|

Costs

In production, research, retail, and accounting, a cost is the value of money that has been used up to produce something or deliver a service, and hence is not available for use anymore. In business, the cost may be one of acquisition, in which case the amount of money expended to acquire it is counted as cost. In this case, money is the input that is gone in order to acquire the thing. This acquisition cost may be the sum of the cost of production as incurred by the original producer, and further costs of transaction as incurred by the acquirer over and above the price paid to the producer. Usually, the price also includes a mark-up for profit over the cost of production. More generalized in the field of economics, cost is a metric that is totaling up as a result of a process or as a differential for the result of a decision. Hence cost is the metric used in the standard modeling paradigm applied to economic processes. Costs (pl.) are often further described based on th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overhead (business)

In business, overhead or overhead expense refers to an ongoing expense of operating a business. Overheads are the expenditure which cannot be conveniently traced to or identified with any particular revenue unit, unlike operating expenses such as raw material and labor. Therefore, overheads cannot be immediately associated with the products or services being offered, thus do not directly generate profits. However, overheads are still vital to business operations as they provide critical support for the business to carry out profit making activities. For example, overhead costs such as the rent for a factory allows workers to manufacture products which can then be sold for a profit. Such expenses are incurred for output generally and not for particular work order; e.g., wages paid to watch and ward staff, heating and lighting expenses of factory, etc. Overheads are also a very important cost element along with direct materials and direct labor. Overheads are often related to accounti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Cost

Economic cost is the combination of losses of any goods that have a value attached to them by any one individual. Economic cost is used mainly by economists as means to compare the prudence of one course of action with that of another. The comparison includes the gains and losses precluded by taking a course of action as well as those of the course taken itself. Economic cost differs from accounting cost because it includes opportunity cost. (Some sources refer to accounting cost as ''explicit cost'' and opportunity cost as ''implicit cost''.) Aspects of economic costs *Variable cost: Variable costs are the costs paid to the variable input. Inputs include labor, capital, materials, power and land and buildings. Variable inputs are inputs whose use vary with output. Conventionally the variable input is assumed to be labor. ** Total variable cost (TVC) is the same as variable costs. *Fixed cost (TFC) are the costs of the fixed assets those that do not vary with production. **Tota ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Externality

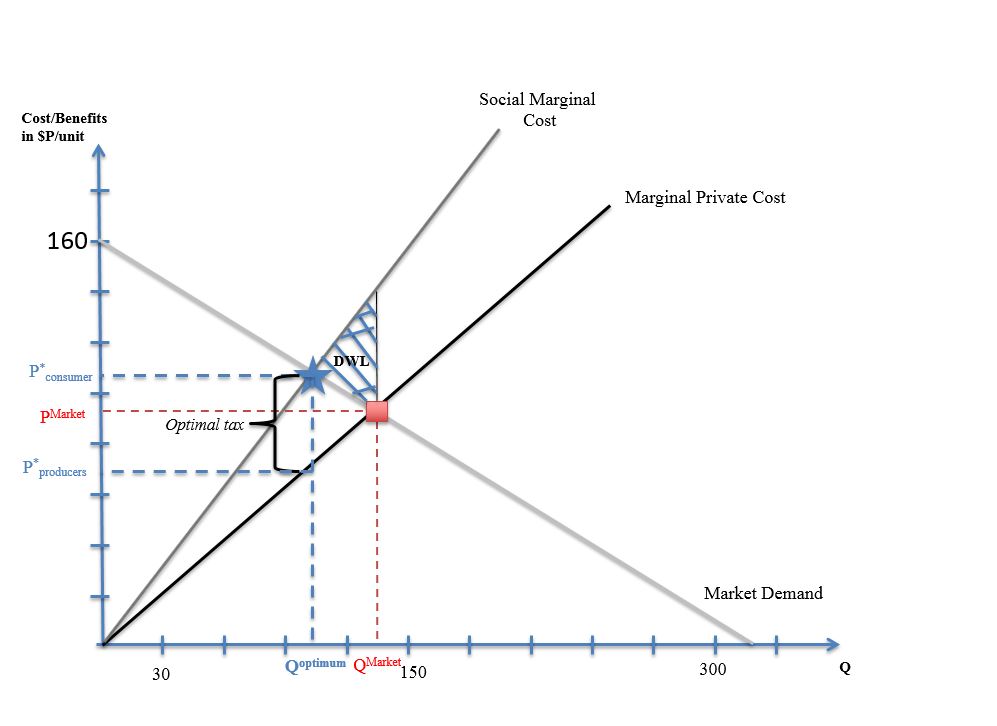

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either consumer or producer market transactions. Air pollution from motor vehicles is one example. The cost of air pollution to society is not paid by either the producers or users of motorized transport to the rest of society. Water pollution from mills and factories is another example. All consumers are all made worse off by pollution but are not compensated by the market for this damage. A positive externality is when an individual's consumption in a market increases the well-being of others, but the individual does not charge the third party for the benefit. The third party is essentially getting a free product. An example of this might be the apartment above a bakery receiving the benefit of enjoyment from smelling fresh pastries every morni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Cost

Social cost in neoclassical economics is the sum of the private costs resulting from a transaction and the costs imposed on the consumers as a consequence of being exposed to the transaction for which they are not compensated or charged. In other words, it is the sum of private and external costs. This might be applied to any number of economic problems: for example, social cost of carbon has been explored to better understand the costs of carbon emissions for proposed economic solutions such as a carbon tax. Private costs refer to direct costs to the producer for producing the good or service. Social cost includes these private costs and the additional costs (or external costs) associated with the production of the good which are not accounted for by the free market. In short, when the consequences of an action cannot be taken by the initiator, we will have external costs in the society. We will have private costs when initiator can take responsibility for agent's action.de V. Gra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Opportunity Cost

In microeconomic theory, the opportunity cost of a particular activity is the value or benefit given up by engaging in that activity, relative to engaging in an alternative activity. More effective it means if you chose one activity (for example, an investment) you are giving up the opportunity to do a different option. The optimal activity is the one that, net of its opportunity cost, provides the greater return compared to any other activities, net of their opportunity costs. For example, if you buy a car and use it exclusively to transport yourself, you cannot rent it out, whereas if you rent it out you cannot use it to transport yourself. If your cost of transporting yourself without the car is more than what you get for renting out the car, the optimal choice is to use the car yourself. In basic equation form, opportunity cost can be defined as: "Opportunity Cost = (returns on best Forgone Option) - (returns on Chosen Option)." The opportunity cost of mowing one’s own l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services. Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on these elements. Other broad distinctions within economics include those between positive economics, describing "what is", and normative economics, advocating "what ought to be"; between economic theory and applied economics; between rati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Overrun

A cost overrun, also known as a cost increase or budget overrun, involves unexpected incurred costs. When these costs are in excess of budgeted amounts due to a value engineering underestimation of the actual cost during budgeting, they are known by these terms. Cost overruns are common in infrastructure, building, and technology projects. For IT projects, a 2004 industry study by the Standish Group found an average cost overrun of 43 percent; 71 percent of projects came in over budget, exceeded time estimates, and had estimated too narrow a scope; and total waste was estimated at $55 billion per year in the US alone. Many major construction projects have incurred cost overruns; cost estimates used to decide whether important transportation infrastructure should be built can mislead grossly and systematically. Cost overrun is distinguished from cost escalation, which is an ''anticipated'' growth in a budgeted cost due to factors such as inflation. Causes Recent works by Ahi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Manufacturing Overhead Cost

Manufacturing overhead costs (MOH cost) are all manufacturing costs that are related to the cost object (work in process and then finished goods) but cannot be traced to that cost object in an economically feasible way. Examples include supplies, indirect materials such as lubricants, indirect manufacturing labor such as plant maintenance and cleaning labor, plant rent, plant insurance, property taxes on the plant, plant depreciation, and the compensation of plant managers. This cost category is also referred to as Factory overhead Factory overhead, also called manufacturing overhead or work overhead, or factory burden in American English, is the total cost involved in operating all production facilities of a manufacturing business that cannot be traced directly to a produc ... cost (FO cost). Items of the overhead Manufacturing overhead includes other costs in manufacturing that are neither direct materials costs nor direct labor costs. It might also be referred as the fac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Direct Labor Cost

Direct labor cost is a part of wage-bill or payroll that can be specifically and consistently assigned to or associated with the manufacture of a product, a particular work order, or provision of a service. Also, we can say it is the cost of the work done by those workers who actually make the product on the production line. Determination of the direct labor cost *Planning the work to be performed. *Describing the job content of the work, by indicating the skill, knowledge, etc. *Matching the jobs with the employees. Usage The direct labor cost is part of the manufacturing cost. Calculation of direct labor cost In the direct labor cost we need to have the job time and wage we will pay it to the worker to calculate the direct labor cost as in this formulation:- \text = \text \times \text Depending on the context, there are various methods to calculate personnel costs, such as on an hourly or daily basis. Wage The wage is the payment rendered to the worker per hour as a compensa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Direct Materials Cost

Direct materials cost the cost of direct materials which can be easily identified with the unit of production. For example, the cost of glass is a direct materials cost in light bulb manufacturing. The manufacture of products or goods required material as the prime element. In general, these materials are divided into two categories. These categories are direct materials and indirect materials. Direct materials are also called productive materials, raw materials, raw stock, stores and only materials without any descriptive title. Direct materials cost estimation Steps to estimate the direct material costs:Phillip W. Gillet, Jr., J.D. notes, Chapter three #Find the total amount to be produced. This is usually noted as the order size. #Calculate the total amount of raw materials required to produce the order size. #Multiply that amount by the cost associated with the raw materials. #If there is a waste or scrap, its cost should be added to the costs in step 3. #If the waste or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Manufacturing Cost

Manufacturing cost is the sum of costs of all resources consumed in the process of making a product. The manufacturing cost is classified into three categories: direct materials cost, direct labor cost and manufacturing overhead. It is a factor in total delivery cost. Direct materials cost Direct materials are the raw materials that become a part of the finished product. Manufacturing adds value to raw materials by applying a chain of operations to maintain a deliverable product. There are many operations that can be applied to raw materials such as welding, cutting and painting. It is important to differentiate between direct materials and indirect materials. Direct labour cost The direct labour cost is the cost of workers who can be easily identified with the unit of production. Types of labour who are considered to be part of the direct labour cost are the assembly workers on an assembly line. Manufacturing overhead Manufacturing overhead is any manufacturing cost t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Raw Materials

A raw material, also known as a feedstock, unprocessed material, or primary commodity, is a basic material that is used to produce goods, finished goods, energy, or intermediate materials that are feedstock for future finished products. As feedstock, the term connotes these materials are bottleneck assets and are required to produce other products. The term ''raw material'' denotes materials in unprocessed or minimally processed states; e.g., raw latex, crude oil, cotton, coal, raw biomass, iron ore, air, logs, water, or "any product of agriculture, forestry, fishing or mineral in its natural form or which has undergone the transformation required to prepare it for international marketing in substantial volumes". The term ''secondary raw material'' denotes waste material which has been recycled and injected back into use as productive material. Ceramic While pottery originated in many different points around the world, it is certain that it was brought to light mostly throu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |