Emissions trading is a market-based approach to controlling

pollution

Pollution is the introduction of contaminants into the natural environment that cause adverse change. Pollution can take the form of any substance (solid, liquid, or gas) or energy (such as radioactivity, heat, sound, or light). Pollutants, the ...

by providing

economic

An economy is an area of the Production (economics), production, Distribution (economics), distribution and trade, as well as Consumption (economics), consumption of Goods (economics), goods and Service (economics), services. In general, it is ...

incentive

In general, incentives are anything that persuade a person to alter their behaviour. It is emphasised that incentives matter by the basic law of economists and the laws of behaviour, which state that higher incentives amount to greater levels of ...

s for reducing the emissions of

pollutant

A pollutant or novel entity is a substance or energy introduced into the environment that has undesired effects, or adversely affects the usefulness of a resource. These can be both naturally forming (i.e. minerals or extracted compounds like oi ...

s.

The concept is also known as cap and trade (CAT) or emissions trading scheme (ETS).

Carbon emission trading

Emission trading (ETS) for carbon dioxide (CO2) and other greenhouse gases (GHG) is a form of carbon price, carbon pricing; also known as cap and trade (CAT) or carbon pricing. It is an approach to Climate change mitigation, limit climate c ...

for and other

greenhouse gas

A greenhouse gas (GHG or GhG) is a gas that Absorption (electromagnetic radiation), absorbs and Emission (electromagnetic radiation), emits radiant energy within the thermal infrared range, causing the greenhouse effect. The primary greenhouse ...

es has been introduced in

China

China, officially the People's Republic of China (PRC), is a country in East Asia. It is the world's most populous country, with a population exceeding 1.4 billion, slightly ahead of India. China spans the equivalent of five time zones and ...

, the

European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been des ...

and other countries as a key tool for

climate change mitigation

Climate change mitigation is action to limit climate change by reducing Greenhouse gas emissions, emissions of greenhouse gases or Carbon sink, removing those gases from the atmosphere. The recent rise in global average temperature is mostly caus ...

. Other schemes include

sulfur dioxide

Sulfur dioxide (IUPAC-recommended spelling) or sulphur dioxide (traditional Commonwealth English) is the chemical compound with the formula . It is a toxic gas responsible for the odor of burnt matches. It is released naturally by volcanic activ ...

and other pollutants.

In an emissions trading scheme, a central authority or

governmental

A government is the system or group of people governing an organized community, generally a State (polity), state.

In the case of its broad associative definition, government normally consists of legislature, Executive (government), e ...

body allocates or sells a limited number (a "cap") of permits that allow a discharge of a specific quantity of a specific pollutant over a set time period.

[ Polluters are required to hold permits in amount equal to their emissions. Polluters that want to increase their emissions must buy permits from others willing to sell them.]command-and-control

Command and control (abbr. C2) is a "set of organizational and technical attributes and processes ... hatemploys human, physical, and information resources to solve problems and accomplish missions" to achieve the goals of an organization or en ...

environmental regulations such as best available technology

The best available technology or best available techniques (BAT) is the technology approved by legislators or regulators for meeting output standards for a particular process, such as pollution abatement. Similar terms are ''best practicable means ...

(BAT) standards and government subsidies

A subsidy or government incentive is a form of financial aid or support extended to an economic sector (business, or individual) generally with the aim of promoting economic and social policy. Although commonly extended from the government, the ter ...

.

Introduction

Pollution

Pollution is the introduction of contaminants into the natural environment that cause adverse change. Pollution can take the form of any substance (solid, liquid, or gas) or energy (such as radioactivity, heat, sound, or light). Pollutants, the ...

is a prime example of a market externality. An externality

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either co ...

is an effect of some activity on an entity (such as a person) that is not party to a market transaction related to that activity. Emissions trading is a market-based approach to address pollution. The overall goal of an emissions trading plan is to minimize the cost of meeting a set emissions target

A climate target, climate goal or climate pledge is a measurable commitment for climate policy and energy policy with the aim of limiting the climate change. Researchers within, among others, the UN climate panel have identified probable co ...

.[Cap and Trade 101](_blank)

, Center for American Progress

The Center for American Progress (CAP) is a public policy research and advocacy organization which presents a liberal viewpoint on economic and social issues. It has its headquarters in Washington, D.C.

The president and chief executive officer ...

, January 16, 2008.

In an emissions trading system, the government sets an overall limit on emissions, and defines permits (also called allowances), or limited authorizations to emit, up to the level of the overall limit. The government may sell the permits, but in many existing schemes, it gives permits to participants (regulated polluters) equal to each participant's baseline emissions. The baseline is determined by reference to the participant's historical emissions. To demonstrate compliance, a participant must hold permits at least equal to the quantity of pollution it actually emitted during the time period. If every participant complies, the total pollution emitted will be at most equal to the sum of individual limits.[Boswall, J. and Lee, R. (2002). Economics, ethics and the environment. London: Cavendish. pp.62–66.] Because permits can be bought and sold, a participant can choose either to use its permits exactly (by reducing its own emissions); or to emit less than its permits, and perhaps sell the excess permits; or to emit more than its permits, and buy permits from other participants. In effect, the buyer pays a charge for polluting, while the seller gains a reward for having reduced emissions.

Emissions Trading results in the incorporation of economic costs into the costs of production which incentivizes corporations to consider investment returns and capital expenditure decisions with a model that includes the price of carbon and greenhouse gases

A greenhouse gas (GHG or GhG) is a gas that absorbs and emits radiant energy within the thermal infrared range, causing the greenhouse effect. The primary greenhouse gases in Earth's atmosphere are water vapor (), carbon dioxide (), methane ...

(GHG).

In many schemes, organizations which do not pollute (and therefore have no obligations) may also trade permits and financial derivative

In finance, a derivative is a contract that ''derives'' its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the "underlying". Derivatives can be u ...

s of permits.["Emissions trading schemes around the world"](_blank)

, Parliament of Australia, 2013.

In some schemes, participants can bank allowances to use in future periods. In some schemes, a proportion of all traded permits must be retired periodically, causing a net reduction in emissions over time. Thus, environmental group

The environmental movement (sometimes referred to as the ecology movement), also including conservation and green politics, is a diverse philosophical, social, and political movement for addressing environmental issues. Environmentalists advoc ...

s may buy and retire permits, driving up the price of the remaining permits according to the law of demand

In microeconomics, the law of demand is a fundamental principle which states that there is an inverse relationship between price and quantity demanded. In other words, "conditional on all else being equal, as the price of a good increases (↑), q ...

. In most schemes, permit owners can donate permits to a nonprofit entity and receive a tax deduction

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. T ...

s. Usually, the government lowers the overall limit over time, with an aim towards a national emissions reduction target.Environmental Defense Fund

Environmental Defense Fund or EDF (formerly known as Environmental Defense) is a United States-based nonprofit environmental advocacy group. The group is known for its work on issues including global warming, ecosystem restoration, oceans, and hu ...

, cap-and-trade is the most environmentally and economically sensible approach to controlling greenhouse gas emissions

Greenhouse gas emissions from human activities strengthen the greenhouse effect, contributing to climate change. Most is carbon dioxide from burning fossil fuels: coal, oil, and natural gas. The largest emitters include coal in China and lar ...

, the primary cause of global warming, because it sets a limit on emissions, and the trading encourages companies to innovate in order to emit less.

There are active trading programs in several air pollutant

Air pollution is the contamination of air due to the presence of substances in the atmosphere that are harmful to the health of humans and other living beings, or cause damage to the climate or to materials. There are many different types ...

s. An earlier application was the US national market to reduce acid rain

Acid rain is rain or any other form of precipitation that is unusually acidic, meaning that it has elevated levels of hydrogen ions (low pH). Most water, including drinking water, has a neutral pH that exists between 6.5 and 8.5, but acid ...

. The United States now has several regional markets in nitrogen oxides Nitrogen oxide may refer to a binary compound of oxygen and nitrogen, or a mixture of such compounds:

Charge-neutral

*Nitric oxide (NO), nitrogen(II) oxide, or nitrogen monoxide

*Nitrogen dioxide (), nitrogen(IV) oxide

*Nitrogen trioxide (), or ni ...

. For GHG, which cause climate change, carbon emission trade has been introduced in the European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been des ...

, China, the UK, Australia, New Zealand, some US states including California and a collection of Northeastern states, and other countries.

History

The efficiency of what later was to be called the "cap-and-trade" approach to air pollution

Air pollution is the contamination of air due to the presence of substances in the atmosphere that are harmful to the health of humans and other living beings, or cause damage to the climate or to materials. There are many different types ...

abatement was first demonstrated in a series of micro-economic computer simulation studies between 1967 and 1970 for the National Air Pollution Control Administration (predecessor to the United States Environmental Protection Agency

The Environmental Protection Agency (EPA) is an independent executive agency of the United States federal government tasked with environmental protection matters. President Richard Nixon proposed the establishment of EPA on July 9, 1970; it be ...

's Office of Air and Radiation) by Ellison Burton and William Sanjour. These studies used mathematical models of several cities and their emission sources in order to compare the cost and effectiveness of various control strategies. Each abatement strategy was compared with the "least-cost solution" produced by a computer optimization program to identify the least-costly combination of source reductions in order to achieve a given abatement goal. In each case it was found that the least-cost solution was dramatically less costly than the same amount of pollution reduction produced by any conventional abatement strategy. Burton and later Sanjour along with Edward H. Pechan continued improving and advancing these computer models at the newly created U.S. Environmental Protection Agency. The agency introduced the concept of computer modeling with least-cost abatement strategies (i.e., emissions trading) in its 1972 annual report to Congress on the cost of clean air. This led to the concept of "cap and trade" as a means of achieving the "least-cost solution" for a given level of abatement.

The development of emissions trading over the course of its history can be divided into four phases:

# Gestation: Theoretical articulation of the instrument (by Coase

Ronald Harry Coase (; 29 December 1910 – 2 September 2013) was a British economist and author. Coase received a bachelor of commerce degree (1932) and a PhD from the London School of Economics, where he was a member of the faculty until 1951. ...

, Crocker, Dales, MontgomeryAcid Rain Program

The Acid Rain Program is a market-based initiative taken by the United States Environmental Protection Agency in an effort to reduce overall atmospheric levels of sulfur dioxide and nitrogen oxides, which cause acid rain. The program is an implem ...

in Title IV of the 1990 Clean Air Act

The Clean Air Act (CAA) is the United States' primary federal air quality law, intended to reduce and control air pollution nationwide. Initially enacted in 1963 and amended many times since, it is one of the United States' first and most infl ...

, officially announced as a paradigm shift in environmental policy, as prepared by "Project 88", a network-building effort to bring together environmental and industrial interests in the US.

# Regime formation: branching out from the US clean air policy to global climate policy, and from there to the European Union, along with the expectation of an emerging global carbon

Carbon () is a chemical element with the symbol C and atomic number 6. It is nonmetallic and tetravalent

In chemistry, the valence (US spelling) or valency (British spelling) of an element is the measure of its combining capacity with o ...

market and the formation of the "carbon industry".

In the United States, the acid rain

Acid rain is rain or any other form of precipitation that is unusually acidic, meaning that it has elevated levels of hydrogen ions (low pH). Most water, including drinking water, has a neutral pH that exists between 6.5 and 8.5, but acid ...

related emission trading system was principally conceived by C. Boyden Gray

Clayland Boyden Gray (born February 6, 1943) is an American lawyer and former diplomat who served as White House Counsel from 1989 to 1993 and as U.S. Ambassador to the European Union from 2006 to 2007. He is a founding partner of the Washington, ...

, a G.H.W. Bush administration attorney. Gray worked with the Environmental Defense Fund

Environmental Defense Fund or EDF (formerly known as Environmental Defense) is a United States-based nonprofit environmental advocacy group. The group is known for its work on issues including global warming, ecosystem restoration, oceans, and hu ...

(EDF), who worked with the EPA to write the bill that became law as part of the Clean Air Act of 1990. The new emissions cap on NOx and gases took effect in 1995, and according to '' Smithsonian'' magazine, those acid rain emissions dropped 3 million tons that year.

In 1997, the Kyoto Protocol

The Kyoto Protocol was an international treaty which extended the 1992 United Nations Framework Convention on Climate Change (UNFCCC) that commits state parties to reduce greenhouse gas emissions, based on the scientific consensus that (part ...

was the first major agreement to reduce greenhouse gases. 38 developed countries (Annex 1 countries) committed themselves to targets and timetables.

Economics of emission trading

It is possible for a country to reduce emissions using a command-and-control

Command and control (abbr. C2) is a "set of organizational and technical attributes and processes ... hatemploys human, physical, and information resources to solve problems and accomplish missions" to achieve the goals of an organization or en ...

approach, such as regulation, direct

Direct may refer to:

Mathematics

* Directed set, in order theory

* Direct limit of (pre), sheaves

* Direct sum of modules, a construction in abstract algebra which combines several vector spaces

Computing

* Direct access (disambiguation), a ...

and indirect tax

An indirect tax (such as sales tax, per unit tax, value added tax (VAT), or goods and services tax (GST), excise, consumption tax, tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the i ...

es. The cost of that approach differs between countries because the Marginal Abatement Cost Curve (MAC)—the cost of eliminating an additional unit of pollution—differs by country.

Pricing the externality

An emissions trading scheme for greenhouse gas emissions

Greenhouse gas emissions from human activities strengthen the greenhouse effect, contributing to climate change. Most is carbon dioxide from burning fossil fuels: coal, oil, and natural gas. The largest emitters include coal in China and lar ...

(GHGs) works by establishing property rights

The right to property, or the right to own property (cf. ownership) is often classified as a human right for natural persons regarding their possessions. A general recognition of a right to private property is found more rarely and is typically ...

for the atmosphere

An atmosphere () is a layer of gas or layers of gases that envelop a planet, and is held in place by the gravity of the planetary body. A planet retains an atmosphere when the gravity is great and the temperature of the atmosphere is low. A s ...

.public good Public good may refer to:

* Public good (economics), an economic good that is both non-excludable and non-rivalrous

* The common good, outcomes that are beneficial for all or most members of a community

See also

* Digital public goods

Digital pu ...

, and GHG emissions are an international externality

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either co ...

(p. 21). The emissions from all sources of GHGs contribute to the overall stock of GHGs in the atmosphere. In the cap-and-trade variant of emissions trading, a limit on access to a resource (the cap) is defined and then allocated among users in the form of permits. Compliance is established by comparing actual emissions with permits surrendered including any permits traded within the cap.

Efficiency and equity

For the purposes of analysis, it is possible to separate efficiency

Efficiency is the often measurable ability to avoid wasting materials, energy, efforts, money, and time in doing something or in producing a desired result. In a more general sense, it is the ability to do things well, successfully, and without ...

(achieving a given objective at lowest cost) and equity

Equity may refer to:

Finance, accounting and ownership

* Equity (finance), ownership of assets that have liabilities attached to them

** Stock, equity based on original contributions of cash or other value to a business

** Home equity, the dif ...

(fairness). Economists generally agree that to regulate emissions efficiently, all polluters need to face the full costs of their actions (that is, the full marginal

Marginal may refer to:

* ''Marginal'' (album), the third album of the Belgian rock band Dead Man Ray, released in 2001

* ''Marginal'' (manga)

* '' El Marginal'', Argentine TV series

* Marginal seat or marginal constituency or marginal, in polit ...

social cost

Social cost in neoclassical economics is the sum of the private costs resulting from a transaction and the costs imposed on the consumers as a consequence of being exposed to the transaction for which they are not compensated or charged. In other w ...

s of their actions). Regulation of emissions that is applied only to one economic sector or region drastically reduces the efficiency of efforts to reduce global emissions. There is, however, no scientific consensus over how to share the costs and benefits of reducing future climate change (mitigation

Mitigation is the reduction of something harmful or the reduction of its harmful effects. It may refer to measures taken to reduce the harmful effects of hazards that remain ''in potentia'', or to manage harmful incidents that have already occur ...

of climate change), or the costs and benefits of adapting to any future climate change (see also economics of global warming

The economics of climate change concerns the economic aspects of climate change; this can inform policies that governments might consider in response. A number of factors make this and the politics of climate change a difficult problem: it is a l ...

).

Carbon leakage

A domestic ETS can only regulate the emissions of the country having the trading scheme. In this case, GHG emissions can "leak" (carbon leakage

Carbon leakage occurs when there is an increase in greenhouse gas emissions in one country as a result of an emissions reduction by a second country with a strict climate policy.

Carbon leakage may occur for a number of reasons:

* If the emission ...

) to another region or sector with less regulation (p. 21). Leakages may be positive, where they reduce the effectiveness of domestic emission abatement efforts. Leakages may also be negative, and increase the effectiveness of domestic abatement efforts (negative leakages are sometimes called spillover) (IPCC, 2007). For example, a carbon tax

A carbon tax is a tax levied on the carbon emissions required to produce goods and services. Carbon taxes are intended to make visible the "hidden" social costs of carbon emissions, which are otherwise felt only in indirect ways like more sev ...

applied only to developed countries might lead to a positive leakage to developing countries (Goldemberg ''et al.'', 1996, pp. 27–28). However, a negative leakage might also occur due to technological developments driven by domestic regulation of GHGs. This can help to reduce emissions even in less regulated regions.

Competitiveness risks

One way of addressing carbon leakage is to give sectors vulnerable to international competition free emission permits (Carbon Trust, 2009). This acts as a subsidy

A subsidy or government incentive is a form of financial aid or support extended to an economic sector (business, or individual) generally with the aim of promoting economic and social policy. Although commonly extended from the government, the ter ...

for the sector in question. Free allocation of permits was opposed by the Garnaut Climate Change Review

Professor Ross Garnaut led two climate change reviews, the first commencing in 2007 and the second in 2010.

The first Garnaut Climate Change Review was a study by Professor Ross Garnaut, commissioned by then Opposition Leader, Kevin Rudd and by ...

as it considered there were no circumstances that justify it and that governments could deal with market failure or claims for compensation more transparently with the revenue from full auctioning of permits.protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations. ...

. Some types of border adjustment may also not prevent emissions leakage.

Issuing the permits: 'grandfathering' versus auctions

Tradable emissions permits can be issued to firms within an ETS by two main ways: by free allocation of permits to existing emitters or by auction. Allocating permits based on past emissions is called "grandfathering" (Goldemberg ''et al.'', 1996, p. 38). Grandfathering permits, just like the other option of selling (auctioning) permits, sets a price on emissions. This gives permit-liable polluters an incentive to reduce their emissions. However, grandfathering permits can lead to perverse incentive

A perverse incentive is an incentive that has an unintended and undesirable result that is contrary to the intentions of its designers. The cobra effect is the most direct kind of perverse incentive, typically because the incentive unintentionall ...

s, e.g., a firm that aimed to cut emissions drastically would then be given fewer permits in the future. Allocation may also slow down technological development towards less polluting technologies. The Garnaut Climate Change Review

Professor Ross Garnaut led two climate change reviews, the first commencing in 2007 and the second in 2010.

The first Garnaut Climate Change Review was a study by Professor Ross Garnaut, commissioned by then Opposition Leader, Kevin Rudd and by ...

noted that 'grandfathered' permits are not 'free'. As the permits are scarce they have value and the benefit of that value is acquired in full by the emitter. The cost is imposed elsewhere in the economy, typically on consumers who cannot pass on the costs.tax

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

es. Auctioning permits can therefore be more efficient and equitable than allocating permits (Hepburn, 2006, pp. 236–237).economic rents

In political economy, economics, economic rent is any payment (in the context of a market transaction) to the owner of a factor of production in excess of the cost needed to bring that factor into production. In classical economics, economic re ...

.

Lobbying for free allocation

According to Hepburn (2006, pp. 238–239),rent-seeking

Rent-seeking is the act of growing one's existing wealth without creating new wealth by manipulating the social or political environment.

Rent-seeking activities have negative effects on the rest of society. They result in reduced economic effi ...

behaviour and lobbying of governments, activities that dissipate economic value.

Coase model

Coase (1960) argued that social costs could be accounted for by negotiating property rights according to a particular objective. Coase's model assumes perfectly operating market

Market is a term used to describe concepts such as:

* Market (economics), system in which parties engage in transactions according to supply and demand

* Market economy

*Marketplace, a physical marketplace or public market

Geography

*Märket, a ...

s and equal bargaining power

Bargaining power is the relative ability of parties in an argumentative situation (such as bargaining, contract writing, or making an agreement) to exert influence over each other. If both parties are on an equal footing in a debate, then they w ...

among those arguing for property rights.

In Coase's model, efficiency, i.e., achieving a given reduction in emissions at lowest cost, is promoted by the market system. This can also be looked at from the perspective of having the greatest flexibility to reduce emissions. Flexibility is desirable because the marginal

Marginal may refer to:

* ''Marginal'' (album), the third album of the Belgian rock band Dead Man Ray, released in 2001

* ''Marginal'' (manga)

* '' El Marginal'', Argentine TV series

* Marginal seat or marginal constituency or marginal, in polit ...

costs, that is to say, the incremental costs of reducing emissions, varies among countries. Emissions trading allows emission reductions to be first made in locations where the marginal costs of abatement are lowest (Bashmakov ''et al''., 2001). Over time, efficiency can also be promoted by allowing "banking" of permits (Goldemberg ''et al''., 1996, p. 30). This allows polluters to reduce emissions at a time when it is most efficient to do so.

Equity

One of the advantages of Coase's model is that it suggests that fairness (equity) can be addressed in the distribution of property rights, and that regardless of how these property rights are assigned, the market will produce the most efficient outcome.[ In reality, according to the held view, markets are not perfect, and it is therefore possible that a trade off will occur between equity and efficiency (Halsnæs ''et al''., 2007).

]

Trading

In an emissions trading system, permits may be traded by emitters who are liable to hold a sufficient number of permits in system. Some analysts argue that allowing others to participate in trading, e.g., private broker

A broker is a person or firm who arranges transactions between a buyer and a seller for a commission when the deal is executed. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Neither role should be confu ...

age firms, can allow for better management of risk in the system, e.g., to variations in permit prices (Bashmakov ''et al.'', 2001). It may also improve the efficiency of system. According to Bashmakov ''et al''. (2001), regulation of these other entities may be necessary, as is done in other financial market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets ...

s, e.g., to prevent abuses of the system, such as insider trading

Insider trading is the trading of a public company's stock or other securities (such as bonds or stock options) based on material, nonpublic information about the company. In various countries, some kinds of trading based on insider information ...

.

Incentives and allocation

Emissions trading gives polluters an incentive to reduce their emissions. However, there are possible perverse incentive

A perverse incentive is an incentive that has an unintended and undesirable result that is contrary to the intentions of its designers. The cobra effect is the most direct kind of perverse incentive, typically because the incentive unintentionall ...

s that can exist in emissions trading. Allocating permits on the basis of past emissions ("grandfathering") can result in firms having an incentive to maintain emissions. For example, a firm that reduced its emissions would receive fewer permits in the future (IMF, 2008, pp. 25–26).external cost

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either co ...

s (Halsnæs ''et al.'', 2007). This problem can also be criticized on ethical grounds, since the polluter is being paid to reduce emissions (Goldemberg ''et al''., 1996, p. 38).[ On the other hand, a permit system where permits are auctioned rather than given away, provides the government with revenues. These revenues might be used to improve the efficiency of overall climate policy, e.g., by funding energy efficiency programs (ACEEE 2019) or reductions in distortionary taxes (Fisher ''et al''., 1996, p. 417).

In Coase's model of social costs, either choice (grandfathering or auctioning) leads to efficiency. In reality, grandfathering subsidizes polluters, meaning that polluting industries may be kept in business longer than would otherwise occur. Grandfathering may also reduce the rate of technological improvement towards less polluting technologies (Fisher ''et al.'', 1996, p. 417).

William Nordhaus argues that allocations cost the economy as they cause the under utilisation an efficient form of taxation.]Ross Garnaut

Ross Gregory Garnaut (born 28 July 1946, Perth) is an Australian economist, currently serving as a vice-chancellor's fellow and professorial fellow of economics at the University of Melbourne. He is the author of numerous publications in schol ...

states that permits allocated to existing emitters by 'grandfathering' are not 'free'. As the permits are scarce they have value and the benefit of that value is acquired in full by the emitter. The cost is imposed elsewhere in the economy, typically on consumers who cannot pass on the costs.

Market and least-cost

Some economists have urged the use of market-based instruments such as emissions trading to address environmental problems instead of prescriptive "command-and-control" regulation.Command and control regulation

Command and Control (CAC) regulation finds common usage in academic literature and beyond. The relationship between CAC and environmental policy is considered in this article, an area that demonstrates the application of this type of regulation. Ho ...

is criticized for being insensitive to geographical and technological differences, and therefore inefficient; however, this is not always so, as shown by the WWII rationing program in the U.S. in which local and regional boards made adjustments for these differences.

After an emissions limit has been set by a government political process, individual companies are free to choose how or whether to reduce their emissions. Failure to report emissions and surrender emission permits is often punishable by a further government regulatory mechanism, such as a fine that increases costs of production. Firms will choose the least-cost way to comply with the pollution regulation, which will lead to reductions where the least expensive solutions exist, while allowing emissions that are more expensive to reduce.

Under an emissions trading system, each regulated polluter has flexibility to use the most cost-effective combination of buying or selling emission permits, reducing its emissions by installing cleaner technology, or reducing its emissions by reducing production. The most cost-effective strategy depends on the polluter's marginal abatement cost and the market price of permits. In theory, a polluter's decisions should lead to an economically efficient allocation of reductions among polluters, and lower compliance costs for individual firms and for the economy overall, compared to command-and-control mechanisms.

Measuring, reporting, verification and enforcement

Assuring compliance with an emissions trading scheme requires measuring, reporting and verification (MRV). These measurements are reported to a regulator. For greenhouse gases, all trading countries maintain an inventory of emissions at national and installation level; in addition, trading groups within North America maintain inventories at the state level through The Climate Registry

The Climate Registry (TCR) is a non-profit organization governed by U.S. states and Canadian provinces and territories. TCR designs and operates voluntary and compliance greenhouse gas (GHG) reporting programs globally, and assists organizations ...

. For trading between regions, these inventories must be consistent, with equivalent units and measurement techniques.

In some industrial processes, emissions can be physically measured by inserting sensors and flowmeters in chimneys and stacks, but many types of activity rely on theoretical calculations instead of measurement. Depending on local legislation, measurements may require additional checks and verification by government or third party auditor

An auditor is a person or a firm appointed by a company to execute an audit.Practical Auditing, Kul Narsingh Shrestha, 2012, Nabin Prakashan, Nepal To act as an auditor, a person should be certified by the regulatory authority of accounting and au ...

s, prior or post submission to the local regulator.

Enforcement methods include fines Fines may refer to:

*Fines, Andalusia, Spanish municipality

*Fine (penalty)

* Fine, a dated term for a premium on a lease of land, a large sum the tenant pays to commute (lessen) the rent throughout the term

*Fines, ore or other products with a sma ...

and sanctions for polluters that have exceeded their allowances. Concerns include the cost of MRV and enforcement, and the risk that facilities may lie about actual emissions.

Pollution markets

An emission license directly confers a right to emit pollutants up to a certain rate.

In contrast, a pollution license for a given location confers the right to emit pollutants at a rate which will cause no more than a specified increase at the pollution-level. For concreteness, consider the following model.fair river sharing Fair river sharing is a kind of a fair division problem in which the waters of a river has to be divided among countries located along the river. It differs from other fair division problems in that the resource to be divided—the water—flows in ...

setting).

* Pollution in the upstream country is determined only by the emission of the upstream country: .

* Pollution in the middle country is determined by its own emission and by the emission of country 1: .

* Pollution in the downstream country is the sum of all emissions: .

So the matrix in this case is a triangular matrix of ones.

Each pollution-license for location permits its holder to emit pollutants that will cause at most this level of pollution at location . Therefore, a polluter that affects water quality at a number of points has to hold a portfolio of licenses covering all relevant monitoring-points. In the above example, if country 2 wants to emit a unit of pollutant, it should purchase two permits: one for location 2 and one for location 3.

Montgomery shows that, while both markets lead to efficient license allocation, the market in pollution-licenses is more widely applicable than the market in emission-licenses.

International emissions trading

Example

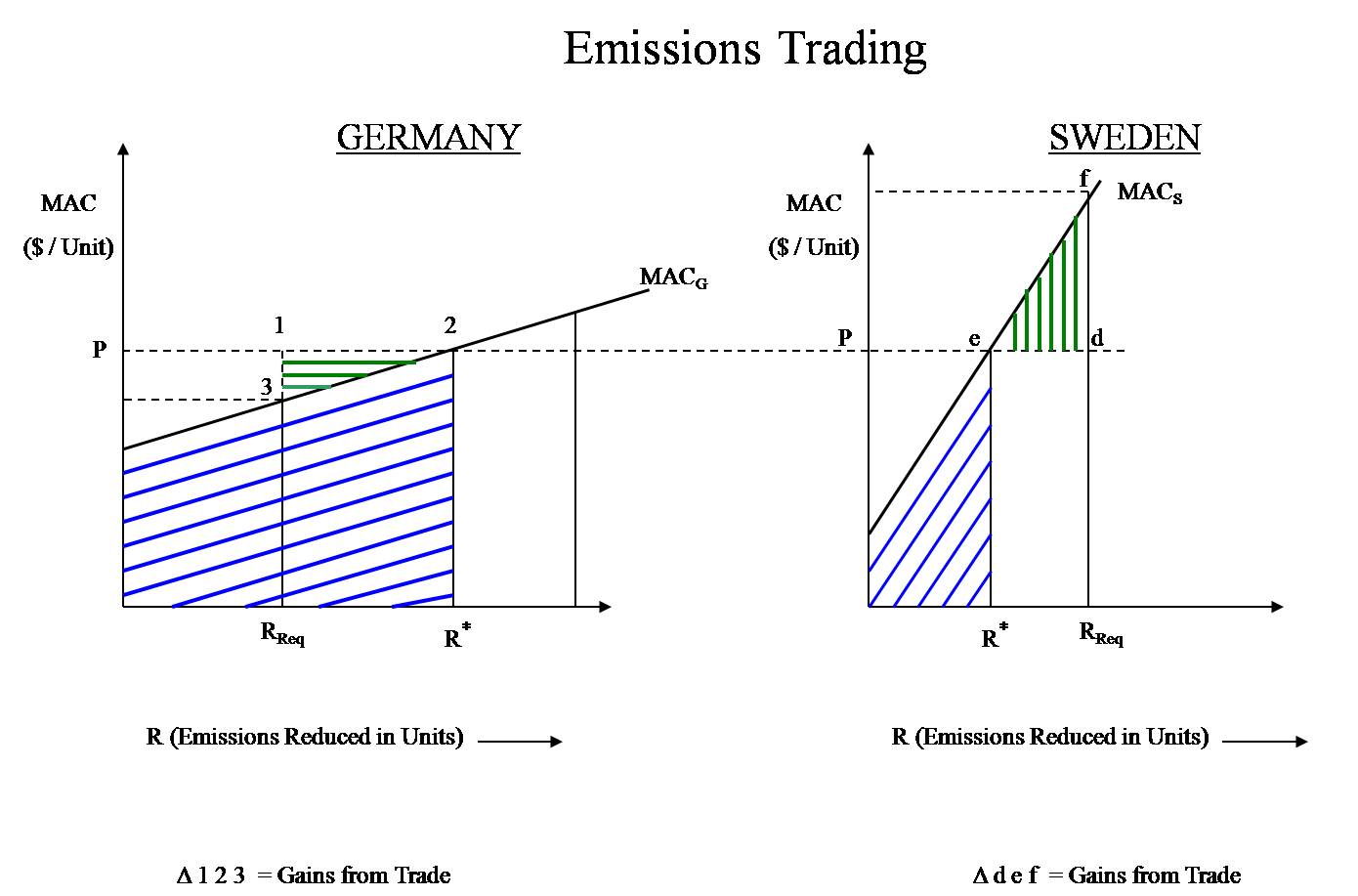

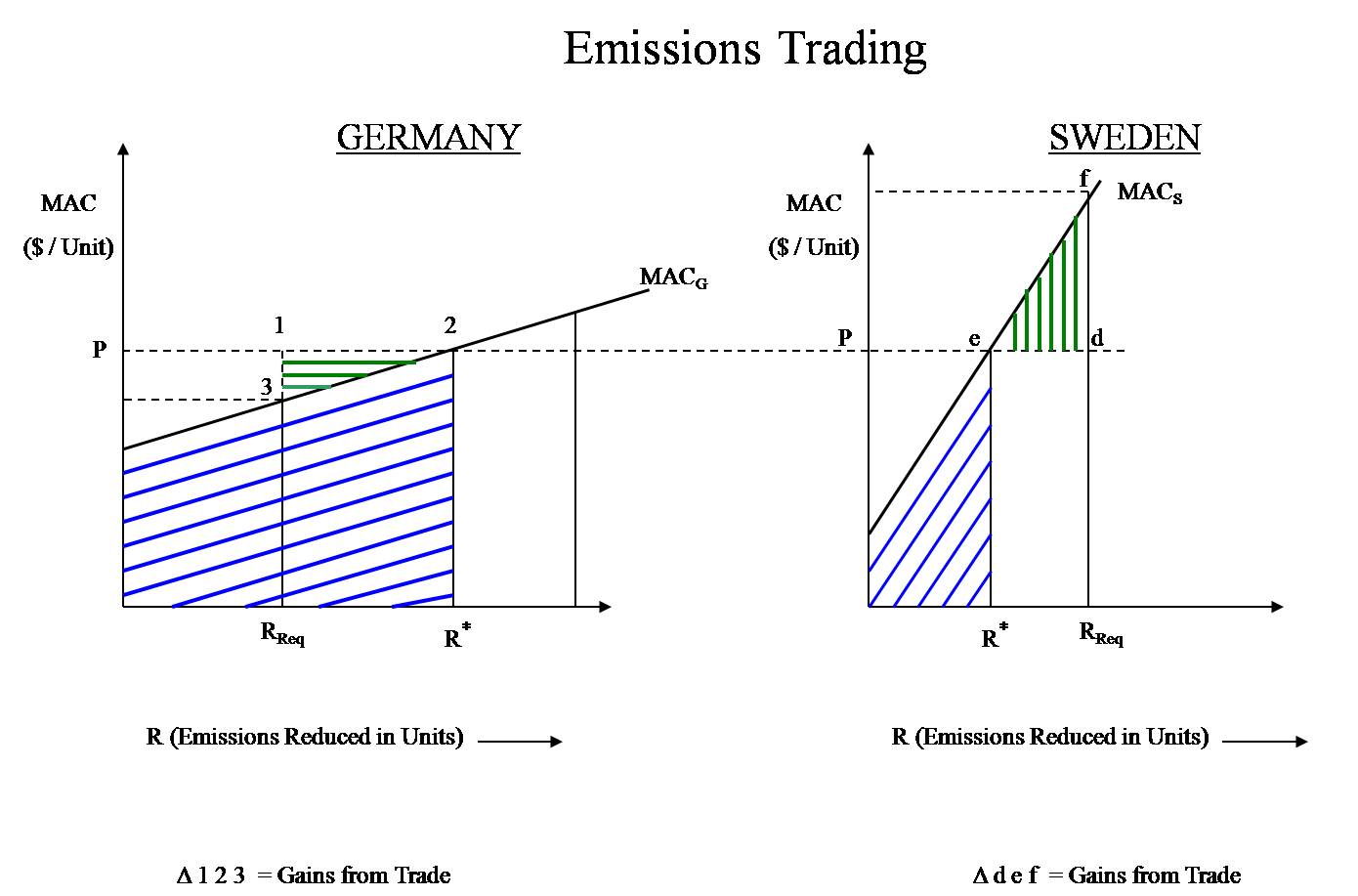

Emissions trading through ''Gains from Trade'' can be more beneficial for both the buyer and the seller than a simple emissions capping scheme.

Consider two European countries, such as Germany and Sweden. Each can either reduce all the required amount of emissions by itself or it can choose to buy or sell in the market.

Suppose Germany can abate its CO2 at a much cheaper cost than Sweden, i.e. MACS > MACG where the MAC curve of Sweden is steeper (higher slope) than that of Germany, and RReq is the total amount of emissions that need to be reduced by a country.

On the left side of the graph is the MAC curve for Germany. RReq is the amount of required reductions for Germany, but at RReq the MACG curve has not intersected the market emissions permit price of CO2 (market permit price = P = λ). Thus, given the market price of CO2 allowances, Germany has potential to profit if it abates more emissions than required.

On the right side is the MAC curve for Sweden. RReq is the amount of required reductions for Sweden, but the MACS curve already intersects the market price of CO2 permits before RReq has been reached. Thus, given the market price of CO2 permits, Sweden has potential to make a cost saving if it abates fewer emissions than required internally, and instead abates them elsewhere.

In this example, Sweden would abate emissions until its MACS intersects with P (at R*), but this would only reduce a fraction of Sweden's total required abatement.

After that it could buy emissions credits from Germany for the price ''P'' (per unit). The internal cost of Sweden's own abatement, combined with the permits it buys in the market from Germany, adds up to the total required reductions (RReq) for Sweden. Thus Sweden can make a saving from buying permits in the market (Δ d-e-f). This represents the "Gains from Trade", the amount of additional expense that Sweden would otherwise have to spend if it abated all of its required emissions by itself without trading.

Germany made a profit on its additional emissions abatement, above what was required: it met the regulations by abating all of the emissions that was required of it (RReq). Additionally, Germany sold its surplus permits to Sweden, and was paid ''P'' for every unit it abated, while spending less than ''P''. Its total revenue is the area of the graph (RReq 1 2 R*), its total abatement cost is area (RReq 3 2 R*), and so its net benefit from selling emission permits is the area (Δ 1-2-3) i.e. Gains from Trade

The two R* (on both graphs) represent the efficient allocations that arise from trading.

* Germany: sold (R* - RReq) emission permits to Sweden at a unit price ''P''.

* Sweden bought emission permits from Germany at a unit price ''P''.

If the total cost for reducing a particular amount of emissions in the ''Command Control'' scenario is called ''X'', then to reduce the same amount of combined pollution in Sweden and Germany, the total abatement cost would be less in the ''Emissions Trading'' scenario i.e. (X — Δ 123 - Δ def).

The example above applies not just at the national level, but also between two companies in different countries, or between two subsidiaries within the same company.

Suppose Germany can abate its CO2 at a much cheaper cost than Sweden, i.e. MACS > MACG where the MAC curve of Sweden is steeper (higher slope) than that of Germany, and RReq is the total amount of emissions that need to be reduced by a country.

On the left side of the graph is the MAC curve for Germany. RReq is the amount of required reductions for Germany, but at RReq the MACG curve has not intersected the market emissions permit price of CO2 (market permit price = P = λ). Thus, given the market price of CO2 allowances, Germany has potential to profit if it abates more emissions than required.

On the right side is the MAC curve for Sweden. RReq is the amount of required reductions for Sweden, but the MACS curve already intersects the market price of CO2 permits before RReq has been reached. Thus, given the market price of CO2 permits, Sweden has potential to make a cost saving if it abates fewer emissions than required internally, and instead abates them elsewhere.

In this example, Sweden would abate emissions until its MACS intersects with P (at R*), but this would only reduce a fraction of Sweden's total required abatement.

After that it could buy emissions credits from Germany for the price ''P'' (per unit). The internal cost of Sweden's own abatement, combined with the permits it buys in the market from Germany, adds up to the total required reductions (RReq) for Sweden. Thus Sweden can make a saving from buying permits in the market (Δ d-e-f). This represents the "Gains from Trade", the amount of additional expense that Sweden would otherwise have to spend if it abated all of its required emissions by itself without trading.

Germany made a profit on its additional emissions abatement, above what was required: it met the regulations by abating all of the emissions that was required of it (RReq). Additionally, Germany sold its surplus permits to Sweden, and was paid ''P'' for every unit it abated, while spending less than ''P''. Its total revenue is the area of the graph (RReq 1 2 R*), its total abatement cost is area (RReq 3 2 R*), and so its net benefit from selling emission permits is the area (Δ 1-2-3) i.e. Gains from Trade

The two R* (on both graphs) represent the efficient allocations that arise from trading.

* Germany: sold (R* - RReq) emission permits to Sweden at a unit price ''P''.

* Sweden bought emission permits from Germany at a unit price ''P''.

If the total cost for reducing a particular amount of emissions in the ''Command Control'' scenario is called ''X'', then to reduce the same amount of combined pollution in Sweden and Germany, the total abatement cost would be less in the ''Emissions Trading'' scenario i.e. (X — Δ 123 - Δ def).

The example above applies not just at the national level, but also between two companies in different countries, or between two subsidiaries within the same company.

Applying the economic theory

The nature of the pollutant plays a very important role when policy-makers decide which framework should be used to control pollution. CO2 acts globally, thus its impact on the environment is generally similar wherever in the globe it is released. So the location of the originator of the emissions does not matter from an environmental standpoint.

The policy framework should be different for regional pollutants (e.g. SO2 and NOx, and also mercury

Mercury commonly refers to:

* Mercury (planet), the nearest planet to the Sun

* Mercury (element), a metallic chemical element with the symbol Hg

* Mercury (mythology), a Roman god

Mercury or The Mercury may also refer to:

Companies

* Merc ...

) because the impact of these pollutants may differ by location. The same amount of a regional pollutant can exert a very high impact in some locations and a low impact in other locations, so it matters where the pollutant is released. This is known as the ''Hot Spot'' problem.

A Lagrange framework is commonly used to determine the least cost of achieving an objective, in this case the total reduction in emissions required in a year. In some cases, it is possible to use the Lagrange optimization framework to determine the required reductions for each country (based on their MAC) so that the total cost of reduction is minimized. In such a scenario, the Lagrange multiplier

In mathematical optimization, the method of Lagrange multipliers is a strategy for finding the local maxima and minima of a function subject to equality constraints (i.e., subject to the condition that one or more equations have to be satisfied ex ...

represents the market allowance price (P) of a pollutant, such as the current market price of emission permits in Europe and the USA.

Countries face the permit market price that exists in the market that day, so they are able to make individual decisions that would minimize their costs while at the same time achieving regulatory compliance. This is also another version of the Equi-Marginal Principle, commonly used in economics to choose the most economically efficient decision.

Prices versus quantities, and the safety valve

There has been longstanding debate on the relative merits of ''price'' versus ''quantity'' instruments to achieve emission reductions.

An emission cap and permit trading system is a ''quantity'' instrument because it fixes the overall emission level (quantity) and allows the price to vary. Uncertainty in future supply and demand conditions (market volatility) coupled with a fixed number of pollution permits creates an uncertainty in the future price of pollution permits, and the industry must accordingly bear the cost of adapting to these volatile market conditions. The burden of a volatile market thus lies with the industry rather than the controlling agency, which is generally more efficient. However, under volatile market conditions, the ability of the controlling agency to alter the caps will translate into an ability to pick "winners and losers" and thus presents an opportunity for corruption.

In contrast, an emission tax is a ''price'' instrument because it fixes the price while the emission level is allowed to vary according to economic activity. A major drawback of an emission tax is that the environmental outcome (e.g. a limit on the amount of emissions) is not guaranteed. On one hand, a tax will remove capital from the industry, suppressing possibly useful economic activity, but conversely, the polluter will not need to hedge as much against future uncertainty since the amount of tax will track with profits. The burden of a volatile market will be borne by the controlling (taxing) agency rather than the industry itself, which is generally less efficient. An advantage is that, given a uniform tax rate and a volatile market, the taxing entity will not be in a position to pick "winners and losers" and the opportunity for corruption will be less.

Assuming no corruption and assuming that the controlling agency and the industry are equally efficient at adapting to volatile market conditions, the best choice depends on the sensitivity of the costs of emission reduction, compared to the sensitivity of the benefits (i.e., climate damage avoided by a reduction) when the level of emission control is varied.

Because there is high uncertainty in the compliance costs of firms, some argue that the optimum choice is the price mechanism. However, the burden of uncertainty cannot be eliminated, and in this case it is shifted to the taxing agency itself.

The overwhelming majority of climate scientists have repeatedly warned of a threshold in atmospheric concentrations of carbon dioxide beyond which a run-away

There has been longstanding debate on the relative merits of ''price'' versus ''quantity'' instruments to achieve emission reductions.

An emission cap and permit trading system is a ''quantity'' instrument because it fixes the overall emission level (quantity) and allows the price to vary. Uncertainty in future supply and demand conditions (market volatility) coupled with a fixed number of pollution permits creates an uncertainty in the future price of pollution permits, and the industry must accordingly bear the cost of adapting to these volatile market conditions. The burden of a volatile market thus lies with the industry rather than the controlling agency, which is generally more efficient. However, under volatile market conditions, the ability of the controlling agency to alter the caps will translate into an ability to pick "winners and losers" and thus presents an opportunity for corruption.

In contrast, an emission tax is a ''price'' instrument because it fixes the price while the emission level is allowed to vary according to economic activity. A major drawback of an emission tax is that the environmental outcome (e.g. a limit on the amount of emissions) is not guaranteed. On one hand, a tax will remove capital from the industry, suppressing possibly useful economic activity, but conversely, the polluter will not need to hedge as much against future uncertainty since the amount of tax will track with profits. The burden of a volatile market will be borne by the controlling (taxing) agency rather than the industry itself, which is generally less efficient. An advantage is that, given a uniform tax rate and a volatile market, the taxing entity will not be in a position to pick "winners and losers" and the opportunity for corruption will be less.

Assuming no corruption and assuming that the controlling agency and the industry are equally efficient at adapting to volatile market conditions, the best choice depends on the sensitivity of the costs of emission reduction, compared to the sensitivity of the benefits (i.e., climate damage avoided by a reduction) when the level of emission control is varied.

Because there is high uncertainty in the compliance costs of firms, some argue that the optimum choice is the price mechanism. However, the burden of uncertainty cannot be eliminated, and in this case it is shifted to the taxing agency itself.

The overwhelming majority of climate scientists have repeatedly warned of a threshold in atmospheric concentrations of carbon dioxide beyond which a run-away warming

Warming may refer to: People

*Eugenius Warming, (1841–1924), Danish botanist

* Thomas Warming, (b. 1969), Danish illustrator, painter and author See also

*Global warming

*Warming up

*Warming Land

Warming Land is a peninsula in far northern G ...

effect could take place, with a large possibility of causing irreversible damage. With such a risk, a quantity instrument may be a better choice because the quantity of emissions may be capped with more certainty. However, this may not be true if this risk exists but cannot be attached to a known level of greenhouse gas (GHG) concentration or a known emission pathway.

A third option, known as a ''safety valve'', is a hybrid of the price and quantity instruments. The system is essentially an emission cap and permit trading system but the maximum (or minimum) permit price is capped. Emitters have the choice of either obtaining permits in the marketplace or buying them from the government at a specified trigger price (which could be adjusted over time). The system is sometimes recommended as a way of overcoming the fundamental disadvantages of both systems by giving governments the flexibility to adjust the system as new information comes to light. It can be shown that by setting the trigger price high enough, or the number of permits low enough, the safety valve can be used to mimic either a pure quantity or pure price mechanism.

All three methods are being used as policy instruments to control greenhouse gas emissions: the EU-ETS is a ''quantity'' system using the cap and trading system to meet targets set by National Allocation Plan

The European Union Emissions Trading System (EU ETS) is a "cap and trade" scheme where a limit is placed on the right to emit specified pollutants over an area and companies can trade emission rights within that area. It covers around 45% of th ...

s; Denmark has a price system using a carbon tax

A carbon tax is a tax levied on the carbon emissions required to produce goods and services. Carbon taxes are intended to make visible the "hidden" social costs of carbon emissions, which are otherwise felt only in indirect ways like more sev ...

(World Bank, 2010, p. 218),Clean Development Mechanism

The Clean Development Mechanism (CDM) is a United Nations-run carbon offset scheme allowing countries to fund greenhouse gas emissions-reducing projects in other countries and claim the saved emissions as part of their own efforts to meet internati ...

projects, but imposes a ''safety valve'' of a minimum price per tonne of CO2.

Comparison with other methods of emission reduction

Cap and trade is the textbook example of an ''emissions trading program''. Other market-based approaches include baseline-and-credit, and pollution tax. They all put a price on pollution (for example, see carbon price

Carbon pricing (or pricing), also known as cap and trade (CAT) or emissions trading scheme (ETS), is a method for nations to reduce global warming. The cost is applied to greenhouse gas emissions in order to encourage polluters to reduce the co ...

), and so provide an economic incentive to reduce pollution beginning with the lowest-cost opportunities. By contrast, in a command-and-control approach, a central authority designates pollution levels each facility is allowed to emit. Cap and trade essentially functions as a tax where the tax rate is variable based on the relative cost of abatement per unit, and the tax base is variable based on the amount of abatement needed.

Baseline and credit

In a baseline and credit program, polluters can create permits, called credits or offsets, by reducing their emissions below a baseline level, which is often the historical emissions level from a designated past year.

Pollution tax

Emissions fees or environmental tax is a surcharge on the pollution created while producing goods and services.carbon tax

A carbon tax is a tax levied on the carbon emissions required to produce goods and services. Carbon taxes are intended to make visible the "hidden" social costs of carbon emissions, which are otherwise felt only in indirect ways like more sev ...

is a tax on the carbon content of fossil fuels that aims to discourage their use and thereby reduce carbon dioxide emissions.[ The two approaches are overlapping sets of policy designs. Both can have a range of scopes, points of regulation, and price schedules. They can be fair or unfair, depending on how the revenue is used. Both have the effect of increasing the price of goods (such as fossil fuels) to consumers.]inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

(changes to overall prices) automatically, while emissions fees must be changed by regulators.

Responsiveness to cost changes: It is not clear which approach is better. It is possible to combine the two into a safety valve price: a price set by regulators, at which polluters can buy additional permits beyond the cap.

Responsiveness to recessions: This point is closely related to responsiveness to cost changes, because recessions cause a drop in demand. Under cap and trade, the emissions cost automatically decreases, so a cap-and-trade scheme adds another automatic stabilizer In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and welfare spending, that act to damp out fluctuations in real GDP.

The size of the government budget deficit tends to ...

to the economy—in effect, an automatic fiscal stimulus. However, a lower pollution price also results in reduced efforts to reduce pollution. If the government is able to stimulate the economy regardless of the cap-and-trade scheme, an excessively low price causes a missed opportunity to cut emissions faster than planned. Instead, it might be better to have a price floor (a tax). This is especially true when cutting pollution is urgent, as with greenhouse gas emissions. A price floor also provides certainty and stability for investment in emissions reductions: recent experience from the UK shows that nuclear power operators are reluctant to invest on "un-subsidised" terms unless there is a guaranteed price floor for carbon (which the EU emissions trading scheme does not presently provide).

Responsiveness to uncertainty: As with cost changes, in a world of uncertainty, it is not clear whether emissions fees or cap-and-trade systems are more efficient—it depends on how fast the marginal social benefits of reducing pollution fall with the amount of cleanup (e.g., whether inelastic or elastic marginal social benefit schedule).

Other: The magnitude of the tax will depend on how sensitive the supply of emissions is to the price. The permit price of cap-and-trade will depend on the pollutant market. A tax generates government revenue, but full-auctioned emissions permits can do the same. A similar upstream cap-and-trade system could be implemented. An upstream carbon tax might be the simplest to administer. Setting up a complex cap-and-trade arrangement that is comprehensive has high institutional needs.

Command-and-control regulation

Command and control is a system of regulation that prescribes emission limits and compliance methods for each facility or source. It is the traditional approach to reducing air pollution.[

Command-and-control regulations are more rigid than incentive-based approaches such as pollution fees and cap and trade. An example of this is a performance standard which sets an emissions goal for each polluter that is fixed and, therefore, the burden of reducing pollution cannot be shifted to the firms that can achieve it more cheaply. As a result, performance standards are likely to be more costly overall.]

Trading systems

Apart from the dynamic development in carbon emission trading

Emission trading (ETS) for carbon dioxide (CO2) and other greenhouse gases (GHG) is a form of carbon price, carbon pricing; also known as cap and trade (CAT) or carbon pricing. It is an approach to Climate change mitigation, limit climate c ...

, other pollutants have also been targeted.

United States

Sulfur dioxide

An early example of an emission trading system has been the sulfur dioxide

Sulfur dioxide (IUPAC-recommended spelling) or sulphur dioxide (traditional Commonwealth English) is the chemical compound with the formula . It is a toxic gas responsible for the odor of burnt matches. It is released naturally by volcanic activ ...

(SO2) trading system under the framework of the Acid Rain Program

The Acid Rain Program is a market-based initiative taken by the United States Environmental Protection Agency in an effort to reduce overall atmospheric levels of sulfur dioxide and nitrogen oxides, which cause acid rain. The program is an implem ...

of the 1990 Clean Air Act in the U.S. Under the program, which is essentially a cap-and-trade emissions trading system, SO2 emissions were reduced by 50% from 1980 levels by 2007. Some experts argue that the cap-and-trade system of SO2 emissions reduction has reduced the cost of controlling acid rain by as much as 80% versus source-by-source reduction.Cross-State Air Pollution Rule The Cross-State Air Pollution Rule (CSAPR) is a rule by the United States Environmental Protection Agency (EPA) that requires member states of the United States to reduce power plant emissions that contribute to ozone and/or fine particle pollution ...

(CSAPR). Under the CSAPR, the national SO2 trading program was replaced by four separate trading groups for SO2 and NOx.

SO2 emissions from Acid Rain Program sources have fallen from 17.3 million tons in 1980 to about 7.6 million tons in 2008, a decrease in emissions of 56 percent. A 2014 EPA analysis estimated that implementation of the Acid Rain Program avoided between 20,000 and 50,000 incidences of premature mortality annually due to reductions of ambient PM2.5 concentrations, and between 430 and 2,000 incidences annually due to reductions of ground-level ozone.

Nitrogen oxides

In 2003, the Environmental Protection Agency (EPA) began to administer the Budget Trading Program (NBP) under the State Implementation Plan (also known as the "NOx SIP Call"). The Budget Trading Program was a market-based cap and trade program created to reduce emissions of nitrogen oxides (NOx) from power plants and other large combustion sources in the eastern United States. NOx is a prime ingredient in the formation of ground-level ozone (smog

Smog, or smoke fog, is a type of intense air pollution. The word "smog" was coined in the early 20th century, and is a portmanteau of the words ''smoke'' and '' fog'' to refer to smoky fog due to its opacity, and odor. The word was then inte ...

), a pervasive air pollution problem in many areas of the eastern United States. The NBP was designed to reduce NOx emissions during the warm summer months, referred to as the ozone season, when ground-level ozone concentrations are highest. In March 2008, EPA again strengthened the 8-hour ozone standard to 0.075 parts per million (ppm) from its previous 0.08 ppm.

Ozone season emissions decreased by 43 percent between 2003 and 2008, even while energy demand remained essentially flat during the same period. CAIR will result in $85 billion to $100 billion in health benefits and nearly $2 billion in visibility benefits per year by 2015 and will substantially reduce premature mortality in the eastern United States.

NOx reductions due to the Budget Trading Program have led to improvements in ozone and PM2.5, saving an estimated 580 to 1,800 lives in 2008.American Economic Review

The ''American Economic Review'' is a monthly peer-reviewed academic journal published by the American Economic Association. First published in 1911, it is considered one of the most prestigious and highly distinguished journals in the field of ec ...

'' found that the Budget Trading Program decreased emissions and ambient ozone concentrations.

Volatile organic compounds

In the United States the

In the United States the Environmental Protection Agency

A biophysical environment is a biotic and abiotic surrounding of an organism or population, and consequently includes the factors that have an influence in their survival, development, and evolution. A biophysical environment can vary in scale f ...

(EPA) classifies Volatile Organic Compounds

Volatile organic compounds (VOCs) are organic compounds that have a high vapour pressure at room temperature

Colloquially, "room temperature" is a range of air temperatures that most people prefer for indoor settings. It feels comfortable to a ...

(VOCs) as gases emitted from certain solids and liquids that may have adverse health effects.United States Geological Survey

The United States Geological Survey (USGS), formerly simply known as the Geological Survey, is a scientific agency of the United States government. The scientists of the USGS study the landscape of the United States, its natural resources, ...

for its presence in groundwater supply.

China

In an effort to reverse the adverse consequences of air pollution, in 2006, China started to consider a national pollution permit trading system in order to use market-based mechanisms to incentivize companies to cut pollution. This has been based on a previous pilot project called the Industrial emission trading pilot scheme, which was launched in 2002. Four provinces, three municipalities and one business entity was involved in this pilot project (also known as the 4+3+1 project). They are Shandong, Shanxi, Jiangsu, Henan, Shanghai, Tianjin, Liuzhou and China Huaneng Group, a state-owned company in the power industry.

Europe

The EU Emission Trading System was established in the year 2005 - in line with the commitment period of the Kyoto protocol. It follows the cap and trade model where one allowance permits the holder to emit 1 ton of (tCO2). The scheme was said to cover energy and heat generation industries and around 11,186 plants participated in the first stage. These plants only accounted for 45% of all European emissions at the time. More than 90% of all these allowances were free of cost in both periods to build a strong base of abatements for the future phases. This free allocation resulted in the volume and value of allowances growing three-fold over 2006 with the price moving from €19/tCO₂ in 2005 to its peak of €30/tCO₂ which revealed a new problem. The overallocation of allowances caused the price to drop to €1/tCO₂ in the first few months of 2007 which created market price instabilities for businesses to reinvest in low carbon technologies.

The EU Emission Trading System was established in the year 2005 - in line with the commitment period of the Kyoto protocol. It follows the cap and trade model where one allowance permits the holder to emit 1 ton of (tCO2). The scheme was said to cover energy and heat generation industries and around 11,186 plants participated in the first stage. These plants only accounted for 45% of all European emissions at the time. More than 90% of all these allowances were free of cost in both periods to build a strong base of abatements for the future phases. This free allocation resulted in the volume and value of allowances growing three-fold over 2006 with the price moving from €19/tCO₂ in 2005 to its peak of €30/tCO₂ which revealed a new problem. The overallocation of allowances caused the price to drop to €1/tCO₂ in the first few months of 2007 which created market price instabilities for businesses to reinvest in low carbon technologies.

Renewable energy certificates

Renewable Energy Certificates Renewable Energy Certificates (RECs), also known as Green tags, Renewable Energy Credits, Renewable Electricity Certificates, or Tradable Renewable Certificates (TRCs), are tradable, non-tangible energy certificates in the United States that repres ...

(occasionally referred to as or "green tags"), are a largely unrelated form of market-based instruments that are used to achieve renewable energy targets, which may be environmentally motivated (like emissions reduction targets), but may also be motivated by other aims, such as energy security or industrial policy.

Criticism

Emissions trading has been criticised for a variety of reasons.

For example, in the popular science magazine ''New Scientist

''New Scientist'' is a magazine covering all aspects of science and technology. Based in London, it publishes weekly English-language editions in the United Kingdom, the United States and Australia. An editorially separate organisation publishe ...

'', Lohmann (2006) argued that trading pollution allowances should be avoided as a climate stabilization policy for several reasons. First, climate change requires more radical changes than previous pollution trading schemes such as the US SO2 market. It requires reorganizing society and technology to "leave most remaining fossil fuels safely underground". Carbon trading schemes have tended to reward the heaviest polluters with 'windfall profits' when they are granted enough carbon credits to match historic production. Expensive long-term structural changes will not be made if there are cheaper sources of carbon credits which are often available from less developed countries, where they may be generated by local polluters at the expense of local communities.

Distributional effects

The US Congressional Budget Office

The Congressional Budget Office (CBO) is a federal agency within the legislative branch of the United States government that provides budget and economic information to Congress.

Inspired by California's Legislative Analyst's Office that manages ...

(CBO, 2009) examined the potential effects of the American Clean Energy and Security Act

The American Clean Energy and Security Act of 2009 (ACES) was an energy bill in the 111th United States Congress () that would have established a variant of an emissions trading plan similar to the European Union Emission Trading Scheme. The bil ...

on US households. This act relies heavily on the free allocation of permits. The Bill was found to protect low-income consumers, but it was recommended that the Bill be made more efficient by reducing welfare provisions for corporations, and more resources be made available for consumer relief. A cap-and-trade initiative in the U.S. Northeast caused concerns it would be regressive and poorer households would absorb most of the new tax.

Carbon Leakage

The current state of ETS shows that roughly 22% of global greenhouse emissions are covered by 64 carbon taxes and emission trading systems as of 2021. This means that there are still several member states that have not ratified the Kyoto Protocol. This is a cause of concern for energy intensive industries that are covered by such instruments that claim that there is a loss of competitiveness. Such corporations are thereby forced to take strategic production decisions that contribute to the issue of carbon leakage

Carbon leakage occurs when there is an increase in greenhouse gas emissions in one country as a result of an emissions reduction by a second country with a strict climate policy.

Carbon leakage may occur for a number of reasons:

* If the emission ...

.

Linking

Distinct cap-and-trade systems can be linked together through the mutual or unilateral recognition of emissions allowances for compliance. Linking systems creates a larger carbon market, which can reduce overall compliance costs, increase market liquidity and generate a more stable carbon market. Linking systems can also be politically symbolic as it shows willingness to undertake a common effort to reduce GHG emissions. Some scholars have argued that linking may provide a starting point for developing a new, bottom-up international climate policy architecture, whereby multiple unique systems successively link their various systems.

In 2014, the U.S. state of California and the Canadian province of Québec successfully linked their systems. In 2015, the provinces of Ontario and Manitoba agreed to join the linked system between Quebec and California. On 22 September 2017, the premiers

Premier is a title for the head of government in central governments, state governments and local governments of some countries. A second in command to a premier is designated as a deputy premier.

A premier will normally be a head of governm ...

of Quebec and Ontario, and the Governor of California

The governor of California is the head of government of the U.S. state of California. The governor is the commander-in-chief of the California National Guard and the California State Guard.

Established in the Constitution of California, the g ...

, signed the formal agreement establishing the linkage.

See also

* Acid Rain Retirement Fund

The Acid Rain Program is a market-based initiative taken by the United States Environmental Protection Agency in an effort to reduce overall atmospheric levels of sulfur dioxide and nitrogen oxides, which cause acid rain. The program is an implemen ...

* AP 42 Compilation of Air Pollutant Emission Factors

The ''AP 42 Compilation of Air Pollutant Emission Factors'' is a compilation of the US Environmental Protection Agency (EPA)'s emission factor information on air pollution, first published in 1968. , the last edition is the 5th from 2010.

Histo ...

* Asia-Pacific Emissions Trading Forum

The Asia-Pacific Emissions Trading Forum (AETF) was an information service and business network dealing with domestic and international developments in emissions trading policy in Australia and the Asia-Pacific region. The AETF was originally calle ...

* Cap and Dividend

Cap and dividend is a market-based trading system which retains the original capping method of cap and trade, but also includes compensation for energy consumers. This compensation is to offset the cost of products produced by companies that rais ...

* Cap and Share

Cap and Share was originally developed by Feasta (the Foundation for the Economics of Sustainability). It is a regulatory and economic framework for controlling the use of fossil fuels in relation to climate stabilisation. Convinced that climate ...

* Carbon credit

A carbon credit is a generic term for any tradable certificate or permit representing the right to emit a set amount of carbon dioxide or the equivalent amount of a different greenhouse gas (tCO2e).

Carbon credits and carbon markets are a compo ...

* Carbon emissions reporting

Greenhouse gas accounting or Carbon accounting is a framework of methods to measure and track how much greenhouse gas (GHG) an organization emits or takes actions to reduce. Corporations, cities and other groups use these techniques to help li ...

* Carbon finance

Carbon finance is a branch of environmental finance that covers financial tools such as carbon emission trading to reduce the impact of greenhouse gases (GHG) on the environment by giving carbon emissions a price.

Financial risks and opportunities ...

* Carbon offset

A carbon offset is a reduction or removal of emissions of carbon dioxide or other greenhouse gases made in order to compensate for emissions made elsewhere. Offsets are measured in tonnes of carbon dioxide-equivalent (CO2e). One ton of carbon ...

* Carbon tax

A carbon tax is a tax levied on the carbon emissions required to produce goods and services. Carbon taxes are intended to make visible the "hidden" social costs of carbon emissions, which are otherwise felt only in indirect ways like more sev ...

* Emission standard

Emission standards are the legal requirements governing air pollutants released into the atmosphere. Emission standards set quantitative limits on the permissible amount of specific air pollutants that may be released from specific sources over ...

* Energy law

Energy laws govern the use and taxation of energy, both renewable energy, renewable and non-renewable energy, non-renewable. These laws are the primary authority, primary authorities (such as caselaw, statutes, rules, regulations and edicts) re ...

* Flexible Mechanisms

Flexible mechanisms, also sometimes known as Flexibility Mechanisms or Kyoto Mechanisms, refers to emissions trading, the Clean Development Mechanism and Joint Implementation. These are mechanisms defined under the Kyoto Protocol intended to lower ...

* Green certificate

A green certificate are a tradable commodity proving that certain electricity is generated using renewable energy sources. Typically one certificate represents the generation of one Megawatthour of electricity. What is defined as "renewable" varie ...

* Green investment scheme

The Kyoto Protocol was an international treaty which extended the 1992 United Nations Framework Convention on Climate Change (UNFCCC) that commits state parties to reduce greenhouse gas emissions, based on the scientific consensus that (part ...

* Individual and political action on climate change

Individual action on climate change can include personal choices in many areas, such as diet, travel, household energy use, consumption of goods and services, and family size. Individuals can also engage in local and political advocacy around iss ...