|

Protective Tariff

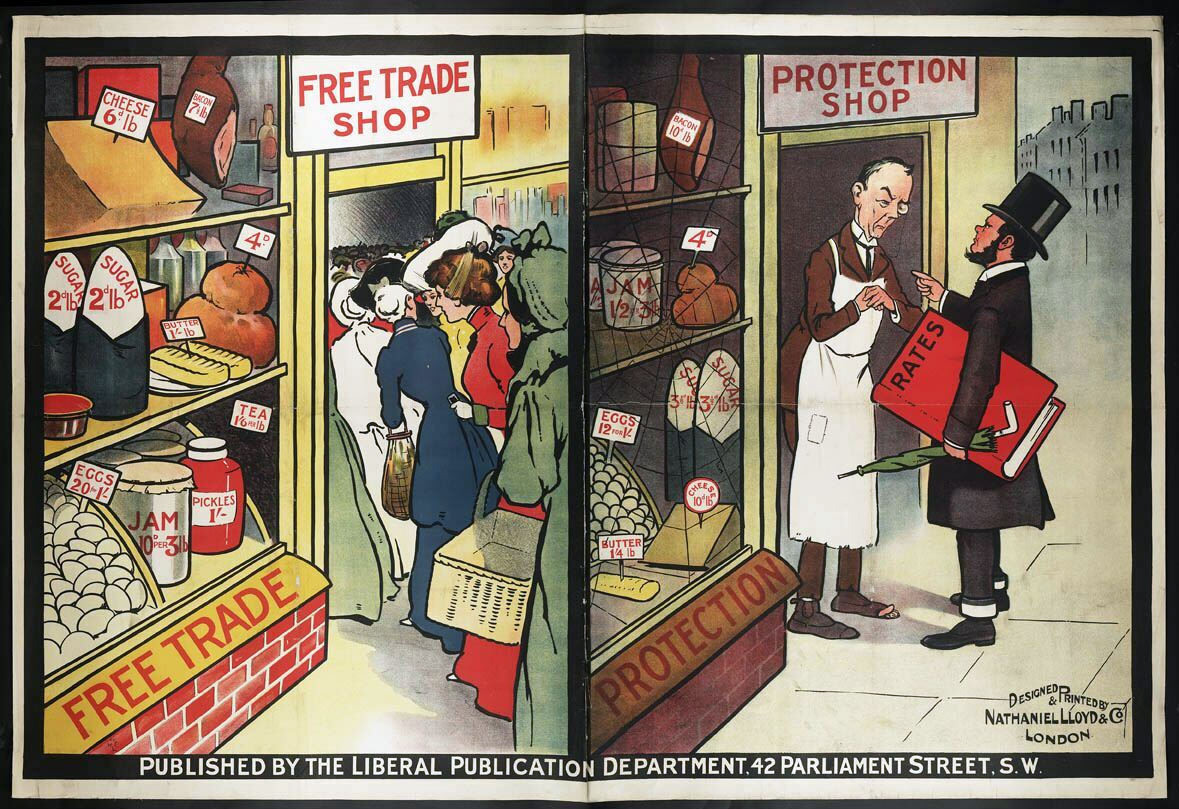

Protective tariffs are tariffs that are enacted with the aim of protecting a domestic industry. They aim to make imported goods cost more than equivalent goods produced domestically, thereby causing sales of domestically produced goods to rise, supporting local industry. Tariffs are also imposed in order to raise government revenue, or to reduce an undesirable activity (sin tax). Although a tariff can simultaneously protect domestic industry and earn government revenue, the goals of protection and revenue maximization suggest different tariff rates, entailing a tradeoff between the two aims. How tariffs work A tariff is a tax added onto goods imported into a country; protective tariffs are taxes that are intended to increase the cost of an import so it is less competitive against a roughly equivalent domestic good. For example, if similar cloth for sale in America cost $4 in for a version imported from Britain (including additional shipping, etc.) and $4 for a version originat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tariff

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. ''Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States House Of Representatives

The United States House of Representatives, often referred to as the House of Representatives, the U.S. House, or simply the House, is the Lower house, lower chamber of the United States Congress, with the United States Senate, Senate being the Upper house, upper chamber. Together they comprise the national Bicameralism, bicameral legislature of the United States. The House's composition was established by Article One of the United States Constitution. The House is composed of representatives who, pursuant to the Uniform Congressional District Act, sit in single member List of United States congressional districts, congressional districts allocated to each U.S. state, state on a basis of population as measured by the United States Census, with each district having one representative, provided that each state is entitled to at least one. Since its inception in 1789, all representatives have been directly elected, although universal suffrage did not come to effect until after ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Customs Duties

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. ''Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World Trade Organization

The World Trade Organization (WTO) is an intergovernmental organization that regulates and facilitates international trade. With effective cooperation in the United Nations System, governments use the organization to establish, revise, and enforce the rules that govern international trade. It officially commenced operations on 1 January 1995, pursuant to the 1994 Marrakesh Agreement, thus replacing the General Agreement on Tariffs and Trade (GATT) that had been established in 1948. The WTO is the world's largest international economic organization, with 164 member states representing over 98% of global trade and global GDP. The WTO facilitates trade in goods, services and intellectual property among participating countries by providing a framework for negotiating trade agreements, which usually aim to reduce or eliminate tariffs, quotas, and other restrictions; these agreements are signed by representatives of member governmentsUnderstanding the WTO' Handbook at WTO officia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Protectionism In The United States

Protectionism in the United States is protectionist economic policy that erects tariffs and other barriers on imported goods. In the US this policy was most prevalent in the 19th century. At that time it was mainly used to protect Northern industries and was opposed by Southern states that wanted free trade to expand cotton and other agricultural exports. Protectionist measures included tariffs and quotas on imported goods, along with subsidies and other means, to restrain the free movement of imported goods, thus encouraging local industry. There was a general lessening of protectionist measures from the 1930s onwards, culminating in the free trade period that followed the Second World War. After the war the U.S. promoted the General Agreement on Tariffs and Trade (GATT), to liberalize trade among all capitalist countries. In 1995 GATT became the World Trade Organization (WTO), and with the collapse of Communism its open markets/low tariff ideology became dominant worldwide. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations. Proponents argue that protectionist policies shield the producers, businesses, and workers of the Import substitution industrialization, import-competing sector in the country from foreign competitors. Opponents argue that protectionist policies reduce trade and adversely affect consumers in general (by raising the cost of imported goods) as well as the producers and workers in export sectors, both in the country implementing protectionist policies and in the countries protected against. Protectionism is advocated mainly by parties that hold Economic nationalism, economic nationalist or left-wing positions, while economically right-wing political parties generally support free trade. There is a consensus among economists that protectioni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tariffs

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. ''Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who served as the 45th president of the United States from 2017 to 2021. Trump graduated from the Wharton School of the University of Pennsylvania with a bachelor's degree in 1968. He became president of his father's real estate business in 1971 and renamed it The Trump Organization. He expanded the company's operations to building and renovating skyscrapers, hotels, casinos, and golf courses. He later started side ventures, mostly by licensing his name. From 2004 to 2015, he co-produced and hosted the reality television series ''The Apprentice (American TV series), The Apprentice''. Trump and his businesses have been involved in more than 4,000 state and federal legal actions, including six bankruptcies. Trump's political positions have been described as populist, protectionist, isolationist, and nationalist. He won the 2016 United States presidential election as the Repu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression In The United States

In the United States, the Great Depression began with the Wall Street Crash of October 1929 and then spread worldwide. The nadir came in 1931–1933, and recovery came in 1940. The stock market crash marked the beginning of a decade of high unemployment, poverty, low profits, deflation, plunging farm incomes, and lost opportunities for economic growth as well as for personal advancement. Altogether, there was a general loss of confidence in the economic future. The usual explanations include numerous factors, especially high consumer debt, ill-regulated markets that permitted overoptimistic loans by banks and investors, and the lack of high-growth new industries. These all interacted to create a downward economic spiral of reduced spending, falling confidence and lowered production. Industries that suffered the most included construction, shipping, mining, logging, and agriculture. Also hard hit was the manufacturing of durable goods like automobiles and appliances, whose purc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emergency Tariff Of 1921

An emergency is an urgent, unexpected, and usually dangerous situation that poses an immediate risk to health, life, property, or environment and requires immediate action. Most emergencies require urgent intervention to prevent a worsening of the situation, although in some situations, mitigation may not be possible and agencies may only be able to offer palliative care for the aftermath. While some emergencies are self-evident (such as a natural disaster that threatens many lives), many smaller incidents require that an observer (or affected party) decide whether it qualifies as an emergency. The precise definition of an emergency, the agencies involved and the procedures used, vary by jurisdiction, and this is usually set by the government, whose agencies (emergency services) are responsible for emergency planning and management. Defining an emergency An incident, to be an emergency, conforms to one or more of the following, if it: * Poses an immediate threat to life, hea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nelson W

Nelson may refer to: Arts and entertainment * ''Nelson'' (1918 film), a historical film directed by Maurice Elvey * ''Nelson'' (1926 film), a historical film directed by Walter Summers * ''Nelson'' (opera), an opera by Lennox Berkeley to a libretto by Alan Pryce-Jones * Nelson (band), an American rock band * ''Nelson'', a 2010 album by Paolo Conte People * Nelson (surname), including a list of people with the name * Nelson (given name), including a list of people with the name * Horatio Nelson, 1st Viscount Nelson (1758–1805), British admiral * Nelson Mandela, the first black South African president Fictional characters * Alice Nelson, the housekeeper on the TV series ''The Brady Bunch'' * Dave Nelson, a main character on the TV series ''NewsRadio'' * Emma Nelson, on the TV series ''Degrassi: The Next Generation'' * Foggy Nelson, law partner of Matt Murdock in the Marvel Comic Universe * Greg Nelson, on the American soap opera ''All My Children'' * Harriman Nelson, on the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.gif)

.png)

.png)