Tariff on:

[Wikipedia]

[Google]

[Amazon]

A tariff is a

Before the new Constitution took effect in 1788, the Congress could not levy taxesit sold land or begged money from the states. The new national government needed revenue and decided to depend upon a tax on imports with the Tariff of 1789. The policy of the U.S. before 1860 was low tariffs "for revenue only" (since duties continued to fund the national government). A high tariff was attempted in 1828 but the South denounced it as a "

Before the new Constitution took effect in 1788, the Congress could not levy taxesit sold land or begged money from the states. The new national government needed revenue and decided to depend upon a tax on imports with the Tariff of 1789. The policy of the U.S. before 1860 was low tariffs "for revenue only" (since duties continued to fund the national government). A high tariff was attempted in 1828 but the South denounced it as a "

5th edition 1910 is online

/ref> In the early 1860s, Europe and the United States pursued completely different trade policies. The 1860s were a period of growing protectionism in the United States, while the European free trade phase lasted from 1860 to 1892. The tariff average rate on imports of manufactured goods was in 1875 from 40% to 50% in the United States against 9% to 12% in continental Europe at the height of free trade. In 1896, the GOP pledged platform pledged to "renew and emphasize our allegiance to the policy of protection, as the bulwark of American industrial independence, and the foundation of development and prosperity. This true American policy taxes foreign products and encourages home industry. It puts the burden of revenue on foreign goods; it secures the American market for the American producer. It upholds the American standard of wages for the American workingman". In 1913, following the electoral victory of the Democrats in 1912, there was a significant reduction in the average tariff on manufactured goods from 44% to 25%. However, the First World War rendered this bill ineffective, and new "emergency" tariff legislation was introduced in 1922, after the Republicans returned to power in 1921. According to economic historian Douglas Irwin, a common myth about United States trade policy is that low tariffs harmed American manufacturers in the early 19th century and then that high tariffs made the United States into a great industrial power in the late 19th century. A review by the ''Economist'' of Irwin's 2017 book ''Clashing over Commerce: A History of US Trade Policy'' notes:

Neoclassical economic theorists tend to view tariffs as distortions to the

Neoclassical economic theorists tend to view tariffs as distortions to the

Primeros movimientos sociales chileno (1890–1920)

'. Memoria Chilena.Benjamin S. 1997. Meat and Strength: The Moral Economy of a Chilean Food Riot. '' Cultural Anthropology'', 12, pp. 234–268.

Types of TariffsEffectively applied tariff by Country 2008 to 2012MFN Trade Weighted Average Tariff by country 2008–2012World Bank's site for Trade and TariffMarket Access Map, an online database of customs tariffs and market requirementsWTO Tariff Analysis Online – Detailed information on tariff and trade data

{{Trade {{Authority control Customs duties International taxation International economics

tax

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

imposed by the government

A government is the system or group of people governing an organized community, generally a state.

In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is a ...

of a country or by a supranational union on imports

An import is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade.

In international trade, the importation and exportation of goods are limited ...

or exports

An export in international trade is a good produced in one country that is sold into another country or a service provided in one country for a national or resident of another country. The seller of such goods or the service provider is an ...

of goods. Besides being a source of revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business.

Commercial revenue may also be referred to as sales or as turnover. Some companies receive reven ...

for the government, import duties can also be a form of regulation of foreign trade

International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services. (see: World economy)

In most countries, such trade represents a significant ...

and policy that taxes foreign products to encourage or safeguard domestic industry. ''Protective tariff

Protective tariffs are tariffs that are enacted with the aim of protecting a domestic industry. They aim to make imported goods cost more than equivalent goods produced domestically, thereby causing sales of domestically produced goods to rise, ...

s'' are among the most widely used instruments of protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulatio ...

, along with import quota

An import quota is a type of trade restriction that sets a physical limit on the quantity of a good that can be imported into a country in a given period of time.

Quotas, like other trade restrictions, are typically used to benefit the producers ...

s and export quota

Non-tariff barriers to trade (NTBs; also called non-tariff measures, NTMs) are trade barriers that restrict imports or exports of goods or services through mechanisms other than the simple imposition of tariffs.

The Southern African Development C ...

s and other non-tariff barriers to trade

Non-tariff barriers to trade (NTBs; also called non-tariff measures, NTMs) are trade barriers that restrict imports or exports of goods or services through mechanisms other than the simple imposition of tariffs.

The Southern African Developme ...

.

Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce the trade deficit. They have historically been justified as a means to protect infant industries

The infant industry argument is an economic rationale for trade protectionism. The core of the argument is that nascent industries often do not have the economies of scale that their older competitors from other countries may have, and thus nee ...

and to allow import substitution industrialization

Import substitution industrialization (ISI) is a trade and economic policy that advocates replacing foreign imports with domestic production.''A Comprehensive Dictionary of Economics'' p.88, ed. Nelson Brian 2009. It is based on the premise that ...

. Tariffs may also be used to rectify artificially low prices for certain imported goods, due to 'dumping', export subsidies or currency manipulation.

There is near unanimous consensus among economists that tariffs have a negative effect on economic growth and economic welfare, while free trade

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold econ ...

and the reduction of trade barrier

Trade barriers are government-induced restrictions on international trade. According to the theory of comparative advantage, trade barriers are detrimental to the world economy and decrease overall economic efficiency.

Most trade barriers work o ...

s has a positive effect on economic growth. Although trade liberalization

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold econ ...

can sometimes result in large and unequally distributed losses and gains, and can, in the short run In economics, the long-run is a theoretical concept in which all markets are in equilibrium, and all prices and quantities have fully adjusted and are in equilibrium. The long-run contrasts with the short-run, in which there are some constraints a ...

, cause significant economic dislocation of workers in import-competing sectors, free trade has advantages of lowering costs of goods and services for both producers and consumers.

Etymology

The English term ''tariff'' derives from the which is itself a descendant of the which derives from . This term was introduced to the Latin-speaking world through contact with the Turks and derives from the . This Turkish term is aloanword

A loanword (also loan word or loan-word) is a word at least partly assimilated from one language (the donor language) into another language. This is in contrast to cognates, which are words in two or more languages that are similar because th ...

of the . The Persian term derives from which is the verbal noun of .

History

Ancient Greece

In the city state ofAthens

Athens ( ; el, Αθήνα, Athína ; grc, Ἀθῆναι, Athênai (pl.) ) is both the capital and largest city of Greece. With a population close to four million, it is also the seventh largest city in the European Union. Athens dominates ...

, the port of Piraeus

Piraeus ( ; el, Πειραιάς ; grc, Πειραιεύς ) is a port city within the Athens urban area ("Greater Athens"), in the Attica region of Greece. It is located southwest of Athens' city centre, along the east coast of the Saron ...

enforced a system of levies to raise taxes for the Athenian government. Grain was a key commodity that was imported through the port, and Piraeus was one of the main ports in the east Mediterranean

Eastern Mediterranean is a loose definition of the eastern approximate half, or third, of the Mediterranean Sea, often defined as the countries around the Levantine Sea.

It typically embraces all of that sea's coastal zones, referring to commun ...

. A levy of two percent was placed on goods arriving in the market through the docks of Piraeus. Despite the Peloponnesian War preceding year 399 BC, Piraeus had documented a tax income of 1,800 in harbor dues. The Athenian government also placed restrictions on the lending of money and transport of grain to only be allowed through the port of Piraeus.

Great Britain

In the 14th century, Edward III (1312–1377) took interventionist measures, such as banning the import of woollen cloth in an attempt to develop local woollen cloth manufacturing. Beginning in 1489, Henry VII took actions such as increasing export duties on raw wool. The Tudor monarchs, especially Henry VIII and Elizabeth I, used protectionism, subsidies, distribution of monopoly rights, government-sponsored industrial espionage and other means of government intervention to develop the wool industry, leading to England became the largest wool-producing nation in the world. A protectionist turning point in British economic policy came in 1721, when policies to promote manufacturing industries were introduced by Robert Walpole. These included increased tariffs on imported foreign manufactured goods, and export subsidies. These policies were similar to those used by countries such as Japan, Korea and Taiwan after the Second World War. In addition, in its colonies, Great Britain imposed a ban on advanced manufacturing activities that it did not want to see developed. Britain also banned exports from its colonies that competed with its own products at home and abroad, forcing the colonies to leave the most profitable industries in Britain's hands. In 1800, Britain, with about 10% of Europe's population, supplied 29% of all pig iron produced in Europe, a proportion that had risen to 45% by 1830. Per capita industrial production was even higher: in 1830 it was 250% higher than in the rest of Europe, up from 110% in 1800. Protectionist policies of industrial promotion continued until the mid-19th century. At the beginning of that century, the average tariff on British manufactured goods was about 50%, the highest of all major European countries. Thus, according to economic historianPaul Bairoch

Paul Bairoch (24 July 1930 in Antwerp – 12 February 1999 in Geneva) was a (in 1985 naturalised) Swiss economic historian of Belgian descent who specialized in urban history and historical demography. He published or co-authored more than two d ...

, Britain's technological advance was achieved "behind high and enduring tariff barriers". In 1846, the country's per capita rate of industrialization was more than twice that of its closest competitors. Even after adopting free trade

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold econ ...

for most goods, Britain continued to closely regulate trade in strategic capital goods, such as machinery for the mass production of textiles.

Free trade in Britain began in earnest with the repeal of the Corn Laws

The Corn Laws were tariffs and other trade restrictions on imported food and corn enforced in the United Kingdom between 1815 and 1846. The word ''corn'' in British English denotes all cereal grains, including wheat, oats and barley. They we ...

in 1846, which was equivalent to free trade in grain. The Corn Acts had been passed in 1815 to restrict wheat imports and to guarantee the incomes of British farmers; their repeal devastated Britain's old rural economy, but began to mitigate the effects of the Great Famine in Ireland. Tariffs on many manufactured goods were also abolished. But while liberalism was progressing in Britain, protectionism continued on the European mainland and in the United States.

On June 15, 1903, the Secretary of State for Foreign Affairs, Henry Petty-Fitzmaurice, 5th Marquess of Lansdowne

Henry Charles Keith Petty-Fitzmaurice, 5th Marquess of Lansdowne, (14 January 18453 June 1927), was a British statesman who served successively as Governor General of Canada, Viceroy of India, Secretary of State for War and Secretary of State f ...

, made a speech in the House of Lords in which he defended fiscal retaliation against countries that applied high tariffs and whose governments subsidized products sold in Britain (known as "premium products", later called " dumping"). The retaliation was to take the form of threats to impose duties in response to goods from that country. Liberal unionists

The Liberal Unionist Party was a British political party that was formed in 1886 by a faction that broke away from the Liberal Party. Led by Lord Hartington (later the Duke of Devonshire) and Joseph Chamberlain, the party established a political ...

had split from the liberals, who advocated free trade, and this speech marked a turning point in the group's slide toward protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulatio ...

. Lansdowne argued that the threat of retaliatory tariffs was similar to gaining respect in a room of gunmen by pointing a big gun (his exact words were "a gun a little bigger than everyone else's"). The "Big Revolver" became a slogan of the time, often used in speeches and cartoons.

In response to the Great Depression, Britain finally abandoned free trade in 1932 and reintroduced tariffs on a large scale, noticing that it had lost its production capacity to protectionist countries like the United States and Weimar Germany

The Weimar Republic (german: link=no, Weimarer Republik ), officially named the German Reich, was the government of Germany from 1918 to 1933, during which it was a constitutional federal republic for the first time in history; hence it is als ...

.

United States

Before the new Constitution took effect in 1788, the Congress could not levy taxesit sold land or begged money from the states. The new national government needed revenue and decided to depend upon a tax on imports with the Tariff of 1789. The policy of the U.S. before 1860 was low tariffs "for revenue only" (since duties continued to fund the national government). A high tariff was attempted in 1828 but the South denounced it as a "

Before the new Constitution took effect in 1788, the Congress could not levy taxesit sold land or begged money from the states. The new national government needed revenue and decided to depend upon a tax on imports with the Tariff of 1789. The policy of the U.S. before 1860 was low tariffs "for revenue only" (since duties continued to fund the national government). A high tariff was attempted in 1828 but the South denounced it as a "Tariff of Abominations

The Tariff of 1828 was a very high protective tariff that became law in the United States in May 1828. It was a bill designed to not pass Congress because it was seen by free trade supporters as hurting both industry and farming, but surprising ...

" and it almost caused a rebellion in South Carolina until it was lowered.

Between 1816 and the end of the Second World War, the United States had one of the highest average tariff rates on manufactured imports in the world. According to Paul Bairoch, the United States was "the homeland and bastion of modern protectionism"during this period

Many American intellectuals and politicians during the country's catching-up period felt that the free trade theory advocated by British classical economists was not suited to their country. They argued that the country should develop manufacturing industries and use government protection and subsidies for this purpose, as Britain had done before them. Many of the great American economists of the time, until the last quarter of the 19th century, were strong advocates of industrial protection: Daniel Raymond Daniel Raymond (1786–1849) was the first important political economist to appear in the United States. He authored ''Thoughts on Political Economy'' (1820) and ''The Elements of Political Economy'' (1823).

Economic theory

He theorized that "labor ...

who influenced Friedrich List

Georg Friedrich List (6 August 1789 – 30 November 1846) was a German-American economist who developed the "National System" of political economy. He was a forefather of the German historical school of economics, and argued for the German Custom ...

, Mathew Carey

Mathew Carey (January 28, 1760 – September 16, 1839) was an Irish-born American publisher and economist who lived and worked in Philadelphia, Pennsylvania. He was the father of economist Henry Charles Carey.

Early life and education

Care ...

and his son Henry, who was one of Lincoln's economic advisers. The intellectual leader of this movement was Alexander Hamilton, the first Secretary of the Treasury of the United States (1789-1795). Thus, it was against David Ricardo

David Ricardo (18 April 1772 – 11 September 1823) was a British political economist. He was one of the most influential of the classical economists along with Thomas Malthus, Adam Smith and James Mill. Ricardo was also a politician, and a ...

's theory of comparative advantage

In an economic model, agents have a comparative advantage over others in producing a particular good if they can produce that good at a lower relative opportunity cost or autarky price, i.e. at a lower relative marginal cost prior to trade. Comp ...

that the United States protected its industry. They pursued a protectionist policy from the beginning of the 19th century until the middle of the 20th century, after the Second World War.

In Report on Manufactures

The Report on the Subject of Manufactures, generally referred to by its shortened title Report on Manufactures, is the third major report, and ''magnum opus'', of American Founding Father and first United States Treasury Secretary Alexander Hami ...

, considered the first text to express modern protectionist theory, Alexander Hamilton argued that if a country wished to develop a new activity on its soil, it would have to temporarily protect it. According to him, this protection against foreign producers could take the form of import duties or, in rare cases, prohibition of imports. He called for customs barriers to allow American industrial development and to help protect infant industries, including bounties (subsidies) derived in part from those tariffs. He also believed that duties on raw materials should be generally low. Hamilton argued that despite an initial "increase of price" caused by regulations that control foreign competition, once a "domestic manufacture has attained to perfection… it invariably becomes cheaper. He believed that political independence was predicated upon economic independence. Increasing the domestic supply of manufactured goods, particularly war materials, was seen as an issue of national security. And he feared that Britain's policy towards the colonies would condemn the United States to be only producers of agricultural products and raw materials.

Britain initially did not want to industrialize the American colonies, and implemented policies to that effect (for example, banning high value-added manufacturing activities). Under British rule, America was denied the use of tariffs to protect its new industries. This explains why, after independence, the Tariff Act of 1789 was the second bill of the Republic signed by President Washington allowing Congress to impose a fixed tariff of 5% on all imports, with a few exceptions.

The Congress passed a tariff act (1789), imposing a 5% flat rate tariff on all imports. Between 1792 and the war with Britain in 1812, the average tariff level remained around 12.5%. In 1812 all tariffs were doubled to an average of 25% in order to cope with the increase in public expenditure due to the war. A significant shift in policy occurred in 1816, when a new law was introduced to keep the tariff level close to the wartime level—especially protected were cotton, woolen, and iron goods. The American industrial interests that had blossomed because of the tariff lobbied to keep it, and had it raised to 35 percent in 1816. The public approved, and by 1820, America's average tariff was up to 40 percent.

In the 19th century, statesmen such as Senator Henry Clay continued Hamilton's themes within the Whig Party under the name " American System which consisted of protecting industries and developing infrastructure in explicit opposition to the "British system" of free trade. Before 1860 they were always defeated by the low-tariff Democrats.

From 1846 to 1861, during which American tariffs were lowered but this was followed by a series of recessions and the 1857 panic, which eventually led to higher demands for tariffs than President James Buchanan, signed in 1861 (Morrill Tariff).

During the American Civil War (1861-1865), agrarian interests in the South were opposed to any protection, while manufacturing interests in the North wanted to maintain it. The war marked the triumph of the protectionists of the industrial states of the North over the free traders of the South. Abraham Lincoln was a protectionist like Henry Clay of the Whig Party, who advocated the "American system" based on infrastructure development and protectionism. In 1847, he declared: ''"Give us a protective tariff, and we will have the greatest nation on earth"''. Once elected, Lincoln raised industrial tariffs and after the war, tariffs remained at or above wartime levels. High tariffs were a policy designed to encourage rapid industrialisation and protect the high American wage rates.

The policy from 1860 to 1933 was usually high protective tariffs (apart from 1913 to 1921). After 1890, the tariff on wool did affect an important industry, but otherwise the tariffs were designed to keep American wages high. The conservative Republican tradition, typified by William McKinley

William McKinley (January 29, 1843September 14, 1901) was the 25th president of the United States, serving from 1897 until his assassination in 1901. As a politician he led a realignment that made his Republican Party largely dominant in ...

was a high tariff, while the Democrats typically called for a lower tariff to help consumers but they always failed until 1913.F.W. Taussig,. ''The Tariff History of the United States''. 8th edition (1931)5th edition 1910 is online

/ref> In the early 1860s, Europe and the United States pursued completely different trade policies. The 1860s were a period of growing protectionism in the United States, while the European free trade phase lasted from 1860 to 1892. The tariff average rate on imports of manufactured goods was in 1875 from 40% to 50% in the United States against 9% to 12% in continental Europe at the height of free trade. In 1896, the GOP pledged platform pledged to "renew and emphasize our allegiance to the policy of protection, as the bulwark of American industrial independence, and the foundation of development and prosperity. This true American policy taxes foreign products and encourages home industry. It puts the burden of revenue on foreign goods; it secures the American market for the American producer. It upholds the American standard of wages for the American workingman". In 1913, following the electoral victory of the Democrats in 1912, there was a significant reduction in the average tariff on manufactured goods from 44% to 25%. However, the First World War rendered this bill ineffective, and new "emergency" tariff legislation was introduced in 1922, after the Republicans returned to power in 1921. According to economic historian Douglas Irwin, a common myth about United States trade policy is that low tariffs harmed American manufacturers in the early 19th century and then that high tariffs made the United States into a great industrial power in the late 19th century. A review by the ''Economist'' of Irwin's 2017 book ''Clashing over Commerce: A History of US Trade Policy'' notes:

Political dynamics would lead people to see a link between tariffs and the economic cycle that was not there. A boom would generate enough revenue for tariffs to fall, and when the bust came pressure would build to raise them again. By the time that happened, the economy would be recovering, giving the impression that tariff cuts caused the crash and the reverse generated the recovery. Mr Irwin also methodically debunks the idea that protectionism made America a great industrial power, a notion believed by some to offer lessons for developing countries today. As its share of global manufacturing powered from 23% in 1870 to 36% in 1913, the admittedly high tariffs of the time came with a cost, estimated at around 0.5% of GDP in the mid-1870s. In some industries, they might have sped up development by a few years. But American growth during its protectionist period was more to do with its abundant resources and openness to people and ideas.The economist

Ha-Joon Chang

Ha-Joon Chang (; ; born 7 October 1963) is a South Korean institutional economist, specialising in development economics. Chang is the author of several widely discussed policy books, most notably ''Kicking Away the Ladder: Development Strateg ...

disagrees with the idea that the United States has developed and reached the top of the world economic hierarchy by adopting free trade. On the contrary, according to him, they have adopted an interventionist policy to promote and protect their industries through tariffs. It was their protectionist policy that would have allowed the United States to experience the fastest economic growth in the world throughout the 19th century and into the 1920s.

Tariffs and the Great Depression

Most economists hold the opinion that the Smoot-Hawley Tariff Act in the United States did not greatly worsen the Great Depression:Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was th ...

writes that protectionism does not lead to recessions. According to him, the decrease in imports (which can be obtained by introducing tariffs) has an expansive effect, that is, it is favorable to growth. Thus, in a trade war, since exports and imports will decrease equally, for everyone, the negative effect of a decrease in exports will be offset by the expansionary effect of a decrease in imports. Therefore, a trade war does not cause a recession. Furthermore, he points out that the Smoot-Hawley tariff did not cause the Great Depression. The decline in trade between 1929 and 1933 "was almost entirely a consequence of the Depression, not a cause. Trade barriers were a response to the Depression, partly as a consequence of deflation."

Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

held the opinion that the tariffs of 1930 did not cause the Great Depression, instead he blamed the lack of sufficient action on the part of the Federal Reserve. Douglas A. Irwin wrote: "most economists, both liberal and conservative, doubt that Smoot–Hawley played much of a role in the subsequent contraction".

Peter Temin

Peter Temin (; born 17 December 1937) is an economist and economic historian, currently Gray Professor Emeritus of Economics, MIT and former head of the Economics Department.

Education

Temin graduated from Swarthmore College in 1959 before earnin ...

, an economist at the Massachusetts Institute of Technology, explained that a tariff is an expansionary policy, like a devaluation as it diverts demand from foreign to home producers. He noted that exports were 7 percent of GNP in 1929, they fell by 1.5 percent of 1929 GNP in the next two years and the fall was offset by the increase in domestic demand from tariff. He concluded that contrary the popular argument, contractionary effect of the tariff was small.

William Bernstein wrote: "Between 1929 and 1932, real GDP fell 17 percent worldwide, and by 26 percent in the United States, but most economic historians now believe that only a minuscule part of that huge loss of both world GDP and the United States’ GDP can be ascribed to the tariff wars. .. At the time of Smoot-Hawley's passage, trade volume accounted for only about 9 percent of world economic output. Had all international trade been eliminated, and had no domestic use for the previously exported goods been found, world GDP would have fallen by the same amount — 9 percent. Between 1930 and 1933, worldwide trade volume fell off by one-third to one-half. Depending on how the falloff is measured, this computes to 3 to 5 percent of world GDP, and these losses were partially made up by more expensive domestic goods. Thus, the damage done could not possibly have exceeded 1 or 2 percent of world GDP — nowhere near the 17 percent falloff seen during the Great Depression... The inescapable conclusion: contrary to public perception, Smoot-Hawley did not cause, or even significantly deepen, the Great Depression,"(''A Splendid Exchange: How Trade Shaped the World, William Bernstein'')

Jacques Sapir explains that the crisis has other causes than protectionism. He points out that "domestic production in major industrialized countries is declining...faster than international trade is declining." If this decrease (in international trade) had been the cause of the depression that the countries have experienced, we would have seen the opposite". "Finally, the chronology of events does not correspond to the thesis of the free traders... The bulk of the contraction of trade occurred between January 1930 and July 1932, that is, before the introduction of protectionist measures, even self-sufficient, in some countries, with the exception of those applied in the United States in the summer of 1930, but with negative effects. very limited. He noted that "the credit crunch is one of the main causes of the trade crunch." "In fact, international liquidity is the cause of the trade contraction. This liquidity collapsed in 1930 (-35.7%) and 1931 (-26.7%). A study by the National Bureau of Economic Research highlights the predominant influence of currency instability (which led to the international liquidity crisis) and the sudden rise in transportation costs in the decline of trade during the 1930s .

Russia

The Russian Federation adopted more protectionist trade measures in 2013 than any other country, making it the world leader in protectionism. It alone introduced 20% of protectionist measures worldwide and one-third of measures in the G20 countries. Russia's protectionist policies include tariff measures, import restrictions, sanitary measures, and direct subsidies to local companies. For example, the government supported several economic sectors such as agriculture, space, automotive, electronics, chemistry, and energy.India

From 2017, as part of the promotion of its "Make in India

Make in India is an initiative by the Government of India to create and encourage companies to develop, manufacture and assemble products made in India and incentivize dedicated investments into manufacturing. The policy approach was to crea ...

" programme to stimulate and protect domestic manufacturing industry and to combat current account deficits, India has introduced tariffs on several electronic products and "non-essential items". This concerns items imported from countries such as China and South Korea. For example, India's national solar energy programme favours domestic producers by requiring the use of Indian-made solar cells.

Armenia

Armenia

Armenia (), , group=pron officially the Republic of Armenia,, is a landlocked country in the Armenian Highlands of Western Asia.The UNbr>classification of world regions places Armenia in Western Asia; the CIA World Factbook , , and ''Ox ...

, a country located in Western Asia

Western Asia, West Asia, or Southwest Asia, is the westernmost subregion of the larger geographical region of Asia, as defined by some academics, UN bodies and other institutions. It is almost entirely a part of the Middle East, and includes Ana ...

, established its custom service in 1992 after the dissolution of the Soviet Union. When Armenia became a member of the EAEU, it was given access to the Eurasian Customs Union

The Eurasian Customs Union (EACU; russian: Таможенный союз ЕАЭС, Tamozhenyi soyuz) was a customs union consisting of all the member states of the Eurasian Economic Union. The customs union was a principal task of the Eurasian E ...

in 2015; this resulted in mostly tariff-free trade with other members and an increased number of import tariffs from outside of the customs union. Armenia does not currently have export taxes. In addition, it does not declare temporary imports duties and credit on government imports or pursuant to other international assistance imports. Upon joining Eurasian Economic Union in 2015, led by Russians, Armenia

Armenia (), , group=pron officially the Republic of Armenia,, is a landlocked country in the Armenian Highlands of Western Asia.The UNbr>classification of world regions places Armenia in Western Asia; the CIA World Factbook , , and ''Ox ...

applied tariffs on its imports at a rate 0-10 percent. This rate has increased over the years, since in 2009 it was around three percent. Moreover, the tariffs increased significantly on agricultural products rather than on non-agricultural products.

Armenia has committed to ultimately adopting the EAEU's uniform tariff schedule as part of its EAEU admission. Armenia will be authorized to apply customs tariffs that differ from the EAEU tariff rates until 2022, according to Decision No. 113. Some beef, pork, poultry, and dairy products; seed potatoes and peas; olives; fresh and dried fruits; some tea items; cereals, especially wheat and rice; starches, vegetable oils, margarine; some prepared food items, such as infant food; pet food; tobacco; glycerol; and gelatin are included in the list.

Membership in the EAEU is forcing Armenia to apply stricter standardization, sanitary, and phytosanitary requirements in line with EAEU—and, by extension, Russian—standards, regulations, and practices. Armenia has had to surrender control over many aspects of its foreign trade regime in the context of EAEU membership. Tariffs have also increased, granting protection to several domestic industries. Armenia is increasingly beholden to comply with EAEU standards and regulations as post-accession transition periods have, or will soon, end. All Armenian goods circulating in the territory of the EAEU must meet EAEU requirements following the end of relevant transition periods.

The Republic of Armenia has become a member of WTO in 2003, which resulted in the Most Favored Country(MFC) benefits from the organisation. Currently, the tariffs of 2.7% implemented in Armenia are the lowers in the entire framework. Align with the World Customs Organization (WCO), which the country is also a member of harmonized System for tariff classification, which is a method of a consistent numbering system for categorising traded goods.

{{unreferenced section, date=January 2015

A customs duty or due is the indirect tax levied on the import or export of goods in international trade. In economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes ...

a duty is also a kind of consumption tax

A consumption tax is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on consumption. Consumption taxes are usually indirect, such as a sales tax or a value-added tax. However, a consumpti ...

. A duty levied on goods being imported is referred to as an 'import duty', and one levied on exports an 'export duty'.

Calculation of customs duty

Customs duty is calculated on the determination of the 'assess-able value' in case of those items for which the duty is levied {{lang, la,ad valorem

An ''ad valorem'' tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ...

. This is often the transaction value unless a customs officer determines assess-able value in accordance with the Harmonized System

The Harmonized Commodity Description and Coding System, also known as the Harmonized System (HS) of tariff nomenclature is an internationally standardized system of names and numbers to classify traded products. It came into effect in 1988 and has ...

. For certain items like petroleum and alcohol, customs duty is realized at a specific rate applied to the volume of the import or export consignments.{{citation needed, date=September 2021

Harmonized System of Nomenclature

For the purpose of assessment of customs duty, products are given an identification code that has come to be known as theHarmonized System

The Harmonized Commodity Description and Coding System, also known as the Harmonized System (HS) of tariff nomenclature is an internationally standardized system of names and numbers to classify traded products. It came into effect in 1988 and has ...

code. This code was developed by the World Customs Organization

The World Customs Organization (WCO) is an intergovernmental organization headquartered in Brussels, Belgium. The WCO works on customs-related matters including the development of international conventions, instruments, and tools on topics su ...

based in Brussels. A 'Harmonized System' code may be from four to ten digits. For example, 17.03 is the HS code for ''molasses from the extraction or refining of sugar''. However, within 17.03, the number 17.03.90 stands for "Molasses (Excluding Cane Molasses)".

Introduction of Harmonized System codes in the 1990s has largely replaced the previous Standard International Trade Classification (SITC), though SITC remains in use for statistical purposes.{{citation needed, date=September 2021 In drawing up the national tariff, the revenue departments often specifies the rate of customs duty with reference to the HS code of the product. In some countries and customs unions, 6-digit HS codes are locally extended to 8 digits or 10 digits for further tariff discrimination: for example the European Union uses its 8-digit CN (Combined Nomenclature

Council Regulation (EEC) No 2658/87 of 23 July 1987, creates the goods nomenclature called the Combined Nomenclature, or in abbreviated form 'CN', established to meet, at one and the same time, the requirements both of the Common Customs Tariff and ...

) and 10-digit TARIC codes.{{citation needed, date=September 2021

Customs authority

The national customs authority in each country is responsible for collecting taxes on the import into or export of goods out of the country. Normally the customs authority, operating under national law, is authorized to examine cargo in order to ascertain actual description, specification volume or quantity, so that the assessable value and the rate of duty may be correctly determined and applied.{{citation needed, date=September 2021Evasion

{{Main, Tax evasion Evasion of customs duties takes place mainly in two ways. In one, the trader under-declares the value so that the assessable value is lower than actual. In a similar vein, a trader can evade customs duty by understatement of quantity or volume of the product of trade. A trader may also evade duty by misrepresenting traded goods, categorizing goods as items which attract lower customs duties. The evasion of customs duty may take place with or without the collaboration of customs officials. {{Citation needed span, text=Evasion of customs duty does not necessarily constitute smuggling., date=June 2013Duty-free goods

Many countries allow a traveller to bring goods into the countryduty-free

A duty-free shop (or store) is a retail outlet whose goods are exempt from the payment of certain local or national taxes and duties, on the requirement that the goods sold will be sold to travelers who will take them out of the country, w ...

. These goods may be bought at port

A port is a maritime facility comprising one or more wharves or loading areas, where ships load and discharge cargo and passengers. Although usually situated on a sea coast or estuary, ports can also be found far inland, such as H ...

s and airport

An airport is an aerodrome with extended facilities, mostly for commercial air transport. Airports usually consists of a landing area, which comprises an aerially accessible open space including at least one operationally active surface ...

s or sometimes within one country without attracting the usual government taxes and then brought into another country duty-free. Some countries specify 'duty-free allowances' which limit the number or value of duty-free items that one person can bring into the country. These restrictions often apply to tobacco

Tobacco is the common name of several plants in the genus '' Nicotiana'' of the family Solanaceae, and the general term for any product prepared from the cured leaves of these plants. More than 70 species of tobacco are known, but the ...

, wine

Wine is an alcoholic drink typically made from fermented grapes. Yeast consumes the sugar in the grapes and converts it to ethanol and carbon dioxide, releasing heat in the process. Different varieties of grapes and strains of yeasts are m ...

, spirits

Spirit or spirits may refer to:

Liquor and other volatile liquids

* Spirits, a.k.a. liquor, distilled alcoholic drinks

* Spirit or tincture, an extract of plant or animal material dissolved in ethanol

* Volatile (especially flammable) liquids, ...

, cosmetics

Cosmetics are constituted mixtures of chemical compounds derived from either natural sources, or synthetically created ones. Cosmetics have various purposes. Those designed for personal care and skin care can be used to cleanse or protect ...

, gifts

A gift or a present is an item given to someone without the expectation of payment or anything in return. An item is not a gift if that item is already owned by the one to whom it is given. Although gift-giving might involve an expectation ...

and souvenir

A souvenir (), memento, keepsake, or token of remembrance is an object a person acquires for the memories the owner associates with it. A souvenir can be any object that can be collected or purchased and transported home by the traveler as a m ...

s. Often foreign diplomat

A diplomat (from grc, δίπλωμα; romanized ''diploma'') is a person appointed by a state or an intergovernmental institution such as the United Nations or the European Union to conduct diplomacy with one or more other states or internati ...

s and UN officials are entitled to duty-free goods.{{citation needed, date=September 2021

Deferment of tariffs and duties

Goods may be imported and stocked duty-free in abonded warehouse

A bonded warehouse, or bond, is a building or other secured area in which dutiable goods may be stored, manipulated, or undergo manufacturing operations without payment of duty. It may be managed by the state or by private enterprise. In the ...

: duty becomes payable on leaving the facility.{{citation needed, date=September 2021 Products may sometimes be imported into a free economic zone

Free economic zones (FEZ), free economic territories (FETs) or free zones (FZ) are a class of special economic zone (SEZ) designated by the trade and commerce administrations of various countries. The term is used to designate areas in which co ...

(or 'free port'), processed there, then re-exported without being subject to tariffs or duties. According to the 1999 Revised Kyoto Convention, a "'free zone' means a part of the territory of a contracting party where any goods introduced are generally regarded, insofar as import duties and taxes are concerned, as being outside the customs territory".

Economic analysis

Neoclassical economic theorists tend to view tariffs as distortions to the

Neoclassical economic theorists tend to view tariffs as distortions to the free market

In economics, a free market is an economic system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of government or any ot ...

. Typical analyses find that tariffs tend to benefit domestic producers and government at the expense of consumers, and that the net welfare effects of a tariff on the importing country are negative due to domestic firms not producing more efficiently since there is a lack of external competition.{{cite web, last=Radcliffe, first=Brent, title=The Basics Of Tariffs and Trade Barriers, url=https://www.investopedia.com/articles/economics/08/tariff-trade-barrier-basics.asp, access-date=2020-11-07, website=Investopedia, language=en Therefore, domestic consumers are affected since the price is higher due to high costs caused due to inefficient production or if firms aren't able to source cheaper material externally thus reducing the affordability of the products. Normative judgments often follow from these findings, namely that it may be disadvantageous for a country to artificially shield an industry from world markets and that it might be better to allow a collapse to take place. Opposition to all tariff aims to reduce tariffs and to avoid countries discriminating between differing countries when applying tariffs. The diagrams at right show the costs and benefits of imposing a tariff on a good in the domestic economy.

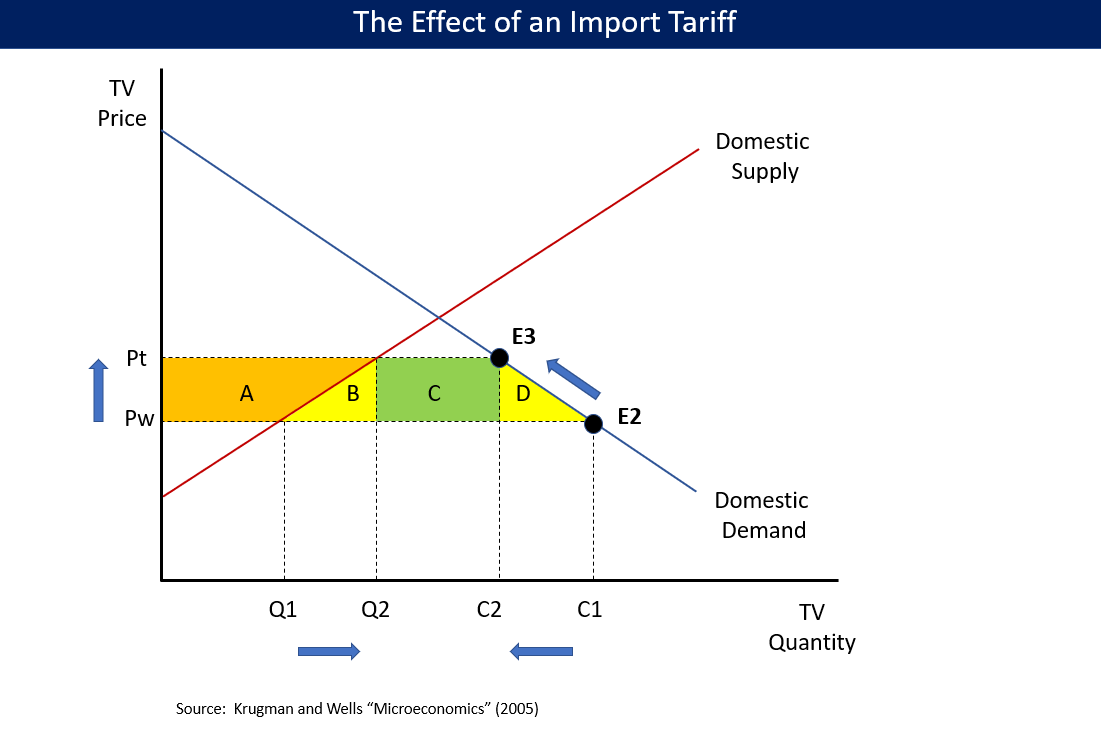

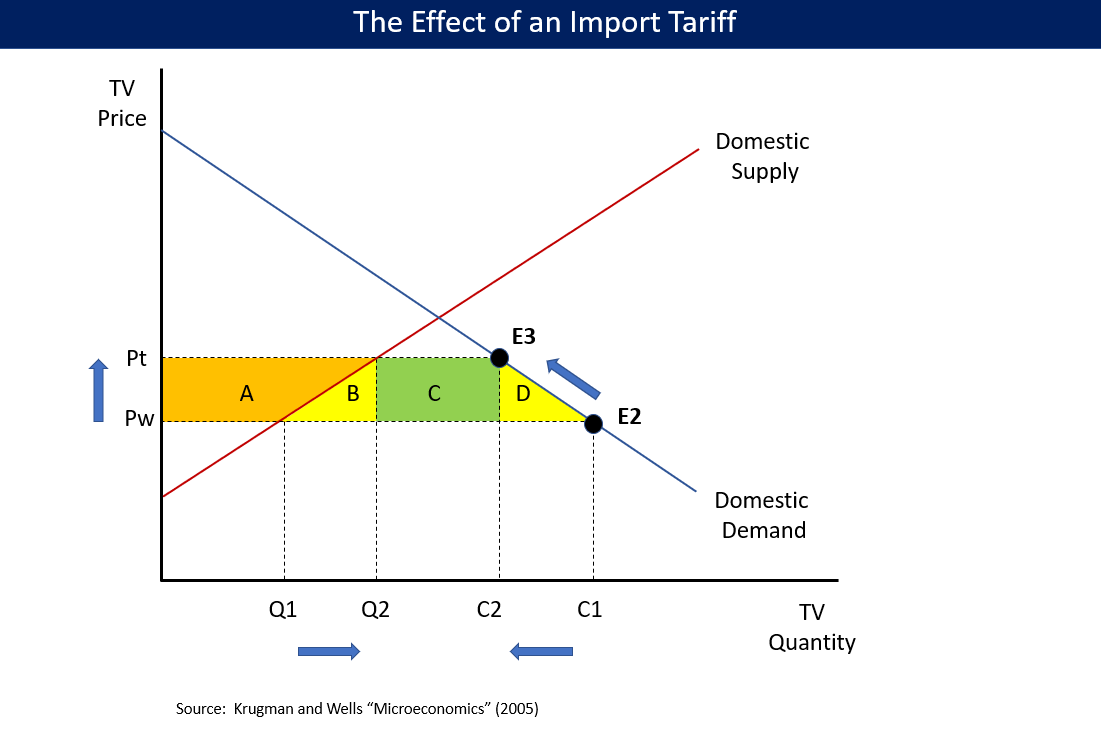

Imposing an import tariff has the following effects, shown in the first diagram in a hypothetical domestic market for televisions:

*Price rises from world price Pw to higher tariff price Pt.

*Quantity demanded by domestic consumers falls from C1 to C2, a movement along the demand curve due to higher price.

*Domestic suppliers are willing to supply Q2 rather than Q1, a movement along the supply curve due to the higher price, so the quantity imported falls from C1−Q1 to C2−Q2.

* Consumer surplus (the area under the demand curve but above price) shrinks by areas A+B+C+D, as domestic consumers face higher prices and consume lower quantities.

* Producer surplus (the area above the supply curve but below price) increases by area A, as domestic producers shielded from international competition can sell more of their product at a higher price.

*Government tax revenue is the import quantity (C2 − Q2) times the tariff price (Pw − Pt), shown as area C.

*Areas B and D are deadweight loss

In economics, deadweight loss is the difference in production and consumption of any given product or service including government tax. The presence of deadweight loss is most commonly identified when the quantity produced ''relative'' to the amoun ...

es, surplus formerly captured by consumers that now is lost to all parties.

The overall change in welfare = Change in Consumer Surplus + Change in Producer Surplus + Change in Government Revenue = (−A−B−C−D) + A + C = −B−D. The final state after imposition of the tariff is indicated in the second diagram, with overall welfare reduced by the areas labeled "societal losses", which correspond to areas B and D in the first diagram. The losses to domestic consumers are greater than the combined benefits to domestic producers and government.

That tariffs overall reduce welfare is not a controversial topic among economists. For example, the University of Chicago surveyed about 40 leading economists in March 2018 asking whether "Imposing new U.S. tariffs on steel and aluminum will improve Americans' welfare." About two-thirds strongly disagreed with the statement, while one third disagreed. None agreed or strongly agreed. Several commented that such tariffs would help a few Americans at the expense of many. This is consistent with the explanation provided above, which is that losses to domestic consumers outweigh gains to domestic producers and government, by the amount of deadweight losses.{{sfnp, Krugman , Wells, 2005

Tariffs are more inefficient than consumption taxes.

A 2021 study found that across 151 countries over the period 1963–2014, "tariff increases are associated with persistent, economically and statistically significant declines in domestic output and productivity, as well as higher unemployment and inequality, real exchange rate appreciation, and insignificant changes to the trade balance."

Optimal tariff

For economic efficiency, ''free trade

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold econ ...

'' is often the best policy, however levying a tariff is sometimes ''second best''.

A tariff is called an optimal tariff if it is set to maximize the welfare of the country imposing the tariff.{{sfnp, El-Agraa, 1984, p=26 It is a tariff derived by the intersection between the ''trade indifference curve'' of that country and the offer curve of another country. In this case, the welfare of the other country grows worse simultaneously, thus the policy is a kind of ''beggar thy neighbor

Begging (also panhandling) is the practice of imploring others to grant a favor, often a gift of money, with little or no expectation of reciprocation. A person doing such is called a beggar or panhandler. Beggars may operate in public plac ...

policy''. If the offer curve of the other country is a line through the origin point, the original country is in the ''condition of a small country'', so any tariff worsens the welfare of the original country.{{sfnp, El-Agraa, 1984, loc=Chap.2 保護:全般的な背景, pages=8–35 (in 8–45 by the Japanese ed.)

It is possible to levy a tariff as a political policy choice, and to consider a theoretical optimum tariff rate.{{sfnp, El-Agraa, 1984, loc=Chap. 5 「雇用−関税」命題の政治経済学的評価, page =76 (by the Japanese ed.) However, imposing an optimal tariff will often lead to the foreign country increasing their tariffs as well, leading to a loss of welfare in both countries. When countries impose tariffs on each other, they will reach a position off the contract curve, meaning that both countries' welfare could be increased by reducing tariffs.{{sfnp, El-Agraa, 1984, loc=Chap. 6 最適関税、報復および国際協力, page=93 (in 83–94 by the Japanese ed.)

Political analysis

{{See also, Tariffs in United States history, List of tariffs in the United States, Protectionism in the United States The tariff has been used as a political tool to establish an independent nation; for example, the United StatesTariff Act of 1789

The Tariff Act of 1789 was the first major piece of legislation passed in the United States after the ratification of the United States Constitution and it had two purposes. It was to protect manufacturing industries developing in the nation and ...

, signed specifically on July 4, was called the "Second Declaration of Independence" by newspapers because it was intended to be the economic means to achieve the political goal of a sovereign and independent United States.

The political impact of tariffs is judged depending on the political perspective; for example the 2002 United States steel tariff

On March 5, 2002, U.S. President George W. Bush placed tariffs on imported steel. The tariffs took effect March 20 and were lifted by Bush on December 4, 2003. Research shows that the tariffs were a net positive, reviving many previously shuttered ...

imposed a 30% tariff on a variety of imported steel products for a period of three years and American steel producers supported the tariff.

Tariffs can emerge as a political issue prior to an election

An election is a formal group decision-making process by which a population chooses an individual or multiple individuals to hold public office.

Elections have been the usual mechanism by which modern representative democracy has opera ...

. In the leadup to the 2007 Australian Federal election, the Australian Labor Party

The Australian Labor Party (ALP), also simply known as Labor, is the major centre-left political party in Australia, one of two major parties in Australian politics, along with the centre-right Liberal Party of Australia. The party forms t ...

announced it would undertake a review of Australian car tariffs if elected. The Liberal Party

The Liberal Party is any of many political parties around the world. The meaning of ''liberal'' varies around the world, ranging from liberal conservatism on the right to social liberalism on the left.

__TOC__ Active liberal parties

This is a li ...

made a similar commitment, while independent candidate Nick Xenophon

Nick Xenophon ( Nicholas Xenophou; born 29 January 1959) is an Australian politician and lawyer who was a Senator for South Australia from 2008 to 2017. He was the leader of two political parties: Nick Xenophon Team federally, and Nick Xenophon ...

announced his intention to introduce tariff-based legislation as "a matter of urgency".

Unpopular tariffs are known to have ignited social unrest, for example the 1905 meat riots

The Meat riot (Spanish: ''Huelga de la carne''), in the Chilean capital Santiago in October 1905, was a violent riot that originated from a demonstration against the tariffs applied to the cattle imports from Argentina. Primeros movimientos soc ...

in Chile that developed in protest against tariffs applied to the cattle imports from Argentina.{{in lang, es Primeros movimientos sociales chileno (1890–1920)

'. Memoria Chilena.Benjamin S. 1997. Meat and Strength: The Moral Economy of a Chilean Food Riot. '' Cultural Anthropology'', 12, pp. 234–268.

Arguments in favor of tariffs

Protection of infant industry

Postulated in the United States by Alexander Hamilton at the end of the 18th century, byFriedrich List

Georg Friedrich List (6 August 1789 – 30 November 1846) was a German-American economist who developed the "National System" of political economy. He was a forefather of the German historical school of economics, and argued for the German Custom ...

in his 1841 book {{LANG, DE, Das nationale System der politischen Oekonomie and by John Stuart Mill, the argument made in favour of this category of tariffs was this: should a country wish to develop a new economic activity on its soil, it would have to temporarily protect it. In their view, it is legitimate to protect certain activities by customs barriers in order to give them time to grow, to reach a sufficient size and to benefit from economies of scale

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced per unit of time. A decrease in cost per unit of output enables ...

through increased production and productivity gains. This would allow them to become competitive in order to face international competition. Indeed, a company needs to reach a certain production volume to be profitable in order to compensate for its fixed costs. Without protectionism, foreign products{{snd which are already profitable because of the volume of production already carried out on their soil{{snd would arrive in the country in large quantities at a lower price than local production. The recipient country's nascent industry would quickly disappear. A firm already established in an industry is more efficient because it is more adapted and has greater production capacity. New firms therefore suffer losses due to a lack of competitiveness linked to their 'apprenticeship' or catch-up period. By being protected from this external competition, firms can therefore establish themselves on their domestic market. As a result, they benefit from greater freedom of manoeuvre and greater certainty regarding their profitability and future development. The protectionist phase is therefore a learning period that would allow the least developed countries to acquire general and technical know-how in the fields of industrial production in order to become competitive on international market.

According to the economists in favour of protecting industries, free trade would condemn developing countries to being nothing more than exporters of raw materials and importers of manufactured goods. The application of the theory of comparative advantage

In an economic model, agents have a comparative advantage over others in producing a particular good if they can produce that good at a lower relative opportunity cost or autarky price, i.e. at a lower relative marginal cost prior to trade. Comp ...

would lead them to specialize in the production of raw materials and extractive products and prevent them from acquiring an industrial base. Protection of infant industries

The infant industry argument is an economic rationale for trade protectionism. The core of the argument is that nascent industries often do not have the economies of scale that their older competitors from other countries may have, and thus nee ...

(e.g. through tariffs on imported products) would therefore be essential for developing countries to industrialize and escape their dependence on the production of raw materials.{{cite conference , url=https://www.cepal.org/prensa/noticias/comunicados/8/7598/chang.pdf , title=Infant Industry Promotion in Historical Perspective{{snd A Rope to Hang Oneself or a Ladder to Climb With? , author=Ha-Joon Chang

Ha-Joon Chang (; ; born 7 October 1963) is a South Korean institutional economist, specialising in development economics. Chang is the author of several widely discussed policy books, most notably ''Kicking Away the Ladder: Development Strateg ...

(Faculty of Economics and Politics, University of Cambridge) , date=2001 , conference=Development Theory at the Threshold of the Twenty-first Century , location=Santiago, Chile , publisher=United Nations Economic Commission for Latin America and the Caribbean

The United Nations Economic Commission for Latin America and the Caribbean, known as ECLAC, UNECLAC or in Spanish and Portuguese CEPAL, is a United Nations regional commission to encourage economic cooperation. ECLAC includes 46 member States (2 ...

, access-date=2021-05-13 , archive-date=2021-03-08 , archive-url=https://web.archive.org/web/20210308192131/https://www.cepal.org/prensa/noticias/comunicados/8/7598/chang.pdf , url-status=dead

Economist Ha-Joon Chang

Ha-Joon Chang (; ; born 7 October 1963) is a South Korean institutional economist, specialising in development economics. Chang is the author of several widely discussed policy books, most notably ''Kicking Away the Ladder: Development Strateg ...

argues that most of today's developed countries have developed through policies that are the opposite of free trade

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold econ ...

and laissez-faire

''Laissez-faire'' ( ; from french: laissez faire , ) is an economic system in which transactions between private groups of people are free from any form of economic interventionism (such as subsidies) deriving from special interest groups ...

. According to him, when they were developing countries themselves, almost all of them actively used interventionist trade and industrial policies to promote and protect infant industries. Instead, they would have encouraged their domestic industries through tariffs, subsidies and other measures. In his view, Britain and the United States have not reached the top of the global economic hierarchy by adopting free trade. In fact, these two countries would have been among the greatest users of protectionist measures, including tariffs. As for the East Asian countries, he points out that the longest periods of rapid growth in these countries do not coincide with extended phases of free trade, but rather with phases of industrial protection and promotion. Interventionist trade and industrial policies would have played a crucial role in their economic success. These policies would have been similar to those used by Britain in the 18th century and the United States in the 19th century. He considers that infant industry protection policy has generated much better growth performance in the developing world than free trade policies since the 1980s.

In the second half of the 20th century, Nicholas Kaldor

Nicholas Kaldor, Baron Kaldor (12 May 1908 – 30 September 1986), born Káldor Miklós, was a Cambridge economist in the post-war period. He developed the "compensation" criteria called Kaldor–Hicks efficiency for welfare comparisons (1939), d ...

takes up similar arguments to allow the conversion of ageing industries. In this case, the aim was to save an activity threatened with extinction by external competition and to safeguard jobs. Protectionism must enable ageing companies to regain their competitiveness in the medium term and, for activities that are due to disappear, it allows the conversion of these activities and jobs.

Protection against dumping

States resorting to protectionism invoke unfair competition or dumping practices: * Monetary manipulation: a currency undergoes adevaluation

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national curre ...

when monetary authorities decide to intervene in the foreign exchange market to lower the value of the currency against other currencies. This makes local products more competitive and imported products more expensive (Marshall Lerner Condition), increasing exports and decreasing imports, and thus improving the trade balance. Countries with a weak currency cause trade imbalances: they have large external surpluses while their competitors have large deficits.

* Tax dumping: some tax haven states have lower corporate and personal tax rates.

* Social dumping: when a state reduces social contributions or maintains very low social standards (for example, in China, labour regulations are less restrictive for employers than elsewhere).

* Environmental dumping

Environmental dumping is the practice of transfrontier shipment of waste (household waste, industrial/nuclear waste, etc.) from one country to another. The goal is to take the waste to a country that has less strict environmental laws, or enviro ...

: when environmental regulations are less stringent than elsewhere.

Free trade and poverty

Sub-Saharan African countries have a lower income per capita in 2003 than 40 years earlier (Ndulu, World Bank, 2007, p. 33). Per capita income increased by 37% between 1960 and 1980 and fell by 9% between 1980 and 2000. Africa's manufacturing sector's share of GDP decreased from 12% in 1980 to 11% in 2013. In the 1970s, Africa accounted for more than 3% of world manufacturing output, and now accounts for 1.5%. In anOp ed

An op-ed, short for "opposite the editorial page", is a written prose piece, typically published by a North-American newspaper or magazine, which expresses the opinion of an author usually not affiliated with the publication's editorial board. O ...

article for ''The Guardian

''The Guardian'' is a British daily newspaper. It was founded in 1821 as ''The Manchester Guardian'', and changed its name in 1959. Along with its sister papers ''The Observer'' and ''The Guardian Weekly'', ''The Guardian'' is part of the Gu ...

'' (UK), Ha-Joon Chang

Ha-Joon Chang (; ; born 7 October 1963) is a South Korean institutional economist, specialising in development economics. Chang is the author of several widely discussed policy books, most notably ''Kicking Away the Ladder: Development Strateg ...

argues that these downturns are the result of free trade policies,{{cite news, url=https://www.theguardian.com/commentisfree/2012/jul/15/africa-industrial-policy-washington-orthodoxy, title=Africa needs an active industrial policy to sustain its growth - Ha-Joon Chang, first=Ha-Joon, last=Chang, date=15 July 2012, access-date=14 April 2019, newspaper=The Guardian{{cite web, author= , url=http://www.newtimes.co.rw/section/read/202574 , title=Why does Africa struggle to industrialise its economies? | The New Times | Rwanda , publisher=The New Times , date=2016-08-13 , access-date=2019-10-07 and elsewhere attributes successes in some African countries such as Ethiopia

Ethiopia, , om, Itiyoophiyaa, so, Itoobiya, ti, ኢትዮጵያ, Ítiyop'iya, aa, Itiyoppiya officially the Federal Democratic Republic of Ethiopia, is a landlocked country in the Horn of Africa. It shares borders with Eritrea to the ...

and Rwanda to their abandonment of free trade and adoption of a "developmental state model".

The poor countries that have succeeded in achieving strong and sustainable growth

Sustainable development is an organizing principle for meeting human development goals while also sustaining the ability of natural systems to provide the natural resources and ecosystem services on which the economy and society depend. The desi ...

are those that have become mercantilists

Mercantilism is an economic policy that is designed to maximize the exports and minimize the imports for an economy. It promotes imperialism, colonialism, tariffs and subsidies on traded goods to achieve that goal. The policy aims to reduce ...

, not free traders: China, South Korea, Japan, Taiwan. Thus, whereas in the 1990s, China and India had the same GDP per capita, China followed a much more mercantilist policy and now has a GDP per capita three times higher than India's.

Indeed, a significant part of China's rise on the international trade scene does not come from the supposed benefits of international competition but from the relocations practiced by companies from developed countries. Dani Rodrik

Dani Rodrik (born August 14, 1957) is a Turkish economist and Ford Foundation Professor of International Political Economy at the John F. Kennedy School of Government at Harvard University. He was formerly the Albert O. Hirschman Professor of t ...

points out that it is the countries that have systematically violated the rules of globalisation that have experienced the strongest growth.

The 'dumping' policies of some countries have also largely affected developing countries. Studies on the effects of free trade show that the gains induced by WTO rules for developing countries are very small.{{cite journal , last1=Ackerman , first1=Frank , title=The Shrinking Gains from Trade: A Critical Assessment of Doha Round Projections , journal=Research in Agricultural and Applied Economics , series=Working Paper No. 05-01 , date=2005 , doi=10.22004/AG.ECON.15580 , s2cid=17272950 This has reduced the gain for these countries from an estimated {{US$, long=no, 539 billion in the 2003 LINKAGE model to {{US$, long=no, 22 billion in the 2005 GTAP model. The 2005 LINKAGE version also reduced gains to 90 billion. As for the "Doha Round

The Doha Development Round or Doha Development Agenda (DDA) is the trade-negotiation round of the World Trade Organization (WTO) which commenced in November 2001 under then director-general Mike Moore. Its objective was to lower trade barriers ...

", it would have brought in only {{US$, long=no, 4 billion to developing countries (including China...) according to the GTAP model. However, it has been argued that the models used are actually designed to maximize the positive effects of trade liberalization, that they are characterized by the absence of taking into account the loss of income caused by the end of tariff barriers.

John Maynard Keynes, tariffs and trade deficit

{{main, John Maynard KeynesThe turning point of the Great Depression

At the beginning of his career, Keynes was an economist close to Alfred Marshall, deeply convinced of the benefits of free trade. From the crisis of 1929 onwards, noting the commitment of the British authorities to defend the gold parity of the pound sterling and the rigidity of nominal wages, he gradually adhered to protectionist measures.{{Cite journal, url=https://www.erudit.org/fr/revues/ae/2010-v86-n1-ae3990/045556ar/, doi = 10.7202/045556ar, title = J.M. Keynes, le libre-échange et le protectionnisme, year = 2011, last1 = Maurin, first1 = Max, journal = L'Actualité Économique, volume = 86, pages = 109–129, doi-access = free On 5 November 1929, when heard by theMacmillan Committee The Macmillan Committee, officially known as the Committee on Finance and Industry, was a committee, composed mostly of economists, formed by the British government after the 1929 stock market crash to determine the root causes of the depressed eco ...

to bring the British economy out of the crisis, Keynes indicated that the introduction of tariffs on imports would help to rebalance the trade balance. The committee's report states in a section entitled "import control and export aid", that in an economy where there is not full employment, the introduction of tariffs can improve production and employment. Thus the reduction of the trade deficit favours the country's growth.

In January 1930, in the Economic Advisory Council, Keynes proposed the introduction of a system of protection to reduce imports. In the autumn of 1930, he proposed a uniform tariff of 10% on all imports and subsidies of the same rate for all exports. In the ''Treatise on Money'', published in the autumn of 1930, he took up the idea of tariffs or other trade restrictions with the aim of reducing the volume of imports and rebalancing the balance of trade.

On 7 March 1931, in the ''New Statesman and Nation

The ''New Statesman'' is a British political and cultural magazine published in London. Founded as a weekly review of politics and literature on 12 April 1913, it was at first connected with Sidney and Beatrice Webb and other leading members o ...

'', he wrote an article entitled ''Proposal for a Tariff Revenue''. He pointed out that the reduction of wages led to a reduction in national demand which constrained markets. Instead, he proposes the idea of an expansionary policy combined with a tariff system to neutralise the effects on the balance of trade. The application of customs tariffs seemed to him "unavoidable, whoever the Chancellor of the Exchequer might be".Thus, for Keynes, an economic recovery policy is only fully effective if the trade deficit is eliminated. He proposed a 15% tax on manufactured and semi-manufactured goods and 5% on certain foodstuffs and raw materials, with others needed for exports exempted (wool, cotton).

In 1932, in an article entitled ''The Pro- and Anti-Tariffs'', published in '' The Listener'', he envisaged the protection of farmers and certain sectors such as the automobile and iron and steel industries, considering them indispensable to Britain.

The critique of the theory of comparative advantage

In the post-crisis situation of 1929, Keynes judged the assumptions of the free trade model unrealistic. He criticised, for example, the neoclassical assumption of wage adjustment.{{Cite thesis, url=http://www.sudoc.abes.fr/cbs/xslt/DB=2.1//SRCH?IKT=12&TRM=170778401, title = Les fondements non neoclassiques du protectionnisme, year = 2013, publisher = Université Bordeaux-IV, last1 = Maurin, first1 = Max As early as 1930, in a note to the Economic Advisory Council, he doubted the intensity of the gain from specialisation in the case of manufactured goods. While participating in the MacMillan Committee, he admitted that he no longer "believed in a very high degree of national specialisation" and refused to "abandon any industry which is unable, for the moment, to survive". He also criticised the static dimension of the theory of comparative advantage, which, in his view, by fixing comparative advantages definitively, led in practice to a waste of national resources. In the Daily Mail of 13 March 1931, he called the assumption of perfect sectoral labour mobility "nonsense" since it states that a person made unemployed contributes to a reduction in the wage rate until he finds a job. But for Keynes, this change of job may involve costs (job search, training) and is not always possible. Generally speaking, for Keynes, the assumptions of full employment and automatic return to equilibrium discredit the theory of comparative advantage. In July 1933, he published an article in the ''New Statesman and Nation'' entitled ''National Self-Sufficiency'', in which he criticised the argument of the specialisation of economies, which is the basis of free trade. He thus proposed the search for a certain degree of self-sufficiency. Instead of the specialisation of economies advocated by the Ricardian theory of comparative advantage, he prefers the maintenance of a diversity of activities for nations. In it he refutes the principle of peacemaking trade. His vision of trade became that of a system where foreign capitalists compete for new markets. He defends the idea of producing on national soil when possible and reasonable and expresses sympathy for the advocates ofprotectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulatio ...

.{{Cite web, url=http://www.mtholyoke.edu/acad/intrel/interwar/keynes.htm, title=John Maynard Keynes, "National Self-Sufficiency," the Yale Review, Vol. 22, no. 4 (June 1933), pp. 755-769., access-date=2021-12-28, archive-date=2011-05-15, archive-url=https://web.archive.org/web/20110515044928/http://www.mtholyoke.edu/acad/intrel/interwar/keynes.htm, url-status=dead

He notes in ''National Self-Sufficiency'':

{{cquote, A considerable degree of international specialization is necessary in a rational world in all cases where it is dictated by wide differences of climate, natural resources, native aptitudes, level of culture and density of population. But over an increasingly wide range of industrial products, and perhaps of agricultural products also, I have become doubtful whether the economic loss of national self-sufficiency is great enough to outweigh the other advantages of gradually bringing the product and the consumer within the ambit of the same national, economic, and financial organization. Experience accumulates to prove that most modern processes of mass production can be performed in most countries and climates with almost equal efficiency.