U.S. savings bond on:

[Wikipedia]

[Google]

[Amazon]

United States savings bonds are

United States savings bonds are

On February 1, 1935, President

On February 1, 1935, President

are guaranteed to double in value over the purchase price when they mature 20 years from issuance, though they continue to earn interest for a total of 30 years. Interest accrues monthly, and is compounded semiannually, that is, becomes part of the principal for future interest earning calculations. If a bond's compounded interest does not meet the guaranteed doubling of the purchase price, Treasury will make a one-time adjustment to the maturity value at 20 years, giving it an effective rate of 3.5%. The bond will continue to earn the fixed rate for 10 more years. All interest is paid when the holder cashes the bond.

For bonds issued before May 2005, the interest rate was an adjustable rate recomputed every six months at 90% of the average five-year Treasury yield for the preceding six months. Bonds issued in May 2005 or later pay a fixed interest rate for the life of the bond.TreasuryDirect Savings Bond Rate Press Release

are guaranteed to double in value over the purchase price when they mature 20 years from issuance, though they continue to earn interest for a total of 30 years. Interest accrues monthly, and is compounded semiannually, that is, becomes part of the principal for future interest earning calculations. If a bond's compounded interest does not meet the guaranteed doubling of the purchase price, Treasury will make a one-time adjustment to the maturity value at 20 years, giving it an effective rate of 3.5%. The bond will continue to earn the fixed rate for 10 more years. All interest is paid when the holder cashes the bond.

For bonds issued before May 2005, the interest rate was an adjustable rate recomputed every six months at 90% of the average five-year Treasury yield for the preceding six months. Bonds issued in May 2005 or later pay a fixed interest rate for the life of the bond.TreasuryDirect Savings Bond Rate Press Release

/ref> Paper EE bonds, last sold in 2011, could be purchased for half their face value; for example, a $100 bond could be purchased for $50, but would only reach its full $100 value at maturity.

American Bonds: How Credit Markets Shaped a Nation

'.

The History of U.S. Savings Bonds

{{Authority control Bonds (finance) United States Department of the Treasury Government bonds issued by the United States

United States savings bonds are

United States savings bonds are debt securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

issued by the United States Department of the Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and ...

to help pay for the U.S. government's borrowing needs. U.S. savings bonds are considered one of the safest investments because they are backed by the full faith and credit of the United States government. The savings bonds are nonmarketable treasury securities

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. gov ...

issued to the public, which means they cannot be traded on secondary markets or otherwise transferable. They are redeemable only by the original purchaser, a recipient (for bonds purchased as gifts) or a beneficiary in case of the original holder's death.

History

On February 1, 1935, President

On February 1, 1935, President Franklin D. Roosevelt

Franklin Delano Roosevelt (; ; January 30, 1882April 12, 1945), often referred to by his initials FDR, was an American politician and attorney who served as the 32nd president of the United States from 1933 until his death in 1945. As the ...

signed legislation that allowed the U.S. Department of the Treasury to sell a new type of security, called the savings bond, to encourage saving during the Great Depression. The first Series A savings bond was issued a month later, with a face value of $25. They were marketed as a safe investment that was accessible to everyone. Series B, C, and D bonds followed over the next few years.

Series E bond

Series E United States Savings Bonds were government bonds marketed by the United States Department of the Treasury as war bonds during World War II from 1941 to 1945. After the war, they continued to be offered as retail investments until 1980, ...

s, referred to as Defense Bonds, were a major source of financing in the period just before U.S. entry into World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposing ...

. On April 30, 1941, Roosevelt purchased the first Series E bond from Treasury Secretary Henry Morgenthau Jr.; the next day, they were made available to the public. After the attack on Pearl Harbor

The attack on Pearl HarborAlso known as the Battle of Pearl Harbor was a surprise military strike by the Imperial Japanese Navy Air Service upon the United States against the naval base at Pearl Harbor in Honolulu, Territory of Hawaii ...

, Defense Bonds became known as War Bonds. Stamps featuring a Minuteman statue design in denominations of 10¢, 25¢, 50¢, $1, and $5 were also sold to be collected in booklets which, when filled, could be exchanged to purchase interest-bearing Series E bonds. All the revenue received from the bonds went directly to support the war effort.

After the war ended, savings bonds became popular with families, with purchasers waiting to redeem them so the bonds would grow in value. To help sustain post-war sales, they were advertised on television, films, and commercials. When John F. Kennedy

John Fitzgerald Kennedy (May 29, 1917 – November 22, 1963), often referred to by his initials JFK and the nickname Jack, was an American politician who served as the 35th president of the United States from 1961 until his assassination ...

was president, he encouraged Americans to purchase them, which stimulated a large enrollment in savings bonds. By 1976, President Ford helped celebrate the 35th anniversary of the U.S. savings bond program.

In 1990, Congress created the Education Savings Bond program which helped Americans finance a college education. A bond purchased on or after January 1, 1990, is tax-free (subject to income limitations) if used to pay tuition and fees at an eligible institution.

In 2002, the Treasury Department started changing the savings bond program by lowering interest rates and closing its marketing offices. As of January 1, 2012, financial institutions no longer sell paper savings bonds. That year, the Department of the Treasury's Bureau of the Public Debt

The Bureau of the Public Debt was an agency within the Fiscal Service of the United States Department of the Treasury. United States Secretary of the Treasury Timothy Geithner issued a directive that the Bureau be combined with the Financial M ...

made savings bonds available for purchasing and redeeming online. U.S. savings bonds are now only sold in electronic form at a Department of the Treasury website, TreasuryDirect, with the exception that paper Series I savings bonds can be purchased with a portion of a federal income tax refund using Form 8888.

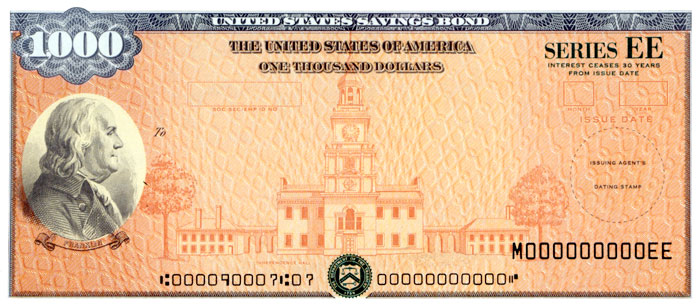

Currently issued bonds

There are two types of savings bonds currently offered by the Treasury, Series EE and Series I.Series EE

are guaranteed to double in value over the purchase price when they mature 20 years from issuance, though they continue to earn interest for a total of 30 years. Interest accrues monthly, and is compounded semiannually, that is, becomes part of the principal for future interest earning calculations. If a bond's compounded interest does not meet the guaranteed doubling of the purchase price, Treasury will make a one-time adjustment to the maturity value at 20 years, giving it an effective rate of 3.5%. The bond will continue to earn the fixed rate for 10 more years. All interest is paid when the holder cashes the bond.

For bonds issued before May 2005, the interest rate was an adjustable rate recomputed every six months at 90% of the average five-year Treasury yield for the preceding six months. Bonds issued in May 2005 or later pay a fixed interest rate for the life of the bond.TreasuryDirect Savings Bond Rate Press Release

are guaranteed to double in value over the purchase price when they mature 20 years from issuance, though they continue to earn interest for a total of 30 years. Interest accrues monthly, and is compounded semiannually, that is, becomes part of the principal for future interest earning calculations. If a bond's compounded interest does not meet the guaranteed doubling of the purchase price, Treasury will make a one-time adjustment to the maturity value at 20 years, giving it an effective rate of 3.5%. The bond will continue to earn the fixed rate for 10 more years. All interest is paid when the holder cashes the bond.

For bonds issued before May 2005, the interest rate was an adjustable rate recomputed every six months at 90% of the average five-year Treasury yield for the preceding six months. Bonds issued in May 2005 or later pay a fixed interest rate for the life of the bond.TreasuryDirect Savings Bond Rate Press Release/ref> Paper EE bonds, last sold in 2011, could be purchased for half their face value; for example, a $100 bond could be purchased for $50, but would only reach its full $100 value at maturity.

Series I

In 1998, the Treasury introduced the which have a variable yield based oninflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

. The Treasury currently issues Series I bonds electronically in any denomination down to the penny, with a minimum purchase of $25. Paper bonds continue to be issued as well, but only as an option for receiving an individual's federal income tax refund using IRS Form 8888. The paper bonds are currently issued in denominations of $50, $100, $200, $500, and $1,000, featuring portraits of Helen Keller, Martin Luther King Jr.

Martin Luther King Jr. (born Michael King Jr.; January 15, 1929 – April 4, 1968) was an American Baptist minister and activist, one of the most prominent leaders in the civil rights movement from 1955 until his assassination in 1968 ...

, Chief Joseph

''Hin-mah-too-yah-lat-kekt'' (or ''Hinmatóowyalahtq̓it'' in Americanist orthography), popularly known as Chief Joseph, Young Joseph, or Joseph the Younger (March 3, 1840 – September 21, 1904), was a leader of the Wal-lam-wat-kain (Wallowa ...

, George C. Marshall

George Catlett Marshall Jr. (December 31, 1880 – October 16, 1959) was an American army officer and statesman. He rose through the United States Army to become Chief of Staff of the US Army under Presidents Franklin D. Roosevelt and Harry ...

, and Albert Einstein

Albert Einstein ( ; ; 14 March 1879 – 18 April 1955) was a German-born theoretical physicist, widely acknowledged to be one of the greatest and most influential physicists of all time. Einstein is best known for developing the theory ...

, respectively. Three additional denominations were previously issued but discontinued: $75, $5,000, and $10,000 featuring Hector P. Garcia, Marian Anderson

Marian Anderson (February 27, 1897April 8, 1993) was an American contralto. She performed a wide range of music, from opera to spirituals. Anderson performed with renowned orchestras in major concert and recital venues throughout the United ...

, and Spark Matsunaga

Spark Masayuki Matsunaga ( ja, 松永 正幸, October 8, 1916April 15, 1990) was an American politician and attorney who served as United States Senator for Hawaii from 1977 until his death in 1990. Matsunaga also represented Hawaii in the U.S. ...

. Gulf Coast Recovery Bonds are a special issue of I series issued from March 29, 2006, through September 30, 2007, in order to encourage public support for hurricane recovery, including Katrina, in the affected states.

The interest rate for Series I bonds consists of two components. The first is a fixed rate which will remain constant over the life of the bond; the second component is a variable rate adjusted every six months from the time the bond is purchased based on the current inflation rate. The fixed rate is determined by the Treasury Department; the variable component is based on the non-seasonally adjusted Consumer Price Index for urban areas (CPI-U) for a six-month period ending one month prior to the rate adjustment. Specifically the variable rate is calculated by looking at the percent change over the previous six months of available data, and multiplying the percent change by two to annualize the rate. New rates are published on May 1 and November 1 of each year. For example, on November 1, 2021 the most recent CPI-U data that was available was from September 2021, where the non-seasonally adjusted CPI-U was 274.310. Six months earlier, in March 2021 the CPI-U was 264.877. Thus, the percent change was 3.56%. Multiplying this by 2 yields the variable component of 7.12%.

As an example, if someone purchases a bond in February, the fixed portion of the rate will remain the same throughout the life of the bond, but the inflation-indexed component will be based on the rate published the previous November. In August, six months after the purchase month, the inflation component will change to the rate that was published in May. During times of deflation, the negative inflation-indexed portion can drop the combined rate below the fixed portion, but the combined rate cannot go below 0% and the bond can not lose value. Like Series EE bonds, interest accrues monthly and is compounded to the principal semiannually. Also like Series EE bonds, Series I bonds have a life of 30 years, and cease accruing interest after maturity.

Common terms

For both types, bonds must be held for 12 months, but Treasury has the authority to waive the holding period for bondholders residing in areas of natural disaster. There is a penalty of three months' interest if they are redeemed before five years. Tax on the interest can be deferred until the bond is redeemed. The annual purchase limit for electronic Series EE and Series I savings bonds is $10,000 for each series; this limit applies to both purchases and bonds received as gifts (except that bonds received as a beneficiary do not count against the limit). For paper Series I Savings Bonds purchased through IRS tax refunds the purchase limit is $5,000, which is in addition to the online purchase limit. Individuals who own either type of bond must have a Social Security number and be either a United States citizen, a legal United States resident, or a civilian employee of the United States regardless of country of residence. Trusts, estates, corporations, partnerships, and other entities may own Series EE bonds if they have a Social Security Number or Employer Identification Number. Trusts and estates may own Series I bonds in some cases.Historical bonds

The U.S. Treasury previously issued bonds in a variety of series, some of which still earn interest today. Series A was issued only during 1935, Series B during 1936, Series C from 1937 to 1938, Series D from 1939 to 1941, Series E from 1941 to 1980, Series F and G from 1941 to 1952, Series H from 1952 to 1979 when it was replaced by Series HH (itself discontinued in 2004), Series J and K from 1952 to 1957, and "Freedom Shares" Savings Notes from 1967 to 1970. In addition, there were special designs for some paper bonds issued during their lifetimes, notably a version of the Series E bonds issued from 1975 to 1976 labeled as a "Bicentennial Bond" and Series EE bonds sold from December 2001 to 2011 labeled as a "Patriot Bond."Series A, B, C, and D

The Treasury began issuing savings bonds in March 1935, with each of the first four series released sequentially without overlap and under similar terms. These bonds were purchased at 75% of their face value and would mature after 10 years. The interest earned would not be taxed for Series A, B, and C, as well as Series D bonds issued before March 1941. The bonds were issued in denominations of $25, $50, $100, $500, and $1,000, and can still be redeemed for face value today.Series E

Series E bonds were introduced in 1941 aswar bond

War bonds (sometimes referred to as Victory bonds, particularly in propaganda) are debt securities issued by a government to finance military operations and other expenditure in times of war without raising taxes to an unpopular level. They are ...

s but continued to be a retail investment long after the end of World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposing ...

. Issued at a discount of the face value, the bonds could be redeemed for the full face value when the bond matured after a number of years that varied with the interest rate at the time of issuance. If not redeemed at maturity, the bonds would continue earning interest for a total of 40 years if issued before December 1965, or for 30 years if issued in December 1965 or later. Series E was replaced by Series EE bonds in 1980, and the last issued Series E bonds ceased earning interest in 2010.

Series F and G

Introduced around the same time as Series E in 1941, the Series F and G bonds offered alternative investment strategies until both were discontinued in April 1952. Series F could be purchased at 74% of the face value and would mature in 12 years with no further interest. Series G bonds were sold at face value and would earn interest paid by check every six months until maturity after 12 years. Both series were issued in denominations of $100, $500, $1,000, $5,000, and $10,000, with Series F also available as $25.Series H, J, and K

Introduced in May and June 1952 to replace Series F and G, the next three series were H, J, and K (skipping the letter I). Series H was issued at face value and earned interest that was paid every six months until maturity approximately 30 years later. Series J was sold at 72% of face value and matured after 12 years with no further interest. Series K was sold at face value and would earn interest paid every six months until maturity 12 years later. Series J and K were discontinued in April 1957 while Series H lasted until December 1979, with a replacement Series HH introduced in January 1980.Series HH

Series HH bonds were sold from 1980 to 2004, and served as a "current income" bond replacing the older Series H. Unlike Series EE and I bonds, they did not increase in value but instead paid earned interest every six months for 20 years directly to the holder. The interest rate of a Series HH bond was set at purchase and remained that rate for 10 years. After 10 years the rate could change, with the new rate for the remaining 10 year life of the bond. After 20 years, the bond would be redeemed for its original purchase price. Issuance of Series HH bonds ended August 31, 2004. Although no longer sold, Series HH bonds continue to earn interest for 20 years after sale, meaning the last bonds will not mature until 2024.Further reading

* Sarah L. Quinn. 2019.American Bonds: How Credit Markets Shaped a Nation

'.

Princeton University Press

Princeton University Press is an independent publisher with close connections to Princeton University. Its mission is to disseminate scholarship within academia and society at large.

The press was founded by Whitney Darrow, with the financia ...

.

References

External links

The History of U.S. Savings Bonds

{{Authority control Bonds (finance) United States Department of the Treasury Government bonds issued by the United States