Macroeconomic

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole.

For example, using interest rates, taxes, and ...

theory has its origins in the study of

business cycle

Business cycles are intervals of Economic expansion, expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are ...

s and

monetary theory

Monetary economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions (such as medium of exchange, store of value and unit of account), and it ...

. In general, early theorists believed monetary factors could not affect

real

Real may refer to:

Currencies

* Brazilian real (R$)

* Central American Republic real

* Mexican real

* Portuguese real

* Spanish real

* Spanish colonial real

Music Albums

* ''Real'' (L'Arc-en-Ciel album) (2000)

* ''Real'' (Bright album) (2010)

...

factors such as real output.

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in ...

attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual,

microeconomic

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics fo ...

parts. Attempting to explain

unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for Work (human activity), w ...

and

recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

s, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that

markets always clear, leaving no surplus of goods and no willing labor left idle.

The generation of economists that followed Keynes synthesized his theory with

neoclassical microeconomics to form the

neoclassical synthesis

The neoclassical synthesis (NCS), neoclassical–Keynesian synthesis, or just neo-Keynesianism was a neoclassical economics academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Key ...

. Although

Keynesian theory

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and ...

originally omitted an explanation of

price levels and

inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

, later Keynesians adopted the

Phillips curve

The Phillips curve is an economic model, named after William Phillips hypothesizing a correlation between reduction in unemployment and increased rates of wage rises within an economy. While Phillips himself did not state a linked relationship ...

to model price-level changes. Some Keynesians opposed the synthesis method of combining Keynes's theory with an equilibrium system and advocated disequilibrium models instead.

Monetarists

Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on nationa ...

, led by

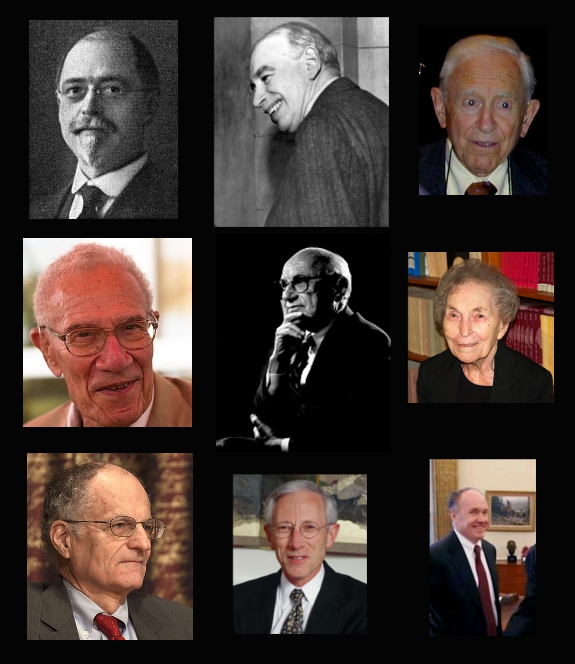

Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

, adopted some Keynesian ideas, such as the importance of the

demand for money

In monetary economics, the demand for money is the desired holding of financial assets in the form of money: that is, cash or bank deposits rather than investments. It can refer to the demand for money narrowly defined as M1 (directly spendable ...

, but argued that Keynesians ignored the role of

money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

in inflation.

Robert Lucas and other

new classical macroeconomists criticized Keynesian models that did not work under

rational expectations

In economics, "rational expectations" are model-consistent expectations, in that agents inside the model

A model is an informative representation of an object, person or system. The term originally denoted the plans of a building in late 16 ...

. Lucas also

argued that Keynesian empirical models would not be as stable as models based on microeconomic foundations.

The new classical school culminated in

real business cycle theory

Real business-cycle theory (RBC theory) is a class of new classical macroeconomics models in which business-cycle fluctuations are accounted for by real (in contrast to nominal) shocks. Unlike other leading theories of the business cycle, RBC the ...

(RBC). Like early classical economic models, RBC models assumed that markets clear and that business cycles are driven by changes in technology and supply, not demand.

New Keynesians tried to address many of the criticisms leveled by Lucas and other new classical economists against Neo-Keynesians. New Keynesians adopted rational expectations and built models with microfoundations of

sticky prices

Nominal rigidity, also known as price-stickiness or wage-stickiness, is a situation in which a nominal price is resistant to change. Complete nominal rigidity occurs when a price is fixed in nominal terms for a relevant period of time. For exampl ...

that suggested recessions could still be explained by demand factors because rigidities stop prices from falling to a market-clearing level, leaving a surplus of goods and labor. The

new neoclassical synthesis

The new neoclassical synthesis (NNS), which is now generally referred to as New Keynesian economics, and occasionally as the New Consensus, is the fusion of the major, modern macroeconomic schools of thought – new classical macroeconomics/ real ...

combined elements of both new classical and new Keynesian macroeconomics into a consensus. Other economists avoided the new classical and new Keynesian debate on short-term dynamics and developed the

new growth theories of long-run economic growth. The

Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

led to a retrospective on the state of the field and some popular attention turned toward

heterodox economics

Heterodox economics is any economic thought or theory that contrasts with orthodox schools of economic thought, or that may be beyond neoclassical economics.Frederic S. Lee, 2008. "heterodox economics," ''The New Palgrave Dictionary of Economics' ...

.

Origins

Macroeconomics descends from two areas of research:

business cycle

Business cycles are intervals of Economic expansion, expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are ...

theory and

monetary theory

Monetary economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions (such as medium of exchange, store of value and unit of account), and it ...

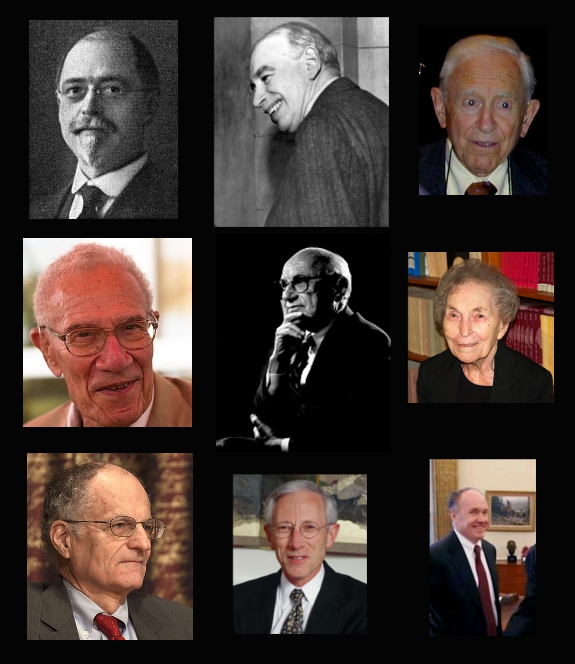

. Monetary theory dates back to the 16th century and the work of

Martín de Azpilcueta

Martín de Azpilcueta (Azpilkueta in Basque) (13 December 1491 – 1 June 1586), or Doctor Navarrus, was an important Spanish canonist and theologian in his time, and an early economist who independently formulated the quantity theory of mone ...

, while business cycle analysis dates from the mid 19th.

Business cycle theory

Beginning with

William Stanley Jevons

William Stanley Jevons (; 1 September 183513 August 1882) was an English economist and logician.

Irving Fisher described Jevons's book ''A General Mathematical Theory of Political Economy'' (1862) as the start of the mathematical method in ec ...

and

Clément Juglar

Clément Juglar (15 October 1819 – 28 February 1905) was a French doctor and statistician.

Juglar cycles

He was one of the first to develop an economic theory of business cycles.The New Encyclopædia Britannica: Macropaedia 1998 "The first autho ...

in the 1860s, economists attempted to explain the cycles of frequent, violent shifts in economic activity. A key milestone in this endeavor was the foundation of the U.S.

National Bureau of Economic Research

The National Bureau of Economic Research (NBER) is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic c ...

by

Wesley Mitchell

Wesley Clair Mitchell (August 5, 1874 – October 29, 1948) was an American economist known for his empirical work on business cycles and for guiding the National Bureau of Economic Research in its first decades.

Mitchell was referred to as Thor ...

in 1920. This marked the beginning of a boom in atheoretical, statistical models of economic fluctuation (models based on cycles and trends instead of economic theory) that led to the discovery of apparently regular economic patterns like the

Kuznets wave.

Other economists focused more on theory in their business cycle analysis. Most business cycle theories focused on a single factor, such as monetary policy or the impact of weather on the largely agricultural economies of the time. Although business cycle theory was well established by the 1920s, work by theorists such as

Dennis Robertson and

Ralph Hawtrey

Sir Ralph George Hawtrey (22 November 1879, Slough – 21 March 1975, London) was a British economist, and a close friend of John Maynard Keynes. He was a member of the Cambridge Apostles, the University of Cambridge intellectual secret society.

...

had little impact on public policy. Their

partial equilibrium

In economics, partial equilibrium is a condition of economic equilibrium which analyzes only a single market, ''ceteris paribus'' (everything else remaining constant) except for the one change at a time being analyzed. In general equilibrium anal ...

theories could not capture

general equilibrium

In economics, general equilibrium theory attempts to explain the behavior of supply, demand, and prices in a whole economy with several or many interacting markets, by seeking to prove that the interaction of demand and supply will result in an ov ...

, where markets interact with each other; in particular, early business cycle theories treated goods markets and financial markets separately. Research in these areas used

microeconomic

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics fo ...

methods to explain

employment

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any othe ...

,

price level

The general price level is a hypothetical measure of overall prices for some set of goods and services (the consumer basket), in an economy or monetary union during a given interval (generally one day), normalized relative to some base set. ...

, and

interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

s.

Monetary theory

Initially, the relationship between price level and output was explained by the

quantity theory of money

In monetary economics, the quantity theory of money (often abbreviated QTM) is one of the directions of Western economic thought that emerged in the 16th-17th centuries. The QTM states that the general price level of goods and services is directly ...

;

David Hume

David Hume (; born David Home; 7 May 1711 NS (26 April 1711 OS) – 25 August 1776) Cranston, Maurice, and Thomas Edmund Jessop. 2020 999br>David Hume" ''Encyclopædia Britannica''. Retrieved 18 May 2020. was a Scottish Enlightenment philo ...

had presented such a theory in his 1752 work ''Of Money'' (''

Essays, Moral, Political, and Literary

''Essays, Moral, Political, and Literary'' (1758) is a two-volume compilation of essays by David Hume. Part I includes the essays from ''Essays, Moral and Political'', plus two essays from '' Four Dissertations''. The content of this part largely ...

'', Part II, Essay III). Quantity theory viewed the entire economy through

Say's law

In classical economics, Say's law, or the law of markets, is the claim that the production of a product creates demand for another product by providing something of value which can be exchanged for that other product. So, production is the source ...

, which stated that whatever is supplied to the market will be sold—in short, that

markets always clear. In this view,

money is neutral and cannot impact the real factors in an economy like output levels. This was consistent with the

classical dichotomy In macroeconomics, the classical dichotomy is the idea, attributed to classical and pre-Keynesian economics, that real and nominal variables can be analyzed separately. To be precise, an economy exhibits the classical dichotomy if real variables s ...

view that real aspects of the economy and nominal factors, such as price levels and money supply, can be considered independent from one another. For example, adding more money to an economy would be expected only to raise prices, not to create more goods.

The quantity theory of money dominated macroeconomic theory until the 1930s. Two versions were particularly influential, one developed by

Irving Fisher

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt def ...

in works that included his 1911 ''The Purchasing Power of Money'' and another by

Cambridge

Cambridge ( ) is a university city and the county town in Cambridgeshire, England. It is located on the River Cam approximately north of London. As of the 2021 United Kingdom census, the population of Cambridge was 145,700. Cambridge bec ...

economists over the course of the early 20th century. Fisher's version of the quantity theory can be expressed by holding

money velocity

image:M3 Velocity in the US.png, 300px, Similar chart showing the logged velocity (green) of a broader measure of money M3 that covers M2 plus large institutional deposits. The US no longer publishes official M3 measures, so the chart only runs thr ...

(the frequency with which a given piece of currency is used in transactions) (V) and

real income

Real income is the income of individuals or nations after adjusting for inflation. It is calculated by dividing nominal income by the price level. Real variables such as real income and real GDP are variables that are measured in physical units, ...

(Q) constant and allowing

money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

(M) and the price level (P) to vary in the

equation of exchange In monetary economics, the equation of exchange is the relation:

:M\cdot V = P\cdot Q

where, for a given period,

:M\, is the total money supply in circulation on average in an economy.

:V\, is the velocity of money, that is the average frequency w ...

:

:

Most classical theories, including Fisher's, held that velocity was stable and independent of economic activity. Cambridge economists, such as

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in ...

, began to challenge this assumption. They developed the

Cambridge cash-balance theory, which looked at money demand and how it impacted the economy. The Cambridge theory did not assume that money demand and supply were always at equilibrium, and it accounted for people holding more cash when the economy sagged. By factoring in the value of holding cash, the Cambridge economists took significant steps toward the concept of

liquidity preference

__NOTOC__

In macroeconomic theory, liquidity preference is the demand for money, considered as liquidity. The concept was first developed by John Maynard Keynes in his book ''The General Theory of Employment, Interest and Money'' (1936) to expl ...

that Keynes would later develop. Cambridge theory argued that people hold money for two reasons: to facilitate transactions and to maintain

liquidity

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include:

* Market liquidity, the ease with which an asset can be sold

* Accounting liquidity, the ability to meet cash obligations when due

* Liqui ...

. In later work, Keynes added a third motive,

speculation

In finance, speculation is the purchase of an asset (a commodity, good (economics), goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline i ...

, to his liquidity preference theory and built on it to create his general theory.

In 1898,

Knut Wicksell

Johan Gustaf Knut Wicksell (December 20, 1851 – May 3, 1926) was a leading Swedish economist of the Stockholm school. His economic contributions would influence both the Keynesian and Austrian schools of economic thought. He was married to th ...

proposed a monetary theory centered on interest rates. His analysis used two rates: the market interest rate, determined by the banking system, and the real or

"natural" interest rate, determined by the

rate of return

In finance, return is a profit on an investment. It comprises any change in value of the investment, and/or cash flows (or securities, or other investments) which the investor receives from that investment, such as interest payments, coupons, ca ...

on capital. In Wicksell's theory, cumulative inflation will occur when technical innovation causes the natural rate to rise or when the banking system allows the market rate to fall. Cumulative deflation occurs under the opposite conditions causing the market rate to rise above the natural. Wicksell's theory did not produce a direct relationship between the quantity of money and price level. According to Wicksell, money would be created endogenously, without an increase in quantity of hard currency, as long as the natural exceeded the market interest rate . In these conditions, borrowers turn a profit and deposit cash into bank reserves, which expands money supply. This can lead to a cumulative process where inflation increases continuously without an expansion in the monetary base. Wicksell's work influenced Keynes and the Swedish economists of the

Stockholm School.

Keynes's ''General Theory''

Modern macroeconomics can be said to have begun with Keynes and the publication of his book ''

The General Theory of Employment, Interest and Money

''The General Theory of Employment, Interest and Money'' is a book by English economist John Maynard Keynes published in February 1936. It caused a profound shift in economic thought, giving macroeconomics a central place in economic theory and ...

'' in 1936. Keynes expanded on the concept of liquidity preferences and built a general theory of how the economy worked. Keynes's theory brought together both monetary and real economic factors for the first time, explained unemployment, and suggested policy achieving economic stability.

Keynes contended that economic output is positively

correlated

In statistics, correlation or dependence is any statistical relationship, whether causal or not, between two random variables or bivariate data. Although in the broadest sense, "correlation" may indicate any type of association, in statistics ...

with money velocity. He explained the relationship via changing liquidity preferences: people increase their money holdings during times of economic difficulty by reducing their spending, which further slows the economy. This

paradox of thrift

The paradox of thrift (or paradox of saving) is a paradox of economics. The paradox states that an increase in autonomous saving leads to a decrease in aggregate demand and thus a decrease in gross output which will in turn lower ''total'' saving ...

claimed that individual attempts to survive a downturn only worsen it. When the demand for money increases, money velocity slows. A slowdown in economic activities means markets might not clear, leaving excess goods to waste and capacity to idle. Turning the quantity theory on its head, Keynes argued that market changes shift quantities rather than prices. Keynes replaced the assumption of stable velocity with one of a fixed price-level. If spending falls and prices do not, the surplus of goods reduces the need for workers and increases unemployment.

Classical economists had difficulty explaining

involuntary unemployment

Involuntary unemployment occurs when a person is unemployed despite being willing to work at the prevailing wage. It is distinguished from voluntary unemployment, where a person refuses to work because their reservation wage is higher than the prev ...

and recessions because they applied Say's Law to the labor market and expected that all those willing to work at the

prevailing wage

In United States government contracting, a prevailing wage is defined as the hourly wage, usual benefits and overtime, paid to the majority of workers, laborers, and mechanics within a particular area. This is usually the union wage.

Prevailing ...

would be employed. In Keynes's model, employment and output are driven by

aggregate demand

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is ...

, the sum of consumption and investment. Since consumption remains stable, most fluctuations in aggregate demand stem from investment, which is driven by many factors including expectations, "

animal spirits", and interest rates. Keynes argued that

fiscal policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables ...

could compensate for this volatility. During downturns, governments could increase spending to purchase excess goods and employ idle labor. Moreover, a

multiplier effect

In macroeconomics, a multiplier is a factor of proportionality that measures how much an endogenous variable changes in response to a change in some exogenous variable.

For example, suppose variable ''x''

changes by ''k'' units, which causes an ...

increases the effect of this direct spending since newly employed workers would spend their income, which would percolate through the economy, while firms would invest to respond to this increase in demand.

Keynes's prescription for strong public investment had ties to his interest in uncertainty. Keynes had given a unique perspective on statistical inference in ''

A Treatise on Probability

''A Treatise on Probability'' is a book published by John Maynard Keynes while at Cambridge University in 1921. The ''Treatise'' attacked the classical theory of probability and proposed a "logical-relationist" theory instead. In a 1922 review, ...

'', written in 1921, years before his major economic works. Keynes thought strong public investment and fiscal policy would counter the negative impacts the uncertainty of economic fluctuations can have on the economy. While Keynes's successors paid little attention to the probabilistic parts of his work, uncertainty may have played a central part in the investment and liquidity-preference aspects of ''General Theory''.

The exact meaning of Keynes's work has been long debated. Even the interpretation of Keynes's policy prescription for unemployment, one of the more explicit parts of ''General Theory'', has been the subject of debates. Economists and scholars debate whether Keynes intended his advice to be a major policy shift to address a serious problem or a moderately conservative solution to deal with a minor issue.

Keynes's successors

Keynes's successors debated the exact formulations, mechanisms, and consequences of the Keynesian model. One group emerged representing the "orthodox" interpretation of Keynes; They combined classical microeconomics with Keynesian thought to produce the "neoclassical synthesis" that dominated economics from the 1940s until the early 1970s. Two camps of Keynesians were critical of this synthesis interpretation of Keynes. One group focused on the disequilibrium aspects of Keynes's work, while the other took a fundamentalist stance on Keynes and began the heterodox post-Keynesian tradition.

Neoclassical synthesis

The generation of economists that followed Keynes, the

neo-Keynesians, created the "

neoclassical synthesis

The neoclassical synthesis (NCS), neoclassical–Keynesian synthesis, or just neo-Keynesianism was a neoclassical economics academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Key ...

" by combining Keynes's macroeconomics with neoclassical microeconomics. Neo-Keynesians dealt with two microeconomic issues: first, providing foundations for aspects of Keynesian theory such as consumption and investment, and, second, combining Keynesian macroeconomics with

general equilibrium theory

In economics, general equilibrium theory attempts to explain the behavior of supply, demand, and prices in a whole economy with several or many interacting markets, by seeking to prove that the interaction of demand and supply will result in an ov ...

. (In general equilibrium theory, individual markets interact with one another and an equilibrium price exists if there is

perfect competition

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In Economic model, theoret ...

, no

externalities

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either co ...

, and

perfect information

In economics, perfect information (sometimes referred to as "no hidden information") is a feature of perfect competition. With perfect information in a market, all consumers and producers have complete and instantaneous knowledge of all market pr ...

.)

Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he "h ...

's ''

Foundations of Economic Analysis

''Foundations of Economic Analysis'' is a book by Paul A. Samuelson published in 1947 (Enlarged ed., 1983) by Harvard University Press. It is based on Samuelson's 1941 doctoral dissertation at Harvard University. The book sought to demonstrate a ...

'' (1947) provided much of the microeconomic basis for the synthesis. Samuelson's work set the pattern for the methodology used by neo-Keynesians: economic theories expressed in formal, mathematical models. While Keynes's theories prevailed in this period, his successors largely abandoned his informal methodology in favor of Samuelson's.

By the mid 1950s, the vast majority of economists had ceased debating Keynesianism and accepted the synthesis view; however, room for disagreement remained. The synthesis attributed problems with market clearing to sticky prices that failed to adjust to changes in supply and demand. Another group of Keynesians focused on disequilibrium economics and tried to reconcile the concept of equilibrium with the absence of market clearing.

Neo-Keynesian models

In 1937

John Hicks

Sir John Richards Hicks (8 April 1904 – 20 May 1989) was a British economist. He is considered one of the most important and influential economists of the twentieth century. The most familiar of his many contributions in the field of economic ...

published an article that incorporated Keynes's thought into a general equilibrium framework where the markets for goods and money met in an overall equilibrium. Hick's

IS/LM (Investment-Savings/Liquidity preference-Money supply) model became the basis for decades of theorizing and policy analysis into the 1960s. The model represents the goods market with the IS curve, a set of points representing equilibrium in investment and savings. The money market equilibrium is represented with the LM curve, a set of points representing the equilibrium in supply and demand for money. The intersection of the curves identifies an aggregate equilibrium in the economy where there are unique equilibrium values for interest rates and economic output. The IS/LM model focused on interest rates as the "

monetary transmission mechanism

The monetary transmission mechanism is the process by which asset prices and general economic conditions are affected as a result of monetary policy decisions. Such decisions are intended to influence the aggregate demand, interest rates, and amo ...

," the channel through which money supply affects real variables like aggregate demand and employment. A decrease in money supply would lead to higher interest rates, which reduce investment and thereby lower output throughout the economy. Other economists built on the IS/LM framework. Notably, in 1944,

Franco Modigliani

Franco Modigliani (18 June 1918 – 25 September 2003) was an Italian-American economist and the recipient of the 1985 Nobel Memorial Prize in Economics. He was a professor at University of Illinois at Urbana–Champaign, Carnegie Mellon Uni ...

added a labor market. Modigliani's model represented the economy as a system with general equilibrium across the interconnected markets for labor, finance, and goods, and it explained unemployment with rigid nominal wages.

Growth had been of interest to 18th-century classical economists like

Adam Smith

Adam Smith (baptized 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the thinking of political economy and key figure during the Scottish Enlightenment. Seen by some as "The Father of Economics"——— ...

, but work tapered off during the 19th and early 20th century

marginalist revolution

Marginalism is a theory of economics that attempts to explain the discrepancy in the value of goods and services by reference to their secondary, or marginal, utility. It states that the reason why the price of diamonds is higher than that of wa ...

when researchers focused on microeconomics. The study of growth revived when neo-Keynesians

Roy Harrod

Sir Henry Roy Forbes Harrod (13 February 1900 – 8 March 1978) was an English economist. He is best known for writing ''The Life of John Maynard Keynes'' (1951) and for the development of the Harrod–Domar model, which he and Evsey Domar devel ...

and

Evsey Domar

Evsey David Domar (russian: Евсей Давидович Домашевицкий, ''Domashevitsky''; April 16, 1914 – April 1, 1997) was a Russian American economist, famous as developer of the Harrod–Domar model.

Life

Evsey Domar was bor ...

independently developed the

Harrod–Domar model

The Harrod–Domar model is a Keynesian model of economic growth. It is used in development economics to explain an economy's growth rate in terms of the level of saving and of capital. It suggests that there is no natural reason for an economy to ...

, an extension of Keynes's theory to the long-run, an area Keynes had not looked at himself. Their models combined Keynes's multiplier with an

accelerator model of investment, and produced the simple result that growth equaled the savings rate divided by the capital output ratio (the amount of capital divided by the amount of output). The Harrod–Domar model dominated growth theory until

Robert Solow

Robert Merton Solow, GCIH (; born August 23, 1924) is an American economist whose work on the theory of economic growth culminated in the exogenous growth model named after him. He is currently Emeritus Institute Professor of Economics at the Ma ...

and

Trevor Swan

Trevor Winchester Swan (14 January 1918 – 15 January 1989) was an Australian economist. He is best known for his work on the Solow–Swan growth model, published simultaneously by American economist Robert Solow, for his work on integrating i ...

independently developed

neoclassical growth model

Neoclassical or neo-classical may refer to:

* Neoclassicism or New Classicism, any of a number of movements in the fine arts, literature, theatre, music, language, and architecture beginning in the 17th century

** Neoclassical architecture, an ar ...

s in 1956. Solow and Swan produced a more empirically appealing model with "balanced growth" based on the substitution of labor and capital in production. Solow and Swan suggested that increased savings could only temporarily increase growth, and only technological improvements could increase growth in the long-run. After Solow and Swan, growth research tapered off with little or no research on growth from 1970 until 1985.

Economists incorporated the theoretical work from the synthesis into

large-scale macroeconometric models that combined individual equations for factors such as consumption, investment, and money demand with empirically observed data. This line of research reached its height with the MIT-Penn-Social Science Research Council (MPS) model developed by Modigliani and his collaborators. MPS combined IS/LM with other aspects of the synthesis including the neoclassical growth model and the Phillips curve relation between inflation and output. Both large-scale models and the Phillips curve became targets for critics of the synthesis.

Phillips curve

Keynes did not lay out an explicit theory of price level. Early Keynesian models assumed wage and other price levels were fixed. These assumptions caused little concern in the 1950s when inflation was stable, but by the mid-1960s inflation increased and became an issue for macroeconomic models. In 1958

A.W. Phillips set the basis for a price level theory when he made the empirical observation that inflation and unemployment seemed to be inversely related. In 1960

Richard Lipsey

Richard George Lipsey, (born August 28, 1928) is a Canadian academic and economist. He is best known for his work on the economics of the second-best, a theory that demonstrated that piecemeal establishing of individual first best conditions w ...

provided the first theoretical explanation of this correlation. Generally Keynesian explanations of the curve held that excess demand drove high inflation and low unemployment while an

output gap

The GDP gap or the output gap is the difference between actual GDP or actual output and potential GDP, in an attempt to identify the current economic position over the business cycle. The measure of output gap is largely used in macroeconomic po ...

raised unemployment and depressed prices. In the late 1960s and early 1970s, the Phillips curve faced attacks on both empirical and theoretical fronts. The presumed trade-off between output and inflation represented by the curve was the weakest part of the Keynesian system.

Disequilibrium macroeconomics

Despite its prevalence, the neoclassical synthesis had its Keynesian critics. A strain of disequilibrium or "non-Walrasian" theory developed that criticized the synthesis for apparent contradictions in allowing disequilibrium phenomena, especially

involuntary unemployment

Involuntary unemployment occurs when a person is unemployed despite being willing to work at the prevailing wage. It is distinguished from voluntary unemployment, where a person refuses to work because their reservation wage is higher than the prev ...

, to be modeled in equilibrium models. Moreover, they argued, the presence of disequilibrium in one market must be associated with disequilibrium in another, so involuntary unemployment had to be tied to an excess supply in the goods market. Many see

Don Patinkin

Don Patinkin (Hebrew: דן פטינקין) (January 8, 1922 – August 7, 1995) was an American-born Israeli monetary economist, and the President of the Hebrew University of Jerusalem.Nissan Liviatan, 2008. "Patinkin, Don (1922–1995)," ''The N ...

's work as the first in the disequilibrium vein.

Robert W. Clower

Robert Wayne Clower (February 13, 1926 – May 2, 2011) was an American economist. He is credited with having largely created the field of stocks and flows, stock-flow analysis in economics and with seminal works on the microfoundations of monetary ...

(1965) introduced his "dual-decision hypothesis" that a person in a market may determine what he wants to buy, but is ultimately limited in how much he can buy based on how much he can sell. Clower and

Axel Leijonhufvud

Axel Leijonhufvud (6 September 1933 – 2 May 2022)

of the original.

(1968) argued that disequilibrium formed a fundamental part of Keynes's theory and deserved greater attention.

Robert Barro

Robert Joseph Barro (born September 28, 1944) is an American macroeconomist and the Paul M. Warburg Professor of Economics at Harvard University. Barro is considered one of the founders of new classical macroeconomics, along with Robert Lucas, Jr ...

and

Herschel Grossman

Herschel Ivan Grossman (6 March 1939 – 9 October 2004) was an American economist best known for his work on general disequilibrium with Robert Barro in the 1970s and later work on property rights and the emergence of the state.

Life and caree ...

formulated

general disequilibrium

In macroeconomic theory, general disequilibrium is a situation in which some or all of the aggregated markets, such as the money market, the goods market, and the labor market, fail to clear because of price rigidities.Mankiw (1990), 1655. In th ...

models in which individual markets were locked into prices before there was a general equilibrium. These markets produced "false prices" resulting in disequilibrium. Soon after the work of Barro and Grossman, disequilibrium models fell out of favor in the United States, and Barro abandoned Keynesianism and adopted new classical, market clearing hypotheses.

While American economists quickly abandoned disequilibrium models, European economists were more open to models without market clearing. Europeans such as

Edmond Malinvaud

Edmond Malinvaud (25 April 1923 – 7 March 2015) was a French economist. He was the first president of the Pontifical Academy of Social Sciences.

Trained at the École Polytechnique and at the École Nationale de la Statistique et de l'Adminis ...

and

Jacques Drèze

Jacques H. Drèze (5 August 1929 – 25 September 2022) was a Belgian economist noted for his contributions to economic theory, econometrics, and economic policy as well as for his leadership in the economics profession. Drèze was the first P ...

expanded on the disequilibrium tradition and worked to explain price rigidity instead of simply assuming it. Malinvaud (1977) used disequilibrium analysis to develop a theory of unemployment. He argued that disequilibrium in the labor and goods markets could lead to rationing of goods and labor, leading to unemployment. Malinvaud adopted a fixprice framework and argued that pricing would be rigid in modern, industrial prices compared to the relatively flexible pricing systems of raw goods that dominate agricultural economies. Prices are fixed and only quantities adjust. Malinvaud considers an equilibrium state in classical and Keynesian unemployment as most likely. Work in the neoclassical tradition is confined as a special case of Malinvaud's typology, the Walrasian equilibrium. In Malinvaud's theory, reaching the Walrasian equilibrium case is almost impossible to achieve given the nature of industrial pricing.

Monetarism

Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

developed an alternative to Keynesian macroeconomics eventually labeled

monetarism

Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on measures ...

. Generally monetarism is the idea that the supply of money matters for the macroeconomy. When monetarism emerged in the 1950s and 1960s, Keynesians neglected the role money played in inflation and the business cycle, and monetarism directly challenged those points.

Criticizing and augmenting the Phillips curve

The Phillips curve appeared to reflect a clear, inverse relationship between inflation and output. The curve broke down in the 1970s as economies suffered simultaneous economic stagnation and inflation known as

stagflation

In economics, stagflation or recession-inflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since action ...

. The empirical implosion of the Phillips curve followed attacks mounted on theoretical grounds by Friedman and

Edmund Phelps

Edmund Strother Phelps (born July 26, 1933) is an American economist and the recipient of the 2006 Nobel Memorial Prize in Economic Sciences.

Early in his career, he became known for his research at Yale's Cowles Foundation in the first half of ...

. Phelps, although not a monetarist, argued that only unexpected inflation or deflation impacted employment. Variations of Phelps's "expectations-augmented Phillips curve" became standard tools. Friedman and Phelps used models with no long-run trade-off between inflation and unemployment. Instead of the Phillips curve they used models based on the

natural rate of unemployment

The natural rate of unemployment is the name that was given to a key concept in the study of economic activity. Milton Friedman and Edmund Phelps, tackling this 'human' problem in the 1960s, both received the Nobel Memorial Prize in Economic Scienc ...

where expansionary monetary policy can only temporarily shift unemployment below the natural rate. Eventually, firms will adjust their prices and wages for inflation based on real factors, ignoring nominal changes from monetary policy. The expansionary boost will be wiped out.

Importance of money

Anna Schwartz collaborated with Friedman to produce one of monetarism's major works, ''A Monetary History of the United States'' (1963), which linked money supply to the business cycle. The Keynesians of the 1950s and 60s had adopted the view that monetary policy does not impact aggregate output or the business cycle based on evidence that, during the Great Depression, interest rates had been extremely low but output remained depressed. Friedman and Schwartz argued that Keynesians only looked at nominal rates and neglected the role inflation plays in Real interest rate, ''real'' interest rates, which had been high during much of the Depression. In real terms, monetary policy had effectively been contractionary, putting downward pressure on output and employment, even though economists looking only at nominal rates thought monetary policy had been stimulative.

Friedman developed his own quantity theory of money that referred to

Irving Fisher

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt def ...

's but inherited much from Keynes. Friedman's 1956 "The Quantity Theory of Money: A Restatement" incorporated Keynes's demand for money and liquidity preference into an equation similar to the classical equation of exchange. Friedman's updated quantity theory also allowed for the possibility of using monetary or fiscal policy to remedy a major downturn. Friedman broke with Keynes by arguing that money demand is relatively stable—even during a downturn. Monetarists argued that "fine-tuning" through fiscal and monetary policy is counterproductive. They found money demand to be stable even during fiscal policy shifts, and both fiscal and monetary policies suffer from lags that made them too slow to prevent mild downturns.

Prominence and decline

Monetarism attracted the attention of policy makers in the late-1970s and 1980s. Friedman and Phelps's version of the Phillips curve performed better during stagflation and gave monetarism a boost in credibility. By the mid-1970s monetarism had become the new orthodoxy in macroeconomics, and by the late-1970s central banks in the United Kingdom and United States had largely adopted a monetarist policy of targeting money supply instead of interest rates when setting policy. However, targeting monetary aggregates proved difficult for central banks because of measurement difficulties. Monetarism faced a major test when Paul Volcker took over the Federal Reserve Chairmanship in 1979. Volcker tightened the money supply and brought inflation down, creating a severe Early 1980s recession, recession in the process. The recession lessened monetarism's popularity but clearly demonstrated the importance of money supply in the economy. Monetarism became less credible when once-stable money velocity defied monetarist predictions and began to move erratically in the United States during the early 1980s. Monetarist methods of single-equation models and non-statistical analysis of plotted data also lost out to the simultaneous-equation modeling favored by Keynesians. Monetarism's policies and method of analysis lost influence among central bankers and academics, but its core tenets of the long-run neutrality of money (increases in money supply cannot have long-term effects on real variables, such as output) and use of monetary policy for stabilization became a part of the macroeconomic mainstream even among Keynesians.

New classical economics

"New classical economics" evolved from monetarism and presented other challenges to Keynesianism. Early new classicals considered themselves monetarists, but the new classical school evolved. New classicals abandoned the monetarist belief that monetary policy could systematically impact the economy, and eventually embraced real business cycle theory, real business cycle models that ignored monetary factors entirely.

New classicals broke with Keynesian economic theory completely while monetarists had built on Keynesian ideas. Despite discarding Keynesian theory, new classical economists did share the Keynesian focus on explaining short-run fluctuations. New classicals replaced monetarists as the primary opponents to Keynesianism and changed the primary debate in macroeconomics from whether to look at short-run fluctuations to whether macroeconomic models should be grounded in microeconomic theories. Like monetarism, new classical economics was rooted at the University of Chicago, principally with

Robert Lucas. Other leaders in the development of new classical economics include Edward Prescott at University of Minnesota and

Robert Barro

Robert Joseph Barro (born September 28, 1944) is an American macroeconomist and the Paul M. Warburg Professor of Economics at Harvard University. Barro is considered one of the founders of new classical macroeconomics, along with Robert Lucas, Jr ...

at University of Rochester.

New classical economists wrote that earlier macroeconomic theory was based only tenuously on microeconomic theory and described its efforts as providing "microeconomic foundations for macroeconomics." New classicals also introduced

rational expectations

In economics, "rational expectations" are model-consistent expectations, in that agents inside the model

A model is an informative representation of an object, person or system. The term originally denoted the plans of a building in late 16 ...

and argued that governments had little ability to stabilize the economy given the rational expectations of economic agents. Most controversially, new classical economists revived the market clearing assumption, assuming both that prices are flexible and that the market should be modeled at equilibrium.

Rational expectations and policy irrelevance

Keynesians and monetarists recognized that people based their economic decisions on expectations about the future. However, until the 1970s, most models relied on adaptive expectations, which assumed that expectations were based on an average of past trends. For example, if inflation averaged 4% over a period, economic agents were assumed to expect 4% inflation the following year. In 1972 Lucas, influenced by a 1961 agricultural economics paper by John Muth, introduced rational expectations to macroeconomics. Essentially, adaptive expectations modeled behavior as if it were ''backward''-looking while rational expectations modeled economic agents (consumers, producers and investors) who were ''forward''-looking. New classical economists also claimed that an economic model would be internally inconsistent if it assumed that the agents it models behave as if they were unaware of the model. Under the assumption of rational expectations, models assume agents make predictions based on the optimal forecasts of the model itself. This did not imply that people have perfect foresight, but that they act with an informed understanding of economic theory and policy.

Thomas Sargent and Neil Wallace (1975) applied rational expectations to models with Phillips curve trade-offs between inflation and output and found that monetary policy could not be used to systematically stabilize the economy. Sargent and Wallace's policy ineffectiveness proposition found that economic agents would anticipate inflation and adjust to higher price levels before the influx of monetary stimulus could boost employment and output. Only unanticipated monetary policy could increase employment, and no central bank could systematically use monetary policy for expansion without economic agents catching on and anticipating price changes before they could have a stimulative impact.

Robert Hall (economist), Robert E. Hall applied rational expectations to Friedman's permanent income hypothesis that people base the level of their current spending on their wealth and lifetime income rather than current income. Hall found that people will consumption smoothing, smooth their consumption over time and only alter their consumption patterns when their expectations about future income change. Both Hall's and Friedman's versions of the permanent income hypothesis challenged the Keynesian view that short-term stabilization policies like tax cuts can stimulate the economy. The permanent income view suggests that consumers base their spending on wealth, so a temporary boost in income would only produce a moderate increase in consumption. Empirical tests of Hall's hypothesis suggest it may understate boosts in consumption due to income increases; however, Hall's work helped to popularize Euler equation (economics), Euler equation models of consumption.

The Lucas critique and microfoundations

In 1976 Lucas wrote a paper criticizing Large-scale macroeconometric model, large-scale Keynesian models used for forecasting and policy evaluation. Lucas argued that economic models based on empirical relationships between variables are unstable as policies change: a relationship under one policy regime may be invalid after the regime changes. The Lucas critique, Lucas's critique went further and argued that a policy's impact is determined by how the policy alters the expectations of economic agents. No model is stable unless it accounts for expectations and how expectations relate to policy. New classical economists argued that abandoning the disequilibrium models of Keynesianism and focusing on structure- and behavior-based equilibrium models would remedy these faults. Keynesian economists responded by building models with microfoundations grounded in stable theoretical relationships.

Lucas supply theory and business cycle models

Lucas and Leonard Rapping laid out the first new classical approach to aggregate supply in 1969. Under their model, changes in employment are based on worker preferences for leisure time. Lucas and Rapping modeled decreases in employment as voluntary choices of workers to reduce their work effort in response to the prevailing wage.

Lucas (1973) proposed a business cycle theory based on rational expectations, imperfect information, and market clearing. While building this model, Lucas attempted to incorporate the empirical fact that there had been a trade-off between inflation and output without ceding that money was non-neutral in the short-run. This model included the idea of money surprise: monetary policy only matters when it causes people to be surprised or confused by the price of goods changing Relative prices, relative to one another. Lucas hypothesized that producers become aware of changes in their own industries before they recognize changes in other industries. Given this assumption, a producer might perceive an increase in general price level as an increase in the demand for his goods. The producer responds by increasing production only to find the "surprise" that prices had increased across the economy generally rather than specifically for his goods. This "Lucas supply curve" models output as a function of the "price" or "money surprise," the difference between expected and actual inflation. Lucas's "surprise" business cycle theory fell out of favor after the 1970s when empirical evidence failed to support this model.

Real business cycle theory

While "money surprise" models floundered, efforts continued to develop a new classical model of the business cycle. A 1982 paper by Kydland and Prescott introduced

real business cycle theory

Real business-cycle theory (RBC theory) is a class of new classical macroeconomics models in which business-cycle fluctuations are accounted for by real (in contrast to nominal) shocks. Unlike other leading theories of the business cycle, RBC the ...

(RBC). Under this theory business cycles could be explained entirely by the supply side, and models represented the economy with systems at constant equilibrium. RBC dismissed the need to explain business cycles with price surprise, market failure, price stickiness, uncertainty, and instability. Instead, Kydland and Prescott built parsimonious models that explained business cycles with changes in technology and productivity. Employment levels changed because these technological and productivity changes altered the desire of people to work. RBC rejected the idea of high involuntary unemployment in recessions and not only dismissed the idea that money could stabilize the economy but also the monetarist idea that money could destabilize it.

Real business cycle modelers sought to build macroeconomic models based on microfoundations of Arrow–Debreu model, Arrow–Debreu

general equilibrium

In economics, general equilibrium theory attempts to explain the behavior of supply, demand, and prices in a whole economy with several or many interacting markets, by seeking to prove that the interaction of demand and supply will result in an ov ...

. RBC models were one of the inspirations for dynamic stochastic general equilibrium (DSGE) models. DSGE models have become a common methodological tool for macroeconomists—even those who disagree with new classical theory.

New Keynesian economics

New classical economics had pointed out the inherent contradiction of the neoclassical synthesis: Walrasian microeconomics with market clearing and general equilibrium could not lead to Keynesian macroeconomics where markets failed to clear. New Keynesians recognized this paradox, but, while the new classicals abandoned Keynes, new Keynesians abandoned Walras and market clearing.

During the late 1970s and 1980s, new Keynesian researchers investigated how market imperfections like monopolistic competition, Nominal rigidity, nominal frictions like sticky prices, and other frictions made microeconomics consistent with Keynesian macroeconomics. New Keynesians often formulated models with rational expectations, which had been proposed by Lucas and adopted by new classical economists.

Nominal and real rigidities

Stanley Fischer (1977) responded to Thomas J. Sargent and Neil Wallace's monetary ineffectiveness proposition and showed how monetary policy could stabilize an economy even in a model with rational expectations. Fischer's model showed how monetary policy could have an impact in a model with long-term nominal wage contracts. John B. Taylor expanded on Fischer's work and found that monetary policy could have long-lasting effects—even after wages and prices had adjusted. Taylor arrived at this result by building on Fischer's model with the assumptions of Taylor Contracts (economics), staggered contract negotiations and contracts that fixed nominal prices and wage rates for extended periods. These early new Keynesian theories were based on the basic idea that, given fixed nominal wages, a monetary authority (central bank) can control the employment rate. Since wages are fixed at a nominal rate, the monetary authority can control the real wage (wage values adjusted for inflation) by changing the money supply and thus impact the employment rate.

By the 1980s new Keynesian economists became dissatisfied with these early nominal wage contract models since they predicted that real wages would be countercyclical (real wages would rise when the economy fell), while empirical evidence showed that real wages tended to be independent of economic cycles or even slightly procyclical. These contract models also did not make sense from a microeconomic standpoint since it was unclear why firms would use long-term contracts if they led to inefficiencies. Instead of looking for rigidities in the labor market, new Keynesians shifted their attention to the goods market and the sticky prices that resulted from "menu cost" models of price change. The term refers to the literal cost to a restaurant of printing new menus when it wants to change prices; however, economists also use it to refer to more general costs associated with changing prices, including the expense of evaluating whether to make the change. Since firms must spend money to change prices, they do not always adjust them to the point where markets clear, and this lack of price adjustments can explain why the economy may be in disequilibrium. Studies using data from the United States Consumer Price Index confirmed that prices do tend to be sticky. A good's price typically changes about every four to six months or, if sales are excluded, every eight to eleven months.

While some studies suggested that menu costs are too small to have much of an aggregate impact, Laurence Ball and David Romer (1990) showed that real rigidities could interact with nominal rigidities to create significant disequilibrium. Real rigidities occur whenever a firm is slow to adjust its real prices in response to a changing economic environment. For example, a firm can face real rigidities if it has market power or if its costs for inputs and wages are locked-in by a contract. Ball and Romer argued that real rigidities in the labor market keep a firm's costs high, which makes firms hesitant to cut prices and lose revenue. The expense created by real rigidities combined with the menu cost of changing prices makes it less likely that firm will cut prices to a market clearing level.

Coordination failure

Coordination failure (economics), Coordination failure is another potential explanation for recessions and unemployment. In recessions a factory can go idle even though there are people willing to work in it, and people willing to buy its production if they had jobs. In such a scenario, economic downturns appear to be the result of coordination failure: The invisible hand fails to coordinate the usual, optimal, flow of production and consumption. Russell W. Cooper (economist), Russell Cooper and Andrew John (1988) expressed a general form of coordination as models with multiple equilibria where agents could coordinate to improve (or at least not harm) each of their respective situations. Cooper and John based their work on earlier models including Peter A. Diamond, Peter Diamond's (1982) Diamond coconut model, coconut model, which demonstrated a case of coordination failure involving Matching theory (macroeconomics), search and matching theory. In Diamond's model producers are more likely to produce if they see others producing. The increase in possible trading partners increases the likelihood of a given producer finding someone to trade with. As in other cases of coordination failure, Diamond's model has multiple equilibria, and the welfare of one agent is dependent on the decisions of others. Diamond's model is an example of a "thick-market externality" that causes markets to function better when more people and firms participate in them. Other potential sources of coordination failure include self-fulfilling prophecies. If a firm anticipates a fall in demand, they might cut back on hiring. A lack of job vacancies might worry workers who then cut back on their consumption. This fall in demand meets the firm's expectations, but it is entirely due to the firm's own actions.

Labor market failures

New Keynesians offered explanations for the failure of the labor market to clear. In a Walrasian market, unemployed workers bid down wages until the demand for workers meets the supply. If markets are Walrasian, the ranks of the unemployed would be limited to workers transitioning between jobs and workers who choose not to work because wages are too low to attract them. They developed several theories explaining why markets might leave willing workers unemployed. Of these theories, new Keynesians were especially associated with efficiency wages and the insider-outsider model used to explain hysteresis (economics), long-term effects of previous unemployment, where short-term increases in unemployment become permanent and lead to higher levels of unemployment in the long-run.

Insider-outsider model

Economists became interested in hysteresis when unemployment levels spiked with the 1979 energy crisis, 1979 oil shock and early 1980s recessions but did not return to the lower levels that had been considered the natural rate. Olivier Blanchard and Lawrence Summers (1986) explained hysteresis in unemployment with insider-outsider models, which were also proposed by Assar Lindbeck and Dennis Snower in a series of papers and then a book. Insiders, employees already working at a firm, are only concerned about their own welfare. They would rather keep their wages high than cut pay and expand employment. The unemployed, outsiders, do not have any voice in the wage bargaining process, so their interests are not represented. When unemployment increases, the number of outsiders increases as well. Even after the economy has recovered, outsiders continue to be disenfranchised from the bargaining process. The larger pool of outsiders created by periods of economic retraction can lead to persistently higher levels of unemployment. The presence of hysteresis in the labor market also raises the importance of monetary and fiscal policy. If temporary downturns in the economy can create long term increases in unemployment, stabilization policies do more than provide temporary relief; they prevent short term shocks from becoming long term increases in unemployment.

Efficiency wages

In efficiency wage models, workers are paid at levels that maximize productivity instead of clearing the market. For example, in developing countries, firms might pay more than a market rate to ensure their workers can afford enough nutrition to be productive. Firms might also pay higher wages to increase loyalty and morale, possibly leading to better productivity. Firms can also pay higher than market wages to forestall shirking. Shirking models were particularly influential. Carl Shapiro and Joseph Stiglitz (1984) created a model where employees tend to avoid work unless firms can monitor worker effort and threaten slacking employees with unemployment. If the economy is at full employment, a fired shirker simply moves to a new job. Individual firms pay their workers a premium over the market rate to ensure their workers would rather work and keep their current job instead of shirking and risk having to move to a new job. Since each firm pays more than market clearing wages, the aggregated labor market fails to clear. This creates a pool of unemployed laborers and adds to the expense of getting fired. Workers not only risk a lower wage, they risk being stuck in the pool of unemployed. Keeping wages above market clearing levels creates a serious disincentive to shirk that makes workers more efficient even though it leaves some willing workers unemployed.

New growth theory

Following research on the neoclassical growth model in the 1950s and 1960s, little work on economic growth occurred until 1985. Papers by Paul Romer were particularly influential in igniting the revival of growth research. Beginning in the mid-1980s and booming in the early 1990s many macroeconomists shifted their focus to the long-run and started "new growth" theories, including endogenous growth theory, endogenous growth. Growth economists sought to explain empirical facts including the failure of sub-Saharan Africa to catch up in growth, the booming East Asian Tigers, and the slowdown in productivity growth in the United States prior to the technology boom of the 1990s. Convergence in growth rates had been predicted under the neoclassical growth model, and this apparent predictive failure inspired research into endogenous growth.

Three families of new growth models challenged neoclassical models. The first challenged the assumption of previous models that the economic benefits of capital would decrease over time. These early new growth models incorporated positive externalities to capital accumulation where one firm's investment in technology generates spillover benefits to other firms because knowledge spreads. The second focused on the role of innovation in growth. These models focused on the need to encourage innovation through patents and other incentives. A third set, referred to as the "neoclassical revival", expanded the definition of capital in exogenous growth theory to include human capital. This strain of research began with Mankiw, Romer, and Weil (1992), which showed that 78% of the cross-country variance in growth could be explained by a Solow model augmented with human capital.

Endogenous growth theories implied that countries could experience rapid "catch-up" growth through an open society that encouraged the inflow of technology and ideas from other nations. Endogenous growth theory also suggested that governments should intervene to encourage investment in research and development because the private sector might not invest at optimal levels.

New synthesis

A "new synthesis" or "

new neoclassical synthesis

The new neoclassical synthesis (NNS), which is now generally referred to as New Keynesian economics, and occasionally as the New Consensus, is the fusion of the major, modern macroeconomic schools of thought – new classical macroeconomics/ real ...

" emerged in the 1990s drawing ideas from both the new Keynesian and new classical schools. From the new classical school, it adapted RBC hypotheses, including rational expectations, and methods; from the new Keynesian school, it took nominal rigidities (price stickiness) and other market imperfections. The new synthesis implies that monetary policy can have a stabilizing effect on the economy, contrary to new classical theory. The new synthesis was adopted by academic economists and soon by economic policy, policy makers, such as central bankers.

Under the synthesis, debates have become less ideological (concerning fundamental methodological questions) and more empirical. Woodford described the change:

Woodford emphasized that there was now a stronger distinction between works of data characterization, which make no claims regarding their the results' relationship to specific economic decisions, and structural models, where a model with a theoretical basis attempts describe actual relationships and decisions being made by economic actors. The validation of structural models now requires that their specifications reflect "explicit decision problems faced by households or firms". Data characterization, Woodford says, proves useful in "establishing facts structural models should be expected to explain" but not as a tool of policy analysis. Rather it is structural models, explaining those facts in terms of real-life decisions by agents, that form the basis of policy analysis.

New synthesis theory developed RBC models called dynamic stochastic general equilibrium (DSGE) models, which avoid the Lucas critique. DSGE models formulate hypotheses about the behaviors and preferences of firms and households; numerical solutions of the resulting DSGE models are computed. These models also included a "stochastic" element created by shocks to the economy. In the original RBC models these shocks were limited to technological change, but more recent models have incorporated other real changes. Econometric analysis of DSGE models suggested that real factors sometimes affect the economy. A paper by Frank Smets and Rafael Woulters (2007) stated that monetary policy explained only a small part of the fluctuations in economic output. In new synthesis models, shocks can affect both demand and supply.

More recent developments in new synthesis modeling has included the development of heterogeneous agent models, used in monetary policy optimization: these models examine the implications of having distinct groups of consumers with different savings behavior within a population on the transmission of monetary policy through an economy.

[https://copenhagenmacro.dk/wp-content/uploads/2017/09/debortoli-1.pdf ]

2008 financial crisis, Great Recession, and the evolution of consensus

The financial crisis of 2007–2008, 2007–2008 financial crisis and subsequent

Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

challenged the short-term macroeconomics of the time. Few economists predicted the crisis, and, even afterwards, there was great disagreement on how to address it. The new synthesis formed during the Great Moderation and had not been tested in a severe economic environment. Many economists agree that the crisis stemmed from an economic bubble, but neither of the major macroeconomic schools within the synthesis had paid much attention to finance or a theory of asset bubbles. The failures of macroeconomic theory at the time to explain the crisis spurred macroeconomists to re-evaluate their thinking. Commentary ridiculed the mainstream and proposed a major reassessment.

Particular criticism during the crisis was directed at DSGE models, which were developed prior to and during the new synthesis.

Robert Solow

Robert Merton Solow, GCIH (; born August 23, 1924) is an American economist whose work on the theory of economic growth culminated in the exogenous growth model named after him. He is currently Emeritus Institute Professor of Economics at the Ma ...

testified before the U.S. Congress that DSGE modeling "has nothing useful to say about anti-recession policy because it has built into its essentially implausible assumptions the 'conclusion' that there is nothing for macroeconomic policy to do." Solow also criticized DSGE models for frequently assuming that a single, "representative agent" can represent the complex interaction of the many diverse agents that make up the real world. Robert J. Gordon, Robert Gordon criticized much of macroeconomics after 1978. Gordon called for a renewal of disequilibrium theorizing and disequilibrium modeling. He disparaged both new classical and new Keynesian economists who assumed that markets clear; he called for a renewal of economic models that could included both market clearing and sticky-priced goods, such as oil and housing respectively.

The crisis of confidence in DGSE models did not dismantle the deeper consensus that characterizes the new synthesis, and models which could explain the new data continued development. Areas that had seen increased popular and political attention, such as income inequality, received greater focus, as did models which incorporated significant heterogeneity (as opposed to earlier DSGE models).

[https://www8.gsb.columbia.edu/faculty-research/sites/faculty-research/files/finance/Macro%20Workshop/Catch22_HANK_wDSGE_1503208.pdf ] Whilst criticizing DGSE models, Ricardo J. Caballero argued that work in finance showed progress and suggested that modern macroeconomics needed to be re-centered but not scrapped in the wake of the financial crisis. In 2010, Federal Reserve Bank of Minneapolis president Narayana Kocherlakota acknowledged that DSGE models were "not very useful" for analyzing the financial crisis of 2007-2010, but argued that the applicability of these models was "improving" and claimed that there was a growing consensus among macroeconomists that DSGE models need to incorporate both "price stickiness and financial market frictions."

[Kocherlakota (2010)] Despite his criticism of DSGE modeling, he stated that modern models are useful:

University of Minnesota professor of economics V.V. Chari said in 2010 that the most advanced DSGE models allowed for significant heterogeneity in behavior and decisions, from factors such as age, prior experiences and available information.

Alongside such improvements in DSGE modeling, work has also included the development of heterogeneous-agent models of more specific aspects of the economy, such as monetary policy transmission.

Environmental issues

From the 21st century onwards, the concept of ecosystem services (the benefits to humans provided by the natural environment and from healthy ecosystems) are more widely studied in economics.

Also climate change is more widely acknowledged as a major issue in economics, sparking debates about sustainable development in economics. Climate change has also become a factor in the policy of for example the European Central Bank.

Also the field of ecological economics became more popular in the 21st century.