|

TreasuryDirect

TreasuryDirect is a website run by the Bureau of the Fiscal Service under the United States Department of the Treasury that allows US individual investors to purchase treasury securities, such as savings bonds, directly from the US government. It enables people to manage their investments online, including connecting their TreasuryDirect account to a bank account for deposits and withdrawals. TreasuryDirect started in 1986 as a book entry system with business conducted over postal mail, as an alternative to purchasing securities as engraved paper certificates. The current online system launched in 2002. Treasury has been working on a new version since 2014, but it has not launched yet. Products and services A TreasuryDirect account enables purchasing treasury securities: Treasury bills, Treasury notes, Treasury bonds, Inflation-Protected Securities ( TIPS), floating rate notes (FRNs), and Series I and EE Savings Bonds in electronic form. TreasuryDirect charges no fees for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TreasuryDirect Advertisement In 1986

TreasuryDirect is a website run by the Bureau of the Fiscal Service under the United States Department of the Treasury that allows US individual investors to purchase treasury securities, such as savings bonds, directly from the US government. It enables people to manage their investments online, including connecting their TreasuryDirect account to a bank account for deposits and withdrawals. TreasuryDirect started in 1986 as a book entry system with business conducted over postal mail, as an alternative to purchasing securities as engraved paper certificates. The current online system launched in 2002. Treasury has been working on a new version since 2014, but it has not launched yet. Products and services A TreasuryDirect account enables purchasing treasury securities: Treasury bills, Treasury notes, Treasury bonds, Inflation-Protected Securities ( TIPS), floating rate notes (FRNs), and Series I and EE Savings Bonds in electronic form. TreasuryDirect charges no fees for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Treasury Security

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt. There are four types of marketable Treasury securities: Treasury bills, Treasury notes, Treasury bonds, and Treasury Inflation Protected Securities (TIPS). The government sells these securities in auctions conducted by the Federal Reserve Bank of New York, after which they can be traded in secondary markets. Non-marketable securities include savings bonds, issued to the public and transferable only as gifts; the State and Local Government Series (SLGS), purchaseable only with the proceeds of state and municipal bond sales; and the Government Account Series, purchased by units of the federal government. Treasury securities are b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasury Security

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt. There are four types of marketable Treasury securities: Treasury bills, Treasury notes, Treasury bonds, and Treasury Inflation Protected Securities (TIPS). The government sells these securities in auctions conducted by the Federal Reserve Bank of New York, after which they can be traded in secondary markets. Non-marketable securities include savings bonds, issued to the public and transferable only as gifts; the State and Local Government Series (SLGS), purchaseable only with the proceeds of state and municipal bond sales; and the Government Account Series, purchased by units of the federal government. Treasury securities are bac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

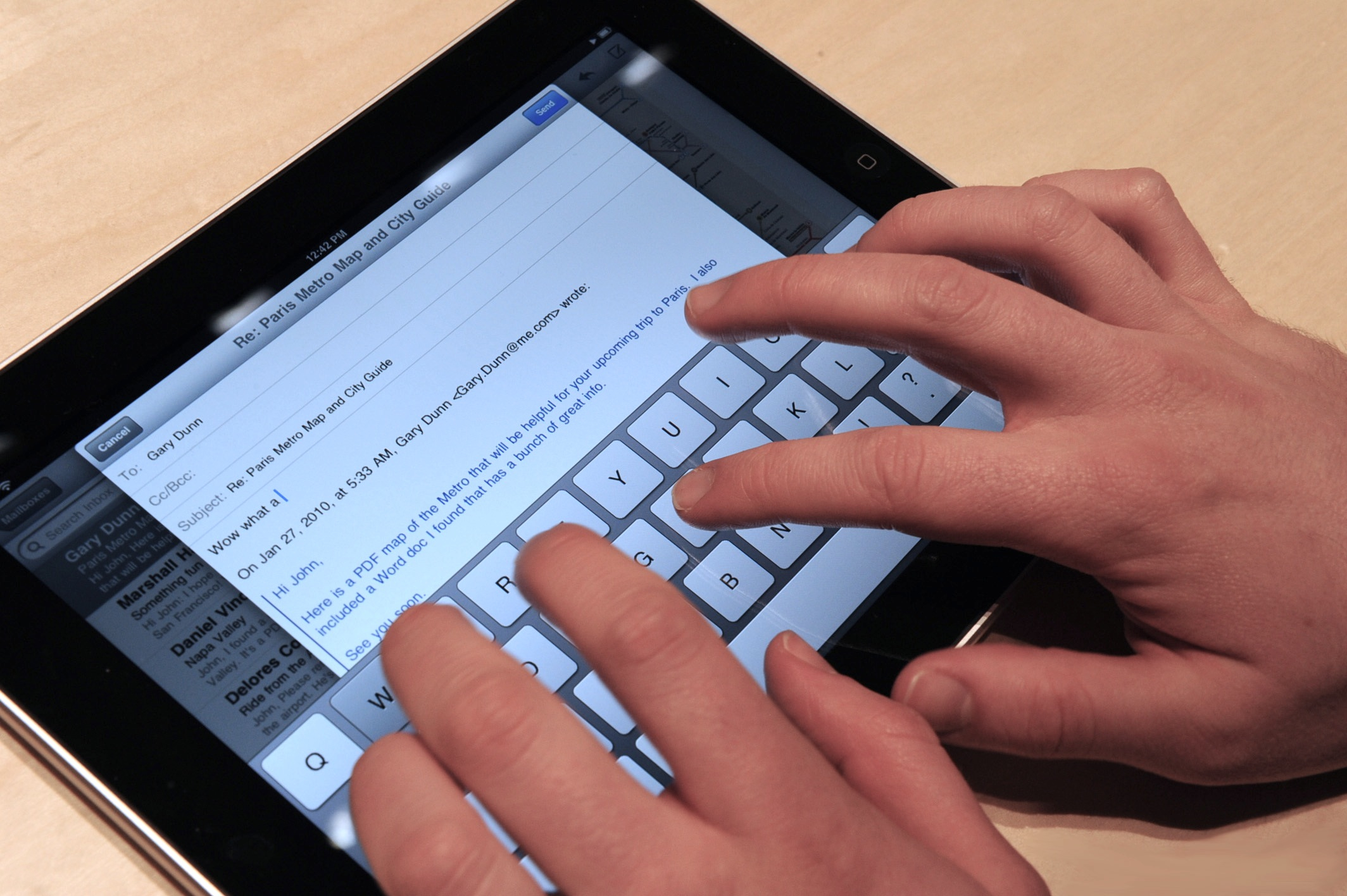

Virtual Keyboard

A virtual keyboard is a software component that allows the Input device, input of characters without the need for physical keys. The interaction with the virtual Computer keyboard, keyboard happens mostly via a touchscreen interface, but can also take place in a different form in Virtual reality, virtual or augmented reality. Types On a desktop computer, a virtual keyboard might provide an alternative input mechanism for users with disability, disabilities who cannot use a conventional keyboard, or for bi- or multilingualism, multi-lingual users who switch frequently between different character sets or alphabets, which may be confusing over time. Although hardware keyboards are available with dual keyboard layouts (e.g. Cyrillic/Latin letters in various national layouts), the on-screen keyboard provides a handy substitute while working at different stations or on laptops, which seldom come with dual layouts. Virtual keyboards can be categorized by the following aspects: * Virtu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Savings Bonds

United States savings bonds are debt securities issued by the United States Department of the Treasury to help pay for the U.S. government's borrowing needs. U.S. savings bonds are considered one of the safest investments because they are backed by the full faith and credit of the United States government. The savings bonds are nonmarketable treasury securities issued to the public, which means they cannot be traded on secondary markets or otherwise transferable. They are redeemable only by the original purchaser, a recipient (for bonds purchased as gifts) or a beneficiary in case of the original holder's death. History On February 1, 1935, President Franklin D. Roosevelt signed legislation that allowed the U.S. Department of the Treasury to sell a new type of security, called the savings bond, to encourage saving during the Great Depression. The first Series A savings bond was issued a month later, with a face value of $25. They were marketed as a safe investment that was acc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bureau Of The Fiscal Service

The Bureau of the Fiscal Service (Fiscal Service) is a bureau of the United States Department of the Treasury, U.S. Department of the Treasury. The Fiscal Service replaced the Bureau of the Public Debt and the Financial Management Service effective October 7, 2012 by directive of Treasury Secretary Timothy Geithner. The Bureau manages the government's accounting, central payment systems, and national debt of the United States, public debt. Among some of its better known duties is to collect any voluntary donations made to the government for reduction of the public debt. The amount of such reductions has hovered around two million dollars per year, and have been widely variable. By comparison, the annual compounding interest on US government debt in the year 2022 has been projected to be about $305B, making it some 152500 times greater than the amount of voluntary donations to the treasury. See also * Title 31 of the Code of Federal Regulations * TreasuryDirect * United States Tre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Bank

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913. The banks are jointly responsible for implementing the monetary policy set forth by the Federal Open Market Committee, and are divided as follows: Some banks also possess branches, with the whole system being headquartered at the Eccles Building in Washington, D.C. History The Federal Reserve Banks are the most recent institutions that the United States government has created to provide functions of a central bank. Prior institutions have included the First (1791–1811) and Second (1818–1824) Banks of the United States, the Independent Treasury (1846–1920) and the National Banking System (1863–1935). Several policy questions have arisen with these institutions, including the degree of influence by private interes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Washington, D

Washington commonly refers to: * Washington (state), United States * Washington, D.C., the capital of the United States ** A metonym for the federal government of the United States ** Washington metropolitan area, the metropolitan area centered on Washington, D.C. * George Washington (1732–1799), the first president of the United States Washington may also refer to: Places England * Washington, Tyne and Wear, a town in the City of Sunderland metropolitan borough ** Washington Old Hall, ancestral home of the family of George Washington * Washington, West Sussex, a village and civil parish Greenland * Cape Washington, Greenland * Washington Land Philippines *New Washington, Aklan, a municipality *Washington, a barangay in Catarman, Northern Samar *Washington, a barangay in Escalante, Negros Occidental *Washington, a barangay in San Jacinto, Masbate *Washington, a barangay in Surigao City United States * Washington, Wisconsin (other) * Fort Washington (other) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Code Of Federal Regulations

In the law of the United States, the ''Code of Federal Regulations'' (''CFR'') is the codification of the general and permanent regulations promulgated by the executive departments and agencies of the federal government of the United States. The CFR is divided into 50 titles that represent broad areas subject to federal regulation. The CFR annual edition is published as a special issue of the '' Federal Register'' by the Office of the Federal Register (part of the National Archives and Records Administration) and the Government Publishing Office. In addition to this annual edition, the CFR is published online on the Electronic CFR (eCFR) website, which is updated daily. Background Congress frequently delegates authority to an executive branch agency to issue regulations to govern some sphere. These statutes are called "enabling legislation." Enabling legislation typically has two parts: a substantive scope (typically using language such as "The Secretary shall promulgate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Terms And Conditions

A contractual term is "any provision forming part of a contract". Each term gives rise to a contractual obligation, the breach of which may give rise to litigation. Not all terms are stated expressly and some terms carry less legal gravity as they are peripheral to the objectives of the contract. The terms of a contract are the essence of a contract, and tell the reader what the contract will do. For instance, the price of a good, the time of its promised delivery and the description of the good will all be terms of the contract. Classification of term Condition or Warranty Conditions are major provision terms that go to the very root of a contract breach of which means there has been substantial failure to perform a basic element in the agreement. Breach of a condition will entitle the innocent party to terminate the contract. A warranty is less imperative than a condition, so the contract will survive a breach. Breach of either a condition or a warranty will give rise to dam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Back Button (web Browser)

A web browser is application software for accessing websites. When a user requests a web page from a particular website, the browser retrieves its files from a web server and then displays the page on the user's screen. Browsers are used on a range of devices, including desktops, laptops, tablets, and smartphones. In 2020, an estimated 4.9 billion people used a browser. The most used browser is Google Chrome, with a 65% global market share on all devices, followed by Safari with 18%. A web browser is not the same thing as a search engine, though the two are often confused. A search engine is a website that provides links to other websites. However, to connect to a website's server and display its web pages, a user must have a web browser installed. In some technical contexts, browsers are referred to as user agents. Function The purpose of a web browser is to fetch content from the World Wide Web or from local storage and display it on a user's device. This process begi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)