors inside an organization to make decisions. This can also be known as Cost Accounting. This is the way toward distinguishing, examining, deciphering and imparting data to supervisors to help accomplish business goals. The information gathered includes all fields of accounting that educates the administration regarding business tasks identifying with the financial expenses and decisions made by the organization. Accountants use plans to measure the overall strategy of operations within the organization. According to the Institute of Management Accountants (IMA), "Management accounting is a profession t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Accounting

Cost accounting is defined as "a systematic set of procedures for recording and reporting measurements of the cost of manufacturing goods and performing services in the aggregate and in detail. It includes methods for recognizing, classifying, allocating, aggregating and reporting such costs and comparing them with standard costs." (IMA) Often considered a subset of managerial accounting, its end goal is to advise the management on how to optimize business practices and processes based on cost efficiency and capability. Cost accounting provides the detailed cost information that management needs to control current operations and plan for the future. Cost accounting information is also commonly used in financial accounting, but its primary function is for use by managers to facilitate their decision-making. Origins of Cost Accounting All types of businesses, whether manufacturing, trading or producing services, require cost accounting to track their activities. Cost accounting h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Standard

Publicly traded companies typically are subject to rigorous standards. Small and midsized businesses often follow more simplified standards, plus any specific disclosures required by their specific lenders and shareholders. Some firms operate on the cash method of accounting which can often be simple and straight forward. Larger firms most often operate on an accrual basis. Accrual basis is one of the fundamental accounting assumptions and if it is followed by the company while preparing the Financial statements then no further disclosure is required. Accounting standards prescribe in considerable detail what accruals must be made, how the financial statements are to be presented, and what additional disclosures are required. Some important elements that accounting standards cover include: identifying the exact entity which is reporting, discussing any "going concern" questions, specifying monetary units, and reporting time frames. Limitations The notable limitations of accounting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Accounting

Financial accounting is the field of accounting concerned with the summary, analysis and reporting of financial transactions related to a business. This involves the preparation of financial statements available for public use. Stockholders, suppliers, banks, employees, government agencies, business owners, and other stakeholders are examples of people interested in receiving such information for decision making purposes. Financial accountancy is governed by both local and international accounting standards. Generally Accepted Accounting Principles (GAAP) is the standard framework of guidelines for financial accounting used in any given jurisdiction. It includes the standards, conventions and rules that accountants follow in recording and summarizing and in the preparation of financial statements. On the other hand, International Financial Reporting Standards (IFRS) is a set of accounting standards stating how particular types of transactions and other events should be repo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convergence (accounting)

The convergence of accounting standards refers to the goal of establishing a single set of accounting standards that will be used internationally.FASB, 2012International Convergence of Accounting Standards—Overview Retrieved on April 27, 2012. Convergence in some form has been taking place for several decades, and efforts today include projects that aim to reduce the differences between accounting standards. Convergence is driven by several factors, including the belief that having a single set of accounting requirements would increase the comparability of different entities' accounting numbers, which will contribute to the flow of international investment and benefit a variety of stakeholders. Criticisms of convergence include its cost and pace, and the idea that the link between convergence and comparability may not be strong. Overview The international convergence of accounting standards refers to the goal of establishing a single set of high-quality accounting standards to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

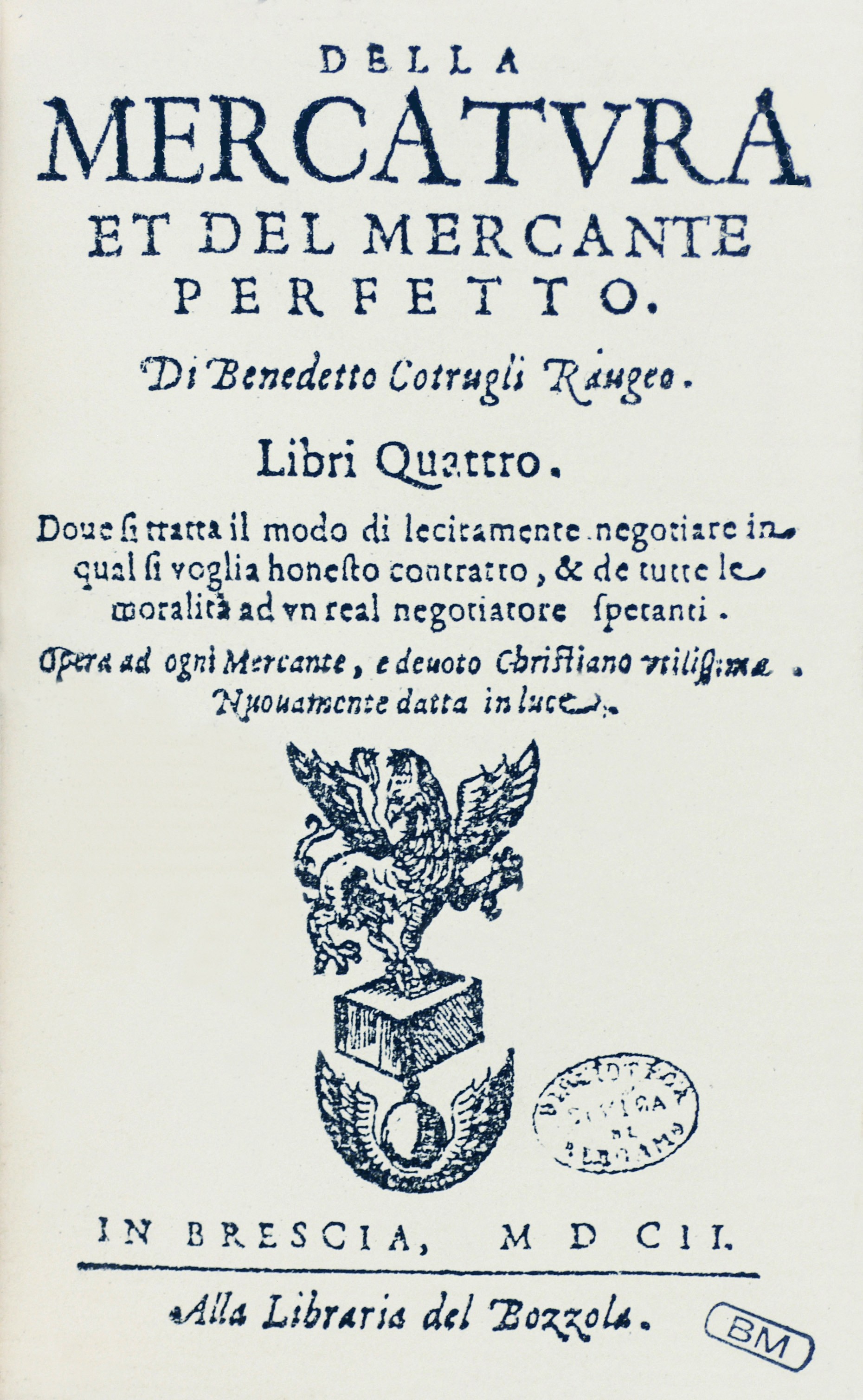

Double-entry Bookkeeping

Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. Every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system has two equal and corresponding sides known as debit and credit. A transaction in double-entry bookkeeping always affects at least two accounts, always includes at least one debit and one credit, and always has total debits and total credits that are equal. The purpose of double-entry bookkeeping is to allow the detection of financial errors and fraud. For example, if a business takes out a bank loan for $10,000, recording the transaction would require a debit of $10,000 to an asset account called "Cash", as well as a credit of $10,000 to a liability account called "Notes Payable". The basic entry to record this transaction in a general ledger will look like this: Double-entry bookkeeping is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IASB

The International Accounting Standards Board (IASB) is the independent accounting standard-setting body of the IFRS Foundation. The IASB was founded on April 1, 2001, as the successor to the International Accounting Standards Committee (IASC). It is responsible for developing International Financial Reporting Standards (IFRS) and for promoting their use and application."About the IASB" IFRS Foundation, 2018. Background and semantics The (IASC) had been established in 1973 and had issued a number of standards known as International Accounting Standards (IAS). As the ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accountant

An accountant is a practitioner of accounting or accountancy. Accountants who have demonstrated competency through their professional associations' certification exams are certified to use titles such as Chartered Accountant, Chartered Certified Accountant or Certified Public Accountant, or Registered Public Accountant. Such professionals are granted certain responsibilities by statute, such as the ability to certify an organization's financial statements, and may be held liable for professional misconduct. Non-qualified accountants may be employed by a qualified accountant, or may work independently without statutory privileges and obligations. Cahan & Sun (2015) used archival study to find out that accountants’ personal characteristics may exert a very significant impact during the audit process and further influence audit fees and audit quality. Practitioners have been portrayed in popular culture by the stereotype of the humorless, introspective bean-counter. It has been ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Networks And Associations

An accounting network or accounting association is a professional services network whose principal purpose is to provide members resources to assist the clients around the world and hence reduce the uncertainty by bringing together a greater number of resources to work on a problem. The networks and associations operate independently of the independent members. The largest accounting networks are known as the Big Four. The Big Four History of accounting networks and associations Foundations Accounting networks were created to meet a specific need. “The accounting profession in the U.S. was built upon a state-established monopoly for audits of financial statements.” Accounting networks arose out of the necessity for public American companies to have audited financial statements for the Securities and Exchange Commission (SEC). For over 70 years, the SEC has continually sought for greater coordination and consistent quality in audits everywhere in the world. Networks w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Reporting

Financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity. Relevant financial information is presented in a structured manner and in a form which is easy to understand. They typically include four basic financial statements accompanied by a management discussion and analysis: # A balance sheet or statement of financial position, reports on a company's assets, liabilities, and owners equity at a given point in time. # An income statement—or profit and loss report (P&L report), or statement of comprehensive income, or statement of revenue & expense—reports on a company's income, expenses, and profits over a stated period. A profit and loss statement provides information on the operation of the enterprise. These include sales and the various expenses incurred during the stated period. # A statement of changes in equity or statement of equity, or statement of retained earnings, reports on th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |