Structure of the Federal Reserve System on:

[Wikipedia]

[Google]

[Amazon]

The Structure of the Federal Reserve System is unique among all the assets within

;Whole:

;Board of Governors:

;

;Whole:

;Board of Governors:

;

The seven-member Board of Governors is the main governing body of the Federal Reserve System. It is charged with overseeing the 12 District Reserve Banks and with helping implement national monetary policy. Governors are appointed by the

The seven-member Board of Governors is the main governing body of the Federal Reserve System. It is charged with overseeing the 12 District Reserve Banks and with helping implement national monetary policy. Governors are appointed by the

(8th Cir. 2005). the Board of Governors does not receive funding from Congress, and the terms of the seven members of the Board span multiple presidential and congressional terms. Members of the Board of Governors function mostly independently. The Board is required to make an annual report of operations to the Speaker of the U.S. House of Representatives. It also supervises and regulates the operations of the Federal Reserve Banks, and the U.S. banking system in general. Membership is by statute limited in term, and a member that has served for a full 14-year term is not eligible for reappointment. There are numerous occasions where an individual was appointed to serve the remainder of another member's uncompleted term, and has been reappointed to serve a full 14-year term. Since "upon the expiration of their terms of office, members of the Board shall continue to serve until their successors are appointed and have qualified", it is possible for a member to serve for significantly longer than a full term of 14 years. The law provides for the removal of a member of the Board by the President "for cause".See . For a list of the current members of the board of governors, see

There are 12 regional Federal Reserve Banks, not to be confused with the "member banks", with 25 branches, which serve as the operating arms of the system. Each Federal Reserve Bank is subject to oversight by the Board of Governors. Each Federal Reserve Bank has a board of directors, whose members work closely with their Reserve Bank president to provide grassroots economic information and input on management and monetary policy decisions. These boards are drawn from the general public and the banking community and oversee the activities of the organization. They also appoint the presidents of the Reserve Banks, subject to the approval of the Board of Governors. Reserve Bank boards consist of nine members: six serving as representatives of nonbanking enterprises and the public (nonbankers) and three as representatives of banking. Each Federal Reserve branch office has its own board of directors, composed of three to seven members, that provides vital information concerning the regional economy.

The Reserve Banks opened for business on November 16, 1914.

There are 12 regional Federal Reserve Banks, not to be confused with the "member banks", with 25 branches, which serve as the operating arms of the system. Each Federal Reserve Bank is subject to oversight by the Board of Governors. Each Federal Reserve Bank has a board of directors, whose members work closely with their Reserve Bank president to provide grassroots economic information and input on management and monetary policy decisions. These boards are drawn from the general public and the banking community and oversee the activities of the organization. They also appoint the presidents of the Reserve Banks, subject to the approval of the Board of Governors. Reserve Bank boards consist of nine members: six serving as representatives of nonbanking enterprises and the public (nonbankers) and three as representatives of banking. Each Federal Reserve branch office has its own board of directors, composed of three to seven members, that provides vital information concerning the regional economy.

The Reserve Banks opened for business on November 16, 1914.

(9th Cir. 1982). the

Retrieved April 27, 2007. They are required to make bids or offers when the Fed conducts

Retrieved March 12, 2008. They consult with both the U.S. Treasury and the Fed about funding the

website

Changes are available a

central banks

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

, with private aspects. It is described as " independent within the government" rather than " independent of government".

The Federal Reserve does not require public funding, instead it remits its profits to no one. It derives its authority and purpose from the Federal Reserve Act

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Panic ...

, which was passed by Congress in 1913 and is subject to Congressional modification or repeal."Is The Fed Public Or Private?"Federal Reserve Bank of Philadelphia

The Federal Reserve Bank of Philadelphia — also known as the Philadelphia Fed or the Philly Fed — headquartered at 10 Independence Mall in Philadelphia, Pennsylvania, is responsible for the Third District of the Federal Reserve, which covers ...

. Retrieved June 29, 2012.

Composition

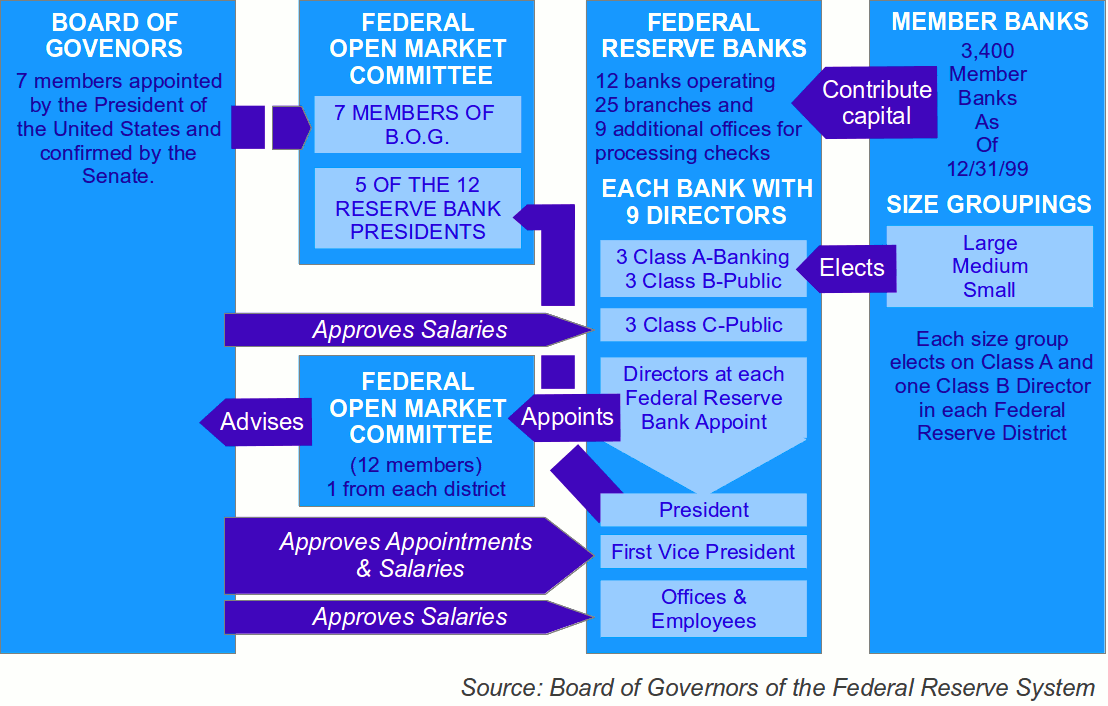

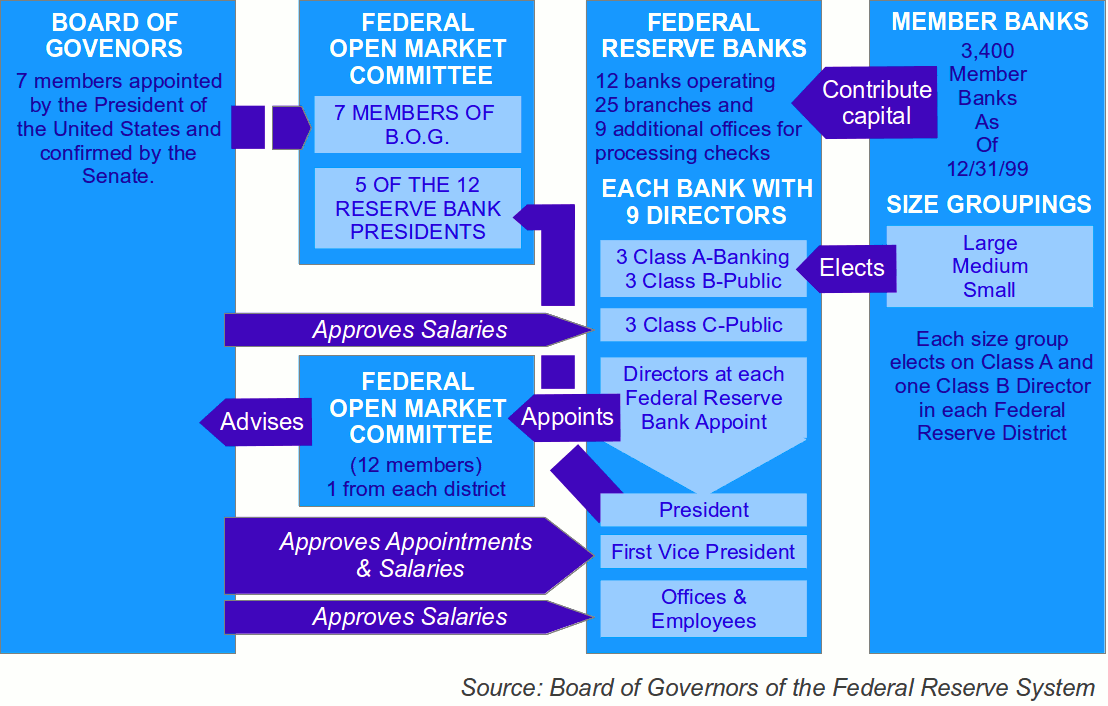

The Federal Reserve System is composed of five parts: # The presidentially appointed Board of Governors (or Federal Reserve Board), an independent federal government agency located inWashington, D.C.

)

, image_skyline =

, image_caption = Clockwise from top left: the Washington Monument and Lincoln Memorial on the National Mall, United States Capitol, Logan Circle, Jefferson Memorial, White House, Adams Morgan, ...

# The Federal Open Market Committee

The Federal Open Market Committee (FOMC), a committee within the Federal Reserve System (the Fed), is charged under United States law with overseeing the nation's open market operations (e.g., the Fed's buying and selling of United States Treas ...

(FOMC), composed of the seven members of the Federal Reserve Board and five of the twelve Federal Reserve Bank presidents, which oversees open market operations

In macroeconomics, an open market operation (OMO) is an activity by a central bank to give (or take) liquidity in its currency to (or from) a bank or a group of banks. The central bank can either buy or sell government bonds (or other financial as ...

, the principal tool of U.S. monetary policy.

# Twelve regional Federal Reserve Bank

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve A ...

s located in major cities throughout the nation, which divide the nation into twelve Federal Reserve districts. The Federal Reserve Banks act as fiscal agents for the U.S. Treasury, and each has its own nine-member board of directors.

# Numerous other private U.S. member banks, which own required amounts of non-transferable stock in their regional Federal Reserve Banks.

# Various advisory councils.

According to the board of governors of the Federal Reserve, "It is not 'owned' by anyone and is 'not a private, profit-making institution'. Instead, it is an independent entity within the government, having both public purposes and private aspects." The U.S. Government does not own shares in the Federal Reserve System or its component banks, but does receive all of the system's annual profits after a statutory dividend

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-in ...

of 6% on their capital investment is paid to member banks and a capital account surplus is maintained. The government also exercises some control over the Federal Reserve by appointing and setting the salaries of the system's highest-level employees.

The division of the responsibilities of a central bank into several separate and independent parts, some private and some public, results in a structure that is considered unique among central banks. It is also unusual in that an entity outside of the central bank – the U.S. Department of the Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and t ...

– creates the currency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins.

A more general def ...

used.

Independent within government

The Federal Reserve System is an independent government institution that has private aspects. The System is not a private organization and does not operate for the purpose of making a profit. The stocks of the regional federal reserve banks are owned by the banks operating within that region and which are part of the system. The System derives its authority and public purpose from theFederal Reserve Act

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Panic ...

passed by Congress in 1913. As an independent institution, the Federal Reserve System has the authority to act on its own without prior approval from Congress or the President. The members of its Board of Governors are appointed for long, staggered terms, limiting the influence of day-to-day political considerations. The Federal Reserve System's unique structure also provides internal checks and balances, ensuring that its decisions and operations are not dominated by any one part of the system. It also generates revenue independently without need for Congressional funding. Congressional oversight and statutes, which can alter the Fed's responsibilities and control, allow the government to keep the Federal Reserve System in check. Since the System was designed to be independent while also remaining within the government of the United States, it is often said to be "independent within the government".

The twelve Federal Reserve banks provide the financial means to operate the Federal Reserve System. Each reserve bank is organized much like a private corporation so that it can provide the necessary revenue to cover operational expenses and implement the demands of the board. A member bank is a privately owned bank that must buy an amount equal to 3% of its combined capital and surplus of stock in the Reserve Bank within its region of the Federal Reserve System. This stock "may not be sold, traded, or pledged as security for a loan" and all member banks receive a 6% annual dividend. No stock in any Federal Reserve Bank has ever been sold to the public, to foreigners, or to any non-bank U.S. firm. These member banks must maintain fractional reserves either as vault currency or on account at its Reserve Bank. As of October 2008, the Federal Reserve has paid interest to banks' holdings in Reserve Banks' accounts. The dividends paid by the Federal Reserve Banks to member banks are considered partial compensation for the lack of interest paid on the required reserves. All profit after expenses is returned to the U.S. Treasury or contributed to the surplus capital of the Federal Reserve Banks. Since shares in ownership of the Federal Reserve Banks are redeemable only at par, the nominal "owners" do not benefit from this surplus capital. In 2010, the Federal Reserve System contributed $79 billion to the U.S. Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and t ...

.

Outline

;Whole:

;Board of Governors:

;

;Whole:

;Board of Governors:

; Federal Open Market Committee

The Federal Open Market Committee (FOMC), a committee within the Federal Reserve System (the Fed), is charged under United States law with overseeing the nation's open market operations (e.g., the Fed's buying and selling of United States Treas ...

:

; Federal Reserve Bank

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve A ...

s:

; Member banks:

; Advisory Committees:

Board of Governors

The seven-member Board of Governors is the main governing body of the Federal Reserve System. It is charged with overseeing the 12 District Reserve Banks and with helping implement national monetary policy. Governors are appointed by the

The seven-member Board of Governors is the main governing body of the Federal Reserve System. It is charged with overseeing the 12 District Reserve Banks and with helping implement national monetary policy. Governors are appointed by the President of the United States

The president of the United States (POTUS) is the head of state and head of government of the United States of America. The president directs the executive branch of the federal government and is the commander-in-chief of the United Stat ...

and confirmed by the Senate

A senate is a deliberative assembly, often the upper house or chamber of a bicameral legislature. The name comes from the ancient Roman Senate (Latin: ''Senatus''), so-called as an assembly of the senior (Latin: ''senex'' meaning "the el ...

for staggered, 14-year terms. By law, the appointments must yield a "fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country", and as stipulated in the Banking Act of 1935, the Chairman and Vice Chairman of the Board are two of seven members of the Board of Governors who are appointed by the President

President most commonly refers to:

*President (corporate title)

*President (education), a leader of a college or university

*President (government title)

President may also refer to:

Automobiles

* Nissan President, a 1966–2010 Japanese ful ...

from among the sitting Governors.See As an independent federal government agency,Kennedy C. Scott v. Federal Reserve Bank of Kansas City, et al.(8th Cir. 2005). the Board of Governors does not receive funding from Congress, and the terms of the seven members of the Board span multiple presidential and congressional terms. Members of the Board of Governors function mostly independently. The Board is required to make an annual report of operations to the Speaker of the U.S. House of Representatives. It also supervises and regulates the operations of the Federal Reserve Banks, and the U.S. banking system in general. Membership is by statute limited in term, and a member that has served for a full 14-year term is not eligible for reappointment. There are numerous occasions where an individual was appointed to serve the remainder of another member's uncompleted term, and has been reappointed to serve a full 14-year term. Since "upon the expiration of their terms of office, members of the Board shall continue to serve until their successors are appointed and have qualified", it is possible for a member to serve for significantly longer than a full term of 14 years. The law provides for the removal of a member of the Board by the President "for cause".See . For a list of the current members of the board of governors, see

Federal Reserve Board of Governors

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the mon ...

.

Federal Open Market Committee

TheFederal Open Market Committee

The Federal Open Market Committee (FOMC), a committee within the Federal Reserve System (the Fed), is charged under United States law with overseeing the nation's open market operations (e.g., the Fed's buying and selling of United States Treas ...

(FOMC) created under comprises the seven members of the board of governors and five representatives selected from the regional Federal Reserve Banks. The FOMC is charged under law with overseeing open market operations

In macroeconomics, an open market operation (OMO) is an activity by a central bank to give (or take) liquidity in its currency to (or from) a bank or a group of banks. The central bank can either buy or sell government bonds (or other financial as ...

, the principal tool of national monetary policy. These operations affect the amount of Federal Reserve balances available to depository institutions, thereby influencing overall monetary and credit conditions. The FOMC also directs operations undertaken by the Federal Reserve in foreign exchange markets. The representative from the Second District, New York, is a permanent member, while the rest of the banks rotate at two- and three-year intervals. All the presidents participate in FOMC discussions, contributing to the committee's assessment of the economy and of policy options, but only the five presidents who are committee members vote on policy decisions. The FOMC, under law, determines its own internal organization and by tradition elects the Chairman of the Board of Governors as its chairman and the president of the Federal Reserve Bank of New York as its vice chairman. Formal meetings typically are held eight times each year in Washington, D.C. Telephone consultations and other meetings are held when needed.

Federal Reserve Banks

There are 12 regional Federal Reserve Banks, not to be confused with the "member banks", with 25 branches, which serve as the operating arms of the system. Each Federal Reserve Bank is subject to oversight by the Board of Governors. Each Federal Reserve Bank has a board of directors, whose members work closely with their Reserve Bank president to provide grassroots economic information and input on management and monetary policy decisions. These boards are drawn from the general public and the banking community and oversee the activities of the organization. They also appoint the presidents of the Reserve Banks, subject to the approval of the Board of Governors. Reserve Bank boards consist of nine members: six serving as representatives of nonbanking enterprises and the public (nonbankers) and three as representatives of banking. Each Federal Reserve branch office has its own board of directors, composed of three to seven members, that provides vital information concerning the regional economy.

The Reserve Banks opened for business on November 16, 1914.

There are 12 regional Federal Reserve Banks, not to be confused with the "member banks", with 25 branches, which serve as the operating arms of the system. Each Federal Reserve Bank is subject to oversight by the Board of Governors. Each Federal Reserve Bank has a board of directors, whose members work closely with their Reserve Bank president to provide grassroots economic information and input on management and monetary policy decisions. These boards are drawn from the general public and the banking community and oversee the activities of the organization. They also appoint the presidents of the Reserve Banks, subject to the approval of the Board of Governors. Reserve Bank boards consist of nine members: six serving as representatives of nonbanking enterprises and the public (nonbankers) and three as representatives of banking. Each Federal Reserve branch office has its own board of directors, composed of three to seven members, that provides vital information concerning the regional economy.

The Reserve Banks opened for business on November 16, 1914. Federal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 ...

s were created as part of the legislation to provide a supply of currency. The notes were to be issued to the Reserve Banks for subsequent transmittal to banking institutions. The various components of the Federal Reserve System have differing legal statuses.

Legal status

The Federal Reserve Banks have an intermediate legal status, with some features of private corporations and some features of public federal agencies. The United States has an interest in the Federal Reserve Banks as tax-exempt federally created instrumentalities whose profits belong to the federal government, but this interest is not proprietary. Each member bank (commercial banks in the Federal Reserve district) owns a nonnegotiable share of stock in its regional Federal Reserve Bank. However, holding Federal Reserve Bank stock is unlike owning stock in a publicly traded company. The charter of each Federal Reserve Bank is established by law and cannot be altered by the member banks. Federal Reserve Bank stock cannot be sold or traded, and member banks do not control the Federal Reserve Bank as a result of owning this stock. They do, however, elect six of the nine members of the Federal Reserve Banks' boards of directors. In ''Lewis v. United States'',680 F.2d 1239(9th Cir. 1982). the

United States Court of Appeals for the Ninth Circuit

The United States Court of Appeals for the Ninth Circuit (in case citations, 9th Cir.) is the U.S. federal court of appeals that has appellate jurisdiction over the U.S. district courts in the following federal judicial districts:

* District ...

stated that: "The Reserve Banks are not federal instrumentalities for purposes of the FTCA he_Federal_Tort_Claims_Act.html" ;"title="Federal_Tort_Claims_Act.html" ;"title="he Federal Tort Claims Act">he Federal Tort Claims Act">Federal_Tort_Claims_Act.html" ;"title="he Federal Tort Claims Act">he Federal Tort Claims Act but are independent, privately owned and locally controlled corporations." The opinion went on to say, however, that: "The Reserve Banks have properly been held to be federal instrumentalities for some purposes." Another relevant decision is ''Scott v. Federal Reserve Bank of Kansas City'', in which the distinction is made between Federal Reserve Banks, which are federally created instrumentalities, and the Board of Governors, which is a federal agency.

As noted by many economic and legal scholars, the Federal Reserve System in the United States is not a single, independent entity. Rather, it is a large, convoluted net of many agencies and parties who frequently consult with outsiders to determine their actions.

Board of directors

The nine member board of directors of each district is made up of three classes, designated as classes A, B, and C. The directors serve a term of three years. The makeup of the boards of directors is outlined in U.S. Code, Title 12, Chapter 3, Subchapter 7:Class A

*three members chosen by, and representative of, the stockholding banks. *member banks are divided into 3 groups based on size—large, medium, and small banks. Each group elects one member of Class A.Class B

*three members *no director of class B shall be an officer, director, or employee of any bank *represent the public with due but not exclusive consideration to the interests of agriculture, commerce, industry, services, labor, and consumers. *member banks are divided into three groups based on size—large, medium, and small banks. Each group elects one member of Class B.Class C

*three members *no director of class C shall be an officer, director, employee, or stockholder of any bank *designated by the Board of Governors of the Federal Reserve System. They shall be elected to represent the public, and with due but not exclusive consideration to the interests of agriculture, commerce, industry, services, labor, and consumers. *Shall have been for at least two years residents of the district for which they are appointed, one of whom shall be designated by said board as chairman of the board of directors of the Federal reserve bank and as Federal reserve agent. A list of all of the members of the Reserve Banks' boards of directors is published by the Federal Reserve.President

The Federal Reserve Act provides that the president of a Federal Reserve Bank shall be the chief executive officer of the Bank, appointed by the board of directors of the Bank, with the approval of the Board of Governors of the Federal Reserve System, for a term of five years. The terms of all the presidents of the twelve District Banks run concurrently, ending on the last day of February every five years. The appointment of a President who takes office after a term has begun ends upon the completion of that term. A president of a Reserve Bank may be reappointed after serving a full term or an incomplete term. Reserve Bank presidents are subject to mandatory retirement upon becoming 65 years of age. However, presidents initially appointed after age 55 can, at the option of the board of directors, be permitted to serve until attaining ten years of service in the office or age 70, whichever comes first.List of Federal Reserve Banks

The Federal Reserve Districts are listed below along with their identifying letter and number. These are used on Federal Reserve Notes to identify the issuing bank for each note. The 25 branches are also listed.Primary dealers

A primary dealer is a bank or securities broker-dealer that may trade directly with the Federal Reserve System of the United States.Federal Reserve Bank of New York:Primary DealersRetrieved April 27, 2007. They are required to make bids or offers when the Fed conducts

open market operations

In macroeconomics, an open market operation (OMO) is an activity by a central bank to give (or take) liquidity in its currency to (or from) a bank or a group of banks. The central bank can either buy or sell government bonds (or other financial as ...

, provide information to the Fed's open market trading desk, and to participate actively in U.S. Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and t ...

securities auctions

An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition ex ...

.Reserve Bank of New York:Primary Dealer PoliciesRetrieved March 12, 2008. They consult with both the U.S. Treasury and the Fed about funding the

budget deficit

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget ...

and implementing monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

. Many former employees of primary dealers work at the Treasury, because of their expertise in the government debt markets, though the Fed avoids a similar revolving door

A revolving door typically consists of three or four doors that hang on a central shaft and rotate around a vertical axis within a cylindrical enclosure. Revolving doors are energy efficient as they, acting as an airlock, prevent drafts, thus de ...

policy.

Between them, these dealers purchase the vast majority of the U.S. Treasury securities

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. gov ...

(T-bills, T-notes, and T-bonds) sold at auction, and resell them to the public. Their activities extend well beyond the Treasury market, for example, according to the ''Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published ...

'' Europe (2/9/06 p. 20), all of the top ten dealers in the foreign exchange market

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspec ...

are also primary dealers, and between them account for almost 73% of forex trading volume. Arguably, this group's members are the most influential and powerful non-governmental institutions in world financial markets.

The primary dealers form a worldwide network that distributes new U.S. government debt. For example, Daiwa Securities and Mizuho Securities distribute the debt to Japanese buyers. BNP Paribas, Barclays, Deutsche Bank, and RBS Greenwich Capital

NatWest Markets is the investment banking arm of NatWest Group.

It was created from the then RBS Group's corporate and institutional banking division in 2016, as part of a structural reform intended to comply with the requirements of the Finan ...

(a division of the Royal Bank of Scotland

The Royal Bank of Scotland plc (RBS; gd, Banca Rìoghail na h-Alba) is a major retail and commercial bank in Scotland. It is one of the retail banking subsidiaries of NatWest Group, together with NatWest (in England and Wales) and Ulster Bank ...

) distribute the debt to European buyers. Goldman Sachs, and Citigroup account for many American buyers. Nevertheless, most of these firms compete internationally and in all major financial centers.

Current list of primary dealers

As of July 1, 2014, according to theFederal Reserve Bank of New York

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is responsible for the Second District of the Federal Reserve System, which encompasses the State of New York, the 12 northern counties of New ...

, the list of primary dealers includes:

* Bank of Nova Scotia, New York Agency

* BMO Capital Markets Corp.

* BNP Paribas Securities Corp.

* Barclays Capital Inc.

* Cantor Fitzgerald & Co.

* Citigroup Global Markets Inc.

* Credit Suisse Securities (USA) LLC

* Daiwa Capital Markets America Inc.

* Deutsche Bank Securities Inc.

* Goldman, Sachs & Co.

* HSBC Securities (USA) Inc.

*Jefferies LLC

Jefferies Group LLC is an American multinational independent investment bank and financial services company that is headquartered in New York City. The firm provides clients with capital markets and financial advisory services, institutional brok ...

* J.P. Morgan Securities LLC

*Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment bank ...

, Pierce, Fenner & Smith Incorporated

* Mizuho Securities USA Inc.

* Morgan Stanley & Co. LLC

* Nomura Securities International, Inc.

* RBC Capital Markets, LLC

* RBS Securities Inc.

* SG Americas Securities, LLC

* TD Securities (USA) LLC

* UBS Securities LLC.

The Primary Dealers List is available at the Federal Reserve Bank of New Yorwebsite

Changes are available a

Member banks

Each member bank is a private bank (e.g., a privately owned corporation) that holds stock in one of the twelve regional Federal Reserve banks. The amount of stock each member bank must buy is set to be equal to 3% of its combined capital and surplus of stock in the Reserve Bank within its region of the Federal Reserve System. All of the commercial banks in the United States can be divided into three types according to which governmental body charters them and whether or not they are members of the Federal Reserve System: All nationally chartered banks hold stock in one of the Federal Reserve banks. State-chartered banks may choose to be members (and hold stock in a regional Federal Reserve bank), upon meeting certain standards. Holding stock in a Federal Reserve bank is not, however, like owning publicly traded stock. The stock cannot be sold or traded. Member banks receive a fixed, 6% dividend annually on their stock, and they do not directly control the applicable Federal Reserve bank as a result of owning this stock. They do, however, elect six of the nine members of Reserve banks' boards of directors. Federal statute provides (in part): "Every national bank in any State shall, upon commencing business or within ninety days after admission into the Union of the State in which it is located, become a member bank of the Federal Reserve System by subscribing and paying for stock in the Federal Reserve bank of its district in accordance with the provisions of this chapter and shall thereupon be an insured bank under the Federal Deposit Insurance Act . . . Other banks may elect to become member banks. According to the Federal Reserve Bank of Boston: For example, as of October 2006 the member banks in New Hampshire included Community Guaranty Savings Bank, The Lancaster National Bank, The Pemigewasset National Bank of Plymouth, and other banks. In California, member banks, as of September 2006, included Bank of America California, National Association, The Bank of New York Trust Company, National Association, Barclays Global Investors, National Association, and many other banks.List of member banks

The majority of U.S. banks are not members of the Federal Reserve System.Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures cred ...

(FDIC)-insured banks. national banks (N) and state members (SM) are members of the Federal Reserve System while the rest of the FDIC-insured banks are not members.

Each charter type is defined as follows:

* N: Commercial bank, national (federal) charter and Fed member, supervised by the Office of the Comptroller of the Currency

The Office of the Comptroller of the Currency (OCC) is an independent bureau within the United States Department of the Treasury that was established by the National Currency Act of 1863 and serves to charter, regulate, and supervise all nation ...

(OCC) – Dept of Treasury

* SM: Commercial bank, state charter and Fed member, supervised by the Federal Reserve (FRB)

* NM: Commercial bank, state charter and Fed nonmember, supervised by the FDIC

* OI: Insured U.S. branch of a foreign chartered institution (IBA)

* SA: Savings association

A savings and loan association (S&L), or thrift institution, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans. The terms "S&L" or "thrift" are mainly used in the United States; simi ...

s, state or federal charter, supervised by the Office of Thrift Supervision

The Office of Thrift Supervision (OTS) was a List of federal agencies in the United States, United States federal agency under the United States Department of the Treasury, Department of the Treasury that chartered, supervised, and regulated all ...

(OTS)

* SB: Savings bank

A savings bank is a financial institution whose primary purpose is accepting savings account, savings deposits and paying interest on those deposits.

History of banking, They originated in Europe during the 18th century with the aim of providi ...

s, state charter, supervised by the FDIC

While the OI, SA, and SB categories are not members of the system, they are sometimes treated as if they were members under certain circumstances.

A list of all member banks can be found at the website of the Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures cred ...

(FDIC). Most commercial banks in the United States are not members of the Federal Reserve System, but the total value of all the banking assets of member banks is substantially larger than the total value of the banking assets of nonmembers.http://www4.fdic.gov/IDASP/index.asp Cookies must be enabled to use this interactive website. Choose the "Find Institutions" section. Then leave all of the fields with the default value then choose "find". Wait a few moments to be prompted to "save as". It will be a 3.4MB .csv file that will be downloaded. This file can be viewed with a spreadsheet such as openoffice.org or microsoft excel. This is a list of all banks that are insured by the FDIC, which means that every member bank of the Federal Reserve System is listed here along with non-members who are FDIC-insured. Commercial banks that are not insured by the FDIC are not included. This is a comprehensive list with many categories describing the characteristics of each bank such as the total assets, bank holding company, charter type, location of headquarters, federal reserve district, and several others.

Advisory committees

The Federal Reserve System uses advisory committees in carrying out its varied responsibilities. Three of these committees advise the Board of Governors directly: * Federal Advisory Council * Consumer Advisory Council * Thrift Institutions Advisory Council Of these advisory committees, perhaps the most important are the committees (one for each Reserve Bank) that advise the Banks on matters of agriculture, small business, and labor. Biannually, the Board solicits the views of each of these committees by mail.References

Notes {{Reflist Federal Reserve System