Seven states of randomness on:

[Wikipedia]

[Google]

[Amazon]

The seven states of randomness in

The seven states of randomness in

/ref> Intuitively speaking, Mandelbrot argued that the traditional normal distribution does not properly capture empirical and "real world" distributions and there are other forms of randomness that can be used to model extreme changes in risk and randomness. He observed that randomness can become quite "wild" if the requirements regarding finite

The classification was formally introduced in his 1997 book ''Fractals and Scaling in Finance'', as a way to bring insight into the three main states of randomness: mild, slow, and wild . Given ''N'' addends, ''portioning'' concerns the relative contribution of the addends to their sum. By ''even'' portioning, Mandelbrot meant that the addends were of same

The classification was formally introduced in his 1997 book ''Fractals and Scaling in Finance'', as a way to bring insight into the three main states of randomness: mild, slow, and wild . Given ''N'' addends, ''portioning'' concerns the relative contribution of the addends to their sum. By ''even'' portioning, Mandelbrot meant that the addends were of same

The seven states of randomness in

The seven states of randomness in probability theory

Probability theory is the branch of mathematics concerned with probability. Although there are several different probability interpretations, probability theory treats the concept in a rigorous mathematical manner by expressing it through a set ...

, fractals

In mathematics, a fractal is a geometric shape containing detailed structure at arbitrarily small scales, usually having a fractal dimension strictly exceeding the topological dimension. Many fractals appear similar at various scales, as illus ...

and risk analysis are extensions of the concept of randomness

In common usage, randomness is the apparent or actual lack of pattern or predictability in events. A random sequence of events, symbols or steps often has no order and does not follow an intelligible pattern or combination. Individual rand ...

as modeled by the normal distribution. These seven states were first introduced by Benoît Mandelbrot

Benoit B. Mandelbrot (20 November 1924 – 14 October 2010) was a Polish-born French-American mathematician and polymath with broad interests in the practical sciences, especially regarding what he labeled as "the art of roughness" of phy ...

in his 1997 book ''Fractals and Scaling in Finance'', which applied fractal analysis

Fractal analysis is assessing fractal characteristics of data. It consists of several methods to assign a fractal dimension and other fractal characteristics to a dataset which may be a theoretical dataset, or a pattern or signal extracted from p ...

to the study of risk and randomness.Benoît Mandelbrot

Benoit B. Mandelbrot (20 November 1924 – 14 October 2010) was a Polish-born French-American mathematician and polymath with broad interests in the practical sciences, especially regarding what he labeled as "the art of roughness" of phy ...

(1997) ''Fractals and scaling in finance'' pages 136–142 https://books.google.com/books/about/Fractals_and_Scaling_in_Finance.html?id=6KGSYANlwHAC&redir_esc=y This classification builds upon the three main states of randomness: mild, slow, and wild.

The importance of seven states of randomness classification for mathematical finance is that methods such as Markowitz mean variance portfolio and Black–Scholes model

The Black–Scholes or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing derivative investment instruments. From the parabolic partial differential equation in the model, known as the Black� ...

may be invalidated as the tails of the distribution of returns are fattened: the former relies on finite standard deviation ( volatility) and stability of correlation, while the latter is constructed upon Brownian motion

Brownian motion, or pedesis (from grc, πήδησις "leaping"), is the random motion of particles suspended in a medium (a liquid or a gas).

This pattern of motion typically consists of random fluctuations in a particle's position insi ...

.

History

These seven states build on earlier work of Mandelbrot in 1963: "The variations of certain speculative prices" and "New methods in statistical economics" in which he argued that most statistical models approached only a first stage of dealing withindeterminism

Indeterminism is the idea that events (or certain events, or events of certain types) are not caused, or do not cause deterministically.

It is the opposite of determinism and related to chance. It is highly relevant to the philosophical prob ...

in science, and that they ignored many aspects of real world turbulence

In fluid dynamics, turbulence or turbulent flow is fluid motion characterized by chaotic changes in pressure and flow velocity. It is in contrast to a laminar flow, which occurs when a fluid flows in parallel layers, with no disruption between ...

, in particular, most cases of financial modeling

Financial modeling is the task of building an abstract representation (a model) of a real world financial situation. This is a mathematical model designed to represent (a simplified version of) the performance of a financial asset or portfolio ...

. This was then presented by Mandelbrot in the International Congress for Logic (1964) in an address titled "The Epistemology of Chance in Certain Newer Sciences"B. Mandelbrot, Toward a second stage of indeterminism in Science, Interdisciplinary Science Reviews 198/ref> Intuitively speaking, Mandelbrot argued that the traditional normal distribution does not properly capture empirical and "real world" distributions and there are other forms of randomness that can be used to model extreme changes in risk and randomness. He observed that randomness can become quite "wild" if the requirements regarding finite

mean

There are several kinds of mean in mathematics, especially in statistics. Each mean serves to summarize a given group of data, often to better understand the overall value (magnitude and sign) of a given data set.

For a data set, the '' ari ...

and variance

In probability theory and statistics, variance is the expectation of the squared deviation of a random variable from its population mean or sample mean. Variance is a measure of dispersion, meaning it is a measure of how far a set of numbe ...

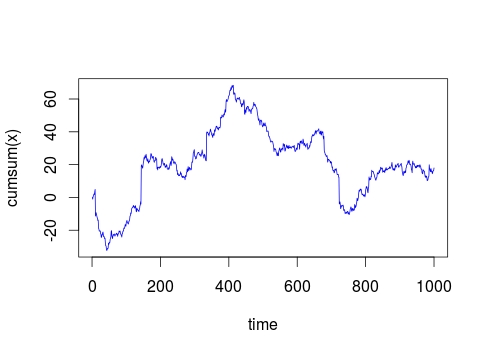

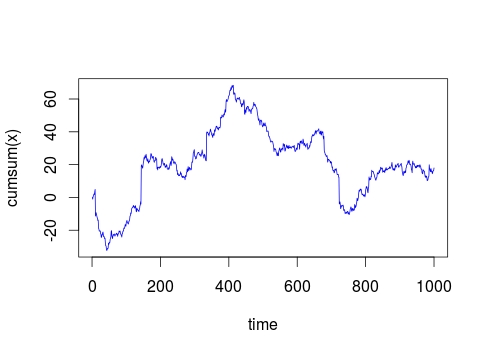

are abandoned. Wild randomness corresponds to situations in which a single observation, or a particular outcome can impact the total in a very disproportionate way.

The classification was formally introduced in his 1997 book ''Fractals and Scaling in Finance'', as a way to bring insight into the three main states of randomness: mild, slow, and wild . Given ''N'' addends, ''portioning'' concerns the relative contribution of the addends to their sum. By ''even'' portioning, Mandelbrot meant that the addends were of same

The classification was formally introduced in his 1997 book ''Fractals and Scaling in Finance'', as a way to bring insight into the three main states of randomness: mild, slow, and wild . Given ''N'' addends, ''portioning'' concerns the relative contribution of the addends to their sum. By ''even'' portioning, Mandelbrot meant that the addends were of same order of magnitude

An order of magnitude is an approximation of the logarithm of a value relative to some contextually understood reference value, usually 10, interpreted as the base of the logarithm and the representative of values of magnitude one. Logarithmic di ...

, otherwise he considered the portioning to be ''concentrated''. Given the moment of order ''q'' of a random variable, Mandelbrot called the root of degree ''q'' of such moment the ''scale factor'' (of order ''q'').

The seven states are:

# Proper mild randomness: short-run portioning is even for ''N'' = 2, e.g. the normal distribution

# Borderline mild randomness: short-run portioning is concentrated for ''N'' = 2, but eventually becomes even as ''N'' grows, e.g. the exponential distribution with rate ''λ'' = 1 (and so with expected value 1/''λ'' = 1)

# Slow randomness with finite delocalized moments: scale factor increases faster than ''q'' but no faster than