social costs on:

[Wikipedia]

[Google]

[Amazon]

Social cost in

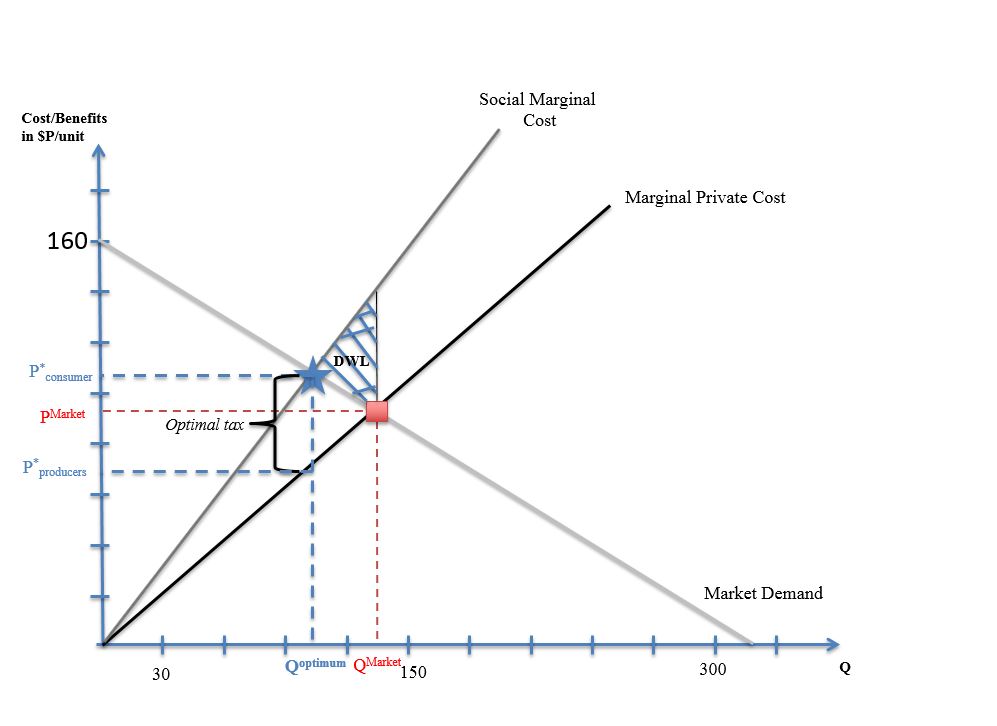

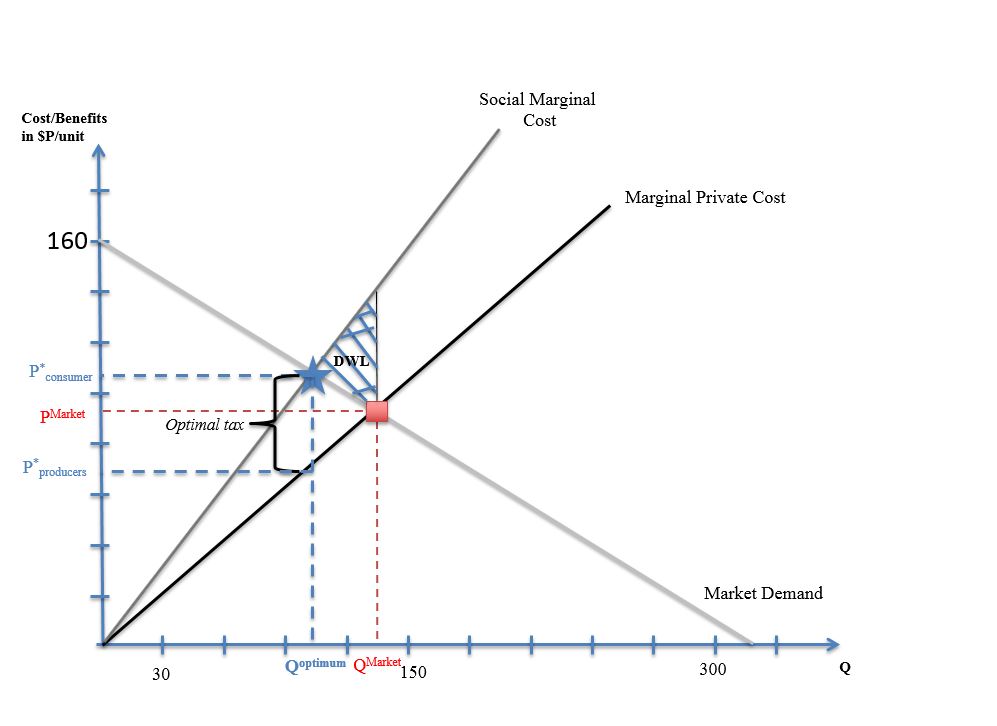

This example can be better elucidated with a diagram. Profit-maximizing organizations in a free market will set output at QMarket where marginal private costs (MPC) is equal to marginal benefit (MB). Intuitively, this is the point on the diagram where the private supply curve (MPC) and consumer demand curve (MB) intersect i.e. where consumer demand meets firm supply. This results in a competitive market equilibrium price of pMarket.

In the presence of a negative production externality, the private marginal cost increases i.e. shifted upwards to the left by marginal damages to yield the marginal social curve. The star in the diagram, or the point where the new supply curve (inclusive of marginal damages to society) and the consumer demand intersect, represents the socially optimum quantity Qoptimum and price. At this social optimum, the price paid by the consumer is p*consumer and the price received by the producers is p*producer.

High positive social costs, in the form of marginal damages, lead to an over-production. In the diagram, there is overproduction at QMarket - Qoptimum with an associated deadweight loss of the shaded triangle. One of the public sector remedies for internalizing externalities is a corrective tax. According to neoclassical economist Arthur Pigou, in order to correct this market failure (or externality) the government should levy a tax which equals to marginal damages per unit. This would effectively increase the firm's private marginal so that SMC = PMC.

The prospect of government intervention in regards to correcting an externality has been hotly debated. Economists like

This example can be better elucidated with a diagram. Profit-maximizing organizations in a free market will set output at QMarket where marginal private costs (MPC) is equal to marginal benefit (MB). Intuitively, this is the point on the diagram where the private supply curve (MPC) and consumer demand curve (MB) intersect i.e. where consumer demand meets firm supply. This results in a competitive market equilibrium price of pMarket.

In the presence of a negative production externality, the private marginal cost increases i.e. shifted upwards to the left by marginal damages to yield the marginal social curve. The star in the diagram, or the point where the new supply curve (inclusive of marginal damages to society) and the consumer demand intersect, represents the socially optimum quantity Qoptimum and price. At this social optimum, the price paid by the consumer is p*consumer and the price received by the producers is p*producer.

High positive social costs, in the form of marginal damages, lead to an over-production. In the diagram, there is overproduction at QMarket - Qoptimum with an associated deadweight loss of the shaded triangle. One of the public sector remedies for internalizing externalities is a corrective tax. According to neoclassical economist Arthur Pigou, in order to correct this market failure (or externality) the government should levy a tax which equals to marginal damages per unit. This would effectively increase the firm's private marginal so that SMC = PMC.

The prospect of government intervention in regards to correcting an externality has been hotly debated. Economists like

Brookings Institution. Analysts from Brookings Institution contend that one of the reasons the estimation of the social cost of carbon is incredibly complex is that the external costs imposed on society as a result of the transactions of one firm in China, for example, impact the quality of lives and health of consumers living in the United States. Social costs are also linked with the analysis of market failure. Take the national dividend, for example; to maximize the national dividend it is required that one set marginal social costs and marginal social benefits equal to each other. Marginal private costs and marginal private benefits also need to be equal to each other to maximize market behaviors. However, the market will not be maximized without both sets of costs and benefits equal to each other.

neoclassical economics

Neoclassical economics is an approach to economics in which the production, consumption and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good ...

is the sum of the private costs resulting from a transaction and the costs imposed on the consumers as a consequence of being exposed to the transaction for which they are not compensated or charged. In other words, it is the sum of private and external cost

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either co ...

s. This might be applied to any number of economic problems: for example, social cost of carbon

The social cost of carbon (SCC) is the marginal cost of the impacts caused by emitting one extra tonne of greenhouse gas (carbon dioxide equivalent) at any point in time, inclusive of 'non-market' impacts on the environment and human health. Th ...

has been explored to better understand the costs of carbon emissions for proposed economic solutions such as a carbon tax

A carbon tax is a tax levied on the carbon emissions required to produce goods and services. Carbon taxes are intended to make visible the "hidden" social costs of carbon emissions, which are otherwise felt only in indirect ways like more sev ...

.

Private costs refer to direct costs to the producer for producing the good or service. Social cost includes these private costs and the additional costs (or external costs) associated with the production of the good which are not accounted for by the free market. In short, when the consequences of an action cannot be taken by the initiator, we will have external costs in the society. We will have private costs when initiator can take responsibility for agent's action.de V. Graaff J. (1987). "Social Cost". In: ''The New Palgrave Dictionary of Economics''. Palgrave Macmillan, London.

Definitions

Mathematically, social marginal cost is the sum of private marginal cost and the external costs.Jonathan Gruber, ''Public Finance and Public Policy'', Fourth Edition, 2012 Worth Publishers For example, when selling a glass oflemonade

Lemonade is a sweetened lemon-flavored beverage.

There are varieties of lemonade found throughout the world. In North America and South Asia, cloudy still lemonade is the most common variety. There it is traditionally a homemade drink using ...

at a lemonade stand, the private costs involved in this transaction are the costs of the lemons and the sugar and the water that are ingredients to the lemonade, the opportunity cost of the labor to combine them into lemonade, as well as any transaction costs, such as walking to the stand. An example of marginal damages associated with social costs of driving includes wear and tear, congestion, and the decreased quality of life due to drunks driving or impatience, and many people displaced from their homes and localities due to construction work. Another social cost of driving includes the pollution driving costs to other people in the society. For both private costs and external costs, the agents involved are assumed to be optimizing.

Alternatives

The alternative to the above neoclassical definition is provided by the heterodox economics theory of social costs by K. William Kapp. Social costs are here defined as the socialized portion of the total costs of production, i.e., the costs which businesses shift to society in their attempts to increase their profits.Economic theory

According to theInternational Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

, "there are differences between private costs and the costs to the society as a whole". In a situation where there are positive social costs, it means that the first of the Fundamental theorems of welfare economics

There are two fundamental theorems of welfare economics. The first states that in economic equilibrium, a set of complete markets, with complete information, and in perfect competition, will be Pareto optimal (in the sense that no further exchang ...

failed in that relying merely on private markets for price and quantity lead to an inefficient outcome. Market failures

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value. Market failures can be viewed as scenarios where indiv ...

or situations in which consumption, investment, and production decisions made by individuals or firms result in indirect costs i.e. have an effect on parties external to the transaction are one of the most common reasons for government intervention. In economics, these indirect costs Indirect costs are costs that are not directly accountable to a cost object (such as a particular project, facility, function or product). Like direct costs, indirect costs may be either fixed or variable. Indirect costs include administration, ...

which lead to inefficiencies in the market and result in a difference between the private costs and the social costs are called externalities

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either co ...

. Thus, social costs are the costs pertaining to the transaction costs

In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market. Oliver E. Williamson defines transaction costs as the costs of running an economic system of companies, and unlike pro ...

to the society as a whole. Generally, social costs are easier to think about in marginal terms i.e. marginal social cost. Marginal social cost refers to the total costs that the society pays for the production of an extra unit of the good or service in question. Mathematically, this can be represented by Marginal Social Cost (MSC) = Marginal Private Cost (MPC) + Marginal External Costs (MEC).

Social costs can be of two types—Negative Production Externality and Positive Production Externality. Negative Production Externality refers to a situation in which marginal damages are social costs to society that result in Marginal Social Cost being greater than the Marginal Private Cost i.e. MSC > MPC. Intuitively, this refers to a situation in which the production of the firm reduces the well-being of the people in the society who are not compensated for the same. For example, steel production results in a negative externality because of the marginal damages pertaining to pollution and negative environmental effects. Steelmaking

Steelmaking is the process of producing steel from iron ore and carbon/or scrap. In steelmaking, impurities such as nitrogen, silicon, phosphorus, sulfur and excess carbon (the most important impurity) are removed from the sourced iron, and alloy ...

results in indirect costs as a result of emission of pollutants, lower air quality, etc. For example, these indirect costs might include the health of a homeowner near the production unit and higher healthcare costs which have not been factored into the free market

In economics, a free market is an economic system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of government or any ot ...

price and quantity. Given that the producer does not bear the burden of these costs, they are not passed down to the end user thus creating a situation where MSC > MPC.

This example can be better elucidated with a diagram. Profit-maximizing organizations in a free market will set output at QMarket where marginal private costs (MPC) is equal to marginal benefit (MB). Intuitively, this is the point on the diagram where the private supply curve (MPC) and consumer demand curve (MB) intersect i.e. where consumer demand meets firm supply. This results in a competitive market equilibrium price of pMarket.

In the presence of a negative production externality, the private marginal cost increases i.e. shifted upwards to the left by marginal damages to yield the marginal social curve. The star in the diagram, or the point where the new supply curve (inclusive of marginal damages to society) and the consumer demand intersect, represents the socially optimum quantity Qoptimum and price. At this social optimum, the price paid by the consumer is p*consumer and the price received by the producers is p*producer.

High positive social costs, in the form of marginal damages, lead to an over-production. In the diagram, there is overproduction at QMarket - Qoptimum with an associated deadweight loss of the shaded triangle. One of the public sector remedies for internalizing externalities is a corrective tax. According to neoclassical economist Arthur Pigou, in order to correct this market failure (or externality) the government should levy a tax which equals to marginal damages per unit. This would effectively increase the firm's private marginal so that SMC = PMC.

The prospect of government intervention in regards to correcting an externality has been hotly debated. Economists like

This example can be better elucidated with a diagram. Profit-maximizing organizations in a free market will set output at QMarket where marginal private costs (MPC) is equal to marginal benefit (MB). Intuitively, this is the point on the diagram where the private supply curve (MPC) and consumer demand curve (MB) intersect i.e. where consumer demand meets firm supply. This results in a competitive market equilibrium price of pMarket.

In the presence of a negative production externality, the private marginal cost increases i.e. shifted upwards to the left by marginal damages to yield the marginal social curve. The star in the diagram, or the point where the new supply curve (inclusive of marginal damages to society) and the consumer demand intersect, represents the socially optimum quantity Qoptimum and price. At this social optimum, the price paid by the consumer is p*consumer and the price received by the producers is p*producer.

High positive social costs, in the form of marginal damages, lead to an over-production. In the diagram, there is overproduction at QMarket - Qoptimum with an associated deadweight loss of the shaded triangle. One of the public sector remedies for internalizing externalities is a corrective tax. According to neoclassical economist Arthur Pigou, in order to correct this market failure (or externality) the government should levy a tax which equals to marginal damages per unit. This would effectively increase the firm's private marginal so that SMC = PMC.

The prospect of government intervention in regards to correcting an externality has been hotly debated. Economists like Ronald Coase

Ronald Harry Coase (; 29 December 1910 – 2 September 2013) was a British economist and author. Coase received a bachelor of commerce degree (1932) and a PhD from the London School of Economics, where he was a member of the faculty until 1951. ...

contend that the market can internalize an externality and provide for an external outcome through bargaining among affected parties. For example, in the above-mentioned case, the homeowners could negotiate with the pollution firm and strike a deal in which they would pay the firm not to pollute or to charge the firm for pollution; the outcome pertaining to who pays is determined by bargaining power

Bargaining power is the relative ability of parties in an argumentative situation (such as bargaining, contract writing, or making an agreement) to exert influence over each other. If both parties are on an equal footing in a debate, then they w ...

. According to Thomas Helbing at the International Monetary Fund, government intervention might be most optimal in situations where one party might have undue bargaining power compared to the other party.

In an alternative scenario, positive production externality occurs when the social costs of production are lower than the marginal private costs of production. For example, the social benefit of research and development not only applies to the profits made by the firm but also helps improve the health of society through better quality of life, lower healthcare costs, etc. In this case, the marginal social cost curve would shift downwards and there would be underproduction. In this case, government intervention would result in a Pigouvian subsidy in order to decrease the firm's private marginal cost so that MPC = SMC.

Issues

Quantification of social costs, for damages or benefits in the future resulting from current production, is a critical problem for the presentation of social costs and when attempting to formulate policy to correct the externality. For example, damages to the environment, socioeconomic or political impacts, and costs or benefits that span long horizons are difficult to predict and quantify. Thus, it is difficult to include in a cost-benefit analysis. Another example concerning the difficulty surrounding the estimation of social costs is thesocial cost of carbon

The social cost of carbon (SCC) is the marginal cost of the impacts caused by emitting one extra tonne of greenhouse gas (carbon dioxide equivalent) at any point in time, inclusive of 'non-market' impacts on the environment and human health. Th ...

. In trying to monetize the social costs arising from carbon, one needs to understand "the effect of a ton of a greenhouse gas on global temperatures, the effect of temperature change on agricultural yields, human health, flood risk, and myriad other harms to the ecosystem

An ecosystem (or ecological system) consists of all the organisms and the physical environment with which they interact. These biotic and abiotic components are linked together through nutrient cycles and energy flows. Energy enters the syste ...

"."The social costs of carbon"Brookings Institution. Analysts from Brookings Institution contend that one of the reasons the estimation of the social cost of carbon is incredibly complex is that the external costs imposed on society as a result of the transactions of one firm in China, for example, impact the quality of lives and health of consumers living in the United States. Social costs are also linked with the analysis of market failure. Take the national dividend, for example; to maximize the national dividend it is required that one set marginal social costs and marginal social benefits equal to each other. Marginal private costs and marginal private benefits also need to be equal to each other to maximize market behaviors. However, the market will not be maximized without both sets of costs and benefits equal to each other.

Applications

Social cost has been applied on a number of different critical social issues. Notably the social cost of carbon and monopolies are common topics of exploration.Carbon

See also

*Bargaining power

Bargaining power is the relative ability of parties in an argumentative situation (such as bargaining, contract writing, or making an agreement) to exert influence over each other. If both parties are on an equal footing in a debate, then they w ...

* Economic interventionism

*Environmental economics

Environmental economics is a sub-field of economics concerned with environmental issues. It has become a widely studied subject due to growing environmental concerns in the twenty-first century. Environmental economics "undertakes theoretical or ...

*Public bad

A public bad, in economics, is the symmetrical opposite of a public good. Air pollution is the most obvious example since it is non-excludable and non-rival, and negatively affects welfare.For current definitions of public bads see: Charles D. Ko ...

*ISO 26000

ISO 26000:2010 ''Guidance on social responsibility'' is an international standard providing guidelines for social responsibility (SR, often CSR - ''corporate social responsibility''). An organization's relationship with the society and the enviro ...

*Public economics

Public economics ''(or economics of the public sector)'' is the study of government policy through the lens of economic efficiency and equity. Public economics builds on the theory of welfare economics and is ultimately used as a tool to improve s ...

* Supply and demand

* Construction of schools

Notes

Further reading

* Berger, Sebastian. 2017. The Social Costs of Neoliberalism - Essays on the Economics of K. William Kapp, Nottingham: Spokesman. * Gruber, Jonathan. “Tobacco at the crossroads: the past and future of smoking regulation in the United States.” The Journal of Economic Perspectives 15.2 (2001): 193–212. * Social Costs and Public Action in Modern Capitalism (2006), edited by Wolfram Elsner, Pietro Frigato and Paolo Ramazzotti, Routledge. * Nordhaus, William D., and Joseph Boyer. “Warming the World: Economic Models of Global Warming.” MIT Press (MA), 2000. *Hazilla, M. and R. J. Kopp. 1990. Social cost of environmental quality regulations: a general equilibrium analysis. Journal of Political Economy, 98 (4): 853–873. * Gramlich, E. M. 1981. Cost-Benefit Analysis of Government Programs. Englewood Cliffs, NJ: Prentice-Hall, Inc. * Parry, Ian, W. H., Margaret Walls, and Winston Harrington. 2007. "Automobile Externalities and Policies." Journal of Economic Literature, 45(2): 373–399. {{Authority control Costs Public economics Rational choice theory