|

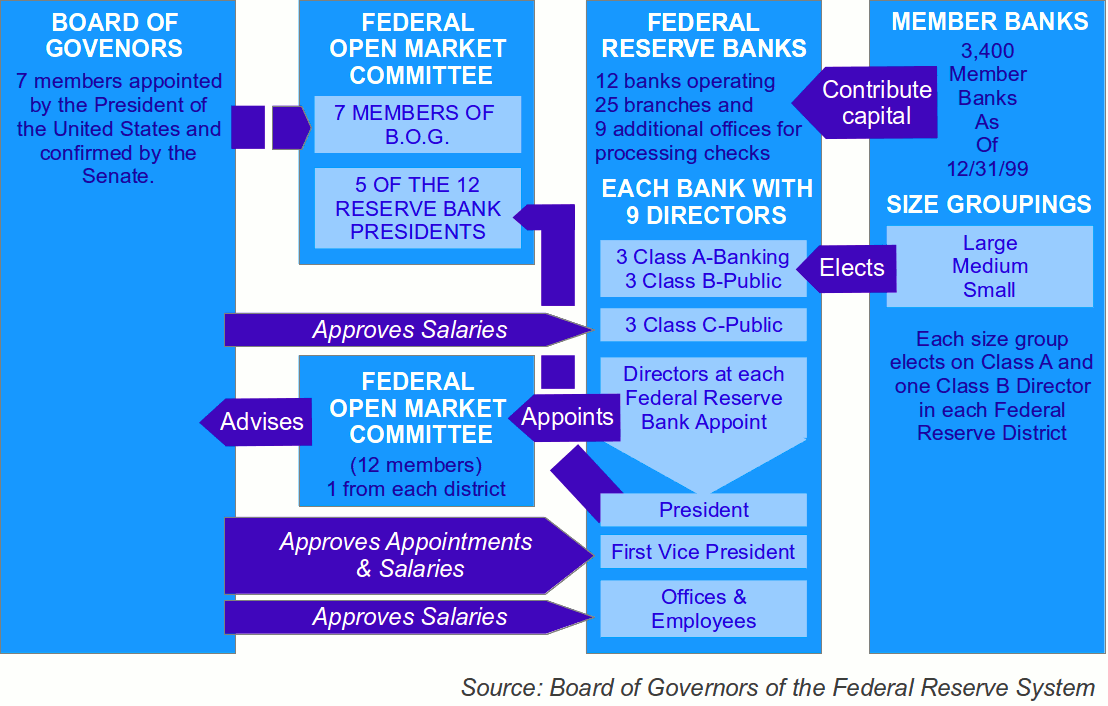

Structure Of The Federal Reserve System

The Structure of the Federal Reserve System is unique among all the assets within central banks, with private aspects. It is described as " independent within the government" rather than " independent of government". The Federal Reserve does not require public funding, instead it remits its profits to no one. It derives its authority and purpose from the Federal Reserve Act, which was passed by Congress in 1913 and is subject to Congressional modification or repeal."Is The Fed Public Or Private?" . Retrieved June 29, 2012. Composition Th ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Banks

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Most central banks also have supervisory and regulatory powers to ensure the stability of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks. Central banks in most developed nations are institutionally independent from political interference. Still, limited control by the executive and legislative bodies exists. Activities of central banks Functions of a central bank usually include: * Monetary policy: by setting the official interest rate and controlling the money supply; *Financial stability: acting as a government's banker and as the bankers' bank (" lender of last resort"); * Reserve management: managing a coun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Seal Of The United States Federal Reserve Board (B&W)

Seal may refer to any of the following: Common uses * Pinniped, a diverse group of semi-aquatic marine mammals, many of which are commonly called seals, particularly: ** Earless seal, or "true seal" ** Fur seal * Seal (emblem), a device to impress an emblem, used as a means of authentication, on paper, wax, clay or another medium (the impression is also called a seal) * Seal (mechanical), a device which helps prevent leakage, contain pressure, or exclude contamination where two systems join Arts, entertainment and media * ''Seal'' (1991 album), by Seal * ''Seal'' (1994 album), sometimes referred to as ''Seal II'', by Seal * ''Seal IV'', a 2003 album by Seal * ''Seal Online'', a 2003 massively multiplayer online role-playing game Law * Seal (contract law), a legal formality for contracts and other instruments * Seal (East Asia), a stamp used in East Asia as a form of a signature * Record sealing Military * ''Fairey Seal'', a 1930s British carrier-borne torpedo bomber aircra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Bank Of New York

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is responsible for the Second District of the Federal Reserve System, which encompasses the State of New York, the 12 northern counties of New Jersey, Fairfield County in Connecticut, Puerto Rico, and the U.S. Virgin Islands. Located at 33 Liberty Street in Lower Manhattan, it is by far the largest (by assets), the most active (by volume), and the most influential of the Reserve Banks. The Federal Reserve Bank of New York is solely responsible for implementing monetary policy on behalf of the Federal Open Market Committee and acts as the market agent of the entire Federal Reserve System (as it houses the Open Market Trading Desk and manages System Open Market Account). It is also the sole fiscal agent of the U.S. Department of the Treasury, the bearer of the Treasury's General Account, and the custodian of the world's largest gold storage reserve. Aside from these distin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eric S

The given name Eric, Erich, Erikk, Erik, Erick, or Eirik is derived from the Old Norse name ''Eiríkr'' (or ''Eríkr'' in Old East Norse due to monophthongization). The first element, ''ei-'' may be derived from the older Proto-Norse ''* aina(z)'', meaning "one, alone, unique", ''as in the form'' ''Æ∆inrikr'' explicitly, but it could also be from ''* aiwa(z)'' "everlasting, eternity", as in the Gothic form ''Euric''. The second element ''- ríkr'' stems either from Proto-Germanic ''* ríks'' "king, ruler" (cf. Gothic ''reiks'') or the therefrom derived ''* ríkijaz'' "kingly, powerful, rich, prince"; from the common Proto-Indo-European root * h₃rḗǵs. The name is thus usually taken to mean "sole ruler, autocrat" or "eternal ruler, ever powerful". ''Eric'' used in the sense of a proper noun meaning "one ruler" may be the origin of ''Eriksgata'', and if so it would have meant "one ruler's journey". The tour was the medieval Swedish king's journey, when newly elected, to s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Bank Of Boston

The Federal Reserve Bank of Boston, commonly known as the Boston Fed, is responsible for the Federal Reserve Bank, First District of the Federal Reserve, which covers New England: Maine, Massachusetts, New Hampshire, Rhode Island, Vermont and all of Connecticut except Fairfield County, Connecticut, Fairfield County. The code of the Bank is A1, meaning that dollar bills from this Bank will have the letter A on them. The Boston Fed describes its mission as promoting "growth and financial stability in New England and the nation". The Boston Fed also includes the New England Public Policy Center. Current Federal Reserve Bank of Boston president is Susan M. Collins (economist), Susan Collins, who is the first Black woman and the first woman of color to lead any of the 12 regional Federal bank branches. It has been headquartered since 1977 in the distinctive tall, 32-story Federal Reserve Bank Building (Boston), Federal Reserve Bank Building at 600 Atlantic Avenue (Boston), Atlantic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Tort Claims Act

The Federal Tort Claims Act (August 2, 1946, ch.646, Title IV, 28 U.S.C. Part VI, Chapter 171and ) ("FTCA") is a 1946 federal statute that permits private parties to sue the United States in a federal court for most torts committed by persons acting on behalf of the United States. Historically, citizens have not been able to sue their state—a doctrine referred to as sovereign immunity. The FTCA constitutes a limited waiver of sovereign immunity, permitting citizens to pursue some tort claims against the government. It was passed and enacted as a part of the Legislative Reorganization Act of 1946. Limitations Under the FTCA, " e United States sliable ... in the same manner and to the same extent as a private individual under like circumstances, but s notliable for interest prior to judgment or for punitive damages." . Federal courts have jurisdiction over such claims, but apply the law of the state "where the act or omission occurred". (b). Thus, both federal and state law ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Court Of Appeals For The Ninth Circuit

The United States Court of Appeals for the Ninth Circuit (in case citations, 9th Cir.) is the U.S. federal court of appeals that has appellate jurisdiction over the U.S. district courts in the following federal judicial districts: * District of Alaska * District of Arizona * Central District of California * Eastern District of California * Northern District of California * Southern District of California * District of Hawaii * District of Idaho * District of Montana * District of Nevada * District of Oregon * Eastern District of Washington * Western District of Washington The Ninth Circuit also has appellate jurisdiction over the territorial courts for the District of Guam and the District of the Northern Mariana Islands. Additionally, it sometimes handles appeals that originate from American Samoa, which has no district court and partially relies on the District of Hawaii for its federal cases.https://www.gao.gov/products/GAO-08-1124T GAO (U.S. Government Accounta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 and issues them to the Federal Reserve Banks at the discretion of the Board of Governors of the Federal Reserve System. The Reserve Banks then circulate the notes to their member banks, at which point they become liabilities of the Reserve Banks and obligations of the United States. Federal Reserve Notes are legal tender, with the words "this note is legal tender for all debts, public and private" printed on each note. The notes are backed by financial assets that the Federal Reserve Banks pledge as collateral, which are mainly Treasury securities and mortgage agency securities that they purchase on the open market by fiat payment. History Prior to centralized banking, each commercial bank issued its own notes. The first insti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Assets Of Federal Reserve Banks From 1996-2009

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetaryThere are different methods of assessing the monetary value of the assets recorded on the Balance Sheet. In some cases, the ''Historical Cost'' is used; such that the value of the asset when it was bought in the past is used as the monetary value. In other instances, the present fair market value of the asset is used to determine the value shown on the balance sheet. value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. Assets can be grouped into two major classes: tangible assets and intangible assets. Tangible assets contain various subclasses, inclu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Districts Map - Banks & Branches

Federal or foederal (archaic) may refer to: Politics General *Federal monarchy, a federation of monarchies *Federation, or ''Federal state'' (federal system), a type of government characterized by both a central (federal) government and states or regional governments that are partially self-governing; a union of states *Federal republic, a federation which is a republic *Federalism, a political philosophy *Federalist, a political belief or member of a political grouping * Federalization, implementation of federalism Particular governments *Federal government of the United States **United States federal law **United States federal courts *Government of Argentina * Government of Australia *Government of Pakistan *Federal government of Brazil *Government of Canada *Government of India *Federal government of Mexico * Federal government of Nigeria * Government of Russia *Government of South Africa * Government of Philippines Other *''The Federalist Papers'', critical early arguments i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Open Market Committee (FOMC) In Washington DC April 26-27, 2016

The Federal Open Market Committee (FOMC), a committee within the Federal Reserve System (the Fed), is charged under United States law with overseeing the nation's open market operations (e.g., the Fed's buying and selling of United States Treasury securities). This Federal Reserve committee makes key decisions about interest rates and the growth of the United States money supply. Under the terms of the original Federal Reserve Act, each of the Federal Reserve banks was authorized to buy and sell in the open market bonds and short term obligations of the United States Government, bank acceptances, cable transfers, and bills of exchange. Hence, the reserve banks were at times bidding against each other in the open market. In 1922, an informal committee was established to execute purchases and sales. The Banking Act of 1933 formed an official FOMC. The FOMC is the principal organ of United States national monetary policy. The Committee sets monetary policy by specifying the sho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Board Of Governors

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the monetary policy of the United States. Governors are appointed by the president of the United States and confirmed by the Senate for staggered 14-year terms.See Statutory description By law, the appointments must yield a "fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country". As stipulated in the Banking Act of 1935, the Chair and Vice Chair of the Board are two of seven members of the Board of Governors who are appointed by the President from among the sitting governors of the Federal Reserve Banks. The terms of the seven members of the Board span multiple presidential and congressional terms. Once a member of the Board of Governors is appointed by the presi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)