Double-entry Bookkeeping on:

[Wikipedia]

[Google]

[Amazon]

Double-entry bookkeeping, also known as double-entry accounting, is a method of

The double-entry accounting method was said to be developed independently earlier in Korea during the

The double-entry accounting method was said to be developed independently earlier in Korea during the

current equity = sum of equity changes across time (increases on the left side are debits, and increases on the right side are credits, and vice versa for decreases)

current equity = Assets – Liabilities

sum of equity changes across time = owner's investment (Capital above) + Revenues – Expenses

A Concise Explanation of the Accounting Equation

Bean Counter's bookkeeping tutorial

GnuCash data entry concepts

GnuCash website {{DEFAULTSORT:Double-entry bookkeeping Accounting systems Italian inventions Accounting terminology History of accounting Economic history of Italy

bookkeeping

Bookkeeping is the recording of financial transactions, and is part of the process of accounting in business and other organizations. It involves preparing source documents for all transactions, operations, and other events of a business. ...

that relies on a two-sided accounting entry to maintain financial information. Every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system has two equal and corresponding sides known as debit and credit. A transaction in double-entry bookkeeping always affects at least two accounts, always includes at least one debit and one credit, and always has total debits and total credits that are equal. The purpose of double-entry bookkeeping is to allow the detection of financial errors and fraud.

For example, if a business takes out a bank loan for $10,000, recording the transaction would require a debit of $10,000 to an asset account called "Cash", as well as a credit of $10,000 to a liability account called "Notes Payable".

The basic entry to record this transaction in a general ledger will look like this:

Double-entry bookkeeping is based on balancing the accounting equation. The accounting equation serves as an error detection tool; if at any point the sum of debits for all accounts does not equal the corresponding sum of credits for all accounts, an error has occurred. However, satisfying the equation does not guarantee a lack of errors; the ledger may still "balance" even if the wrong ledger accounts have been debited or credited.

History

The earliest extant accounting records that follow the modern double-entry system in Europe come fromAmatino Manucci

Amatino Manucci was a merchant based in Nîmes, France, in the last 13th century, whose work includes the earliest extant accounting of double-entry bookkeeping.

Manucci kept the accounts for Giovanni Farolfi & Company, a merchant partnership bas ...

, a Florentine merchant at the end of the 13th century. Manucci was employed by the Farolfi firm and the firm's ledger of 1299–1300 evidences full double-entry bookkeeping. Giovannino Farolfi & Company, a firm of Florentine merchants headquartered in Nîmes, acted as moneylenders to the Archbishop of Arles, their most important customer. Some sources suggest that Giovanni di Bicci de' Medici introduced this method for the Medici bank

The Medici Bank (Italian: ''Banco dei Medici'' ) was a financial institution created by the Medici family in Italy during the 15th century (1397–1494). It was the largest and most respected bank in Europe during its prime. There are some estim ...

in the 14th century, though evidence for this is lacking.

The double-entry system began to propagate for practice in Italian merchant cities during the 14th century. Before this there may have been systems of accounting records on multiple books which, however, do not yet have the formal and methodical rigor necessary to control the business economy. In the course of the 16th century, Venice produced the theoretical accounting science by the writings of Luca Pacioli

Fra Luca Bartolomeo de Pacioli (sometimes ''Paccioli'' or ''Paciolo''; 1447 – 19 June 1517) was an Italian mathematician, Franciscan friar, collaborator with Leonardo da Vinci, and an early contributor to the field now known as accountin ...

, Domenico Manzoni, Bartolomeo Fontana, the accountant Alvise Casanova and the erudite Giovanni Antonio Tagliente.

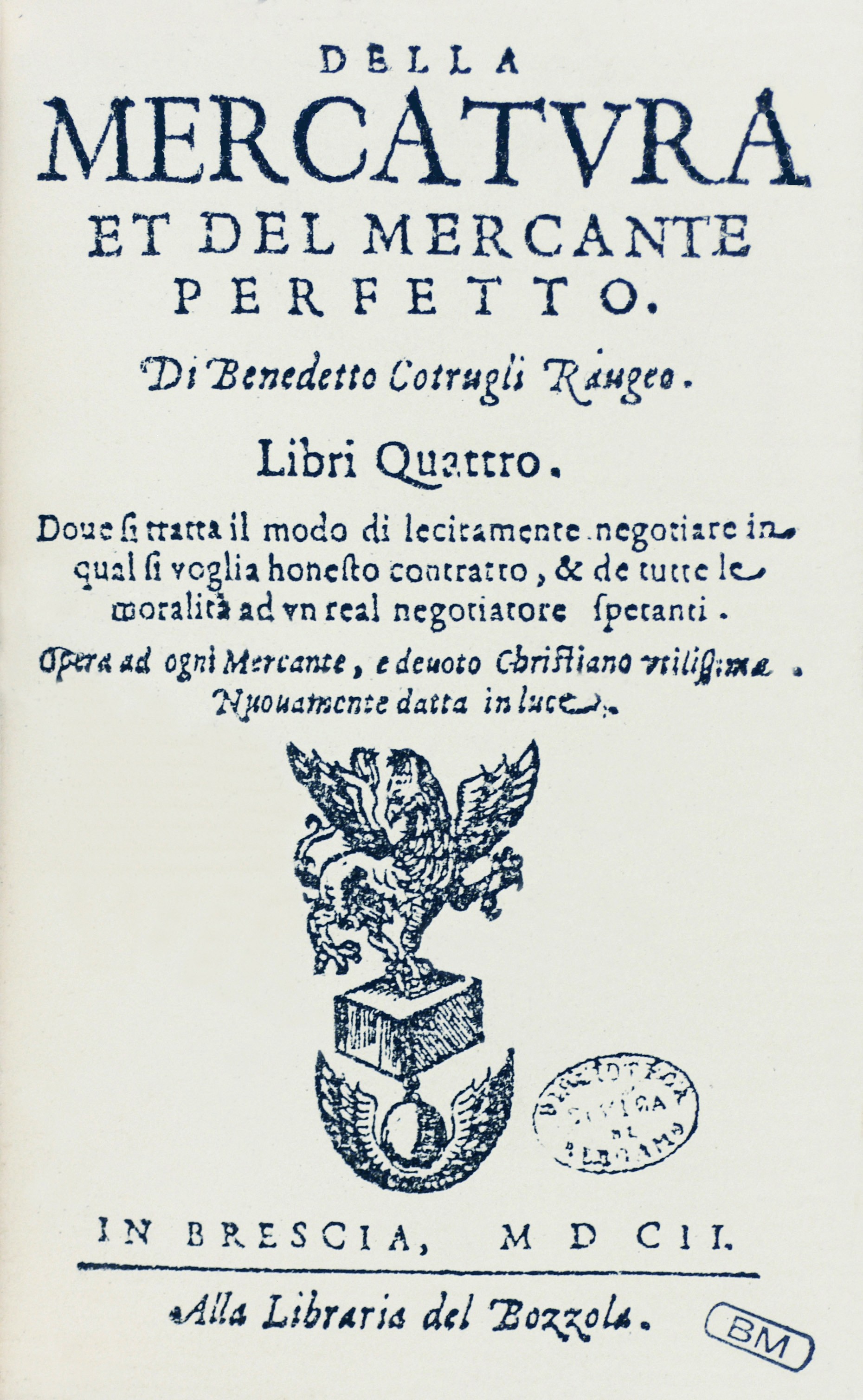

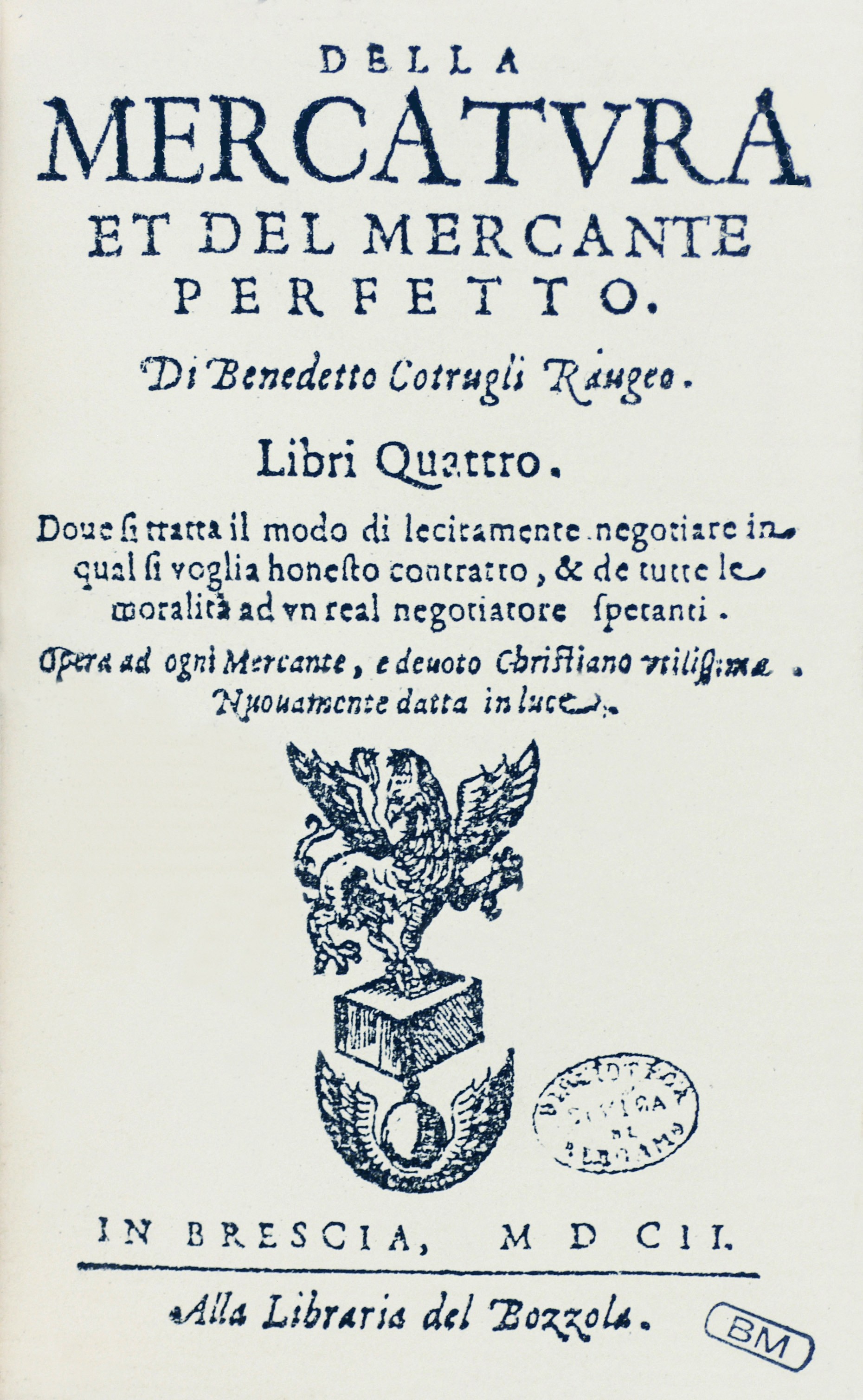

Ragusan precursor Benedetto Cotrugli's 1458 treatise '' Della mercatura e del mercante perfetto'' contained the earliest known description of a double-entry system, published in print in Venice in 1573. Luca Pacioli

Fra Luca Bartolomeo de Pacioli (sometimes ''Paccioli'' or ''Paciolo''; 1447 – 19 June 1517) was an Italian mathematician, Franciscan friar, collaborator with Leonardo da Vinci, and an early contributor to the field now known as accountin ...

, a Franciscan friar and collaborator of Leonardo da Vinci

Leonardo di ser Piero da Vinci (15 April 14522 May 1519) was an Italian polymath of the High Renaissance who was active as a painter, Drawing, draughtsman, engineer, scientist, theorist, sculptor, and architect. While his fame initially re ...

, first codified the system in his mathematics textbook

A textbook is a book containing a comprehensive compilation of content in a branch of study with the intention of explaining it. Textbooks are produced to meet the needs of educators, usually at educational institutions. Schoolbooks are textboo ...

'' Summa de arithmetica, geometria, proportioni et proportionalità'' published in Venice

Venice ( ; it, Venezia ; vec, Venesia or ) is a city in northeastern Italy and the capital of the Veneto region. It is built on a group of 118 small islands that are separated by canals and linked by over 400 bridges. The isla ...

in 1494. Pacioli

Fra Luca Bartolomeo de Pacioli (sometimes ''Paccioli'' or ''Paciolo''; 1447 – 19 June 1517) was an Italian mathematician, Franciscan friar, collaborator with Leonardo da Vinci, and an early contributor to the field now known as accounting ...

is often called the "father of accounting" because he was the first to publish a detailed description of the double-entry system, thus enabling others to study and use it.

In pre-modern Europe, double-entry bookkeeping had theological and cosmological connotations, recalling "both the scales of justice and the symmetry of God's world".

Other claimants

Per some sources, double-entry bookkeeping was first pioneered by the Romans and in the Jewish community of the early-medieval Middle East. In AD 70Pliny the Elder

Gaius Plinius Secundus (AD 23/2479), called Pliny the Elder (), was a Roman author, naturalist and natural philosopher, and naval and army commander of the early Roman Empire, and a friend of the emperor Vespasian. He wrote the encyclopedic ...

described the structure of the "Tabulae Rationum" as "On one page all the disbursements are entered, on the other page all the receipts; both pages constitute a whole for each operation

of every man".

11th century Jewish bankers in Cairo

Cairo ( ; ar, القاهرة, al-Qāhirah, ) is the capital of Egypt and its largest city, home to 10 million people. It is also part of the largest urban agglomeration in Africa, the Arab world and the Middle East: The Greater Cairo met ...

used an intermediary form of credit-debit accounts in some of their documentation. The Italian system has similarities with the older Indian " Jama–Nama" system which had debits and credits in a reverse order. It is B. M. Lall Nigam's opinion that the Italian merchants likely learned the method from their interaction with ancient Indian merchants during the Greek and Roman sea trade relations, though he is unable to substantiate this with evidence. The oldest European record of a complete double-entry system is the ''Messari'' ( Italian: Treasurer

A treasurer is the person responsible for running the treasury of an organization. The significant core functions of a corporate treasurer include cash and liquidity management, risk management, and corporate finance.

Government

The treasury o ...

's) accounts of the Republic of Genoa

The Republic of Genoa ( lij, Repúbrica de Zêna ; it, Repubblica di Genova; la, Res Publica Ianuensis) was a medieval and early modern maritime republic from the 11th century to 1797 in Liguria on the northwestern Italian coast. During the L ...

in 1340. The ''Messari'' accounts contain debits and credits journalised in a bilateral form, and include balances carried forward from the preceding year, and therefore enjoy general recognition as a double-entry system. By the end of the 15th century, the bankers and merchants of Florence

Florence ( ; it, Firenze ) is a city in Central Italy and the capital city of the Tuscany region. It is the most populated city in Tuscany, with 383,083 inhabitants in 2016, and over 1,520,000 in its metropolitan area.Bilancio demografico ...

, Genoa

Genoa ( ; it, Genova ; lij, Zêna ). is the capital of the Regions of Italy, Italian region of Liguria and the List of cities in Italy, sixth-largest city in Italy. In 2015, 594,733 people lived within the city's administrative limits. As of t ...

, Venice

Venice ( ; it, Venezia ; vec, Venesia or ) is a city in northeastern Italy and the capital of the Veneto region. It is built on a group of 118 small islands that are separated by canals and linked by over 400 bridges. The isla ...

and Lübeck

Lübeck (; Low German also ), officially the Hanseatic City of Lübeck (german: Hansestadt Lübeck), is a city in Northern Germany. With around 217,000 inhabitants, Lübeck is the second-largest city on the German Baltic coast and in the stat ...

used this system widely.

The double-entry accounting method was said to be developed independently earlier in Korea during the

The double-entry accounting method was said to be developed independently earlier in Korea during the Goryeo dynasty

Goryeo (; ) was a Korean kingdom founded in 918, during a time of national division called the Later Three Kingdoms period, that unified and ruled the Korean Peninsula until 1392. Goryeo achieved what has been called a "true national unificat ...

(918–1392) when Kaesong was a center of trade and industry. The ''Four-element bookkeeping system'' was said to originate in the 11th or 12th century.A Global History of Accounting, Financial Reporting and Public Policy: Asia ... By Gary John Previts, Peter Wolnizer

Accounting entries

In the double-entry accounting system, at least two accounting entries are required to record each financial transaction. These entries may occur in asset, liability, equity, expense, or revenue accounts. Recording of a debit amount to one or more accounts and an equal credit amount to one or more accounts results in total debits being equal to total credits when considering all accounts in the general ledger. If the accounting entries are recorded without error, the aggregate balance of all accounts having ''Debit'' balances will be equal to the aggregate balance of all accounts having ''Credit'' balances. Accounting entries that debit and credit related accounts typically include the same date and identifying code in both accounts, so that in case of error, each debit and credit can be traced back to a journal and transaction source document, thus preserving an audit trail. The accounting entries are recorded in the "Books of Accounts". Regardless of which accounts and how many are involved by a given transaction, the fundamental accounting equation of ''assets equal liabilities plus equity'' will hold.Approaches

There are two different ways to record the effects of debits and credits on accounts in the double-entry system of bookkeeping. They are the Traditional Approach and the Accounting Equation Approach. Irrespective of the approach used, the effect on the books of accounts remains the same, with two aspects (debit and credit) in each of the transactions.Traditional approach

Following the Traditional Approach (also called the British Approach) accounts are classified as real, personal, and nominal accounts. Real accounts are accounts relating to assets both tangible and intangible in nature. Personal accounts are accounts relating to persons or organisations with whom the business has transactions and will mainly consist of accounts of debtors and creditors. Nominal accounts are accounts relating to revenue, expenses, gains, and losses. Transactions are entered in the books of accounts by applying the following golden rules of accounting: # Real account: Debit what comes in and credit what goes out. # Personal account: Debit the receiver and credit the giver. # Nominal account: Debit all expenses & losses and credit all incomes & gainsAccounting equation approach

This approach is also called the American approach. Under this approach transactions are recorded based on the accounting equation, i.e., Assets = Liabilities + Capital. The accounting equation is a statement of equality between the debits and the credits. The rules of debit and credit depend on the nature of an account. For the purpose of the accounting equation approach, all the accounts are classified into the following five types: assets, capital, liabilities, revenues/incomes, or expenses/losses. If there is an increase or decrease in a set of accounts, there will be equal decrease or increase in another set of accounts. Accordingly, the following rules of debit and credit hold for the various categories of accounts: # Assets Accounts: debit entry represents an increase in assets and a credit entry represents a decrease in assets. # Capital Account: credit entry represents an increase in capital and a debit entry represents a decrease in capital. # Liabilities Accounts: credit entry represents an increase in liabilities and a debit entry represents a decrease in liabilities. # Revenues or Incomes Accounts: credit entry represents an increase in incomes and gains, and debit entry represents a decrease in incomes and gains. # Expenses or Losses Accounts: debit entry represents an increase in expenses and losses, and credit entry represents a decrease in expenses and losses. These five rules help learning about accounting entries and also are comparable with traditional (British) accounting rules.Books of accounts

Eachfinancial transaction

A financial transaction is an agreement, or communication, between a buyer and seller to exchange goods, services, or assets for payment. Any transaction involves a change in the status of the finances of two or more businesses or individuals. ...

is recorded in at least two different nominal ledger accounts within the financial accounting system, so that the total debits equals the total credits in the general ledger, i.e. the accounts balance. This is a partial check that each and every transaction has been correctly recorded. The transaction is recorded as a "debit entry" (Dr) in one account, and a "credit entry" (Cr) in a second account. The debit entry will be recorded on the debit side (left-hand side) of a general ledger account, and the credit entry will be recorded on the credit side (right-hand side) of a general ledger account. If the total of the entries on the debit side of one account is greater than the total on the credit side of the same nominal account, that account is said to have a debit balance.

Double entry is used only in nominal ledgers. It is not used in daybooks Day Book may refer to:

* ''The Day Book'', a newspaper in Chicago 1911–1917

* '' Weekly Day Book'', a newspaper which primarily existed to propagate white supremacist ideas, 1848–1879

* General journal, or day book

**a day book in bookkeeping ...

(journals), which normally do not form part of the nominal ledger system. The information from the daybooks will be used in the nominal ledger and it is the nominal ledgers that will ensure the integrity of the resulting financial information created from the daybooks (provided that the information recorded in the daybooks is correct).

The reason for this is to limit the number of entries in the nominal ledger: entries in the daybooks can be totalled before they are entered in the nominal ledger. If there are only a relatively small number of transactions it may be simpler instead to treat the daybooks as an integral part of the nominal ledger and thus of the double-entry system.

However, as can be seen from the examples of daybooks shown below, it is still necessary to check, within each daybook, that the postings from the daybook balance.

The double entry system uses nominal ledger accounts. From these nominal ledger accounts, a trial balance

A trial balance is a list of all the general ledger accounts (both revenue and capital) contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nomi ...

can be created. The trial balance lists all the nominal ledger account balances. The list is split into two columns, with debit balances placed in the left hand column and credit balances placed in the right hand column. Another column will contain the name of the nominal ledger account describing what each value is for. The total of the debit column must equal the total of the credit column.

Debits and credits

Double-entry bookkeeping is governed by the accounting equation. If revenue equals expenses, the following (basic) equation must be true: :''assets = liabilities + equity'' For the accounts to remain in balance, a change in one account must be matched with a change in another account. These changes are made by debits and credits to the accounts. Note that the usage of these terms in accounting is not identical to their everyday usage. Whether one uses a debit or credit to increase or decrease an account depends on the normal balance of the account. Assets, Expenses, andDrawings

Drawing is a visual art that uses an instrument to mark paper or another two-dimensional surface. The instruments used to make a drawing are pencils, crayons, pens with inks, brushes with paints, or combinations of these, and in more modern times ...

accounts (on the left side of the equation) have a normal balance of ''debit''. Liability, Revenue, and Capital accounts (on the right side of the equation) have a normal balance of ''credit''. On a general ledger, debits are recorded on the left side and credits on the right side for each account. Since the accounts must always balance, for each transaction there will be a debit made to one or several accounts and a credit made to one or several accounts. The sum of all debits made in each day's transactions must equal the sum of all credits in those transactions. After a series of transactions, therefore, the sum of all the accounts with a debit balance will equal the sum of all the accounts with a credit balance.

Debits and credits are numbers recorded as follows:

* ''Debits'' are recorded on the left side of a ledger account, a.k.a. T account. Debits increase balances in asset accounts and expense accounts and decrease balances in liability accounts, revenue accounts, and capital accounts.

* ''Credits'' are recorded on the right side of a T account in a ledger. Credits increase balances in liability accounts, revenue accounts, and capital accounts, and decrease balances in asset accounts and expense accounts.

* ''Debit accounts'' are asset and expense accounts that usually have debit balances, i.e. the total debits usually exceed the total credits in each debit account.

* ''Credit accounts'' are revenue (income, gains) accounts and liability accounts that usually have credit balances.

The mnemonic DEADCLIC is used to help remember the effect of debit or credit transactions on the relevant accounts. DEAD: Debit to increase Expense, Asset and Drawing accounts and CLIC: Credit to increase Liability, Income and Capital accounts.

A second popular mnemonic is DEA-LER, where DEA represents Dividend, Expenses, Assets for Debit increases, and Liabilities, Equity, Revenue for Credit increases.

The account types are related as follows:current equity = sum of equity changes across time (increases on the left side are debits, and increases on the right side are credits, and vice versa for decreases)

current equity = Assets – Liabilities

sum of equity changes across time = owner's investment (Capital above) + Revenues – Expenses

See also

* Debits and credits * Desi Namu * Momentum accounting and triple-entry bookkeeping * Merdiban * Nostro and vostro accounts * Single-entry bookkeepingNotes and references

Further reading

* *External links

A Concise Explanation of the Accounting Equation

Bean Counter's bookkeeping tutorial

GnuCash data entry concepts

GnuCash website {{DEFAULTSORT:Double-entry bookkeeping Accounting systems Italian inventions Accounting terminology History of accounting Economic history of Italy