Public funds on:

[Wikipedia]

[Google]

[Amazon]

Government spending or expenditure includes all government consumption, investment, and transfer payments. In

Government spending can be a useful economic policy tool for governments.

Government spending can be a useful economic policy tool for governments.

''Statistics Explained'' European Union Statistics Directorate, European Commission Acquisition of goods and services is made through production by the government (using the government's labour force, fixed assets and purchased goods and services for

/ref>

OECD Government spending statistics

Canadian Governments Compared

Eurostat's government spending per sector

{{DEFAULTSORT:Government Spending Government spending, Government finances Fiscal policy

national income accounting

A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), gross national product (GNP), net national income (NNI), and adjusted nati ...

, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure Government final consumption expenditure (GFCE) is an aggregate transaction amount on a country's national income accounts representing government expenditure on goods and services that are used for the direct satisfaction of individual needs (''in ...

. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product

Gross domestic product (GDP) is a money, monetary Measurement in economics, measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjec ...

.

Government spending can be financed by government borrowing

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

, taxes

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or ...

, custom duties

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs ha ...

, the sale or lease of natural resources, and various fees like national park entry fees or licensing fees. When Governments choose to borrow money, they have to pay interest on the money borrowed. Changes in government spending is a major component of fiscal policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables ...

used to stabilize the macroeconomic business cycle

Business cycles are intervals of Economic expansion, expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are ...

.

Macroeconomic fiscal policy

Government spending can be a useful economic policy tool for governments.

Government spending can be a useful economic policy tool for governments. Fiscal policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables ...

can be defined as the use of government spending and/or taxation

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal person, legal entity) by a governmental organization in order to fund government spending and various public expenditures (regiona ...

as a mechanism to influence an economy. There are two types of fiscal policy: expansionary fiscal policy, and contractionary fiscal policy. Expansionary fiscal policy is an increase in government spending or a decrease in taxation, while contractionary fiscal policy is a decrease in government spending or an increase in taxes. Expansionary fiscal policy can be used by governments to stimulate the economy during a recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

. For example, an increase in government spending directly increases demand

In economics, demand is the quantity of a good that consumers are willing and able to purchase at various prices during a given time. The relationship between price and quantity demand is also called the demand curve. Demand for a specific item ...

for goods and services, which can help increase output

Output may refer to:

* The information produced by a computer, see Input/output

* An output state of a system, see state (computer science)

* Output (economics), the amount of goods and services produced

** Gross output in economics, the value of ...

and employment

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any othe ...

. On the other hand, contractionary fiscal policy can be used by governments to cool down the economy during an economic boom. A decrease in government spending can help check inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

. During economic downturns, in the short run, government spending can be changed either via automatic stabilization In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and welfare spending, that act to damp out fluctuations in real GDP.

The size of the government budget deficit tends t ...

or discretionary stabilization. Automatic stabilization is when existing policies automatically change government spending or taxes in response to economic changes, without the additional passage of laws. A primary example of an automatic stabilizer In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and welfare spending, that act to damp out fluctuations in real GDP.

The size of the government budget deficit tends to ...

is unemployment insurance

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployed people. In the United States, benefits are funded by a comp ...

, which provides financial assistance to unemployed workers. Discretionary stabilization is when a government takes actions to change government spending or taxes in direct response to changes in the economy. For instance, a government may decide to increase government spending as a result of a recession. With discretionary stabilization, the government must pass a new law to make changes in government spending.

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in ...

was one of the first economists

An economist is a professional and practitioner in the social science discipline of economics.

The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this field there are ...

to advocate for government deficit spending

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget ...

as part of the fiscal policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables ...

response to an economic contraction

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

. According to Keynesian economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

, increased government spending raises aggregate demand

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is ...

and increases consumption

Consumption may refer to:

*Resource consumption

*Tuberculosis, an infectious disease, historically

* Consumption (ecology), receipt of energy by consuming other organisms

* Consumption (economics), the purchasing of newly produced goods for curren ...

, which leads to increased production and faster recovery from recessions. Classical economists

Classical economics, classical political economy, or Smithian economics is a school of thought in political economy that flourished, primarily in Britain, in the late 18th and early-to-mid 19th century. Its main thinkers are held to be Adam Smit ...

, on the other hand, believe that increased government spending exacerbates an economic contraction

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

by shifting resources from the private sector, which they consider productive, to the public sector, which they consider unproductive.

In economics

Economics () is the social science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and intera ...

, the potential "shifting" in resources from the private sector

The private sector is the part of the economy, sometimes referred to as the citizen sector, which is owned by private groups, usually as a means of establishment for profit or non profit, rather than being owned by the government.

Employment

The ...

to the public sector

The public sector, also called the state sector, is the part of the economy composed of both public services and public enterprises. Public sectors include the public goods and governmental services such as the military, law enforcement, infra ...

as a result of an increase in government deficit spending

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget ...

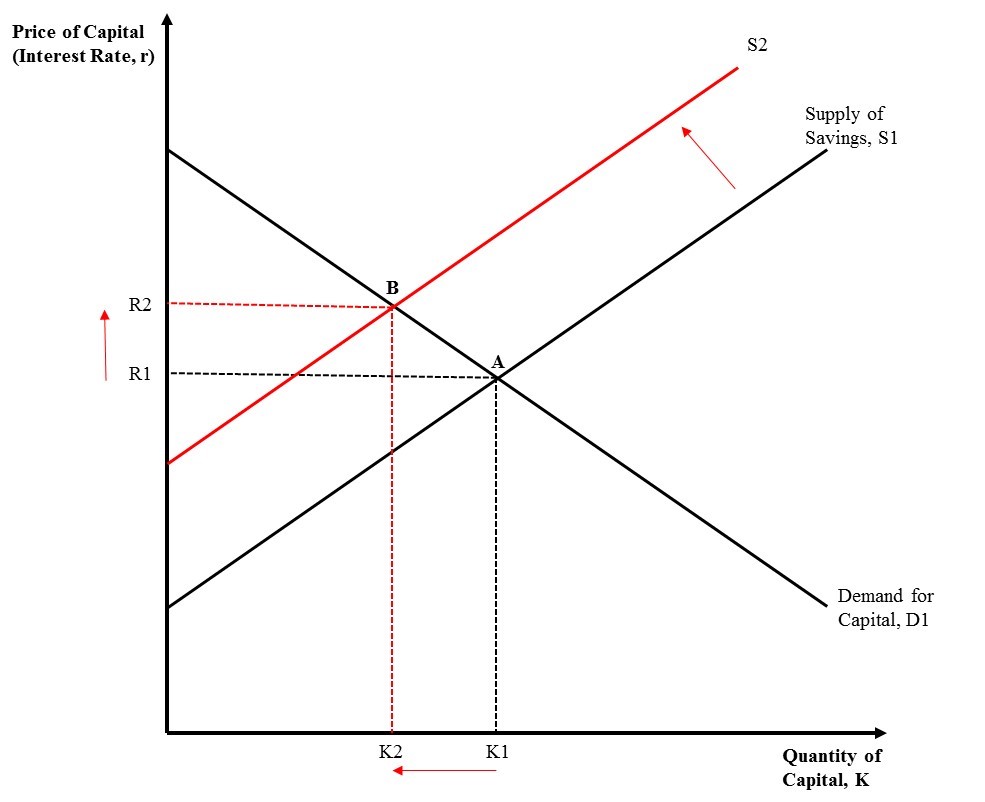

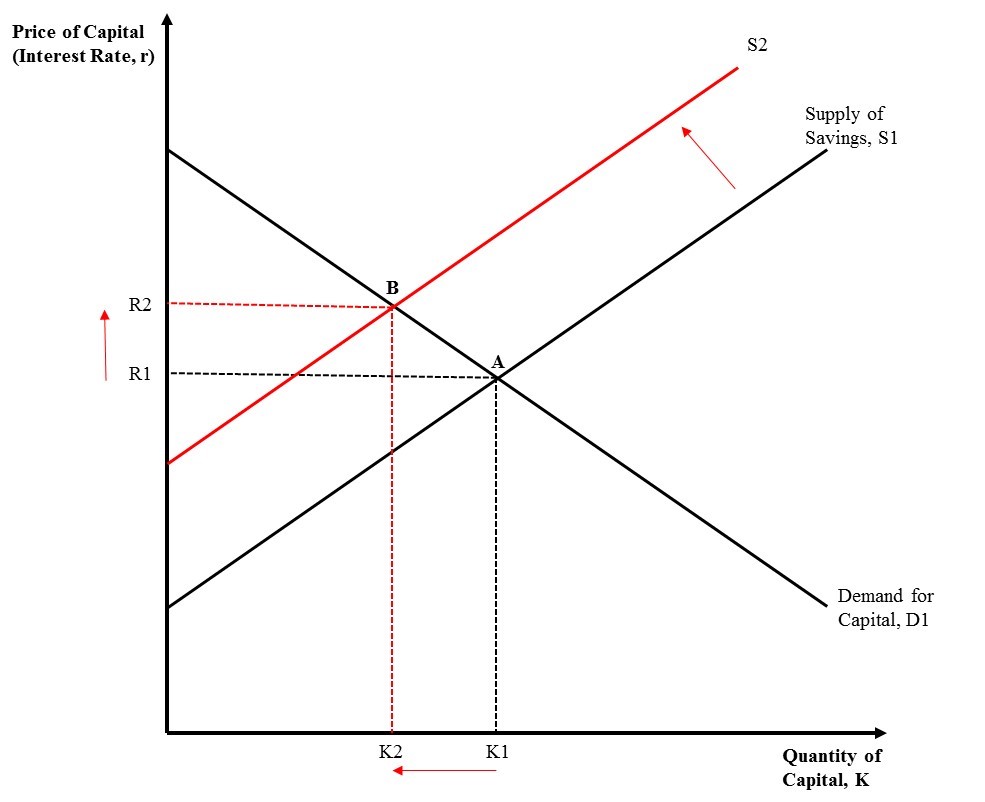

is called crowding out. The figure to the right depicts the market for capital, otherwise known as the market for loanable funds In economics, the loanable funds doctrine is a theory of the market interest rate. According to this approach, the interest rate is determined by the demand for and supply of loanable funds. The term ''loanable funds'' includes all forms of credit, ...

. The downward sloping demand curve

In economics, a demand curve is a graph depicting the relationship between the price of a certain commodity (the ''y''-axis) and the quantity of that commodity that is demanded at that price (the ''x''-axis). Demand curves can be used either for ...

D1 represents demand for private capital by firm

A company, abbreviated as co., is a Legal personality, legal entity representing an association of people, whether Natural person, natural, Legal person, legal or a mixture of both, with a specific objective. Company members share a common p ...

s and investor

An investor is a person who allocates financial capital with the expectation of a future Return on capital, return (profit) or to gain an advantage (interest). Through this allocated capital most of the time the investor purchases some specie ...

s, and the upward sloping supply curve

In economics, supply is the amount of a resource that firms, producers, labourers, providers of financial assets, or other economic agents are willing and able to provide to the marketplace or to an individual. Supply can be in produced goods, la ...

S1 represents savings by private individuals. The initial equilibrium in this market is represented by point A, where the equilibrium quantity of capital is K1 and the equilibrium interest rate is R1. If the government increases deficit spending

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget ...

, it will borrow money from the private capital market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers t ...

and reduce the supply of savings to S2. The new equilibrium is at point B, where the interest rate has increased to R2 and the quantity of capital available to the private sector has decreased to K2. The government has essentially made borrowing more expensive and has taken away savings from the market, which "crowds out" some private investment. The crowding out of private investment could limit the economic growth from the initial increase government spending.

Current use: final consumption

Government spending ongoods and services

Goods are items that are usually (but not always) tangible, such as pens, physical books, salt, apples, and hats. Services are activities provided by other people, who include architects, suppliers, contractors, technologists, teachers, doctor ...

for current use to directly satisfy individual or collective needs of the members of the community is called government final consumption expenditure (GFCE.) It is a purchase from the national accounts "use of income account" for goods and services directly satisfying of individual needs (''individual consumption'') or collective needs of members of the community (''collective consumption''). GFCE consists of the value of the goods and services produced by the government itself other than own-account capital formation

Capital formation is a concept used in macroeconomics, national accounts and financial economics. Occasionally it is also used in corporate accounts. It can be defined in three ways:

*It is a specific statistical concept, also known as net invest ...

and sales and of purchases by the government of goods and services produced by market producers that are supplied to households—without any transformation—as "social transfers" in kind.

Government spending or government expenditure can be divided into three primary groups, government consumption, transfer payments, and interest payments.

# Government consumption are government purchases of goods and services. Examples include road and infrastructure repairs, national defence, schools, healthcare, and government workers’ salaries.

# Investments in sciences and strategic technological innovations to serve the public needs.

# Transfer payments are government payments to individuals. Such payments are made without the exchange of good or services, for example Old Age Security

The Old Age Security (OAS) (SV; french: Sécurité de la vieillesse) program is a universal retirement pension available to most residents and citizens of Canada who have reached 65 years old. This pension is supplemented by the Guaranteed Income ...

payments, Employment Insurance

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployed people. In the United States, benefits are funded by a compu ...

benefits, veteran and civil service pensions, foreign aid, and social assistance payments. Subsidies to businesses are also included in this category.

# Interest payments are the interest paid to the holders of government bonds, such as Saving Bonds and Treasury bills

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. gov ...

.

National defense spending

The United States spends vastly more than other countries on national defense. For example, In 2019 the United States approved a budget of 686.1 billion in discretionary military spending, China was second with an estimated 261 billion dollars in military spending. The table below shows the top 10 countries with the largest military expenditures as of 2015, the most recent year with publicly available data. As the table suggests, the United States spent nearly 3 times as much on the military asChina

China, officially the People's Republic of China (PRC), is a country in East Asia. It is the world's most populous country, with a population exceeding 1.4 billion, slightly ahead of India. China spans the equivalent of five time zones and ...

, the country with the next largest military spending. The U.S. military budget dwarfed spending by all other countries in the top 10, with 8 out of countries spending less than $100 billion in 2016. In 2022, the omnibus spending package increased the military budget by another $42 billion further increasing the United States as the largest defense spenders.

Healthcare and medical research

Research Australia found 91% of Australians think 'improving hospitals and the health system' should be the Australian Government's first spending priority. Crowding 'in' also happens in university life science research Subsidies, funding and government business or projects like this are often justified on the basis of their positive return on investment. Life science crowding in contrasts with crowding out in public funding of research more widely: "10% increase in government R&D funding reduced private R&D expenditure by 3%...In Australia, the average cost of public funds is estimated to be $1.20 and $1.30 for each dollar raised (Robson, 2005). The marginal cost is probably higher, but estimates differ widely depending on the tax that is increased". In the US the total investment in medical and health research and development (R&D) in the US had grown by 27% over the five years from 2013 to 2017, and it is led by industry and the federal government. However, the industry accounted for 67% of total spending in 2017, followed by the federal government at 22%. According to theNational Institute of Health

The National Institutes of Health, commonly referred to as NIH (with each letter pronounced individually), is the primary agency of the United States government responsible for biomedical and public health research. It was founded in the late 1 ...

(NIH) accounted for the lion's share of federal spending in medical and health research in 2017 was $32.4 billion or 82.1%.

Also, academic and research institutions, this includes colleges, and universities, independent research (IRIs), and independent hospital medical research centres also increased spending, dedicating more than $14.2 billion of their own funds (endowment, donations etc.) to medical and health R&D in 2017. Although other funding sources - foundations, state and local government, voluntary health associations and professional societies - accounted for 3.7% of total medical and health R&D expenditure.

On the other hand, global health spending continues to increase and rise rapidly – to US$7.8 trillion in 2017 or about 10% of GDP and $1.80 per capita – up from US£7.6 trillion in 2016. In addition, about 605 of this spending was public and 40% private, with donor funding representing less than 0.2% of the total although the health spending in real terms has risen by 3.79% in a year while global GDP had grown by 3.0%.

According to the World Health Organisation (WHO), the increase in health spending in low-income countries, and it rose by 7.8% a year between 2000 and 2017 while their economy grew by 6.4%, it is explained in the figure. However, the middle-income economies health spending grew more than 6%, and average annual growth in high-income countries was 3.5%, which is about twice as fast as economic growth. In contrast, health spending by the high-income countries continues to represent to be the largest share of global spending, which is about 81%, despite it covers only 16% of world's population; although it down from 87% in 2000. The primary driver of this change in global spending on healthcare is India and China, which they moved to higher-income groups. Furthermore, just over 40% of the world population lived in low-income countries, which is now they dropped to 10%. Moreover, significant spending increment was in upper-middle-income economies population share has more than doubled over the period of, and share of global health spending nearly also doubled due to China and India's vast population joining that group. Unfortunately, all other spending share income groups had declined.

From the continent view, North America, Western Europe, and Oceanic countries have the highest levels of spending, and West Central Asia, and East Africa the lowest, which is followed closely by South Asia, it is explained in the figure.

It is also true that fast economic growth is associated with increased health spending and sustained rapid economic growth between 2000 and 2017. Even more, fast economic growth which is generally associated with the higher government revenues and health spending is mostly located in Asia such as China, India and Indonesia followed by the Middle East and Latin America. In these countries, the real health spending per capita grew by 2.2 times and increased by 0.6 percentage point as per a share of GDP from 2000 to 2017.

Infrastructure and investment: gross fixed capital formation

Government acquisition intended to create future benefits, such as infrastructure investment or research spending, is called gross fixed capital formation, or government investment, which usually is the largest part of the government."Gross capital formation"''Statistics Explained'' European Union Statistics Directorate, European Commission Acquisition of goods and services is made through production by the government (using the government's labour force, fixed assets and purchased goods and services for

intermediate consumption

Intermediate consumption (also called "intermediate expenditure") is an economic concept used in national accounts, such as the United Nations System of National Accounts (UNSNA), the US National Income and Product Accounts (NIPA) and the European ...

) or through purchases of goods and services from market producers. In economic theory

Economics () is the social science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes ...

or in macroeconomics

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole.

For example, using interest rates, taxes, and ...

, investment is the amount purchased of goods

In economics, goods are items that satisfy human wants

and provide utility, for example, to a consumer making a purchase of a satisfying product. A common distinction is made between goods which are transferable, and services, which are not tran ...

which are not consumed but are to be used for future production (i.e. capital

Capital may refer to:

Common uses

* Capital city, a municipality of primary status

** List of national capital cities

* Capital letter, an upper-case letter Economics and social sciences

* Capital (economics), the durable produced goods used f ...

). Examples include railroad

Rail transport (also known as train transport) is a means of transport that transfers passengers and goods on wheeled vehicles running on rails, which are incorporated in tracks. In contrast to road transport, where the vehicles run on a pre ...

or factory

A factory, manufacturing plant or a production plant is an industrial facility, often a complex consisting of several buildings filled with machinery, where workers manufacture items or operate machines which process each item into another. T ...

construction.

Infrastructure

Infrastructure is the set of facilities and systems that serve a country, city, or other area, and encompasses the services and facilities necessary for its economy, households and firms to function. Infrastructure is composed of public and priv ...

spending is considered government investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing i ...

because it will usually save money in the long run, and thereby reduce the net present value

The net present value (NPV) or net present worth (NPW) applies to a series of cash flows occurring at different times. The present value of a cash flow depends on the interval of time between now and the cash flow. It also depends on the discount ...

of government liabilities.

Spending on physical infrastructure

Infrastructure is the set of facilities and systems that serve a country, city, or other area, and encompasses the services and facilities necessary for its economy, households and firms to function. Infrastructure is composed of public and priv ...

in the U.S. returns an average of about $1.92 for each $1.00 spent on nonresidential construction because it is almost always less expensive to maintain than repair or replace once it has become unusable.

Likewise, government spending on social infrastructure, such as preventative health care, can save several hundreds of billions of dollars per year in the U.S., because for example cancer

Cancer is a group of diseases involving abnormal cell growth with the potential to invade or spread to other parts of the body. These contrast with benign tumors, which do not spread. Possible signs and symptoms include a lump, abnormal b ...

patients are more likely to be diagnosed at Stage I where curative treatment is typically a few outpatient visits, instead of at Stage III or later in an emergency room

An emergency department (ED), also known as an accident and emergency department (A&E), emergency room (ER), emergency ward (EW) or casualty department, is a medical treatment facility specializing in emergency medicine, the acute care of pati ...

where treatment can involve years of hospitalization and is often terminal.

Per capita spending

In 2010 national governments spent an average of $2,376 per person, while the average for the world's 20 largest economies (in terms of GDP) was $16,110 per person. Norway and Sweden expended the most at $40,908 and $26,760 per capita respectively. The federal government of the United States spent $11,041 per person. Other large economy country spending figures include South Korea ($4,557), Brazil ($2,813), Russia ($2,458), China ($1,010), and India ($226). The figures below of 42% of GDP spending and a GDP per capita of $54,629 for the U.S. indicate a total per person spending including national, state, and local governments was $22,726 in the U.S.As a percentage of GDP

This is a list of countries by government spending as a percentage ofgross domestic product

Gross domestic product (GDP) is a money, monetary Measurement in economics, measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjec ...

(GDP) for the listed countries, according to the ''2014 Index of Economic Freedom

The ''Index of Economic Freedom'' is an annual index and ranking created in 1995 by The Heritage Foundation and ''The Wall Street Journal'' to measure the degree of economic freedom in the world's nations. The creators of the index claim to tak ...

'' by The Heritage Foundation

The Heritage Foundation (abbreviated to Heritage) is an American conservative think tank based in Washington, D.C. that is primarily geared toward public policy. The foundation took a leading role in the conservative movement during the presiden ...

and ''The Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published ...

''. Tax revenue

Tax revenue is the income that is collected by governments through taxation. Taxation is the primary source of government revenue. Revenue may be extracted from sources such as individuals, public enterprises, trade, royalties on natural resou ...

is included for comparison. These statistics utilize the United Nations' System of National Accounts

The System of National Accounts (often abbreviated as SNA; formerly the United Nations System of National Accounts or UNSNA) is an international standard system of national accounts, the first international standard being published in 1953. Handbo ...

(SNA), which measures the government sector differently than the U.S. Bureau of Economic Analysis

The Bureau of Economic Analysis (BEA) of the United States Department of Commerce is a U.S. government agency that provides official economy of the United States, macroeconomic and industry statistics, most notably reports about the gross domestic ...

(BEA). The SNA counts as government spending the gross cost of public services such as state universities and public hospitals. For example, the SNA counts the entire cost of running the public-university system, not just what legislators appropriate to supplement students' tuition payments. Those adjustments push up the SNA's measure of spending by roughly 4 percent of GDP compared with the standard measure tallied by the BEA.

Public social spending by country

Public social spending comprises cash benefits, direct in-kind provision of goods and services, and tax breaks with social purposes provided by general government (that is central, state, and local governments, including social security funds).OECD data/ref>

Research, assessments and transparency

There is research into government spending such as their efficacies or effective design or comparisons to other options as well as research containing conclusions of public spending-related recommendations. Examples of such are studies outlining benefits of participation in bioeconomy innovation or identifying potential "misallocations" or "misalignments". Often, such spending may be broad – indirect in terms of national interests – such as with human resources/education-related spending or establishments of novel reward systems. In some cases, various goals and expenditures are made public to various degrees, referred to "budget transparency" or "government spending transparency". ;Informed and optimized allocations A study suggests "Greater attention to the development of methods and evidence to better inform theallocation

Allocation may refer to:

Computing

* Block allocation map

* C++ allocators

* Delayed allocation

* File allocation table

* IP address allocation

* Memory allocation

* No-write allocation (cache)

* Register allocation

Economics

* Asset alloca ...

of public sector spending between departments" may be needed and that decisions about public spending may miss opportunities to improve social welfare from existing budgets.

;Underlying drivers of spending alterations

A study investigated funding allocations for public investment in energy research, development and demonstration reported insights about past impacts of its drivers, that may be relevant to adjusting (or facilitating) "investment in clean energy

Clean may refer to:

* Cleaning, the process of removing unwanted substances, such as dirt, infectious agents, and other impurities, from an object or environment

* Cleanliness, the state of being clean and free from dirt

Arts and media Music Al ...

" "to come close to achieving meaningful global decarbonization". The investigated drivers can be broadly described as crisis responses, cooperations and competitions.

Principles and ethics

Studies and organizations have called for systemtically applying principles to spending decisions or to take current issues and goals such asclimate change mitigation

Climate change mitigation is action to limit climate change by reducing Greenhouse gas emissions, emissions of greenhouse gases or Carbon sink, removing those gases from the atmosphere. The recent rise in global average temperature is mostly caus ...

into account in all such decisions. For example:

* scientists have suggested in ''Nature

Nature, in the broadest sense, is the physics, physical world or universe. "Nature" can refer to the phenomenon, phenomena of the physical world, and also to life in general. The study of nature is a large, if not the only, part of science. ...

'' that governments should withstand various pressures and influences and "only support agriculture and food system

The term food system describes the interconnected systems and processes that influence nutrition

Nutrition is the biochemical and physiological process by which an organism uses food to support its life. It provides organisms with nutrients ...

s that deliver on the SDG

The Sustainable Development Goals (SDGs) or Global Goals are a collection of 17 interlinked objectives designed to serve as a "shared blueprint for peace and prosperity for people and the planet, now and into the future".United Nations (2017) R ...

s (in line with "public funds for public goods")"

* a campaign by the FSFE

The Free Software Foundation Europe (FSFE) is an ''eingetragener Verein'' (registered voluntary association) under German law. It was founded in 2001 to support all aspects of the free software movement in Europe, with registered chapters in seve ...

calls for a principle of "Public Money, Public Code" – that software created using taxpayers' money is developed as free and open source software

Free and open-source software (FOSS) is a term used to refer to groups of software consisting of both free software and open-source software where anyone is freely licensed to use, copy, study, and change the software in any way, and the source ...

* Plan S

Plan S is an initiative for open-access science publishing launched in 2018 by "cOAlition S", a consortium of national research agencies and funders from twelve European countries. The plan requires scientists and researchers who benefit from s ...

calls for a requirement for scientific publications that result from research funded by public grants being published as open access

Open access (OA) is a set of principles and a range of practices through which research outputs are distributed online, free of access charges or other barriers. With open access strictly defined (according to the 2001 definition), or libre op ...

Public sector ethics Ethics in the public sector is a broad topic that is usually considered a branch of political ethics. In the public sector, ethics addresses the fundamental premise of a public administrator's duty as a "steward" to the public. In other words, it i ...

may also concern government spending, affecting the shares and intentions of government spending or their respective rationales (beyond ethical principles or implications of the contextual socioeconomic structures), as well as corruption or diversion of public funds.

Other areas of spending

Science funding

Governments fund various research beyond healthcare and medical research and defense research . Sometimes, relevant funding decision-making makes use of coordinative and prioritizing tools, data or methods, such as evaluated relevances toglobal issues

A global issue is a matter of public concern worldwide. This list of global issues presents problems or phenomena affecting people around the world, including but not limited to widespread social issues, economic issues, and environmental issues ...

or international goals or national goals or major causes of human diseases and early deaths (health impacts).

Energy infrastructure

See also

* Rahn curve *Open government

Open government is the governing doctrine which sustain that citizens have the right to access the documents and proceedings of the government to allow for effective public oversight. In its broadest construction, it opposes reason of state and ...

* Government operations

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual o ...

* Public expenditure

Public expenditure is spending made by the government of a country on collective needs and wants, such as pension, provisions, security, infrastructure, etc. Until the 19th century, public expenditure was limited as laissez faire philosophies be ...

* Public finance

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achie ...

* Government budget

A government budget is a document prepared by the government and/or other political entity presenting its anticipated tax revenues (Inheritance tax, income tax, corporation tax, import taxes) and proposed spending/expenditure (Healthcare, Educa ...

* Government waste

Government failure, in the context of public economics, is an economic inefficiency caused by a government intervention, if the inefficiency would not exist in a true free market. The costs of the government intervention are greater than the bene ...

* Fiscal policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables ...

* Fiscal council

A fiscal council is an independent body set up by a government to evaluate its expenditure and tax policy. Typically, councils are staffed by economists and statisticians who do not have the ability to set policy, but provide advice to governments ...

* Sovereign wealth fund

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such ...

* Tax

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

* Mandatory spending

The United States federal budget is divided into three categories: mandatory spending, discretionary spending, and interest on debt. Also known as entitlement spending, in US fiscal policy, mandatory spending is government spending on certain p ...

* Taxpayer groups, Taxpayers unions

* Eurostat

* Government spending in the United Kingdom

* Government spending in the United States

* List of countries by government spending as percentage of GDP

References

External links

OECD Government spending statistics

Canadian Governments Compared

Eurostat's government spending per sector

{{DEFAULTSORT:Government Spending Government spending, Government finances Fiscal policy