The United States dollar (

symbol

A symbol is a mark, sign, or word that indicates, signifies, or is understood as representing an idea, object, or relationship. Symbols allow people to go beyond what is known or seen by creating linkages between otherwise very different conc ...

:

$;

code

In communications and information processing, code is a system of rules to convert information—such as a letter, word, sound, image, or gesture—into another form, sometimes shortened or secret, for communication through a communication ...

: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from

other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official

currency of the

United States and

several other countries. The

Coinage Act of 1792 introduced the U.S. dollar at par with the

Spanish silver dollar

The Spanish dollar, also known as the piece of eight ( es, Real de a ocho, , , or ), is a silver coin of approximately diameter worth eight Spanish reales. It was minted in the Spanish Empire following a monetary reform in 1497 with content ...

, divided it into 100

cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of

Federal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 ...

s, popularly called greenbacks due to their predominantly green color.

The

monetary policy of the United States is conducted by the

Federal Reserve System, which acts as the nation's

central bank.

The U.S. dollar was originally defined under a

bimetallic standard

Bimetallism, also known as the bimetallic standard, is a monetary standard in which the value of the monetary unit is defined as equivalent to certain quantities of two metals, typically gold and silver, creating a fixed rate of exchange betwee ...

of (0.7735 troy ounces) fine silver or, from 1837, fine gold, or $20.67 per

troy ounce. The

Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, its equivalence to gold was revised to $35 per

troy ounce. Since 1971, all links to gold have been repealed.

The U.S. dollar became an important international

reserve currency

A reserve currency (or anchor currency) is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international tran ...

after the

First World War, and displaced the

pound sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and t ...

as the world's primary reserve currency by the

Bretton Woods Agreement towards the end of the

Second World War. The dollar is the

most widely used currency in

international transactions, and a

free-floating currency

In macroeconomics and economic policy, a floating exchange rate (also known as a fluctuating or flexible exchange rate) is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange marke ...

. It is also the

official currency in several countries and the

''de facto'' currency in many others, with

Federal Reserve Notes

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 ...

(and, in a few cases, U.S. coins) used in circulation.

As of February 10, 2021, currency in circulation amounted to , of which is in Federal Reserve Notes (the remaining is in the form of

coins and older-style

United States Notes).

Overview

In the Constitution

Article I,

Section 8 of the

U.S. Constitution provides that

Congress has the power "

coin money." Laws implementing this power are currently codified in

Title 31 of the

U.S. Code

In the law of the United States, the Code of Laws of the United States of America (variously abbreviated to Code of Laws of the United States, United States Code, U.S. Code, U.S.C., or USC) is the official compilation and codification of the ...

, under Section 5112, which prescribes the forms in which the United States dollars should be issued.

[''Denominations, specifications, and design of coins''. .] These coins are both designated in the section as "

legal tender" in payment of debts.

The

Sacagawea dollar is one example of the

copper alloy dollar, in contrast to the

American Silver Eagle which is pure

silver. Section 5112 also provides for the

minting and

issuance

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations (or other non-debt assets which generate receivables) and selling ...

of other coins, which have values ranging from

one cent (

U.S. Penny

The cent, the United States one-cent coin (symbol: Cent_(currency)#Symbol, ¢), often called the "penny", is a unit of currency equaling one one-hundredth of a United States dollar. It has been the lowest face-value physical unit of U.S. currenc ...

) to 100 dollars.

These other coins are more fully described in

Coins of the United States dollar.

Article I, Section 9 of the Constitution provides that "a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time," which is further specified by Section 331 of Title 31 of the U.S. Code. The sums of money reported in the "Statements" are currently expressed in U.S. dollars, thus the U.S. dollar may be described as the

unit of account of the United States. "Dollar" is one of the first words of Section 9, in which the term refers to the

Spanish milled dollar

The Spanish dollar, also known as the piece of eight ( es, Real de a ocho, , , or ), is a silver coin of approximately diameter worth eight Spanish reales. It was minted in the Spanish Empire following a monetary reform in 1497 with content ...

, or the coin worth eight

Spanish reales.

The Coinage Act

In 1792, the

U.S. Congress passed the

Coinage Act, of which Section 9 authorized the production of various coins, including:

[ U.S. Congress. 1792. ]

Coinage Act of 1792

'. 2nd Congress, 1st Session. Sec. 9, ch. 16. Retrieved June 6, 2020.Section 20 of the Act designates the United States dollar as the

unit of currency of the United States:

Decimal units

Unlike the Spanish milled dollar, the

Continental Congress

The Continental Congress was a series of legislative bodies, with some executive function, for thirteen of Britain's colonies in North America, and the newly declared United States just before, during, and after the American Revolutionary War. ...

and the Coinage Act prescribed a

decimal system of units to go with the unit dollar, as follows:

the mill, or one-thousandth of a dollar; the cent, or one-hundredth of a dollar; the dime, or one-tenth of a dollar; and the eagle, or ten dollars. The current relevance of these units:

* Only the

cent (¢) is used as everyday division of the dollar.

* The

dime is used solely as the name of the

coin with the value of 10 cents.

* The

mill (₥) is relatively unknown, but before the mid-20th century was familiarly used in matters of

sales taxes, as well as

gasoline prices

The usage and pricing of gasoline (or ''petrol'') results from factors such as crude oil prices, processing and distribution costs, local demand, the strength of local currencies, local taxation, and the availability of local sources of gas ...

, which are usually in the form of $ΧΧ.ΧΧ9 per

gallon (e.g., $3.599, commonly written as $).

* The

eagle is also largely unknown to the general public.

This term was used in the ''Coinage Act of 1792'' for the denomination of ten dollars, and subsequently was used in naming gold coins.

The

Spanish peso or dollar was historically divided into eight

reales (colloquially, ''bits'') – hence ''pieces of eight''. Americans also learned counting in non-decimal ''bits'' of cents before 1857 when Mexican ''bits'' were more frequently encountered than American cents; in fact this practice survived in

New York Stock Exchange quotations until 2001.

In 1854,

Secretary of the Treasury James Guthrie proposed creating $100, $50, and $25 gold coins, to be referred to as a ''

union'', ''

half union'', and ''quarter union'', respectively, thus implying a denomination of 1 Union = $100. However, no such coins were ever struck, and only patterns for the $50 half union exist.

When currently issued in circulating form, denominations less than or equal to a dollar are emitted as

U.S. coins, while denominations greater than or equal to a dollar are emitted as

Federal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 ...

s, disregarding these special cases:

* Gold coins issued for

circulation

Circulation may refer to:

Science and technology

* Atmospheric circulation, the large-scale movement of air

* Circulation (physics), the path integral of the fluid velocity around a closed curve in a fluid flow field

* Circulatory system, a bio ...

until the 1930s, up to the value of $20 (known as the ''

double eagle'')

* Bullion or commemorative

gold,

silver,

platinum, and

palladium coin

Palladium coins are a form of coinage made out of the rare silver-white transition metal palladium. Palladium is assigned the code XPD by ISO 4217. The first palladium coins were produced in 1966.

History

Sierra Leone issued the first palladium c ...

s valued up to $100 as legal tender (though worth far more as

bullion

Bullion is non-ferrous metal that has been refined to a high standard of elemental purity. The term is ordinarily applied to bulk metal used in the production of coins and especially to precious metals such as gold and silver. It comes from t ...

).

* Civil War paper currency issue in denominations below $1, i.e. fractional currency, sometimes pejoratively referred to as ''

shinplaster

Shinplaster was paper money of low denomination, typically less than one dollar, circulating widely in the economies of the 19th century where there was a shortage of circulating coinage. The shortage of circulating coins was primarily due t ...

s''.

Etymology

In the 16th century, Count

Hieronymus Schlick

Hieronymus Schlick was a Bohemian count who authorised the minting of ''joachimstalers ,''after Joachimstal, the valley in which the silver was mined. Joachimstalers was later shortened to taler, the origin of the word "dollar

Dollar is the ...

of

Bohemia

Bohemia ( ; cs, Čechy ; ; hsb, Čěska; szl, Czechy) is the westernmost and largest historical region of the Czech Republic. Bohemia can also refer to a wider area consisting of the historical Lands of the Bohemian Crown ruled by the Bohem ...

began minting coins known as ''joachimstalers'', named for

Joachimstal, the valley in which the silver was mined. In turn, the valley's name is titled after

Saint Joachim

Joachim (; ''Yəhōyāqīm'', "he whom Yahweh has set up"; ; ) was, according to Christian tradition, the husband of Saint Anne and the father of Mary, the mother of Jesus. The story of Joachim and Anne first appears in the Biblical apocryphal ...

, whereby ''thal'' or ''tal'', a cognate of the English word , is

German

German(s) may refer to:

* Germany (of or related to)

**Germania (historical use)

* Germans, citizens of Germany, people of German ancestry, or native speakers of the German language

** For citizens of Germany, see also German nationality law

**Ger ...

for 'valley.'

["Ask US." '']National Geographic

''National Geographic'' (formerly the ''National Geographic Magazine'', sometimes branded as NAT GEO) is a popular American monthly magazine published by National Geographic Partners. Known for its photojournalism, it is one of the most widely ...

''. June 2002. p. 1. The ''joachimstaler'' was later shortened to the German ''

taler'', a word that eventually found its way into many languages, including:

''tolar'' (

Czech,

Slovak and

Slovenian

Slovene or Slovenian may refer to:

* Something of, from, or related to Slovenia, a country in Central Europe

* Slovene language, a South Slavic language mainly spoken in Slovenia

* Slovenes

The Slovenes, also known as Slovenians ( sl, Sloven ...

); ''daler'' (

Danish

Danish may refer to:

* Something of, from, or related to the country of Denmark

People

* A national or citizen of Denmark, also called a "Dane," see Demographics of Denmark

* Culture of Denmark

* Danish people or Danes, people with a Danish ance ...

and

Swedish

Swedish or ' may refer to:

Anything from or related to Sweden, a country in Northern Europe. Or, specifically:

* Swedish language, a North Germanic language spoken primarily in Sweden and Finland

** Swedish alphabet, the official alphabet used by ...

);

''dalar'' and ''daler'' (

Norwegian); ''daler'' or ''daalder'' (

Dutch);

''

talari'' (

Ethiopian);

''tallér'' (

Hungarian);

''tallero'' (

Italian);

''دولار'' (

Arabic); and ''

dollar'' (

English).

Though the

Dutch pioneered in modern-day

New York

New York most commonly refers to:

* New York City, the most populous city in the United States, located in the state of New York

* New York (state), a state in the northeastern United States

New York may also refer to:

Film and television

* '' ...

in the 17th century the use and the counting of money in silver dollars in the form of German-Dutch ''

reichsthalers'' and native Dutch ''

leeuwendaalder

A thaler (; also taler, from german: Taler) is one of the large silver coins minted in the states and territories of the Holy Roman Empire and the Habsburg monarchy during the Early Modern period. A ''thaler'' size silver coin has a diameter o ...

s'' ('lion dollars'), it was the ubiquitous

Spanish American

eight-real coin which became exclusively known as the ''dollar'' since the 18th century.

Nicknames

The

colloquialism

Colloquialism (), also called colloquial language, everyday language or general parlance, is the style (sociolinguistics), linguistic style used for casual (informal) communication. It is the most common functional style of speech, the idiom norm ...

''

buck(s)'' (much like the British ''quid'' for the

pound sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and t ...

) is often used to refer to dollars of various nations, including the U.S. dollar. This term, dating to the 18th century, may have originated with the colonial

leather trade, or it may also have originated from a

poker

Poker is a family of comparing card games in which players wager over which hand is best according to that specific game's rules. It is played worldwide, however in some places the rules may vary. While the earliest known form of the game w ...

term.

''Greenback'' is another nickname, originally applied specifically to the 19th-century

Demand Note

A Demand Note is a type of United States paper money that was issued between August 1861 and April 1862 during the American Civil War in denominations of 5, 10, and 20 . Demand Notes were the first issue of paper money by the United States ...

dollars, which were printed black and green on the backside, created by

Abraham Lincoln to finance the

North for the

Civil War. It is still used to refer to the U.S. dollar (but not to the dollars of other countries). The term ''greenback'' is also used by the financial press in other countries, such as

Australia

Australia, officially the Commonwealth of Australia, is a Sovereign state, sovereign country comprising the mainland of the Australia (continent), Australian continent, the island of Tasmania, and numerous List of islands of Australia, sma ...

,

,

,

and

India.

Other well-known names of the dollar as a whole in denominations include ''greenmail'', ''green'', and ''dead presidents'', the latter of which referring to the deceased presidents pictured on most bills. Dollars in general have also been known as ''bones'' (e.g. "twenty bones" = $20). The newer designs, with portraits displayed in the main body of the obverse (rather than in

cameo insets), upon paper color-coded by denomination, are sometimes referred to as ''bigface'' notes or ''

Monopoly money''.

''

Piastre

The piastre or piaster () is any of a number of units of currency. The term originates from the Italian for "thin metal plate". The name was applied to Spanish and Hispanic American pieces of eight, or pesos, by Venice, Venetian traders in the ...

'' was the original French word for the U.S. dollar, used for example in the French text of the

Louisiana Purchase. Though the U.S. dollar is called ''dollar'' in Modern French, the term ''piastre'' is still used among the speakers of

Cajun French and

New England French

New England French (french: français de Nouvelle-Angleterre) is a variety of French spoken in the New England region of the United States. It descends from Canadian French because it originally came from French Canadians who immigrated to New Eng ...

, as well as speakers in

Haiti

Haiti (; ht, Ayiti ; French: ), officially the Republic of Haiti (); ) and formerly known as Hayti, is a country located on the island of Hispaniola in the Greater Antilles archipelago of the Caribbean Sea, east of Cuba and Jamaica, and ...

and other

French-speaking Caribbean islands.

Nicknames specific to denomination:

* The

quarter dollar

The term "quarter dollar" refers to a quarter-unit of several currencies that are named " dollar". One dollar ( $1) is normally divided into subsidiary currency of 100 cents, so a quarter dollar is equal to 25 cents. These quarter dollars (aka q ...

coin is known as ''two bits'', betraying the dollar's origins as the "piece of eight" (bits or ''reales'').

* The

$1 bill is nicknamed ''buck'' or ''single''.

* The infrequently-used

$2 bill is sometimes called ''deuce'', ''Tom'', or ''Jefferson'' (after

Thomas Jefferson).

* The

$5 bill is sometimes called ''Lincoln'', ''fin'', ''fiver'', or ''five-spot''.

* The

$10 bill is sometimes called ''sawbuck'', ''ten-spot'', or ''Hamilton'' (after

Alexander Hamilton

Alexander Hamilton (January 11, 1755 or 1757July 12, 1804) was an American military officer, statesman, and Founding Father who served as the first United States secretary of the treasury from 1789 to 1795.

Born out of wedlock in Charlest ...

).

* The

$20 bill is sometimes called ''double sawbuck'', ''Jackson'' (after

Andrew Jackson), or ''

double eagle''.

* The

$50 bill is sometimes called a ''yardstick'', or a ''grant'', after President

Ulysses S. Grant

Ulysses S. Grant (born Hiram Ulysses Grant ; April 27, 1822July 23, 1885) was an American military officer and politician who served as the 18th president of the United States from 1869 to 1877. As Commanding General, he led the Union Ar ...

.

* The

$100 bill is called ''Benjamin'', ''Benji'', ''Ben'', or ''Franklin'', referring to its portrait of

Benjamin Franklin. Other nicknames include ''C-note'' (C being the

Roman numeral for 100), ''century note'', or ''bill'' (e.g. ''two bills'' = $200).

* Amounts or multiples of $1,000 are sometimes called ''

grand'' in colloquial speech, abbreviated in written form to ''G'', ''K'', or ''k'' (from

''kilo''; e.g. $10k = $10,000). Likewise, a ''large'' or ''stack'' can also refer to a multiple of $1,000 (e.g. "fifty large" = $50,000).

Dollar sign

The symbol , usually written before the numerical amount, is used for the U.S. dollar (as well as for many other currencies). The sign was the result of a late 18th-century evolution of the

scribal abbreviation ''p

s'' for the

peso, the common name for the

Spanish dollars that were in wide circulation in the

New World from the 16th to the 19th centuries. The ''p'' and the ''s'' eventually came to be written over each other giving rise to ''$''.

Another popular explanation is that it is derived from the

Pillars of Hercules on the

Spanish Coat of arms of the

Spanish dollar. These

Pillars of Hercules on the silver Spanish dollar coins take the form of two vertical bars (, , ) and a swinging cloth band in the shape of an ''S''.

Yet another explanation suggests that the dollar sign was formed from the capital letters ''U'' and ''S'' written or printed one on top of the other. This theory, popularized by novelist

Ayn Rand

Alice O'Connor (born Alisa Zinovyevna Rosenbaum;, . Most sources transliterate her given name as either ''Alisa'' or ''Alissa''. , 1905 – March 6, 1982), better known by her pen name Ayn Rand (), was a Russian-born American writer and p ...

in ''

Atlas Shrugged

''Atlas Shrugged'' is a 1957 novel by Ayn Rand. It was her longest novel, the fourth and final one published during her lifetime, and the one she considered her '' magnum opus'' in the realm of fiction writing. ''Atlas Shrugged'' includes eleme ...

'', does not consider the fact that the symbol was already in use before the formation of the United States.

History

Origins: the Spanish dollar

The U.S. dollar was introduced at par with the Spanish-American

silver dollar (or ''Spanish peso'', ''Spanish milled dollar'', ''eight-real coin'', ''piece-of-eight''). The latter was produced from the rich silver mine output of

Spanish America; minted in

Mexico City,

Potosí

Potosí, known as Villa Imperial de Potosí in the colonial period, is the capital city and a municipality of the Department of Potosí in Bolivia. It is one of the highest cities in the world at a nominal . For centuries, it was the location o ...

(Bolivia),

Lima (Peru) and elsewhere; and was in wide circulation throughout the Americas, Asia and Europe from the 16th to 19th centuries. The minting of machine-milled Spanish dollars since 1732 boosted its worldwide reputation as a trade coin and positioned it to be model for the new currency of the

United States.

Even after the

United States Mint commenced issuing coins in 1792, locally minted ''dollars'' and ''cents'' were less abundant in circulation than

Spanish American ''pesos'' and ''reales''; hence Spanish, Mexican and American dollars all remained legal tender in the United States until the

Coinage Act of 1857. In particular, Colonists' familiarity with the Spanish two-''real quarter peso'' was the reason for issuing a quasi-decimal

25-cent quarter dollar coin rather than a 20-cent coin.

For the relationship between the

Spanish dollar and the individual state colonial currencies, see

Connecticut pound

The pound was the currency of Connecticut until 1793. Initially, sterling coin circulated along with foreign currencies. This was supplemented by local paper money from 1709. Although the local currency was denominated in £sd, it was worth less ...

,

Delaware pound

The pound was the currency of Delaware until 1793. Initially, sterling coin circulated along with foreign currencies. This was supplemented by local paper money from 1723. Although the local currency was denominated in £sd, it was worth less tha ...

,

Georgia pound,

Maryland pound

The pound (later dollar) was the currency of Maryland from 1733 until its gradual replacement with the Continental currency and later the United States dollar between the American Revolution and the early 1800s. Initially, sterling coin circulat ...

,

Massachusetts pound,

New Hampshire pound

The pound was the currency of New Hampshire until 1793. Initially, sterling coin circulated, supplemented from 1709 by local paper money. These notes were denominated in £sd but were worth less than sterling, with 1 New Hampshire shilling = 9 pen ...

,

New Jersey pound

The pound was the currency of New Jersey until 1793. Initially, sterling coin and some foreign currencies circulated, supplemented from 1709 by local paper money. Although the notes were denominated in £sd, they were worth less than sterling. A ...

,

New York pound,

North Carolina pound

The pound (symbol: £) was the currency of North Carolina until 1793. Initially, sterling coin circulated, supplemented from 1709 by the introduction of colonial currency denominated in pounds, shillings and pence in 1712. The North Carolina ...

,

Pennsylvania pound

The pound was the currency of Pennsylvania until 1793. It was created as a response to the global economic downturn caused by the collapse of the South Sea Company. Initially, Pound sterling, sterling and certain foreign coins circulated, suppleme ...

,

Rhode Island pound,

South Carolina pound

The pound was the currency of South Carolina until 1793. Initially, sterling coin circulated, supplemented from 1703 by local paper money.Newman, 2008, p. 405. Although these notes were denominated in £sd, they were worth less than sterling, w ...

, and

Virginia pound

The pound was the currency of Virginia until 1793. Initially, Pound sterling, sterling coin circulated along with foreign currencies, supplemented from 1755 by local paper money.Newman, 2008, p. 437. Although these notes were denominated in £sd ...

.

Coinage Act of 1792

On July 6, 1785, the

Continental Congress

The Continental Congress was a series of legislative bodies, with some executive function, for thirteen of Britain's colonies in North America, and the newly declared United States just before, during, and after the American Revolutionary War. ...

resolved that the money unit of the United States, the dollar, would contain 375.64

grains of fine silver; on August 8, 1786, the Continental Congress continued that definition and further resolved that the money of account, corresponding with the division of coins, would proceed in a

decimal ratio, with the sub-units being mills at 0.001 of a dollar, cents at 0.010 of a dollar, and dimes at 0.100 of a dollar.

After the adoption of the

United States Constitution

The Constitution of the United States is the Supremacy Clause, supreme law of the United States, United States of America. It superseded the Articles of Confederation, the nation's first constitution, in 1789. Originally comprising seven ar ...

, the U.S. dollar was defined by the

Coinage Act of 1792. It specified a "dollar" based on the

Spanish milled dollar

The Spanish dollar, also known as the piece of eight ( es, Real de a ocho, , , or ), is a silver coin of approximately diameter worth eight Spanish reales. It was minted in the Spanish Empire following a monetary reform in 1497 with content ...

to contain

grain

A grain is a small, hard, dry fruit (caryopsis) – with or without an attached hull layer – harvested for human or animal consumption. A grain crop is a grain-producing plant. The two main types of commercial grain crops are cereals and legum ...

s of fine silver, or of "standard silver" of fineness 371.25/416 = 89.24%; as well as an "eagle" to contain grains of fine gold, or of 22

karat or 91.67% fine gold.

Alexander Hamilton

Alexander Hamilton (January 11, 1755 or 1757July 12, 1804) was an American military officer, statesman, and Founding Father who served as the first United States secretary of the treasury from 1789 to 1795.

Born out of wedlock in Charlest ...

arrived at these numbers based on a treasury assay of the average fine silver content of a selection of worn

Spanish dollars, which came out to be 371 grains. Combined with the prevailing gold-silver ratio of 15, the standard for gold was calculated at 371/15 = 24.73 grains fine gold or 26.98 grains 22K gold. Rounding the latter to 27.0 grains finalized the dollar's standard to 24.75 grains of fine gold or 24.75*15 = 371.25 grains = 24.0566 grams = 0.7735 troy ounces of fine silver.

The same coinage act also set the value of an eagle at 10 dollars, and the dollar at eagle. It called for silver coins in denominations of 1, , , , and dollar, as well as gold coins in denominations of 1, and eagle. The value of gold or silver contained in the dollar was then converted into relative value in the economy for the buying and selling of goods. This allowed the value of things to remain fairly constant over time, except for the influx and outflux of gold and silver in the nation's economy.

Though a

Spanish dollar freshly minted after 1772 theoretically contained 417.7 grains of silver of fineness 130/144 (or 377.1 grains fine silver), reliable assays of the period in fact confirmed a fine silver content of for the average Spanish dollar in circulation.

The new U.S. silver dollar of therefore compared favorably and was received at par with the Spanish dollar for foreign payments, and after 1803 the

United States Mint had to suspend making this coin out of its limited resources since it failed to stay in domestic circulation. It was only after Mexican independence in 1821 when their peso's fine silver content of 377.1 grains was firmly upheld, which the U.S. later had to compete with using a heavier

Trade dollar coin.

Design

The early currency of the United States did not exhibit faces of presidents, as is the custom now; although today, by law, only the portrait of a deceased individual may appear on United States currency. In fact, the newly formed government was against having portraits of leaders on the currency, a practice compared to the policies of European monarchs. The currency as we know it today did not get the faces they currently have until after the early 20th century; before that "heads" side of coinage used profile faces and striding, seated, and standing figures from Greek and Roman mythology and composite Native Americans. The last coins to be converted to profiles of historic Americans were the dime (1946) and the Dollar (1971).

Continental currency

After the

American Revolution, the

thirteen colonies became

independent. Freed from British monetary regulations, they each issued

£sd paper money to pay for military expenses. The

Continental Congress

The Continental Congress was a series of legislative bodies, with some executive function, for thirteen of Britain's colonies in North America, and the newly declared United States just before, during, and after the American Revolutionary War. ...

also began issuing "Continental Currency" denominated in Spanish dollars. For its value relative to states' currencies, see

Early American currency.

Continental currency

depreciated badly during the war, giving rise to the famous phrase "not worth a continental". A primary problem was that monetary policy was not coordinated between Congress and the states, which continued to issue bills of credit. Additionally, neither Congress nor the governments of the several states had the will or the means to retire the bills from circulation through taxation or the sale of bonds. The currency was ultimately replaced by the silver dollar at the rate of 1 silver dollar to 1000 continental dollars. It gave rise to the phrase "not worth a continental", and was responsible for the clause in

article 1, section 10 of the

United States Constitution

The Constitution of the United States is the Supremacy Clause, supreme law of the United States, United States of America. It superseded the Articles of Confederation, the nation's first constitution, in 1789. Originally comprising seven ar ...

which reads: "No state shall... make anything but gold and silver coin a tender in payment of debts".

Silver and gold standards, 19th century

From implementation of the 1792

Mint Act

The Coinage Act of 1792 (also known as the Mint Act; officially: ''An act establishing a mint, and regulating the Coins of the United States''), passed by the United States Congress on April 2, 1792, created the United States dollar as the countr ...

to the 1900 implementation of the

gold standard the dollar was on a

bimetallic silver-and-gold standard, defined as either 371.25

grains (24.056 g) of fine silver or 24.75 grains of fine gold (gold-silver ratio 15).

Subsequent to the

Coinage Act of 1834

The Coinage Act of 1834 was passed by the United States Congress on June 28, 1834. It raised the silver-to-gold weight ratio from its 1792 level of 15:1 (established by the Coinage Act of 1792) to 16:1 thus setting the mint price for silver at a le ...

the dollar's fine gold equivalent was revised to 23.2 grains; it was slightly adjusted to in 1837 (gold-silver ratio ~16). The same act also resolved the difficulty in minting the "standard silver" of 89.24% fineness by revising the dollar's alloy to 412.5 grains, 90% silver, still containing 371.25 grains fine silver. Gold was also revised to 90% fineness: 25.8 grains gross, 23.22 grains fine gold.

Following the rise in the price of silver during the

California Gold Rush

The California Gold Rush (1848–1855) was a gold rush that began on January 24, 1848, when gold was found by James W. Marshall at Sutter's Mill in Coloma, California. The news of gold brought approximately 300,000 people to California fro ...

and the disappearance of circulating silver coins, the

Coinage Act of 1853 reduced the standard for silver coins less than $1 from 412.5 grains to , 90% silver per 100 cents (slightly revised to 25.0 g, 90% silver in 1873). The Act also limited the

free silver

Free silver was a major economic policy issue in the United States in the late 19th-century. Its advocates were in favor of an expansionary monetary policy featuring the unlimited coinage of silver into money on-demand, as opposed to strict adhe ...

right of individuals to convert

bullion

Bullion is non-ferrous metal that has been refined to a high standard of elemental purity. The term is ordinarily applied to bulk metal used in the production of coins and especially to precious metals such as gold and silver. It comes from t ...

into only one coin, the silver dollar of 412.5 grains; smaller coins of lower standard can only be produced by the

United States Mint using its own bullion.

Summary and

links to coins issued in the 19th century:

* In base metal:

1/2 cent,

1 cent,

5 cents.

* In silver:

half dime,

dime,

quarter dollar

The term "quarter dollar" refers to a quarter-unit of several currencies that are named " dollar". One dollar ( $1) is normally divided into subsidiary currency of 100 cents, so a quarter dollar is equal to 25 cents. These quarter dollars (aka q ...

,

half dollar,

silver dollar.

* In gold:

gold $1,

$2.50 quarter eagle,

$5 half eagle,

$10 eagle,

$20 double eagle

* Less common denominations:

bronze 2 cents,

nickel 3 cents,

silver 3 cents,

silver 20 cents,

gold $3.

Note issues, 19th century

In order to finance the

War of 1812, Congress authorized the issuance of

Treasury Note

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. gov ...

s, interest-bearing short-term debt that could be used to pay public dues. While they were intended to serve as debt, they did function "to a limited extent" as money. Treasury Notes were again printed to help resolve the reduction in public revenues resulting from the

Panic of 1837

The Panic of 1837 was a financial crisis in the United States that touched off a major depression, which lasted until the mid-1840s. Profits, prices, and wages went down, westward expansion was stalled, unemployment went up, and pessimism abound ...

and the

Panic of 1857

The Panic of 1857 was a financial panic in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph by Samuel F. Morse in 1844, the Panic of 1857 was ...

, as well as to help finance the

Mexican–American War and the

Civil War.

Paper money was issued again in 1862 without the backing of precious metals due to the

Civil War. In addition to Treasury Notes, Congress in 1861 authorized the Treasury to borrow $50 million in the form of

Demand Notes

A Demand Note is a type of United States paper money that was issued between August 1861 and April 1862 during the American Civil War in denominations of 5, 10, and 20 . Demand Notes were the first issue of paper money by the United States ...

, which did not bear interest but could be redeemed on demand for precious metals. However, by December 1861, the

Union government's supply of specie was outstripped by demand for redemption and they were forced to suspend redemption temporarily. In February 1862 Congress passed the

''Legal Tender Act of 1862'', issuing

United States Notes

A United States Note, also known as a Legal Tender Note, is a type of paper money that was issued from 1862 to 1971 in the U.S. Having been current for 109 years, they were issued for longer than any other form of U.S. paper money. They were k ...

, which were not redeemable on demand and bore no interest, but were

legal tender, meaning that creditors had to accept them at face value for any payment except for public debts and import tariffs. However, silver and gold coins continued to be issued, resulting in the depreciation of the newly printed notes through

Gresham's Law. In 1869, Supreme Court ruled in

Hepburn v. Griswold

''Hepburn v. Griswold'', 75 U.S. (8 Wall.) 603 (1870), was a United States Supreme Court case in which the Chief Justice of the United States, Salmon P. Chase, speaking for the Court, declared certain parts of the Legal Tender Acts to be uncons ...

that Congress could not require creditors to accept United States Notes, but overturned that ruling the next year in the

Legal Tender Cases

The ''Legal Tender Cases'' were two 1871 Supreme Court of the United States, United States Supreme Court cases that affirmed the constitutionality of banknote, paper money. The two cases were ''Knox v. Lee'' and ''Parker v. Davis''.

The U.S. fede ...

. In 1875, Congress passed the ''

Specie Payment Resumption Act'', requiring the Treasury to allow U.S. Notes to be redeemed for gold after January 1, 1879.

Gold standard, 20th century

Though the dollar came under the

gold standard ''de jure'' only after 1900, the

bimetallic era was ended ''de facto'' when the

Coinage Act of 1873 suspended the minting of the standard

silver dollar of 412.5 grains (26.73 g = 0.8595 oz t), the only fully legal tender coin that individuals could convert bullion into in unlimited (or

Free silver

Free silver was a major economic policy issue in the United States in the late 19th-century. Its advocates were in favor of an expansionary monetary policy featuring the unlimited coinage of silver into money on-demand, as opposed to strict adhe ...

) quantities, and right at the onset of the

silver rush

A silver rush is the silver-mining equivalent of a gold rush, where the discovery of silver-bearing ore sparks a mass migration of individuals seeking wealth in the new mining region.

Notable silver rushes have taken place in Mexico, Chile, the U ...

from the

Comstock Lode in the 1870s. This was the so-called "Crime of '73".

The ''

Gold Standard Act'' of 1900 repealed the U.S. dollar's historic link to silver and defined it solely as of fine gold (or $20.67 per

troy ounce of 480 grains). In 1933, gold coins were confiscated by

Executive Order 6102 under

Franklin D. Roosevelt, and in 1934 the standard was changed to $35 per troy ounce fine gold, or per dollar.

After 1968 a series of revisions to the gold peg was implemented, culminating in the

Nixon Shock of August 15, 1971, which suddenly ended the convertibility of dollars to gold. The U.S. dollar has since floated freely on the

foreign exchange market

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspec ...

s.

Federal Reserve Notes, 20th century to present

Congress continued to issue paper money after the Civil War, the latest of which is the

Federal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 ...

that was authorized by the

Federal Reserve Act of 1913

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Pani ...

. Since the discontinuation of all other types of notes (Gold Certificates in 1933, Silver Certificates in 1963, and United States Notes in 1971), U.S. dollar notes have since been issued exclusively as

Federal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 ...

s.

Emergence as reserve currency

The U.S. dollar first emerged as an important international

reserve currency

A reserve currency (or anchor currency) is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international tran ...

in the 1920s, displacing the British

pound sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and t ...

as it emerged from the

First World War relatively unscathed and since the United States was a significant recipient of wartime gold inflows. After the United States emerged as an even stronger global

superpower

A superpower is a state with a dominant position characterized by its extensive ability to exert influence or project power on a global scale. This is done through the combined means of economic, military, technological, political and cultural s ...

during the

Second World War, the

Bretton Woods Agreement of 1944 established the U.S. dollar as the world's primary reserve currency and the only post-war currency linked to gold. Despite all links to gold being severed in 1971, the dollar continues to be the world's foremost reserve currency for international trade to this day.

The Bretton Woods Agreement of 1944 also defined the post-World War II monetary order and relations among modern-day

independent states, by setting up a system of rules, institutions, and procedures to regulate the

international monetary system. The agreement founded the

International Monetary Fund and other institutions of the modern-day

World Bank Group, establishing the infrastructure for conducting international payments and accessing the global capital markets using the U.S. dollar.

The

monetary policy of the United States is conducted by the

Federal Reserve System, which acts as the nation's

central bank. It was founded in 1913 under the

Federal Reserve Act in order to furnish an elastic currency for the United States and to supervise its banking system, particularly in the aftermath of the

Panic of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange fell almost 50% from ...

.

For most of the post-war period, the

U.S. government

The federal government of the United States (U.S. federal government or U.S. government) is the national government of the United States, a federal republic located primarily in North America, composed of 50 states, a city within a fede ...

has financed its own spending by borrowing heavily from the dollar-lubricated global capital markets, in debts denominated in its own currency and at minimal interest rates. This ability to borrow heavily without facing a significant

balance of payments crisis

A currency crisis is a type of financial crisis, and is often associated with a real economic crisis. A currency crisis raises the probability of a banking crisis or a default crisis. During a currency crisis the value of foreign denominated deb ...

has been described as the

United States's

exorbitant privilege

The term exorbitant privilege (''privilège exorbitant'' in French) refers to the benefits the United States has due to its own currency (the US dollar) being the international reserve currency. For example, the US would not face a balance of pa ...

.

Coins

The

United States Mint has issued legal tender coins every year from 1792 to the present. From 1934 to the present, the only denominations produced for circulation have been the familiar penny, nickel, dime, quarter, half dollar, and dollar.

Gold and silver coins have been previously minted for general circulation from the 18th to the 20th centuries. The last gold coins were minted in 1933. The last 90% silver coins were minted in 1964, and the last 40% silver half dollar was minted in 1970.

The

United States Mint currently produces circulating coins at the

Philadelphia and

Denver Mints, and commemorative and proof coins for collectors at the

San Francisco and

West Point Mints. Mint mark conventions for these and for past mint branches are discussed in ''

Coins of the United States dollar#Mint marks''.

The

one-dollar coin has never been in popular circulation from 1794 to present, despite several attempts to increase their usage since the 1970s, the most important reason of which is the continued production and popularity of the

one-dollar bill.

Half dollar coins were commonly used currency since inception in 1794, but has fallen out of use from the mid-1960s when all silver half dollars began to be hoarded.

The

nickel is the only coin whose size and composition (5 grams, 75% copper, and 25% nickel) is still in use from 1865 to today, except for wartime 1942-1945

Jefferson nickels which contained silver.

Due to the penny's low value, some

efforts have been made to eliminate the penny as circulating coinage.

For a discussion of other discontinued and canceled denominations, see ''

Obsolete denominations of United States currency#Coinage'' and ''

Canceled denominations of United States currency#Coinage''.

Collector coins

Collector coins are technically legal tender at face value but are usually worth far more due to their numismatic value or for their precious metal content. These include:

*

American Eagle bullion coins American Eagle bullion coins are produced by the United States Mint.

These include:

* American Silver Eagle

* American Gold Eagle

* American Platinum Eagle

The American Platinum Eagle is the official platinum bullion coin of the United States. ...

**

American Silver Eagle $1 (1

troy oz

Troy weight is a system of units of mass that originated in 15th-century England, and is primarily used in the precious metals industry. The troy weight units are the grain, the pennyweight (24 grains), the troy ounce (20 pennyweights), and t ...

) Silver bullion coin 1986–present

**

American Gold Eagle $5 ( troy oz), $10 ( troy oz), $25 ( troy oz), and $50 (1 troy oz) Gold bullion coin 1986–present

**

American Platinum Eagle $10 ( troy oz), $25 ( troy oz), $50 ( troy oz), and $100 (1 troy oz) Platinum bullion coin 1997–present

**

American Palladium Eagle

The American Palladium Eagle is the official palladium bullion coin of the United States. Each coin has a face value of $25 and is composed of 99.95% fine palladium, with 1 troy ounce actual palladium weight.

History

The Palladium Eagle was aut ...

$25 (1 troy oz) Palladium bullion coin 2017–present

*

United States commemorative coins—special issue coins, among these:

**

$50.00 (Half Union) minted for the

Panama-Pacific International Exposition (1915)

**Silver proof sets minted since 1992 with dimes, quarters and half-dollars made of silver rather than the standard copper-nickel

**

Presidential dollar coins proof sets minted since 2007

Banknotes

The

U.S. Constitution provides that Congress shall have the power to "borrow money on the credit of the United States." Congress has exercised that power by authorizing

Federal Reserve Banks

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve A ...

to issue

Federal Reserve Notes

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 ...

. Those notes are "obligations of the United States" and "shall be redeemed in lawful money on demand at the Treasury Department of the United States, in the city of Washington, District of Columbia, or at any Federal Reserve bank". Federal Reserve Notes are designated by law as "

legal tender" for the payment of debts. Congress has also authorized the issuance of

more than 10 other types of banknotes, including the

United States Note and the

Federal Reserve Bank Note

Federal Reserve Bank Notes are banknotes that are legal tender in the United States issued between 1915 and 1934, together with United States Notes, Silver Certificates, Gold Certificates, National Bank Notes and Federal Reserve Notes. They were ...

. The Federal Reserve Note is the only type that remains in circulation since the 1970s.

Federal Reserve Notes

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 ...

are printed by the

Bureau of Engraving and Printing and are made from

cotton fiber paper (as opposed to

wood fiber used to make common paper). The "

large-sized notes" issued before 1928 measured , while

small-sized note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 ...

s introduced that year measure . The dimensions of the modern (small-size) U.S. currency is identical to the size of

Philippine peso banknotes issued under United States administration after 1903, which had proven highly successful. The American large-note bills became known as "horse blankets" or "saddle blankets."

Currently printed denominations are

$1,

$2,

$5,

$10,

$20,

$50 There are many $50 banknotes, bills, or coins, including:

* Australian fifty-dollar note

* Canadian fifty-dollar bill

* New Zealand fifty-dollar note

* United States fifty-dollar bill

* Nicaraguan fifty-cordoba note

* Hong Kong fifty-dollar note ...

, and

$100. Notes above the $100 denomination stopped being printed in 1946 and were officially withdrawn from circulation in 1969. These notes were used primarily in inter-bank transactions or by

organized crime; it was the latter usage that prompted President

Richard Nixon to issue an executive order in 1969 halting their use. With the advent of electronic banking, they became less necessary. Notes in denominations of $500, $1,000, $5,000, $10,000, and $100,000 were all produced at one time; see

large denomination bills in U.S. currency

Large denominations of United States currency greater than were circulated by the United States Treasury until 1969. Since then, U.S. dollar banknotes have only been issued in seven denominations: $1, $2, $5, $10, $20, $50, and $100.

Overvi ...

for details. With the exception of the $100,000 bill (which was only issued as a Series 1934 Gold Certificate and was never publicly circulated; thus it is illegal to own), these notes are now collectors' items and are worth more than their face value to collectors.

Though still predominantly green, the post-2004 series incorporate other colors to better distinguish different denominations. As a result of a 2008 decision in an accessibility lawsuit filed by the

American Council of the Blind

The American Council of the Blind (ACB) is a nationwide organization in the United States. It is an organization mainly made up of blind and visually impaired people who want to achieve independence and equality (although there are many sighted m ...

, the

Bureau of Engraving and Printing is planning to implement a raised tactile feature in the next redesign of each note, except the $1 and the current version of the $100 bill. It also plans larger, higher-contrast numerals, more color differences, and distribution of currency readers to assist the visually impaired during the transition period.

Countries that use US dollar

Formal

*

*

*

*

*

*

*

*

*

*

Informal

*

*

*

*

*

*

*

*

*

*

*

Monetary policy

The

Federal Reserve Act created the

Federal Reserve System in 1913 as the

central bank of the

United States. Its primary task is

to conduct the nation's

monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy. It is also tasked to promote the stability of the financial system and regulate financial institutions, and to act as

lender of last resort.

The

Monetary policy of the United States is conducted by the

Federal Open Market Committee, which is composed of the

Federal Reserve Board of Governors and 5 out of the 12 Federal Reserve Bank presidents, and is implemented by all twelve regional

Federal Reserve Banks.

Monetary policy refers to actions made by central banks that determine the size and growth rate of the

money supply available in the economy, and which would result in desired objectives like low inflation, low unemployment, and stable financial systems. The economy's aggregate

money supply is the total of

* M0 money, or Monetary Base - "dollars" in currency and

bank money

Demand deposits or checkbook money are funds held in demand accounts in commercial banks. These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country. Simply put, these are depo ...

balances credited to the central bank's depositors, which are backed by the central bank's assets,

* plus M1, M2, M3 money - "dollars" in the form of

bank money

Demand deposits or checkbook money are funds held in demand accounts in commercial banks. These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country. Simply put, these are depo ...

balances credited to banks' depositors, which are backed by the bank's assets and investments.

The FOMC influences the level of money available to the economy by the following means:

* Reserve requirements - specifies a required minimum percentage of deposits in a

commercial bank that should be held as a reserve (i.e. as deposits with the Federal Reserve), with the rest available to loan or invest. Higher requirements mean less money loaned or invested, helping keep inflation in check. Raising the

federal funds rate earned on those reserves also helps achieve this objective.

* Open market operations - the Federal Reserve buys or sells

US Treasury bonds

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. gov ...

and other securities held by banks in exchange for reserves; more reserves increase a bank's capacity to loan or invest elsewhere.

* Discount window lending - banks can borrow from the Federal Reserve.

Monetary policy directly affects interest rates; it indirectly affects stock prices, wealth, and currency exchange rates. Through these channels, monetary policy influences spending, investment, production, employment, and inflation in the United States. Effective

monetary policy complements

fiscal policy to support economic growth.

The adjusted monetary base has increased from approximately $400 billion in 1994, to $800 billion in 2005, and to over $3 trillion in 2013.

When the Federal Reserve makes a purchase, it credits the seller's reserve account (with the Federal Reserve). This money is not transferred from any existing funds—it is at this point that the Federal Reserve has created new

high-powered money. Commercial banks then decide how much money to keep in deposit with the Federal Reserve and how much to hold as physical currency. In the latter case, the Federal Reserve places an order for printed money from the U.S. Treasury Department. The Treasury Department, in turn, sends these requests to the Bureau of Engraving and Printing (to print new

dollar bills) and the Bureau of the Mint (to stamp the coins).

The Federal Reserve's monetary policy objectives to keep prices stable and unemployment low is often called the ''dual mandate''. This replaces past practices under a

gold standard where the main concern is the gold equivalent of the local currency, or under a gold exchange standard where the concern is fixing the exchange rate versus another gold-convertible currency (previously practiced worldwide under the

Bretton Woods Agreement of 1944 via fixed exchange rates to the U.S. dollar).

International use as reserve currency

Ascendancy

The primary currency used for global trade between

Europe,

Asia, and

the Americas

The Americas, which are sometimes collectively called America, are a landmass comprising the totality of North America, North and South America. The Americas make up most of the land in Earth's Western Hemisphere and comprise the New World. ...

has historically been the Spanish-American

silver dollar, which created a global

silver standard system from the 16th to 19th centuries, due to abundant silver supplies in

Spanish America.

The U.S. dollar itself was derived from this coin. The

Spanish dollar was later displaced by the British

pound sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and t ...

in the advent of the international

gold standard in the last quarter of the 19th century.

The U.S. dollar began to displace the

pound sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and t ...

as international

reserve currency

A reserve currency (or anchor currency) is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international tran ...

from the 1920s since it emerged from the

First World War relatively unscathed and since the

United States was a significant recipient of wartime gold inflows.

After the U.S. emerged as an even stronger global

superpower

A superpower is a state with a dominant position characterized by its extensive ability to exert influence or project power on a global scale. This is done through the combined means of economic, military, technological, political and cultural s ...

during the

Second World War, the

Bretton Woods Agreement of 1944 established the post-war international monetary system, with the U.S. dollar ascending to become the world's primary

reserve currency

A reserve currency (or anchor currency) is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international tran ...

for international trade, and the only post-war currency linked to gold at $35 per

troy ounce.

As international reserve currency

The U.S. dollar is joined by the world's other major currencies - the

euro,

pound sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and t ...

,

Japanese yen

The is the official currency of Japan. It is the third-most traded currency in the foreign exchange market, after the United States dollar (US$) and the euro. It is also widely used as a third reserve currency after the US dollar and the ...

and Chinese

renminbi

The renminbi (; symbol: ¥; ISO code: CNY; abbreviation: RMB) is the official currency of the People's Republic of China and one of the world's most traded currencies, ranking as the fifth most traded currency in the world as of April 2022. ...

- in the currency basket of the

special drawing rights of the

International Monetary Fund. Central banks worldwide have huge reserves of U.S. dollars in their holdings and are significant buyers of

U.S. treasury bills and notes.

Foreign companies, entities, and private individuals hold U.S. dollars in foreign deposit accounts called

eurodollars (not to be confused with the

euro), which are outside the jurisdiction of the

Federal Reserve System. Private individuals also hold dollars outside the banking system mostly in the form of

US$100 bills, of which 80% of its supply is held overseas.

The

United States Department of the Treasury exercises considerable oversight over the

SWIFT financial transfers network, and consequently has a huge sway on the global

financial transaction

A financial transaction is an agreement, or communication, between a buyer and seller to exchange goods, services, or assets for payment. Any transaction involves a change in the status of the finances of two or more businesses or individuals. A ...

s systems, with the ability to impose sanctions on foreign entities and individuals.

In the global markets

The U.S. dollar is predominantly the standard currency unit in which goods are quoted and traded, and with which payments are settled in, in the global

commodity markets. The

U.S. Dollar Index is an important indicator of the dollar's strength or weakness versus a basket of six foreign currencies.

The

United States Government is capable of borrowing trillions of dollars from the global capital markets in U.S. dollars issued by the

Federal Reserve, which is itself under U.S. government purview, at minimal interest rates, and with virtually zero default risk. In contrast, foreign governments and corporations incapable of raising money in their own local currencies are forced to issue debt denominated in U.S. dollars, along with its consequent higher interest rates and risks of default.

The United States's ability to borrow in its own currency without facing a significant balance of payments crisis has been frequently described as its

exorbitant privilege

The term exorbitant privilege (''privilège exorbitant'' in French) refers to the benefits the United States has due to its own currency (the US dollar) being the international reserve currency. For example, the US would not face a balance of pa ...

.

A frequent topic of debate is whether the

strong dollar policy

The strong dollar policy is the United States economic policy based on the assumption that a strong exchange rate of the United States dollar (where a smaller dollar amount is needed to buy the same amount of other currency than would otherwise be ...

of the United States is indeed in America's own best interests, as well as in the best interest of the

international community

The international community is an imprecise phrase used in geopolitics and international relations to refer to a broad group of people and governments of the world.

As a rhetorical term

Aside from its use as a general descriptor, the term is ...

.

Currencies fixed to the U.S. dollar

For a more exhaustive discussion of countries using the U.S. dollar as official or customary currency, or using currencies which are pegged to the U.S. dollar, see ''

International use of the U.S. dollar#Dollarization and fixed exchange rates'' and ''

Currency substitution#US dollar''.

Countries using the U.S. dollar as their official currency include:

* In the Americas:

Panama,

Ecuador,

El Salvador

El Salvador (; , meaning " The Saviour"), officially the Republic of El Salvador ( es, República de El Salvador), is a country in Central America. It is bordered on the northeast by Honduras, on the northwest by Guatemala, and on the south b ...

,

British Virgin Islands,

Turks and Caicos Islands, and the

Caribbean Netherlands.

* The constituent states of the former

Trust Territory of the Pacific Islands:

Palau, the

Federated States of Micronesia, and the

Marshall Islands.

* Others:

East Timor.

Among the countries using the U.S. dollar together with other foreign currencies and their local currency are

Cambodia and

Zimbabwe.

Currencies pegged to the U.S. dollar include:

* In the Caribbean: the

Bahamian dollar,

Barbadian dollar,

Belize dollar,

Bermudan dollar

The Bermudian dollar ( symbol: $; code: BMD; also abbreviated BD$; informally called the Bermuda dollar) is the official currency of the British Overseas Territory of Bermuda. It is subdivided into 100 cents. The Bermudian dollar is n ...

,

Cayman Islands dollar,

East Caribbean dollar,

Netherlands Antillean guilder

The Netherlands Antillean guilder ( nl, gulden) is the currency of Curaçao and Sint Maarten, which until 2010 formed the Netherlands Antilles along with Bonaire, Saba, and Sint Eustatius. It is subdivided into 100 ''cents'' (Dutch plural form: ...

and the

Aruban florin.

* The currencies of five oil-producing Arab countries: the

Saudi riyal

The Saudi riyal ( ar, ريال سعودي ') is the currency of Saudi Arabia. It is abbreviated as

or SAR ''(Saudi Arabian Riyal)''. It is subdivided into 100 halalas ( ar, هللة '). The currency is pegged to the US dollar at a constant rate ...

,

United Arab Emirates dirham,

Omani rial,

Qatari riyal and the

Bahraini dinar.

* Others: the

Hong Kong dollar,

Macanese pataca,

Jordanian dinar

The Jordanian dinar ( ar, دينار أردني; ISO 4217, code: JOD; unofficially abbreviated as JD) has been the currency of Jordan since 1950. The dinar is divided into 10 dirhams, 100 qirsh (also called piastres) or 1000 fils (currency), fulu ...

,

Lebanese pound.

Value

The 6th paragraph of

Section 8 of Article 1 of the U.S. Constitution provides that the U.S. Congress shall have the power to "coin money" and to "regulate the value" of domestic and foreign coins. Congress exercised those powers when it enacted the

Coinage Act of 1792. That Act provided for the minting of the

first U.S. dollar and it declared that the U.S. dollar shall have "the value of a

Spanish milled dollar

The Spanish dollar, also known as the piece of eight ( es, Real de a ocho, , , or ), is a silver coin of approximately diameter worth eight Spanish reales. It was minted in the Spanish Empire following a monetary reform in 1497 with content ...

as the same is now current".

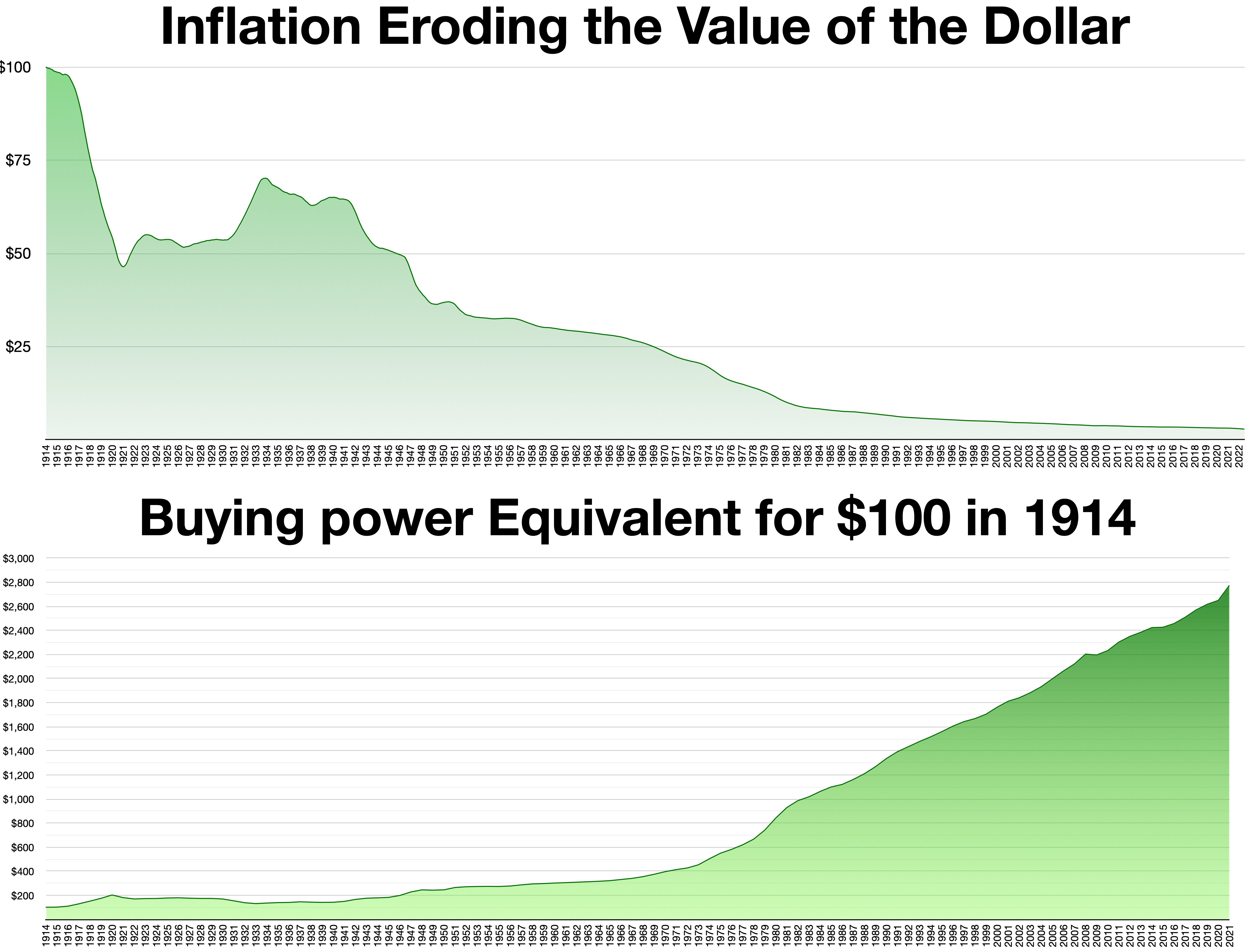

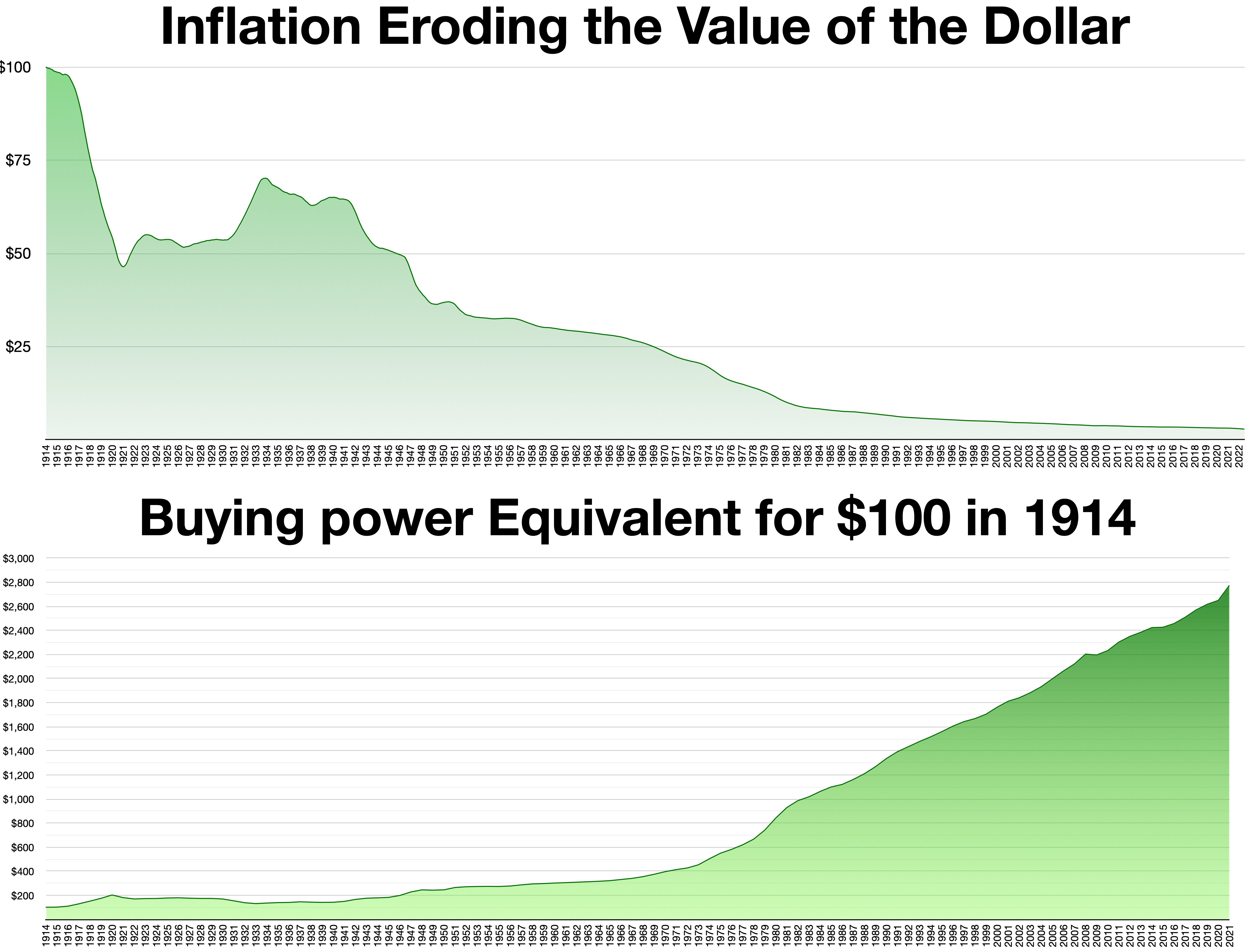

The table above shows the equivalent amount of goods that, in a particular year, could be purchased with $1. The table shows that from 1774 through 2012 the U.S. dollar has lost about 97.0% of its buying power.

The decline in the value of the U.S. dollar corresponds to

price inflation, which is a rise in the general level of prices of goods and services in an economy over a period of time. A

consumer price index

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time.

Overview

A CPI is a statistica ...

(CPI) is a measure estimating the average price of consumer goods and services purchased by households. The

United States Consumer Price Index, published by the

Bureau of Labor Statistics

The Bureau of Labor Statistics (BLS) is a unit of the United States Department of Labor. It is the principal fact-finding agency for the U.S. government in the broad field of labor economics and statistics and serves as a principal agency of t ...

, is a measure estimating the average price of consumer goods and services in the United States. It reflects inflation as experienced by consumers in their day-to-day living expenses. A graph showing the U.S. CPI relative to 1982–1984 and the annual year-over-year change in CPI is shown at right.

The value of the U.S. dollar declined significantly during wartime, especially during the

American Civil War, World War I, and World War II. The

Federal Reserve, which was established in 1913, was designed to furnish an "elastic" currency subject to "substantial changes of quantity over short periods", which differed significantly from previous forms of

high-powered money such as gold, national banknotes, and silver coins. Over the very long run, the prior gold standard kept prices stable—for instance, the price level and the value of the U.S. dollar in 1914 were not very different from the price level in the 1880s. The Federal Reserve initially succeeded in maintaining the value of the U.S. dollar and price stability, reversing the inflation caused by the First World War and stabilizing the value of the dollar during the 1920s, before presiding over a 30% deflation in U.S. prices in the 1930s.

Under the

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japan after the 1944 Bretton Woods Agreement. The Bretto ...

established after World War II, the value of gold was fixed to $35 per ounce, and the value of the U.S. dollar was thus anchored to the value of gold. Rising government spending in the 1960s, however, led to doubts about the ability of the United States to maintain this convertibility, gold stocks dwindled as banks and international investors began to convert dollars to gold, and as a result, the value of the dollar began to decline. Facing an emerging

currency crisis and the imminent danger that the United States would no longer be able to redeem dollars for gold, gold convertibility was finally terminated in 1971 by

President Nixon, resulting in the "

Nixon shock".

The value of the U.S. dollar was therefore no longer anchored to gold, and it fell upon the Federal Reserve to maintain the value of the U.S. currency. The Federal Reserve, however, continued to increase the money supply, resulting in

stagflation and a rapidly declining value of the U.S. dollar in the 1970s. This was largely due to the prevailing economic view at the time that inflation and real economic growth were linked (the

Phillips curve), and so inflation was regarded as relatively benign.

Between 1965 and 1981, the U.S. dollar lost two thirds of its value.

In 1979,

President Carter

James Earl Carter Jr. (born October 1, 1924) is an American politician who served as the 39th president of the United States from 1977 to 1981. A member of the Democratic Party, he previously served as the 76th governor of Georgia from 19 ...

appointed

Paul Volcker Chairman of the Federal Reserve. The Federal Reserve tightened the money supply and inflation was substantially lower in the 1980s, and hence the value of the U.S. dollar stabilized.

Over the thirty-year period from 1981 to 2009, the U.S. dollar lost over half its value.

This is because the Federal Reserve has targeted not zero inflation, but a low, stable rate of inflation—between 1987 and 1997, the rate of inflation was approximately 3.5%, and between 1997 and 2007 it was approximately 2%. The so-called "Great Moderation" of economic conditions since the 1970s is credited to monetary policy targeting price stability.

There is an ongoing debate about whether central banks should target zero inflation (which would mean a constant value for the U.S. dollar over time) or low, stable inflation (which would mean a continuously but slowly declining value of the dollar over time, as is the case now). Although some economists are in favor of a zero inflation policy and therefore a constant value for the U.S. dollar,

others contend that such a policy limits the ability of the central bank to control interest rates and stimulate the economy when needed.

Pegged currencies

*

Aruban florin

*

Bahamian dollar (at par)

*

Bahraini dinar (higher value)

*

Barbadian dollar

* Belarusian ruble (alongside Euro and Russian Ruble in currency basket)

*

Belize dollar

* Bermudian dollar (at par)

*

Cayman Islands dollar (higher value)

* Costa Rican colon

* Cuban peso

*

East Caribbean Dollar

* East Timor centavo coins (at par)

* Ecuadorian centavo coins (at par)

* Salvadoran colon

* Eritrean nakfa

* Guatemalan quetzal

* Haitian gourde

* Honduran lempira

*

Hong Kong dollar (narrow band)

* Iraqi dinar

*

Jordanian dinar

The Jordanian dinar ( ar, دينار أردني; ISO 4217, code: JOD; unofficially abbreviated as JD) has been the currency of Jordan since 1950. The dinar is divided into 10 dirhams, 100 qirsh (also called piastres) or 1000 fils (currency), fulu ...

(higher value)

* Kuwaiti dinar (higher value)

*

Lebanese pound

* Antillean guilder

* Nicaraguan cordoba

* Nigerian naira

*

Omani rial (higher value)

* Panamanian balboa (at par)

*

Qatari riyal

*

Saudi riyal

The Saudi riyal ( ar, ريال سعودي ') is the currency of Saudi Arabia. It is abbreviated as

or SAR ''(Saudi Arabian Riyal)''. It is subdivided into 100 halalas ( ar, هللة '). The currency is pegged to the US dollar at a constant rate ...

* Sierra Leonean leone

* Trinidad and Tobago dollar

*

United Arab Emirates dirham

* Yemeni rial (lower value)