utility class on:

[Wikipedia]

[Google]

[Amazon]

As a topic of economics, utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or happiness as part of the theory of utilitarianism by moral philosophers such as Jeremy Bentham and

Individual utility and social utility can be construed as the value of a utility function and a social welfare function respectively. When coupled with production or commodity constraints, by some assumptions these functions can be used to analyze Pareto efficiency, such as illustrated by Edgeworth boxes in

Individual utility and social utility can be construed as the value of a utility function and a social welfare function respectively. When coupled with production or commodity constraints, by some assumptions these functions can be used to analyze Pareto efficiency, such as illustrated by Edgeworth boxes in

Slope = -P(x)/P(y)

Slope = -P(x)/P(y)

Definition of Utility by InvestopediaSimpler Definition with example from InvestopediaMaximization of Originality - redefinition of classic utility

]

Form

and perhaps als

{{Authority control Utility, Choice modelling Ethical principles

John Stuart Mill

John Stuart Mill (20 May 1806 – 7 May 1873) was an English philosopher, political economist, Member of Parliament (MP) and civil servant. One of the most influential thinkers in the history of classical liberalism, he contributed widely to ...

. The term has been adapted and reapplied within neoclassical economics, which dominates modern economic theory, as a utility function that represents a single consumer's preference ordering over a choice set but is not comparable across consumers. This concept of utility is personal and based on choice rather than on pleasure received, and so is specified more rigorously than the original concept but makes it less useful (and controversial) for ethical decisions.

Utility function

Consider a set of alternatives among which a person can make a preference ordering. The utility obtained from these alternatives is an unknown function of the utilities obtained from each alternative, not the sum of each alternative. A utility function is able to represent that ordering if it is possible to assign a real number to each alternative in such a manner that ''alternative a'' is assigned a number greater than ''alternative b'' if and only if the individual prefers ''alternative a'' to ''alternative b''. In this situation someone who selects the most preferred alternative is necessarily also selecting the alternative that maximizes the associated utility function. Suppose James has utility function such that x is the number of apples and y is the number of chocolates. Alternative A has apples and chocolates; alternative B has apples and chocolates. Putting the values x, y into the utility function yields for alternative A and for B, so James prefers alternative B. In general economic terms, a utility function measures preferences concerning a set of goods and services. Utility is often correlated with concepts such as happiness, satisfaction, and welfare which are difficult to measure. Thus, economists utilize consumption baskets of preferences in order to measure these abstract, nonquantifiable ideas.Gérard Debreu

Gérard Debreu (; 4 July 1921 – 31 December 2004) was a French-born economist and mathematician. Best known as a professor of economics at the University of California, Berkeley, where he began work in 1962, he won the 1983 Nobel Memorial Prize ...

precisely defined the conditions required for a preference ordering to be representable by a utility function. For a finite set of alternatives these require only that the preference ordering is complete (so the individual is able to determine which of any two alternatives is preferred or that they are equal), and that the preference order is transitive.

Very often the set of alternatives is not finite, because even if the number of goods is finite, the quantity chosen can be any real number on an interval. A commonly specified Choice Set in Consumer Choice is , where is the number of goods. In this case, there exists a continuous utility function to represent a consumer's preferences if and only if the consumer's preferences are complete, transitive and continuous.

Applications

Utility is usually applied by economists to such constructs as theindifference curve

In economics, an indifference curve connects points on a graph representing different quantities of two goods, points between which a consumer is ''indifferent''. That is, any combinations of two products indicated by the curve will provide the c ...

, which plot the combination of commodities that an individual would accept to maintain a given level of satisfaction. Utility and indifference curves are used by economists to understand the causes of demand curve

In economics, a demand curve is a graph depicting the relationship between the price of a certain commodity (the ''y''-axis) and the quantity of that commodity that is demanded at that price (the ''x''-axis). Demand curves can be used either for ...

s as part of supply and demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris paribus, holding all else equal, in a perfect competition, competitive market, the unit price for a ...

analysis, which is used to analyze the workings of goods markets.

A diagram of a general indifference curve is shown below (Figure 1). The vertical axes and the horizontal axes represent an individual's consumption of commodity Y and X respectively. All the combinations of commodity X and Y along the same indifference curve are regarded indifferently by individuals, which means all the combinations along an indifference curve result in the same value of utility.

Individual utility and social utility can be construed as the value of a utility function and a social welfare function respectively. When coupled with production or commodity constraints, by some assumptions these functions can be used to analyze Pareto efficiency, such as illustrated by Edgeworth boxes in

Individual utility and social utility can be construed as the value of a utility function and a social welfare function respectively. When coupled with production or commodity constraints, by some assumptions these functions can be used to analyze Pareto efficiency, such as illustrated by Edgeworth boxes in contract curve

In microeconomics, the contract curve or Pareto set is the set of points representing final allocations of two goods between two people that could occur as a result of mutually beneficial trading between those people given their initial allocatio ...

s. Such efficiency is a major concept in welfare economics.

In finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fina ...

, utility is applied to generate an individual's price for an asset known as the indifference price. Utility functions are also related to risk measures, with the most common example being the entropic risk measure.

For artificial intelligence, utility functions are used to convey the value of various outcomes to intelligent agents. This allows the agents to plan actions with the goal of maximizing the utility (or "value") of available choices.

Preference

Preference, as human's specific likes and dislikes, is used primarily when individuals make choices or decisions among different alternatives. Individual preferences are influenced by various factors such as geographical location, gender, cultures and education. The ranking of utility indicates individuals’ preferences. Althoughpreference

In psychology, economics and philosophy, preference is a technical term usually used in relation to choosing between alternatives. For example, someone prefers A over B if they would rather choose A than B. Preferences are central to decision theo ...

s are the conventional foundation of microeconomics

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics fo ...

, it is often convenient to represent preferences with a utility function and analyze human behavior indirectly with utility functions. Let ''X'' be the consumption set, the set of all mutually-exclusive baskets the consumer could conceivably consume. The consumer's utility function ranks each package in the consumption set. If the consumer strictly prefers ''x'' to ''y'' or is indifferent between them, then .

For example, suppose a consumer's consumption set is ''X'' = , and his utility function is ''u''(nothing) = 0, ''u''(1 apple) = 1, ''u''(1 orange) = 2, ''u''(1 apple and 1 orange) = 5, ''u''(2 apples) = 2 and ''u''(2 oranges) = 4. Then this consumer prefers 1 orange to 1 apple, but prefers one of each to 2 oranges.

In micro-economic models, there are usually a finite set of L commodities, and a consumer may consume an arbitrary amount of each commodity. This gives a consumption set of , and each package is a vector containing the amounts of each commodity. For the example, there are two commodities: apples and oranges. If we say apples is the first commodity, and oranges the second, then the consumption set is and ''u''(0, 0) = 0, ''u''(1, 0) = 1, ''u''(0, 1) = 2, ''u''(1, 1) = 5, ''u''(2, 0) = 2, ''u''(0, 2) = 4 as before. Note that for ''u'' to be a utility function on ''X'', however, it must be defined for every package in ''X'', so now the function needs to be defined for fractional apples and oranges too. One function that would fit these numbers is

Preferences have three main properties:

* Completeness

Assume an individual has two choices, A and B. By ranking the two choices, one and only one of the following relationships is true: an individual strictly prefers A (A>B); an individual strictly prefers B (B>A); an individual is indifferent between A and B (A=B).

Either a ≥ b OR b ≥ a (OR both) for all (a,b)

* Transitivity

Individuals’ preferences are consistent over bundles. If an individual prefers bundle A to bundle B, and prefers bundle B to bundle C, then it can be assumed that the individual prefers bundle A to bundle C.

(If a ≥ b and b ≥ c, then a ≥ c for all (a,b,c)).

* Non-Satiation (Monotone Preferences)

All else being constant, individuals always prefer more of positive goods rather than negative goods, vice versa. In terms of the indifferent curves, individuals will always prefer bundles that are on a higher indifference curve. In other words, all else being the same, more is better than less of the commodity.

* When a commodity is good, more of it is preferred to less.

* When a commodity is bad, less of it is preferred more, like pollution.

Revealed preference

It was recognized that utility could not be measured or observed directly, so instead economists devised a way to infer relative utilities from observed choice. These 'revealed preferences', as termed by Paul Samuelson, were revealed e.g. in people's willingness to pay:Utility is assumed to be correlative to Desire or Want. It has been argued already that desires cannot be measured directly, but only indirectly, by the outward phenomena which they cause: and that in those cases with which economics is mainly concerned the measure is found by the price which a person is willing to pay for the fulfillment or satisfaction of his desire.

Revealed preference in finance

For financial applications, e.g. portfolio optimization, an investor chooses a financial portfolio which maximizes his/her own utility function, or, equivalently, minimizes his/her risk measure. For example, modern portfolio theory selects variance as a measure of risk; other popular theories are expected utility theory, and prospect theory. To determine a specific utility function for any given investor, one could design a questionnaire procedure with questions in the form: How much would you pay for ''x%'' chance of getting ''y''? Revealed preference theory suggests a more direct method: observe a portfolio ''X*'' which an investor currently has, and then find a utility function/risk measure such that ''X*'' becomes an optimal portfolio.There has been some controversy concerning whether the utility of a

commodity

In economics, a commodity is an economic good, usually a resource, that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them.

The price of a comm ...

can be measured or not. At one time, it was assumed that the consumer was able to say exactly how much utility he got from the commodity. The economists who made this assumption belonged to the 'cardinalist school' of economics. Presently utility functions, expressing utility as a function of the amounts of the various goods consumed, are treated as either ''cardinal'' or ''ordinal'', depending on whether they are or are not interpreted as providing more information than simply the rank ordering of preferences among bundles of goods, such as information concerning the strength of preferences.

Cardinal

Cardinal utility states that the utilities obtained from consumption can be measured and ranked objectively and are representable by numbers. There are fundamental assumptions of cardinal utility. Economic agents should be able to rank different bundles of goods based on their own preferences or utilities, and also sort different transitions of two bundles of goods. A cardinal utility function can be transformed to another utility function by a positive linear transformation (multiplying by a positive number, and adding some other number); however, both utility functions represent the same preferences. When cardinal utility is assumed, the magnitude of utility differences is treated as an ethically or behaviorally significant quantity. For example, suppose a cup of orange juice has utility of 120 "utils", a cup of tea has a utility of 80 utils, and a cup of water has a utility of 40 utils. With cardinal utility, it can be concluded that the cup of orange juice is better than the cup of tea by exactly the same amount by which the cup of tea is better than the cup of water. Formally, this means that if a person has a cup of tea, he or she would be willing to take any bet with a probability, p, greater than .5 of getting a cup of juice, with a risk of getting a cup of water equal to 1-p. One cannot conclude, however, that the cup of tea is two thirds of the goodness of the cup of juice, because this conclusion would depend not only on magnitudes of utility differences, but also on the "zero" of utility. For example, if the "zero" of utility was located at -40, then a cup of orange juice would be 160 utils more than zero, a cup of tea 120 utils more than zero. Cardinal utility can be considered as the assumption that utility can be measured by quantifiable characteristics, such as height, weight, temperature, etc. Neoclassical economics has largely retreated from using cardinal utility functions as the basis of economic behavior. A notable exception is in the context of analyzing choice with conditions of risk (seebelow

Below may refer to:

*Earth

*Ground (disambiguation)

*Soil

*Floor

*Bottom (disambiguation)

Bottom may refer to:

Anatomy and sex

* Bottom (BDSM), the partner in a BDSM who takes the passive, receiving, or obedient role, to that of the top or ...

).

Sometimes cardinal utility is used to aggregate utilities across persons, to create a social welfare function.

Ordinal

Instead of giving actual numbers over different bundles, ordinal utilities are only the rankings of utilities received from different bundles of goods or services. For example, ordinal utility could tell that having two ice creams provide a greater utility to individuals in comparison to one ice cream but could not tell exactly how much extra utility received by the individual. Ordinal utility, it does not require individuals to specify how much extra utility he or she received from the preferred bundle of goods or services in comparison to other bundles. They are only required to tell which bundles they prefer. When ordinal utilities are used, differences in utils (values assumed by the utility function) are treated as ethically or behaviorally meaningless: the utility index encodes a full behavioral ordering between members of a choice set, but tells nothing about the related ''strength of preferences''. For the above example, it would only be possible to say that juice is preferred to tea to water. Thus, ordinal utility utilizes comparisons, such as "preferred to", "no more", "less than", etc. If a function is ordinal, it is equivalent to the function , because taking the 3rd power is an increasing monotone (or monotonic) transformation. This means that the ordinal preference induced by these functions is the same (although they are two different functions). In contrast, if is cardinal, it is not equivalent to .Constructing utility functions

For many decision models, utility functions are determined by the problem formulation. For some situations, the decision maker's preference must be elicited and represented by a utility (or objective) scalar-valued function. The methods existing for constructing such functions are collected in the proceedings of two dedicated conferences. The mathematical foundations for the most common types of utility functions — quadratic and additive — were laid down by Gerard Debreu, and the methods for their construction from both ordinal and cardinal data, in particular from interviewing a decision maker, were developed by Andranik Tangian.Examples

In order to simplify calculations, various alternative assumptions have been made concerning details of human preferences, and these imply various alternative utility functions such as: * CES (''constant elasticity of substitution''). * Isoelastic utility * Exponential utility * Quasilinear utility * Homothetic preferences * Stone–Geary utility function * Gorman polar form **Greenwood–Hercowitz–Huffman preferences Greenwood–Hercowitz–Huffman preferences are a particular functional form of utility developed by Jeremy Greenwood, Zvi Hercowitz, and Gregory Huffman, in their 1988 paper ''Investment, Capacity Utilization, and the Real Business Cycle''.An arch ...

** King–Plosser–Rebelo preferences In economics, King–Plosser–Rebelo preferences are a particular functional form of utility that is used in many macroeconomic models and dynamic stochastic general equilibrium models. Having originally been proposed in an article that appeared in ...

* Hyperbolic absolute risk aversion

Most utility functions used for modeling or theory are well-behaved. They are usually monotonic and quasi-concave. However, it is possible for preferences not to be representable by a utility function. An example is lexicographic preferences which are not continuous and cannot be represented by a continuous utility function.

Marginal utility

Economists distinguish between total utility and marginal utility. Total utility is the utility of an alternative, an entire consumption bundle or situation in life. The rate of change of utility from changing the quantity of one good consumed is termed the marginal utility of that good. Marginal utility therefore measures the slope of the utility function with respect to the changes of one good. Marginal utility usually decreases with consumption of the good, the idea of "diminishing marginal utility". In calculus notation, the marginal utility of good X is . When a good's marginal utility is positive, additional consumption of it increases utility; if zero, the consumer is satiated and indifferent about consuming more; if negative, the consumer would pay to reduce his consumption.Law of diminishing marginal utility

Rational individuals only consume additional units of goods if it increases the marginal utility. However, the law of diminishing marginal utility means an additional unit consumed brings a less marginal utility than that brought by the previous unit consumed. For example, drinking one bottle of water makes a thirsty person satisfied; as the consumption of water increases, he may feel begin to feel bad which causes the marginal utility to decrease to zero or even become negative. Furthermore, this is also used to analyze progressive taxes as the greater taxes can result in the loss of utility.Marginal rate of substitution (MRS)

Marginal rate of substitution is the slope of the indifference curve, which measures how much an individual is willing to switch from one good to another. Using a mathematic equation, keeping U (x1,x2) constant. Thus, MRS is how much an individual is willing to pay for consuming a greater amount of x1. MRS is related to marginal utility. The relationship between marginal utility and MRS is:Expected utility

Expected utility theory deals with the analysis of choices among risky projects with multiple (possibly multidimensional) outcomes. The St. Petersburg paradox was first proposed by Nicholas Bernoulli in 1713 and solved byDaniel Bernoulli

Daniel Bernoulli FRS (; – 27 March 1782) was a Swiss mathematician and physicist and was one of the many prominent mathematicians in the Bernoulli family from Basel. He is particularly remembered for his applications of mathematics to mechan ...

in 1738. D. Bernoulli argued that the paradox could be resolved if decision-makers displayed risk aversion and argued for a logarithmic cardinal utility function. (Analysis of international survey data during the 21st century has shown that insofar as utility represents happiness, as for utilitarianism, it is indeed proportional to log of income.)

The first important use of the expected utility theory was that of John von Neumann and Oskar Morgenstern, who used the assumption of expected utility maximization in their formulation of game theory

Game theory is the study of mathematical models of strategic interactions among rational agents. Myerson, Roger B. (1991). ''Game Theory: Analysis of Conflict,'' Harvard University Press, p.&nbs1 Chapter-preview links, ppvii–xi It has appli ...

.

In finding the probability-weighted average of the utility from each possible outcome:

EU=r(z)×u(value(z))

R, or r, is the eighteenth letter of the Latin alphabet, used in the modern English alphabet, the alphabets of other western European languages and others worldwide. Its name in English is ''ar'' (pronounced ), plural ''ars'', or in Irelan ...

r(y)×u(value(y))

R, or r, is the eighteenth letter of the Latin alphabet, used in the modern English alphabet, the alphabets of other western European languages and others worldwide. Its name in English is ''ar'' (pronounced ), plural ''ars'', or in Irelan ...

von Neumann–Morgenstern

Von Neumann and Morgenstern addressed situations in which the outcomes of choices are not known with certainty, but have probabilities associated with them. A notation for a ''lottery

A lottery is a form of gambling that involves the drawing of numbers at random for a prize. Some governments outlaw lotteries, while others endorse it to the extent of organizing a national or state lottery. It is common to find some degree of ...

'' is as follows: if options A and B have probability ''p'' and 1 − ''p'' in the lottery, we write it as a linear combination:

:

More generally, for a lottery with many possible options:

:

where .

By making some reasonable assumptions about the way choices behave, von Neumann and Morgenstern showed that if an agent can choose between the lotteries, then this agent has a utility function such that the desirability of an arbitrary lottery can be computed as a linear combination of the utilities of its parts, with the weights being their probabilities of occurring.

This is termed the ''expected utility theorem''. The required assumptions are four axioms about the properties of the agent's preference relation over 'simple lotteries', which are lotteries with just two options. Writing to mean 'A is weakly preferred to B' ('A is preferred at least as much as B'), the axioms are:

# completeness: For any two simple lotteries and , either or (or both, in which case they are viewed as equally desirable).

# transitivity: for any three lotteries , if and , then .

# convexity/continuity (Archimedean property): If , then there is a between 0 and 1 such that the lottery is equally desirable as .

# independence: for any three lotteries and any probability ''p'', if and only if . Intuitively, if the lottery formed by the probabilistic combination of and is no more preferable than the lottery formed by the same probabilistic combination of and then and only then .

Axioms 3 and 4 enable us to decide about the relative utilities of two assets or lotteries.

In more formal language: A von Neumann–Morgenstern utility function is a function from choices to the real numbers:

:

which assigns a real number to every outcome in a way that represents the agent's preferences over simple lotteries. Using the four assumptions mentioned above, the agent will prefer a lottery to a lottery if and only if, for the utility function characterizing that agent, the expected utility of is greater than the expected utility of :

:.

Of all the axioms, independence is the most often discarded. A variety of generalized expected utility theories have arisen, most of which omit or relax the independence axiom.

As probability of success

Castagnoli and LiCalzi (1996) and Bordley and LiCalzi (2000) provided another interpretation for Von Neumann and Morgenstern's theory. Specifically for any utility function, there exists a hypothetical reference lottery with the expected utility of an arbitrary lottery being its probability of performing no worse than the reference lottery. Suppose success is defined as getting an outcome no worse than the outcome of the reference lottery. Then this mathematical equivalence means that maximizing expected utility is equivalent to maximizing the probability of success. In many contexts, this makes the concept of utility easier to justify and to apply. For example, a firm's utility might be the probability of meeting uncertain future customer expectations.Indirect utility

An indirect utility function gives the optimal attainable value of a given utility function, which depends on the prices of the goods and the income or wealth level that the individual possesses.Money

One use of the indirect utility concept is the notion of the utility of money. The (indirect) utility function for money is a nonlinear function that isbounded

Boundedness or bounded may refer to:

Economics

* Bounded rationality, the idea that human rationality in decision-making is bounded by the available information, the cognitive limitations, and the time available to make the decision

* Bounded e ...

and asymmetric about the origin. The utility function is concave in the positive region, representing the phenomenon of diminishing marginal utility. The boundedness represents the fact that beyond a certain amount money ceases being useful at all, as the size of any economy at that time is itself bounded. The asymmetry about the origin represents the fact that gaining and losing money can have radically different implications both for individuals and businesses. The non-linearity of the utility function for money has profound implications in decision-making processes: in situations where outcomes of choices influence utility by gains or losses of money, which are the norm for most business settings, the optimal choice for a given decision depends on the possible outcomes of all other decisions in the same time-period.

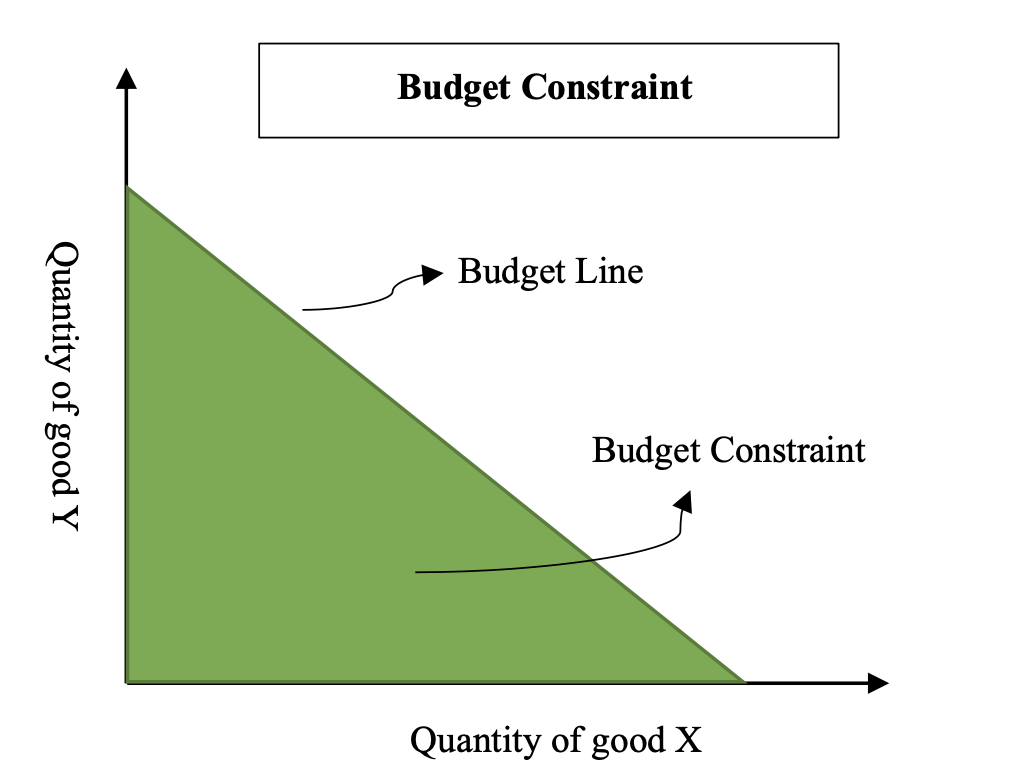

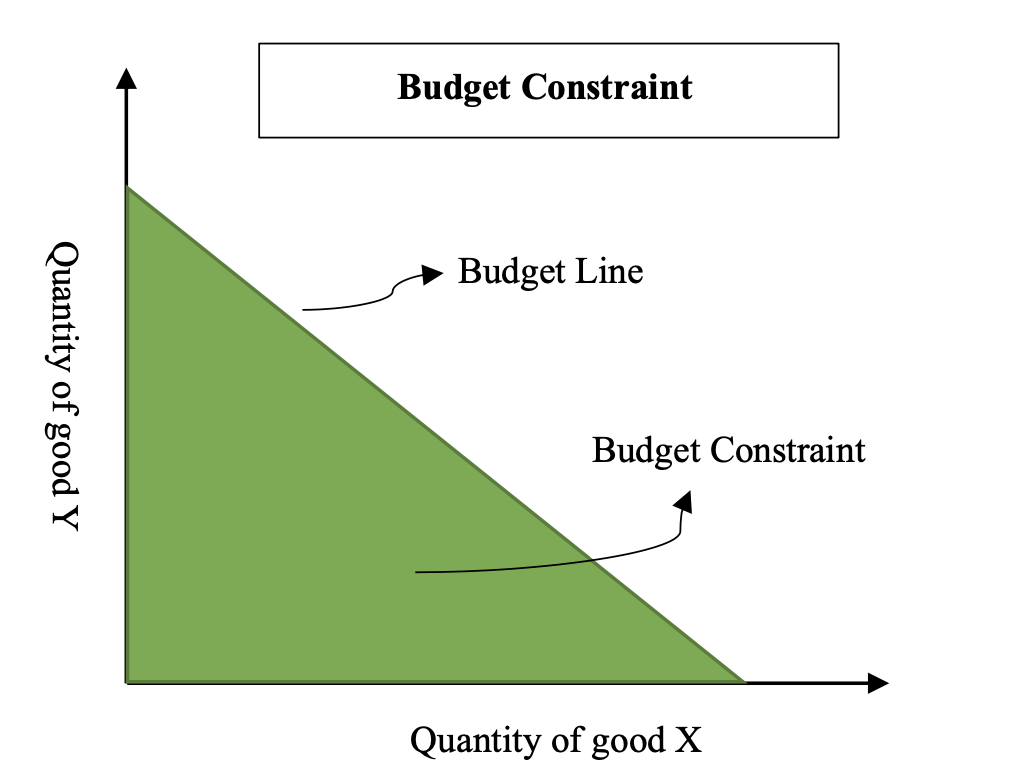

Budget constraints

Individuals' consumptions are constrained by their budget allowance. The graph of budget line is a linear, downward-sloping line between X and Y axes. All the bundles of consumption under the budget line allow individuals to consume without using the whole budget as the total budget is greater than the total cost of bundles (Figure 2). If only considers prices and quantities of two goods in one bundle, a budget constraint could be formulated as , where p1 and p2 are prices of the two goods, X1 and X2 are quantities of the two goods. Slope = -P(x)/P(y)

Slope = -P(x)/P(y)

Constrained utility optimisation

Rational consumers wish to maximise their utility. However, as they have budget constraints, a change of price would affect the quantity of demand. There are two factors could explain this situation: * Purchasing Power. Individuals obtain greater purchasing power when the price of a good decreases. The reduction of the price allows individuals to increase their savings so they could afford to buy other products. * Substitution Effect. If the price of good A decreases, then the good becomes relatively cheaper with respect to its substitutes. Thus, individuals would consume more of good A as the utility would increase by doing so.Discussion and criticism

Cambridge economist Joan Robinson famously criticized utility for being a circular concept: "Utility is the quality incommodities

In economics, a commodity is an economic good, usually a resource, that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them.

The price of a comm ...

that makes individuals want to buy them, and the fact that individuals want to buy commodities shows that they have utility". Robinson also stated that because the theory assumes that preferences are fixed this means that utility is not a testable assumption. This is so because if we observe changes of peoples' behavior in relation to a change in prices or a change in budget constraint we can never be sure to what extent the change in behavior was due to the change of price or budget constraint and how much was due to a change of preference. This criticism is similar to that of the philosopher Hans Albert who argued that the ''ceteris paribus

' (also spelled '; () is a Latin phrase, meaning "other things equal"; some other English translations of the phrase are "all other things being equal", "other things held constant", "all else unchanged", and "all else being equal". A statement ...

'' (all else equal) conditions on which the marginalist theory of demand rested rendered the theory itself a meaningless tautology, incapable of being tested experimentally. In essence, a curve of demand and supply (a theoretical line of quantity of a product which would have been offered or requested for given price) is purely ontological and could never have been demonstrated empirically.

Another criticism derives from the assertion that neither cardinal

Cardinal or The Cardinal may refer to:

Animals

* Cardinal (bird) or Cardinalidae, a family of North and South American birds

**''Cardinalis'', genus of cardinal in the family Cardinalidae

**''Cardinalis cardinalis'', or northern cardinal, the ...

nor ordinal utility are observable empirically in the real world. For the case of cardinal utility it is impossible to measure the degree of satisfaction "quantitatively" when someone consumes or purchases an apple. For ordinal utility, it is impossible to determine what choices were made when someone purchases, for example, an orange. Any act would involve preference over a vast set of choices (such as apple, orange juice, other vegetable, vitamin C tablets, exercise, not purchasing, etc.).

Other questions of what arguments ought to be included in a utility function are difficult to answer, yet seem necessary to understanding utility. Whether people gain utility from coherence of wants, beliefs or a sense of duty

A duty (from "due" meaning "that which is owing"; fro, deu, did, past participle of ''devoir''; la, debere, debitum, whence "debt") is a commitment or expectation to perform some action in general or if certain circumstances arise. A duty may ...

is important to understanding their behavior in the utility organon. Likewise, choosing between alternatives is itself a process of determining what to consider as alternatives, a question of choice within uncertainty.

An evolutionary psychology theory is that utility may be better considered as due to preferences that maximized evolutionary fitness in the ancestral environment but not necessarily in the current one.

See also

* Law of demand *Marginal utility

In economics, utility is the satisfaction or benefit derived by consuming a product. The marginal utility of a Goods (economics), good or Service (economics), service describes how much pleasure or satisfaction is gained by consumers as a result o ...

* Utility maximization problem

* Decision-making software

References

Further reading

* * * * * * * * *External links

Definition of Utility by Investopedia

]

Form

and perhaps als

{{Authority control Utility, Choice modelling Ethical principles